Amerix Completes IP Survey Over Gold Targets at Limao Property, Brazil

April 02 2012 - 12:06PM

Marketwired Canada

(TSX VENTURE:APM) Amerix Precious Metals Corporation ("Amerix" or the "Company")

is pleased to provide an update on activities at the Company's Limao Gold

Property, located in the Tapajos Gold Province, Para State, Brazil. Amerix owns

a 100% interest in the Limao Gold Property, which is located along the

"Tocantizinho gold trend".

Amerix recently completed a 3D induced polarization/resistivity geophysical

survey ("IP survey") with SJ Geophysics Ltd. to cover three separate mineralized

targets named the South Grid, Limao Pit, and a new zone, the Jambu Zone on two

separate grids. The grid locations and IP survey targets are presented in the

linked Figure 1 and are described below. The Company awaits the final

interpretation of the IP survey to aid its diamond drill program that is planned

to begin in the 2nd quarter of 2012.

To view Figure 1 image, please copy and paste URL below into new browser:

http://www.rmcommunicationsinc.com/snapmail/img/file20120402102453.pdf

The South Grid target is characterized by a greater than 20 parts per billion

("ppb") gold in soil anomaly traceable for 350 metres along an east-west trend

and corresponds to gold bearing quartz-sulphide veins hosted along a sheared

contact between quartz diorite, diabase, and granite. Rock and soil sample assay

results from the shear and veins were outlined in News Releases 2012 - 01 and

2012 - 03. Another target at the South Grid that was tested by the IP survey is

a broad, easterly trending, gold in soil geochemical anomaly located 300 metres

northeast of the shear.

The main target at the Central Grid, and target of the IP survey, is pyrite

bearing syenite that was exploited at the Limao pit by small scale artisanal

miners during the 1980's. As noted in earlier news releases, historic, non

43-101 compliant, diamond drill holes that drilled under the Limao pit returned

promising results, such as 47 grams per tonne gold over 13 metres and 18.7 grams

per tonne gold over 6.8 metres. During 2009 and 2010, Amerix collected sixteen

grab samples of stockpiled pyrite bearing syenite from near the Limao pit that

returned assay values between 2.37 and 106.6 grams per tonne gold (0.01 to 3.43

ounces per tonne gold) with an average of 38.13 grams per tonne gold (1.22

ounces per tonne gold). One of those above mentioned sixteen samples was

collected from a piece of dumped drill core that contained pyritic fractures in

syenite and analyzed 34.77 grams per tonne gold (1.12 ounces per tonne gold).

Gold in soil assay results have recently been received for a new zone, the Jambu

Zone, which is located 800 metres northwest of the Limao pit and was also tested

by the IP survey. Five hundred and sixty two, 1 metre soil auger samples were

collected at the Jambu Zone during 2011 and 2012 within a 300 metre by 300 metre

infill grid on 20 metre by 10 metre sample stations. The soil auger samples were

analysed for gold by fire assay and outlined a greater than 25 ppb gold in soil

anomaly with an ovoidal shape that is elongate to the northwest and measures 340

metres by 225 metres. 21% of those soil samples assayed between 0 to 15 ppb

gold, 25% assayed between 15 to 25 ppb gold, 27% assayed between 25 to 50 ppb

gold, 18% assayed between 50 to 100 ppb gold, and 9% assayed between 100 to 470

ppb gold. The Jambu Zone is located on a ridge and the soil assay results

between 50 to 100 and 100 to 470 ppb gold form the core of the ovoidal anomaly.

The Company is currently compiling hand trench, limited outcrop mapping, and

deeper manual auger sampling from this zone.

Further to those activities, the Company is pleased to announce it has been

granted an additional 1,268 hectares of mineral claims in the form of 'requests

for exploration permits' by the Brazilian National Department of Mineral

Production (DNPM). These requests, as part of the claim staking process, give

the claim holder priority to receive the exploration permit that is granted by

the DNPM. The 1,268 hectares are comprised of 5 'requests' that are both

contiguous and non-contiguous to the Limao Gold Property. The additional claims

are outlined in the linked Figure 1 and increase the total hectares of the Limao

Gold Property to approximately 11,500.

Mr. Ryan Grywul, P. Geo., and Vice President, Corporate Development for Amerix,

and a qualified person as defined in National Policy 43-101 is responsible for

all technical information contained in this news release.

Amerix is well funded to complete its first drill campaign at Limao, and is

excited by the potential of the Limao Gold Property, located in the historically

gold rich Tapajos district of Brazil.

All soil samples were delivered to Acme Labs preparation facility in Itaituba,

Brazil where the samples were dried, sieved, and shipped to Acme's Santiago,

Chile laboratory for gold analysis by fire assay with atomic absorption finish

on a 50 gram split. Rock samples were delivered to SGS Geosol's or Acme Labs'

preparation facility in Itaituba. Rock samples prepared by SGS Geosol were

crushed, pulverized, split to 50 grams, and shipped to SGS's assay laboratory in

Vespasiano, Brazil for gold analysis by fire assay with atomic absorption

finish. Rock samples prepared by Acme were crushed, pulverized, split to 30

grams, and shipped to Acme's Santiago, Chile laboratory for gold analysis by

fire assay with atomic absorption finish. Both SGS and Acme reanalyzed over

limit gold samples with a gravimetric finish. Both SGS and Acme are ISO

certified laboratories.

About Amerix Precious Metals Corporation

Amerix Precious Metals Corporation is an Ontario company, managed by an

experienced team, exploring for precious metals in Brazil. Amerix's objective is

to create value for shareholders through the delineation and expansion of

bedrock gold resources, and realization of value from placer and tailings gold

resources at the Company's properties. Brazil has significant gold potential and

is a proven mining-friendly country. Amerix will continue to seek exploration

properties of merit via staking, acquisition or merger. The Company's shares

trade on the TSX Venture Exchange under the symbol "APM" and at the Frankfurt

Stock Exchange under the symbol "NJGN".

Disclosure Regarding Forward-Looking Statements: This press release contains

certain "Forward-Looking Statements" within the meaning of applicable securities

legislation. All statements, other than statements of historical fact, included

herein are forward-looking statements that involve various risks and

uncertainties. There can be no assurance that such statements will prove to be

accurate, and actual results and future events could differ materially from

those anticipated in such statements. Important factors that could cause actual

results to differ materially from the Company's expectations are disclosed in

the Company's documents filed from time to time with the TSX Venture Exchange

and, among others, the Ontario Securities Commission as well as under the

heading "Risk Factors" in the Management Discussion and Analysis.

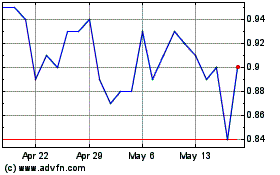

Andean Precious Metals (TSXV:APM)

Historical Stock Chart

From Jun 2024 to Jul 2024

Andean Precious Metals (TSXV:APM)

Historical Stock Chart

From Jul 2023 to Jul 2024