CANB - Can B Corp Reports 96% YoY Revenue Growth in Q2 2021

September 03 2021 - 9:34AM

InvestorsHub NewsWire

September 3, 2021 -- InvestorsHub NewsWire -- via pennymillions

--

Facts About CBD - By Roland Perry

Can B Corp (OTCMKTS:

CANB) has announced its Q2 2021 financial results

for the three months ending June 30, 2021, in which revenue was up

96% YoY to $0.4 million.

Can B had an EBITDA loss of $2.1

million

The company reported an adjusted EBITDA loss of $2.1 million for

the first six months of 2021. The increase in revenue was mainly a

result of the resumption of elective surgeries that were halted

temporarily last year because of the COVID-19 pandemic. Also, the

growth was attributed to the enhanced operations connected to the

Delta-8 synthesizing operations and medical equipment revenue for

devices used in elective surgery.

Gross profit dropped $0.1 million from $0.2 million a year ago

with a gross margin of $35.6 relative to 76.6% in Q2 2020. Net loss

in Q2 2021 was $2.8 million or $0.12 per share versus a net loss of

$1.2 million or net loss of $0.33 per share a year ago.

CEO Marco Alfonsi said, “We witnessed a nice uptick in business

during the quarter as elective surgeries resumed and our medical

durable equipment segment benefitted. Our business pipeline remains

strong for both our own branded lines and our private label

contract manufacturing. Additionally, our high activity of

strategic corporate discussions and negotiations have led to

meaningful opportunities such as the TWS Pharma asset acquisition

announced via an 8K filing on August 17, 2021, adding over $5

million in assets to our balance sheet. Opportunities like these we

believe will accelerate our growth and further solidify our balance

sheet.”

Resumption and surge of elective surgeries impacted

revenue.

For the six months ending June 30, 2021, revenue was $0.7

million, which is a 9% decline compared to $0.8 million in Q2 2020.

Can B saw a rebound and revenue increase in Q2 2021 compared to

prior periods because of the surge and resumption of elective

surgeries. Gross profit was $0.4 million, dropping by $0.2 million

from a year ago with a gross margin of 52.7%.

*Past performance is not a predictor of future results. All

investing involves risk of loss and individual investments may

vary. The examples provided may not be representative of typical

results. Your capital is at risk when you invest – you can lose

some or all of your money. Never risk more than you can afford to

lose.

Source - https://factsaboutcbd.org/can-b-corp-otcmkts-canb-reports-96-yoy-revenue-growth-in-q2-2021-4852

Other stocks on the move include

NSAV,

AABB, and

GVSI.

SOURCE: pennymillions

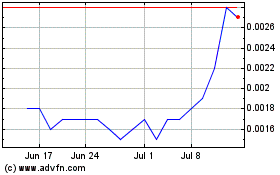

Good Vibrations Shoes (PK) (USOTC:GVSI)

Historical Stock Chart

From Feb 2025 to Mar 2025

Good Vibrations Shoes (PK) (USOTC:GVSI)

Historical Stock Chart

From Mar 2024 to Mar 2025