Use these links to rapidly review the document

TABLE OF CONTENTS

TABLE OF CONTENTS

Table of Contents

Filed Pursuant to Rule 424B5

Registration Statement No. 333-228157

CALCULATION OF REGISTRATION FEE

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Title of Each Class of Securities

to be Registered

|

|

Amount To be

Registered(1)

|

|

Proposed Maximum

Offering Price Per

Security

|

|

Proposed Maximum

Aggregate Offering

Price

|

|

Amount of

Registration Fee(2)

|

|

|

|

Common Stock, par value $0.01 per share

|

|

12,650,000

|

|

$69.25

|

|

$876,012,500.00

|

|

$106,172.72

|

|

|

-

(1)

-

Includes

1,650,000 shares of Common Stock, par value $0.01 per share, which may be purchased by the underwriters upon the exercise of the underwriters' option to

purchase additional shares of Common Stock.

-

(2)

-

Calculated

in accordance with Rules 456(b) and 457(r) of the Securities Act.

Table of Contents

PROSPECTUS SUPPLEMENT

(To prospectus dated November 5, 2018)

11,000,000 Shares

Common Stock

All of the 11,000,000 shares are being sold by us. We currently pay regular monthly dividends to holders of our common stock, which is listed on

the New York Stock Exchange, or NYSE, under the symbol "O." On May 3, 2019, the last reported sale price of our common stock on the NYSE was $70.30 per share.

Realty

Income Corporation, The Monthly Dividend Company®, is an S&P 500 company dedicated to providing stockholders with dependable monthly dividends that increase

over time. We are structured as a real estate investment trust, or REIT, requiring us annually to distribute at least 90% of our taxable income (excluding net capital gains) in the form of dividends

to our stockholders. Our monthly dividends are supported by the cash flow generated from real estate owned under long-term, net lease agreements with regional and national commercial tenants. As of

March 31, 2019, we owned a diversified portfolio of 5,876 properties located in 49 states and Puerto Rico, with over 95.2 million square feet of leasable space leased to 261 different

commercial tenants doing business in 48 separate industries.

Investing in our common stock involves risks. See "Risk Factors" beginning on page S-6 of this prospectus

supplement.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Per Share

|

|

Total

|

|

|

|

Public offering price

|

|

$69.25

|

|

$761,750,000

|

|

|

|

Underwriting discount

|

|

$2.42

|

|

$26,620,000

|

|

|

|

Proceeds, before expenses, to Realty Income Corporation

|

|

$66.83

|

|

$735,130,000

|

|

|

The

underwriters have the option to purchase up to an additional 1,650,000 shares of common stock from us.

Neither

the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or passed upon the adequacy or accuracy of this

prospectus supplement or the accompanying prospectus. Any representation to the contrary is a criminal offense.

The

shares of common stock will be ready for delivery on or about May 9, 2019.

Joint Book-Running Managers

|

|

|

|

|

|

|

BofA Merrill Lynch

|

|

Morgan Stanley

|

|

Wells Fargo Securities

|

|

|

|

|

|

|

|

|

|

Credit Suisse

|

|

Goldman Sachs & Co. LLC

|

|

J.P. Morgan

|

|

RBC Capital Markets

|

|

|

|

|

|

|

|

|

|

|

|

Barclays

|

|

Citigroup

|

|

Jefferies

|

|

Mizuho Securities

|

|

Stifel

|

Lead Managers

|

|

|

|

|

|

|

Baird

|

|

Regions Securities LLC

|

|

UBS Investment Bank

|

Senior Co-Managers

|

|

|

|

|

|

|

|

|

BB&T Capital Markets

|

|

BTIG

|

|

BMO Capital Markets

|

|

BNY Mellon Capital Markets, LLC

|

|

MUFG

|

|

|

|

Scotiabank

|

|

TD Securities

|

Co-Managers

|

|

|

|

|

|

|

|

|

Comerica Securities

|

|

D.A. Davidson & Co.

|

|

Janney Montgomery Scott

|

|

Ladenburg Thalmann

|

|

Ramirez & Co., Inc.

|

|

Raymond James

|

|

Evercore ISI

|

|

Moelis & Company

|

The date of this prospectus supplement is May 6, 2019.

Table of Contents

TABLE OF CONTENTS

Prospectus Supplement

You

should rely only on the information contained or incorporated by reference in this prospectus supplement and the accompanying prospectus and, if applicable, any free writing

prospectus we may provide you in connection with this offering. We have not, and the underwriters have not, authorized any person to provide you with different information. If anyone provides you with

different or inconsistent information, you should not rely on it. We are not, and the underwriters are not, making an offer to sell these securities or soliciting an offer to buy these securities in

any jurisdiction where, or to any person to whom, the offer or sale of these securities is not permitted. You should assume that the information appearing in this prospectus supplement, the

accompanying prospectus, the documents incorporated by reference herein or therein and, if applicable, any free writing prospectus we may provide you in connection with this offering is accurate only

as of those documents' respective dates. Our business, financial condition, results of operations and prospects may have changed since those dates.

This

document is in two parts. The first part is this prospectus supplement, which adds to and updates information contained in the accompanying prospectus. The second part, the

prospectus, provides more general information, some of which may not apply to this offering. Unless otherwise

i

Table of Contents

expressly

stated or the context otherwise requires, when we refer to this prospectus, we are referring to both parts of this document combined. To the extent there is a conflict between the

information contained in this prospectus supplement and the information contained in the accompanying prospectus, you should rely on the information in this prospectus supplement.

Before

purchasing any securities, you should carefully read both this prospectus supplement and the accompanying prospectus, together with the incorporated documents described under the

headings "Supplemental U.S. Federal Income Tax Considerations" in this prospectus supplement and "Incorporation by Reference" in this prospectus supplement and the accompanying prospectus, and any

free writing prospectus we may provide to you in connection with this offering.

No

action has been or will be taken in any jurisdiction by us or by any underwriter that would permit a public offering of these securities or possession or distribution of this

prospectus supplement, the accompanying prospectus or any related free writing prospectus where action for that purpose is required, other than in the United States. Unless otherwise expressly stated

or the context otherwise requires, references to "dollars" and "$" in this prospectus supplement, the accompanying prospectus and any related free writing prospectus are to United States dollars.

ii

Table of Contents

PROSPECTUS SUPPLEMENT SUMMARY

This summary does not contain all the information that may be important to you. You should read this entire prospectus

supplement and the accompanying prospectus and the documents incorporated and deemed to be incorporated by reference herein and therein, including the financial statements and related notes, and, if

applicable, any free writing prospectus we may provide you in connection with this offering before making an investment decision. Unless this prospectus supplement otherwise indicates or the context

otherwise requires, (a) the terms "Realty Income," "our," "us" and "we" as used in this prospectus supplement refer to Realty Income Corporation, a Maryland corporation, and its subsidiaries on

a consolidated basis and (b) references to our "$3.0 billion revolving credit facility," our "revolving credit facility" and similar references mean our $3.0 billion unsecured

revolving credit facility and references to our "$250.0 million term loan facilities," our "term loan facilities" and similar references mean our two $250.0 million unsecured term loan

facilities.

Realty Income

Realty Income Corporation, The Monthly Dividend Company®, is an S&P 500 company dedicated to providing stockholders with

dependable monthly dividends that increase over time. We are structured as a real estate investment trust, or REIT, requiring us annually to distribute at least 90% of our taxable income (excluding

net capital gains) in the form of dividends to our stockholders. Our monthly dividends are supported by the cash flow generated from real estate owned under long-term, net lease agreements with

regional and national commercial tenants. We seek to increase earnings and distributions to stockholders through active portfolio management, asset management and the acquisition of additional

properties.

As

of March 31, 2019, we owned a diversified portfolio of 5,876 properties located in 49 states and Puerto Rico, with over 95.2 million square feet of leasable space leased

to 261 different commercial tenants doing business in 48 separate industries. Of the 5,876 properties in the portfolio, 5,847, or 99.5%, were single-tenant properties, and the remaining were

multi-tenant properties. At March 31, 2019, of the 5,847 single-tenant properties, 5,748 were leased with a weighted average remaining lease term (excluding rights to extend a lease at the

option of the tenant) of approximately 9.2 years.

Our

principal executive offices are located at 11995 El Camino Real, San Diego, California 92130 and our telephone number is (858) 284-5000.

Recent Developments

Increases in Monthly Dividends to Common Stockholders

We have continued our 50-year policy of paying monthly dividends. In addition, we increased the dividend five times during 2018, and three times

during 2019. As of May 3, 2019, we have paid 86

S-1

Table of Contents

consecutive

quarterly dividend increases and increased the dividend 101 times since our listing on the New York Stock Exchange (the "NYSE") in 1994.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Month Declared

|

|

Month Paid

|

|

Dividend

Per Share

|

|

Increase

Per Share

|

|

|

2018 Dividend Increases

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

1st increase

|

|

|

Dec 2017

|

|

|

Jan 2018

|

|

$

|

0.2125

|

|

$

|

0.0005

|

|

|

2nd increase

|

|

|

Jan 2018

|

|

|

Feb 2018

|

|

|

0.2190

|

|

|

0.0065

|

|

|

3rd increase

|

|

|

Mar 2018

|

|

|

Apr 2018

|

|

|

0.2195

|

|

|

0.0005

|

|

|

4th increase

|

|

|

June 2018

|

|

|

Jul 2018

|

|

|

0.2200

|

|

|

0.0005

|

|

|

5th increase

|

|

|

Sep 2018

|

|

|

Oct 2018

|

|

|

0.2205

|

|

|

0.0005

|

|

|

2019 Dividend Increases

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

1st increase

|

|

|

Dec 2018

|

|

|

Jan 2019

|

|

$

|

0.2210

|

|

$

|

0.0005

|

|

|

2nd increase

|

|

|

Jan 2019

|

|

|

Feb 2019

|

|

|

0.2255

|

|

|

0.0045

|

|

|

3rd increase

|

|

|

Mar 2019

|

|

|

Apr 2019

|

|

|

0.2260

|

|

|

0.0005

|

|

The

dividends paid per share of common stock during the first three months of 2019 totaled approximately $0.672, as compared to approximately $0.651 during the first three months of

2018, an increase of approximately $0.021 per share, or 3.2%.

The

current monthly dividend of $0.2260 per share of common stock represents a current annualized dividend of $2.712 per share, and an annualized dividend yield of approximately 3.9%

based on the last reported sale price of our common stock on the NYSE of $70.30 on May 3, 2019. Although we expect to continue our policy of paying monthly dividends, we cannot guarantee that

we will maintain our current level of dividends, that we will continue our pattern of increasing dividends per share, or what our actual dividend yield will be in any future period.

Acquisitions During the First Three Months of 2019

During the first three months of 2019, we invested $519.5 million in 105 new properties and properties under development or expansion,

with an estimated initial weighted average contractual lease rate of 6.7%. The 105 new properties and properties under development or expansion

are located in 25 states, will contain approximately 2.3 million leasable square feet, and are 100% leased with a weighted average lease term of 17.0 years. The tenants occupying the new

properties operate in 14 industries and the property types are 98.7% retail and 1.3% industrial, based on rental revenue. During the first three months of 2019, none of our real estate investments

caused any one tenant to be 10% or more of our total assets at March 31, 2019.

The

estimated initial weighted average contractual lease rate for a property is generally computed as estimated contractual first year cash net operating income, which, in the case of a

net leased property, is equal to the aggregate cash base rent for the first full year of each lease, divided by the total cost of the property. Since it is possible that a tenant could default on the

payment of contractual rent, we cannot provide assurance that the actual return on the funds invested will remain at the percentage listed above. For information on how we calculate the estimated

contractual lease rate on a property under development or expansion, see "Management's Discussion and Analysis of Financial Condition and Results of Operations—Recent

Developments—Acquisitions During the First Three Months of 2019" in our Quarterly Report on

Form 10-Q for the quarter ended March 31, 2019,

which

is incorporated by reference in the accompanying prospectus.

On

April 22, 2019, we announced that we signed a definitive agreement to acquire, from a joint venture of affiliates of J Sainsbury PLC ("Sainsbury's") and British

Land PLC, 12 properties located in the United Kingdom for £429.0 million under long-term net lease agreements with Sainsbury's, which represents our first international real

estate investment. The transaction is expected to close on or around May 22, 2019, subject to customary closing conditions. In connection with the expected closing

S-2

Table of Contents

of

the transaction, we intend to borrow approximately £300.0 million in 15-year, senior unsecured debt via private placement, and to use the proceeds from those borrowings and other

available funds to pay the purchase price thereof.

Net Income Available to Common Stockholders

Net income available to common stockholders was $110.9 million in the first three months of 2019, as compared to $83.2 million in

the first three months of 2018, an increase of $27.7 million. On a diluted per common share basis, net income available to common stockholders was $0.37 in the first three months of 2019, as

compared to $0.29 in the first three months of 2018, an increase of $0.08, or 27.6%.

The

calculation to determine net income available to common stockholders includes impairments and gains from the sale of properties, which can vary from period to period based on timing

and can significantly impact net income available to common stockholders.

Gains

from the sale of properties during the first three months of 2019 were $7.3 million, as compared to gains from the sale of properties of $3.2 million during the first

three months of 2018. Total provisions for impairment recorded during the first three months of 2019 were $4.7 million, as compared to provisions for impairment of $14.2 million during

the first three months of 2018.

Funds from Operations Available to Common Stockholders (FFO)

In the first three months of 2019, FFO increased by $20.8 million, or 9.2%, to $245.7 million, compared to $224.9 million

in the first three months of 2018. On a diluted per common share basis, FFO was $0.81 in the first three months of 2019, compared to $0.79 in the first three months of 2018, an increase of $0.02, or

2.5%.

For

information on how we define FFO (which is not a financial measure under U.S. generally accepted accounting principles, or GAAP), as well as a reconciliation of net income available

to common stockholders (which we believe is the most comparable GAAP financial measure) to FFO, see "Management's Discussion and Analysis of Financial Condition and Results of

Operations—Funds From Operations Available to Common Stockholders (FFO)" in our Quarterly Report on

Form 10-Q for the quarter ended March 31, 2019,

which

is incorporated by reference in the accompanying prospectus.

Adjusted Funds from Operations Available to Common Stockholders (AFFO)

In the first three months of 2019, AFFO increased by $24.1 million, or 10.7%, to $248.7 million, compared to $224.6 million

in the first three months of 2018. On a diluted per common share basis, AFFO was $0.82 in the first three months of 2019, compared to $0.79 in the first three months of 2018, an increase of $0.03, or

3.8%.

For

information on how we define AFFO (which is not a financial measure under GAAP), as well as a reconciliation of net income available to common stockholders (which we believe is the

most comparable GAAP financial measure) to AFFO, see "Management's Discussion and Analysis of Financial Condition and Results of Operations—Adjusted Funds From Operations Available to

Common Stockholders (AFFO)" in our Quarterly Report on

Form 10-Q for the

quarter ended March 31, 2019,

which is incorporated by reference in the accompanying prospectus.

Proposed Increase in Authorized Common Stock

Our Board of Directors has approved an amendment to our charter that, if approved by our stockholders, would increase the number of authorized

shares of our common stock from 370,100,000 shares to 740,200,000 shares. The amendment will be considered and voted on by our stockholders at our 2019 Annual Meeting of Stockholders, which will be

held on May 14, 2019. If the amendment is approved by our stockholders, it will become effective upon the filing of articles of amendment to our charter with, and acceptance for record by, the

State Department of Assessments and Taxation of Maryland.

S-3

Table of Contents

The Offering

We are selling all of the shares of common stock offered by this prospectus supplement and no shares are being sold by our stockholders. For a

description of our common stock, see "Recent Developments—Proposed Increase in Authorized Common Stock" above and "Description of Common Stock," "Restrictions on Ownership and Transfers of

Stock" and "Certain Provisions of Maryland Law and of our Charter and Bylaws" in the accompanying prospectus.

|

|

|

|

|

Issuer

|

|

Realty Income Corporation

|

|

Common Stock we are Offering

|

|

11,000,000 shares of common stock, plus up to an additional 1,650,000 shares if the underwriters exercise their option to

purchase additional shares of common stock from us in full.

|

|

Shares to be Outstanding After this Offering(1)

|

|

314,816,812 shares of common stock (or 316,466,812 shares if the underwriters exercise their option to purchase additional

shares of common stock from us in full).

|

|

Use of Proceeds

|

|

We intend to use the net proceeds from this offering to repay all or a portion of the borrowings outstanding under our

$3.0 billion revolving credit facility, and to the extent not used for that purpose, to fund potential investment opportunities and/or for other general corporate purposes. On May 2, 2019, we had approximately $912.0 million of

outstanding borrowings under our revolving credit facility. Borrowings under the revolving credit facility were generally used to acquire properties. For information concerning potential conflicts of interest that may arise from the use of proceeds

to repay borrowings under our $3.0 billion revolving credit facility, see "Underwriting (Conflicts of Interest)—Other Relationships" and "Underwriting (Conflicts of Interest)—Conflicts of Interest" in this prospectus

supplement.

|

|

Restrictions on Ownership and Transfer

|

|

Our charter contains restrictions on the ownership and transfer of our common stock intended, among other purposes, to

assist us in maintaining our status as a REIT for United States federal and/or state income tax purposes. For example, our charter restricts any person from acquiring beneficial or constructive ownership of more than 9.8% (by value or number of

shares, whichever is more restrictive) of our outstanding shares of common stock, as more fully described in the section entitled "Restrictions on Ownership and Transfers of Stock" in the accompanying prospectus.

|

|

NYSE Symbol

|

|

"O"

|

|

Risk Factors

|

|

An investment in our common stock involves various risks and prospective investors should carefully consider the matters

discussed under "Risk Factors" in this prospectus supplement, as well as the other risks described in this prospectus supplement, the accompanying prospectus and the documents incorporated and deemed to be incorporated by reference therein, before

making a decision to invest in the common stock.

|

S-4

Table of Contents

|

|

|

|

|

Conflicts of Interest

|

|

As described above under "Use of Proceeds," we intend to use net proceeds from this offering to repay all or a portion of the borrowings

outstanding under our revolving credit facility. Because affiliates of some of the underwriters are lenders under our revolving credit facility, more than 5% of the net proceeds of this offering (not including underwriting discounts and commissions)

may be received by such affiliates. Nonetheless, in accordance with the Financial Industry Regulatory Authority, Inc. Rule 5121, the appointment of a qualified independent underwriter is not necessary in connection with this offering

because we, the issuer of the securities in this offering, are a real estate investment trust. For additional information, see "Underwriting (Conflicts of Interest)—Other Relationships" and "Underwriting (Conflicts of Interest)—Conflicts of

Interest" in this prospectus supplement.

|

-

(1)

-

Based

on 303,816,812 shares outstanding as of May 2, 2019. Does not include, as of May 2, 2019 (i) 321,095 shares of our common stock issuable

pursuant to outstanding equity awards, which include restricted stock units and potential awards under our long term incentive plans, assuming the issuance of shares based on target performance,

(ii) 851,824 additional shares of our common stock reserved for future issuance under our equity incentive plans, (iii) 11,729,347 shares of our common stock reserved for future issuance

under our Dividend Reinvestment and Stock Purchase Plan, (iv) 20,453,861 shares of our common stock that may be issued under our current ATM equity distribution plan, and (v) up to

463,119 shares (subject to adjustment under specified circumstances) of common stock that may be issued upon the exchange of outstanding operating partnership units issued by our subsidiary, Realty

Income, L.P.

Our

board of directors has authorized and we have declared a monthly dividend of $0.2260 per share of common stock payable on May 15, 2019 to stockholders of record of our common

stock as of the close of business on May 1, 2019.

Purchasers of shares of common stock in this offering will not be entitled to receive the May 15, 2019 dividend

on the shares of common stock they purchase in this offering.

S-5

Table of Contents

RISK FACTORS

In evaluating an investment in our common stock, you should carefully consider the following risk factors and the risk

factors described under the captions "Forward-Looking Statements" in this prospectus supplement and "Risk Factors" in the accompanying prospectus and in our Annual Report on

Form 10-K, as amended, for the year ended December 31,

2018,

which is incorporated by reference in the accompanying prospectus, in addition to the other risks and uncertainties described in this prospectus supplement, the accompanying

prospectus, the documents incorporated and deemed to be incorporated by reference therein and, if applicable, any free writing prospectus we may provide you in connection with this offering. You

should also carefully consider the risks described below under the caption "Forward-Looking Statements." As used under the captions "Risk Factors" in this prospectus supplement and in our Annual

Report on Form 10-K for the year ended

December 31,

2018,

as amended, references to our capital stock include both our common stock, including the common stock offered by this prospectus supplement, and any class or series of our

preferred

stock that we may issue, and references to our stockholders include holders of our common stock and holders of any class or series of our preferred stock that we may issue, in each case unless

otherwise expressly stated or the context otherwise requires.

We are subject to risks associated with debt and capital stock financing.

We intend to incur additional indebtedness in the future, including borrowings under our $3.0 billion unsecured revolving credit

facility. At March 31, 2019, we had $838.0 million of outstanding borrowings under our revolving credit facility, a total of $5.4 billion of outstanding unsecured senior debt

securities (excluding unamortized original issuance premiums of $10.3 million and deferred financing costs of $32.5 million), $500.0 million of borrowings outstanding under our

senior unsecured term loans (excluding deferred financing costs of $1.3 million) and approximately $297.1 million of outstanding mortgage debt (excluding net unamortized premiums

totaling $4.0 million and deferred financing costs of $169,000 of this mortgage debt), and we had approximately $912.0 million of outstanding borrowings under our revolving credit

facility on May 2, 2019. Our revolving credit facility grants us the option, subject to customary conditions, to expand the borrowing limits thereunder to up to $4.0 billion. We also may

in the future enter into amendments and restatements of our current revolving credit facility and term loan facilities, which may increase the amounts we are entitled to borrow, subject to customary

conditions, compared to our current revolving credit facility and term loan facilities, or we may incur other indebtedness. For example, as described above under "Prospectus Supplement

Summary—Recent Developments—Acquisitions During the First Three Months of 2019," we intend to borrow approximately £300.0 million of senior unsecured debt in

connection with a proposed acquisition. To the extent that new indebtedness is added to our current debt levels, the related risks that we now face would increase. As a result, we are and will be

subject to risks associated with debt financing, including the risk that our cash flow could be insufficient to make required payments on our debt. We also face variable interest rate risk as the

interest rates on our revolving credit facility, our term loans and some of our mortgage debt are variable and could therefore increase over time. We also face the risk that we may be unable to

refinance or repay our debt as it comes due. Given past disruptions in the financial markets and the ongoing global financial crisis and related uncertainties, including the impact of the United

Kingdom's advisory referendum to withdraw from the European Union (referred to as Brexit), we also face the risk that one or more of the participants in our revolving credit facility may not be able

to lend us money.

In

addition, our revolving credit facility, our term loan facilities and mortgage loan documents contain provisions that could limit or, in certain cases, prohibit the payment of

dividends and other distributions on our common stock and any outstanding preferred stock. In particular, our revolving credit facility and our two $250.0 million term loan facilities, all of

which are governed by the same credit agreement, provide that, if an event of default (as defined in the credit agreement) exists, neither we nor any of our subsidiaries (other than our wholly-owned

subsidiaries) may pay any dividends or

S-6

Table of Contents

other

distributions on (except distributions payable in shares of a given class of our stock to the stockholders of that class), or repurchase or redeem, among other things, any shares of our common

stock or any outstanding preferred stock, during any period of four consecutive fiscal quarters in an aggregate amount in excess of the greater of:

-

•

-

the sum of (a) 95% of our adjusted funds from operations (as defined in the credit agreement) for that period plus (b) the

aggregate amount of cash distributions on our outstanding preferred stock, if any, for that period, and

-

•

-

the minimum amount of cash distributions required to be made to our stockholders in order to maintain our status as a REIT for federal income

tax purposes and to avoid the payment of any income or excise taxes that would otherwise be imposed under specified sections of the Internal Revenue Code of 1986, as amended, or the Code, on income we

do not distribute to our stockholders,

except

that we may repurchase or redeem shares of our outstanding preferred stock, if any, with net proceeds from the issuance of shares of our common stock or preferred stock. The credit agreement

further provides that, in the event of a failure to pay principal, interest or any other amount payable thereunder when due or upon the occurrence of certain events of bankruptcy, insolvency or

reorganization with respect to us or with respect to one or more of our subsidiaries that in the aggregate meet a significance test set forth in the credit agreement, we and our subsidiaries (other

than our wholly-owned subsidiaries) may not pay any dividends or other distributions on (except for (a) distributions payable in shares of a given class of our stock to the stockholders of that

class and (b) dividends and distributions described in the second bullet point above), or repurchase or redeem, among other things, any shares of our common stock or preferred stock. If any

such event of default under the credit agreement were to occur, it would likely have a material adverse effect on the market price of our outstanding common stock, including the shares of common stock

offered hereby, and any outstanding preferred stock and on the market value of our debt securities, could limit the amount of dividends or other distributions payable on our common stock and any

outstanding preferred stock or the amount of interest and principal we are able to pay on our indebtedness, or prevent us from paying those dividends, other distributions, interest or principal

altogether, and may adversely affect our ability to qualify, or prevent us from qualifying, as a REIT.

Our

indebtedness could also have other important consequences to holders of our common stock, including the common stock offered hereby, any outstanding preferred stock and our debt

securities, including:

-

•

-

Increasing our vulnerability to general adverse economic and industry conditions;

-

•

-

Limiting our ability to obtain additional financing to fund future working capital, acquisitions, capital expenditures and other general

corporate requirements;

-

•

-

Requiring the use of a substantial portion of our cash flow from operations for the payment of principal and interest on our indebtedness,

thereby reducing our ability to use our cash flow to fund working capital, acquisitions, capital expenditures and general corporate requirements;

-

•

-

Limiting our flexibility in planning for, or reacting to, changes in our business and our industry; and

-

•

-

Putting us at a disadvantage compared to our competitors with less indebtedness.

If

we default under a credit facility, loan agreement or other debt instrument, the lenders will generally have the right to demand immediate repayment of the principal and interest on

all of their loans and, in the case of secured indebtedness, to exercise their rights to seize and sell the collateral.

S-7

Table of Contents

Negative market conditions or adverse events affecting our existing or potential tenants, or the industries

in which they operate, could have an adverse impact on our ability to attract new tenants, re-lease space, collect rent or renew leases, which could adversely affect our cash flow from operations and

inhibit growth.

Cash flow from operations depends in part on our ability to lease space to tenants on economically favorable terms. We could be adversely

affected by various facts and events over which we have limited or no control, such as:

-

•

-

Lack of demand in areas where our properties are located;

-

•

-

Inability to retain existing tenants and attract new tenants;

-

•

-

Oversupply of space and changes in market rental rates;

-

•

-

Declines in our tenants' creditworthiness and ability to pay rent, which may be affected by their operations, economic downturns and

competition within their industries from other operators;

-

•

-

Defaults by and bankruptcies of tenants, failure of tenants to pay rent on a timely basis, or failure of tenants to comply with their

contractual obligations;

-

•

-

Economic or physical decline of the areas where the properties are located; and

-

•

-

Deterioration of physical condition of our properties.

At

any time, any tenant may experience a downturn in its business that may weaken its operating results or overall financial condition. As a result, a tenant may delay lease

commencement, fail to make rental payments when due, decline to extend a lease upon its expiration, become insolvent or declare bankruptcy. Any tenant bankruptcy or insolvency, leasing delay or

failure to make rental payments when due could result in the termination of the tenant's lease and material losses to us.

If

tenants do not renew their leases as they expire, we may not be able to rent or sell the properties. Furthermore, leases that are renewed, and some new leases for properties that are

re-leased, may have terms that are less economically favorable than expiring lease terms, or may require us to incur significant costs, such as renovations, tenant improvements or lease transaction

costs. Negative market conditions may cause us to sell vacant properties for less than their carrying value, which could result in impairments. Any of these events could adversely affect cash flow

from operations and our ability to make distributions to stockholders, including holders of shares of common stock offered hereby, and service our indebtedness. A significant portion of the costs of

owning property, such as real estate taxes, insurance and maintenance, are not necessarily reduced when circumstances cause a decrease in rental revenue from the properties. In a weakened financial

condition, tenants may not be able to pay these costs of ownership and we may be unable to recover these operating expenses from them.

Further,

the occurrence of a tenant bankruptcy or insolvency could diminish the income we receive from the tenant's lease or leases. In addition, a bankruptcy court might authorize the

tenant to terminate its leases with us. If that happens, our claim against the bankrupt tenant for unpaid future rent would be subject to statutory limitations that most likely would result in rent

payments that would be substantially less than the remaining rent we are owed under the leases or we may elect not to pursue claims against a tenant for terminated leases. In addition, any claim we

have for unpaid past rent, if any, may not be paid in full, or at all. Moreover, in the case of a tenant's leases that are not terminated as the result of its bankruptcy, we may be required or elect

to reduce the rent payable under those leases or provide other concessions, reducing amounts we receive under those leases. As a result, tenant bankruptcies may have a material adverse effect on our

results of operations. Any of these events could adversely affect our cash flow from operations and our ability to make distributions

to stockholders, including owners of the shares of common stock offered hereby, and service our indebtedness.

S-8

Table of Contents

At

March 31, 2019, 102 of our properties were available for lease or sale, all of which were single-tenant properties. At March 31, 2019, 71 of our properties under lease

were unoccupied and available for sublease by the tenants, all of which were current with their rent and other obligations. During the first three months of 2019, none of our tenants accounted for

more than 10% of our rental revenue.

For

the first three months of 2019, our tenants in the "convenience store" industry accounted for approximately 12.2% of our rental revenue. A downturn in this industry could have a

material adverse effect on our financial position, results of operations, our ability to pay the principal of and interest on our debt securities and other indebtedness and to make distributions on

our common stock, including the common stock offered hereby, and any outstanding preferred stock.

Individually,

each of the other industries in our property portfolio accounted for less than 10% of our rental revenue for the first three months of 2019. Nevertheless, downturns in

these industries could also adversely affect our tenants, which in turn could also have a material adverse effect on our financial position, results of operations and our ability to pay the principal

of and interest on our debt securities and other indebtedness and to make distributions on our common stock, including the common stock offered hereby, and any outstanding preferred stock.

In

addition, some of our properties are leased to tenants that may have limited financial and other resources, and therefore, they are more likely to be adversely affected by a downturn

in their respective businesses or in the regional, national, or international economy.

Our charter contains restrictions upon ownership of our common stock.

Our charter contains restrictions on ownership and transfer of our common stock intended to, among other purposes, assist us in maintaining our

status as a REIT for United States federal and/or state income tax purposes. For example, our charter restricts any person from acquiring beneficial or constructive ownership of more than 9.8% (by

value or number of shares, whichever is more restrictive) of our outstanding common stock. See "Restrictions on Ownership and Transfers of Stock" in the accompanying prospectus. These restrictions

could have anti-takeover effects and could

reduce the possibility that a third party will attempt to acquire control of us, which could adversely affect the market price of our common stock.

We could issue preferred stock without stockholder approval.

Our charter authorizes our board of directors to issue up to 69,900,000 shares of preferred stock, including convertible preferred stock,

without stockholder approval. The board of directors may establish the preferences, rights and other terms of any class or series of preferred stock we may issue, including the right to vote and the

right to convert any shares issued into common stock. The issuance of preferred stock could delay or prevent a tender offer or a change of control, even if a tender offer or a change of control were

in our stockholders' interests, and could dilute or otherwise adversely affect the voting or other rights and economic interests of holders of our common stock, any of which could adversely affect the

market price of our common stock, including the shares of common stock offered hereby. See "General Description of Preferred Stock" and "Certain Provisions of Maryland Law and of our Charter and

Bylaws" in the accompanying prospectus. As of May 2, 2019, we had no outstanding shares of preferred stock.

This offering and future issuances of our common stock could be dilutive to our earnings per share, funds

from operations per share and adjusted funds from operations per share.

The issuance and sale by us of any shares of our common stock in this offering, the receipt of the net proceeds therefrom and the use of those

net proceeds could have a dilutive effect on our earnings per share, funds from operations per share and adjusted funds from operations per share. Additional issuances of our common stock could also

be dilutive to our earnings per share, funds from operations

S-9

Table of Contents

per

share and adjusted funds from operations per share. The issuance and sale by us of our common stock, including the sale by us of shares in this offering or the perception that such additional

issuances or sales could occur, could also adversely affect the trading price of our common stock and our ability to raise capital through future offerings of equity or equity-related securities. In

addition, if we are unable to apply any net proceeds we may receive from this offering or other issuances of our common stock to make investments that generate sufficient revenues to offset the

dilutive impact of the issuance by us of those shares, there will be further dilution of our earnings per share, funds from operations per share and adjusted funds from operations per share.

S-10

Table of Contents

FORWARD-LOOKING STATEMENTS

This prospectus supplement, the accompanying prospectus and the documents incorporated or deemed to be incorporated by reference therein

contain, and any free writing prospectus we may provide you in connection with this offering may contain, forward-looking statements within the meaning of the Private Securities Litigation Reform Act

of 1995, Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. When used in this prospectus supplement, the

accompanying prospectus, the documents incorporated or deemed to be incorporated by reference therein and any free writing prospectus we may provide you in connection with this offering, the words

"estimated," "anticipated," "expect," "believe," "intend" and similar expressions are intended to identify forward-looking statements. Forward-looking statements include, without limitation,

discussions of strategy, plans and intentions and statements regarding estimated or future results of operations, financial condition or prospects (including, without limitation, estimated and future

normalized and adjusted funds from operations and net income, estimated initial weighted average contractual lease rates, estimated square footage of properties under development or expansion, the

timing and terms of potential or planned acquisitions, statements regarding the payment, dependability and amount of and potential increases in future

common stock dividends, statements regarding future cash flow or cash generation and statements regarding our ability to meet our liquidity needs). Forward-looking statements are subject to risks,

uncertainties and assumptions about us, including, among other things:

-

•

-

our anticipated growth strategies;

-

•

-

our intention to acquire additional properties and the timing of these acquisitions;

-

•

-

our intention to sell properties and the timing of these property sales;

-

•

-

our intention to re-lease vacant properties;

-

•

-

anticipated trends in our business, including trends in the market for long-term net leases of freestanding, single-tenant properties; and

-

•

-

future expenditures for development projects.

Future

events and actual results, financial and otherwise, may differ materially from the results discussed in or implied by the forward-looking statements. In particular,

forward-looking statements regarding estimated or future results of operations are based upon numerous assumptions and estimates and are inherently subject to substantial uncertainties and actual

results of operations may differ materially from those expressed or implied in the forward-looking statements, particularly if actual events differ from those reflected in the estimates and

assumptions upon which such

forward-looking statements are based. Some of the factors that could cause actual results to differ materially are:

-

•

-

our continued qualification as a real estate investment trust;

-

•

-

general, local or foreign business and economic conditions;

-

•

-

competition;

-

•

-

fluctuating interest rates;

-

•

-

access to debt and equity capital markets;

-

•

-

continued volatility and uncertainty in the credit markets and broader financial markets;

-

•

-

other risks inherent in the real estate business, including tenant defaults, potential liability relating to environmental matters, illiquidity

of real estate investments and potential damages from natural disasters;

S-11

Table of Contents

-

•

-

impairments in the value of our real estate assets;

-

•

-

changes in the tax laws of the United States of America or other jurisdictions;

-

•

-

the outcome of any legal proceedings to which we are a party or which may occur in the future; and

-

•

-

acts of terrorism and war.

Additional

factors that may cause future events and actual results, financial or otherwise, to differ, potentially materially, from those discussed in or implied by the forward-looking

statements include the risks and uncertainties discussed in the section "Risk Factors" in this prospectus supplement, the sections entitled "Business," "Risk Factors" and "Management's Discussion and

Analysis of Financial Condition and Results of Operations" in our Annual Report on

Form 10-K for the year ended December 31, 2018,

as

amended, and the section entitled "Management's Discussion and Analysis of Financial Condition and Results of Operations" in our subsequent Quarterly Report on

Form 10-Q,

and also include risks and other information

discussed in those and other documents that are incorporated by reference in this prospectus supplement, the accompanying prospectus and any free writing prospectus we may provide you in connection

with this offering.

You

are cautioned not to place undue reliance on forward-looking statements contained in this prospectus supplement, the accompanying prospectus, the documents incorporated by reference

therein and any free writing prospectus we may provide you in connection with this offering. Those forward-looking statements are not guarantees of future performance and speak only as of the

respective dates of those documents or, in the case of documents incorporated by reference in the accompanying prospectus, as of the respective dates those documents were filed with the Securities and

Exchange Commission, or the SEC, and we undertake no obligation to update any information contained in this prospectus supplement, the accompanying prospectus, the documents incorporated by reference

therein and any free writing prospectus we may provide you in connection with this offering or to publicly release the results of any revisions to these forward-looking statements that may be made to

reflect events or circumstances after the respective dates or filing dates, as the case may be, of those documents or to reflect the occurrence of unanticipated events. In light of these risks and

uncertainties, the forward-looking events discussed in this prospectus supplement, the accompanying prospectus, the documents incorporated by reference therein and any free writing prospectus we may

provide you in connection with this offering might not occur.

S-12

Table of Contents

USE OF PROCEEDS

We estimate that the net proceeds from the sale of common stock offered by this prospectus supplement will be approximately

$734.7 million, or approximately $844.9 million if the underwriters' option to purchase additional shares from us in this offering is exercised in full, in each case after deducting the

underwriting discount and estimated expenses payable by us.

We

intend to use the net proceeds from this offering to repay all or a portion of the borrowings outstanding under our $3.0 billion revolving credit facility, and to the extent

not used for that purpose, to fund potential investment opportunities and/or for other general corporate purposes. On May 2, 2019, we had approximately $912.0 million of outstanding

borrowings under our revolving credit facility. Borrowings under the revolving credit facility were generally used to acquire properties. Our revolving credit facility matures on March 24,

2023, but may, at our option, be extended by up to two six-month extensions, subject to certain terms and conditions. As of May 2, 2019, the weighted average interest rate of borrowings under

the revolving credit facility was approximately 3.3% per annum. Borrowings under our revolving credit facility that we repay with net proceeds from this offering may be reborrowed, subject to

customary conditions.

Pending

application of the net proceeds for the purposes described above, we may temporarily invest the net proceeds in short-term government securities, short-term money market funds

and/or bank certificates of deposit.

Affiliates

of some of the underwriters participating in this offering are lenders under our revolving credit facility and, accordingly, they will receive net proceeds from this offering

through the repayment of borrowings under that facility. See "Underwriting (Conflicts of Interest)—Other Relationships" and "Underwriting (Conflicts of Interest)—Conflicts of

Interest."

S-13

Table of Contents

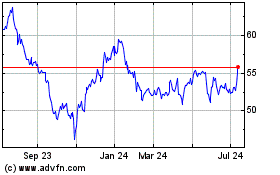

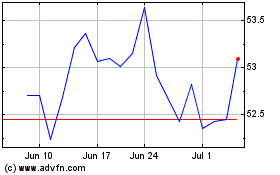

PRICE RANGE OF COMMON STOCK AND DIVIDEND HISTORY

On May 3, 2019, the last reported sales price per share of our common stock on the NYSE was $70.30. The table below sets forth for the

periods indicated the high and low sales prices per share of our common stock, as reported by the NYSE, and dividends declared per share of our common stock.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Price Per Share

of Common Stock

|

|

|

|

|

|

Dividends

Declared

Per Share(1)

|

|

|

|

High

|

|

Low

|

|

|

2017

|

|

|

|

|

|

|

|

|

|

|

|

First Quarter

|

|

$

|

63.60

|

|

$

|

56.92

|

|

$

|

0.6320

|

|

|

Second Quarter

|

|

|

62.31

|

|

|

52.86

|

|

|

0.6335

|

|

|

Third Quarter

|

|

|

60.02

|

|

|

53.35

|

|

|

0.6350

|

|

|

Fourth Quarter

|

|

|

58.22

|

|

|

53.02

|

|

|

0.6365

|

|

|

2018

|

|

|

|

|

|

|

|

|

|

|

|

First Quarter

|

|

|

57.07

|

|

|

47.26

|

|

|

0.6575

|

|

|

Second Quarter

|

|

|

54.99

|

|

|

48.81

|

|

|

0.6590

|

|

|

Third Quarter

|

|

|

59.18

|

|

|

52.74

|

|

|

0.6605

|

|

|

Fourth Quarter

|

|

|

66.85

|

|

|

55.56

|

|

|

0.6620

|

|

|

2019

|

|

|

|

|

|

|

|

|

|

|

|

First Quarter

|

|

|

74.14

|

|

|

61.60

|

|

|

0.6770

|

|

|

Second Quarter (through May 3, 2019)(2)

|

|

|

73.51

|

|

|

67.23

|

|

|

0.2260

|

|

-

(1)

-

Common

stock cash dividends currently are declared monthly by us, based on financial results for the prior months.

-

(2)

-

Our

board of directors has authorized and we have declared a monthly dividend of $0.2260 per share of common stock payable on May 15, 2019 to stockholders of

record of our common stock as of the close of business on May 1, 2019.

Purchasers of shares of common stock in this offering will not be entitled to receive the

May 15, 2019 dividend on the shares they purchase in this offering.

The May 15, 2019 common stock dividend is reflected in the forgoing table in dividends

declared per share for the second quarter of 2019.

Future

dividends on our common stock will be at the discretion of our board of directors and will depend on, among other things, our results of operations, funds from operations, cash

flow from operations, financial condition and capital requirements, the annual distribution requirements under the REIT provisions of the Code, our debt service requirements, dividend requirements on

our outstanding preferred stock (if any), applicable law and any other factors our board of directors deems relevant. In addition, our revolving credit facility, our term loan facilities and our

mortgage loan documents contain provisions that could limit or, in certain cases, prohibit the payment of dividends and other distributions on our common stock and any outstanding preferred stock. See

"Risk Factors—We are subject to risks associated with debt and capital stock financing" above.

Accordingly,

although we expect to continue our policy of paying monthly dividends in cash on our common stock, we cannot guarantee that we will maintain the current level of cash

dividends per share of common stock, that we will continue our pattern of increasing cash dividends per share of common stock, or what our actual dividend yield will be for any future period.

S-14

Table of Contents

UNDERWRITING (CONFLICTS OF INTEREST)

Subject to the terms and conditions contained in a purchase agreement between us and each of the underwriters named below, for whom Merrill

Lynch, Pierce, Fenner & Smith Incorporated, Morgan Stanley & Co. LLC and Wells Fargo Securities, LLC are acting as representatives, or the representatives, the

underwriters have severally agreed to purchase from us, and we have agreed to sell, the number of shares of our common stock listed opposite their names below.

|

|

|

|

|

|

|

Underwriter

|

|

Number

of Shares

|

|

|

Merrill Lynch, Pierce, Fenner & Smith

Incorporated

|

|

|

1,375,000

|

|

|

Morgan Stanley & Co. LLC

|

|

|

1,265,000

|

|

|

Wells Fargo Securities, LLC

|

|

|

1,100,000

|

|

|

Credit Suisse Securities (USA) LLC

|

|

|

605,000

|

|

|

Goldman Sachs & Co. LLC

|

|

|

605,000

|

|

|

J.P. Morgan Securities LLC

|

|

|

605,000

|

|

|

RBC Capital Markets, LLC

|

|

|

605,000

|

|

|

Barclays Capital Inc.

|

|

|

550,000

|

|

|

Citigroup Global Markets Inc.

|

|

|

550,000

|

|

|

Jefferies LLC

|

|

|

550,000

|

|

|

Mizuho Securities USA LLC

|

|

|

550,000

|

|

|

Stifel, Nicolaus & Company, Incorporated

|

|

|

550,000

|

|

|

Robert W. Baird & Co. Incorporated

|

|

|

275,000

|

|

|

Regions Securities LLC

|

|

|

275,000

|

|

|

UBS Securities LLC

|

|

|

275,000

|

|

|

BB&T Capital Markets, a division of BB&T Securities, LLC

|

|

|

165,000

|

|

|

BTIG, LLC

|

|

|

165,000

|

|

|

BMO Capital Markets Corp.

|

|

|

110,000

|

|

|

BNY Mellon Capital Markets, LLC

|

|

|

110,000

|

|

|

MUFG Securities Americas Inc.

|

|

|

110,000

|

|

|

Scotia Capital (USA) Inc.

|

|

|

110,000

|

|

|

TD Securities (USA) LLC

|

|

|

110,000

|

|

|

Comerica Securities, Inc.

|

|

|

55,000

|

|

|

D.A. Davidson & Co.

|

|

|

55,000

|

|

|

Janney Montgomery Scott LLC

|

|

|

55,000

|

|

|

Ladenburg Thalmann & Co. Inc.

|

|

|

55,000

|

|

|

Samuel A. Ramirez & Company, Inc.

|

|

|

55,000

|

|

|

Raymond James & Associates, Inc.

|

|

|

55,000

|

|

|

Evercore Group L.L.C.

|

|

|

27,500

|

|

|

Moelis & Company LLC

|

|

|

27,500

|

|

|

|

|

|

|

|

|

Total

|

|

|

11,000,000

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

The

purchase agreement provides that the obligations of the several underwriters to purchase the shares offered hereby are subject to certain conditions and that the underwriters will

purchase all of the shares offered by this prospectus supplement if any of these shares are purchased. If an underwriter defaults, the purchase agreement provides that the purchase commitments of the

non-defaulting underwriters may be increased or the purchase agreement may be terminated.

The

underwriters are offering the shares, subject to prior sale, when, as and if issued to and accepted by them, subject to approval of legal matters by their counsel and other

conditions contained in the purchase agreement. The underwriters reserve the right to withdraw, cancel or modify offers to the public and to reject orders in whole or in part.

S-15

Table of Contents

We have agreed to indemnify the underwriters against certain liabilities, including liabilities under the Securities Act of 1933, as amended, or to contribute to

payments the underwriters may be required to make in respect of any of these liabilities.

Commissions and Discounts

The underwriters have advised us that the underwriters propose initially to offer the shares to the public at the public offering price listed

on the cover page of this prospectus supplement and to dealers at that price less a concession not in excess of $1.45 per share. After the initial public offering, the public offering price and

concession may be changed.

The

following table shows the public offering price, underwriting discount and proceeds before expenses to Realty Income. This information assumes either no exercise or full exercise by

the underwriters of their option to purchase additional shares from us in this offering.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Per Share

|

|

Without

Option

|

|

With

Option

|

|

|

Public offering price

|

|

$

|

69.25

|

|

$

|

761,750,000

|

|

$

|

876,012,500

|

|

|

Underwriting discount

|

|

$

|

2.42

|

|

$

|

26,620,000

|

|

$

|

30,613,000

|

|

|

Proceeds, before expenses, to Realty Income

|

|

$

|

66.83

|

|

$

|

735,130,000

|

|

$

|

845,399,500

|

|

The

expenses of this offering, not including the underwriting discount, are estimated at $450,000 and are payable by Realty Income.

Underwriters' Option

We have granted an option to the underwriters to purchase up to 1,650,000 additional shares of our common stock at the initial public offering

price less the underwriting discount

and less any dividends or distributions paid or payable by us on the shares initially purchased by the underwriters but not on the shares to be purchased upon exercise of such option. The underwriters

may exercise this option for 30 days after the date of this prospectus supplement. If the underwriters exercise this option, each underwriter will be obligated, subject to conditions contained

in the purchase agreement, to purchase approximately the same percentage of those additional shares as the number of shares of common stock to be purchased by that underwriter as shown in the above

table represents as a percentage of the total number of shares shown in that table.

No Sales of Similar Securities

We have agreed, with exceptions, not to sell or transfer any common stock for 30 days after the date of this prospectus supplement

without first obtaining the prior written consent of Merrill Lynch, Pierce, Fenner & Smith Incorporated, Morgan Stanley & Co. LLC and Wells Fargo Securities, LLC.

Specifically, we have agreed not to directly or indirectly:

-

•

-

Offer, pledge, sell or contract to sell any common stock;

-

•

-

Sell any option or contract to purchase any common stock;

-

•

-

Purchase any option or contract to sell any common stock;

-

•

-

Grant any option, right or warrant to purchase any common stock;

-

•

-

Otherwise transfer or dispose of any common stock; or

-

•

-

Enter into any swap or other agreement or transaction that transfers, in whole or in part, the economic consequence of ownership of any common

stock,

S-16

Table of Contents

whether

any such swap, agreement or transaction referred to in any of the foregoing bullet points is to be settled by delivery of common stock or other securities, in cash or otherwise. This lock-up

provision applies to common stock and to securities convertible into or exchangeable or exercisable for common stock. Merrill Lynch, Pierce, Fenner & Smith Incorporated, Morgan

Stanley & Co. LLC and Wells Fargo Securities, LLC may, in their sole discretion and at any time or from time to time, without notice, release all or any of the shares or

other securities subject to this lock-up provision.

Our

lock-up agreement contains an exception that permits us to issue shares of common stock to acquire other businesses or in connection with our entering into joint ventures and similar

arrangements and that also permits any subsidiary of ours that is a limited partnership to issue limited partnership interests to acquire properties, so long as the recipients of those shares (but not

any such limited partnership interests) agree not to sell or transfer those shares for 30 days after the date of this prospectus supplement, subject to the right of Merrill Lynch, Pierce,

Fenner & Smith Incorporated, Morgan Stanly & Co. LLC and Wells Fargo Securities, LLC to release all or any shares subject to any such agreement. Our lock-up

agreement also contains exceptions that permit us to issue shares of common stock to the underwriters in this offering, to issue shares of common stock upon the exercise of outstanding options, to

issue shares and options pursuant to employee benefit plans, to issue shares of common stock pursuant to non-employee director stock plans, to issue shares of common stock pursuant to a dividend

reinvestment and stock purchase plan filed with, or described in a prospectus supplement or prospectus filed with, the SEC, and to issue shares of our common stock in accordance with the terms of the

limited partnership agreement of any subsidiary of ours that is a limited partnership upon the exchange of limited partnership interests in such limited partnership that are outstanding on the date of

this prospectus supplement or that are issued after the date of this prospectus supplement pursuant to the preceding sentence.

New York Stock Exchange Listing

Our common stock is listed on the NYSE under the symbol "O."

Price Stabilization and Short Positions

In connection with this offering of shares of our common stock, the underwriters may engage in transactions that stabilize, maintain or

otherwise affect the market price of our common stock. Specifically, the underwriters may sell more shares than they are obligated to purchase under the purchase agreement, creating a short position.

A short sale is covered if the short position is no greater than the number of shares available for purchase by the underwriters under their option to purchase additional shares from us. The

underwriters may close out a covered short sale by exercising their option or purchasing shares in the open market. In determining the source of shares to close out a covered short sale, the

underwriters may consider, among other things, the market price of our common stock compared to the price payable under their option. The underwriters may also sell shares in excess of their option,

creating a naked short position. The underwriters must close out any naked short position by purchasing our common stock in the open market. A naked short position is more likely to be created if the

underwriters are concerned that there may be downward pressure on the price of our common stock in the open market after the date of pricing of this offering that could adversely affect investors who

purchase in this offering.

As

an additional means of facilitating this offering, the underwriters may bid for, and purchase, shares of our common stock in the open market to stabilize or maintain the market price

of our common stock. These stabilizing transactions may occur before or after the pricing of this offering.

The

underwriters may also impose a penalty bid. This occurs when a particular underwriter repays to the underwriters a portion of the underwriting discount received by it because the

representatives of

S-17

Table of Contents

the

underwriters have repurchased shares sold by or for the account of such underwriter in stabilizing or short covering transactions.

The

foregoing transactions, if commenced, may raise or maintain the market price of our common stock above independent market levels or prevent or retard a decline in the market price of

our common stock.

The

representatives of the underwriters have advised us that these transactions, if commenced, may be effected on the NYSE or otherwise. Neither we nor any of the underwriters makes any

representation that the underwriters will engage in any of the transactions described above and these transactions, if commenced, may be discontinued without notice. Neither we nor any of the

underwriters makes any representation or prediction as to the direction or magnitude of the effect that the transactions described above, if commenced, may have on the market price of our common

stock.

Electronic Distribution

In connection with the offering, the underwriters or securities dealers may distribute this prospectus supplement and the accompanying

prospectus, as well as any free writing prospectus we may provide you in connection with this offering, by electronic means, such as e-mail.

Other Relationships

Some or all of the underwriters and/or their respective affiliates have provided and in the future may provide investment banking, commercial

banking and/or other financial services, including the provision of credit facilities, to us in the ordinary course of business for which they have received and may in the future receive compensation.

In particular, as described below under "—Conflicts of Interest," affiliates of some of the underwriters participating in this offering are lenders under our $3.0 billion revolving

credit facility and our term loan facilities. Because we intend to use net proceeds from this offering to repay borrowings outstanding under our revolving credit facility, lenders under that credit

facility that are affiliated with underwriters of this offering will receive net proceeds from this offering through the repayment of those borrowings under that facility.

In

addition, in the ordinary course of their business activities, the underwriters and their respective affiliates may make or hold a broad array of investments and actively trade debt

and equity securities (or related derivative securities) and financial instruments (including bank loans) for their own account and for the accounts of their customers. Such investments and securities

activities may involve securities and/or instruments of ours or our affiliates. In the case of any underwriters or any of their respective

affiliates that have lending relationships with us, certain of those underwriters and/or their respective affiliates routinely hedge, and certain other of those underwriters and/or their respective

affiliates may hedge, their credit exposure to us consistent with their customary risk management policies. Typically, these underwriters and their respective affiliates would hedge such exposure by

entering into transactions which consist of either the purchase of credit default swaps or the creation of short positions in our securities. The underwriters and their affiliates may also make

investment recommendations and/or publish or express independent research views in respect of such securities or financial instruments and may hold, or recommend to clients that they acquire, long

and/or short positions in such securities and instruments.

Associated

Investment Services, Inc. (AIS), a Financial Industry Regulatory Authority, Inc. member and a subsidiary of Associated Banc-Corp, is being paid a referral fee by

Samuel A. Ramirez & Company, Inc. A subsidiary of Associated Banc-Corp is a lender under our revolving credit facility.

Comerica

Securities, Inc., a Financial Industry Regulatory Authority, Inc. member, is paying a referral fee to an affiliated entity, Comerica Bank, which is a lender under

our revolving credit facility.

S-18

Table of Contents

Stifel,

Nicolaus & Company, Incorporated may pay an unaffiliated entity, which is also a lender under our revolving credit facility, or its affiliate a fee in connection with this

offering.

Conflicts of Interest

As described above under "Use of Proceeds," we intend to use net proceeds from this offering to repay all or a portion of the borrowings

outstanding under our revolving credit facility. Because, as described above under "—Other Relationships," affiliates of some of the underwriters are lenders under our revolving credit

facility, more than 5% of the net proceeds of this offering (not including underwriting discounts and commissions) may be received by such affiliates. Nonetheless, in accordance with the Financial

Industry Regulatory Authority, Inc. Rule 5121, the appointment of a qualified independent underwriter is not necessary in connection with this offering because we, the issuer of the

securities in this offering, are a real estate investment trust.

Sales Outside of the United States

Hong Kong.

The common stock has not been offered or sold and will not be offered or sold in Hong Kong, by means of any document, other

than

(a) to "professional investors" as defined in the Securities and Futures Ordinance (Cap. 571) of Hong Kong and any rules made under that Ordinance; or (b) in other circumstances which do

not result in the document being a "prospectus" as defined in the Companies (Winding Up and Miscellaneous Provisions) Ordinance (Cap. 32) of Hong Kong or which do not constitute an offer to the

public within the meaning of that Ordinance. No advertisement, invitation or document relating to the common stock has been or may be issued or has been or may be in the possession of any person for

the purposes of issue, whether in Hong Kong or elsewhere, which is directed at, or the contents of which are likely to be accessed or read by, the public of Hong Kong (except if permitted to do so