- The Company reported fiscal third quarter net income of $89

million, or $0.88 per diluted share; including select items(1) of

$(0.04) per diluted share

- The North America Solutions ("NAS") segment exited the third

quarter of fiscal year 2024 with 146 active rigs and recognized

revenue per day of $39,800/day with associated direct margins(2)

per day of $20,300/day during the quarter

- Quarterly NAS operating income increased $16 million

sequentially; while direct margins(2) increased by $6 million to

$277 million, as revenues increased by $6 million to $620 million

and expenses remained relatively flat at $343 million

- H&P's NAS segment anticipates exiting the fourth quarter

of fiscal year 2024 between 147-153 active rigs

- On June 5, 2024, the Board of Directors of the Company

declared a quarterly base cash dividend of $0.25 per share and a

supplemental cash dividend of $0.17 per share; both dividends are

payable on August 30, 2024 to stockholders of record at the close

of business on August 16, 2024

Helmerich & Payne, Inc. (NYSE: HP) reported net income of

$89 million, or $0.88 per diluted share, from operating revenues of

$698 million for the quarter ended June 30, 2024, compared to net

income of $85 million, or $0.84 per diluted share, from operating

revenues of $688 million for the quarter ended March 31, 2024. The

net income per diluted share for the third and second quarters of

fiscal year 2024 include net $(0.04) and net $0.00 of after-tax

gains and losses, respectively, comprised of select items(1). For

the third quarter of fiscal year 2024, select items were comprised

of:

- $0.06 of after-tax gains related to the non-cash fair market

value adjustments to our equity investments

- $(0.10) of after-tax losses related to a Blue Chip Swap

transaction and non-recurring professional service fees

Net cash provided by operating activities was $197 million for

the third quarter of fiscal year 2024 compared to net cash provided

by operating activities of $144 million for the second quarter of

fiscal year 2024.

President and CEO John Lindsay commented, “Our financial results

for the third fiscal quarter continue to demonstrate the resilience

of our strategy in the North America Solutions segment. Once again,

it was particularly notable, that despite a more sizeable decline

in the overall industry rig count, our NAS active rig count

remained relatively stable during the third fiscal quarter which is

a reflection of H&P’s unyielding focus on providing value to

our customers. On the international front, the Company's first

super-spec FlexRig® arrived in Saudi Arabia, which is another step

in our strategy to increase our operational presence in the

region.

“Macro headwinds, both directly and indirectly related to the

oil and gas industry, persist and are still causing a more

cautionary outlook for the industry. With the cyclical nature of

our industry, we are hopeful that these will subside and bring

about a more positive outlook for the industry in the coming

quarters. Contractual churn remains prevalent in the U.S. market,

but our people are doing a good job managing through this. We

expect the churn to continue and as we have seen in recent summers,

we also anticipate our active rig count to be flat with perhaps a

modest incline heading into our fiscal year-end.

“Activity levels in the International Solutions segment in the

fourth fiscal quarter are expected to remain consistent with the

third fiscal quarter with the exception that the first of the eight

Saudi Arabia rigs is expected to commence work in the fiscal fourth

quarter once contractual acceptance procedures are completed. The

preparation work for the remaining seven super-spec rigs is

progressing as planned with export dates expected through the

balance of the calendar year. We are looking forward to working

with Saudi Aramco and building a long-term, valuable relationship

with our new customer.”

Senior Vice President and CFO Mark Smith also commented,

“Currently, we expect our active NAS rig count in the fourth fiscal

quarter to remain consistent with our third fiscal quarter average.

Accordingly, our NAS direct margin guidance also remains relatively

consistent with the level recognized during the third fiscal

quarter. Contract economics remain the cornerstone of our NAS

strategy and we do not anticipate the same level of volatility or

correlation to overall rig counts that we have experienced in the

past. Recent quarterly results continue to provide evidence of

that.

“The Company returned another $42 million to shareholders in the

form of base and supplemental dividends during the quarter and the

Board of Directors declared the fourth and final installment of the

supplemental dividend under the 2024 Supplemental Shareholder

Return Plan. Looking ahead, we have just begun the process of

establishing our fiscal 2025 capital budget and preliminarily we

believe the projected maintenance and walking rig conversions capex

will be similar to fiscal 2024 levels with the biggest swing factor

related to any international tender awards that would result in

additional capex. As part of its budgeting process for the fiscal

year ahead, the Company continuously evaluates the uses of cash and

capital allocation priorities.”

John Lindsay concluded, “The Company will continue to execute as

it always has with a customer-centric approach and safety focus,

which is ingrained in our Company culture. We look forward to

commencing work in Saudi Arabia and taking advantage of additional

opportunities as those arise in the coming quarters."

Operating Segment Results for the Third

Quarter of Fiscal Year 2024

North America Solutions:

This segment had operating income of $163.4 million compared to

operating income of $147.1 million during the previous quarter. The

increase in operating income was primarily attributable to a higher

direct margin and the prior quarter experiencing higher

depreciation and research and development expenses. Direct

margin(2) increased by $6.0 million to $277.4 million

sequentially.

International Solutions:

This segment had an operating loss of $4.8 million compared to

operating income of $3.6 million during the previous quarter. The

decrease in operating income was mainly due to recommissioning

expenses for rigs that will be exported to Saudi Arabia and related

start-up costs. Direct margin(2) during the third fiscal quarter

was $0.4 million compared to $8.4 million during the previous

quarter. Current quarter results included a $2.1 million foreign

currency loss compared to a $0.5 million foreign currency loss in

the previous quarter.

Offshore Gulf of Mexico:

This segment had operating income of $5.0 million compared to

operating income of $0.1 million during the previous quarter.

Direct margin(2) for the quarter was $7.6 million compared to $2.9

million in the previous quarter. The increase in operating income

was primarily attributable to rigs moving to full operating rates

earlier than planned.

Operational Outlook for the Fourth

Quarter of Fiscal Year 2024

North America Solutions:

- We expect North America Solutions direct margins(2) to be

between $260-$280 million

- We expect to exit the quarter between approximately 147-153

contracted rigs

International Solutions:

- We expect International Solutions direct margins(2) to be

between $(2)-$2 million, exclusive of any foreign exchange gains or

losses

- Projected International Solutions direct margins(2) for the

fourth fiscal quarter are inclusive of approximately $6-$8 million

of rig preparation and start-up expense related to our Saudi Arabia

operations, higher than previous guidance as some costs shifted

from the third fiscal quarter into the fourth fiscal quarter

Offshore Gulf of Mexico:

- We expect Offshore Gulf of Mexico direct margins(2) to be

between $6-$8 million

Other Estimates for Fiscal Year

2024

- Gross capital expenditures are still expected to be

approximately $500 million;

- Ongoing asset sales that include reimbursements for lost and

damaged tubulars and sales of other used drilling equipment offset

a portion of the gross capital expenditures, and are now expected

to total approximately $45 million in fiscal year 2024

- Depreciation for fiscal year 2024 is now expected to be

approximately $400 million

- Research and development expenses for fiscal year 2024 are now

expected to be roughly $40 million

- General and administrative expenses for fiscal year 2024 are

now expected to be approximately $250 million

- Cash taxes to be paid in fiscal year 2024 are still expected to

be approximately $150-$200 million

Select Items(1) Included in Net Income

per Diluted Share

Third quarter of fiscal year 2024 net income of $0.88 per

diluted share included a net impact $(0.04) per share in after-tax

gains and losses comprised of the following:

- $0.06 of non-cash after-tax gains related to fair market value

adjustments to equity investments

- $(0.05) of after-tax losses on a Blue Chip Swap transaction to

repatriate cash to the U.S. from Argentina

- $(0.05) of after-tax losses related to non-recurring

professional service fees

Second quarter of fiscal year 2024 net income of $0.84 per

diluted share included $0.00 in after-tax losses comprised of the

following:

- $0.03 of non-cash after-tax gains related to fair market value

adjustments to equity investments

- $(0.03) of after-tax losses related to research and development

expenses associated with an asset acquisition

Conference Call

A conference call will be held on Thursday, July 25, 2024 at

11:00 a.m. (ET) with John Lindsay, President and CEO, Mark Smith,

Senior Vice President and CFO, and Dave Wilson, Vice President of

Investor Relations, to discuss the Company’s third quarter fiscal

year 2024 results. Dial-in information for the conference call is

(800) 225-9448 for domestic callers or (203) 518-9814 for

international callers. The call access code is ‘Helmerich’. You may

also listen to the conference call that will be broadcast live over

the Internet by logging on to the Company’s website at

http://www.helmerichpayne.com and accessing the corresponding link

through the investor relations section by clicking on “Investors”

and then clicking on “News and Events - Events & Presentations”

to find the event and the link to the webcast.

About Helmerich & Payne,

Inc.

Founded in 1920, Helmerich & Payne, Inc. (H&P) (NYSE:

HP) is committed to delivering industry leading levels of drilling

productivity and reliability. H&P operates with the highest

level of integrity, safety and innovation to deliver superior

results for its customers and returns for shareholders. Through its

subsidiaries, the Company designs, fabricates and operates

high-performance drilling rigs in conventional and unconventional

plays around the world. H&P also develops and implements

advanced automation, directional drilling and survey management

technologies. At June 30, 2024, H&P's fleet included 232 land

rigs in the United States, 23 international land rigs and seven

offshore platform rigs. For more information, see H&P online at

www.helmerichpayne.com.

Forward-Looking

Statements

This release includes “forward-looking statements” within the

meaning of the Securities Act of 1933 and the Securities Exchange

Act of 1934, and such statements are based on current expectations

and assumptions that are subject to risks and uncertainties. All

statements other than statements of historical facts included in

this release, including, without limitation, statements regarding

the registrant’s business strategy, future financial position,

operations outlook, future cash flow, future use of generated cash

flow, dividend amounts and timing, supplemental shareholder return

plans and amounts of any future dividends, future share

repurchases, investments, active rig count projections, projected

costs and plans, objectives of management for future operations,

contract terms, financing and funding, capex spending and budgets,

outlook for domestic and international markets, future commodity

prices, and future customer activity and relationships are

forward-looking statements. For information regarding risks and

uncertainties associated with the Company’s business, please refer

to the “Risk Factors” and “Management’s Discussion and Analysis of

Financial Condition and Results of Operations” sections and other

disclosures in the Company’s SEC filings, including but not limited

to its annual report on Form 10‑K and quarterly reports on Form

10‑Q. As a result of these factors, Helmerich & Payne, Inc.’s

actual results may differ materially from those indicated or

implied by such forward-looking statements. Investors are cautioned

not to put undue reliance on such statements. We undertake no duty

to publicly update or revise any forward-looking statements,

whether as a result of new information, changes in internal

estimates, expectations or otherwise, except as required under

applicable securities laws.

Helmerich & Payne uses its Investor Relations website as a

channel of distribution for material company information. Such

information is routinely posted and accessible on its Investor

Relations website at www.helmerichpayne.com. Information on our

website is not part of this release.

Note Regarding Trademarks. Helmerich & Payne, Inc. owns

or has rights to the use of trademarks, service marks and trade

names that it uses in conjunction with the operation of its

business. Some of the trademarks that appear in this release or

otherwise used by H&P include FlexRig, which may be registered

or trademarked in the United States and other

jurisdictions.

(1) Select items are considered non-GAAP metrics and are

included as a supplemental disclosure as the Company believes

identifying and excluding select items is useful in assessing and

understanding current operational performance, especially in making

comparisons over time involving previous and subsequent periods

and/or forecasting future periods results. Select items are

excluded as they are deemed to be outside the Company's core

business operations. See Non-GAAP Measurements.

(2) Direct margin, which is considered a non-GAAP metric, is

defined as operating revenues (less reimbursements) less direct

operating expenses (less reimbursements) and is included as a

supplemental disclosure. We believe it is useful in assessing and

understanding our current operational performance, especially in

making comparisons over time. See Non-GAAP Measurements for a

reconciliation of segment operating income(loss) to direct margin.

Expected direct margin for the third quarter of fiscal 2024 is

provided on a non-GAAP basis only because certain information

necessary to calculate the most comparable GAAP measure is

unavailable due to the uncertainty and inherent difficulty of

predicting the occurrence and the future financial statement impact

of certain items. Therefore, as a result of the uncertainty and

variability of the nature and amount of future items and

adjustments, which could be significant, we are unable to provide a

reconciliation of expected direct margin to the most comparable

GAAP measure without unreasonable effort.

HELMERICH & PAYNE, INC.

UNAUDITED CONDENSED CONSOLIDATED

STATEMENTS OF OPERATIONS

Three Months Ended

Nine Months Ended

(in thousands, except per share

amounts)

June 30,

March 31,

June 30,

June 30,

June 30,

2024

2024

2023

2024

2023

OPERATING REVENUES

Drilling services

$

695,139

$

685,131

$

721,567

$

2,054,835

$

2,205,419

Other

2,585

2,812

2,389

7,979

7,396

697,724

687,943

723,956

2,062,814

2,212,815

OPERATING COSTS AND EXPENSES

Drilling services operating expenses,

excluding depreciation and amortization

417,028

401,851

429,182

1,222,182

1,306,543

Other operating expenses

1,144

1,026

1,003

3,307

3,317

Depreciation and amortization

97,816

104,545

94,811

296,352

287,721

Research and development

10,555

12,942

7,085

32,105

22,720

Selling, general and administrative

66,870

62,037

49,271

185,484

150,581

Asset impairment charges

—

—

—

—

12,097

Gain on reimbursement of drilling

equipment

(9,732

)

(7,461

)

(10,642

)

(24,687

)

(37,940

)

Other (gain) loss on sale of assets

2,730

2,431

4,504

2,718

(394

)

586,411

577,371

575,214

1,717,461

1,744,645

OPERATING INCOME

111,313

110,572

148,742

345,353

468,170

Other income (expense)

Interest and dividend income

11,888

6,567

10,748

29,189

20,508

Interest expense

(4,336

)

(4,261

)

(4,324

)

(12,969

)

(12,918

)

Gain (loss) on investment securities

389

3,747

(18,538

)

102

6,123

Other

3,134

400

(672

)

2,991

(1,218

)

11,075

6,453

(12,786

)

19,313

12,495

Income before income taxes

122,388

117,025

135,956

364,666

480,665

Income tax expense

33,703

32,194

40,663

95,977

124,187

NET INCOME

$

88,685

$

84,831

$

95,293

$

268,689

$

356,478

Basic earnings per common share

$

0.89

$

0.85

$

0.93

$

2.68

$

3.40

Diluted earnings per common share

$

0.88

$

0.84

$

0.93

$

2.67

$

3.39

Weighted average shares outstanding:

Basic

98,752

98,774

101,163

98,891

103,464

Diluted

99,007

99,046

101,550

99,116

103,852

HELMERICH & PAYNE, INC.

UNAUDITED CONDENSED CONSOLIDATED

BALANCE SHEETS

June 30,

September 30,

(in thousands except share data and share

amounts)

2024

2023

ASSETS

Current Assets:

Cash and cash equivalents

$

203,633

$

257,174

Restricted cash

78,369

59,064

Short-term investments

86,088

93,600

Accounts receivable, net of allowance of

$2,377 and $2,688, respectively

415,395

404,188

Inventories of materials and supplies,

net

115,312

94,227

Prepaid expenses and other, net

71,522

97,727

Assets held-for-sale

—

645

Total current assets

970,319

1,006,625

Investments

292,229

264,947

Property, plant and equipment, net

3,014,345

2,921,695

Other Noncurrent Assets:

Goodwill

45,653

45,653

Intangible assets, net

55,752

60,575

Operating lease right-of-use asset

57,315

50,400

Other assets, net

49,369

32,061

Total other noncurrent assets

208,089

188,689

Total assets

$

4,484,982

$

4,381,956

LIABILITIES & SHAREHOLDERS'

EQUITY

Current liabilities:

Accounts payable

$

158,896

$

130,852

Dividends payable

42,045

25,194

Accrued liabilities

255,851

262,885

Total current liabilities

456,792

418,931

Noncurrent Liabilities:

Long-term debt, net

545,589

545,144

Deferred income taxes

494,412

517,809

Other

131,344

128,129

Total noncurrent liabilities

1,171,345

1,191,082

Shareholders' Equity:

Common stock, $0.10 par value, 160,000,000

shares authorized, 112,222,865 shares issued as of June 30, 2024

and September 30, 2023, and 98,755,412 and 99,426,526 shares

outstanding as of June 30, 2024 and September 30, 2023,

respectively

11,222

11,222

Preferred stock, no par value, 1,000,000

shares authorized, no shares issued

—

—

Additional paid-in capital

510,379

525,369

Retained earnings

2,833,136

2,707,715

Accumulated other comprehensive loss

(8,499

)

(7,981

)

Treasury stock, at cost, 13,467,453 shares

and 12,796,339 shares as of June 30, 2024 and September 30, 2023,

respectively

(489,393

)

(464,382

)

Total shareholders’ equity

2,856,845

2,771,943

Total liabilities and shareholders'

equity

$

4,484,982

$

4,381,956

HELMERICH & PAYNE, INC.

UNAUDITED CONDENSED CONSOLIDATED

STATEMENTS OF CASH FLOWS

Nine Months Ended June

30,

(in thousands)

2024

2023

CASH FLOWS FROM OPERATING

ACTIVITIES:

Net income

$

268,689

$

356,478

Adjustments to reconcile net income to net

cash provided by operating activities:

Depreciation and amortization

296,352

287,721

Asset impairment charges

—

12,097

Provision for credit loss

(213

)

2,165

Stock-based compensation

23,777

23,884

Gain on investment securities

(102

)

(6,123

)

Gain on reimbursement of drilling

equipment

(24,687

)

(37,940

)

Other (gain) loss on sale of assets

2,718

(394

)

Deferred income tax expense (benefit)

(23,634

)

4,197

Other

3,011

3,960

Changes in assets and liabilities

(30,004

)

(27,045

)

Net cash provided by operating

activities

515,907

619,000

CASH FLOWS FROM INVESTING

ACTIVITIES:

Capital expenditures

(389,095

)

(281,790

)

Purchase of short-term investments

(148,451

)

(102,140

)

Purchase of long-term investments

(9,167

)

(18,813

)

Proceeds from sale of short-term

investments

152,034

148,651

Insurance proceeds from involuntary

conversion

5,533

—

Proceeds from asset sales

35,148

63,048

Net cash used in investing activities

(353,998

)

(191,044

)

CASH FLOWS FROM FINANCING

ACTIVITIES:

Dividends paid

(126,417

)

(152,579

)

Payments for employee taxes on net

settlement of equity awards

(12,176

)

(14,410

)

Payment of contingent consideration from

acquisition of business

(6,250

)

(250

)

Share repurchases

(51,302

)

(247,213

)

Other

—

(540

)

Net cash used in financing activities

(196,145

)

(414,992

)

Net increase (decrease) in cash and cash

equivalents and restricted cash

(34,236

)

12,964

Cash and cash equivalents and restricted

cash, beginning of period

316,238

269,009

Cash and cash equivalents and restricted

cash, end of period

$

282,002

$

281,973

HELMERICH & PAYNE, INC.

SEGMENT REPORTING

Three Months Ended

Nine Months Ended

June 30,

March 31,

June 30,

June 30,

June 30,

(in thousands, except operating

statistics)

2024

2024

2023

2024

2023

NORTH AMERICA SOLUTIONS

Operating revenues

$

620,040

$

613,339

$

641,612

$

1,827,661

$

1,944,555

Direct operating expenses

342,617

341,938

364,688

1,022,763

1,111,154

Depreciation and amortization

89,207

97,573

87,209

273,799

266,093

Research and development

10,623

13,006

7,254

32,318

23,051

Selling, general and administrative

expense

14,234

13,692

12,962

43,802

43,364

Asset impairment charges

—

—

—

—

3,948

Segment operating income

$

163,359

$

147,130

$

169,499

$

454,979

$

496,945

Financial Data and Other Operating

Statistics1:

Direct margin (Non-GAAP)2

$

277,423

$

271,401

$

276,924

$

804,898

$

833,401

Revenue days3

13,683

14,123

15,075

41,516

48,142

Average active rigs4

150

155

166

152

176

Number of active rigs at the end of

period5

146

152

153

146

153

Number of available rigs at the end of

period

232

233

233

232

233

Reimbursements of "out-of-pocket"

expenses

$

74,915

$

73,584

$

82,688

$

218,227

$

239,288

INTERNATIONAL SOLUTIONS

Operating revenues

$

47,882

$

45,878

$

48,692

$

148,512

$

159,383

Direct operating expenses

47,446

37,514

45,390

129,479

133,642

Depreciation

2,797

2,418

2,171

7,549

5,215

Selling, general and administrative

expense

2,483

2,377

2,528

7,336

8,245

Asset impairment charges

—

—

—

—

8,149

Segment operating income (loss)

$

(4,844

)

$

3,569

$

(1,397

)

$

4,148

$

4,132

Financial Data and Other Operating

Statistics1:

Direct margin (Non-GAAP)2

$

436

$

8,364

$

3,302

$

19,033

$

25,741

Revenue days3

1,067

1,038

1,215

3,278

3,618

Average active rigs4

12

11

13

12

13

Number of active rigs at the end of

period5

12

11

13

12

13

Number of available rigs at the end of

period

23

22

22

23

22

Reimbursements of "out-of-pocket"

expenses

$

2,069

$

1,964

$

2,098

$

7,417

$

7,743

OFFSHORE GULF OF MEXICO

Operating revenues

$

27,218

$

25,913

$

31,221

$

78,662

$

101,364

Direct operating expenses

19,611

23,010

23,913

62,200

75,292

Depreciation

1,798

1,941

1,873

5,807

5,671

Selling, general and administrative

expense

799

884

730

2,515

2,263

Segment operating income

$

5,010

$

78

$

4,705

$

8,140

$

18,138

Financial Data and Other Operating

Statistics1:

Direct margin (Non-GAAP)2

$

7,607

$

2,903

$

7,308

$

16,462

$

26,072

Revenue days3

273

273

364

835

1,092

Average active rigs4

3

3

4

3

4

Number of active rigs at the end of

period5

3

3

4

3

4

Number of available rigs at the end of

period

7

7

7

7

7

Reimbursements of "out-of-pocket"

expenses

$

7,746

$

8,857

$

7,823

$

24,430

$

23,006

(1)

These operating metrics and financial

data, including average active rigs, are provided to allow

investors to analyze the various components of segment financial

results in terms of activity, utilization and other key results.

Management uses these metrics to analyze historical segment

financial results and as the key inputs for forecasting and

budgeting segment financial results.

(2)

Direct margin, which is considered a

non-GAAP metric, is defined as operating revenues (less

reimbursements) less direct operating expenses (less

reimbursements) and is included as a supplemental disclosure

because we believe it is useful in assessing and understanding our

current operational performance, especially in making comparisons

over time. See — Non-GAAP Measurements below for a reconciliation

of segment operating income (loss) to direct margin.

(3)

Defined as the number of contractual days

we recognized revenue for during the period.

(4)

Active rigs generate revenue for the

Company; accordingly, 'average active rigs' represents the average

number of rigs generating revenue during the applicable time

period. This metric is calculated by dividing revenue days by total

days in the applicable period (i.e. 91 days for the three months

ended June 30, 2024, March 31, 2024, and June 30, 2023, 274 days

for the nine months ended June 30, 2024 and 273 days for the nine

months ended June 30, 2023).

(5)

Defined as the number of rigs generating

revenue at the applicable end date of the time period.

Segment operating income (loss) for all segments is a non-GAAP

financial measure of the Company’s performance, as it excludes gain

on sale of assets, corporate selling, general and administrative

expenses and corporate depreciation. The Company considers segment

operating income (loss) to be an important supplemental measure of

operating performance for presenting trends in the Company’s core

businesses. This measure is used by the Company to facilitate

period-to-period comparisons in operating performance of the

Company’s reportable segments in the aggregate by eliminating items

that affect comparability between periods. The Company believes

that segment operating income (loss) is useful to investors because

it provides a means to evaluate the operating performance of the

segments and the Company on an ongoing basis using criteria that

are used by our internal decision makers. Additionally, it

highlights operating trends and aids analytical comparisons.

However, segment operating income (loss) has limitations and should

not be used as an alternative to operating income or loss, a

performance measure determined in accordance with GAAP, as it

excludes certain costs that may affect the Company’s operating

performance in future periods.

Income from discontinued operations was presented as a separate

line item on our Unaudited Condensed Consolidated Statements of

Operations during the three and nine months ended June 30, 2023. To

conform with the current fiscal year presentation, we reclassified

amounts previously presented in Income from discontinued

operations, which were not material, to Other within Other income

(expense) on our Unaudited Condensed Consolidated Statements of

Operations for the three and nine months ended June 30, 2023.

The following table reconciles operating income per the

information above to income (loss) from continuing operations

before income taxes as reported on the Unaudited Condensed

Consolidated Statements of Operations:

Three Months Ended

Nine Months Ended

June 30,

March 31,

June 30,

June 30,

June 30,

(in thousands)

2024

2024

2023

2024

2023

Operating income (loss)

North America Solutions

$

163,359

$

147,130

$

169,499

$

454,979

$

496,945

International Solutions

(4,844

)

3,569

(1,397

)

4,148

4,132

Offshore Gulf of Mexico

5,010

78

4,705

8,140

18,138

Other

(4,791

)

2,785

2,104

(2,073

)

13,604

Eliminations

(616

)

(772

)

4,470

(1,054

)

4,513

Segment operating income

$

158,118

$

152,790

$

179,381

$

464,140

$

537,332

Gain on reimbursement of drilling

equipment

9,732

7,461

10,642

24,687

37,940

Other gain (loss) on sale of assets

(2,730

)

(2,431

)

(4,504

)

(2,718

)

394

Corporate selling, general and

administrative costs and corporate depreciation

(53,807

)

(47,248

)

(36,777

)

(140,756

)

(107,496

)

Operating income

$

111,313

$

110,572

$

148,742

$

345,353

$

468,170

Other income (expense):

Interest and dividend income

11,888

6,567

10,748

29,189

20,508

Interest expense

(4,336

)

(4,261

)

(4,324

)

(12,969

)

(12,918

)

Gain (loss) on investment securities

389

3,747

(18,538

)

102

6,123

Other

3,134

400

(672

)

2,991

(1,218

)

Total unallocated amounts

11,075

6,453

(12,786

)

19,313

12,495

Income before income taxes

$

122,388

$

117,025

$

135,956

$

364,666

$

480,665

SUPPLEMENTARY STATISTICAL

INFORMATION

Unaudited

U.S. LAND RIG COUNTS &

MARKETABLE FLEET STATISTICS

July 24,

June 30,

March 31,

Q3FY24

2024

2024

2024

Average

U.S. Land Operations

Term Contract Rigs

88

83

96

86

Spot Contract Rigs

60

63

56

64

Total Contracted Rigs

148

146

152

150

Idle or Other Rigs

84

86

81

82

Total Marketable Fleet

232

232

233

232

H&P GLOBAL FLEET UNDER

TERM CONTRACT STATISTICS

Number of Rigs Already Under

Long-Term Contracts(*)

(Estimated Quarterly Average —

as of 6/30/24)

Q4

Q1

Q2

Q3

Q4

Q1

Q2

Segment

FY24

FY25

FY25

FY25

FY25

FY26

FY26

U.S. Land Operations

86.9

72.5

40.8

30.4

27.1

19.3

4.0

International Land Operations

9.0

10.9

13.1

11.7

11.0

10.9

10.0

Offshore Operations

—

—

—

—

—

—

—

Total

95.9

83.4

53.9

42.1

38.1

30.2

14.0

(*) All of the above rig contracts have

original terms equal to or in excess of six months and include

provisions for early termination fees.

NON-GAAP MEASUREMENTS

NON-GAAP RECONCILIATION OF

SELECT ITEMS AND ADJUSTED NET INCOME(**)

Three Months Ended June 30,

2024

(in thousands, except per share data)

Pretax

Tax Impact

Net

EPS

Net income (GAAP basis)

$

88,685

$

0.88

(-) Fair market adjustment to equity

investments

$

7,508

$

1,944

$

5,564

$

0.06

(-) Non-recurring professional service

fees

$

(6,680

)

$

(1,730

)

$

(4,950

)

$

(0.05

)

(-) Losses on a Blue Chip Swap

transaction

$

(7,112

)

$

(1,842

)

$

(5,270

)

$

(0.05

)

Adjusted net income

$

93,341

$

0.92

Three Months Ended March 31,

2024

(in thousands, except per share data)

Pretax

Tax Impact

Net

EPS

Net income (GAAP basis)

$

84,831

$

0.84

(-) Fair market adjustment to equity

investments

$

3,777

$

920

$

2,857

$

0.03

(-) Research and development expenses

associated with an asset acquisition

$

(3,840

)

$

(995

)

$

(2,845

)

$

(0.03

)

Adjusted net income

$

84,819

$

0.84

(**)The Company believes identifying and excluding select items

is useful in assessing and understanding current operational

performance, especially in making comparisons over time involving

previous and subsequent periods and/or forecasting future period

results. Select items are excluded as they are deemed to be outside

of the Company's core business operations.

NON-GAAP

RECONCILIATION OF DIRECT MARGIN

Direct margin is considered a non-GAAP metric. We define "direct

margin" as operating revenues (less reimbursements) less direct

operating expenses (less reimbursements). Direct margin is included

as a supplemental disclosure because we believe it is useful in

assessing and understanding our current operational performance,

especially in making comparisons over time. Direct margin is not a

substitute for financial measures prepared in accordance with GAAP

and should therefore be considered only as supplemental to such

GAAP financial measures.

The following table reconciles direct margin to segment

operating income (loss), which we believe is the financial measure

calculated and presented in accordance with GAAP that is most

directly comparable to direct margin.

Three Months Ended June 30,

2024

(in thousands)

North America

Solutions

International

Solutions

Offshore Gulf of

Mexico

Segment operating income (loss)

$

163,359

$

(4,844

)

$

5,010

Add back:

Depreciation and amortization

89,207

2,797

1,798

Research and development

10,623

—

—

Selling, general and administrative

expense

14,234

2,483

799

Direct margin (Non-GAAP)

$

277,423

$

436

$

7,607

Three Months Ended March 31,

2024

(in thousands)

North America

Solutions

International

Solutions

Offshore Gulf of

Mexico

Segment operating income

$

147,130

$

3,569

$

78

Add back:

Depreciation and amortization

97,573

2,418

1,941

Research and development

13,006

—

—

Selling, general and administrative

expense

13,692

2,377

884

Direct margin (Non-GAAP)

$

271,401

$

8,364

$

2,903

Three Months Ended June 30,

2023

(in thousands)

North America

Solutions

International

Solutions

Offshore Gulf of

Mexico

Segment operating income (loss)

$

169,499

$

(1,397

)

$

4,705

Add back:

Depreciation and amortization

87,209

2,171

1,873

Research and development

7,254

—

—

Selling, general and administrative

expense

12,962

2,528

730

Direct margin (Non-GAAP)

$

276,924

$

3,302

$

7,308

Nine Months Ended June 30,

2024

(in thousands)

North America

Solutions

International

Solutions

Offshore Gulf of

Mexico

Segment operating income

$

454,979

$

4,148

$

8,140

Add back:

Depreciation and amortization

273,799

7,549

5,807

Research and development

32,318

—

—

Selling, general and administrative

expense

43,802

7,336

2,515

Direct margin (Non-GAAP)

$

804,898

$

19,033

$

16,462

Nine Months Ended June 30,

2023

(in thousands)

North America

Solutions

International

Solutions

Offshore Gulf of

Mexico

Segment operating income

$

496,945

$

4,132

$

18,138

Add back:

Depreciation and amortization

266,093

5,215

5,671

Research and development

23,051

—

—

Selling, general and administrative

expense

43,364

8,245

2,263

Asset impairment charges

3,948

8,149

—

Direct margin (Non-GAAP)

$

833,401

$

25,741

$

26,072

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240724653817/en/

Dave Wilson, Vice President of Investor Relations

investor.relations@hpinc.com (918) 588‑5190

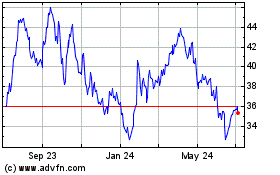

Helmerich and Payne (NYSE:HP)

Historical Stock Chart

From Dec 2024 to Jan 2025

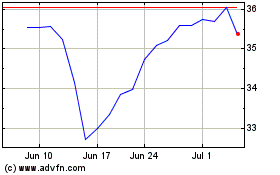

Helmerich and Payne (NYSE:HP)

Historical Stock Chart

From Jan 2024 to Jan 2025