- Record revenue of $138.2 million up 5% over first

quarter 2011

- Record EBITDA of $17.3 million up 55% over first

quarter 2011

- Record earnings from continuing operations per diluted

common share of $0.08 versus a loss of $0.19 in first quarter

2011

Churchill Downs Incorporated (Nasdaq:CHDN) ("Company") today

reported results for the first quarter ended March 31, 2012.

Due primarily to revenue growth of 20% within CDI's

Online Business segment, the Company's net revenues from continuing

operations for the first quarter of 2012 increased 5% to $138.2

from $131.6 million during the same period of the prior year.

CDI's online wagering company, Twinspires.com,

experienced a handle increase of 15.2% as compared to the

prior-year period driven primarily by new customer growth. During

the first quarter of 2012, total wagering on U.S. Thoroughbred

races increased 5.4% compared to the same period in 2011, according

to statistics released by the Equibase Company.

Quarter-over-quarter EBITDA (earnings before interest, taxes,

depreciation, and amortization) grew to $17.3 million, compared to

EBITDA of $11.2 million during the first quarter of 2011. EBITDA

from our Online business increased $2.9 million, or 38%.

Our Gaming Business segment EBITDA increased $2.9 million, or

16%, and benefitted from insurance recoveries, net of losses of

$1.5 million, which reflects the settlement of our 2011 wind damage

claim sustained at Harlow's Casino Resort & Hotel ("Harlow's.")

Additionally, Calder Casino received $0.8 million in proceeds for a

non-recurring reimbursement of administrative expenses.

Net earnings from continuing operations for the period were $1.4

million, or $0.08 per diluted common share, compared to a net loss

from continuing operations of $3.2 million, or $0.19 per diluted

common share, during the first quarter of 2011.

CDI Chairman and Chief Executive Officer Robert L. Evans said

the first quarter results show the positive effect the new business

model is having:

"All three of our business segments, Racing, Gaming and Online,

showed improved EBITDA performance in the first quarter leading to

positive first quarter earnings from continuing operations.

Historically, the seasonal nature of our racing operations resulted

in losses for the quarter, but the diversification of our business

model into our Gaming and Online Businesses more than offset first

quarter losses from Racing.

"While our first quarter results do not reflect the economics of

Kentucky Oaks and Kentucky Derby, I have to mention the exciting

week we just concluded starting with our Opening Night event on

Saturday, April 28, and ending with an incredible Kentucky Derby on

Saturday, May 5.

"Oaks Day attendance of 112,552 was the second-highest ever.

Total all-sources handle on the Oaks Day card totaled a record

$39.9 million, up 7% over 2011's $37.5 million, the previous

record.

"The Oaks and our Thursday night Taste of Derby event generated

approximately $200,000 for our cancer and hunger charitable

partners. These two events have generated over $700,000 in

charitable contributions since we started the now famous Oaks "Pink

Out" in 2009 and the Taste of Derby event in 2010.

"And then there was the Kentucky Derby; pick a record and we

probably set it this year. Attendance was a record 165,307, up from

the previous record of 164,858 set last year. All-sources handle

for the 13 Derby Day races totaled a record $187.0 million, up 13%

from last year's $165.2 million, and 7% above the previous record

of $175.1 million set in 2006.

"Handle on just the Kentucky Derby race was $133.1 million, up

19% from last year's $112 million and 12% higher than the previous

record of $118.4 million set in 2006.

"While still preliminary and subject to change, Oaks and Derby

Week EBITDA will be approximately $4.5 to $5.5 million higher than

in 2011, and will be a new record.

"Finally, on behalf of our investors, our Board of Directors and

our management team, I want to thank our fans, our sponsors, our

partners at NBC Sports and, most of all, the horsemen and our over

11,000 full and part-time employees who put on this spectacular

event."

A conference call regarding this news release is scheduled for

Tuesday, May 8, 2012, at 9 a.m. ET. Investors and other interested

parties may listen to the teleconference by accessing the online,

real-time webcast and broadcast of the call at

www.churchilldownsincorporated.com or www.earnings.com, or by

dialing (877) 372-0878 and entering the pass code75239964 at least

10 minutes before the appointed time. International callers should

dial (253) 237-1169. The online replay will be available at

approximately noon EDT and continue for two weeks. A copy of the

Company's news release announcing quarterly results and relevant

financial and statistical information about the period will be

accessible at www.churchilldownsincorporated.com.

In addition to the results provided in accordance with U.S.

Generally Accepted Accounting Principles ("GAAP"), the Company has

provided a non-GAAP measurement, which presents a financial measure

of earnings before interest, taxes, depreciation and amortization

("EBITDA"). Churchill Downs Incorporated uses EBITDA as a key

performance measure of results of operations for purposes of

evaluating performance internally. The Company believes the use of

this measure enables management and investors to evaluate and

compare, from period to period, the Company's operating performance

in a meaningful and consistent manner. This non-GAAP measurement is

not intended to replace the presentation of the Company's financial

results in accordance with GAAP.

ABOUT CHURCHILL DOWNS INCORPORATED

Churchill Downs Incorporated ("CDI") (Nasdaq:CHDN),

headquartered in Louisville, Ky., owns and operates the

world-renowned Churchill Downs Racetrack, home of the Kentucky

Derby and Kentucky Oaks, as well as racetrack and casino operations

and a poker room in Miami Gardens, Fla.; racetrack, casino and

video poker operations in New Orleans, La.; racetrack operations in

Arlington Heights, Ill.; and a casino resort in Greenville, Miss.

CDI also owns the country's premier account-wagering company,

TwinSpires.com, and other advance-deposit wagering providers; the

totalisator company, United Tote; Bluff Media, an Atlanta-based

multimedia poker content, brand and publishing company; and a

collection of racing-related telecommunications and data companies.

Information about CDI can be found online at

www.churchilldownsincorporated.com.

Information set forth in this news release contains various

"forward-looking statements" within the meaning of Section 27A of

the Securities Act of 1933 and Section 21E of the Securities

Exchange Act of 1934. The Private Securities Litigation Reform Act

of 1995 (the "Act") provides certain "safe harbor" provisions for

forward-looking statements. All forward-looking statements made in

this news release are made pursuant to the Act. The reader is

cautioned that such forward-looking statements are based on

information available at the time and/or management's good faith

belief with respect to future events, and are subject to risks and

uncertainties that could cause actual performance or results to

differ materially from those expressed in the statements.

Forward-looking statements speak only as of the date the statement

was made. We assume no obligation to update forward-looking

information to reflect actual results, changes in assumptions or

changes in other factors affecting forward-looking information.

Forward-looking statements are typically identified by the use of

terms such as "anticipate," "believe," "could," "estimate,"

"expect," "intend," "may," "might," "plan," "predict," "project,"

"should," "will," and similar words, although some forward-looking

statements are expressed differently. Although we believe that the

expectations reflected in such forward-looking statements are

reasonable, we can give no assurance that such expectations will

prove to be correct. Important factors that could cause actual

results to differ materially from expectations include: the effect

of global economic conditions, including any disruptions in the

credit markets; a decrease in consumers' discretionary income; the

effect (including possible increases in the cost of doing business)

resulting from future war and terrorist activities or political

uncertainties; the overall economic environment; the impact of

increasing insurance costs; the impact of interest rate

fluctuations; the effect of any change in our accounting policies

or practices; the financial performance of our racing operations;

the impact of gaming competition (including lotteries, online

gaming and riverboat, cruise ship and land-based casinos) and other

sports and entertainment options in the markets in which we

operate; our ability to maintain racing and gaming licenses to

conduct our businesses; the impact of live racing day competition

with other Florida, Illinois and Louisiana racetracks within those

respective markets; the impact of higher purses and other

incentives in states that compete with our racetracks; costs

associated with our efforts in support of alternative gaming

initiatives; costs associated with customer relationship management

initiatives; a substantial change in law or regulations affecting

pari-mutuel and gaming activities; a substantial change in

allocation of live racing days; changes in Kentucky, Florida,

Illinois or Louisiana law or regulations that impact revenues or

costs of racing operations in those states; the presence of

wagering and gaming operations at other states' racetracks and

casinos near our operations; our continued ability to effectively

compete for the country's horses and trainers necessary to achieve

full field horse races; our continued ability to grow our share of

the interstate simulcast market and obtain the consents of

horsemen's groups to interstate simulcasting; our ability to enter

into agreements with other industry constituents for the purchase

and sale of racing content for wagering purposes; our ability to

execute our acquisition strategy and to complete or successfully

operate planned expansion projects; our ability to successfully

complete any divestiture transaction; market reaction to our

expansion projects; the inability of our totalisator company,

United Tote, to maintain its processes accurately or keep its

technology current; our accountability for environmental

contamination; the inability of our Online Business to prevent

security breaches within its online technologies; the loss of key

personnel; the impact of natural and other disasters on our

operations and our ability to obtain insurance recoveries in

respect of such losses (including losses related to business

interruption); our ability to integrate any businesses we acquire

into our existing operations, including our ability to maintain

revenues at historic levels and achieve anticipated cost savings;

the impact of wagering laws, including changes in laws or

enforcement of those laws by regulatory agencies; the outcome of

pending or threatened litigation; changes in our relationships with

horsemen's groups and their memberships; our ability to reach

agreement with horsemen's groups on future purse and other

agreements (including, without limiting, agreements on sharing of

revenues from gaming and advance deposit wagering); the effect of

claims of third parties to intellectual property rights; and the

volatility of our stock price.

You should read this discussion in conjunction with the

Condensed Consolidated Financial Statements included in this

Quarterly Report on Form 10-Q and the Company's Annual Report on

Form 10-K for the year ended December 31, 2011 for further

information, including Part I – Item 1A, "Risk Factors" for a

discussion regarding some of the reasons that actual results may be

materially different from those we anticipate, as modified by Part

II – Item 1A, "Risk Factors" of this Quarterly Report on Form

10-Q.

| |

| CHURCHILL DOWNS

INCORPORATED |

| CONDENSED CONSOLIDATED

STATEMENTS OF NET EARNINGS (LOSS) AND COMPREHENSIVE

EARNINGS |

| for the three months

ended March 31, 2012 and 2011 |

| (Unaudited) (In

thousands, except per share data) |

| |

Three Months

Ended |

| |

March

31, |

| |

2012 |

2011 |

% Change |

| Net revenues |

|

|

|

| Racing |

$ 30,182 |

$ 31,628 |

(5) |

| Gaming |

59,336 |

59,087 |

-- |

| Online |

44,035 |

36,803 |

20 |

| Other |

4,643 |

4,036 |

15 |

| |

138,196 |

131,554 |

5 |

| Operating expenses |

|

|

|

| Racing |

42,988 |

45,585 |

(6) |

| Gaming |

40,940 |

41,402 |

(1) |

| Online |

30,151 |

26,365 |

14 |

| Other |

5,709 |

5,051 |

13 |

| Selling, general and administrative

expenses |

16,199 |

16,004 |

1 |

| Insurance recoveries, net of losses |

(1,511) |

-- |

NM |

| |

|

|

|

| Operating income (loss) |

3,720 |

(2,853) |

F |

| |

|

|

|

| Other income (expense): |

|

|

|

| Interest income |

18 |

68 |

(74) |

| Interest expense |

(1,223) |

(2,460) |

(50) |

| Equity in loss of unconsolidated

investments |

(220) |

(416) |

(47) |

| Miscellaneous, net |

33 |

457 |

(93) |

| |

(1,392) |

(2,351) |

(41) |

| Earnings (loss) from continuing operations

before (provision) benefit for income taxes |

2,328 |

(5,204) |

F |

| Income tax (provision) benefit |

(974) |

2,018 |

U |

| Earnings (loss) from continuing

operations |

1,354 |

(3,186) |

F |

| Discontinued operations, net of income

taxes: |

|

|

|

| (Loss) earnings from operations |

(1) |

1 |

U |

| Net earnings (loss) and comprehensive

earnings |

$ 1,353 |

$ (3,185) |

F |

| |

|

|

|

| |

|

|

|

| Net earnings (loss) per common share

data: |

|

|

|

| Basic |

$ 0.08 |

$ (0.19) |

F |

| Diluted |

$ 0.08 |

$ (0.19) |

F |

| |

|

|

|

| Weighted average shares outstanding: |

|

|

|

| Basic |

16,903 |

16,358 |

|

| Diluted |

17,433 |

16,358 |

|

| |

|

|

|

| |

|

|

|

| NM: Not

meaningful

U: >100%

unfavorable

F: >100% favorable |

|

|

|

| |

|

|

|

| CHURCHILL DOWNS

INCORPORATED |

| SUPPLEMENTAL

INFORMATION BY OPERATING UNIT |

| for the three months

ended March 31, 2012 and 2011 |

| (Unaudited)

(In thousands) |

| |

Three Months

Ended |

| |

March

31, |

| |

2012 |

2011 |

% Change |

| |

|

|

|

| Net revenues from external

customers: |

|

|

|

| Churchill Downs |

$ 2,550 |

$ 2,322 |

10 |

| Arlington Park |

9,417 |

9,348 |

1 |

| Calder |

1,868 |

2,668 |

(30) |

| Fair Grounds |

16,347 |

17,290 |

(5) |

| Total Racing

Operations |

30,182 |

31,628 |

(5) |

| Calder Casino |

21,879 |

20,612 |

6 |

| Fair Ground Slots |

12,031 |

12,171 |

(1) |

| VSI |

9,563 |

9,427 |

1 |

| Harlow's Casino |

15,863 |

16,877 |

(6) |

| Total Gaming |

59,336 |

59,087 |

-- |

| Online Business |

44,035 |

36,803 |

20 |

| Other Investments |

4,502 |

3,965 |

14 |

| Corporate |

141 |

71 |

99 |

| Net revenues from external

customers |

$ 138,196 |

$ 131,554 |

5 |

| |

|

|

|

| Intercompany net

revenues: |

|

|

|

| Churchill Downs |

$ 186 |

$ 148 |

26 |

| Arlington Park |

556 |

533 |

4 |

| Calder |

10 |

61 |

(84) |

| Fair Grounds |

747 |

778 |

(4) |

| Total Racing

Operations |

1,499 |

1,520 |

(1) |

| Online Business |

206 |

196 |

5 |

| Other Investments |

750 |

599 |

25 |

| Eliminations |

(2,455) |

(2,315) |

(6) |

| Intercompany net

revenues |

$ -- |

$ -- |

-- |

| |

|

|

|

| Reconciliation of Segment

EBITDA to net earnings (loss): |

|

|

| Racing Operations |

$ (11,539) |

$ (12,638) |

9 |

| Gaming |

20,389 |

17,533 |

16 |

| Online Business |

10,421 |

7,545 |

38 |

| Other Investments |

(330) |

(92) |

U |

| Corporate |

(1,601) |

(1,174) |

(36) |

| Total EBITDA |

17,340 |

11,174 |

55 |

| Depreciation and amortization |

(13,807) |

(13,986) |

(1) |

| Interest income (expense), net |

(1,205) |

(2,392) |

(50) |

| Income tax (provision) benefit |

(974) |

2,018 |

U |

| Earnings (loss) from

continuing operations |

1,354 |

(3,186) |

F |

| Discontinued operations, net of income

taxes |

(1) |

1 |

U |

| Net earnings

(loss) |

$ 1,353 |

$ (3,185) |

F |

| |

|

|

|

| |

|

|

|

| NM: Not

meaningful

U: >100%

unfavorable

F: >100% favorable |

| |

|

|

|

| |

|

|

|

|

| CHURCHILL DOWNS

INCORPORATED |

| SUPPLEMENTAL

INFORMATION BY OPERATING UNIT |

| for the three months

ended March 31, 2012 and 2011 |

| (Unaudited) (In

thousands) |

| |

|

|

|

|

| |

Three Months

Ended March 31, |

Change |

| Management fee (expense)

income: |

2012 |

2011 |

$ |

% |

| Racing Operations |

$ (1,406) |

$ (1,462) |

$ (56) |

-4% |

| Gaming |

(2,633) |

(2,607) |

26 |

1% |

| Online Business |

(1,963) |

(1,632) |

331 |

20% |

| Other Investments |

(227) |

(201) |

26 |

13% |

| Corporate |

6,229 |

5,902 |

(327) |

6% |

| Total

management fees |

$ -- |

$ -- |

$ -- |

-- |

| |

|

|

|

|

| |

|

|

| CHURCHILL DOWNS

INCORPORATED |

| CONDENSED, CONSOLIDATED

STATEMENT OF CASH FLOWS |

| for the three months

ended March 31, 2012 and 2011 |

| (Unaudited) (In

thousands) |

| |

|

|

| |

2012 |

2011 |

| Cash flows from operating

activities: |

|

|

| Net earnings (loss) |

$ 1,353 |

$ (3,185) |

| Adjustments to reconcile net earnings

(loss) to net cash provided by operating activities: |

|

|

| Depreciation and amortization |

13,807 |

13,986 |

| Asset impairment loss |

1,369 |

60 |

| Gain on asset disposition |

(21) |

-- |

| Equity in losses of unconsolidated

investments |

220 |

416 |

| Unrealized gain on derivative

instruments |

-- |

(204) |

| Share-based compensation |

1,924 |

1,531 |

| Other |

228 |

271 |

| Increase

(decrease) in cash resulting from changes in operating assets and

liabilities, net of business acquisition: |

| Restricted

cash |

4,327 |

6,547 |

| Accounts

receivable |

7,160 |

10,451 |

| Other current

assets |

(7,280) |

(5,129) |

| Accounts

payable |

(2,399) |

(2,349) |

| Purses

payable |

209 |

(3,189) |

| Accrued

expenses |

(5,462) |

(2,774) |

| Deferred

revenue |

38,782 |

37,774 |

| Income taxes

receivable and payable |

110 |

5,163 |

| Other assets

and liabilities |

782 |

1,106 |

|

Net cash provided by operating activities |

55,109 |

60,475 |

| Cash flows from investing

activities: |

|

|

| Additions to property and equipment |

(9,120) |

(5,517) |

| Acquisition of business, net of cash |

(6,630) |

-- |

| Investment in joint venture |

(4,275) |

-- |

| Purchases of minority investments |

(1,482) |

-- |

| Assumption of note receivable |

(1,100) |

-- |

| Proceeds on sale of property and

equipment |

65 |

46 |

| Proceeds from insurance recoveries |

1,369 |

-- |

| Change in deposit wagering asset |

(1,675) |

388 |

| Net cash used

in investing activities |

(22,848) |

(5,083) |

| Cash flows from financing

activities: |

|

|

| Borrowings on bank line of credit |

79,135 |

72,436 |

| Repayments on bank line of credit |

(98,936) |

(114,683) |

| Change in book overdraft |

(3,241) |

(4,064) |

| Payment of dividends |

(10,110) |

(8,165) |

| Repurchase of common stock |

(268) |

(151) |

| Common stock issued |

391 |

-- |

| Windfall tax benefit from share-based

compensation |

443 |

-- |

| Change in deposit wagering liability |

1,882 |

(318) |

| Net cash used

in financing activities |

(30,704) |

(54,945) |

| Net increase in cash and cash

equivalents |

1,557 |

447 |

| Cash and cash equivalents, beginning of

period |

27,325 |

26,901 |

| Cash and cash equivalents, end of period |

$ 28,882 |

$ 27,348 |

| |

|

|

| |

|

|

| CHURCHILL DOWNS

INCORPORATED |

| CONDENSED CONSOLIDATED

BALANCE SHEETS |

| As of March 31, 2012,

and December 31, 2011 |

| (in

thousands) |

| |

|

|

| |

|

|

| |

March 31, |

December 31, |

| ASSETS |

2012 |

2011 |

| Current assets: |

|

|

| Cash and cash equivalents |

$ 28,882 |

$ 27,325 |

| Restricted cash |

41,907 |

44,559 |

| Accounts receivable, net |

24,118 |

49,773 |

| Deferred income taxes |

8,018 |

8,727 |

| Income taxes receivable |

3,569 |

3,679 |

| Other current assets |

17,551 |

10,399 |

| Total current assets |

124,045 |

144,462 |

| |

|

|

| Property and equipment, net |

475,480 |

477,356 |

| Goodwill |

216,883 |

213,712 |

| Other intangible assets, net |

106,811 |

103,827 |

| Other assets |

13,969 |

8,665 |

| Total assets |

$ 937,188 |

$ 948,022 |

| |

|

|

| LIABILITIES AND SHAREHOLDERS'

EQUITY |

|

|

| Current liabilities: |

|

|

| Accounts payable |

$ 53,422 |

$ 56,514 |

| Bank overdraft |

2,232 |

5,473 |

| Purses payable |

20,275 |

20,066 |

| Accrued expenses |

39,649 |

47,816 |

| Dividends payable |

-- |

10,110 |

| Deferred revenue |

56,035 |

33,472 |

| Total current

liabilities |

171,613 |

173,451 |

| |

|

|

| Long-term debt |

107,761 |

127,563 |

| Other liabilities |

30,621 |

29,542 |

| Deferred revenue |

18,860 |

17,884 |

| Deferred income taxes |

15,552 |

15,552 |

| Total liabilities |

344,407 |

363,992 |

| |

|

|

| Commitments and contingencies |

|

|

| Shareholders' equity: |

|

|

| Preferred stock, no par value; 250 shares

authorized; no shares issued |

-- |

-- |

| Common stock, no par value; 50,000 shares

authorized; 17,347 shares issued at March 31, 2012 and 17,178

shares issued at December 31, 2011 |

267,597 |

260,199 |

| Retained earnings |

325,184 |

323,831 |

| Total shareholders'

equity |

592,781 |

584,030 |

| Total liabilities and

shareholders' equity |

$ 937,188 |

$ 948,022 |

| |

|

|

CONTACT: Courtney Yopp Norris

(502) 636-4564

Courtney.Norris@kyderby.com

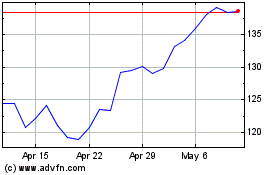

Churchill Downs (NASDAQ:CHDN)

Historical Stock Chart

From Apr 2024 to May 2024

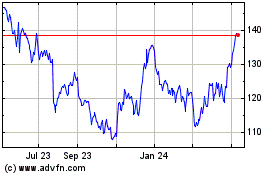

Churchill Downs (NASDAQ:CHDN)

Historical Stock Chart

From May 2023 to May 2024