Bourque Industries, Inc. (OTC: BORK) management today announced

four key strategic business acquisitions to consolidate all facets

of Kryron technology into a single corporate entity. This includes

all sales, distribution, manufacturing, future product development,

and intellectual property comprising all global Kryron patents and

licensing rights.

Bourque also announced an enhancement to its business strategy,

which will now expand to focus on the development, licensing, and

commercialization of a broad range of products utilizing Kryron,

its patented aluminum alloy, and other Kryronized metal alloys. The

Company will also develop basalt-based materials using technology

from newly-acquired Basalt Fiber Technologies, LLC.

Beyond its current line of protective ballistic armor plates

under development, Bourque plans to pursue development of

conductive materials, agriculture and heavy equipment, mining

technology, aviation and automotive components, and consumer

electronics as well as other products which will benefit from the

unique materials technology it has under development.

In execution of this strategy, the Company entered into

Acquisition Agreements on September 26, 2011, to acquire three

companies controlled by John M. Bourque – Bourque Industries’

principal shareholder, CEO, Director and Chief Scientist – each of

which hold certain pre-existing license rights to Kryron

technology. Upon consummation of these three acquisitions, Bourque

Industries will control all rights to the Kryron material and

Kryron patents for all uses, worldwide, in all markets and for all

products.

“This fundamental restructuring is a major leap forward for

Bourque Industries and Kryron technology,” said John M. Bourque.

“With the consolidation of all technology and operations into one

company, Bourque Industries is ideally positioned to pursue our

mission of redefining industry standards by developing

revolutionary materials for a wide range of industrial, commercial,

and military applications.”

Bourque Industries will acquire Bourque Alloys, LLC; Bourque

Alloys Manufacturing, Inc.; and Kryron Global, LLC through reverse

mergers and convert them into wholly-owned Company subsidiaries. In

exchange, the shareholders of the respective target companies will

receive 5.6 million shares, 92 million shares, and 12.5 million

shares, respectively, of restricted Bourque Industries Common

Stock. John M. Bourque, the inventor of Kryron, owns 100% of Kryron

Global, which held all Kryron-related patents before the merge, and

owns approximately 54.5% of the outstanding stock of the other two

companies.

Bourque also entered into an Acquisition Agreement to acquire –

through a reverse merger into a wholly-owned Company subsidiary –

all of Basalt Fiber Technologies, LLC, in exchange for the issuance

of 5.9 million shares of Bourque Industries restricted Common Stock

to the target company’s shareholders. Kim D. Southworth, Basalt

Fiber Technologies' President and a Director of the Company, owns

approximately 75% of the outstanding stock of Basalt Fiber

Technologies.

Basalt Fiber Technologies is developing new technology to

produce basalt fiber in quantities far exceeding current production

methods and at substantially lower costs. Basalt fiber is made from

quarried basalt rock, which is heated and pushed through fine

nozzles to create streams of molten rock that solidify into fibers.

The resulting product is similar to fiberglass, but is physically

stronger and significantly cheaper.

An inert rock found worldwide – and in great quantities in the

western United States – basalt is the generic term for solidified

volcanic lava. Basalt is used in the production of fireproof

textiles for the aerospace and automotive industries and as a

composite to produce a wide range of enhanced, innovative products.

Bourque Industries plans to combine basalt with Kryron to develop

new materials and applications and to diversify the revenue streams

of the Company.

Bourque Industries will privately issue a total of approximately

116 million shares of Common Stock to acquire these four companies,

out of which 65.5 million shares will be issued to John M. Bourque

in exchange for his shares in three of the companies. Kim D.

Southworth will be issued 4.5 million shares in exchange for his

shares in Basalt Fiber Technologies, and 16 million shares for his

minority position in Bourque Alloys Manufacturing. Upon

consummation of these acquisitions, John M. Bourque’s holding of

Bourque Industries, Inc. Common Stock will increase from

approximately 52.5% to approximately 53.5%, and Kim D. Southworth’s

holdings of Bourque Industries, Inc. Common Stock will increase

from 0% to 6.9%. The Company’s total shares of Common Stock

outstanding will increase to approximately 299 million shares.

These mergers and acquisitions are expected to be consummated in

a matter of days, and although minority shareholders in each target

company will be entitled to exercise dissenter’s rights, Company

management does not anticipate that such rights will be

exercised.

In furtherance of this new strategy, on September 23, 2011,

Bourque Industries entered into a Royalty Agreement with John M.

Bourque, whereby it acquired all remaining unlicensed rights to the

Kryron technology and patents in exchange for the grant of a

royalty interest to John M. Bourque. The Agreement has a term of 20

years, and provides for payment to Mr. Bourque of a 5% royalty on

gross sales of products and services utilizing the Kryron

technology and all derivative products.

The Company at the same time entered into an employment

agreement with John M. Bourque, retaining him as CEO and Chief

Scientist, to pursue further development, commercialization,

marketing, and sale of products utilizing Kryron technology. The

Agreement has a 10-year term (with renewal terms), which provides

for an initial salary of $360,000 per year and the immediate

issuance to Mr. Bourque of 100,000,000 shares of Bourque Industries

Series A Preferred Stock.

The Preferred Stock is convertible into Common Stock at the rate

of one Common share for each 1,000 Series A Preferred shares

converted, is entitled to share in any dividends declared with

Common at the rate of 1/1000th of the amount of any Common

dividend, and is entitled to vote on all matters with Common,

including the election of Directors, and has voting rights of four

votes per each share, as contrasted to the one vote per share of

outstanding Common Stock.

As a result of this issuance of Series A Preferred Stock to John

M. Bourque, Mr. Bourque receives through ownership of the Series A

Preferred Stock a right to receive any dividends declared in an

amount equal to 100,000 shares of Common Stock, and retains the

right at present to elect a majority of the Board of Directors and

to determine other matters presented to the shareholders for a

vote, since the Series A Preferred Stockholder will be entitled to

cast 400 million votes on any matter, as compared to the

approximately 199 million votes entitled to be cast by the

currently outstanding Common Stock.

All actions were approved by the Company’s newly expanded Board

of Directors with any affected Directors abstaining in each

case.

ABOUT BOURQUE AND KRYRON

Bourque Industries, Inc. is a publicly-traded (OTC: BORK)

development stage company based in Tucson, Ariz. Bourque is the

distributor of Kryron-based technologies.

The Company has focused on development of state-of-the-art

protective armor material that management believes can provide

superior protection to first-response teams in the military and law

enforcement at a pinnacle level of performance and innovation,

utilizing a new material developed by John Bourque named

“Kryron.”

Kryron is a patented aluminum alloy and represents what

management believes to be the optimal material for protective

ballistic armor plates. Compared to industry-standard personal

protection ceramic plates, Kryron Terminator armor demonstration

products are lighter, far more durable, and eliminate spall and

ricochet.

Using proprietary Kryron and basalt technologies, Bourque

Industries will develop and market alloys and materials that

management believes will have applications across a broad range of

industries, including conductive materials, agriculture and heavy

equipment, mining, aviation and automotive, and consumer

electronics.

This communication to shareholders and the public contains

certain forward-looking statements. Sometimes these statements will

contain words such as "believes," "expects," "intends," "should,"

"will," "plans," and other similar words. The events described in

these forward looking statements are not certain to occur. These

statements are only predictions and involve known and unknown

risks, uncertainties and many factors beyond our control. Among

these risks are the risks that the new products under development

by the Company will not work as anticipated, will not find market

acceptance, and/or will not be able to be produced on a commercial

scale which permits a profit, as well as the risks that the Company

will be unable to obtain the necessary capital to complete

development, commercialize, manufacture and distribute such

products, or obtain such necessary capital on commercially

reasonable terms. Although forward-looking statements, and any

assumptions upon which they are based, are made in good faith and

reflect our management’s current expectations, actual results could

differ materially from those anticipated in such statements.

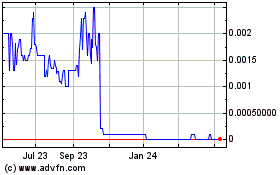

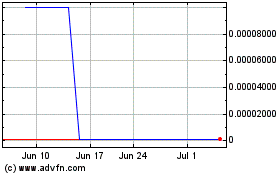

Bourque Industries (CE) (USOTC:BORK)

Historical Stock Chart

From Mar 2024 to Apr 2024

Bourque Industries (CE) (USOTC:BORK)

Historical Stock Chart

From Apr 2023 to Apr 2024