Tufton Oceanic Assets Ltd. Divestment of Containership (1136W)

December 20 2021 - 2:00AM

UK Regulatory

TIDMSHIP

RNS Number : 1136W

Tufton Oceanic Assets Ltd.

20 December 2021

20 December 2021

Tufton Oceanic Assets Limited (The "Company")

Divestment of Containership

The Board of Tufton Oceanic Assets Limited (ticker: SHIP.L) is

pleased to announce that it has agreed to divest the Containership

Swordfish for $19m. The realised net IRR will be 27% and realised

net MOIC will be 2.4x. Swordfish was acquired in January 2018 for

$10.25m as one of the Company's first two investments together with

the Containership Kale, which was sold earlier this year.

This will be the Company's seventh divestment. Whilst the

Company aims to hold its investments over the longer term, the

Investment Manager will seek to realise investments where

additional value can be generated for shareholders. This

divestment, together with the various divestments announced since

late 2020, demonstrates the Company's commitment to capital

re-allocation. This is increasingly relevant given the absolute and

relative movements in asset values across and within the main

shipping markets since 3Q20.

The Investment Manager continues to identify an attractive

pipeline of opportunities across a range of the Company's target

sectors and expects to redeploy these proceeds promptly.

Prospective investments include chemical or product tankers as well

as bulkers. The Company will announce a further update in due

course.

For further information, please contact:

Tufton Investment Management Ltd (Investment

Manager)

Andrew Hampson

Paulo Almeida +44 (0) 20 7518 6700

Singer Capital Markets

James Maxwell, Alex Bond (Corporate Finance)

Alan Geeves, James Waterlow, Sam Greatrex

(Sales) +44 (0) 20 7496 3000

Hudnall Capital LLP

Andrew Cade +44 (0) 20 7520 9085

About the Company

Tufton Oceanic Assets Limited invests in a diversified portfolio

of secondhand commercial sea-going vessels with the objective of

delivering strong cash flow and capital gains to investors. The

Company's investment manager is Tufton Investment Management Ltd.

The Company has raised a total of approximately $316.5m (gross)

through its Initial Public Offering on the Specialist Fund Segment

of the London Stock Exchange on 20 December 2017 and subsequent

capital raises.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

DISFZMMZFLMGMZM

(END) Dow Jones Newswires

December 20, 2021 02:00 ET (07:00 GMT)

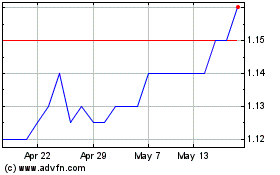

Tufton Oceanic Assets (LSE:SHIP)

Historical Stock Chart

From Jul 2024 to Aug 2024

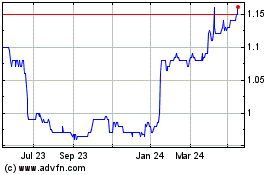

Tufton Oceanic Assets (LSE:SHIP)

Historical Stock Chart

From Aug 2023 to Aug 2024