U.S. Securities and Exchange Commission

Washington, DC 20549

NOTICE OF EXEMPT SOLICITATION

1. Name of the Registrant:

DOMINO'S PIZZA, INC.

2. Name of the person relying on exemption:

CTW INVESTMENT GROUP

3. Address of the person relying on exemption:

1900 L STREET, NW, SUITE 900 WASHINGTON, DC 20036

4. Written materials. Attach written materials required to be submitted

pursuant to Rule 14a6(g)(1):

CTW INVESTMENT GROUP

March 31, 2014

Please WITHOLD support for the re-election of Director Andrew Balson and vote

Meeting on April 29, 2014.

Dear Domino's Pizza Shareholder:

We urge you to Vote No on the Advisory Vote to Approve Executive Compensation

("Say-on-Pay"), and to Withhold support for the re-election of Andrew Balson,

the sole member of the board's Compensation Committee up for re-election on

April 29, 2014. We believe Domino's Pizza's aggressively leveraged balance

sheet and the market's pricing in of high growth expectations places long-term

shareholder value at a sensitive crossroads, making it essential that excessive

and poorly structured pay practices are reformed, and compensation disclosures

and oversight strengthened. For investors, the following are of immediate

concern:

* Large discretionary equity awards that inflate executive pay, betray poor

judgment, and also benefit independent directors;

* Long-term performance incentives that suffer from excessive short-termism,

a lack of vital disclosures, and a generous pay-for-failure vesting schedule;

* An annual incentive plan that operates as a de-facto semi-annual bonus plan

risking a myopic focus on quarterly performance; and

* Compensation Committee Chairman Mr. Balson's record of questionable pay

oversight at public companies.

The CtW Investment Group works with pension funds sponsored by affiliates of

Change to Win - a federation of unions representing over six million members

- to enhance long-term shareholder value through active ownership. These

funds have $250 billion in assets under management, and are substantial

shareholders of Domino's Pizza.

DOMINO'S PIZZA'S AGGRESSIVE STRATEGY REINFORCES THE NEED FOR LONG-TERM FOCUSED

PAY.

Domino's Pizza's stock price valuation leaves as much to fear as to hope, with

very high growth expectations priced into the stock. The shares of our company

have benefited from strong multiple expansion over the past two years leaving

Domino's Pizza's price to earnings ratio at a five-year high - 32x TTM and

close to double the median multiple for consumer discretionary. It is vital,

in this situation, that management is not incentivized to manage or meet

these expectations in the short-run at the expense of long-term value creation.

Domino's Pizza's aggressive leverage at 4.6x EBITDA, high above industry

averages, similarly demands careful oversight and management incentives that

encourage the prudent administration of the capital structure, attendant

liquidity risks and capital return policies.

ONE-TIME AWARDS INFLATE ALREADY HIGH EXECUTIVE PAY AND BETRAY POOR JUDGMENT.

CEO Patrick Doyle has been handsomely rewarded for the company's performance

with his current 3-year realizable pay (based on Equilar Inc.'s "ISS Realizable

Pay" metric) exceeding $43 million, 3x the peer median. We see no reason,

therefore, to grant Mr. Doyle an additional $2.6 million in discretionary equity

awards last year. Indeed, the explanation for this award (paid 80% in the form

of time-vesting stock options; 20% in performance shares) as well as similar

grants to other NEOs - namely that it compensated executives holding options for

the establishment of a regular dividend - is profoundly flawed. We recognize

that anti-dilution payments for special dividends, as contractually paid out

to our executives in 2012 following that year's special dividend, are not

uncommon or wholly unjustified. However, granting additional awards for the

initiation of a regular dividend is something quite different. In contrast to

special dividends, there is no evidence that regular dividends permanently

lower the share price. Instead, the initiation of a regular dividend lowers

earnings and share-price volatilities.

While such a reduction in volatility is clearly in the interest of long-term

shareholders, it does reduce the estimated value of stock options, as reflected

in the construction of the Black-Scholes valuation model. But this observation

only bolsters the case against stock options as a mechanism to align executive

incentives with shareholders' interests; granting executives these additional

options simply exacerbates this misalignment. Moreover, our executives are

already in position to receive dividends on their existing equity holdings, and

stand to benefit from any improved market sentiment following the initiation of

the regular dividend.

Given our concerns over the generosity and necessity of these grants, it is all

the more worrying for our company's corporate governance that the board made

similar discretionary grants to its outside directors holding stock options

(Vernon Hamilton, James Goldman, Andrew Balson, Diana Cantor, Greg Trojan),

exacerbating already high pay for members of our board. Mr. Hamilton, for

instance, received over $350,000 in 2013, 175% the median paid at S&P 500

companies of comparable market capitalization ($2 billion to $7.5 billion) and

bringing his total pay over the past two years to $723,000.

1900 L Street, NW, Suite 900 Washington, DC 20036

202-721-6060

www.ctwinvestment group.com

LONG-TERM AND ANNUAL INCENTIVE VEHICLES SUFFER FROM TRUNCATED PERFORMANCE

HORIZONS, AND PAY-FOR-FAILURE VESTING SCHEDULE

Contrary to its name, the annual incentive plan incorporates a six-month time

horizon, while the long-term performance share plan is more akin to an annual

compensation plan than a truly long-term incentive vehicle. With the remainder

of incentive pay comprising "plain vanilla" stock options, Domino's Pizza's

incentive pay lacks a credible connection to the risks and opportunities of

long-term value creation.

Rather than focusing exclusively on full-year performance, the annual cash

incentive plan incorporates a mid-year payout equal to 50% of the award, based

on performance over the first two quarters. Critically, this mid-year payout

is "not subject to forfeiture" if the full-year performance falls short. We

believe this structure could lead to a possible excessive short-term quarterly-

by-quarterly focus. Meanwhile, the use of performance shares (approximately

50% of the equity mix, with the remainder in plain vanilla stock options) is

undermined by having each tranche vest on the basis of annually established

performance targets. While this may provide retention benefits over an annual

cash plan, it risks incentivizing exactly the same short-term performance

horizon, not the long-term. Moreover, the integrity of these awards is further

diluted by providing for full, 100% vesting on the basis of an 85% achievement

level.

WE URGE THE DISCLOSURE OF VITAL PERFORMANCE METRICS.

Of course, a stretch target might go some way to ameliorating concerns here;

however, not only is the target performance not disclosed, but the performance

metric itself is not given to investors. Shareholders, as a result, have no way

of assessing how this plan aligns with long-term value creation or the

credibility of its performance hurdles.

DIRECTOR BALSON IS A "SERIAL OVERPAYER" WHOSE ONGOING ROLE ON DOMINO'S PIZZA'S

BOARD NEEDS MORE EXPLANATION.

Besides being culpable, as chairman of the Compensation Committee, for the

compensation flaws at Domino's Pizza, Mr. Balson serves on two other

compensation committees with serious pay concerns: Bloomin' Brands Inc. and

FleetCor Technologies, Inc. At last year's Bloomin' Brands shareholder meeting,

a majority of shares cast by outside shareholders opposed the company's "Say

on Pay," while at Fleetcor's 2013 annual meeting approximately a quarter voted

against FleetCor's stock plan (there was no "Say on Pay" proposal), with

leading proxy advisory firm Institutional Shareholder Services recommending

such a vote as well as a vote against directors up for election because of

problematic pay practices. This unenviable record raises serious concerns

over Mr. Balson's continued ability to serve as a member of our compensation

committee.

Moreover, Mr. Balson's departure from the board is long overdue given the

significant changes in our company's shareholder base since the 2005 public

offering. A long-time Managing Director of Bain Capital, Mr. Balson joined

Domino's Pizza's board in 1999 while the company was under the control of Bain.

Mr. Balson's tenure has continued, however, despite Bain completely exiting

Domino's Pizza in 2010. While it is understandable that private equity sponsors

retain board representation after a company's initial public offering, this

representation typically ends when the remaining stake is drawn down, with the

board subsequently transitioning to a membership more reflective of the broader

shareholder base. Not only did this not happen, but the board evidently

rejected Mr. Balson's recent resignation letter, which he was required to

submit under the company's Governance Guidelines following his recent

retirement from Bain. In light of this, the board needs to explain to

shareholders its succession planning regarding Mr. Balson.

We urge you to join us by WITHHOLDING support for Mr. Balson (Item 1) and

voting AGAINST approval of the advisory vote on executive compensation (Item

2). If you would like to discuss our concerns directly with us, please

contact my colleague Michael Pryce-Jones at (202) 721-6079 or

michael.pryce-jones@changetowin.org.

Sincerely,

/s/ Dieter Waizenegger

Dieter Waizenegger

Executive Director, CtW Investment Group

|

THIS IS NOT A SOILICITATION OF AUTHORITY TO VOTE YOUR PROXY. PLEASE DO NOT SEND

US YOUR PROXY CARD AS IT WILL NOT BE ACCEPTED.

[The letter printed above was also an attachment to the following communication

on Twitter:]

CtW Investment Group ?@CtWInvGrp

See our call to vote against #Execpay at Domino's Pizza - vote against

#sayonpay and director Balson http://ow.ly/vjgRr

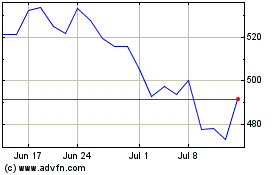

Dominos Pizza (NYSE:DPZ)

Historical Stock Chart

From Apr 2024 to May 2024

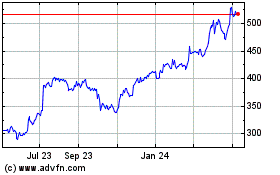

Dominos Pizza (NYSE:DPZ)

Historical Stock Chart

From May 2023 to May 2024