TIDMMIG5

RNS Number : 9734G

Maven Income and Growth VCT 5 PLC

24 July 2023

Maven Income and Growth VCT 5 PLC

Interim Results for the Six Months Ended 31 May 2023

(Unaudited)

The Directors announce the Chairman's Statement, Investment

Manager's Interim Review and the unaudited Financial Statements for

the six months ended 31 May 2023.

Highlights

-- NAV total return at 31 May 2023 of 84.33p per share

-- NAV at 31 May 2023 of 34.18p per share, after payment of the

2022 final dividend of 0.50p per share on 5 May 2023

-- Interim dividend of 0.75p per share paid on 21 July 2023

-- Offer for Subscription closed, raising GBP7.02 million, with

a further fund raising to be launched in Autumn 2023

Overview

On behalf of your Board, I am pleased to present the results for

the six months to 31 May 2023 where, against a backdrop of high

inflation and rising interest rates, your Company has delivered

resilient performance. The slight reduction in NAV total return,

compared to the position at the previous year end, largely reflects

the subdued conditions in AIM where, despite encouraging newsflow

and positive market updates from most AIM quoted investee

companies, share prices have continued to be weak, which has

impacted the value of your Company's AIM quoted portfolio.

Conversely, the performance of the unlisted portfolio has generally

been encouraging, particularly across the early stage investments,

where many companies have continued to deliver revenue growth and

achieve commercial milestones. Your Board remains committed to

making regular Shareholder distributions and was pleased to declare

an interim dividend of 0.75p per share, which was paid on 21 July

2023.

Whilst the outlook for the UK economy has slightly improved,

inflation remains stubbornly high and interest rates continue to

rise, meaning that the prevailing economic conditions continue to

present challenges for many businesses and consumers. Despite these

adverse economic factors, the Directors are pleased to report that

your Company has delivered robust performance. This reflects the

strength of the underlying portfolio that has been carefully

constructed over recent years and provides exposure to a wide range

of high quality, growth companies, many of which operate in

defensive or counter cyclical sectors, which have continued to grow

despite the macroeconomic challenges. It is worthwhile noting that,

across the portfolio, the level of external debt remains low and

there is limited direct exposure to consumer facing sectors, which

has provided a degree of insulation against the inflationary

pressures. The Board and the Manager believe that the underlying

growth prospects for the majority of companies within the portfolio

remain positive and that your Company is well positioned to make

further progress in line with its long term investment

objective.

During the reporting period, the private company portfolio has

generally performed well, with most companies continuing to make

commercial progress and achieve their business plans. Your Board is

encouraged by the progress of the early stage portfolio, where a

number of companies are achieving scale and demonstrating their

ability to create significant value. In certain cases, this has

warranted uplifts to valuations to reflect the sustained progress

that has been achieved.

Over recent years, your Company has been steadily reducing its

exposure to AIM, as part of the strategic objective to rebalance

the portfolio towards private company investments. Following the

realisation of a large holding in the prior year, the exposure to

AIM has now materially reduced and accounts for 7.2% of net assets.

During the reporting period, the performance of AIM continued to be

muted. Although some listed markets have experienced a recovery

during the current year, investor sentiment towards AIM continues

to be subdued and there has been very limited IPO and new share

issuance activity to help stimulate demand. As a result of these

market conditions, the value of your Company's AIM quoted portfolio

has declined. For the majority of holdings, the share price

reductions reflect the reduced appetite for investment in smaller,

earlier stage growth businesses, with genuine progress and positive

news effectively being disregarded. The Board and the Manager

continue to believe that selective exposure to AIM offers scope to

broaden the investee company portfolio, as well as providing the

ability to generate early liquidity if share prices perform well.

The Manager will, however, remain cautious on any new AIM

investments until there is clear evidence of a recovery in this

market and an improvement in the quality and quantity of companies

seeking VCT funding.

In May 2023, your Company closed its most recent Offer for

Subscription, raising a total of GBP7.02 million across the 2022/23

and 2023/24 tax years. This additional capital will enable your

Company to progress the investment strategy that has been in place

for a number of years and which has the core objective of building

a large and sectorally diversified portfolio of high growth private

and AIM quoted companies that are capable of achieving scale and

generating a capital gain on exit. During the first half of the

year, two new private companies were added to the portfolio. Your

Board is aware of the healthy pipeline of opportunities that the

Manager is currently reviewing, and it is anticipated that there

will be a good level of new investment in the second half of the

year.

Shareholders will find full details of the key portfolio

developments, including the new investments that have been

completed, in the Investment Manager's Review in the Interim

Report.

Liquidity Management

As Shareholders will be aware from recent Annual and Interim

Reports, your Company maintains a proactive approach to liquidity

management, with the objective of generating income from cash

resources held prior to investment in VCT qualifying companies.

This strategy also helps to satisfy the criteria of the Nature of

Income condition, which is a mandatory requirement of the VCT

legislation where not less than 70% of a VCT's income must be

derived from shares or securities. To meet this requirement, the

Board had previously approved the construction of a focused

portfolio of permitted, non-qualifying holdings in carefully

selected investment trusts with strong fundamentals and attractive

income characteristics. The recent upward trend in interest rates

has, however, required the Board and the Manager to revise the

approach to funds held prior to investment. Following a whole of

market review, the Manager has selected a number of leading money

market funds and a portfolio of investment trusts that will allow

your Company to maximise the income receivable on residual cash

held prior to investment, whilst also ensuring compliance with the

Nature of Income condition. During the reporting period, several

new investments were completed in support of the revised liquidity

management strategy, and details can be found in the Investments

table in the Interim Report.

Interim Dividend

In respect of the year ending 30 November 2023, an interim

dividend of 0.75p per Ordinary Share was paid on 21 July 2023 to

Shareholders on the register at 23 June 2023. Since the Company's

launch, and after receipt of this latest dividend, 50.90p per share

has been distributed in tax free dividends. It should be noted that

the payment of a dividend reduces the NAV of the Company by the

total cost of the distribution.

Dividend Policy

Decisions on distributions take into consideration a number of

factors, including the realisation of capital gains, the adequacy

of distributable reserves, the availability of surplus revenue and

the VCT qualifying level, all of which are kept under close and

regular review.

The Board and the Manager recognise the importance of tax free

distributions to Shareholders and, subject to the considerations

outlined above, will seek, as a guide, to pay an annual dividend

that represents 5% of the NAV per Ordinary Share at the immediately

preceding year end.

The Directors would like to remind Shareholders that, as the

portfolio continues to expand and a greater proportion of holdings

are in younger companies with growth potential, the timing of

distributions will be more closely linked to realisation activity,

whilst also reflecting the Company's requirement to maintain its

VCT qualifying level. If larger distributions are required as a

consequence of significant exits, this will result in a

corresponding reduction in NAV per share. However, the Board and

the Manager consider this to be a tax efficient means of returning

value to Shareholders, whilst ensuring ongoing compliance with the

VCT legislation.

Dividend Investment Scheme (DIS)

Your Company operates a DIS, through which Shareholders can, at

any time, elect to have their future dividend payments utilised to

subscribe for new Ordinary Shares issued by the Company under the

standing authority requested from Shareholders at Annual General

Meetings. Shares issued under the DIS should qualify for VCT tax

relief applicable for the tax year in which they are allotted,

subject to an individual Shareholder's particular

circumstances.

Shareholders can elect to participate in the DIS in respect of

future dividends by completing a DIS mandate form and returning it

to the Registrar (City Partnership). The mandate form, terms &

conditions and full details of the scheme (including tax

considerations) are available from the Company's webpage at:

mavencp.com/migvct5. Election to participate in the DIS can also be

made through the online investor hub:

maven-cp.cityhub.uk.com/login.

If a Shareholder is in any doubt about the merits of

participating in the DIS, or their own tax status, they should seek

advice from a suitably qualified adviser.

Offer for Subscription

On 7 October 2022, your Company, alongside Maven Income and

Growth VCT PLC, Maven Income and Growth VCT 3 PLC and Maven Income

and Growth VCT 4 PLC, launched Offers for Subscription for up to

GBP30 million in aggregate, with over-allotment facilities for up

to GBP10 million in aggregate. On 26 May 2023, the Offers closed

with your Company having raised a total of GBP7.02 million across

the 2022/23 and 2023/24 tax years.

With respect to the 2022/23 tax year, an allotment of 9,705,619

new Ordinary Shares completed on 8 February 2023, with a further

allotment of 1,005,373 new Ordinary Shares on 3 March 2023, and a

final allotment of 6,427,303 new Ordinary Shares on 5 April 2023.

An allotment of 2,429,067 new Ordinary Shares for the 2023/24 tax

year took place on 2 June 2023.

The Directors are confident that Maven's regional office network

will continue to source and complete attractive investments in VCT

qualifying companies across a range of sectors, and the additional

liquidity provided by the fundraising will facilitate further

expansion and development of the portfolio in line with the

investment strategy. Furthermore, the funds raised will allow your

Company to maintain its share buy-back policy, whilst also

spreading costs over a wider asset base in line with the objective

of maintaining a competitive total expense ratio for the benefit of

all Shareholders.

Further to the announcement of 6 July 2023, the Directors have

elected to launch a new Offer in Autumn 2023, which will run

alongside Offers by the other Maven managed VCTs. Full details of

the Offers will be included in the Prospectus, which is expected to

be published in Autumn 2023.

Share Buy-backs

Shareholders will be aware that a primary objective for the

Board is to ensure that the Company retains sufficient liquidity

for making investments in line with its stated policy, and for the

continued payment of dividends. However, the Directors also

acknowledge the need to maintain an orderly market in the Company's

shares and have, therefore, delegated authority to the Manager for

the Company to buy back its own shares in the secondary market, for

cancellation or to be held in treasury, subject always to such

transactions being in the best interests of Shareholders.

It is intended that the Company will seek to buy back shares

with a view to maintaining a share price that is at a discount of

approximately 5% to the latest published NAV per share. Any

purchase of the Company's own shares will be subject to market

conditions, available liquidity and the maintenance of the

Company's VCT qualifying status and, when appropriate, will also

take into account any period when the shares are trading

ex-dividend.

Shareholders should note that neither the Company nor the

Manager can execute a direct transaction in the Company's shares.

Any instruction to buy or sell shares on the secondary market must

be directed through a stockbroker, in which case a Shareholder or

their broker can contact the Company's Broker, Shore Capital

Stockbrokers on 020 7647 8132, to discuss a transaction. It should,

however, be noted that such transactions cannot take place whilst

the Company is in a closed period, which is the time from the end

of a reporting period until the announcement of the relevant

results or the release of an unaudited NAV. A closed period may

also be introduced if the Directors and Manager are in possession

of price sensitive information.

During the period under review, 720,000 shares were bought back

at a total cost of GBP240,265.

Principal and Emerging Risks and Uncertainties

The principal and emerging risks and uncertainties facing the

Company were set out in full in the Strategic Report contained

within the 2022 Annual Report, and are the risks associated with

investment in small and medium sized unlisted and AIM/AQSE quoted

companies which, by their nature, carry a higher level of risk and

are subject to lower liquidity than investments in larger quoted

companies. The valuation of investee companies may be affected by

economic conditions, the credit environment and other risks

including legislation, regulation, adherence to VCT qualifying

rules and the effectiveness of the internal controls operated by

the Company and the Manager. These risks and procedures are

reviewed regularly by the Risk Committee and reported to your

Board. The Board has confirmed that all tests, including the

criteria for VCT qualifying status, continue to be monitored and

met.

The invasion of Ukraine by Russia was added to the Risk Register

as an emerging risk during a previous period, as the Directors were

not only aware of the heightened cyber security risk but were

mindful of the impact that any change in the underlying economic

conditions could have on the valuation of investment companies.

These included fluctuating interest rates, increased fuel and

energy costs, and the availability of bank finance, all of which

could be impacted during times of geopolitical uncertainty and

volatile markets. The Board and the Manager continue to monitor the

impact of the conflict, and wider market conditions, on portfolio

companies.

Regulatory Update

During the period under review, there were no further amendments

to the rules governing VCTs. However, Shareholders may be aware

that, as approved by the European Commission in 2015, the VCT

scheme included a "sunset" clause, which provided that, unless the

legislation was renewed by an HM Treasury order, income tax relief

would no longer be available on subscriptions for new shares in

VCTs made on or after 6 April 2025. There has been a considerable

level of activity by industry representatives such as the Venture

Capital Trust Association (VCTA), of which the Manager is an active

member, and The Association of Investment Companies (AIC), of which

the Company is a member, to demonstrate the important role of VCT

investment in supporting SMEs across the country and stimulating

economic growth and regional employment. The Board and the Manager

welcomed the announcement by the UK Government in its Autumn 2022

budget statement of an intention to extend the income tax relief

available on new VCT shares beyond 2025. This commitment was

reaffirmed in the Spring 2023 budget, and the Manager remains

involved in discussions regarding the process for implementing this

extension.

Consistent with industry best practice, the Board and the

Manager continue to apply the International Private Equity and

Venture Capital Valuation (IPEV) Guidelines (Valuation Guidelines)

as the central methodology for all private company valuations. The

Valuation Guidelines are the prevailing framework for fair value

information in the private equity and venture capital industry and

the Directors and the Manager continue to adhere to the Valuation

Guidelines in assessing all private company holdings.

Environmental, Social and Governance (ESG) Considerations

The Board and the Manager recognise the importance of ESG

considerations. Whilst your Company's investment policy does not

incorporate specific ESG objectives, and investee companies are not

required to meet any particular targets, Maven continues to develop

its ESG framework and oversight capabilities as part of its

investment approach. Early stage ESG due diligence is now a

standard part of the pre-investment decision making process and is

a core component within the selection criteria, thereby ensuring

that all ESG risks and opportunities are fully discussed prior to

an investment completing. During the period under review, the

Manager has invested additional resource into its ESG capabilities

in recognition of the growing importance of this area and the

requirement to have detailed monitoring across the portfolio. A

number of investee companies are already highly focused on the

environment or making improvements to society and local communities

and have set themselves specific ESG related goals. Where this is

not the case, the Manager is able to support and advise on the

value of improving these metrics and can help portfolio companies

by sharing best practice.

The ESG regulatory landscape is evolving, and the Manager

provides the Board with regular updates on the latest developments.

A relevant regulation is the Task Force on Climate-related

Financial Disclosures (TCFD) on which neither the Company nor the

Manager are required to report. However, the Board and the Manager

acknowledge the aims and importance of the TCFD and, therefore,

reporting in line with the TCFD is an objective of the Manager as

part of its approach to ESG.

The Manager continues to be an active signatory to the UN

Principles for Responsible Investment (UNPRI) and is preparing its

first UNPRI report to demonstrate its ESG capabilities and

commitment to those principles. Additionally, the Manager is a

signatory to the Investing in Women Code, which aims to reduce

barriers to tools, resources and finance for UK based female

entrepreneurs.

Your Company has a number of investments in companies with

strong ESG credentials that are achieving growth in expanding

markets. The Manager is committed to maintaining a responsible

approach to new and existing investments.

Board Constitution

The Directors regularly discuss Board composition and recognise

the importance of succession planning. Further to recent

discussions, it has been agreed that one of the Directors will not

stand for re-election at the 2024 AGM and a process for identifying

and appointing a new Non-executive Director is well progressed.

Shareholders will be advised of the agreed changes to the

composition of the Board in the coming months.

Outlook

Despite the current well publicised economic challenges, the UK

remains at the forefront of global technological innovation, with a

large number of emerging younger companies seeking capital to

achieve their growth ambitions. In recent years, the Manager has

demonstrated an ability to construct a large and sectorally diverse

portfolio of predominantly private company investments and, based

on the current pipeline, it is anticipated that this will continue

to expand during the second half of 2023. Although exit activity

has slowed in the last 12 months, this tends to be a cyclical

market dynamic and, at the time of writing, there are signs of

improving M&A activity from both trade and private equity

buyers.

Your Board, therefore, remains confident that your Company is

well placed to deliver on its investment objective, including the

payment of regular distributions to Shareholders in support of the

target annual dividend yield of 5%.

Graham Miller

Chairman

24 July 2023

Summary Of Investment Changes

For The Six Month Period Ended 31 May 2023

Valuation Valuation

30 November 2022 31 May 2023

---------------- ---------------

Net investment/ Appreciation/

(disinvestment) (depreciation)

GBP'000 % GBP'000 GBP'000 GBP'000 %

------------------------ ---------- ------- ---------------- --------------- -------- -----

Unlisted investments

Equities 32,363 51.8 2,309 344 35,016 53.0

Loan stocks 4,912 7.9 1,845 (221) 6,536 9.9

======================== ========== ======= ================ =============== ======== =====

37,275 59.7 4,154 123 41,552 62.9

AIM/AQSE investments(1)

Equities 5,815 9.4 - (1,080) 4,735 7.2

Listed investments(2)

OEICs - - 3,000 (15) 2,985 4.5

Money market funds - - 6,003 - 6,003 9.1

Investment trusts - - 3,678 14 3,692 5.6

======================== ========== ======= ================ =============== ======== =====

Total Portfolio 43,090 69.1 16,835 (958) 58,967 89.3

Cash 19,303 30.9 (12,646) - 6,657 10.1

Other assets 58 - 329 - 387 0.6

======================== ========== ======= ================ =============== ======== =====

Net assets 62,451 100.0 4,518 (958) 66,011 100.0

======================== ========== ======= ================ =============== ======== =====

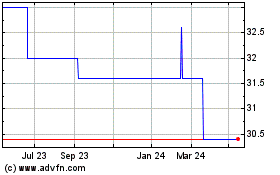

Ordinary Shares in

issue 176,391,734 193,101,989

Net asset value (NAV)

per Ordinary Share 35.40p 34.18p

Mid-market share

price 33.00p 33.00p

Discount to NAV 6.78% 3.47%

(1) Shares traded on the Alternative Investment Market (AIM) and the Aquis Stock Exchange (AQSE).

(2) These holdings represent the liquidity management portfolio,

which has been constructed from a range of carefully selected,

permitted non-qualifying holdings in investment trusts, open-ended

investment companies (OEICs) and money market funds.

Investment Manager's Interim Review

-- Two new VCT qualifying private company holdings added to the portfolio

-- Follow on funding provided to 10 unlisted portfolio companies

Overview

During the first half of the financial year, the macroeconomic

environment remained challenging and growth prospects continue to

be suppressed by inflationary pressures and rising interest rates.

Against this backdrop, it is encouraging to report on the further

progress that has been achieved by your Company. After a sustained

period of investment, the portfolio of investee companies has

increased in size and scale and now comprises of over 100 private

and AIM quoted companies that operate in high growth sectors such

as cyber security, data analytics, healthcare, and

Software-as-a-Service (SaaS), where growth has been maintained

despite the unsettled conditions in the wider market.

Following the success of the recent fundraising, your Company

has good levels of liquidity to support the further expansion and

development of the portfolio through the completion of new

investments and the provision of follow-on funding to support those

companies that are achieving commercial targets and require

additional capital to fully scale before progressing to an exit.

During the period, two new private companies were added to the

portfolio, both of which provide disruptive software solutions and

operate in attractive growth markets. Maven will generally only

invest in companies that can demonstrate meaningful commercial

traction and the potential for further strong revenue growth. This

is often measured in terms of contracted annual recurring revenue

(ARR), which provides a degree of visibility on the growth

trajectory for each company. Maven's regional network of investment

executives continues to review a healthy pipeline of opportunities

across a wide range of sectors and, at the time of writing, there

are a number of potential investments which are at various stages

of due diligence and legal contract. Based on this pipeline, it is

anticipated that there will be a good rate of new investment during

the second half of the financial year.

Your Company continues to follow a strategy focused on

constructing a large and sectorally diversified portfolio of

dynamic and entrepreneurial private and AIM quoted companies that

operate in defensive or counter cyclical markets where growth is

less dependent on the conditions in the wider economy. Most

companies within the unlisted portfolio have continued to make

positive progress, with some of the more mature holdings now

trading ahead of pre-pandemic levels. In the earlier stage

portfolio, the majority of companies are meeting their commercial

milestones, increasing ARR and achieving further scale. Where there

has been sustained positive performance, valuations have been

uplifted, however, the impact of improved revenues has been

curtailed by the well-publicised reduction in valuation multiples

across public and private markets, particularly in the technology

sector.

During the period under review, AIM has continued to be affected

by poor investor sentiment towards smaller companies, particularly

those that are growth focused. Fundraising activity by AIM

companies, and IPOs, has remained at unusually low levels and when

companies have been able to raise capital through a secondary

offer, many have done so at a discount to the prevailing share

price. These subdued market conditions have affected share prices

across your Company's AIM quoted portfolio where, in many cases,

negative sentiment has continued to outweigh positive newsflow and

robust business fundamentals. Whilst the Manager continues to

believe that exposure to AIM offers a balanced approach to long

term portfolio construction, and the ability to generate early

liquidity if companies perform well, the Manager will remain

cautious on any new investments until there is clear evidence of a

recovery in this market.

The Manager maintains an active approach to portfolio

management, with a view to supporting investee companies throughout

the period of ownership. The Maven appointed board representative

works closely with each unlisted portfolio company that is

considering, or is engaged in, a sale process, helping to identify

the most suitable corporate finance advisor and potential acquirers

that may be willing to pay a premium or strategic price for the

business. Whilst there have been no material realisations during

the reporting period, there remains a good level of external

interest in a number of portfolio companies and, based on historic

trends, the Manager is optimistic that M&A activity will resume

when economic conditions stabilise.

Portfolio Developments

Private Company Holdings

Integrated drug discovery services provider BioAscent Discovery

continues to make strong progress and has consistently achieved

double digit annual revenue growth in each of the four years since

your Company first invested. To maintain this momentum, BioAscent

is focused on expanding its range of services and the near term

objective is to move into complementary areas such as custom

protein production, immune-oncology and further translational

assays. As part of the long term growth strategy, and to ensure

that the business is able to meet the requirements of its global

customer base, BioAscent is in advanced discussions to achieve a

significant increase in laboratory and office space, whilst

remaining at a single location in Scotland. This additional space

will enable the company to increase its market presence by making

the drug discovery process more efficient, which should help it

attract more clients and achieve further scale.

Graduate recruitment specialist Bright Network continues to make

positive progress, with revenues now in excess of GBP11 million and

over 900,000 active members. Its digital solution enables leading

employers to identify, reach and recruit high quality graduates and

young professionals, and it has established a leading market

position. Working with over 300 partner firms such as Amazon,

Bloomberg, Google and Vodafone, it offers a comprehensive range of

services, including advice and support to assist its members in

securing their first job or internship, as well as providing access

to a range of in-person networking events. The business is

committed to serving a diverse range of applicants and it is

encouraging to note that 79% of the membership base are state

educated, 55% are female and 40% are from first generation

university households. During 2021, the business launched its

Technology Academy, which seeks to address the digital skills

shortage by providing high performing graduates with an intensive

software development training programme, and then deploying them in

client organisations. The Technology Academy has gained good

commercial traction and already has consultants deployed with

Lloyds Bank and Marks and Spencer. It was also recently named

Learning Solution of the Year at the 2022 Tiara Talent Tech Star

Awards, which recognise excellence in the recruitment and talent

acquisition industry.

Following a challenging period during the pandemic, when global

electronic component shortages and supply chain disruption impacted

order fulfilment capabilities, specialist manufacturer CB

Technology has experienced a good recovery, with sales now back to

pre-pandemic levels. Over recent years, the strategy to diversify

the customer base away from a reliance on the oil & gas sector

has been successful, with new clients secured in sectors such as

communication, instrumentation and medical technology, where demand

has remained resilient. To support future growth, the business

continues to make strategic investments to ensure that it has the

necessary infrastructure in place to best serve its clients. As

part of this initiative, it is currently implementing a new

enterprise resource planning (ERP) system, which will help to

improve operational efficiencies. With a strong orderbook, the

prospects for the year ahead are positive.

Over recent years, cybercrime has become an increasing threat to

everyday business activities, with most companies and organisations

recognising the need to implement robust defences. Against this

backdrop, cyber security specialist CYSIAM has made good progress.

The business, which provides a 24/7 managed detection and response

service, aims to reduce system security breaches and stop

ransomware attacks and is a preferred partner to public sector

organisations in the UK. The team at CYSIAM are experts in their

field, with a background in military intelligence, law enforcement

and national security, which has also enabled the business to

launch a consultancy arm that is gaining commercial traction. The

consultants work with clients to help them understand their

security position and build appropriate cyber resilience. CYSIAM

has achieved good growth in the year to date and, with a good

pipeline of opportunities, the outlook is encouraging.

Following changes to the senior leadership team and the

appointment of a new CEO, data transfer specialist DiffusionData

has delivered strong growth, with ARR nearly doubling since your

Company first invested in 2020. The business, which provides a

market leading platform to improve the speed, security and

efficiency of critical data transfer, is focused on the financial

services, gaming and internet of things (IoT) markets, where

accurate and timely data transfer is vital. DiffusionData has

established a blue chip client base that includes 188 Bet, Baker

Technology, Betfair, Caesars, Lloyds Bank and William Hill, with an

objective for the year ahead of growing its market position. To

support this strategy, a new engineering and testing hub is being

established in Newcastle, which will create a number of local jobs

and serve as a quality and assurance centre to ensure that

DiffusionData can maintain its high standard of service delivery as

it scales. In 2022, the business achieved notable industry

recognition for its innovative data platform, winning four awards

and being shortlisted for a further 12.

During the period under review, sustainable packaging

manufacturer iPac has continued to deliver a good rate of sales

growth, and has a strong pipeline of new opportunities. The

business, which manufactures and supplies thermoformed sustainable

packaging solutions to the food and pharmaceutical sectors,

recently opened its sixth production line to accommodate increased

demand. In February 2023, it opened a new production and

warehousing facility in County Durham, which has created a number

of local jobs and has capacity to house up to eight new production

lines, which will be phased in to meet client demand. iPac

continues to develop new products and its strategic objective is to

move into adjacent markets where there is demand for sustainable

packaging solutions. Given its strong and expanding product

portfolio, coupled with attractive ESG credentials, the business is

well placed to continue to deliver good growth in the year

ahead.

Crematorium developer and operator Horizon Ceremonies continues

to make good operational and strategic progress. Since your Company

first invested in 2017, it has established a portfolio of three

crematoria, all of which are trading ahead of plan, and is

continuing to build a strong market position. Whilst the planning

process for a new crematorium can be lengthy, there is a good

pipeline of opportunities at varying stages of the approval

process. The medium-term strategic objective remains to build a

portfolio of modern, technologically advanced crematoria that offer

a professional and compassionate service, whilst also meeting the

highest environmental standards, including the objective of

achieving net zero status by 2025, and to sell the business to a

trade, private equity or infrastructure acquirer when all sites are

fully developed.

Since your Company first invested in December 2021, Liftango, a

provider of environmentally friendly transport planning solutions,

has gained significant commercial traction. The business, which

enables clients such as corporates, universities and public

transport providers, to plan, launch and scale sustainable

transport solutions, including climate-positive carpooling,

fixed-route shuttles and on-demand buses, recently signed a five

year contract with National Express to digitalise its existing

dial-a-ride service, adding another client to an impressive blue

chip list that includes Amazon, IKEA, Tesla, Qantas and Volvo.

During the period, Liftango received additional funding from the

Maven VCTs as part of a larger funding round supported by existing

investors. This further investment will help the business to

increase ARR by accelerating its international growth plan and

capitalising on emerging opportunities in Europe and North America,

whilst also broadening its product offering to existing regions and

clients.

Digital archiving specialist MirrorWeb continues to deliver

impressive revenue growth and has increased ARR over 80% compared

to the prior year. During the period, the business received

additional funding from the Maven VCTs to support its expansion

into the US, which is regarded as a pivotal market for future

growth. The international expansion is being led by the CEO, who

relocated to Austin, Texas in early 2023. The strategy for growth

in the US will focus on increasing sales by targeting large

financial institutions and compliance consultancies, where the need

to archive digital communications is either a regulatory or best

practice requirement, and where MirrorWeb's comprehensive and

secure product offering provides a compelling solution. The

business will also continue to build its presence in the UK, where

its blue chip customer base includes Aegon, Baillie Gifford, the

BBC, HM Treasury, Tesco Bank and The National Archives.

During the period under review, Rockar, a developer of a

disruptive digital platform for buying new and used cars, has made

positive progress and further enhanced its position in the evolving

automotive ecommerce market. The business, which provides a white

label cloud-based solution to help manufacturers and retailers

develop digital alternatives to replace or complement existing

showroom models, has achieved good commercial traction and recently

added Volvo to its existing client base, which includes BMW, Jaguar

Land Rover, Porsche and Toyota. The strategy for the year ahead

remains focused on building relationships with global automotive

manufacturers to enable the business to scale further.

Whilst the majority of companies in the unlisted portfolio have

continued to make positive progress, there are a small number that

have not achieved their commercial targets, largely as a result of

conditions within the wider economy. Specialist IT integrator Flow

has experienced challenging trading conditions resulting from

hardware and component shortages, and a provision against cost has

been taken to reflect the lower than expected trading

performance.

Quoted Holdings

Global biopharmaceutical company Arecor Therapeutics reported

results for the full year to 31 December 2022, which were in line

with market expectations. Revenue more than doubled to GBP2.4

million, comprising GBP1.4 million from formulation development and

GBP1.0 million from product sales, enhanced by the five month

contribution from Tetris Pharma following its acquisition in August

2022. The cash position at the year end was comfortable at GBP12.8

million. Operational developments during the year included positive

results from the US Phase I clinical trial of its ultra rapid

insulin product, AT247, and the commencement of a second Phase I

trial of AT278, an ultra-rapid acting ultra concentrate product for

people with Type 2 diabetes, with results anticipated in the fourth

quarter of 2023. In the year ahead, the company anticipates

royalties from novel formulation AT220 to begin to filter through,

following its expected launch by a global pharma partner into a

multi billion dollar market. Arecor also noted that the commercial

roll-out of Tetris Pharma's key diabetes product, Ogluo, a glucagon

pre-filled autoinjector pen, would accelerate across key European

territories during 2023.

In the year to 31 December 2022, ultrasound artificial

intelligence (AI) software and simulation company Intelligent

Ultrasound recorded good growth, with revenue up 33% to a record

level of GBP10.1 million and gross profit increasing 36% to GBP6.3

million. Operating losses reduced by 15% and cash at the year end

was GBP7.17 million, following an oversubscribed fundraising in

November 2022. Divisionally, simulation revenue grew by 28% to

GBP9.4 million, driven by strong sales on three key simulator

platforms ScanTrainer (for obstetrics and gynaecology training),

HeartWorks (for echocardiography training) and BodyWorks (a point

of care simulator for emergency medicine and critical care

scenarios). Clinical AI revenues are beginning to gain commercial

traction, with revenues increasing by over 200% to nearly

GBP700,000. The division now has three AI driven software products,

which will help it to progress its Classroom to Clinic ultrasound

expansion strategy. The company highlighted a positive start to

2023, with growth achieved of both AI and simulation related

products and, post the fundraise, its anticipated that the

performance in the full year to the end of December 2023 will show

further progress towards its objective of achieving profitability

by the end of 2024.

K3 Business Technology , a provider of business critical

software focused on fashion and apparel brands, reported results

for the year to 30 November 2022, which highlighted revenue growth

of 5% to GBP47.5million, with recurring and predictable revenue up

11% to GBP37.6 million and now accounting for 79% of total revenue.

EBITDA (earnings before interest, taxes, depreciation and

amortisation) increased by 16% to GBP5.1 million, with net cash at

the period end of GBP7.1 million. With respect to operational

progress, the company noted that its Third-party Solutions continue

to generate a significant proportion of recurring and predictable

revenue, with Products, which has a strong track record in the

delivery of ERP and Point of Sale solutions, delivering an

encouraging underlying performance. The former is an increasingly

important area with legislation driving the adoption of

sustainability solutions and, in particular, supply chain

traceability. K3 noted that the new financial year had started

well, continuing the momentum of the prior year.

Customer engagement software specialist Netcall announced

interim results for the six months to 31 December 2022, which

reported a 19% increase in revenues to GBP17.5 million driven by

growth in both Intelligent Automation and Customer Engagement

solutions. Adjusted EBITDA rose 29% to GBP4.4 million and profit

before tax by 109%. The order backlog increased by 52% to GBP54.5

million, with GBP30 million of this due to be delivered within the

next 12 months, and cash at the period end was GBP20.4 million. The

main growth driver continues to be Netcall's cloud offering, which

is exploring how new technologies such as ChatGPT and other

generative AI models can help transform the automation capabilities

of its Liberty Platform. The positive trading momentum has

continued into the second half of the year, and the healthy

pipeline provides good visibility for the remainder of the

year.

In the year to 31 December 2022, Water Intelligence, a leading

provider of minimally invasive water leak detection and repair

solutions, delivered a strong performance. Despite the

macroeconomic volatility, revenue increased by 31% to $71.3

million, with adjusted EBITDA up 20% to $12.4 million, whilst

network sales, which are a proxy for market share, increased by 11%

to $165 million. The net cash position at the year end was $6.2

million. Notwithstanding the ongoing economic uncertainty, the

company reiterated the positive message of the first quarter

trading update, stating that it had made a good start to 2023, with

revenue up 18% year on year to $19.4 million and adjusted EBITDA up

11% to $3.5 million, and the outlook for the remainder of the year

was noted to be encouraging. Despite consistently reporting a solid

financial and operational performance, the share price of Water

Intelligence has been disappointing, demonstrating the impact of

the sector wide de-rating. The Manager remains optimistic in the

long term growth strategy that is being pursued by the company and

will continue to monitor performance closely.

Liquidity Management

In line with the updated liquidity management strategy outlined

in the Chairman's Statement, during the reporting period a number

of new investments were completed in permitted non-qualifying

investment trusts and money market funds, the details of which can

be found in the Investments table in the Interim Report. The

objective remains to build a focused portfolio of income generating

holdings to support the objective of maximising income from monies

held prior to investment, whilst ensuring that your Company remains

compliant with all aspects of the VCT legislation.

New Investments

During the reporting period, two new private companies were

added to the portfolio:

-- iAM Compliant is a software company that has established a

strong position in the eLearning market and which operates through

two core divisions. The first, iAM Compliant, is a cloud-based

estates and compliance management platform, covering areas such as

estates management, health and safety, status reporting and

premises checks. The division has achieved a good rate of recurring

revenue and maintains a high client retention rate. The second

division, iAM Learning, has developed a digital learning library

that contains over 275 continuing professional development (CPD)

and Institute of Occupational Safety and Health (IOSH) approved

courses covering a wide range of topics such as cyber security,

leadership, mental health and safeguarding. The courses are

designed to be accessible and engaging, and existing clients

include Countrywide, DPD, Dunelm, Lotus Cars and Moonpig. The

funding from the Maven VCTs will enable the business to enhance

product development, support sales and marketing initiatives, and

provide general working capital headroom.

-- Manufacture 2030 (M2030) has developed a software solution to

assist large corporates with complex manufacturing supply chains to

work with their suppliers to measure and actively reduce carbon

emissions. The platform enables companies to collate environmental

impact data and formulate reduction strategies, whilst tracking

progress and reporting this to their customers. The business has

developed a strong client base, including multi-nationals such as

Asda, Bayer, Ford, General Motors, Morrisons and SC Johnson. The

funding from the Maven VCTs is being used to expand M2030's market

position in key sectors such as automotive, chemical,

pharmaceuticals and retail, and to support further product

development to enhance platform functionality.

The following investments have been completed during the

reporting period:

Investment

cost

Investments Date Sector GBP'000

---------------------------------- -------------- ------------------------------------------------ ----------

New unlisted

================================== ============== ================================================ ==========

2 degrees Limited

(trading as Manufacture 2030) March 2023 Software & technology 997

================================== ============== ================================================ ==========

Learning & development/

iAM Compliant Limited May 2023 recruitment technology 489

================================== ============== ================================================ ==========

Total new unlisted 1,486

==================================================================================================== ==========

Follow-on unlisted

================================== ============== ================================================ ==========

Delio Limited March 2023 Software & technology 300

================================== ============== ================================================ ==========

Draper & Dash Limited (trading Pharmaceuticals, biotechnology

as RwHealth) April 2023 & healthcare 250

================================== ============== ================================================ ==========

Enpal Limited (trading as Guru

Systems) April 2023 Software & technology 194

================================== ============== ================================================ ==========

Horizon Technologies Consultants

Limited February 2023 Industrial & engineering 500

================================== ============== ================================================ ==========

Liftango Group Limited February 2023 Software & technology 600

================================== ============== ================================================ ==========

MirrorWeb Limited February 2023 Software & technology 300

================================== ============== ================================================ ==========

NorthRow Limited

(formerly Contego Solutions

Limited) December 2022 Software & technology 136

================================== ============== ================================================ ==========

Investment

cost

Investments (continued) Date Sector GBP'000

------------------------------------------ -------------- --------------------------------------------- ----------

New unlisted (continued)

========================================== ============== ============================================= ==========

Marketing & advertising

Relative Insight Limited May 2023 technology 200

========================================== ============== ============================================= ==========

Turnkey Group (UK) Holdings

Limited March 2023 Software & technology 748

========================================== ============== ============================================= ==========

Zinc Digital Business Solutions

Limited April 2023 Software & technology 51

========================================== ============== ============================================= ==========

Total follow-on unlisted 3,279

========================================================================================================= ==========

Total unlisted 4,765

========================================================================================================= ==========

Open-ended investment companies

(1)

========================================== ============== ============================================= ==========

Royal London Short Term Fixed

Income Fund (Class Y Income) February 2023 Money market fund 1,000

========================================== ============== ============================================= ==========

Royal London Short Term Money

Market Fund (Class Y Income) March 2023 Money market fund 2,000

========================================== ============== ============================================= ==========

Total open-ended investment

companies 3,000

========================================================================================================= ==========

Money market funds (1)

========================================== ============== ============================================= ==========

Aberdeen Standard Liquidity

Fund (Lux) - Sterling Fund (Class

K3) May 2023 Money market fund 1,000

========================================== ============== ============================================= ==========

Aviva Investors Sterling Liquidity

Fund (Class 3) April 2023 Money market fund 1,003

========================================== ============== ============================================= ==========

BlackRock Institutional Sterling

Liquidity Fund (Core) May 2023 Money market fund 1,000

========================================== ============== ============================================= ==========

Fidelity Institutional Liquidity

Sterling Fund (Class F) March 2023 Money market fund 1,000

========================================== ============== ============================================= ==========

Goldman Sachs Sterling Government

Liquid Reserves Ireland (Institutional) May 2023 Money market fund 1,000

========================================== ============== ============================================= ==========

HSBC Sterling Liquidity Fund

(Class A) May 2023 Money market fund 1,000

========================================== ============== ============================================= ==========

Total money market funds 6,003

========================================================================================================= ==========

Investment

cost

Investments (continued) Date Sector GBP'000

------------------------------------ ----------- ----------------- ----------

Private equity investment trusts

(1)

==================================== =========== ================= ==========

abrdn Private Equity Opportunities

Trust PLC (formerly Standard

Life Private Equity Trust PLC) March 2023 Investment trust 377

==================================== =========== ================= ==========

Alliance Trust PLC May 2023 Investment trust 149

==================================== =========== ================= ==========

Apax Global Alpha Limited May 2023 Investment trust 225

==================================== =========== ================= ==========

HgCapital Trust PLC March 2023 Investment trust 499

==================================== =========== ================= ==========

ICG Enterprise Trust PLC May 2023 Investment trust 121

==================================== =========== ================= ==========

JPMorgan Global Growth & Income

PLC May 2023 Investment trust 150

==================================== =========== ================= ==========

NB Private Equity Partners Limited March 2023 Investment trust 412

==================================== =========== ================= ==========

Total private equity investment

trusts 1,933

==================================================================== ==========

Real estate investment trust

(1)

==================================== =========== ================= ==========

Impact Healthcare REIT PLC May 2023 Investment trust 185

==================================== =========== ================= ==========

Total real estate investment

trust 185

==================================================================== ==========

Infrastructure investment trusts

(1)

==================================== =========== ================= ==========

3i Infrastructure PLC May 2023 Investment trust 320

==================================== =========== ================= ==========

BBGI Global Infrastructure S.A. May 2023 Investment trust 320

==================================== =========== ================= ==========

International Public Partnerships

Limited May 2023 Investment trust 300

==================================== =========== ================= ==========

JLEN Environmental Assets Group

Limited May 2023 Investment trust 320

==================================== =========== ================= ==========

Pantheon Infrastructure PLC March 2023 Investment trust 300

==================================== =========== ================= ==========

Total infrastructure investment

trusts 1,560

==================================================================== ==========

Total investments 17,446

==================================================================== ==========

(1) Investments completed as part of the liquidity management

strategy, details of which can be found in the Interim Report.

At the period end, the portfolio contained 139 unlisted and

quoted investments, at a total cost of GBP61.29 million.

Realisations

The table below gives details of all realisations completed

during the reporting period:

Cost Value Gain/(loss)

of shares at 30 Realised over 30

Year Complete/ disposed November Sales gain/ November

first partial of 2022 proceeds (loss) 2022 value

Realisations invested exit GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

--------------------------- ---------- ---------- ---------- --------- --------- -------- -----------

Unlisted

=========================== ========== ========== ========== ========= ========= ======== ===========

ADC Biotechnology Limited

(1) 2017 Complete - - 113 113 113

=========================== ========== ========== ========== ========= ========= ======== ===========

Ensco 969 Limited

(trading as DPP) (2) 2013 Partial 29 37 29 - (8)

=========================== ========== ========== ========== ========= ========= ======== ===========

Maven Co-invest Endeavour

Limited Partnership

(3) 2013 Complete 1 375 385 384 10

=========================== ========== ========== ========== ========= ========= ======== ===========

Optoscribe Limited (4) 2018 Complete - - 61 61 61

=========================== ========== ========== ========== ========= ========= ======== ===========

R&M Engineering Group

Limited 2013 Complete 358 80 56 (302) (24)

=========================== ========== ========== ========== ========= ========= ======== ===========

Total unlisted 388 492 644 256 152

=================================================== ========== ========= ========= ======== ===========

Total realisations 388 492 644 256 152

=================================================== ========== ========= ========= ======== ===========

(1) Deferred consideration following the sale in March 2021.

(2) Proceeds from loan note repayment, excludes yield received,

which is disclosed as revenue for financial reporting purposes.

(3) Release of monies following the sale of the underlying company in June 2022.

(4) Deferred consideration following the sale in January 2022.

Outlook

With good levels of liquidity, your Company's strategy remains

focused on growing and developing further the investee company

portfolio. The pipeline of potential new investments across Maven's

regional network of offices remains strong and it is anticipated

that there will be a good rate of new investment through the second

half of the year. The Manager will also continue to work closely

with existing portfolio companies, particularly those that are

growing rapidly and demonstrating the potential to create

significant Shareholder value, to ensure that their value is

maximised at the point of exit. This dual focus on portfolio

expansion and value maximisation is aimed at ensuring a steady flow

of profitable exits occur in support of the objective of providing

Shareholders with regular tax free dividend payments.

On behalf of the Board

Maven Capital Partners UK LLP

Manager

24 July 2023

Investment Portfolio Summary

As at 31 May 2023

% of

equity

% of % of held by

Valuation Cost total equity other

Investment GBP'000 GBP'000 assets held clients(1)

===================================== ========= ======== ======= ======= ===========

Unlisted

===================================== ========= ======== ======= ======= ===========

Bright Network (UK) Limited 2,179 940 3.3 8.2 31.7

===================================== ========= ======== ======= ======= ===========

MirrorWeb Limited 2,157 1,300 3.3 8.7 41.1

===================================== ========= ======== ======= ======= ===========

Horizon Technologies Consultants

Limited 1,826 1,296 2.8 5.5 11.7

===================================== ========= ======== ======= ======= ===========

Rockar 2016 Limited (trading

as Rockar) 1,479 1,023 2.2 4.7 14.8

===================================== ========= ======== ======= ======= ===========

Delio Limited 1,327 948 2.0 4.0 9.6

===================================== ========= ======== ======= ======= ===========

Horizon Ceremonies Limited

(trading as Horizon Cremation) 1,298 660 2.0 3.6 49.1

===================================== ========= ======== ======= ======= ===========

DiffusionData Limited

(formerly Push Technology Limited) 1,186 725 1.8 3.2 13.3

===================================== ========= ======== ======= ======= ===========

Relative Insight Limited 1,185 800 1.8 4.6 27.1

===================================== ========= ======== ======= ======= ===========

Liftango Limited 1,147 1,147 1.7 3.4 10.5

===================================== ========= ======== ======= ======= ===========

GradTouch Limited 1,133 567 1.7 5.3 29.3

===================================== ========= ======== ======= ======= ===========

Nano Interactive Group Limited 1,126 625 1.7 3.7 11.2

===================================== ========= ======== ======= ======= ===========

BioAscent Discovery Limited 1,056 174 1.6 4.4 35.6

===================================== ========= ======== ======= ======= ===========

Precursive Limited 1,000 1,000 1.5 6.7 27.5

===================================== ========= ======== ======= ======= ===========

2 degrees Limited

(trading as Manufacture 2030) 997 997 1.5 3.5 7.6

===================================== ========= ======== ======= ======= ===========

Turnkey Group (UK) Holdings

Limited 996 996 1.5 15.6 23.1

===================================== ========= ======== ======= ======= ===========

NorthRow Limited

(formerly Contego Solutions

Limited) 979 979 1.5 4.9 27.3

===================================== ========= ======== ======= ======= ===========

mypura.com Group Limited (trading

as Pura) 896 448 1.4 2.3 20.1

===================================== ========= ======== ======= ======= ===========

Enpal Limited (trading as Guru

Systems) 891 891 1.3 7.5 14.1

===================================== ========= ======== ======= ======= ===========

CB Technology Group Limited 856 521 1.3 10.1 64.9

===================================== ========= ======== ======= ======= ===========

Draper & Dash Limited (trading

as RwHealth) 847 847 1.3 2.9 10.6

===================================== ========= ======== ======= ======= ===========

Bud Systems Limited 846 846 1.3 4.8 12.2

===================================== ========= ======== ======= ======= ===========

Rico Developments Limited (trading

as Adimo) 760 760 1.2 3.3 6.4

===================================== ========= ======== ======= ======= ===========

Hublsoft Group Limited 756 675 1.1 5.5 18.3

===================================== ========= ======== ======= ======= ===========

Plyable Limited 647 647 1.0 6.1 11.3

===================================== ========= ======== ======= ======= ===========

Summize Limited 647 647 1.0 4.2 28.9

===================================== ========= ======== ======= ======= ===========

CYSIAM Limited 630 373 1.0 6.5 13.5

===================================== ========= ======== ======= ======= ===========

Biorelate Limited 597 597 0.9 3.4 22.3

===================================== ========= ======== ======= ======= ===========

FodaBox Limited 597 597 0.9 2.0 3.0

===================================== ========= ======== ======= ======= ===========

Ensco 969 Limited (trading as

DPP) 592 469 0.9 2.2 32.3

===================================== ========= ======== ======= ======= ===========

Whiterock Group Limited 561 321 0.8 5.2 24.8

===================================== ========= ======== ======= ======= ===========

As at 31 May 2023

% of

equity

% of % of held by

Valuation Cost total equity other

Investment (continued) GBP'000 GBP'000 assets held clients(1)

====================================== ========= ======== ======= ======= ===========

Unlisted (continued)

====================================== ========= ======== ======= ======= ===========

Novatus Global Limited

(formerly Novatus Advisory Limited) 547 547 0.8 3.6 9.7

====================================== ========= ======== ======= ======= ===========

WaterBear Education Limited 517 245 0.8 5.1 34.1

====================================== ========= ======== ======= ======= ===========

Glacier Energy Services Holdings

Limited 509 643 0.8 2.5 25.2

====================================== ========= ======== ======= ======= ===========

ORCHA Health Limited 497 497 0.8 1.3 4.2

====================================== ========= ======== ======= ======= ===========

QikServe Limited 494 494 0.7 2.2 13.6

====================================== ========= ======== ======= ======= ===========

iAM Compliant Limited 489 489 0.7 6.3 32.5

====================================== ========= ======== ======= ======= ===========

Boomerang Commerce IQ

(trading as CommerceIQ) (2) 485 646 0.7 0.1 0.3

====================================== ========= ======== ======= ======= ===========

XR Games Limited 483 299 0.7 1.7 18.5

====================================== ========= ======== ======= ======= ===========

Reed Thermoformed Packaging Limited

(trading as iPac) 477 448 0.7 2.5 9.9

====================================== ========= ======== ======= ======= ===========

CODILINK UK Limited (trading

as Coniq) 450 450 0.7 1.3 3.6

====================================== ========= ======== ======= ======= ===========

Filtered Technologies Limited 435 400 0.7 4.1 21.3

====================================== ========= ======== ======= ======= ===========

HiveHR Limited 413 413 0.6 6.0 38.6

====================================== ========= ======== ======= ======= ===========

Zinc Digital Business Solutions

Limited 400 400 0.6 6.3 17.6

====================================== ========= ======== ======= ======= ===========

Vodat Communications Group

(VCG) Holding Limited 396 264 0.6 2.3 29.6

====================================== ========= ======== ======= ======= ===========

HCS Control Systems Group Limited 373 373 0.6 3.0 33.5

====================================== ========= ======== ======= ======= ===========

Flow UK Holdings Limited 350 498 0.5 6.0 29.0

====================================== ========= ======== ======= ======= ===========

ebb3 Limited 346 206 0.5 6.6 72.3

====================================== ========= ======== ======= ======= ===========

Kanabo GP Limited (3) 337 1,639 0.5 13.8 53.4

====================================== ========= ======== ======= ======= ===========

Servoca PLC (4) 322 138 0.5 0.7 -

====================================== ========= ======== ======= ======= ===========

RevLifter Limited 300 300 0.5 3.1 23.5

====================================== ========= ======== ======= ======= ===========

Cat Tech International Limited 299 299 0.5 2.9 27.2

====================================== ========= ======== ======= ======= ===========

Snappy Shopper Limited 298 298 0.5 0.4 1.3

====================================== ========= ======== ======= ======= ===========

Shortbite Limited (trading as

Fixtuur) 290 484 0.4 6.5 50.8

====================================== ========= ======== ======= ======= ===========

Growth Capital Ventures Limited 275 264 0.4 4.8 42.6

====================================== ========= ======== ======= ======= ===========

Automated Analytics Limited

(formerly eSales Hub Limited) 150 150 0.2 1.9 18.7

====================================== ========= ======== ======= ======= ===========

The Algorithm People Limited 140 140 0.2 2.0 14.2

====================================== ========= ======== ======= ======= ===========

Project Falcon Topco Limited

(trading as Quorum Cyber) (5) 126 126 0.2 0.3 2.6

====================================== ========= ======== ======= ======= ===========

ISN Solutions Group Limited 98 250 0.1 3.6 51.4

====================================== ========= ======== ======= ======= ===========

LightwaveRF PLC (4) 40 74 0.1 0.9 0.9

====================================== ========= ======== ======= ======= ===========

Other unlisted investments 22 2,826 -

====================================== ========= ======== ======= ======= ===========

Total unlisted 41,552 37,116 62.9

====================================== ========= ======== ======= ======= ===========

As at 31 May 2023

% of

equity

% of % of held by

Valuation Cost total equity other

Investment (continued) GBP'000 GBP'000 assets held clients(1)

================================ ========= ======== ======= ======= ===========

AIM/AQSE quoted

================================ ========= ======== ======= ======= ===========

Water Intelligence PLC 1,001 163 1.6 1.2 -

-------------------------------- --------- -------- ------- ------- -----------

Netcall PLC 390 26 0.6 0.2 -

-------------------------------- --------- -------- ------- ------- -----------

Avingtrans PLC 368 54 0.6 0.3 -

-------------------------------- --------- -------- ------- ------- -----------

Access Intelligence PLC 347 224 0.6 0.4 0.1

-------------------------------- --------- -------- ------- ------- -----------

Concurrent Technologies PLC 317 161 0.6 0.7 -

-------------------------------- --------- -------- ------- ------- -----------

K3 Business Technology Group

PLC 251 238 0.4 0.5 -

-------------------------------- --------- -------- ------- ------- -----------

Vianet Group PLC 240 405 0.4 1.1 0.3

-------------------------------- --------- -------- ------- ------- -----------

GENinCode PLC 222 397 0.3 1.8 9.3

-------------------------------- --------- -------- ------- ------- -----------

Arecor Therapeutics PLC 185 167 0.3 0.2 0.2

-------------------------------- --------- -------- ------- ------- -----------

Synectics PLC 144 308 0.2 0.8 -

-------------------------------- --------- -------- ------- ------- -----------

Intelligent Ultrasound Group

PLC 132 118 0.2 0.4 1.5

-------------------------------- --------- -------- ------- ------- -----------

Avacta Group PLC 94 13 0.1 - 0.1

-------------------------------- --------- -------- ------- ------- -----------

Polarean Imaging PLC 94 246 0.1 0.2 0.4

-------------------------------- --------- -------- ------- ------- -----------

Anpario PLC 86 57 0.1 0.2 -

-------------------------------- --------- -------- ------- ------- -----------

Croma Security Solutions Group

PLC 69 433 0.1 1.0 -

-------------------------------- --------- -------- ------- ------- -----------

Feedback PLC 58 74 0.1 0.4 1.3

-------------------------------- --------- -------- ------- ------- -----------

Directa Plus PLC 56 120 0.1 0.1 0.1

================================ ========= ======== ======= ======= ===========

Crossword Cybersecurity PLC 52 150 0.1 0.6 1.5

-------------------------------- --------- -------- ------- ------- -----------

Vertu Motors PLC 51 50 0.1 - -

-------------------------------- --------- -------- ------- ------- -----------

Eden Research PLC 48 83 0.1 0.4 1.0

-------------------------------- --------- -------- ------- ------- -----------

Destiny Pharma PLC 46 100 0.1 0.2 1.3

-------------------------------- --------- -------- ------- ------- -----------

Saietta Group PLC 45 111 0.1 0.1 0.1

-------------------------------- --------- -------- ------- ------- -----------

Velocys PLC 43 148 0.1 0.1 0.1

-------------------------------- --------- -------- ------- ------- -----------

C4X Discovery Holdings PLC 42 40 0.1 0.1 0.8

-------------------------------- --------- -------- ------- ------- -----------

SulNOx PLC 39 130 0.1 0.4 0.4

-------------------------------- --------- -------- ------- ------- -----------

Gelion PLC 29 121 - 0.1 0.1

-------------------------------- --------- -------- ------- ------- -----------

RUA Life Sciences PLC 28 229 - 0.3 1.3

-------------------------------- --------- -------- ------- ------- -----------

Transense Technologies PLC 28 1,188 - 0.3 -

-------------------------------- --------- -------- ------- ------- -----------

Egdon Resources PLC 26 48 - 0.1 -

-------------------------------- --------- -------- ------- ------- -----------

Incanthera PLC 26 49 - 0.6 0.6

-------------------------------- --------- -------- ------- ------- -----------

LungLife AI 26 114 - 0.3 0.2

================================ ========= ======== ======= ======= ===========

As at 31 May 2023

% of

equity

% of % of held by

Valuation Cost total equity other

Investment (continued) GBP'000 GBP'000 assets held clients(1)

==================================== ========= ======== ======= ======= ===========

AIM/AQSE quoted (continued)

==================================== ========= ======== ======= ======= ===========

Verici Dx PLC 26 83 - 0.2 1.4

------------------------------------ --------- -------- ------- ------- -----------

Oncimmune Holdings PLC 25 250 - 0.2 0.3

------------------------------------ --------- -------- ------- ------- -----------

Merit Group PLC 22 450 - 0.2 -

------------------------------------ --------- -------- ------- ------- -----------

Renalytix PLC 22 - - - -

------------------------------------ --------- -------- ------- ------- -----------

XP Factory PLC (formerly Escape

Hunt PLC) 16 26 - 0.1 0.1

------------------------------------ --------- -------- ------- ------- -----------

ReNeuron Group PLC 12 150 - 0.4 1.7

------------------------------------ --------- -------- ------- ------- -----------

Osirium Technologies PLC 10 199 - 0.6 1.0

------------------------------------ --------- -------- ------- ------- -----------

Other quoted investments 19 4,574 -

------------------------------------ --------- -------- ------- ------- -----------

Total AIM/AQSE quoted 4,735 11,497 7.2

==================================== ========= ======== ======= ======= ===========

Private equity investment trusts

(6)

==================================== ========= ======== ======= ======= ===========

HgCapital Trust PLC 587 499 0.9 - 0.1

==================================== ========= ======== ======= ======= ===========

NB Private Equity Partners Limited 385 412 0.6 - -

==================================== ========= ======== ======= ======= ===========

abrdn Private Equity Opportunities

Trust PLC (formerly Standard

Life Private Equity Trust PLC) 368 377 0.6 - 0.1

==================================== ========= ======== ======= ======= ===========

Apax Global Alpha Limited 212 225 0.3 - 0.1

==================================== ========= ======== ======= ======= ===========

JPMorgan Global Growth & Income