An

Emerging Markets Sponsored Commentary

ORLANDO, FL -- July 7, 2021 -- InvestorsHub NewsWire -- via

Emerging Markets

Consulting -- Many will fairly argue that the small and

microcap sector of the markets is the Wild West anew, a mercurial,

fast-changing landscape where huge hits and misses happen over and

over again.

They aren't wrong.

Of course the meme stocks like AMC Entertainment

Holdings Inc. and GameStop

Corporation remind us that wild rides aren't just the

province of the smaller exchanges.

Crazy can happen anywhere, even on the noble New York Stock

Exchange.

But what we find is present more often than not among the better

micro and small cap stories is a good idea and a plan of action.

Since talk is cheap among the aforementioned what we need to see is

actual action. Good ideas are frankly everywhere.

Enter Pennexx Foods Inc. (Other

OTC: PNNX), a technology company within the Software /

Internet and Fintech industries. Pennexx's products capitalize on

the multibillion dollar social media market by enabling merchants

to use social media to acquire, retain and grow their customer base

using the Company's proprietary Your Social Offers

(YSO) program. YSO users scan a QR code or click a

post online, register and share that reward with their friends so

the marketing impact can be viral and exponential.

That should grab your attention.

Right now, Pennexx is also developing prepaid debit cards which

link to its YSO program so rewards can be automatically added. YSO

will also leverage artificial intelligence to optimize and create

targeted marketing campaigns. Additionally, Pennexx is creating a

unique pre-paid debit card.

We love the idea of reduced and aggressive customer acquisition.

We know that space is hot.

But it's just a great idea in a deck or on a white board without

action and execution.

If you've read this far you had to know it was leading to some

recent action items for Pennexx.

We appreciate your patience. :)

We've cherry picked some stuff from Pennexx that we think could

be a big, big deal.

Hear us out:

Pennexx Has Added 740 Million LinkedIn Users to

the Reach of Its Your Social Offers Platform

Our take: LinkedIn is simply a fantastic

place to market. It's a far more professional and well-healed

community versus other Big Social and if being able to market to

social media users is a gun, LinkedIn is a machine gun

comparatively. The 740 million LinkedIn users speaks for

itself.

Pennexx Has Entered Into a Joint Marketing

Agreement With One of the Fastest Growing Business Solutions

Companies in the $74 Billion Worldwide Payment Processing Market,

Hybrid Business Solutions

Our take: Any regular reader of

the Emerging Markets

Report know that we love Big Deals with industry

leaders. It's not even the inherent revenue possibilities at scale,

it's the signal it sends that the well-informed industry titan are

believers and willing to work with the upstart, the junior firm…

the up and comer.

Pennexx to be Introduced to More Than 100 Million

National TV Viewers Across Networks Such as Fox News, Bloomberg,

American Agenda and Others Through Interviews With Jane

King

And perhaps equally important, Pennexx is taking the show on the

digital road. We often lament "Field of Dreams Theory" for smaller

pubcos, with laid-back/complacent CEO's thinking "If you build it

they will come."

Nope, the story often dies in the proverbial cornfield.

So, click on the link in the headline and look at A) the size of

the audience that Pennexx is tapping into and B) the

constituencies, which again like LinkedIn are often a source of a

higher quality lead.

And these are just three Action Items from their recent press

string. Take a look

at them in full and note the combination of a

real compelling story and some real Action Items under way.

About The Emerging Markets Report:

The Emerging Markets Report is

owned and operated by Emerging Markets Consulting (EMC), a

syndicate of investor relations consultants representing years of

experience. Our network consists of stockbrokers, investment

bankers, fund managers, and institutions that actively seek

opportunities in the micro and small-cap equity markets.

For more informative reports such as this, please sign up

at http://www.emergingmarketsllc.com/newsletter.php

Must Read OTC Markets/SEC policy on stock promotion and

investor protection

Section 17(b) of the Securities Act of 1933 requires that any

person that uses the mails to publish, give publicity to, or

circulate any publication or communication that describes a

security in return for consideration received or to be received

directly or indirectly from an issuer, underwriter, or dealer, must

fully disclose the type of consideration (i.e. cash, free trading

stock, restricted stock, stock options, stock warrants) and the

specific amount of the consideration. In connection therewith, EMC

has received the following compensation and/or has an agreement to

receive in the future certain compensation, as described below.

We may purchase Securities of the Profiled Company prior to

their securities becoming publicly traded, which we may later sell

publicly before, during or after our dissemination of the

Information, and make profits therefrom. EMC does not verify or

endorse any medical claims for any of its client companies.

EMC is under contract to receive $75,000 by Pennexx Foods Inc.

for various marketing services including this report. EMC does not

independently verify any of the content linked-to from this

editorial. http://emergingmarketsllc.com/disclaimer.php

Emerging Markets Consulting, LLC

Florida Office

390 North Orange Ave STE 2300

Orlando, FL 32801

E-mail: jamespainter@emergingmarketsllc.com

Web: www.emergingmarketsllc.com

SOURCE: Emerging Markets

Consulting

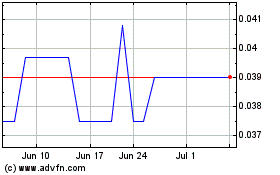

Pennexx Foods (PK) (USOTC:PNNX)

Historical Stock Chart

From Sep 2024 to Oct 2024

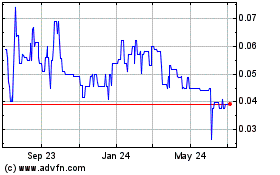

Pennexx Foods (PK) (USOTC:PNNX)

Historical Stock Chart

From Oct 2023 to Oct 2024