0001529864false00015298642025-03-072025-03-07

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

|

Date of Report (Date of earliest event reported): March 07, 2025 |

ENOVA INTERNATIONAL, INC.

(Exact name of Registrant as Specified in Its Charter)

|

|

|

|

|

Delaware |

1-35503 |

45-3190813 |

(State or Other Jurisdiction

of Incorporation) |

(Commission File Number) |

(IRS Employer

Identification No.) |

|

|

|

|

|

175 West Jackson Boulevard |

|

Chicago, Illinois |

|

60604 |

(Address of Principal Executive Offices) |

|

(Zip Code) |

|

Registrant’s Telephone Number, Including Area Code: 312 568-4200 |

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

Title of each class

|

|

Trading

Symbol(s) |

|

Name of each exchange on which registered

|

Common Stock, $.00001 par value per share |

|

ENVA |

|

New York Stock Exchange LLC |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

ITEM 7.01 REGULATION FD DISCLOSURE

The information in this Current Report on Form 8-K, including, without limitation, Exhibit 99.1, is being furnished pursuant to Item 7.01 and shall not be deemed to be “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that section, nor shall it be deemed to be incorporated by reference in any filing under the Securities Act or the Exchange Act, except as shall be expressly provided by specific reference in such filing. Furthermore, this report will not be deemed an admission as to the materiality of any information in the report that is required to be disclosed solely by Regulation FD.

Proposed Private Notes Offering

Enova International, Inc. (the “Company”) is furnishing this report to provide information about a proposed private offering of $261,392,000 in aggregate principal amount of Series 2025-1 Fixed Rate Asset-Backed Notes (the “Offered Notes”) by its wholly-owned indirect subsidiary, OnDeck Asset Securitization IV, LLC (the “Issuer”), which will issue the Offered Notes. Collateral for the Offered Notes will consist of, among other things, a revolving pool of small business loans originated or purchased by ODK Capital, LLC, which is a wholly-owned indirect subsidiary of the Company (“OnDeck”). The Offered Notes may be issued in one or more classes. The Issuer will use the net proceeds of the proposed private offering to purchase small business loans from OnDeck that will be pledged as collateral for the Offered Notes. The Company will use the money it receives from the Issuer for general corporate purposes.

The exact terms and timing of the proposed offering will depend upon market conditions and other factors. The Issuer will be the sole obligor of the Offered Notes; the Offered Notes will not be obligations of, or guaranteed by, the Company or OnDeck.

The Offered Notes will not be registered under the Securities Act of 1933, as amended (the “Securities Act”), or any state securities laws, and may not be offered or sold in the United States absent registration or an applicable exemption from, or a transaction not subject to, the registration requirements of the Securities Act and applicable state securities laws. The Offered Notes are being offered only to qualified institutional buyers under Rule 144A and to persons outside the United States pursuant to Regulation S under the Securities Act.

This Current Report on Form 8-K is not an offer to sell, nor a solicitation of an offer to buy, any securities, nor shall there be any sale of these securities in any state or jurisdiction in which the offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of such state or jurisdiction. Any offers of the securities will be made only by means of a private offering memorandum.

Disclosure of Supplemental Information Relating to the Offered Notes

On March 7, 2025, the Company made and intends to make certain of its supplemental historic loan performance and other data (collectively, the “Supplemental Data”) available during informational meetings with qualified third parties that are potential purchasers of the Offered Notes. A copy of the Supplemental Data is furnished as Exhibit 99.1 to this Current Report on Form 8-K and is incorporated herein solely for purposes of this Item 7.01.

By design, the Supplemental Data is different from, and not directly comparable to, the Company’s or OnDeck’s previously published loan performance information. The Supplemental Data includes information for a specific subset of OnDeck’s daily, weekly and monthly pay U.S. term loans, including both on-balance sheet loans and loans sold to investors, that: (i) have an original term of 24 months or less and (ii) a specified minimum loan yield (excluding origination fees) greater than or equal to 10%. The Supplemental Data also includes information for a specific subset of OnDeck’s daily, weekly and monthly pay U.S. lines of credit, including both on-balance sheet loans and loans sold to investors, that: (i) have an original term of 24 months or less and (ii) a specified minimum loan yield (excluding origination fees) greater than or equal to 10%.

In addition, the Supplemental Data sets forth certain historical delinquency data on the basis of “missed payment factor,” as defined on Exhibit 99.1, and not calendar days past due for term loans and lines of credit. The Supplemental Data also sets forth certain historical delinquency data on the basis of cumulative net loss for term loans as well as annualized net loss rate for each of term loan and line of credit. As described in more detail on Exhibit 99.1, the Supplemental Data includes information as of and for the dates and periods shown.

No assurance is given that the Supplemental Data is indicative of the future performance of the Company’s or OnDeck’s existing or future on-balance sheet loans, or loans sold or loans to be sold. The Company undertakes no duty to update the Supplemental Data in the future except as may be required by applicable law. The furnishing of the Supplemental Data is not an admission as to the materiality of all or any portion thereof. The Supplemental Data is not to be viewed in isolation and is intended to be considered in the context of more complete information included in the Company’s filings with the Securities and Exchange Commission (the “SEC”), including its Annual Report on Form 10-K for the year ended December 31, 2024, and other public filings or announcements that the Company has made and may make from time to time with the SEC, by press release or otherwise.

Cautionary Note Regarding Forward-Looking Statements

This Current Report on Form 8-K contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995, as amended, and other legal authority. Forward-looking statements can be identified by words such as “proposed,” “will,” “enables,” “expects,” “allows,” “continues,” “believes,” “anticipates,” “estimates” or similar expressions. These include statements regarding the proposed private offering of the Offered Notes, the contemplated size of the proposed offering of the Offered Notes, possible completion of the proposed offering of the Offered Notes and the prospective impact of the proposed offering of the Offered Notes. Forward-looking statements are neither historical facts nor assurances of future performance. They are based only on our current beliefs, expectations and assumptions regarding the future of our business, anticipated events and trends, the economy and other future conditions. As such, they are subject to inherent uncertainties, risks and changes in circumstances that are difficult to predict and in many cases outside our control. Therefore, you should not rely on any of these forward-looking statements. Our expected results may not be achieved, and actual results may differ materially from our expectations. There can be no assurance that the proposed offering of the Offered Notes will be completed as currently contemplated or at all. Factors that could cause or contribute to actual results differing from our forward-looking statements include risks relating to: changes in the financial markets, including changes in credit markets, interest rates, securitization markets generally and our proposed private offering in particular, that can impact the willingness of investors to buy the Offered Notes and the prices and interest rates that investors may require; adverse developments regarding the Company, its business or the online or broader marketplace lending industry generally, which could impact demand for or pricing of the Offered Notes; and other risks, including those described under the heading “Risk Factors” in our Annual Report on Form 10-K for the year ended December 31, 2024, and in other documents that we file with the SEC from time to time, which are or will be available on the SEC’s website at www.sec.gov. Except as required by law, we undertake no duty to update the information in this report.

ITEM 9.01 FINANCIAL STATEMENTS AND EXHIBITS

(d) Exhibits

The following exhibits are furnished as part of this Report on Form 8-K:

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

Enova International, Inc. |

|

|

|

|

Date: |

March 7, 2025 |

By: |

/s/ Sean Rahilly |

|

|

|

Sean Rahilly

General Counsel & Secretary |

Delinquencies and Net Charge-Offs

The following Supplemental Data provides historical information relating to (1) delinquency experience as of the dates indicated for a specific subset of OnDeck’s daily, weekly and monthly pay U.S. term loans and lines of credit (as indicated in the headings below), including both on-balance sheet loans and loans sold to investors, as further described in Item 7.01 of the Current Report on Form 8-K to which this Exhibit 99.1 is attached, (2) static pool net charge-off data for such term loans originated in the particular year or quarter specified in such net charge-off table and (3) annualized net charge-off data for such term loans and lines of credit (as indicated in the headings below) as of the particular year or quarter specified in such annualized net charge-off table.

Term Loan Delinquency Experience1, 2

|

|

|

|

|

|

|

|

|

12/31/2024 |

12/31/2023 |

12/31/2022 |

12/31/2021 |

12/31/2020 |

12/31/2019 |

12/31/2018 |

Number of Term Loans Outstanding |

21,409 |

20,445 |

18,027 |

11,951 |

10,473 |

19,576 |

21,116 |

Aggregate Unpaid Principal Balance |

$1,232,053,261 |

$1,081,407,606 |

$958,048,846 |

$564,833,713 |

$402,659,159 |

$855,865,052 |

$892,216,278 |

|

|

|

|

|

|

|

|

|

Unpaid Principal Balance of Past Due Term Loans |

1-14 missed payment factor |

$30,882,336 |

$34,595,627 |

$41,980,019 |

$15,395,906 |

$14,295,617 |

$27,535,137 |

$29,859,987 |

15-29 missed payment factor |

$23,933,022 |

$26,264,683 |

$25,013,844 |

$7,018,340 |

$11,737,335 |

$18,005,152 |

$17,017,747 |

30-44 missed payment factor |

$18,624,782 |

$22,313,096 |

$20,890,824 |

$5,985,236 |

$4,681,417 |

$13,677,209 |

$12,643,866 |

45-59 missed payment factor |

$16,505,861 |

$20,230,938 |

$14,293,284 |

$4,307,708 |

$3,017,883 |

$12,827,053 |

$12,090,837 |

60+ non-write off paying |

$45,242,828 |

$26,936,769 |

$15,727,287 |

$14,702,587 |

$50,274,475 |

$17,877,544 |

$18,208,895 |

60+ non-write off not paying |

$11,548,935 |

$18,655,548 |

$12,841,244 |

$6,794,343 |

$15,395,179 |

$26,591,630 |

$11,970,251 |

Total 61+ DPD |

$56,791,763 |

$45,592,317 |

$28,568,531 |

$21,496,930 |

$65,669,654 |

$44,469,174 |

$30,179,146 |

|

|

|

|

|

|

|

|

|

Term Loans past due as a % of Unpaid Principal Balance |

1-14 missed payment factor |

2.51% |

3.20% |

4.38% |

2.73% |

3.55% |

3.22% |

3.35% |

15-29 missed payment factor |

1.94% |

2.43% |

2.61% |

1.24% |

2.91% |

2.10% |

1.91% |

30-44 missed payment factor |

1.51% |

2.06% |

2.18% |

1.06% |

1.16% |

1.60% |

1.42% |

45-59 missed payment factor |

1.34% |

1.87% |

1.49% |

0.76% |

0.75% |

1.50% |

1.36% |

60+ non-write off paying |

3.67% |

2.49% |

1.64% |

2.60% |

12.49% |

2.09% |

2.04% |

60+ non-write off not paying |

0.94% |

1.73% |

1.34% |

1.20% |

3.82% |

3.11% |

1.34% |

1 The delinquency experience is measured by the missed payment factors of the term loans in the Term Loan Comparable Serviced Portfolio. The missed payment factor of a daily pay loan is the sum of the total past due amount of scheduled loan payments thereunder divided by the required daily scheduled loan payment thereunder plus the number of scheduled loan payment dates (if any) past the maturity date on which scheduled loan payment were due but not received on such loan. The missed payment factor of a weekly pay loan is calculated utilizing the same methodology, normalized to account for loans with only one scheduled payment per week and the missed payment factor of a monthly pay loan is calculated utilizing the same methodology, normalized to account for loans with only one scheduled payment per month.

2 Paid off Term Loans are viewed as $0 Unpaid Principal Balance.

Line of Credit Delinquency Experience3, 4

|

|

|

|

|

|

|

|

|

12/31/2024 |

12/31/2023 |

12/31/2022 |

12/31/2021 |

12/31/2020 |

12/31/2019 |

12/31/2018 |

Number of Lines of Credit Outstanding |

28,149 |

19,195 |

19,756 |

16,547 |

15,448 |

16,672 |

15,223 |

Aggregate Unpaid Principal Balance |

$556,419,013 |

$333,457,534 |

$282,699,515 |

$187,967,324 |

$155,589,302 |

$270,416,296 |

$181,065,400 |

|

|

|

|

|

|

|

|

|

Unpaid Principal Balance of Past Due Lines of Credit |

1-14 missed payment factor |

$15,129,970 |

$9,265,803 |

$7,587,935 |

$2,719,867 |

$3,096,655 |

$5,563,570 |

$3,142,169 |

15-29 missed payment factor |

$14,268,337 |

$5,601,523 |

$4,472,181 |

$1,305,146 |

$1,553,464 |

$3,390,316 |

$2,057,493 |

30-44 missed payment factor |

$8,758,919 |

$4,596,375 |

$3,469,618 |

$909,273 |

$909,064 |

$3,085,334 |

$1,808,989 |

45-59 missed payment factor |

$6,009,457 |

$4,437,468 |

$2,363,179 |

$640,028 |

$957,284 |

$2,326,662 |

$1,039,825 |

60+ non-write off paying |

$5,732,864 |

$5,678,597 |

$2,173,499 |

$2,066,120 |

$8,537,274 |

$1,950,686 |

$1,257,142 |

60+ non-write not off paying |

$8,306,417 |

$5,884,622 |

$1,597,465 |

$2,081,177 |

$4,316,810 |

$5,099,439 |

$3,255,459 |

Total 61+ missed payment factor |

$14,039,282 |

$11,563,219 |

$3,770,964 |

$4,147,297 |

$12,854,084 |

$7,050,124 |

$4,512,602 |

|

|

|

|

|

|

|

|

|

Lines of Credit past due as a % of Unpaid Principal Balance |

1-14 missed payment factor |

2.76% |

2.82% |

2.72% |

1.47% |

2.02% |

2.08% |

1.75% |

15-29 missed payment factor |

2.60% |

1.71% |

1.60% |

0.70% |

1.01% |

1.27% |

1.15% |

30-44 missed payment factor |

1.60% |

1.40% |

1.25% |

0.49% |

0.59% |

1.15% |

1.01% |

45-59 missed payment factor |

1.10% |

1.35% |

0.85% |

0.35% |

0.62% |

0.87% |

0.58% |

60+ non-write off paying |

1.05% |

1.73% |

0.78% |

1.12% |

5.56% |

0.73% |

0.70% |

60+ non-write off not paying |

1.52% |

1.79% |

0.57% |

1.12% |

2.81% |

1.91% |

1.82% |

3 The delinquency experience is measured by the missed payment factors of the line of credit loans in the Line of Credit Comparable Serviced Portfolio. The missed payment factor of a daily pay loan is the sum of the total past due amount of scheduled loan payments thereunder divided by the required daily scheduled loan payment thereunder plus the number of scheduled loan payment dates (if any) past the maturity date on which scheduled loan payment were due but not received on such loan. The missed payment factor of a weekly pay loan is calculated utilizing the same methodology, normalized to account for loans with only one scheduled payment per week and the missed payment factor of a monthly pay loan is calculated utilizing the same methodology, normalized to account for loans with only one scheduled payment per month. Historically, line of credit loans have been weekly pay loans.

4 Dormant Lines of Credit are viewed as $0 Unpaid Principal Balance.

|

|

|

|

|

|

|

|

|

|

|

Term Loan Cumulative Net Charge-Off Experience5 |

Origination Vintages (based on calendar year or quarter): Overall |

|

|

|

|

|

|

|

|

|

|

|

|

2024 Q4 |

2024 Q3 |

2024 Q2 |

2024 Q1 |

2023 |

2022 |

2021 |

2020 |

2019 |

2018 |

Number of Loans Originated |

6,780 |

6,494 |

5,998 |

6,545 |

23,999 |

23,008 |

15,091 |

10,944 |

28,717 |

31,070 |

Aggregate Original Principal Balance |

579,813,208 |

569,073,421 |

490,579,522 |

523,136,590 |

1,814,411,411 |

1,647,779,313 |

951,026,442 |

658,440,346 |

1,708,671,260 |

1,835,659,879 |

Cumulative Net Charge-Offs (as a % of aggregate original principal balance)6 |

Months Since Origination |

2024 Q4 |

2024 Q3 |

2024 Q2 |

2024 Q1 |

2023 |

2022 |

2021 |

2020 |

2019 |

2018 |

1 |

0.00% |

0.00% |

0.00% |

0.00% |

0.00% |

0.00% |

0.00% |

0.00% |

0.00% |

0.01% |

2 |

|

0.01% |

0.00% |

0.00% |

0.00% |

0.01% |

0.03% |

0.01% |

0.03% |

0.04% |

3 |

|

0.19% |

0.00% |

0.00% |

0.00% |

0.03% |

0.09% |

0.15% |

0.07% |

0.10% |

4 |

|

0.83% |

0.48% |

0.05% |

0.14% |

0.27% |

0.30% |

0.39% |

0.23% |

0.28% |

5 |

|

|

1.51% |

0.77% |

0.82% |

1.23% |

0.89% |

0.72% |

0.83% |

0.82% |

6 |

|

|

2.87% |

1.83% |

1.98% |

2.54% |

1.83% |

1.30% |

1.71% |

1.75% |

7 |

|

|

4.20% |

3.14% |

3.16% |

3.81% |

2.67% |

1.90% |

2.56% |

2.77% |

8 |

|

|

|

4.35% |

4.45% |

5.15% |

3.72% |

2.71% |

3.57% |

3.79% |

9 |

|

|

|

5.38% |

5.74% |

6.36% |

4.44% |

3.53% |

4.51% |

4.65% |

10 |

|

|

|

6.10% |

6.86% |

7.41% |

5.17% |

4.20% |

5.39% |

5.40% |

11 |

|

|

|

|

7.72% |

8.40% |

5.72% |

4.62% |

6.25% |

5.85% |

12 |

|

|

|

|

8.49% |

9.17% |

6.25% |

4.98% |

6.85% |

6.28% |

13 |

|

|

|

|

9.04% |

9.96% |

6.54% |

5.21% |

7.39% |

6.63% |

14 |

|

|

|

|

|

10.59% |

6.72% |

5.42% |

7.80% |

6.92% |

15 |

|

|

|

|

|

11.02% |

6.89% |

5.46% |

8.22% |

7.12% |

16 |

|

|

|

|

|

11.37% |

7.04% |

5.60% |

8.50% |

7.29% |

17 |

|

|

|

|

|

11.66% |

7.18% |

5.64% |

8.76% |

7.44% |

18 |

|

|

|

|

|

11.85% |

7.28% |

5.65% |

8.87% |

7.62% |

19 |

|

|

|

|

|

12.02% |

7.33% |

5.68% |

8.98% |

7.71% |

20 |

|

|

|

|

|

12.12% |

7.39% |

5.73% |

9.01% |

7.81% |

21 |

|

|

|

|

|

12.21% |

7.37% |

5.69% |

9.04% |

7.84% |

22 |

|

|

|

|

|

12.28% |

7.38% |

5.69% |

9.07% |

7.86% |

23 |

|

|

|

|

|

12.29% |

7.38% |

5.63% |

9.07% |

7.87% |

24 |

|

|

|

|

|

12.27% |

7.35% |

5.59% |

9.06% |

7.87% |

25 |

|

|

|

|

|

12.26% |

7.33% |

5.58% |

9.02% |

7.87% |

26 |

|

|

|

|

|

|

7.29% |

5.55% |

8.99% |

7.86% |

27 |

|

|

|

|

|

|

7.23% |

5.47% |

8.94% |

7.84% |

28 |

|

|

|

|

|

|

7.20% |

5.42% |

8.89% |

7.82% |

29 |

|

|

|

|

|

|

7.19% |

5.37% |

8.83% |

7.81% |

30 |

|

|

|

|

|

|

7.16% |

5.35% |

8.77% |

7.79% |

5 The historical information in the tables in this section reflect net charge-offs in respect of the Term Loan Comparable Serviced Portfolio that were charged-off by the Seller and/or On Deck Capital, Inc. in accordance with their then-existing policies and procedures. A Pooled Loan will be deemed a Charged-Off Loan under the Indenture if it is charged-off by the Seller and/or On Deck Capital, Inc. in accordance with their Credit Policies or it has a Missed Payment Factor (i) in the case of Daily Pay Loans, higher than 60, (ii) in the case of Weekly Pay Loans, higher than 12 and (iii) in the case of Monthly Pay Loans, higher than 3. The data shown above for the referenced annual or quarterly vintages represents the loans originated during such year or quarter as a static pool, and illustrates how such vintages have performed given equivalent months of seasoning.

6 Cumulative net charge-offs (as a % of aggregate original principal balance) are only included for those vintages and months since origination for

which performance history exists for each loan of such vintage over such number of months since origination.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Origination Vintages (based on calendar year or quarter): OnDeck Score < 470 |

|

|

|

|

|

|

|

|

|

|

|

|

2024 Q4 |

2024 Q3 |

2024 Q2 |

2024 Q1 |

2023 |

2022 |

2021 |

2020 |

2019 |

2018 |

Number of Loans Originated |

52 |

39 |

52 |

11 |

245 |

795 |

834 |

331 |

1,034 |

1,753 |

Aggregate Original Principal Balance |

2,386,000 |

2,350,500 |

2,495,000 |

307,000 |

14,498,930 |

28,105,756 |

27,059,170 |

8,521,102 |

26,174,248 |

42,028,278 |

Cumulative Net Charge-Offs (as a % of aggregate original principal balance)7 |

|

|

|

|

|

|

|

|

|

|

|

Months Since Origination |

2024 Q4 |

2024 Q3 |

2024 Q2 |

2024 Q1 |

2023 |

2022 |

2021 |

2020 |

2019 |

2018 |

1 |

0.00% |

0.00% |

0.00% |

0.00% |

0.00% |

0.00% |

0.00% |

0.00% |

0.00% |

0.00% |

2 |

|

0.00% |

0.00% |

0.00% |

0.00% |

0.00% |

0.17% |

0.00% |

0.10% |

0.24% |

3 |

|

0.00% |

0.00% |

0.00% |

0.00% |

0.00% |

0.21% |

0.14% |

0.15% |

0.56% |

4 |

|

0.00% |

0.00% |

0.00% |

0.68% |

0.56% |

0.71% |

0.14% |

0.39% |

1.23% |

5 |

|

|

0.69% |

0.00% |

6.18% |

4.09% |

3.08% |

0.72% |

2.51% |

2.99% |

6 |

|

|

15.93% |

5.65% |

10.26% |

6.98% |

8.09% |

1.50% |

4.61% |

5.75% |

7 |

|

|

16.26% |

9.95% |

13.10% |

11.02% |

10.65% |

3.26% |

6.64% |

8.96% |

8 |

|

|

|

18.64% |

13.89% |

13.40% |

13.53% |

5.03% |

8.64% |

12.17% |

9 |

|

|

|

18.64% |

14.34% |

15.71% |

15.63% |

5.79% |

10.32% |

13.87% |

10 |

|

|

|

18.60% |

16.70% |

17.23% |

16.55% |

6.44% |

11.83% |

14.89% |

11 |

|

|

|

|

18.50% |

18.52% |

16.27% |

7.41% |

12.68% |

15.52% |

12 |

|

|

|

|

20.74% |

19.83% |

16.65% |

8.31% |

13.77% |

15.82% |

13 |

|

|

|

|

21.71% |

20.86% |

16.78% |

8.46% |

13.89% |

16.44% |

14 |

|

|

|

|

|

21.03% |

17.13% |

8.86% |

13.98% |

16.74% |

15 |

|

|

|

|

|

21.25% |

17.15% |

9.06% |

14.05% |

16.92% |

16 |

|

|

|

|

|

21.23% |

17.10% |

9.31% |

14.73% |

16.93% |

17 |

|

|

|

|

|

21.23% |

17.09% |

9.44% |

14.81% |

16.92% |

18 |

|

|

|

|

|

21.33% |

17.09% |

9.36% |

14.61% |

16.92% |

19 |

|

|

|

|

|

21.25% |

16.44% |

9.33% |

14.66% |

16.84% |

20 |

|

|

|

|

|

21.46% |

16.39% |

9.04% |

14.57% |

16.79% |

21 |

|

|

|

|

|

21.41% |

16.35% |

9.01% |

14.49% |

16.75% |

22 |

|

|

|

|

|

21.60% |

16.26% |

8.97% |

14.33% |

16.71% |

23 |

|

|

|

|

|

21.62% |

16.20% |

8.88% |

14.36% |

16.66% |

24 |

|

|

|

|

|

21.74% |

16.12% |

8.83% |

14.27% |

16.60% |

25 |

|

|

|

|

|

21.58% |

16.03% |

8.65% |

14.16% |

16.56% |

26 |

|

|

|

|

|

|

15.95% |

8.57% |

14.04% |

16.48% |

27 |

|

|

|

|

|

|

15.86% |

8.48% |

13.90% |

16.34% |

28 |

|

|

|

|

|

|

15.81% |

8.41% |

13.79% |

16.16% |

29 |

|

|

|

|

|

|

15.72% |

8.33% |

13.77% |

16.09% |

30 |

|

|

|

|

|

|

15.66% |

8.16% |

13.65% |

16.06% |

7 Cumulative net charge-offs (as a % of aggregate original principal balance) are only included for those vintages and months since origination for which performance history exists for each loan of such vintage over such number of months since origination.

|

|

|

|

|

|

|

|

|

|

|

Origination Vintages (based on calendar year or quarter): OnDeck Score 470-499 |

|

|

|

|

|

|

|

|

|

|

|

|

2024 Q4 |

2024 Q3 |

2024 Q2 |

2024 Q1 |

2023 |

2022 |

2021 |

2020 |

2019 |

2018 |

Number of Loans Originated |

828 |

749 |

741 |

534 |

2,087 |

4,114 |

3,082 |

1,510 |

4,600 |

5,856 |

Aggregate Original Principal Balance |

43,328,058 |

40,296,799 |

35,844,479 |

25,217,009 |

110,247,400 |

203,280,181 |

150,873,809 |

57,734,557 |

176,893,016 |

229,466,667 |

Cumulative Net Charge-Offs (as a % of aggregate original principal balance)8 |

|

|

|

|

|

|

|

|

|

|

|

Months Since Origination |

2024 Q4 |

2024 Q3 |

2024 Q2 |

2024 Q1 |

2023 |

2022 |

2021 |

2020 |

2019 |

2018 |

1 |

0.00% |

0.00% |

0.00% |

0.00% |

0.00% |

0.00% |

0.00% |

0.00% |

0.00% |

0.00% |

2 |

|

0.00% |

0.00% |

0.00% |

0.00% |

0.00% |

0.03% |

0.00% |

0.09% |

0.05% |

3 |

|

0.62% |

0.00% |

0.00% |

0.00% |

0.00% |

0.06% |

0.24% |

0.28% |

0.19% |

4 |

|

1.16% |

1.12% |

0.02% |

0.27% |

0.61% |

0.55% |

0.97% |

0.79% |

0.69% |

5 |

|

|

2.58% |

1.32% |

1.81% |

3.19% |

1.96% |

1.59% |

2.21% |

1.96% |

6 |

|

|

5.95% |

3.59% |

4.02% |

6.16% |

4.40% |

2.83% |

4.75% |

4.11% |

7 |

|

|

8.25% |

6.28% |

6.75% |

8.59% |

6.36% |

3.78% |

6.36% |

6.21% |

8 |

|

|

|

7.77% |

9.43% |

11.29% |

9.46% |

4.81% |

8.35% |

7.99% |

9 |

|

|

|

8.85% |

10.86% |

13.37% |

11.29% |

6.64% |

10.01% |

9.73% |

10 |

|

|

|

10.03% |

12.86% |

14.83% |

12.95% |

7.32% |

11.10% |

11.07% |

11 |

|

|

|

|

14.71% |

16.81% |

14.15% |

8.11% |

12.81% |

12.00% |

12 |

|

|

|

|

15.90% |

18.19% |

15.37% |

8.95% |

13.95% |

12.56% |

13 |

|

|

|

|

16.98% |

19.73% |

15.88% |

9.57% |

14.71% |

13.05% |

14 |

|

|

|

|

|

20.71% |

16.16% |

9.90% |

15.30% |

13.50% |

15 |

|

|

|

|

|

21.31% |

16.24% |

9.88% |

15.63% |

13.86% |

16 |

|

|

|

|

|

21.99% |

16.55% |

10.33% |

16.00% |

14.09% |

17 |

|

|

|

|

|

22.44% |

16.72% |

10.26% |

16.22% |

14.28% |

18 |

|

|

|

|

|

22.68% |

17.04% |

10.26% |

16.26% |

14.50% |

19 |

|

|

|

|

|

23.06% |

17.03% |

10.16% |

16.28% |

14.54% |

20 |

|

|

|

|

|

23.30% |

17.21% |

10.11% |

16.21% |

14.53% |

21 |

|

|

|

|

|

23.36% |

17.09% |

9.87% |

16.11% |

14.61% |

22 |

|

|

|

|

|

23.54% |

17.04% |

9.99% |

16.06% |

14.53% |

23 |

|

|

|

|

|

23.53% |

17.07% |

9.88% |

15.95% |

14.52% |

24 |

|

|

|

|

|

23.50% |

17.04% |

9.84% |

15.94% |

14.51% |

25 |

|

|

|

|

|

23.43% |

16.99% |

9.82% |

15.91% |

14.47% |

26 |

|

|

|

|

|

|

16.99% |

9.68% |

15.83% |

14.44% |

27 |

|

|

|

|

|

|

16.93% |

9.57% |

15.76% |

14.37% |

28 |

|

|

|

|

|

|

16.87% |

9.44% |

15.71% |

14.35% |

29 |

|

|

|

|

|

|

16.87% |

9.30% |

15.62% |

14.31% |

30 |

|

|

|

|

|

|

16.82% |

9.16% |

15.49% |

14.23% |

8 Cumulative net charge-offs (as a % of aggregate original principal balance) are only included for those vintages and months since origination for which performance history exists for each loan of such vintage over such number of months since origination.

|

|

|

|

|

|

|

|

|

|

|

Origination Vintages (based on calendar year or quarter): OnDeck Score 500-529 |

|

2024 Q4 |

2024 Q3 |

2024 Q2 |

2024 Q1 |

2023 |

2022 |

2021 |

2020 |

2019 |

2018 |

Number of Loans Originated |

2,473 |

2,385 |

2,242 |

2,535 |

9,770 |

8,793 |

4,793 |

3,282 |

8,710 |

9,007 |

Aggregate Original Principal Balance |

172,888,067 |

171,186,815 |

148,923,195 |

159,269,428 |

597,482,507 |

595,240,252 |

291,543,858 |

176,638,609 |

472,486,919 |

496,682,710 |

Cumulative Net Charge-Offs (as a % of aggregate original principal balance)9 |

|

|

|

|

|

|

|

|

|

|

|

Months Since Origination |

2024 Q4 |

2024 Q3 |

2024 Q2 |

2024 Q1 |

2023 |

2022 |

2021 |

2020 |

2019 |

2018 |

1 |

0.00% |

0.00% |

0.00% |

0.00% |

0.00% |

0.00% |

0.00% |

0.00% |

0.00% |

0.03% |

2 |

|

0.00% |

0.00% |

0.00% |

0.00% |

0.01% |

0.06% |

0.00% |

0.03% |

0.06% |

3 |

|

0.20% |

0.00% |

0.00% |

0.01% |

0.06% |

0.15% |

0.24% |

0.09% |

0.14% |

4 |

|

1.13% |

0.61% |

0.07% |

0.18% |

0.33% |

0.45% |

0.60% |

0.33% |

0.35% |

5 |

|

|

2.22% |

1.56% |

1.20% |

1.57% |

1.01% |

1.19% |

1.21% |

1.29% |

6 |

|

|

4.09% |

3.47% |

2.87% |

3.21% |

2.06% |

2.15% |

2.28% |

2.52% |

7 |

|

|

6.06% |

5.93% |

4.50% |

4.90% |

3.11% |

3.26% |

3.47% |

3.96% |

8 |

|

|

|

7.78% |

6.29% |

6.66% |

4.05% |

4.40% |

4.79% |

5.20% |

9 |

|

|

|

9.21% |

8.18% |

8.31% |

4.85% |

5.64% |

6.29% |

6.34% |

10 |

|

|

|

9.99% |

9.67% |

10.04% |

5.83% |

6.43% |

7.54% |

7.45% |

11 |

|

|

|

|

10.81% |

11.21% |

6.55% |

7.21% |

8.91% |

8.10% |

12 |

|

|

|

|

11.96% |

12.14% |

7.35% |

7.74% |

9.73% |

8.71% |

13 |

|

|

|

|

12.76% |

13.16% |

7.79% |

8.05% |

10.57% |

9.05% |

14 |

|

|

|

|

|

14.11% |

8.05% |

8.38% |

11.15% |

9.41% |

15 |

|

|

|

|

|

14.77% |

8.38% |

8.48% |

11.65% |

9.64% |

16 |

|

|

|

|

|

15.29% |

8.60% |

8.58% |

11.90% |

9.80% |

17 |

|

|

|

|

|

15.66% |

8.80% |

8.62% |

12.35% |

10.08% |

18 |

|

|

|

|

|

15.95% |

8.91% |

8.67% |

12.52% |

10.32% |

19 |

|

|

|

|

|

16.11% |

9.02% |

8.68% |

12.66% |

10.49% |

20 |

|

|

|

|

|

16.15% |

9.04% |

8.81% |

12.68% |

10.60% |

21 |

|

|

|

|

|

16.34% |

9.05% |

8.78% |

12.69% |

10.61% |

22 |

|

|

|

|

|

16.36% |

9.05% |

8.74% |

12.69% |

10.69% |

23 |

|

|

|

|

|

16.42% |

9.02% |

8.70% |

12.76% |

10.69% |

24 |

|

|

|

|

|

16.40% |

8.98% |

8.62% |

12.70% |

10.70% |

25 |

|

|

|

|

|

16.43% |

8.97% |

8.65% |

12.71% |

10.72% |

26 |

|

|

|

|

|

|

8.92% |

8.66% |

12.68% |

10.72% |

27 |

|

|

|

|

|

|

8.79% |

8.56% |

12.63% |

10.68% |

28 |

|

|

|

|

|

|

8.71% |

8.48% |

12.54% |

10.66% |

29 |

|

|

|

|

|

|

8.72% |

8.43% |

12.42% |

10.64% |

30 |

|

|

|

|

|

|

8.67% |

8.37% |

12.34% |

10.62% |

9 Cumulative net charge-offs (as a % of aggregate original principal balance) are only included for those vintages and months since origination for which performance history exists for each loan of such vintage over such number of months since origination.

|

|

|

|

|

|

|

|

|

|

|

Origination Vintages (based on calendar year or quarter): OnDeck Score 530-559 |

|

2024 Q4 |

2024 Q3 |

2024 Q2 |

2024 Q1 |

2023 |

2022 |

2021 |

2020 |

2019 |

2018 |

Number of Loans Originated |

2,293 |

2,309 |

2,096 |

2,363 |

8,000 |

5,922 |

3,834 |

3,341 |

8,337 |

8,263 |

Aggregate Original Principal Balance |

228,472,985 |

228,893,754 |

202,874,437 |

214,581,685 |

692,790,432 |

500,695,163 |

275,356,612 |

219,069,951 |

541,410,531 |

557,559,854 |

Cumulative Net Charge-Offs (as a % of aggregate original principal balance)10 |

|

|

|

|

|

|

|

|

|

|

|

Months Since Origination |

2024 Q4 |

2024 Q3 |

2024 Q2 |

2024 Q1 |

2023 |

2022 |

2021 |

2020 |

2019 |

2018 |

1 |

0.00% |

0.00% |

0.00% |

0.00% |

0.00% |

0.00% |

0.00% |

0.00% |

0.00% |

0.00% |

2 |

|

0.01% |

0.00% |

0.00% |

0.00% |

0.00% |

0.02% |

0.02% |

0.03% |

0.02% |

3 |

|

0.21% |

0.00% |

0.00% |

0.00% |

0.02% |

0.06% |

0.15% |

0.03% |

0.07% |

4 |

|

1.02% |

0.47% |

0.06% |

0.09% |

0.16% |

0.15% |

0.33% |

0.15% |

0.22% |

5 |

|

|

1.52% |

0.49% |

0.58% |

0.52% |

0.51% |

0.63% |

0.63% |

0.46% |

6 |

|

|

2.38% |

1.04% |

1.55% |

1.37% |

0.83% |

1.06% |

1.43% |

1.17% |

7 |

|

|

3.43% |

1.98% |

2.58% |

2.13% |

1.25% |

1.40% |

2.26% |

1.94% |

8 |

|

|

|

3.27% |

3.72% |

3.06% |

1.86% |

2.04% |

3.15% |

2.86% |

9 |

|

|

|

4.37% |

4.94% |

3.92% |

2.20% |

2.52% |

3.94% |

3.57% |

10 |

|

|

|

5.29% |

5.88% |

4.51% |

2.57% |

3.24% |

4.79% |

4.10% |

11 |

|

|

|

|

6.58% |

5.31% |

3.01% |

3.57% |

5.51% |

4.44% |

12 |

|

|

|

|

7.27% |

5.94% |

3.24% |

3.76% |

6.05% |

4.89% |

13 |

|

|

|

|

7.63% |

6.46% |

3.49% |

3.96% |

6.57% |

5.27% |

14 |

|

|

|

|

|

6.88% |

3.62% |

4.22% |

6.94% |

5.52% |

15 |

|

|

|

|

|

7.18% |

3.80% |

4.24% |

7.47% |

5.72% |

16 |

|

|

|

|

|

7.42% |

3.86% |

4.45% |

7.81% |

5.92% |

17 |

|

|

|

|

|

7.68% |

4.02% |

4.57% |

8.05% |

6.06% |

18 |

|

|

|

|

|

7.79% |

4.07% |

4.49% |

8.17% |

6.22% |

19 |

|

|

|

|

|

7.96% |

4.22% |

4.49% |

8.32% |

6.34% |

20 |

|

|

|

|

|

8.09% |

4.29% |

4.57% |

8.40% |

6.47% |

21 |

|

|

|

|

|

8.16% |

4.28% |

4.54% |

8.46% |

6.50% |

22 |

|

|

|

|

|

8.28% |

4.32% |

4.50% |

8.51% |

6.52% |

23 |

|

|

|

|

|

8.27% |

4.36% |

4.40% |

8.47% |

6.54% |

24 |

|

|

|

|

|

8.26% |

4.31% |

4.37% |

8.49% |

6.53% |

25 |

|

|

|

|

|

8.24% |

4.30% |

4.34% |

8.44% |

6.53% |

26 |

|

|

|

|

|

|

4.24% |

4.29% |

8.35% |

6.53% |

27 |

|

|

|

|

|

|

4.22% |

4.20% |

8.30% |

6.51% |

28 |

|

|

|

|

|

|

4.22% |

4.16% |

8.26% |

6.51% |

29 |

|

|

|

|

|

|

4.23% |

4.09% |

8.24% |

6.49% |

30 |

|

|

|

|

|

|

4.20% |

4.08% |

8.17% |

6.46% |

10 Cumulative net charge-offs (as a % of aggregate original principal balance) are only included for those vintages and months since origination for which performance history exists for each loan of such vintage over such number of months since origination.

|

|

|

|

|

|

|

|

|

|

|

Origination Vintages (based on calendar year or quarter): OnDeck Score 560+ |

|

2024 Q4 |

2024 Q3 |

2024 Q2 |

2024 Q1 |

2023 |

2022 |

2021 |

2020 |

2019 |

2018 |

Number of Loans Originated |

1,134 |

1,012 |

867 |

1,102 |

3,897 |

3,384 |

2,548 |

2,480 |

6,036 |

6,191 |

Aggregate Original Principal Balance |

132,738,098 |

126,345,553 |

100,442,411 |

123,761,468 |

399,392,141 |

320,457,960 |

206,192,993 |

196,476,127 |

491,706,545 |

509,922,369 |

Cumulative Net Charge-Offs (as a % of aggregate original principal balance)11 |

|

|

|

|

|

|

|

|

|

|

|

Months Since Origination |

2024 Q4 |

2024 Q3 |

2024 Q2 |

2024 Q1 |

2023 |

2022 |

2021 |

2020 |

2019 |

2018 |

1 |

0.00% |

0.00% |

0.00% |

0.00% |

0.00% |

0.00% |

0.00% |

0.00% |

0.00% |

0.00% |

2 |

|

0.00% |

0.00% |

0.00% |

0.00% |

0.02% |

0.00% |

0.03% |

0.00% |

0.00% |

3 |

|

0.00% |

0.00% |

0.00% |

0.00% |

0.02% |

0.03% |

0.04% |

0.00% |

0.01% |

4 |

|

0.00% |

0.08% |

0.00% |

0.10% |

0.07% |

0.07% |

0.10% |

0.01% |

0.01% |

5 |

|

|

0.08% |

0.15% |

0.21% |

0.21% |

0.14% |

0.16% |

0.10% |

0.05% |

6 |

|

|

0.60% |

0.71% |

0.52% |

0.45% |

0.14% |

0.36% |

0.24% |

0.25% |

7 |

|

|

1.27% |

0.90% |

0.85% |

0.75% |

0.20% |

0.65% |

0.45% |

0.47% |

8 |

|

|

|

1.07% |

1.26% |

1.02% |

0.27% |

1.22% |

0.86% |

0.85% |

9 |

|

|

|

1.45% |

1.76% |

1.31% |

0.38% |

1.75% |

1.13% |

1.14% |

10 |

|

|

|

1.67% |

2.38% |

1.53% |

0.52% |

2.26% |

1.58% |

1.50% |

11 |

|

|

|

|

2.75% |

1.79% |

0.61% |

2.33% |

1.81% |

1.64% |

12 |

|

|

|

|

2.94% |

2.07% |

0.66% |

2.54% |

2.06% |

1.81% |

13 |

|

|

|

|

3.27% |

2.31% |

0.67% |

2.61% |

2.26% |

2.05% |

14 |

|

|

|

|

|

2.50% |

0.70% |

2.62% |

2.52% |

2.24% |

15 |

|

|

|

|

|

2.62% |

0.72% |

2.65% |

2.79% |

2.35% |

16 |

|

|

|

|

|

2.68% |

0.80% |

2.64% |

2.96% |

2.47% |

17 |

|

|

|

|

|

2.76% |

0.80% |

2.62% |

3.09% |

2.53% |

18 |

|

|

|

|

|

2.91% |

0.83% |

2.71% |

3.16% |

2.67% |

19 |

|

|

|

|

|

2.97% |

0.81% |

2.82% |

3.25% |

2.69% |

20 |

|

|

|

|

|

3.03% |

0.82% |

2.83% |

3.29% |

2.80% |

21 |

|

|

|

|

|

3.02% |

0.81% |

2.84% |

3.33% |

2.81% |

22 |

|

|

|

|

|

3.01% |

0.85% |

2.87% |

3.40% |

2.84% |

23 |

|

|

|

|

|

2.98% |

0.85% |

2.85% |

3.43% |

2.88% |

24 |

|

|

|

|

|

2.91% |

0.85% |

2.82% |

3.43% |

2.87% |

25 |

|

|

|

|

|

2.91% |

0.84% |

2.85% |

3.38% |

2.87% |

26 |

|

|

|

|

|

|

0.84% |

2.82% |

3.40% |

2.88% |

27 |

|

|

|

|

|

|

0.83% |

2.79% |

3.38% |

2.89% |

28 |

|

|

|

|

|

|

0.82% |

2.77% |

3.37% |

2.88% |

29 |

|

|

|

|

|

|

0.79% |

2.75% |

3.33% |

2.89% |

30 |

|

|

|

|

|

|

0.77% |

2.80% |

3.31% |

2.90% |

11 Cumulative net charge-offs (as a % of aggregate original principal balance) are only included for those vintages and months since origination for which performance history exists for each loan of such vintage over such number of months since origination.

Term Loan Annualized Net Charge-Offs Experience12

|

|

|

|

|

|

|

|

|

As of 12/31/24 |

2023 |

2022 |

2021 |

2020 |

2019 |

2018 |

Average Number of Term Loans Outstanding |

21,369 |

19,037 |

15,168 |

10,393 |

15,214 |

20,913 |

19,319 |

Average Aggregate Unpaid Principal Balance |

1,165,930,299 |

993,225,017 |

758,591,113 |

442,684,455 |

632,006,246 |

867,112,999 |

834,373,964 |

Net Charge-offs |

204,470,169 |

179,053,893 |

79,759,902 |

24,065,421 |

132,424,601 |

129,489,502 |

101,464,659 |

Annualized Net Charge-off Rate |

17.54% |

18.03% |

10.51% |

5.44% |

20.95% |

14.93% |

12.16% |

Line of Credit Annualized Net Charge-Offs Experience13

|

|

|

|

|

|

|

|

|

As of 12/31/24 |

2023 |

2022 |

2021 |

2020 |

2019 |

2018 |

Average Number of Lines of Credit Outstanding |

23,523 |

18,378 |

18,192 |

15,876 |

16,255 |

16,083 |

13,953 |

Average Aggregate Unpaid Principal Balance |

445,036,918 |

299,483,407 |

230,467,628 |

167,272,754 |

215,144,875 |

226,753,702 |

148,768,339 |

Net Charge-offs |

65,186,241 |

42,524,402 |

14,719,938 |

7,849,107 |

32,804,478 |

22,555,856 |

12,410,990 |

Annualized Net Charge-off Rate |

14.65% |

14.20% |

6.39% |

4.69% |

15.25% |

9.95% |

8.34% |

12 The historical information in this table reflects net charge-offs in respect of the Term Loan Comparable Serviced Portfolio that were charged-off by the Seller and/or On Deck Capital, Inc in accordance with its then-existing policies and procedures. A Pooled Loan will be deemed a Charged-Off Loan under the Indenture if it is charged-off by the Seller and/or On Deck Capital, Inc in accordance with its Credit Policies or it has a Missed Payment Factor (i) in the case of Daily Pay Loans, higher than 60, (ii) in the case of Weekly Pay Loans, higher than 12 and (iii) in the case of Monthly Pay Loans, higher than 3.

13 The historical information in this table reflects net charge-offs in respect of the Line of Credit Comparable Serviced Portfolio that were charged-off by the Seller in accordance with its then-existing policies and procedures. A Pooled Loan will be deemed a Charged-Off Loan under the Indenture if it is charged-off by the Seller in accordance with its Credit Policies or it has a Missed Payment Factor (i) in the case of Daily Pay Loans, higher than 60, (ii) in the case of Weekly Pay Loans, higher than 12 and (iii) in the case of Monthly Pay Loans, higher than 3.

v3.25.0.1

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

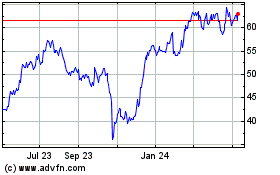

Enova (NYSE:ENVA)

Historical Stock Chart

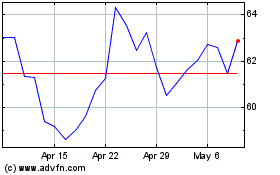

From Feb 2025 to Mar 2025

Enova (NYSE:ENVA)

Historical Stock Chart

From Mar 2024 to Mar 2025