GUIDESTONE FUNDS

Supplement dated March 13, 2014

to

Prospectus dated May 1,

2013, as amended October 31, 2013

This supplement provides new information beyond that contained in the

Prospectus. It should be retained and read in conjunction with the Prospectus, as supplemented.

I.

PORTFOLIO MANAGER CHANGE FOR THE

EXTENDED-DURATION BOND FUND

Effective immediately, William H. Williams no longer serves as a portfolio manager for the portion of the Extended-Duration Bond Fund managed

by Schroder Investment Management North America Inc. All references herein to William H. Williams are deleted in their entirety.

In the section disclosing “Sub-Advisers and Portfolio Managers” for the Extended-Duration Bond Fund on page 74,

the disclosure entitled “Schroder Investment Management North America Inc.” is deleted in its entirety and replaced with the following:

|

|

|

|

|

|

|

Schroder Investment Management North America Inc.

|

|

|

|

|

|

|

|

Edward H. Jewett

Portfolio Manager

|

|

Since August 2001

|

|

|

|

|

|

|

|

Richard A. Rezek, Jr., CFA

Portfolio Manager

|

|

Since December 2002

|

|

|

|

|

|

|

|

Andrew B.J. Chorlton, CFA

Portfolio Manager

|

|

Since July 2007

|

|

|

|

|

|

|

|

Neil G. Sutherland, CFA

Portfolio Manager

|

|

Since November 2008

|

|

|

|

|

|

|

|

Julio C. Bonilla, CFA

Portfolio Manager

|

|

Since March 2010

|

|

|

Under the heading “Sub-Advisers,” the disclosure pertaining to Schroder

Investment Management North America Inc. for the Extended-Duration Bond Fund, on page 140, is deleted in its entirety and replaced with the following:

Schroder Investment Management North America Inc. (“SIMNA”), 875 Third Avenue, 22nd Floor, New York, New York 10022:

SIMNA is

a registered investment adviser under the Investment Advisers Act of 1940 and is an affiliate of Schroders plc, a London Stock Exchange-listed global asset management company. As of December 31, 2013, Schroders plc and its affiliates

(“Schroders”) had approximately $435.4 billion under management, with clients that are major financial institutions including banks and insurance companies, public and private pension funds, endowments and foundations, high net worth

individuals, financial intermediaries and retail investors. Investment decisions for SIMNA’s portion of the Extended-Duration Bond Fund are made by a portfolio management team. The team consists of Edward H. Jewett, Richard A. Rezek, Jr., CFA,

Andrew B.J. Chorlton, CFA, Neil G. Sutherland, CFA and Julio C. Bonilla, CFA, each a Portfolio Manager. Mr. Jewett has been a portfolio manager of the Extended-Duration Bond Fund since inception. All portfolio managers are jointly and primarily

responsible for the

i

day-to-day management of the portfolio account. The portfolio management team transitioned to SIMNA in 2013 as result of the acquisition of STW Fixed Income Management LLC (“STW”).

Messrs. Jewett, Rezek, Chorlton and Sutherland had been with STW for more than five years, each serving as Principal and Portfolio Manager. Mr. Bonilla, an STW Vice President and Portfolio Manager, had been with STW since March 2010, and prior

to that, was Senior Portfolio Manager at Wells Capital Management since June 2000.

II. CHANGES FOR THE

DEFENSIVE MARKET STRATEGIES FUND

Turner Investments, L.P. (“Turner”) has been terminated as sub-adviser to the Defensive

Market Strategies Fund. All references herein to Turner are deleted in their entirety.

Under the section disclosing

“Principal Investment Strategies” on page 86, the second bullet is deleted in its entirety and replaced with following disclosure:

|

|

•

|

|

The principal strategies, and the range of assets that will be allocated to each, is as follows:

|

|

|

|

|

|

|

|

Principal Strategy

|

|

Range of Assets

|

|

|

Long Only Equity

|

|

|

30%-80%

|

|

|

Convertible Bond

|

|

|

0%-50%

|

|

|

Long-Short Equity

|

|

|

0%-35%

|

|

|

Options Equity

|

|

|

0%-35%

|

|

Under the section disclosing “Principal Investment Strategies” on page 86, the

following disclosure is added after the sixth bullet:

|

|

•

|

|

The Options Equity Strategy seeks to capture potential value imbedded in equity index options’ pricing while holding a portfolio that is lower

volatility than the broader U.S. equity markets. The strategy involves the Fund writing cash settled put and call options on a stock index that are significantly “out of the money,” and fully covering those written put and call options

with a mixture of U.S. Treasury Bills and a portfolio of stocks that collectively has characteristics similar to the broader U.S. equity market. When the Fund writes a put option on an equity index, it agrees (in return for receipt of the option

price) to pay the option holder, upon exercise of the option prior to or upon expiration, the difference between the exercise price and price of the index if the index price is below the exercise price at the time of exercise or expiration. When the

Fund writes a call option on an index, it agrees (in return for receipt of the option price) to pay the option holder, upon exercise of the option prior to or upon expiration, the difference between the exercise price and price of the index if the

index price is above the exercise price at the time of exercise or expiration. By selling options that are significantly out of the money, the Fund seeks to profit from the sales price of the options while capitalizing on the general tendency of

options that are significantly out of the money at the time of sale to expire without worth and without being exercised by the holder.

|

ii

In the section disclosing “Sub-Advisers and Portfolio Managers” for

the Defensive Market Strategies Fund on page 89, the following disclosure is added:

|

|

|

|

|

|

|

Parametric Portfolio Associates LLC

|

|

|

|

|

|

|

|

Jay Strohmaier, CFA

Senior Portfolio Manager

|

|

Since March 2014

|

|

|

|

|

|

|

|

Daniel Wamre, CFA

Portfolio Manager

|

|

Since March 2014

|

|

|

|

|

|

|

|

Alex Zweber, CFA

Portfolio Manager

|

|

Since March 2014

|

|

|

|

|

|

|

|

Thomas Seto

Managing Director - Portfolio

Management and Trading

|

|

Since March 2014

|

|

|

Under the heading “Sub-Advisers,” the disclosure pertaining to Turner

Investments, L.P. for the Defensive Market Strategies Fund, beginning on page 142, is deleted in its entirety and replaced with the following:

Parametric Portfolio Associates LLC (“Parametric”), 3600 Minnesota Drive, Suite 325, Minneapolis, Minnesota 55435:

Founded in

1972, Parametric Clifton, a division of Parametric, (“Parametric Clifton”) delivers customized investment solutions to institutional investors. The firm specializes in strategies that seek to improve efficiency and returns while reducing

performance risk through low-cost, derivative-based strategic investment applications. As of December 31, 2013, Parametric had total firm assets under management of approximately $115.7 billion. Parametric Clifton uses a team approach to manage

an assigned portion of the Defensive Market Strategies Fund. The team is led by Jay Strohmaier, CFA, Senior Portfolio Manager, and includes Daniel Wamre, CFA, Portfolio Manager, Alex Zweber, CFA, Portfolio Manager, and Thomas Seto, Managing Director

of Portfolio Management and Trading at Parametric. Messrs. Strohmaier, Wamre and Zweber and Seto have served at Parametric Clifton and Parametric, respectively, for more than five years.

III. SUB-ADVISER CORPORATE REORGANIZATION FOR THE

GROWTH EQUITY FUND

All

references to Rainier Investment Management, Inc. are deleted in their entirety and replaced with Rainier Investment Management, LLC. There are no other changes to the disclosure.

IV. CHANGES FOR THE SMALL CAP EQUITY FUND

Western Asset Management Company and Western Asset Management Company Limited (together, “Western”) have been terminated as

sub-advisers to the Small Cap Equity Fund. All references herein to Western relative to the Small Cap Equity Fund are deleted in their entirety.

Under the section disclosing “Principal Investment Risks” on page 108, the third and fourth bullets are deleted

and the following disclosure is added:

|

|

•

|

|

The Fund may invest to a lesser extent in American Depositary Receipts, which represent ownership of underlying foreign securities that are

denominated in U.S. dollars, and regular shares of foreign companies traded and settled on U.S. exchanges and over-the-counter markets.

|

iii

Under the section disclosing “Principal Investment Risks” on page

109, the fourth, fifth and sixth bullets are deleted in their entirety.

In the section disclosing

“Sub-Advisers and Portfolio Managers” for the Small Cap Equity Fund on page 110, the following disclosure is added:

|

|

|

|

|

|

|

Snow Capital Management L.P.

|

|

|

|

|

|

|

|

Joshua R. Schachter, CFA

Portfolio Manager and Principal

|

|

Since March 2014

|

|

|

|

|

|

|

|

Anne S. Wickland

Co-Portfolio Manager and Principal

|

|

Since March 2014

|

|

|

Under the heading “Sub-Advisers,” the disclosure pertaining to Western Asset

Management Company and Western Asset Management Company Limited for the Small Cap Equity Fund beginning on page 146, is deleted in its entirety and replaced with the following:

Snow Capital Management L.P. (“Snow”), 2000 Georgetowne Drive, Suite 200, Sewickley, Pennsylvania 15143.

Snow is a boutique

investment manager offering several value strategies in multiple formats, and as of December 31, 2013, had assets under management of approximately $3.4 billion. The firm has been managing assets since 1980 through predecessor organizations.

The Small Cap Equity Fund portfolio account is managed by Joshua R. Schachter, CFA, Portfolio Manager and Principal, and Anne S. Wickland, CFA, Co-Portfolio Manager and Principal, who are jointly responsible for the day-to-day management of the

account. Mr. Schachter and Ms. Wickland have more than five years of experience with Snow.

V.

PORTFOLIO MANAGER CHANGE FOR THE

INTERNATIONAL EQUITY FUND

Effective immediately, Tom Record no longer serves as a portfolio manager for the portion of the International Equity Fund managed by Baillie

Gifford Overseas Limited. All references herein to Tom Record are deleted in their entirety.

PLEASE RETAIN THIS SUPPLEMENT FOR FUTURE

REFERENCE.

iv

GUIDESTONE FUNDS

Supplement dated March 13, 2014

to

Statement of Additional

Information (“SAI”) dated May 1, 2013, as amended October 31, 2013

This supplement provides new and additional

information beyond that contained in the SAI. It should be retained and read in conjunction with the SAI.

I.

CHANGES TO MANAGEMENT OF THE FUNDS

Under the heading “Management of the Funds”,

the table beginning on page 42, pertaining to the Trustees and executive officers of GuideStone Funds, is deleted in its entirety and replaced with the following

:

|

|

|

|

|

|

|

|

|

|

|

Name (Date of Birth), Address and

Position(s) with Trust

|

|

Term of Office

and Length of

Time Served

1

|

|

Principal Occupation(s)

During Past 5 Years

|

|

Number of

Portfolios

in Fund

Complex

Overseen

by Trustee

|

|

Other Trusteeships/

Directorships

Held by

Trustee

During Past 5 Years

|

|

|

|

INDEPENDENT TRUSTEES

|

|

|

|

|

|

|

|

Michael R. Buster (1957)

2401 Cedar Springs Road

Dallas,

TX 75201-1407

Trustee

|

|

Since 2002

|

|

Executive Pastor, Prestonwood Baptist Church, 1989 - present.

|

|

31

|

|

Ouachita Baptist University – Board of Trustees Member

|

|

|

|

|

|

|

|

Carson L. Eddy (1943)

2401 Cedar Springs Road

Dallas,

TX 75201-1407

Trustee

|

|

Since 2011

|

|

Retired - Partner in Charge (Orlando office), Carr, Riggs & Ingram, LLC, 2007 - 2013 - Certified Public Accountants; President, Quantum Consulting Group LLC, 2000 - 2013.

|

|

31

|

|

N/A

|

|

|

|

|

|

|

|

William Craig George (1958)

2401 Cedar Springs Road

Dallas,

TX 75201-1407

Trustee

|

|

Since 2004

|

|

Chief Credit Officer, CapStone Bank, 2011 - present; Executive Vice President/Regional Credit Officer, SunTrust Bank, 1995 - 2011.

|

|

31

|

|

N/A

|

|

|

|

|

|

|

|

Grady R. Hazel (1947)

2401 Cedar Springs Road

Dallas,

TX 75201-1407

Trustee

|

|

Since 2011

|

|

G400 Field Representative, American Institute of Certified Public Accountants, 2012 - present; Executive Director, Society of Louisiana CPAs, 1995 - 2012.

|

|

31

|

|

Neighbors Federal Credit Union – Board of Directors Member and Chairman of Audit Committee; Stonetrust Commercial Insurance Company – Board of Directors Member and Member of Audit Committee

|

|

|

|

|

|

|

|

Joseph A. Mack (1939)

2401 Cedar Springs Road

Dallas,

TX 75201-1407

Trustee

|

|

Since 2002

|

|

Retired - Director, Office of Public Policy, South Carolina Baptist Convention, 1999 - 2010.

|

|

31

|

|

N/A

|

|

|

|

|

|

|

|

Franklin R. Morgan (1943)

2401 Cedar Springs Road

Dallas,

TX 75201-1407

Trustee

|

|

Since 2005

|

|

Retired - Senior Vice President, Director of International Administration, Prudential Securities, Inc., January 1962 - May 2003.

|

|

31

|

|

N/A

|

|

|

|

|

|

|

|

Kyle Tucker (1981)

2401 Cedar Springs Road

Dallas,

TX 75201-1407

Trustee

|

|

Since 2013

|

|

Vice President and Financial Advisor – CAPTRUST Financial Advisors, 2007 - Present

|

|

31

|

|

N/A

|

|

|

|

INTERESTED TRUSTEES

2

|

|

|

|

|

|

|

|

Thomas G. Evans (1961)

2401 Cedar Springs Road

Dallas,

TX 75201-1407

Trustee

|

|

Since 2012

|

|

Appraiser, Manager and Owner, Encompass Financial Services, Inc., 1984 - present, President and Owner, Custom Land Management, LLC, 1984 - present; Manager, Private Partners Opportunity Fund, LLC, 2011 - present.

|

|

31

|

|

GuideStone Financial Resources – Board of Trustees Member, June 2010 – present; Baptist Foundation of Oklahoma, Board of Directors Member and Chairman, 2004 – present; Pioneer Spirit Foundation –

Board of Trustees Member, 1993 – present; GuideStone Capital Management, Board of Directors Member, July 2011 – July 2012.

|

i

|

|

|

|

|

|

|

|

|

|

|

Name (Date of Birth), Address and

Position(s) with Trust

|

|

Term of Office

and Length of

Time Served

1

|

|

Principal Occupation(s)

During Past 5 Years

|

|

Number of

Portfolios

in Fund

Complex

Overseen

by Trustee

|

|

Other Trusteeships/

Directorships

Held by

Trustee

During Past 5 Years

|

|

|

|

|

|

|

|

James W. Hixson (1931)

2401 Cedar Springs Road

Dallas,

TX 75201-1407

Trustee

|

|

Since 2010

|

|

Retired

|

|

31

|

|

GuideStone Financial Resources – Board of Trustees Member, June 2008 – present; GuideStone Advisors – Board of Directors Member, July 2008 – present; GuideStone Financial Services – Board of

Directors Member, July 2008 – present

|

|

|

|

OFFICERS WHO ARE NOT TRUSTEES

3

|

|

|

|

|

|

|

|

Ron W. Bass (1966)

2401 Cedar Springs Road

Dallas,

TX 75201-1407

Chief Compliance Officer and

AML Officer

|

|

Since 2009

|

|

Director of Broker/Dealer and RIA Compliance, GuideStone Financial Resources, June 2009 - present; Manager of Broker/Dealer and RIA Compliance, GuideStone Financial Resources, 2008 - May 2009.

|

|

N/A

|

|

N/A

|

|

|

|

|

|

|

|

Jeffrey P. Billinger (1946)

2401 Cedar Springs Road

Dallas,

TX 75201-1407

Vice President and Treasurer

|

|

Since 2000

|

|

Vice President, Treasurer and Chief Financial Officer, GuideStone Financial Resources, 1995 - present.

|

|

N/A

|

|

N/A

|

|

|

|

|

|

|

|

Rodric E. Cummins (1957)

2401 Cedar Springs Road

Dallas,

TX 75201-1407

Vice President and Investment Officer

|

|

Since 2000

|

|

Vice President and Chief Investment Officer, GuideStone Financial Resources, 1998 - present.

|

|

N/A

|

|

N/A

|

|

|

|

|

|

|

|

Ronald C. Dugan, Jr. (1962)

2401 Cedar Springs Road

Dallas,

TX 75201-1407

Vice President and Investment Officer

|

|

Since 2010

|

|

Vice President and Chief Strategic Investment Officer, GuideStone Financial Resources, 2013 - present; Director of Global Investment Strategies, GuideStone Financial Resources, 2010 - 2013; Managing Director, Equities, Russell

Investments, 2000 - 2010.

|

|

N/A

|

|

N/A

|

|

|

|

|

|

|

|

John R. Jones (1953)

2401 Cedar Springs Road

Dallas,

TX 75201-1407

President

|

|

Since 2000

|

|

Executive Vice President and Chief Operating Officer, GuideStone Financial Resources, 1997 - present.

|

|

N/A

|

|

N/A

|

|

|

|

|

|

|

|

Cherika N. Latham (1982)

2401 Cedar Springs Road

Dallas,

TX 75201-1407

Chief Legal Officer and Secretary

|

|

Since 2013

|

|

Assistant Secretary, GuideStone Financial Resources, 2008 - present.

|

|

N/A

|

|

N/A

|

|

(1)

|

Each Independent Trustee serves until his or her resignation, removal or mandatory retirement. Each Interested Trustee serves until his or her

resignation, removal or mandatory retirement or until he or she ceases to be a member of the board of trustees of GuideStone Financial Resources. All Trustees must retire after reaching the age of seventy-seven years or after achieving ten years of

service, whichever occurs last. Officers serve at the pleasure of the Board of Trustees.

|

|

(2)

|

Messrs. Evans and Hixson are “interested persons” of the Trust as the term is defined in the 1940 Act due to their positions on the Board

of Trustees of GuideStone Financial Resources.

|

|

(3)

|

The officers of the Trust may be deemed to be affiliates of the Adviser due to their positions with the Adviser and/or GuideStone Financial

Resources.

|

II. CHANGES FOR THE EXTENDED-DURATION BOND FUND

Effective immediately, William H. Williams no longer serves as a portfolio manager for the portion of the Extended-Duration Bond Fund managed

by Schroder Investment Management North America Inc. All references herein to William H. Williams are deleted in their entirety.

III. CHANGES FOR THE DEFENSIVE MARKET STRATEGIES FUND

Turner Investments, L.P. (“Turner”) has been terminated as sub-adviser to the Defensive Market Strategies Fund. All references

herein to Turner are deleted in their entirety.

ii

In the section entitled “Control Persons of Sub-Advisers” under the

sub-heading for the Defensive Market Strategies Fund, on page 54, the following paragraph is added:

Parametric Portfolio

Associates LLC (“Parametric”), 3600 Minnesota Drive, Suite 325, Minneapolis, Minnesota 55435

: Parametric is a registered investment adviser offering a variety of structure portfolio solutions. Parametric is 92% owned by Eaton Vance

Corp., a Boston-based investment management firm, and 8% owned by current and former employees of Parametric.

In the

section entitled “Portfolio Manager Compensation”, beginning on page 69, the following disclosure pertaining to Parametric Portfolio Associates LLC, which is current as of December 31, 2013, is added:

Parametric Portfolio Associates LLC (“Parametric”).

Parametric’s compensation structure for senior portfolio managers

consists of a fixed base salary and an incentive bonus that is determined annually based on a percentage of the firm’s operating profit. In addition, senior portfolio managers who are also principals of the firm receive quarterly equity-based

distributions based on their percentage of ownership of the firm. Other investment professionals receive a fixed base salary and an annual discretionary bonus that is determined based on the individual’s performance and the financial

performance of the firm. Individual investment professional performance is assessed by the chief investment officer based on the quality of service and advice provided to clients and the level of value added to the investment team and Parametric.

None of the investment professionals’ compensation is directly tied to account performance or the value of assets held in accounts or growth in the value of accounts. Some portfolio managers who are not currently equity owners of the firm may

receive an incentive grant that has some of the characteristics of actual equity ownership but is not actual equity in the firm (i.e., phantom equity).

In Appendix B – Descriptions of Proxy Voting Procedures, the following disclosure is added:

Parametric Portfolio Associates LLC (“Parametric”).

Parametric acts as a discretionary investment adviser for various

clients, which may include clients governed by the Employee Retirement Income Security Act of 1974 (“ERISA”). While Parametric’s standard policy is to not vote proxies for clients, the firm’s authority to vote proxies or act with

respect to other shareholder actions may be established through the delegation of discretionary authority under an investment advisory contract. Therefore, unless a client (including a “named fiduciary” under ERISA) specifically reserves

the right, in writing, in the investment management agreement or in a supplemental written communication, to vote its own proxies or to take shareholder action with respect to other corporate actions requiring shareholder actions, Parametric will

vote all proxies and act on all other actions in a timely manner as part of the firm’s full discretionary authority over client assets in accordance with the proxy voting policies and procedures. Corporate actions may include, for example and

without limitation, tender offers or exchanges, bankruptcy proceedings and class actions.

For proxies voted by Parametric, the firm

receives proxies and votes them in a timely manner and in a manner consistent with the determination of the client’s best interests. Each proxy issue will be considered individually. Proxy voting may be different for different types of clients.

Although many proxy proposals can be voted in accordance with established guidelines (the “Guidelines”), it is recognized that some proposals require special consideration which may dictate that an exception is made to the Guidelines.

Parametric will review all proxy proposals for conflicts of interest as part of the overall vote review process. Where a proxy proposal raises

a material conflict between Parametric’s interests and a client’s interest, the firm will resolve such a conflict in one or more of the following manners: vote in accordance with the Guidelines; obtain consent of clients; and/or client

directive to use an independent third party. To

iii

the extent that Parametric has little or no discretion to deviate from the Guidelines with respect to the proposal in question, the firm will vote in accordance with the pre-determined voting

policy. To the extent that Parametric has discretion to deviate from the Guidelines with respect to the proposal in question, the firm will disclose the conflict to the relevant clients and obtain their consent to the proposed vote prior to voting

the securities. If a client does not respond to such a conflict disclosure request or denies the request, Parametric will abstain from voting the securities held by the client’s account. Lastly, a client may, in writing, specifically direct

Parametric to forward all proxy matters in which the firm has a conflict of interest regarding the client’s securities to an identified independent third party for review and recommendation. When the independent third party’s

recommendations are received on a timely basis, Parametric will vote all such proxies in accordance with the third party’s recommendation; whereas, if the third party’s recommendations are not received in a timely manner, Parametric will

abstain from voting the securities held by that client’s account.

IV. SUB-ADVISER CORPORATE REORGANIZATION

FOR THE

GROWTH EQUITY FUND

All references to Rainier Investment Management, Inc. are deleted in their entirety and replaced with Rainier Investment Management, LLC.

There are no other changes to the disclosure.

V. CHANGES FOR THE SMALL CAP EQUITY FUND

Western Asset Management Company and Western Asset Management Company Limited (together, “Western”) have been terminated as

sub-advisers to the Small Cap Equity Fund. All references herein to Western relative to the Small Cap Equity Fund are deleted in their entirety.

In the section entitled “Control Persons of Sub-Advisers” under the sub-heading for the Small Cap Equity Fund,

beginning on page 56, the following paragraph is added:

Snow Capital Management L.P. (“Snow”), 2000 Georgetowne Drive,

Suite 200, Sewickley, Pennsylvania 15143:

Snow is a registered investment advisory firm that provides investment and capital management services. Snow Capital Management Inc. (“SCM Inc.”) is the general partner of Snow. Richard A. Snow

is the President and sole shareholder of SCM Inc. Mr. Snow and related entities own 61% of the ownership interest in the voting stock of Snow. SCM Inc. and Snow were formed on August 7, 2001, and Snow has operated as an investment advisory

firm since that time.

In the section entitled “Portfolio Manager Compensation”, beginning on page 69, the

following disclosure pertaining to Snow Capital Management L.P., which is current as of December 31, 2013, is added:

Snow

Capital Management L.P. (“Snow”).

Each of the portfolio managers receives compensation in the form of a fixed salary. Portfolio managers are also eligible for a bonus, which is based on the overall profitability of Snow. Additionally,

a portfolio manager may receive equity dividends from his or her ownership in the firm.

In Appendix B –

Descriptions of Proxy Voting Procedures, the following disclosure is added:

Snow Capital Management L.P.

(“Snow”)

.

When delegated authority, Snow votes all proxies relating to the securities held within those client accounts managed by the firm. Snow’s primary objective when voting proxies is to make voting decisions in a

method that the firm believes is most likely to increase the

iv

value of the securities within the portfolio. Snow has adopted procedures and policies formulated to ensure that the firm considers the client’s interests, and not Snow’s interests,

when voting proxies and that any material conflicts that may arise are properly addressed and resolved. The firm utilizes a third party proxy voting service, which includes electronic voting services and research. In addition, Snow conducts its own

proxy research by reading proxies and proposals for each security while using third party research as a guide.

VI. PORTFOLIO MANAGER CHANGE FOR THE

INTERNATIONAL EQUITY FUND

Effective immediately, Tom Record no longer serves as a portfolio manager for the portion of the International Equity Fund managed by Baillie

Gifford Overseas Limited. All references herein to Tom Record are deleted in their entirety.

v

VII. CHANGES TO OTHER ACCOUNTS MANAGED

The “Other Accounts Managed” chart, beginning on page 60, is amended to include information for Parametric

Portfolio Associates LLC and Snow Capital Management L.P. This information is current as of December 31, 2013.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Sub-Advisers

Portfolio Managers

|

|

Total number of other accounts managed by Portfolio Manager(s) within

each category below and the total assets in the accounts managed within

each category below.

|

|

|

For other accounts managed by Portfolio Manager(s) within each

category below, number of accounts and the total assets in the accounts

with respect to which the

advisory fee is based on the performance of the

account.

|

|

|

|

Registered Investment

Companies

|

|

|

Other Pooled

Investment Vehicles

|

|

|

Other Accounts

|

|

|

Registered Investment

Companies

|

|

|

Other Pooled

Investment Vehicles

|

|

|

Other Accounts

|

|

|

|

Number

of

Accounts

|

|

|

Total

Assets

($mm)

|

|

|

Number

of

Accounts

|

|

|

Total

Assets

($mm)

|

|

|

Number

of

Accounts

|

|

|

Total

Assets

($mm)

|

|

|

Number

of

Accounts

|

|

|

Total

Assets

($mm)

|

|

|

Number

of

Accounts

|

|

|

Total

Assets

($mm)

|

|

|

Number

of

Accounts

|

|

|

Total

Assets

($mm)

|

|

|

Parametric Portfolio

Associates LLC

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Jay Strohmaier, CFA

|

|

|

N/A

|

|

|

|

N/A

|

|

|

|

1

|

|

|

$

|

680

|

|

|

|

28

|

|

|

$

|

2,471

|

|

|

|

N/A

|

|

|

|

N/A

|

|

|

|

N/A

|

|

|

|

N/A

|

|

|

|

N/A

|

|

|

|

N/A

|

|

|

Daniel Wamre, CFA

|

|

|

N/A

|

|

|

|

N/A

|

|

|

|

N/A

|

|

|

|

N/A

|

|

|

|

42

|

|

|

$

|

2,503

|

|

|

|

N/A

|

|

|

|

N/A

|

|

|

|

N/A

|

|

|

|

N/A

|

|

|

|

N/A

|

|

|

|

N/A

|

|

|

Alex Zweber, CFA

|

|

|

N/A

|

|

|

|

N/A

|

|

|

|

N/A

|

|

|

|

N/A

|

|

|

|

29

|

|

|

$

|

2,465

|

|

|

|

N/A

|

|

|

|

N/A

|

|

|

|

N/A

|

|

|

|

N/A

|

|

|

|

N/A

|

|

|

|

N/A

|

|

|

Thomas Seto

|

|

|

24

|

|

|

$

|

16,321

|

|

|

|

5

|

|

|

$

|

3,828

|

|

|

|

8,589

|

|

|

$

|

49,007

|

|

|

|

N/A

|

|

|

|

N/A

|

|

|

|

N/A

|

|

|

|

N/A

|

|

|

|

2

|

|

|

$

|

1,314

|

|

|

Snow Capital

Management L.P.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Joshua R. Schachter,

CFA

|

|

|

3

|

|

|

$

|

88

|

|

|

|

N/A

|

|

|

|

N/A

|

|

|

|

2,371

|

|

|

$

|

2,401

|

|

|

|

N/A

|

|

|

|

N/A

|

|

|

|

N/A

|

|

|

|

N/A

|

|

|

|

N/A

|

|

|

|

N/A

|

|

|

Anne S. Wickland,

CFA

|

|

|

2

|

|

|

$

|

87

|

|

|

|

N/A

|

|

|

|

N/A

|

|

|

|

8

|

|

|

$

|

249

|

|

|

|

N/A

|

|

|

|

N/A

|

|

|

|

N/A

|

|

|

|

N/A

|

|

|

|

N/A

|

|

|

|

N/A

|

|

PLEASE RETAIN THIS SUPPLEMENT FOR FUTURE REFERENCE.

vi

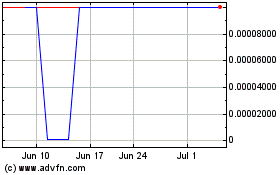

Amarantus Bioscience (CE) (USOTC:AMBS)

Historical Stock Chart

From Mar 2024 to Apr 2024

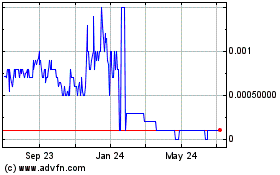

Amarantus Bioscience (CE) (USOTC:AMBS)

Historical Stock Chart

From Apr 2023 to Apr 2024