Delaware North Companies Gaming & Entertainment, one of the

most innovative gaming and racing operators in the country, and

Churchill Downs Incorporated ("CDI") (Nasdaq:CHDN), a premier

racing, gaming and entertainment company, today announced their

joint venture to purchase Lebanon Raceway in Lebanon, Ohio, and

develop a new video lottery terminal (VLT) facility with up to

2,500 VLTs and a harness racetrack.

Through a joint venture agreement, Delaware North Companies

Gaming & Entertainment and CDI have formed a new company, Miami

Valley Gaming & Racing, LLC ("Miami Valley Gaming"), to manage

the development and operation of the VLT facility and racetrack.

Miami Valley Gaming has entered into an asset purchase agreement

through which it intends to acquire the harness racing licenses and

certain assets held by Lebanon Trotting Club Inc. (controlled by

the Carlo family) and Miami Valley Trotting Inc. (controlled by the

Nixon family). These two entities currently conduct harness racing

at Lebanon Raceway at the Warren County Fairgrounds. Miami Valley

Gaming intends to acquire these assets for an aggregate purchase

price of $60 million—$10 million paid in cash with a $50 million

promissory note delivered at closing. An additional $10 million

could be paid to the sellers if certain conditions are met with

respect to the performance of the VLT facility over time.

"We are proud to add Lebanon Raceway to our growing portfolio of

U.S. racing and gaming operations," said William Bissett, President

of Delaware North Companies Gaming & Entertainment. "We are

confident that this facility will create hundreds of jobs and

result in millions of dollars in economic impact."

Bill Carstanjen, President and Chief Operating Officer of CDI

added, "We are excited to partner with Delaware North Companies

Gaming & Entertainment to build a modern gaming and racing

venue in an attractive location. This opportunity fits well with

our strategy to grow the company through both acquisition and

development of new gaming facilities."

The sale is contingent upon the approval of the partnership's

application to the Ohio Lottery Commission and the Ohio State

Racing Commission as well as other customary closing conditions.

Subject to the satisfaction of the closing conditions, including

the resolution of any gaming-based litigation, Delaware North

Companies Gaming & Entertainment and CDI hope to begin

construction of the new facility this year, with completion

scheduled for the fall of 2013. Lebanon Raceway has been awarded 52

race dates in 2012 and will offer live racing during two meets—Jan.

6 through June 9 and Sept. 21 through Dec. 8. Prior to the closing

of the asset purchase agreement, the existing licensees will

continue to conduct harness racing at the current Lebanon Raceway

location. Once the acquisition has closed, Miami Valley Gaming will

continue to host races at this location until construction of the

new facility is completed.

C. Keith Nixon, Jr., Vice President of Miami Valley Trotting,

said, "After all these years of having the track in our families,

we wanted to be certain the new owners would have the resources and

the experience to operate a successful facility. We're confident

that we are placing our families' legacy in good hands with both a

global hospitality company, Delaware North Companies, and the

legendary Churchill Downs Racetrack."

The Nixon and Carlo families, owners of Lebanon Raceway since

1951, will continue to be involved with the new racing and gaming

facility. Both families have agreed to remain consultants to

Delaware North Companies Gaming & Entertainment and CDI.

"This track is a huge part of our life, so we wanted the new

owners to be someone with the vision and the resources to ensure

the raceway remains an economic and entertainment asset for Warren

County and the entire region," said John Carlo, President of

Lebanon Trotting Club. "Delaware North Companies Gaming &

Entertainment and Churchill Downs Incorporated are committed to

keeping the track in Southwest Ohio and provide the best

opportunity to design and operate a successful track and gaming

facility."

Bissett said a new location is necessary to provide more room

for the construction of a video lottery gaming facility and will

provide easier access to Interstate 75. "As with any complex

economic development project, there are many factors that could

impact the final location of the new track and video lottery

facility, and we are currently looking at a number of great

possible sites. We will continue to work with local leadership, the

State of Ohio and Ohio General Assembly leaders on this development

that will create 700 jobs and bring in $24 million a year to the

area," Bissett said.

Delaware North Companies Gaming & Entertainment and CDI will

each own a 50 percent interest in the new venture and will have

equal representation on its Board of Managers. Collectively,

Delaware North Companies Gaming & Entertainment and CDI plan to

contribute up to $90 million in equity with the rest of the

development funded with debt.

Miami Valley Gaming will apply for a 10-year VLT license. In

addition to the $50 million license fee, the joint venture will

invest $175 million in the new facility, including the cost of

VLTs. Total project cost is estimated to be $225

million. Miami Valley Gaming has teamed with other horse

tracks in Ohio for discussions with horse racing associations to

establish purse levels to ensure continued racing in Ohio.

About Delaware North Companies Gaming &

Entertainment

Delaware North Companies Gaming & Entertainment is one of

the most innovative gaming and racing operators in the country,

owning and/or operating several successful regional destination

casinos and specializing in racing venues with added amenities such

as table games, video gaming machines, poker rooms, full-service

restaurants, retail shops and lodging. The company operates gaming

and hospitality services at locations in New York, Illinois,

Florida, West Virginia, Arkansas, and Oklahoma.

Delaware North Companies Gaming & Entertainment is a

subsidiary of Delaware North Companies, a $2.5 billion hospitality

management company that operates food service, lodging, gaming and

retail services at locations in the United States and several other

countries.

About Delaware North Companies

Delaware North Companies is one of the world's leading

hospitality and food service companies. Its family of companies

includes Delaware North Companies Parks & Resorts, Delaware

North Companies Gaming & Entertainment, Delaware North

Companies Travel Hospitality Services, Delaware North Companies

Sportservice, Delaware North Companies International and Delaware

North Companies Boston, owner of TD Garden. Delaware North

Companies is one of the largest and most admired privately held

companies in the world with revenues exceeding $2.5 billion

annually and 55,000 associates serving half a billion customers in

the United States, Canada, the United Kingdom, Australia and New

Zealand. For more information, visit www.DelawareNorth.com.

Delaware North Companies has operated in Ohio for more than 50

years, employing more than 3,200 Ohioans in 2011 and serving in

excess of 10 million guests annually at venues across the state.

Ohio is one of the company's top three states in terms of the

number of locations, revenue and taxes paid. Delaware North

operates all food and retail services at the Great American Ball

Park in Cincinnati and Nationwide Arena in Columbus, as well as

food concessions at Progressive Field and Cleveland Browns Stadium.

Delaware North also manages the Lodge at Geneva-on-the-Lake in the

heart of Ohio's wine country along Lake Erie.

About Churchill Downs Incorporated

Churchill Downs Incorporated ("CDI") (Nasdaq:CHDN),

headquartered in Louisville, Ky., owns and operates the

world-renowned Churchill Downs Racetrack, home of the Kentucky

Derby and Kentucky Oaks, as well as racetrack and casino operations

and a poker room in Miami Gardens, Fla.; racetrack, casino and

video poker operations in New Orleans, La.; racetrack operations in

Arlington Heights, Ill.; and a casino resort in Greenville, Miss.

CDI also owns the country's premier account-wagering company,

TwinSpires.com, and other advance-deposit wagering providers; the

totalizator company, United Tote; Bluff Media, an Atlanta-based

multimedia poker content, brand and publishing company; and a

collection of racing-related telecommunications and data companies.

Information about CDI can be found online at

www.churchilldownsincorporated.com.

Safe Harbor Disclosure for Churchill Downs Incorporated:

Information set forth in this news release contains various

"forward-looking statements" within the meaning of Section 27A of

the Securities Act of 1933 and Section 21E of the Securities

Exchange Act of 1934. The Private Securities Litigation Reform Act

of 1995 (the "Act") provides certain "safe harbor" provisions for

forward-looking statements. All forward-looking statements made in

this Quarterly Report on Form 10-Q are made pursuant to the Act.

The reader is cautioned that such forward-looking statements are

based on information available at the time and/or management's good

faith belief with respect to future events, and are subject to

risks and uncertainties that could cause actual performance or

results to differ materially from those expressed in the

statements. Forward-looking statements speak only as of the date

the statement was made. We assume no obligation to update

forward-looking information to reflect actual results, changes in

assumptions or changes in other factors affecting forward-looking

information. Forward-looking statements are typically identified by

the use of terms such as "anticipate," "believe," "could,"

"estimate," "expect," "intend," "may," "might," "plan," "predict,"

"project," "hope," "should," "will," and similar words, although

some forward-looking statements are expressed differently. Although

we believe that the expectations reflected in such forward-looking

statements are reasonable, we can give no assurance that such

expectations will prove to be correct. Important factors that could

cause actual results to differ materially from expectations

include: the effect of global economic conditions, including any

disruptions in the credit markets; a decrease in consumers'

discretionary income; the effect (including possible increases in

the cost of doing business) resulting from future war and terrorist

activities or political uncertainties; the overall economic

environment; the impact of increasing insurance costs; the impact

of interest rate fluctuations; the effect of any change in our

accounting policies or practices; the financial performance of our

racing operations; the impact of gaming competition (including

lotteries, online gaming and riverboat, cruise ship and land-based

casinos) and other sports and entertainment options in the markets

in which we operate; our ability to maintain racing and gaming

licenses to conduct our businesses; the impact of live racing day

competition with other Florida, Illinois and Louisiana racetracks

within those respective markets; the impact of higher purses and

other incentives in states that compete with our racetracks; costs

associated with our efforts in support of alternative gaming

initiatives; costs associated with customer relationship management

initiatives; a substantial change in law or regulations affecting

pari-mutuel and gaming activities; a substantial change in

allocation of live racing days; changes in Kentucky, Florida,

Illinois or Louisiana law or regulations that impact revenues or

costs of racing operations in those states; the presence of

wagering and gaming operations at other states' racetracks and

casinos near our operations; our continued ability to effectively

compete for the country's horses and trainers necessary to achieve

full field horse races; our continued ability to grow our share of

the interstate simulcast market and obtain the consents of

horsemen's groups to interstate simulcasting; our ability to enter

into agreements with other industry constituents for the purchase

and sale of racing content for wagering purposes; our ability to

execute our acquisition strategy and to complete or successfully

operate planned expansion projects; our ability to successfully

complete any divestiture transaction; market reaction to our

expansion projects; the inability of our totalisator company,

United Tote, to maintain its processes accurately or keep its

technology current; our accountability for environmental

contamination; the ability of our online business to prevent

security breaches within its online technologies; the loss of key

personnel; the impact of natural and other disasters on our

operations and our ability to obtain insurance recoveries in

respect of such losses (including losses related to business

interruption); our ability to integrate any businesses we acquire

into our existing operations, including our ability to maintain

revenues at historic levels and achieve anticipated cost savings;

the impact of wagering laws, including changes in laws or

enforcement of those laws by regulatory agencies; the outcome of

pending or threatened litigation; changes in our relationships with

horsemen's groups and their memberships; our ability to reach

agreement with horsemen's groups on future purse and other

agreements (including, without limiting, agreements on sharing of

revenues from gaming and advance deposit wagering); the effect of

claims of third parties to intellectual property rights; and the

volatility of our stock price.

CONTACT: Delaware North Companies Gaming & Entertainment

Glen White

(716) 858-5753 (office)

(716) 573-5257 (mobile)

gawhite@dncinc.com

Churchill Downs Incorporated

John Asher

(502) 636-4586 (office)

(502) 494-3626 (mobile)

JohnA@kyderby.com

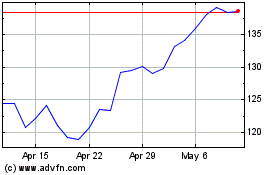

Churchill Downs (NASDAQ:CHDN)

Historical Stock Chart

From Apr 2024 to May 2024

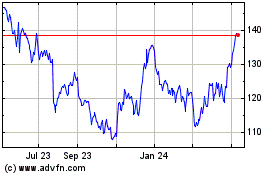

Churchill Downs (NASDAQ:CHDN)

Historical Stock Chart

From May 2023 to May 2024