false

0001575858

0001575858

2023-11-01

2023-11-01

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

8-K

CURRENT

REPORT

Pursuant

to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date

of Report (Date of earliest event reported): November 1, 2023

PUREBASE

CORPORATION

(Exact

name of registrant as specified in charter)

| Nevada |

|

000-55517 |

|

27-2060863 |

(State

or other jurisdiction

of

incorporation) |

|

(Commission

File

Number) |

|

(IRS

Employer

Identification

No.) |

8625

State Hwy, 124

Ione,

CA 95640

(Address

of principal executive offices)

(855)

743-6478

(Registrant’s

telephone number, including area code)

N/A

(Former

name or former address, if changed since last report)

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under

any of the following provisions:

| ☐ |

Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

|

| ☐ |

Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 13e-4 (c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities

registered pursuant to Section 12(b) of the Act:

| Title

of each class |

|

Trading

Symbol(s) |

|

Name

of each exchange on which registered |

| None |

|

N/A |

|

N/A |

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405

of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging

growth company ☒

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

Item

1.01 Entry into a Material Definitive Agreement.

On

November 1, 2023, Purebase Corporation (the “Company”) entered into a Second Amendment (the “Amendment”) to the

Materials Extraction Agreement with US Mine, LLC (“US Mine”), dated May 27, 2021, as amended on October 6, 2021, and further

amended on June 17, 2022 and previously reported by the Company in its Current Reports on Form 8-K filed with the SEC on May 27, 2021

and October 13, 2021, and on Form 8-K/A filed with the SEC on June 21, 2022.

The

Amendment provides, among other things, for the cancellation of US Mine’s option to purchase up to116,000,000 shares of the Company’s

common stock and in lieu thereof the Company will pay US Mine a production royalty of $20.00 per ton of metakaolin supplementary cementitious

materials extracted from property owned by US Mine.

A.

Scott Dockter, the principal executive officer and a director and shareholder of the Company, and John Bremer, a director and shareholder

of the Company, are also manager-members of US Mine. The Company’s board of directors approved the transaction described in this

Report, with Mr. Dockter and Mr. Bremer abstaining from providing consent due to their interest in the transaction.

The

foregoing description of the Amendment does not purport to be complete and is qualified in its entirety by reference to the complete

text of the Amendment, a copy of which is filed with this Current Report on Form 8-K as Exhibit 10.1 and is incorporated herein by reference.

Item

9.01 Financial Statements and Exhibits.

(d)

Exhibits.

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by

the undersigned thereunto duly authorized.

| Date:

November 7, 2023 |

PUREBASE

CORPORATION |

| |

|

|

| |

By: |

/s/

A. Scott Dockter |

| |

|

A.

Scott Dockter |

| |

|

Chief

Executive Officer |

Exhibit

10.1

Second

Amendment to Materials Extraction Agreement

This

Amendment to Materials Extraction Agreement (this “Second Amendment”) is entered into and effective as of November 1, 2023

(“Effective Date”), by and between Purebase Corp. (“Purebase”), a corporation organized under the laws of the

State of Nevada with offices located at 8631 State Highway 124, P.O. Box 757, lone, California 95640 and US Mine, LLC (“US Mine”),

a California limited liability company with offices located at 8625 State Highway 124, lone, P.O. Box 580 California 95640. Purebase

and US Mine are collectively referred to herein as the “Parties” and individually as a “Party.”

RECITALS

WHEREAS,

effective as of May 27, 2021, the Parties executed and delivered a Materials Extraction Agreement (the “Agreement”) with

respect to the acquisition by Purebase of certain rights to extract supplementary cementitious material (SCM) including kaolin (“Materials”),

construct a Metakaolin Plant and to process the SCM into metakaolin on property owned by US Mine (capitalized terms used in this Amendment

not otherwise defined shall have the meanings ascribed to such terms in the Agreement), and

WHEREAS

effective as of October 6, 2021 the Parties executed and delivered an Amendment to the Agreement (“First Amendment”) which

amended the Purchase Price as set forth in Section 2 of the Agreement, and

WHEREAS,

the First Amendment was Amended and Restated effective as of June 17, 2022 to clarify the cancellation of the Promissory Note referred

to therein, and

WHEREAS,

the Parties desire to further amend the Agreement on the terms and provisions contained herein.

NOW,

THEREFORE, in consideration of the premises and agreements contained herein, and other good and valuable consideration, the receipt and

sufficiency of which are hereby acknowledged, the Parties hereby agree as follows:

TERMS

1.

Incorporation of Recitals. The Recitals set forth above are a material part of this Amendment and are incorporated herein by this

reference.

2.

Purchase Price. The previously amended Section 2 of the Agreement shall be deleted in its entirety and replaced with the following:

“Purebase

shall pay US Mine a royalty equal to $20.00 for each ton of Materials extracted from the Properties (the “Production Royalty”).

The Production Royalty shall be paid each month, commencing after the first full month in which Materials are extracted, for the aggregate

amount of Production Royalty due for the previous month. Purebase shall pay the amount of the Production Royalty due for the previous

month no later than the 20th day following the end of each monthly period. Failure of Purebase to pay for any monthly period in which

a Production Royalty is due shall constitute a breach of this Agreement. Any unpaid Production Royalty shall remain a liability of Purebase

until paid in full.

Purebase

shall prepare a Monthly Production Report which shall be submitted to US Mine, at the address set forth above, for each month that the

Agreement is in effect. This report shall be sent to US Mine no later than the 20th day of the following month in which the Materials

were removed from the Properties. Production shall be verified each year following the anniversary date of the contract or at the contract’s

termination, in an Annual Production Report. Purebase shall retain at its place of business records of all production from Mining Activities

on the Properties including records of all removal and processing of Materials from the Properties (“Records”). US Mine may

inspect the Records at any time upon reasonable notice to Purebase.

3.

Option Shares. Upon execution and delivery of this Second Amendment, the Parties agree and acknowledge that the 116,000,000 Option

Shares granted in the First Amendment shall be cancelled in their entirety and shall have no further force and effect.

4.

Amendment. Except as expressly modified by the First Amendment (to the extent not superseded by this Amendment) and this Second

Amendment, all terms and conditions of the Agreement shall remain in full force and effect and are hereby in all respects ratified and

affirmed. All references to the Agreement hereafter shall be deemed to refer to the Agreement, as amended by the First Amendment (to

the extent not superseded by this Amendment) and this Second Amendment.

5.

Miscellaneous Provisions.

(a)

Binding Effect. This Second Amendment is binding upon, and inures to the benefit of, each Party hereto and its directors, officers,

employees, agents, representatives, affiliates, assigns, and successors.

(b)

Non-Waiver. Neither Party shall be deemed, by any act of omission or commission, to have waived any of its rights or remedies

hereunder unless such waiver is in writing and signed by that Party, and then only to the extent specifically set forth in writing. A

waiver with reference to one event shall not be construed as continuing or as a bar to or waiver of any right or remedy as to a subsequent

event.

(c)

Severability. If any provision of this Second Amendment is held by a court of competent jurisdiction to be invalid, void, or unenforceable,

the remaining provisions of the Amendment will continue in full force and effect without being impaired or invalidated in any way and

will be construed in accordance with the purposes and intent of this Second Amendment as set forth by the Parties.

(d)

Interpretation. Each Party acknowledges that it has participated in the drafting of this Second Amendment, and any applicable

rule of construction to the effect that ambiguities are to be resolved against the drafting Party will not be applied in connection with

the construction or interpretation of this Second Amendment.

(e)

Opportunity to Consult Counsel. Each Party represents to the other that it has had an opportunity to have this Second Amendment

reviewed by legal counsel of its choosing and has done so to its satisfaction, that it has had a full opportunity to review the terms

of this Second Amendment, that it fully understands the legal effect of each provision of this Second Amendment, and that it has willingly

consented to the terms of this Second Amendment.

(f)

Further Acts. Each party agrees to perform any further acts and to execute and deliver any documents which may be reasonably necessary

to carry out the provisions of this Second Amendment.

(g)

Governing Law. This Second Amendment shall be governed by and interpreted in accordance with the laws of the State of California,

excluding any choice of law provisions.

(h)

Jurisdiction; Venue. Any action taken to enforce this Second Amendment shall be maintained in the Superior Court of Amador County,

California. The parties expressly consent to the jurisdiction of said court and agree that said court shall be a proper venue for any

such action.

(i)

Mutual Representations. Each Party hereby represents and warrants to the other: that it has full corporate power and authority

and is duly authorized under applicable law, its articles of incorporation and its by-laws, to own its properties and to conduct its

business as presently conducted and as herein contemplated, and to enter into and perform this Second Amendment in accordance with the

terms hereof; and that neither such entering into nor such performance violates or will violate such articles of incorporation or by-laws

or any agreement or other instrument, or any federal, state or local law, regulation or ordinance applicable to such Party or by which

it is bound. Purebase acknowledges that certain members of its board of directors hold an ownership interest in each Party and as a result

have a personal financial interest in the transaction contemplated by the Agreement and this Second Amendment. Purebase has obtained

the approval or unanimous consent of the transactions contemplated by this Second Amendment from its disinterested directors, each of

whom have been fully advised of and provided with the details concerning the nature of the common ownership and personal interests of

the interested directors in accordance with Section 78.140 of the Nevada Revised Statutes.

(j)

Modifications Must Be Made in Writing. This Second Amendment may not be modified, altered, or changed in any manner whatsoever

except by a written instrument duly executed by authorized representatives of the Parties.

(k)

Counterparts. This Second Amendment may be executed in two or more counterparts, each of which is an original, but all of which

together will be deemed to be one and the same instrument. Electronically reproduced and/or transmitted signatures are equivalent to

original signatures for all purposes hereof.

IN

WITNESS WHEREOF, the Parties have executed this Second Amendment as of the Effective Date.

| US

MINE, LLC |

|

| |

|

| By: |

/s/

John Bremer |

|

| Name: |

John

Bremer |

|

| Its: |

Member |

|

| |

|

|

| PUREBASE

CORP. |

|

| |

|

| By: |

/s/

A. Scott Dockter |

|

| Name: |

A.

Scott Dockter |

|

| Its: |

Chairman,

CEO |

|

v3.23.3

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

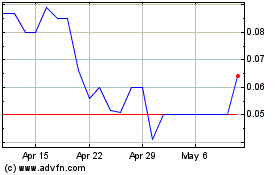

PureBase (PK) (USOTC:PUBC)

Historical Stock Chart

From Jan 2025 to Feb 2025

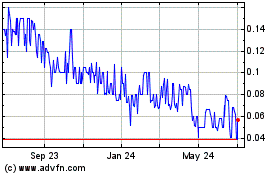

PureBase (PK) (USOTC:PUBC)

Historical Stock Chart

From Feb 2024 to Feb 2025