0000097745FALSE00000977452023-11-072023-11-070000097745us-gaap:CommonStockMember2023-11-072023-11-070000097745tmo:SeniorNotes0.75Due2024Member2023-11-072023-11-070000097745tmo:SeniorNotes0.125Due2025Member2023-11-072023-11-070000097745tmo:SeniorNotes200Due2025Member2023-11-072023-11-070000097745tmo:SeniorNotes3200Due2026Member2023-11-072023-11-070000097745tmo:SeniorNotes1.40Due2026Member2023-11-072023-11-070000097745tmo:A1.45SeniorNotesDue2027Member2023-11-072023-11-070000097745tmo:SeniorNotes175Due2027Member2023-11-072023-11-070000097745tmo:SeniorNotes0.500Due2028Member2023-11-072023-11-070000097745tmo:SeniorNotes1.375Due2028Member2023-11-072023-11-070000097745tmo:SeniorNotes1.95Due2029Member2023-11-072023-11-070000097745tmo:SeniorNotes0.875Due2031Member2023-11-072023-11-070000097745tmo:SeniorNotes2375Due2032Member2023-11-072023-11-070000097745tmo:SeniorNotes3650Due2034Member2023-11-072023-11-070000097745tmo:SeniorNotes2.875Due2037Member2023-11-072023-11-070000097745tmo:SeniorNotes1.500Due2039Member2023-11-072023-11-070000097745tmo:SeniorNotes1.875Due2049Member2023-11-072023-11-07

UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): November 7, 2023

THERMO FISHER SCIENTIFIC INC.

(Exact name of Registrant as specified in its Charter)

| | | | | | | | | | | | | | |

| Delaware | | 1-8002 | | 04-2209186 |

| (State of incorporation) | | (Commission File Number) | | (I.R.S. Employer Identification Number) |

168 Third Avenue

Waltham, Massachusetts 02451

(Address of principal executive offices) (Zip Code)

Registrant’s telephone number, including area code: (781) 622-1000

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act: | | | | | | | | | | | | | | |

| Title of each class | | Trading Symbol(s) | | Name of each exchange on which registered |

| Common Stock, $1.00 par value | | TMO | | New York Stock Exchange |

| 0.750% Notes due 2024 | | TMO 24A | | New York Stock Exchange |

| 0.125% Notes due 2025 | | TMO 25B | | New York Stock Exchange |

| 2.000% Notes due 2025 | | TMO 25 | | New York Stock Exchange |

| 3.200% Notes due 2026 | | TMO 26B | | New York Stock Exchange |

| 1.400% Notes due 2026 | | TMO 26A | | New York Stock Exchange |

| 1.450% Notes due 2027 | | TMO 27 | | New York Stock Exchange |

| 1.750% Notes due 2027 | | TMO 27B | | New York Stock Exchange |

| 0.500% Notes due 2028 | | TMO 28A | | New York Stock Exchange |

| 1.375% Notes due 2028 | | TMO 28 | | New York Stock Exchange |

| 1.950% Notes due 2029 | | TMO 29 | | New York Stock Exchange |

| 0.875% Notes due 2031 | | TMO 31 | | New York Stock Exchange |

| 2.375% Notes due 2032 | | TMO 32 | | New York Stock Exchange |

| 3.650% Notes due 2034 | | TMO 34 | | New York Stock Exchange |

| 2.875% Notes due 2037 | | TMO 37 | | New York Stock Exchange |

| 1.500% Notes due 2039 | | TMO 39 | | New York Stock Exchange |

| 1.875% Notes due 2049 | | TMO 49 | | New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 5.04 Temporary Suspension of Trading Under Registrant’s Employee Benefit Plans.

The Thermo Fisher Scientific Inc. 401(k) Plan (the “401(k) plan”) is transitioning to a new plan administrator. To facilitate the transition, all transactions in the 401(k) plan will be temporarily suspended during a blackout period. Participants in the 401(k) plan were notified of the blackout period on November 7, 2023. During the blackout period, participants in the 401(k) plan will be unable to make changes to their contribution rates and investment allocations, make loan repayments or request new loans, or request withdrawals or distributions under the 401(k) plan, including with respect to the shares of common stock, $1.00 par value per share (the “Common Stock”), of Thermo Fisher Scientific Inc. (the “Company”). The blackout period is expected to begin at 4:00 pm Eastern Time on Thursday, December 21, 2023 and end during the week of January 14, 2024. The notification described under Section 101(i)(2)(E) of the Employment Retirement Income Security Act of 1974 relating to the blackout period was provided to the Company on November 7, 2023.

On November 7, 2023, the Company sent a notice to its directors and executive officers informing them of the 401(k) plan blackout period and the restrictions that will apply to them during the blackout period. During the blackout period, subject to certain limited exemptions, the Company’s directors and executive officers will be prohibited from directly or indirectly purchasing, selling, acquiring or transferring any Common Stock (including derivatives thereof) acquired in connection with their service or employment as a director or executive officer of the Company. This notice was required pursuant to Section 306 of the Sarbanes-Oxley Act of 2002 and Section 104 of Regulation BTR under the Securities Exchange Act of 1934.

A copy of the notice to the directors and executive officers is attached as Exhibit 99.1 and incorporated herein by reference. During the blackout period and for a period of two years after the ending date of the blackout period, shareholders or other interested parties may obtain, without charge, information about the actual beginning and ending dates of the blackout period by contacting the Company’s Corporate Secretary by telephone at (781) 622-1000 or by mail at Corporate Secretary, Thermo Fisher Scientific Inc., 168 Third Avenue, Waltham, Massachusetts 02451.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits.

| | | | | | | | |

| Exhibit | | Description |

| | |

| 104 | | Cover Page Interactive Data File (embedded with the Inline XBRL document) |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | | | | |

| | THERMO FISHER SCIENTIFIC INC. |

| | | |

| | | |

| Date: | November 7, 2023 | By: | /s/ Michael A. Boxer |

| | | Michael A. Boxer |

| | | Senior Vice President and General Counsel |

Exhibit 99.1

TO: Directors and Executive Officers of Thermo Fisher Scientific Inc.

DATE: November 7, 2023

RE: Important Notice of Blackout Period and Regulation BTR Trading Restrictions

Federal securities laws require Thermo Fisher Scientific Inc. (“we”, “us”, “our” or the “Company”) to send you a notice whenever restrictions are imposed on your trading in the shares of our common stock, $1.00 par value per share (the “Common Stock”), (including derivatives thereof) due to a suspension of transactions in the Thermo Fisher Scientific Inc. 401(k) Plan (the “401(k) plan”) that applies to 50% or more of the participants in the 401(k) plan for a period of more than three consecutive business days.

Although the 401(k) Blackout Period (as defined below) falls during a period in which your trading is already restricted under our Insider Trading Policy, we are required to provide you with this notice in order to comply with federal securities laws.

Reason for 401(k) Blackout Period. A temporary suspension of transactions in the 401(k) plan is necessary to facilitate the transition of the 401(k) plan to a new administrator. During the 401(k) Blackout Period, 401(k) plan participants will be unable to make changes to their contribution rates and investment allocations, make loan repayments or request new loans, or request withdrawals or distributions under the 401(k) plan, including with respect to the Thermo Fisher Scientific Inc. Stock Fund.

Length of 401(k) Blackout Period. The transition to a new administrator is expected to begin at 4:00pm Eastern Time on December 21, 2023, and end during the week of January 14, 2024 (the “401(k) Blackout Period”). If the date of the transition changes and we are required to adjust the beginning date or the length of the 401(k) Blackout Period, we will provide you with notice of such adjustment as soon as reasonably practicable.

Restrictions on Executive Officers and Directors During the 401(k) Blackout Period. Federal securities laws provide that, during the 401(k) Blackout Period, you - as a director or executive officer of the Company - are prohibited during the 401(k) Blackout Period from directly or indirectly purchasing, selling or otherwise acquiring or transferring any Common Stock (including derivatives thereof) acquired in connection with your service as a director or employment as an executive officer - even if you are not a participant in the 401(k) plan. These prohibitions also apply to any transaction in which you may have a pecuniary interest (e.g., transactions by members of your immediate family who share your household, as well as to trusts, corporations, and other entities whose ownership of Common Stock may be attributed to you).

Certain transactions are exempt from these trading prohibitions (such as qualified Rule 10b5-1 plan transactions). However, while several narrow exceptions to this prohibition exist, you should not engage in any transaction without first confirming with the Company’s legal department whether an exception is available. If you engage in a transaction that violates these rules, you may be required to disgorge your profits from the transaction, and you may be subject to civil and criminal penalties.

If you have questions regarding the 401(k) Blackout Period, including when it has started or ended, you may contact our Corporate Secretary, Julia Chen, by telephone at (781) 622-1000 or by mail at Corporate Secretary, Thermo Fisher Scientific Inc., 168 Third Avenue, Waltham, Massachusetts 02451.

v3.23.3

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLine items represent financial concepts included in a table. These concepts are used to disclose reportable information associated with domain members defined in one or many axes to the table.

| Name: |

dei_EntityListingsLineItems |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:stringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=us-gaap_CommonStockMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=tmo_SeniorNotes0.75Due2024Member |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=tmo_SeniorNotes0.125Due2025Member |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=tmo_SeniorNotes200Due2025Member |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=tmo_SeniorNotes3200Due2026Member |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=tmo_SeniorNotes1.40Due2026Member |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=tmo_A1.45SeniorNotesDue2027Member |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=tmo_SeniorNotes175Due2027Member |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=tmo_SeniorNotes0.500Due2028Member |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=tmo_SeniorNotes1.375Due2028Member |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=tmo_SeniorNotes1.95Due2029Member |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=tmo_SeniorNotes0.875Due2031Member |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=tmo_SeniorNotes2375Due2032Member |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=tmo_SeniorNotes3650Due2034Member |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=tmo_SeniorNotes2.875Due2037Member |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=tmo_SeniorNotes1.500Due2039Member |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=tmo_SeniorNotes1.875Due2049Member |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

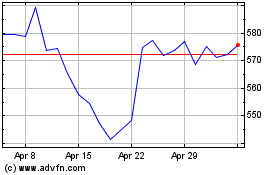

Thermo Fisher Scientific (NYSE:TMO)

Historical Stock Chart

From Jun 2024 to Jul 2024

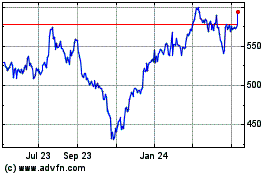

Thermo Fisher Scientific (NYSE:TMO)

Historical Stock Chart

From Jul 2023 to Jul 2024