International Tower Hill Mines Ltd. ("ITH" or the "Company") (TSX:

ITH)(NYSE Amex: THM)(FRANKFURT: IW9) is pleased to announce that it

has signed a letter of intent to enter into a joint venture with

American Mining Corporation ("AMC"), a private Nevada corporation,

on ITH's high grade Terra Gold Project in Alaska. Pursuant to the

LOI, an Alaskan subsidiary of AMC ("Subco") and Raven Gold Alaska

Inc. ("Raven"), a subsidiary of ITH, will form a joint venture (the

"JV") with the aim of developing the Terra Project to production.

It is anticipated that AMC, as operator, will commence a project

development program in June 2010.

Terra Project - Background

The Terra Gold Project is located in the Hartman Mining District

of Western Alaska and hosts a current 43-101 compliant inferred

resource of 428,000 tonnes at a grade of 12.2 g/t gold (168,000

contained ounces) and a grade of 23.1 g/t silver (318,000 contained

ounces), at a cutoff grade of 5 g/t gold, in a vein system which

remains open (see NR 08-04).

The Terra Project consists of 235 State of Alaska unpatented

lode mining claims currently held 100% by the Company plus an

additional 5 unpatented lode mining claims held under lease

(subject to a 3% to 4% NSR royalty to the lessor, dependent upon

the gold price). The property is centered on an 8 kilometre long

trend of high-grade vein occurrences which have returned numerous

surface rock samples and drill intersection in excess of 50 g/t

gold. The bulk of the Company's past drilling has focused on only a

400 metre long section of one of the vein systems (Ben's Vein)

discovered to date. This drilling has outlined the resource noted

above, which is over an average width of 2.3 metres, utilizing 20

HQ diamond holes.

AMC Earn-in and Joint Venture Structure

The initial interests of Subco and Raven in the JV will be 51%

and 49% respectively. Raven's initial contribution to the JV will

be its interest in the Terra Project, including all related data

and property facilities. Subco's initial contribution to the JV

will be funding for the JV totalling USD 6,000,000 over three years

(USD 1,000,000 in 2010). Of these expenditures, USD 100,000 will be

paid to the Company in each of the first and second years to

partially reimburse the Company for the cost of constructing the

existing camp facility at Terra. As consideration for the Company

causing Raven to enter into the JV, AMC will pay the Company USD

300,000, and issue 750,000 common shares of AMC, over the same

three-year period (USD 50,000 and 250,000 shares in 2010). If Subco

fails to make its full initial contribution, or AMC fails to make

all required payments and share issuances to the Company, over such

three-year period, then the JV will terminate and Subco will not

retain any residual interest in the Terra project.

In addition, the JV has granted Raven a sliding scale NSR

royalty of between 0.5% and 5% (depending upon the gold price) on

all precious metal production from the property and a 1% NSR

royalty on all base metal production. The royalty to Raven is in

addition to the current royalty payable to the underlying

lessor.

Upon having completed its initial contribution, Subco will have

the option to increase its JV interest by 29% (to 80% total) by

providing a subsequent contribution of an additional USD 3,050,000

in funding in the fourth year. In addition, AMC will be required to

pay the Company an additional USD 150,000 and issue an additional

150,000 common shares. Should Raven's interest be diluted below 10%

as a consequence of it not funding its proportionate share of JV

expenditures following AMC's having completed its initial

contribution (and subsequent contribution, if applicable), Raven's

JV interest will be converted to an additional 1% property wide NSR

royalty on all metals produced, for an aggregate NSR royalty to

Raven of 1.5% to 6% (depending upon the gold price) on precious

metals and 2% on base metals).

Formation of the JV is subject to the settlement and execution

of a formal agreement and the completion by AMC of due diligence on

the Terra project, both to be completed on or before May 19, 2010

(subject to extension by agreement).

Jeff Pontius, the President and CEO of ITH, stated, "The joint

venture with AMC will significantly benefit ITH shareholders by

partnering with an experienced and highly capable underground

development group such as AMC. This joint venture, along with our

recently announced Chisna joint venture, continues to position the

Company's non-Livengood assets as strategic building blocks for our

Raven Gold initiative, in which we plan to build a company with

significant exposure to partner funded, non-operator, gold-silver

production via royalty and/or carried interest agreements."

About International Tower Hill Mines Ltd.

International Tower Hill Mines Ltd. is a resource exploration

company, focused in Alaska and Nevada, which controls a number of

exploration projects representing a spectrum of early stage to the

advanced multimillion ounce gold discovery at Livengood. ITH is

committed to building shareholder value through new discoveries

while maintaining a majority interest in its key holdings, thereby

giving its shareholders the maximum value for their investment.

On Behalf of INTERNATIONAL TOWER HILL MINES LTD.

Jeffrey A. Pontius, President and Chief Executive Officer

Cautionary Note Regarding Forward-Looking Statements

This press release contains forward-looking statements within

the meaning of Section 27A of the Securities Act and Section 27E of

the Exchange Act. All statements, other than statements of

historical fact, included herein including, without limitation,

statements regarding the anticipated content, commencement and cost

of exploration programs, anticipated exploration program results,

the discovery and delineation of mineral

deposits/resources/reserves, the potential for achieving any

production at the Terra project, business and financing plans and

business trends, are forward-looking statements. Information

concerning mineral resource estimates also may be deemed to be

forward-looking statements in that it reflects a prediction of the

mineralization that would be encountered if a mineral deposit were

developed and mined. Although the Company believes that such

statements are reasonable, it can give no assurance that such

expectations will prove to be correct. Forward-looking statements

are typically identified by words such as: believe, expect,

anticipate, intend, estimate, postulate and similar expressions, or

are those, which, by their nature, refer to future events. The

Company cautions investors that any forward-looking statements by

the Company are not guarantees of future results or performance,

and that actual results may differ materially from those in forward

looking statements as a result of various factors, including, but

not limited to, variations in the nature, quality and quantity of

any mineral deposits that may be located, variations in the market

price of any mineral products the Company and AMC may produce or

plan to produce, the inability of the Company or AMC to obtain any

necessary permits, consents or authorizations required for its

activities, the inability of the Company or AMC to produce minerals

from its properties successfully or profitably, to continue its

projected growth, to raise the necessary capital or to be fully

able to implement their respective business strategies, the

inability of the Company or AMC to settle definitive agreements,

the inability of AMC to raise the necessary funding to meet its

initial and secondary contribution requirements, and other risks

and uncertainties disclosed in the Company's Annual Information

Form filed with certain securities commissions in Canada and the

Company's annual report on Form 40-F filed with the United States

Securities and Exchange Commission (the "SEC"), and other

information released by the Company and filed with the appropriate

regulatory agencies. All of the Company's Canadian public

disclosure filings may be accessed via www.sedar.com and its United

States public disclosure filings may be accessed via www.sec.gov,

and readers are urged to review these materials, including the

technical reports filed with respect to the Company's mineral

properties.

Cautionary Note Regarding References to Resources and

Reserves

National Instrument 43 101 - Standards of Disclosure for Mineral

Projects ("NI 43-101") is a rule developed by the Canadian

Securities Administrators which establishes standards for all

public disclosure an issuer makes of scientific and technical

information concerning mineral projects. Unless otherwise

indicated, all resource estimates contained in or incorporated by

reference in this press release have been prepared in accordance

with NI 43-101 and the guidelines set out in the Canadian Institute

of Mining, Metallurgy and Petroleum (the "CIM") Standards on

Mineral Resource and Mineral Reserves, adopted by the CIM Council

on November 14, 2004 (the "CIM Standards") as they may be amended

from time to time by the CIM.

United States shareholders are cautioned that the requirements

and terminology of NI 43-101 and the CIM Standards differ

significantly from the requirements and terminology of the SEC set

forth Industry Guide 7. Accordingly, the Company's disclosures

regarding mineralization may not be comparable to similar

information disclosed by companies subject to the SEC's Industry

Guide 7. Without limiting the foregoing, while the terms "mineral

resources", "inferred mineral resources" and "indicated mineral

resources" are recognized and required by NI 43-101 and the CIM

Standards, they are not recognized by the SEC and are not permitted

to be used in documents filed with the SEC by companies subject to

Industry Guide 7. Mineral resources which are not mineral reserves

do not have demonstrated economic viability, and United States

shareholders are cautioned not to assume that all or any part of a

mineral resource will ever be converted into reserves. Further,

inferred resources have a great amount of uncertainty as to their

existence and as to whether they can be mined legally or

economically. It cannot be assumed that all or any part of the

inferred resources will ever be upgraded to a higher resource

category. In addition, the NI 43-101 and CIM Standards definition

of a "reserve" differs from the definition adopted by the SEC in

Industry Guide 7. In the United States, a mineral reserve is

defined as a part of a mineral deposit which could be economically

and legally extracted or produced at the time the mineral reserve

determination is made.

This press release is not, and is not to be construed in any way

as, an offer to buy or sell securities in the United States.

NR10-05

Contacts: International Tower Hill Mines Ltd. Quentin Mai

Vice-President - Corporate Communications 1-888-770-7488 or (toll

free) or (604)683-6332 (604) 408-7499 (FAX)

qmai@internationaltowerhill.com www.internationaltowerhill.com

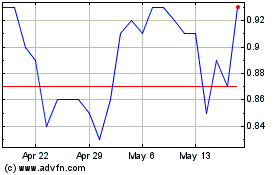

International Tower Hill... (TSX:ITH)

Historical Stock Chart

From May 2024 to Jun 2024

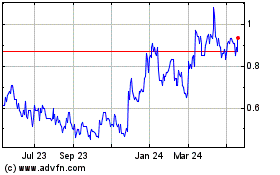

International Tower Hill... (TSX:ITH)

Historical Stock Chart

From Jun 2023 to Jun 2024