UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

SCHEDULE

TO

(Amendment

No. 4)

TENDER

OFFER STATEMENT UNDER SECTION 14(D)(1) OR 13(E)(1) OF THE SECURITIES EXCHANGE ACT OF 1934

SIDECHANNEL,

INC.

(Name

of Subject Company (Issuer) and Name of Filing Person (Issuer))

Warrants

to Purchase Common Stock with an Exercise Price of $0.36

(Title

of Class of Securities)

N/A

(CUSIP

Number of Warrants)

Ryan

Polk

Chief

Financial Officer

SideChannel,

Inc.

146

Main Street, Suite 405

Worcester,

MA 01608

Phone:

(508) 925-0114

(Name,

Address and Telephone Number of Person

Authorized

to Receive Notices and Communications on Behalf of Filing Persons)

with

a copy to:

Michael

E. Storck, Esq. Paul J. Schulz, Esq. Lippes Mathias LLP

50

Fountain Plaza, Suite 1700

Buffalo,

New York 14202

(716)

853-5100

CALCULATION

OF FILING FEE

Transaction

valuation* $4,463,442.48; Amount of filing fee* $658.80

*

Estimated for purposes of calculating the amount of the filing fee only. SideChannel, Inc. (“SideChannel” or the “Company”)

is offering to holders of certain of its warrants, as more fully described herein, the opportunity to exchange such warrants for shares

of the Company’s common stock, par value $0.001 per share (“Shares” or “Common Stock”) by tendering six

(6) warrants with an exercise price of $0.36 in exchange for one (1) share of our Common Stock and to exchange such warrants for new

warrants (“New Warrant” or “New Warrants”) by tendering two and one-half (2.5) warrants with an exercise price

of $0.36 in exchange for one (1) New Warrant. The amount of the filing fee assumes that all outstanding warrants that are the subject

of the offer will be exchanged and is calculated pursuant to Rule 0-11(b) of the Securities Exchange Act of 1934, as amended (the “Exchange

Act”). The transaction value was determined assuming that all warrants to purchase SideChannel’s Common Stock eligible to

participate in the Offer are exchanged, and that the approximately 9,276,824 Shares issued as a result of the Offer have an aggregate

value of $463,841.20 calculated based on the average of the low and high trading price on October 31, 2023 which was $0.05, and that

the approximately 22,219,896 New Warrants issued as a result of the Offer have an aggregate value of $3,999,581.28 calculated using an

exercise price of $0.18.

The

amount of the filing fee, calculated in accordance with Rule 0-11(b) under the Exchange Act, equals $147.60 per million

dollars of the transaction valuation.

| Amount

Previously Paid: N/A |

Filing

Party: N/A |

| Form

or Registration No.: N/A |

Date

Filed: N/A |

| ☐ |

Check

the box if the filing relates solely to preliminary communications made before the commencement of a tender offer. |

Check

the appropriate boxes below to designate any transactions to which the statement relates:

| |

☐ |

third-party

tender offer subject to Rule 14d-1. |

| |

☒ |

issuer

tender offer subject to Rule 13e-4. |

| |

☐ |

going-private

transaction subject to Rule 13e-3. |

| |

☐ |

amendment

to Schedule 13D under Rule 13d-2. |

Check

the following box if the filing is a final amendment reporting the results of the tender offer: ☐

SCHEDULE

TO-I

Amendment

No. 4

This

Amendment No. 4 (this “Amendment”) amends the Tender Offer Statement (together with any amendments and supplements

thereto, the “Schedule TO”), filed with the Securities and Exchange Commission (“SEC”) on November 7, 2023

by SideChannel, Inc., a Delaware corporation (the “Company” or “SideChannel”).

This

Schedule TO relates to the offer by the Company to holders of certain of the Company’s outstanding warrants (“2021 Investor

Warrants”). The offer is made upon the terms and subject to the conditions set forth in the Company’s offer to exchange,

dated November 6, 2023 (the “Offer to Exchange” or “Offer”), and in the related Offer to Exchange materials which

are filed as Exhibits (a)(1)(B), (a)(1)(C), (a)(1)(F) and (a)(1)(H) to this Schedule TO (which the Offer to Exchange and related Offer

to Exchange materials, as amended or supplemented from time to time, collectively constitute the “Offer Materials”).

The 55,549,615 2021 Investor Warrants

subject to our Offer to Exchange consist of warrants to purchase an aggregate of 55,549,615 Shares issued to certain investors in 2021

with a five (5) year term and with an exercise price of $0.36. Under the Offer to Exchange, the holders of the 2021 Investor Warrants

will be entitled to receive one (1) share of Common Stock for each six (6) 2021 Investor Warrants exchanged (“Investor Exchange

Ratio for Stock”) and one (1) New Warrant (attached as Exhibit (a)(1)(F)) for each two and one half (2.5) 2021 Investor Warrants

exchanged, exercisable for five (5) years at an exercise price of $0.18 per share (“Investor Exchange Ratio for Warrants”).

The Investor Exchange Ratio for Stock and the Investor Exchange Ratio for Warrants are collectively referred to as the “Investor

Exchange Ratios.” The “Offer Period” is the period commencing on November 6, 2023 and ending at 5:00 p.m., Eastern

Time, on December 26, 2023, or such later date to which the Company may extend the Offer (the “Expiration Date”). If all

of the 2021 Investor Warrants are tendered, the Company will issue approximately 9,267,824 Shares and 22,219,896 New Warrants. The Investor

Exchange Ratios were selected by the Company in order to provide the holders of the 2021 Investor Warrants with an incentive to exchange

the 2021 Investor Warrants.

Except

as otherwise set forth in this Amendment, the information set forth in the Schedule TO remains unchanged and is incorporated herein by

reference to the extent relevant to the items in this Amendment. Capitalized terms used but not defined herein have the meanings ascribed

to them in the Schedule TO.

Items

1 through 10 and 12

The

Offer to Exchange and Items 1 through 9 and 11 of the Schedule TO, to the extent such items incorporate by reference the information

contained in the Offer to Exchange, are hereby amended by adding the following text thereto:

Item

5(a) of this Schedule TO is amended to provide that: “In July 2021, we engaged Paulson Investment Company (“Paulson”)

for strategic advisory services to be delivered over a four-year term in exchange for 4,000,000 shares of common stock as disclosed on

Form 8-K filed with the SEC on July 23, 2021 and incorporated herein as Exhibit (d)(2). We have been consulting with Paulson regarding

the Offer to Exchange through this strategic advisory services agreement. We neither entered into a new agreement with Paulson nor incurred

additional costs with Paulson related to the Offer to Exchange. Paulson has no obligation to us, and we have no expectations of

Paulson to either solicit the tender of any of the 2021 Investor Warrants or make a recommendation to its clients about the Offer to

Exchange.”

Item 2(b) of

this Schedule TO incorporates by reference the Risk Factors, as amended, in the Offer to Exchange.

Item

10 of this Schedule TO incorporates by reference the information in Item 8 of the Offer to Exchange, Financial Information Regarding

the Company, including the summarized financial information contained therein.

The

Company has indicated that as of 5:00 p.m., Eastern Time, on Wednesday December 20, 2023, approximately 41,544,056

warrants had been validly tendered into and not validly withdrawn from the Offer, representing approximately 74.8% of the

2021 Investor Warrants.”

Amendments

to the Offer to Exchange and Exhibits to the Schedule TO

The

references to the New Warrant terms set forth in the Offer to Exchange (Exhibit (a)(1)(H)) Summary Section E is hereby replaced with:

“A

comparison of the terms in the 2021 Investor Warrants that have either been removed or modified in the New Warrants is provided in the

following table. The section numbers for each term are shown in italics.

| Material Terms |

|

2021

Investor Warrant |

|

New

Warrant |

| Term

of the Warrant |

|

Opening:

Five-year term with Termination Dates between March 31, 2026 and April 16, 2026 |

|

Opening:

Five- year term with approximate Termination Date of December 31, 2028 |

| |

|

|

|

|

| Exercise

Price |

|

2(b):

$0.36 |

|

1(b):

$0.18 |

| |

|

|

|

|

| Cashless

Exercise |

|

2(c):

Cashless Exercise allowable only if Registration Statement is not effective at the time of exercise. |

|

1(c):

No restrictions on the use of a Cashless Exercise. |

| |

|

|

|

|

| Cashless

Exercise Formula |

|

2(c):

Cashless exercise formula expressed with generic variables: [(A-B) (X)] by (A)

|

|

1(c):

Variables changed to communicate their meaning and presentation of formula improved to clarify order of functions:

|

| Automatic

Conversion |

|

This

term is not present in the 2021 Investor Warrant. |

|

1(e):

Automatic conversion of New Warrants into Common Stock if the Common Stock trades

at or above a bid price of $0.36 for 30 consecutive trading days.

Company

notifies the Holder within 5 Trading Days of the Automatic Conversion Date.

Holder

has 25 Trading Days from the Automatic Conversion Date to deliver a Notice of Exercise to the Company. |

| |

|

|

|

|

| Adjustment

Upon Issuance of Common Stock |

|

3(b):

Requiring aggregate value of 2021 Investor Warrants after the Issuance of Shares to be equal to the aggregate value

of 2021 Investor Warrants prior to the Issuance of Shares. |

|

This

term is not present in the New Warrant. |

| |

|

|

|

|

| Fundamental

Transaction |

|

3(c):

Defining how 2021 Investor Warrants are included and treated in a Fundamental Transaction. |

|

This

term is not present in the New Warrant. |

The

New Warrant agreement was included in Exhibit (a)(1)(F) of Amendment No. 1 of Schedule TO filed with the SEC on November 14, 2023.

The

reference to the risk titled “There is no assurance that the Offer will be successful.” set forth in the Offer to Exchange

(Exhibit (a)(1)(H)) Risk Factors and Subsection 3(C) “Purpose of the Offer” are hereby amended:

“There

is no assurance that the Offer will be successful.

We have amended our Offer to

Exchange to remove the “all or none” condition and replace it with the condition that “at least sixty-five percent

(65%)” of the 2021 Investor Warrants must be tendered to complete the Tender Offer. As of December 11, 2023, sixty seven

percent (67%) of the 2021 Investor Warrants had been validly tendered into and not validly withdrawn from Tender Offer. Therefore,

if no more 2021 Investor Warrants are tendered through the Expiration Date, and none of the previously tendered 2021 Investor Warrants

are validly withdrawn, we can consummate the Tender Offer on the Expiration Date. In the event that all of the 2021 Investor Warrants

are not tendered in the Tender Offer, we will be more limited in our ability to raise capital and if necessary, we may be forced to sell

debt or equity on terms that are not favorable to the Company or our stockholders. Restricted or limited access to favorable terms on

necessary capital would also inhibit our capacity for acquisitions, strategic partnerships, and organic growth investments. As a result,

we may suffer declining profitability in the future because of decreases in our ability to effectively compete in these areas.

Mitigating this risk may require

us to perform alternate actions after consummation of the Tender Offer to further reduce the obstacles presented by the remaining 2021

Investor Warrants. Alternative actions may include, but are not limited to, attempting a subsequent tender offer to the remaining 2021

Investor Warrant holders and forming relationships with entities that have capital to pursue acquisitions, strategic partnerships, and

organic growth investments. These alternate actions may increase expenses and distract our management, and employees such that our financial

results may be negatively impacted.

There is no assurance that the successful

consummation of this Tender Offer will increase price of our Common Stock.

The price of our Common Stock

and the decision of any investors to make an equity investment in SideChannel are based on numerous material factors, of which our 2021

Investor Warrant overhang is only one. Eliminating or significantly reducing our 2021 Investor Warrant overhang will not generate any

capital for us or increase the market price of our Common Stock.

Moreover, if the holders of

all of our 2021 Investor Warrants accept the Offer, we will issue them additional shares of Common Stock. The issuance of additional

Common Stock upon the exchange of tendered 2021 Investor Warrants will dilute the book value our existing stockholders’ shares

of stock, as well as that of our future stockholders. The issuance also will dilute the percentage ownership interests in our other stockholders.”

References

to Financial Information Regarding the Company set forth in Section 8 of the Offer to Exchange are hereby amended:

“Financial

information required under Item 1-02(bb)(1) of Regulation S-X is provided in the following tables.

SideChannel,

Inc. Summary Financial Data

(In

thousands)

Consolidated

Balance Sheet Data

| | |

As of

September 30,

2021

(Audited) | | |

As of

September 30,

2022

(Audited) | | |

As of

December 31,

2022

(Unaudited) | | |

As of

March 31,

2023 (Unaudited) | | |

As of

June 30,

2023 (Unaudited) | |

| Current assets | |

$ | 832 | | |

$ | 4,142 | | |

$ | 3,577 | | |

$ | 3,261 | | |

$ | 2,662 | |

| Non-current assets | |

| 1 | | |

| 6,626 | | |

| 6,581 | | |

| 6,536 | | |

| 6,515 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | |

| Current liabilities | |

$ | 406 | | |

$ | 1,161 | | |

$ | 1,017 | | |

$ | 1,382 | | |

$ | 1,121 | |

| Non-current liabilities | |

| - | | |

| 211 | | |

| 211 | | |

| 211 | | |

| 211 | |

Consolidated

Statements of Operation Data

| | |

Twelve

Months

Ended

September 30,

2021 | | |

Twelve

Months

Ended

September 30,

2022 | | |

Three

Months

Ended

December 31,

2022 | | |

Three

Months

Ended

March 31,

2023 | | |

Three

Months

Ended

June 30,

2023 | |

| Revenue | |

$ | 2,799 | | |

$ | 4,789 | | |

$ | 1,546 | | |

$ | 1,617 | | |

$ | 1,750 | |

| Gross profit | |

| 1,262 | | |

| 2,321 | | |

| 865 | | |

| 737 | | |

| 874 | |

| Net income (loss) [1] | |

| 513 | | |

| (11,776 | ) | |

| (602 | ) | |

| (856 | ) | |

| (679 | ) |

[1]

The Company reports it financial results on a consolidated basis and does not have discontinued operations; therefore, income or loss

from continuing operations is equal to net income or loss.”

Exhibit

(d)(2), July 23, 2021 Form 8-K Entry into a Material Definitive Agreement with Paulson Investment Company, has been added to the Schedule

TO.

Item

12. Exhibits.

*

Filed herewith.

SIGNATURE

After

due inquiry and to the best of my knowledge and belief, I certify that the information set forth in this statement is true, complete

and correct.

| SIDECHANNEL,

INC. |

|

|

| |

|

|

| Date:

December 21, 2023 |

By: |

/s/

Ryan Polk |

| |

Name: |

Ryan

Polk |

| |

Title: |

Chief

Financial Officer |

Exhibit

99(a)(1)(M)

| To: |

|

2021

Investor Warrant Holder |

| From: |

|

Ryan

Polk |

| Subject: |

|

SideChannel

Warrant Exchange Offer Amended with Clarifying Statements in Response to Questions from the SEC |

| Date: |

|

December

21, 2023 |

The

purpose of this email is to inform you of amendments we have made to the Offer to Exchange your 2021 Investor Warrants for common stock

and new warrants.

These

amendments:

| |

● |

clarify

responses we provided to the SEC on December 1 regarding questions they posed about the Offer to Exchange, |

| |

● |

expand

our description of the risk we perceive from failing to successfully receive 100% participation in the Offer to Exchange, |

| |

● |

do

not change the quantities of common stock and new warrants you will receive from tendering your 2021 Investor Warrants in the

Offer to Exchange, |

| |

● |

do

not change the terms of the new warrants that you will receive, |

| |

● |

do

not require you to complete additional paperwork in order to receive your new stock and new warrants, |

| |

● |

do

not extend the expiration date past 5:00 p.m., Eastern Time, on Tuesday December 26, 2023, and |

| |

● |

do

not delay your receipt of the common stock and new warrants which will be issued immediately after the expiration of the Offer

to Exchange. |

As

of 5:00 p.m., Eastern Time, on Wednesday December 20, 2023, approximately 41,544,056 warrants had been validly tendered into and not

validly withdrawn from the Offer, representing approximately 74.8% of the Warrants which is in excess of the 65.0% requirement to close

threshold set by our Board of Directors on December 11, 2023.

The

Schedule TO-I/A that we filed with the Securities and Exchange Commission on Wednesday, December 20, 2023 is attached for your reference.

If

you have already submitted your Letter of Transmittal then no further action is required from you unless you would like to withdraw your

acceptance in which case, you can reply to this email notifying me as such and we will send you the Notice of Withdrawal paperwork for

you to complete via DocuSign.

If

you have not submitted your Letter of Transmittal, and wish to participate in the offer, then you may do so until to 5:00 p.m., Eastern

Time, December 26, 2023.

You

can contact me via email (ryan@sidechannel.com) or via phone (+1-317-910-0838) with any questions about your status in the Offer to Exchange

or these amendments.

The

remainder of this email contains the amendments to the Offer to Exchange filed with the SEC on December 20, 2023.

Item

5(a) of this Schedule TO is amended to provide that: “In July 2021, we engaged Paulson Investment Company (“Paulson”)

for strategic advisory services to be delivered over a four-year term in exchange for 4,000,000 shares of common stock as disclosed on

Form 8-K filed with the SEC on July 23, 2021 and incorporated herein as Exhibit (d)(2). We have been consulting with Paulson regarding

the Offer to Exchange through this strategic advisory services agreement. We neither entered into a new agreement with Paulson nor incurred

additional costs with Paulson related to the Offer to Exchange. Paulson has no obligation to us, and we have no expectations of Paulson

to either solicit the tender of any of the 2021 Investor Warrants or make a recommendation to its clients about the Offer to Exchange.”

Item

2(b) of this Schedule TO incorporates by reference the Risk Factors, as amended, in the Offer to Exchange.

Item

10 of this Schedule TO incorporates by reference the information in Item 8 of the Offer to Exchange, Financial Information Regarding

the Company, including the summarized financial information contained therein.

Amendments

to the Offer to Exchange and Exhibits to the Schedule TO

The

references to the New Warrant terms set forth in the Offer to Exchange (Exhibit (a)(1)(H)) Summary Section E is hereby replaced with:

“A

comparison of the terms in the 2021 Investor Warrants that have either been removed or modified in the New Warrants is provided in the

following table. The section numbers for each term are shown in italics.

| Material

Terms |

|

2021

Investor Warrant |

|

New

Warrant |

| Term

of the Warrant |

|

Opening:

Five-year term with Termination Dates between March 31, 2026 and April 16, 2026 |

|

Opening:

Five- year term with approximate Termination Date of December 31, 2028 |

| |

|

|

|

|

| Exercise

Price |

|

2(b):

$0.36 |

|

1(b):

$0.18 |

| |

|

|

|

|

| Cashless

Exercise |

|

2(c):

Cashless Exercise allowable only if Registration Statement is not effective at the time of exercise. |

|

1(c):

No restrictions on the use of a Cashless Exercise. |

| |

|

|

|

|

| Cashless

Exercise Formula |

|

2(c):

Cashless exercise formula expressed with generic variables: [(A-B) (X)] by (A)

|

|

1(c):

Variables changed to communicate their meaning and presentation of formula improved to clarify order of functions: |

| Automatic

Conversion |

|

This

term is not present in the 2021 Investor Warrant. |

|

1(e):

Automatic conversion of New Warrants into Common Stock if the Common Stock trades

at or above a bid price of $0.36 for 30 consecutive trading days.

Company

notifies the Holder within 5 Trading Days of the Automatic Conversion Date.

Holder

has 25 Trading Days from the Automatic Conversion Date to deliver a Notice of Exercise to the Company. |

| |

|

|

|

|

| Adjustment

Upon Issuance of Common Stock |

|

3(b):

Requiring aggregate value of 2021 Investor Warrants after the Issuance of Shares to be equal to the aggregate value of 2021 Investor

Warrants prior to the Issuance of Shares. |

|

This

term is not present in the New Warrant. |

| |

|

|

|

|

| Fundamental

Transaction |

|

3(c):

Defining how 2021 Investor Warrants are included and treated in a Fundamental Transaction. |

|

This

term is not present in the New Warrant. |

The

New Warrant agreement was included in Exhibit (a)(1)(F) of Amendment No. 1 of Schedule TO filed with the SEC on November 14, 2023.

The

reference to the risk titled “There is no assurance that the Offer will be successful.” set forth in the Offer to Exchange

(Exhibit (a)(1)(H)) Risk Factors and the reference to the Purpose of the Offer in subsection 3(C) are hereby amended:

“There

is no assurance that the Offer will be successful.

We

have amended our Offer to Exchange to remove the “all or none” condition and replace it with the condition that “at

least sixty-five percent (65%)” of the 2021 Investor Warrants must be tendered to complete the Tender Offer. As of December 11,

2023, sixty seven percent (67%) of the 2021 Investor Warrants had been validly tendered into and not validly withdrawn from Tender Offer.

Therefore, if no more 2021 Investor Warrants are tendered through the Expiration Date, and none of the previously tendered 2021 Investor

Warrants are validly withdrawn, we can consummate the Tender Offer on the Expiration Date. In the event that all of the 2021 Investor

Warrants are not tendered in the Tender Offer, we will be more limited in our ability to raise capital and if necessary, we may be forced

to sell debt or equity on terms that are not favorable to the Company or our stockholders. Restricted or limited access to favorable

terms on necessary capital would also inhibit our capacity for acquisitions, strategic partnerships, and organic growth investments.

As a result, we may suffer declining profitability in the future because of decreases in our ability to effectively compete in these

areas .

Mitigating

this risk may require us to perform alternate actions after consummation of the Tender Offer to further reduce the obstacles presented

by the remaining 2021 Investor Warrants. Alternative actions may include, but are not limited to, attempting a subsequent tender offer

to the remaining 2021 Investor Warrant holders and forming relationships with entities that have capital to pursue acquisitions, strategic

partnerships, and organic growth investments. These alternate actions may increase expenses and distract our management, and employees

such that our financial results may be negatively impacted.

There

is no assurance that the successful consummation of this Tender Offer will increase price of our Common Stock.

The

price of our Common Stock and the decision of any investors to make an equity investment in SideChannel are based on numerous material

factors, of which our 2021 Investor Warrant overhang is only one. Eliminating or significantly reducing our 2021 Investor Warrant overhang

will not generate any capital for us or increase the market price of our Common Stock.

Moreover,

if the holders of all of our 2021 Investor Warrants accept the Offer, we will issue them additional shares of Common Stock. The issuance

of additional Common Stock upon the exchange of tendered 2021 Investor Warrants will dilute the book value our existing stockholders’

shares of stock, as well as that of our future stockholders. The issuance also will dilute the percentage ownership interests in our

other stockholders.”

References

to Financial Information Regarding the Company set forth in Section 8 of the Offer to Exchange are hereby amended:

“Financial

information required under Item 1-02(bb)(1) of Regulation S-X is provided in the following tables.

SideChannel,

Inc. Summary Financial Data

(In

thousands)

Consolidated

Balance Sheet Data

| | |

As

of

September 30,

2021

(Audited) | | |

As

of

September 30,

2022

(Audited) | | |

As

of

December 31,

2022

(Unaudited) | | |

As

of

March 31,

2023 (Unaudited) | | |

As

of

June 30,

2023 (Unaudited) | |

| Current

assets | |

$ | 832 | | |

$ | 4,142 | | |

$ | 3,577 | | |

$ | 3,261 | | |

$ | 2,662 | |

| Non-current

assets | |

| 1 | | |

| 6,626 | | |

| 6,581 | | |

| 6,536 | | |

| 6,515 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | |

| Current

liabilities | |

$ | 406 | | |

$ | 1,161 | | |

$ | 1,017 | | |

$ | 1,382 | | |

$ | 1,121 | |

| Non-current

liabilities | |

| - | | |

| 211 | | |

| 211 | | |

| 211 | | |

| 211 | |

Consolidated

Statements of Operation Data

| | |

Twelve

Months

Ended

September 30,

2021 | | |

Twelve

Months

Ended

September 30,

2022 | | |

Three

Months

Ended

December 31,

2022 | | |

Three

Months

Ended

March 31,

2023 | | |

Three

Months

Ended

June 30,

2023 | |

| Revenue | |

$ | 2,799 | | |

$ | 4,789 | | |

$ | 1,546 | | |

$ | 1,617 | | |

$ | 1,750 | |

| Gross

profit | |

| 1,262 | | |

| 2,321 | | |

| 865 | | |

| 737 | | |

| 874 | |

| Net

income (loss) [1] | |

| 513 | | |

| (11,776 | ) | |

| (602 | ) | |

| (856 | ) | |

| (679 | ) |

[1]

The Company reports it financial results on a consolidated basis and does not have discontinued operations; therefore, income or loss

from continuing operations is equal to net income or loss.”

Regards,

Ryan

Polk, Chief Financial Officer

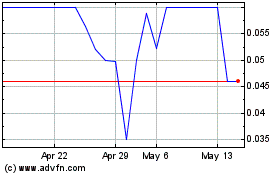

SideChannel (QB) (USOTC:SDCH)

Historical Stock Chart

From Oct 2024 to Nov 2024

SideChannel (QB) (USOTC:SDCH)

Historical Stock Chart

From Nov 2023 to Nov 2024