false

0001417892

00-0000000

0001417892

2025-03-13

2025-03-13

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(D)

OF THE SECURITIES EXCHANGE ACT OF 1934

Date of report (Date of earliest event

reported): March 13, 2025

EMEREN GROUP LTD

(Exact Name of Registrant as Specified in Its Charter)

| British Virgin Islands |

001-33911 |

N/A |

|

(State or other jurisdiction

of incorporation) |

(Commission

File Number) |

(IRS Employer

Identification No.) |

|

149 Water Street, Suite 302

Norwalk, Connecticut |

06854 |

| (Address of principal executive offices) |

(Zip Code) |

Registrant’s telephone number, including

area code: +1 925-425-7335

_______________________________________

(Former name or former address, if changed since

last report.)

Check the appropriate box below if the Form 8-K filing is intended

to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ¨ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

|

| ¨ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

|

| ¨ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

|

| ¨ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class |

|

Trading Symbol(s) |

|

Name of each exchange on which registered |

| American Depositary Shares, each representing 10 shares, no par value per share |

|

SOL |

|

New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth

company as defined in Rule 405 of the Securities Act of 1933 or Rule 12b-2 of the Securities Exchange Act of 1934.

Emerging growth company ¨

If an emerging growth company, indicate by check mark if the registrant

has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant

to Section 13(a) of the Exchange Act. ¨

Item 2.02 Results of Operations and Financial Condition.

On March 13, 2025, Emeren

Group Ltd (the “Company”) issued a press release announcing its preliminary financial results and providing a business update

as of and for the fourth quarter and year ended December 31, 2024. A copy of this press release is furnished as Exhibit 99.1 to this Current

Report on Form 8-K and is incorporated herein by reference.

The information furnished

in this Item 2.02, including Exhibit 99.1, is not deemed to be “filed” for purposes of Section 18 of the Securities Exchange

Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liability of that section. This information will

not be deemed to be incorporated by reference into any filing under the Securities Act of 1933, as amended (the “Securities Act”),

or the Exchange Act, except to the extent that the Company specifically incorporates it by reference.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits:

SIGNATURES

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| |

EMEREN GROUP LTD |

| |

|

|

| Date: March 17, 2025 |

By: |

/s/ Ke Chen |

| |

|

Ke Chen |

| |

|

Chief Financial Officer |

Exhibit 99.1

March 13, 2025

Fellow Shareholders,

2024 was a year of resilience, disciplined execution, and strategic

growth for Emeren. Despite currency headwinds and project sale delays, we successfully monetized renewable energy assets, expanded our

energy storage footprint, and generated positive free cash flow in Q4. Our Independent Power Producer (IPP) and Development Service Agreement

(DSA) segments provided high margins and stable cash flows, while strategic project monetization strengthened our financial position.

We ended the year with $50.0 million in cash, up 40% sequentially, positioning us for continued growth in 2025.

Resilient Growth Driving Free Cash Flow

In Q4 2024, we generated $10.5 million in operating cash flow and

over $5 million in free cash flow, further strengthening our financial position amid a challenging market landscape. For the full year,

we achieved $6.9 million in adjusted EBITDA, demonstrating disciplined execution and a high-margin business model.

Our capital-light model fueled profitable growth while supporting

investment. Strong liquidity and efficiency position us to capitalize on 2025 project sales and opportunities.

Executing High-Margin Expansion

Our resilient high-margin IPP and DSA segments enabled us to deliver

$34.6 million in revenue and $4.8 million in gross profit, achieving a solid 14% gross margin in Q4. While FX losses due to the strength

of U.S. dollar impacted net income, our operating loss improved by 35% Y/Y in Q4, reflecting strong cost discipline.

Although project timing delays in the U.S. and Europe affected Q4

revenue recognition, these projects remain on track to close in 1H 2025, ensuring near-term revenue realization.

Q4 2024 Highlights

We achieved significant milestones across key markets in Q4, strengthening

our position in renewable energy monetization and energy storage.

| o | Completed

the COD sale of a 17 MW solar project portfolio in Poland, with 15 MW under a PPA, reinforcing

our presence in a key market. |

| o | Executed

a 462 MW DSA of battery energy storage system (BESS) in Italy with Arpinge, expanding our

footprint in energy storage. |

| o | Finalized

the sale of 65 MW of solar projects to Trina in Germany through a mixed DSA/SPA structure,

reflecting the strength of our development partnerships. |

| o | Closed

the COD sale of a 2.8 MW community solar project to Altus Power, demonstrating progress in

the distributed generation segment. |

| o | Commissioned

18 MWh BESS projects, successfully integrating them into Huaneng Power International’s

Virtual Power Plant (VPP) platform, strengthening our participation in China’s evolving

energy market. |

These achievements highlight our ability to execute across multiple

regions, ensuring efficient project monetization, expanding our renewable energy portfolio, and strengthening contracted cash flow generation.

Business Line Performance

DSA

The DSA business serves as a cornerstone of our high-margin growth

strategy, providing strong revenue visibility while enabling us to monetize projects at early- and mid-development stages. We extended

our DSA model into key markets, generating approximately $9.5 million (28% of Q4 revenue), primarily from Italy and Germany. For the

full year, we generated approximately $19 million in DSA revenue, reflecting successful contract execution and geographic expansion.

As of December 31, 2024, we have secured DSA contracts with nine

partners for 40 projects totaling over 2.8 GW, comprising 85% BESS and 15% PV. These agreements are expected to generate approximately

$84 million in contracted revenue over the next two to three years, in addition to $19 million recognized in 2024, further reinforcing

our financial stability. Additionally, about 2.5 GW of DSAs are under negotiation, representing a potential revenue pipeline of over

$100 million.

With 75% of our DSA pipeline concentrated in Europe, we are well-positioned

to benefit from strong regulatory support for renewable energy and increasing demand for energy storage solutions.

Solar Power Project Development

In addition to completing major transactions in Poland and the U.S.,

we were active in markets with strong long-term demand for renewable energy. Our solar development business continued to drive monetization

opportunities, leveraging our expertise in advancing projects from development to sale. In 2024, we successfully monetized approximately

200 MW of solar PV projects, including 65 MW in Germany, 57 MW in France, 42 MW in Spain, 17 MW in Poland, 16 MW in China, and 3 MW in

the U.S. We also monetized 1.3 GW of BESS projects, with 1,210 MW in Italy, 72 MW in the U.S., and 18 MW in China. These achievements

reflect our disciplined approach to capital recycling while maintaining a robust development pipeline to support future growth, reinforcing

our position as a leader in the sector.

IPP

The IPP segment was a cornerstone of our profitability, providing

stable and predictable cash flows from long-term operating assets. In 2024, IPP revenue accounted for approximately 31% of total

revenue and 64% of total gross profit, underscoring its high-margin contribution to our financial performance. The segment generated

$5.4 million in Q4, down from Q3 due to seasonality.

Our well-balanced IPP portfolio spans Europe and China, with a growing

U.S. presence. In Q4, we optimized assets, including Branston in the U.K., and advanced our energy storage integration strategy. Notably,

our newly commissioned 18 MWh BESS in China is now fully integrated into Huaneng Power International’s Virtual Power Plant (VPP)

platform, enhancing grid stability and efficiency.

With China’s merchant power market opening in 2025, our BESS

assets are well-positioned to capitalize on price arbitrage, further strengthening long-term profitability and financial resilience.

Full-Year 2024 Financial Summary

For full-year 2024, we generated $92.1 million in revenue and $24.1

million in gross profit, achieving a 26% gross margin. We reported an operating loss of $0.5 million, while non-cash FX losses resulted

in a net loss1 of $12.5 million.

Despite FX headwinds, operating cash flow improved significantly toward

breakeven, reaching negative $4.2 million compared to negative $23.5 million a year ago. Adjusted EBITDA rose to $6.9 million, reflecting

disciplined financial execution. Over the year, we successfully monetized a significant volume of renewable energy assets, including

solar and battery storage projects, strengthening our financial position and reinforcing our capital-efficient business model.

Our disciplined execution, successful project monetization, and strengthened

financial position provide a strong foundation to scale our business efficiently while maintaining capital discipline.

Outlook & Catalysts

Looking ahead, we are confident in our ability to execute our growth

strategy and deliver strong financial performance in 2025. The delay in Q4 revenue recognition does not reflect a loss of business, but

rather timing issues, with the sale of these projects expected to close in 1H 2025. With a highly contracted revenue base, continued

expansion of our DSA and IPP businesses, and strong tailwinds in the renewable energy sector, we are positioned for sustained profitability

and long-term shareholder value creation.

Key drivers supporting our 2025 financial outlook include:

| · | Strong

contracted revenue base: We have secured about $84 million in contracted DSA revenue,

with an additional over $100 million in potential revenue under negotiation, reinforcing

long-term cash flow visibility. |

| · | Profitability

from high-margin segments: Our DSA and IPP businesses are key profit drivers, contributing

strong gross margins and stable cash flows. With increasing energy storage integration and

disciplined execution, our emphasis on high-margin growth drives sustained profitability

and financial strength. |

| · | Robust

solar PV and BESS monetization pipeline: With 75% of our DSA pipeline concentrated in

Europe, as well as strong solar and energy storage project sales in key markets, we are well-positioned

to capitalize on growing demand. Overall, by the end of Q4 2024, our pipeline included over

4.3 GW of advanced-stage storage projects and 2.4 GW of advanced-stage solar PV projects,

reinforcing our long-term growth potential. |

| · | Expansion

in BESS and merchant power trading: Our newly commissioned 18 MWh BESS in China is now

fully integrated into the Huaneng Power International VPP platform, and we are set to benefit

from China’s merchant power market opening in 2025, unlocking new revenue streams through

energy arbitrage. |

1 Net loss attributed to Emeren Group Ltd.

We expect full-year 2025 revenue to be in the range of $80 million

to $100 million, with a gross margin of approximately 30% to 33%. IPP revenue is anticipated to be between $28 million and $30 million,

with a gross margin of approximately 50%. Our DSA segment is expected to contribute between $35 million and $45 million in revenue. We

also expect to achieve positive operating cash flow in 2025.

For the first half of 2025, we anticipate revenue in the range of

$30 million to $35 million, with a gross margin of approximately 30% to 33%.

Full Year 2024 Financial Highlights:

| · | Revenue

of $92.1 million, down 13% Y/Y, reflecting project timing shifts despite strong execution

in high-margin segments. |

| · | IPP

and DSA contributed 52% of total revenue, which demonstrates solid and stable revenue visibility. |

| · | Maintained

a strong 26.2% gross margin, despite a slight Y/Y decline in gross profit to $24.1 million. |

| · | Operating

loss narrowed significantly to $0.5 million from $8.7 million in 2023, reflecting improved

profitability and cost discipline. |

| · | Adjusted

EBITDA surged 102% Y/Y to $6.9 million, demonstrating strong margin expansion in DSA and

IPP businesses. |

| · | Net

loss widened to $12.5 million from $3.2 million in 2023, largely due to non-cash FX losses. |

| $ in millions | |

2024 | | |

2023 | | |

Y/Y | |

| Revenue | |

$ | 92.1 | | |

$ | 105.6 | | |

| -13 | % |

| Gross profit | |

| 24.1 | | |

| 25.0 | | |

| -4 | % |

| Operating loss | |

| (0.5 | ) | |

| (8.7 | ) | |

| +94 | % |

| EBITDA | |

| (2.1 | ) | |

| 4.9 | | |

$ | (7.1 | ) |

| Adjusted EBITDA | |

| 6.9 | | |

| 3.4 | | |

| +102 | % |

| Net loss attributed to Emeren Group Ltd | |

$ | (12.5 | ) | |

$ | (3.2 | ) | |

| -292 | % |

Revenue by segment:

Segment

($ in thousands) | |

2024

Revenue | | |

% of Total

Revenue | |

| Project development | |

| 25,874 | | |

| 28 | % |

| IPP | |

| 28,903 | | |

| 31 | % |

| DSA | |

| 18,959 | | |

| 21 | % |

| EPC | |

| 17,332 | | |

| 19 | % |

| Others | |

| 999 | | |

| 1 | % |

| Total | |

| 92,067 | | |

| 100 | % |

Note: “Others” comprises revenue from ancillary revenues

and expenses and other unallocated costs and expenses.

Revenue by region:

Region

($ in thousands) | |

2024

Revenue | | |

% of Total

Revenue | |

| Europe | |

| 66,963 | | |

| 73 | % |

| USA | |

| 7,273 | | |

| 8 | % |

| China | |

| 17,831 | | |

| 19 | % |

| Total | |

| 92,067 | | |

| 100 | % |

Q4 2024 Financial Highlights:

| · | Revenue

of $34.6 million, down 23% Y/Y and up 169% Q/Q. |

| · | Gross

profit of $4.8 million, down 6% Y/Y and 15% Q/Q. |

| · | Operating

loss of $4.4 million, a 35% Y/Y improvement, despite a $6.5 million increase Q/Q. |

| · | Adjusted

EBITDA of negative $2.4 million, a 27% Y/Y gain in performance. |

| · | Cash

and cash equivalents at the end of Q4 2024 were $50.0 million, up from $35.8 million in Q3

2024. |

| · | Net

loss widened to $11.8 million from $2.0 million in 2023, primarily due to FX losses and project

timing. |

| $ in millions | |

Q4’24 | | |

Q3’24 | | |

Q/Q | | |

Q4’23 | | |

Y/Y | |

| Revenue | |

$ | 34.6 | | |

$ | 12.9 | | |

| +169% | | |

$ | 45.0 | | |

| -23 | % |

| Gross profit | |

| 4.8 | | |

| 5.6 | | |

| -15 | % | |

| 5.1 | | |

| -6 | % |

| Operating Income (loss) | |

| (4.4 | ) | |

| 2.1 | | |

$ | (6.5 | ) | |

| (6.7 | ) | |

| +35%

| |

| EBITDA | |

| (11.5 | ) | |

| 8.5 | | |

$ | (20.1 | ) | |

| 1.1 | | |

$ | (12.6 | ) |

| Adjusted EBITDA | |

| (2.4 | ) | |

| 4.1 | | |

$ | (6.4 | ) | |

| (3.2 | ) | |

| +27%

| |

| Net Income (loss) attributed to Emeren

Group Ltd | |

$ | (11.8 | ) | |

$ | 4.8 | | |

$ | (16.6 | ) | |

$ | (2.0 | ) | |

| -504 | % |

Revenue by segment:

Segment

($ in thousands) | |

Q4’24

Revenue | | |

% of Total

Revenue | |

| Project development | |

| 18,457 | | |

| 53 | % |

| IPP | |

| 5,414 | | |

| 16 | % |

| DSA | |

| 9,507 | | |

| 28 | % |

| EPC | |

| 493 | | |

| 1 | % |

| Others | |

| 679 | | |

| 2 | % |

| Total | |

| 34,550 | | |

| 100 | % |

Note: “Others” comprises revenue from ancillary revenues

and expenses and other unallocated costs and expenses.

Revenue by region:

Region

($ in thousands) | |

Q4’24

Revenue | | |

% of Total

Revenue | |

| Europe | |

| 25,901 | | |

| 75 | % |

| USA | |

| 5,249 | | |

| 15 | % |

| China | |

| 3,400 | | |

| 10 | % |

| Total | |

| 34,550 | | |

| 100 | % |

Advanced-Stage and Early-Stage

Solar Development Project Pipeline

Project

Pipeline by Region (as of December 31, 2024):

| Region | |

Advanced

Stage | | |

Early

Stage | | |

Total

(MW) | |

| Europe | |

| 1,439 | | |

| 3,855 | | |

| 5,294 | |

| U.S. | |

| 941 | | |

| 1,296 | | |

| 2,237 | |

| China | |

| 28 | | |

| — | | |

| 28 | |

| Total | |

| 2,408 | | |

| 5,151 | | |

| 7,559 | |

Project

Pipeline by Country (as of December 31, 2024):

| Country | |

Advanced

Stage | | |

Early

Stage | | |

Total

(MW) | |

| Poland | |

| 399 | | |

| — | | |

| 399 | |

| U.K. | |

| 100 | | |

| 163 | | |

| 263 | |

| Spain | |

| 214 | | |

| 3,033 | | |

| 3,247 | |

| Germany | |

| 129 | | |

| 177 | | |

| 306 | |

| France | |

| 114 | | |

| 5 | | |

| 119 | |

| Italy | |

| 483 | | |

| 477 | | |

| 960 | |

| U.S. | |

| 941 | | |

| 1,296 | | |

| 2,237 | |

| China | |

| 28 | | |

| — | | |

| 28 | |

| Total | |

| 2,408 | | |

| 5,151 | | |

| 7,559 | |

Advanced-Stage

and Early-Stage Solar Storage Project Pipeline

Project

Pipeline by Region (as of December 31, 2024):

| Region | |

Advanced

Stage | | |

Early

Stage | | |

Total

(MW) | |

| Europe | |

| 3,108 | | |

| 3,023 | | |

| 6,131 | |

| U.S. | |

| 1,105 | | |

| 1,057 | | |

| 2,162 | |

| China | |

| 43 | | |

| — | | |

| 43 | |

| Total | |

| 4,256 | | |

| 4,080 | | |

| 8,336 | |

Project

Pipeline by Country (December 31, 2024):

| Country | |

Advanced

Stage | | |

Early

Stage | | |

Total

(MW) | |

| Poland | |

| 878 | | |

| 50 | | |

| 928 | |

| U.K. | |

| 170 | | |

| 275 | | |

| 445 | |

| Spain | |

| 10 | | |

| 1,522 | | |

| 1,532 | |

| France | |

| 14 | | |

| — | | |

| 14 | |

| Italy | |

| 2,036 | | |

| 673 | | |

| 2,709 | |

| Germany | |

| — | | |

| 503 | | |

| 503 | |

| U.S. | |

| 1,105 | | |

| 1,057 | | |

| 2,162 | |

| China | |

| 43 | | |

| — | | |

| 43 | |

| Total | |

| 4,256 | | |

| 4,080 | | |

| 8,336 | |

Notes: The average hours per MW vary across regions. For example,

in the U.S. and Europe, it ranged from 4 - 8 hours per MW of storage, while in China, it was ~2 hours.

Growing IPP Asset Portfolio

in Attractive PPA Regions

As of December 31, we owned and operated

IPP assets comprising approximately 293 MW of solar PV projects and 54 MWh of storage.

Operating

Assets | |

PV

Capacity

(MW) | | |

Storage

(MWh) | |

| China DG | |

| 167 | | |

| 54 | |

| Europe | |

| 102 | | |

| - | |

| U.S. | |

| 24 | | |

| - | |

| Total | |

| 293 | | |

| 54 | |

Q4 2024 Financial Results:

All figures refer to the fourth quarter of

2024, unless stated otherwise.

Revenue

Revenue of $34.6 million declined 23% Y/Y, primarily

due to project delays pending government approvals. However, it surged 169% Q/Q, driven by successful project monetization. While timing

delays in the U.S. and Europe impacted Q4 revenue recognition, these projects remain on track to close in 1H 2025, providing strong near-term

visibility.

Gross Profit and Gross Margin

Gross profit was $4.8 million, compared to $5.6

million in Q3 2024 and $5.1 million in Q4 2023. Gross margin was 13.9%, down from 43.8% in Q3 2024 but up from 11.3% in Q4 2023. The

year-over-year improvement reflects the continued strength of our high-margin IPP and DSA businesses.

Operating Expense

Operating expenses were $9.2 million, up from

$3.5 million in Q3 2024 but down from $11.8 million in Q4 2023. The annual decline was primarily due to fewer write-offs and the absence

of asset impairment losses.

Net loss attributable to Emeren Group Ltd’s

common shareholders

Net loss attributable to Emeren Group Ltd’s

common shareholders was $11.8 million, compared to net income of $4.8 million in Q3 2024 and net loss of $2.0 million in Q4 2023.

Diluted net loss attributable to Emeren Group

Ltd’s common shareholders per American Depositary Share (“ADS”) was $0.23, compared to diluted net income of $0.09

in Q3 2024 and diluted net loss of $0.04 in Q4 2023.

Cash Flow

Cash provided by operating activities was $10.4

million; cash used in investing activities was $5.0 million, and cash provided by financing activities was $2.8 million.

Financial Position

Cash and cash equivalents at the end of Q4 2024

were $50.0 million compared to $35.8 million in Q3 2024.

Net asset value (NAV) is approximately $5.9 per

ADS.

Our debt-to-asset ratio at the end of Q4 2024

was 11.23%, compared to 10.18% at the end of Q3 2024.

Conclusion

The renewable energy sector is benefiting from

strong tailwinds, driven by the global shift toward sustainability and the increasing role of solar and energy storage to meet rising

power demand. Our disciplined execution, robust contracted revenue base, and expanding presence in high-margin segments position us for

sustained growth. As we enter 2025, we remain focused on leveraging our strengths in Development Service Agreement (DSA), Independent

Power Producer (IPP), and energy storage to drive long-term value creation. With a clear strategy, strong financial foundation, and commitment

to innovation, we are confident in our ability to capitalize on industry momentum and deliver lasting shareholder value.

Sincerely,

| Yumin Liu |

Ke Chen |

| Chief Executive Officer |

Chief Financial Officer |

Fourth Quarter and Full Year 2024 Earnings

Results Conference Call

We will host a conference call today to discuss

our fourth quarter and full year 2024 business and financial results. The call is scheduled to begin at 5:00 p.m. U.S.

Eastern Time on Thursday, March 13, 2025.

Please register in advance to join the conference

call using the link provided below and dial in 10 minutes before the call is scheduled to begin. Conference call access information will

be provided upon registration.

Participant Online Registration:

https://register.vevent.com/register/BI53bf135272a04765b47f029df565b83d

Audio-only Webcast:

https://edge.media-server.com/mmc/p/wfuup2dn

Additionally,

an archived webcast of the conference call will be available on the Investor Relations section of Emeren Group Ltd's website at https://ir.emeren.com/.

Safe Harbor Statement

This press release contains statements that constitute

''forward-looking" statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E

of the Securities Exchange Act of 1934, as amended, and as defined in the U.S. Private Securities Litigation Reform Act of 1995. Whenever

you read a statement that is not simply a statement of historical fact (such as when the Company describes what it "believes,"

"expects" or "anticipates" will occur, what "will" or "could" happen, and other similar statements),

you must remember that the Company’s expectations may not be correct, even though it believes that they are reasonable. The Company

does not guarantee that the forward-looking statements will happen as described or that they will happen at all. Further information

regarding risks and uncertainties that could cause actual results to differ materially from those in the forward-looking statements is

included in the Company’s filings with the U.S. Securities and Exchange Commission, including the Company’s annual report

on Form 10-K. The Company undertakes no obligation, beyond that required by law, to update any forward-looking statement to reflect

events or circumstances after the date on which the statement is made, even though the Company’s situation may change in the future.

For investor and media inquiries,

please contact:

Emeren Group

Ltd - Investor Relations

+1 (925) 425-7335

ir@emeren.com

The Blueshirt

Group

Gary Dvorchak

+1 (323) 240-5796

gary@blueshirtgroup.co

Appendix 1: Unaudited Consolidated Statement of Operations

| | |

Three Months Ended | | |

Twelve Months Ended | |

| | |

Dec 31, 2024 | | |

Sep 30, 2024 | | |

Dec 31, 2023 | | |

Dec 31, 2024 | | |

Dec 31, 2023 | |

| | |

| | |

| | |

| | |

| | |

| |

| | |

(in thousands, except per ADS data and ADS) | |

| Net revenues | |

$ | 34,550 | | |

$ | 12,860 | | |

$ | 44,972 | | |

$ | 92,067 | | |

$ | 105,642 | |

| Cost of revenues | |

| (29,763 | ) | |

| (7,229 | ) | |

| (39,899 | ) | |

| (67,945 | ) | |

| (80,629 | ) |

| Gross

profit | |

| 4,787 | | |

| 5,631 | | |

| 5,073 | | |

| 24,122 | | |

| 25,013 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | |

| Operating expenses: | |

| | | |

| | | |

| | | |

| | | |

| | |

| Sales and marketing | |

| (59 | ) | |

| (8 | ) | |

| (105 | ) | |

| (183 | ) | |

| (398 | ) |

| General and administrative | |

| (9,196 | ) | |

| (3,959 | ) | |

| (9,272 | ) | |

| (23,131 | ) | |

| (25,961 | ) |

| Other operating expenses, net | |

| 80 | | |

| 477 | | |

| (2,075 | ) | |

| (1,312 | ) | |

| (5,624 | ) |

| Impairment

loss of assets | |

| - | | |

| - | | |

| (366 | ) | |

| | | |

| (1,691 | ) |

| Total

operating expenses | |

| (9,175 | ) | |

| (3,490 | ) | |

| (11,818 | ) | |

| (24,626 | ) | |

| (33,674 | ) |

| | |

| | | |

| | | |

| | | |

| | | |

| | |

| Income (loss) from operations | |

| (4,388 | ) | |

| 2,141 | | |

| (6,745 | ) | |

| (504 | ) | |

| (8,661 | ) |

| Other (expenses) income: | |

| | | |

| | | |

| | | |

| | | |

| | |

| Interest (expenses) income, net | |

| (231 | ) | |

| (431 | ) | |

| (574 | ) | |

| (559 | ) | |

| (411 | ) |

| Investment (loss) gain | |

| - | | |

| (4 | ) | |

| 39 | | |

| (4 | ) | |

| 278 | |

| Unrealized

foreign exchange (loss) gain | |

| (9,047 | ) | |

| 4,615 | | |

| 5,850 | | |

| (8,522 | ) | |

| 5,892 | |

| Total

other (expense) income, net | |

| (9,278 | ) | |

| 4,180 | | |

| 5,315 | | |

| (9,085 | ) | |

| 5,759 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | |

| Income (loss) before income

tax | |

| (13,666 | ) | |

| 6,321 | | |

| (1,430 | ) | |

| (9,589 | ) | |

| (2,902 | ) |

| | |

| | | |

| | | |

| | | |

| | | |

| | |

| Income tax

benefit (expenses) | |

| 1,124 | | |

| (647 | ) | |

| (2,051 | ) | |

| (2,021 | ) | |

| (2,529 | ) |

| Net income (loss) | |

| (12,542 | ) | |

| 5,674 | | |

| (3,481 | ) | |

| (11,610 | ) | |

| (5,431 | ) |

| | |

| | | |

| | | |

| | | |

| | | |

| | |

| Less: Net income

(loss) attributed to non-controlling interests | |

| (755 | ) | |

| 831 | | |

| (1,531 | ) | |

| 867 | | |

| (2,245 | ) |

| Net

Income (loss) attributed to Emeren Group Ltd | |

| (11,787 | ) | |

| 4,843 | | |

| (1,950 | ) | |

| (12,477 | ) | |

| (3,186 | ) |

| | |

| | | |

| | | |

| | | |

| | | |

| | |

| Income (loss) attributed to Emeren Group Ltd per ADS | |

| | | |

| | | |

| | | |

| | | |

| | |

| Basic | |

$ | (0.23 | ) | |

$ | 0.09 | | |

$ | (0.04 | ) | |

$ | (0.24 | ) | |

$ | (0.06 | ) |

| Diluted | |

$ | (0.23 | ) | |

$ | 0.09 | | |

$ | (0.04 | ) | |

$ | (0.24 | ) | |

$ | (0.06 | ) |

| | |

| | | |

| | | |

| | | |

| | | |

| | |

| Weighted average number of ADS used in computing loss

per ADS* | |

| | | |

| | | |

| | | |

| | | |

| | |

| Basic | |

| 51,317,227 | | |

| 51,254,956 | | |

| 55,197,797 | | |

| 51,845,257 | | |

| 56,526,716 | |

| Diluted | |

| 51,317,227 | | |

| 51,352,136 | | |

| 55,197,797 | | |

| 51,845,257 | | |

| 56,526,716 | |

*Each American depositary shares (ADS) represents 10 common

shares

Appendix 2: Unaudited Consolidated Balance Sheet

| | |

As of | |

| | |

Dec 31, 2024 | | |

Dec 31, 2023 | |

| | |

| | |

| |

| | |

| (in

thousands) | |

| ASSETS | |

| | | |

| | |

| Current assets: | |

| | | |

| | |

| Cash and cash equivalents | |

$ | 50,012 | | |

$ | 70,174 | |

| Accounts receivable trade, net | |

| 21,121 | | |

| 27,123 | |

| Accounts receivable unbilled, net | |

| 41,330 | | |

| 59,598 | |

| Advances to suppliers | |

| 568 | | |

| 4,283 | |

| Value added tax receivable | |

| 8,005 | | |

| 7,103 | |

| Project assets, current | |

| 54,267 | | |

| 39,914 | |

| Prepaid expenses and other current assets, net | |

| 16,085 | | |

| 18,255 | |

| Total current assets | |

| 191,388 | | |

| 226,450 | |

| | |

| | | |

| | |

| Property, plant and equipment, net | |

| 194,839 | | |

| 163,114 | |

| Project assets, non-current | |

| 14,444 | | |

| 36,610 | |

| Operating lease, right-of-use assets | |

| 19,931 | | |

| 21,057 | |

| Finance lease, right-of-use assets | |

| 4,574 | | |

| 14,192 | |

| Other non-current assets | |

| 22,390 | | |

| 16,928 | |

| Total assets | |

$ | 447,566 | | |

$ | 478,351 | |

| | |

| | | |

| | |

| LIABILITIES AND SHAREHOLDERS’ EQUITY | |

| | | |

| | |

| Current liabilities: | |

| | | |

| | |

| Accounts payable | |

| 11,892 | | |

| 16,203 | |

| Advances from customers | |

| 5,042 | | |

| 5,375 | |

| Amounts due to related parties | |

| 4,028 | | |

| 4,967 | |

| Long-term borrowings, current | |

| 1,181 | | |

| 1,385 | |

| Income tax payable | |

| 606 | | |

| 2,102 | |

| Salaries payable | |

| 1,265 | | |

| 718 | |

| Operating lease liabilities, current | |

| 659 | | |

| 363 | |

| Failed sales-leaseback and finance lease liabilities, current | |

| 5,014 | | |

| 4,559 | |

| Other current liabilities | |

| 19,831 | | |

| 21,320 | |

| Total current liabilities | |

| 49,518 | | |

| 56,992 | |

| | |

| | | |

| | |

| Long-term borrowings, non-current | |

| 23,515 | | |

| 22,685 | |

| Operating lease liabilities, non-current | |

| 19,252 | | |

| 20,575 | |

| Failed sale-leaseback and finance lease liabilities, non-current | |

| 13,767 | | |

| 11,258 | |

| Deferred tax liabilities | |

| 3,494 | | |

| 3,532 | |

| Total liabilities | |

$ | 109,546 | | |

$ | 115,042 | |

| | |

| | | |

| | |

| Commitments and contingencies | |

| | | |

| | |

| Shareholders’ equity | |

| | | |

| | |

| Common shares | |

| 806,714 | | |

| 806,714 | |

| Additional paid-in capital | |

| 15,104 | | |

| 14,728 | |

| Treasury stock, at cost | |

| (49,146 | ) | |

| (41,938 | ) |

| Accumulated deficit | |

| (453,040 | ) | |

| (440,563 | ) |

| Accumulated other comprehensive loss | |

| (19,116 | ) | |

| (13,629 | ) |

| Emeren Group Ltd shareholders’ equity | |

| 300,516 | | |

| 325,312 | |

| Non-controlling interest | |

| 37,504 | | |

| 37,997 | |

| Total shareholders’ equity | |

| 338,020 | | |

| 363,309 | |

| Total liabilities and shareholders’ equity | |

$ | 447,566 | | |

$ | 478,351 | |

Appendix 3: Unaudited Consolidated Statement of Cash Flow

| | |

Three Months Ended | | |

Twelve Months Ended | |

| | |

Dec 31, 2024 | | |

Dec 31, 2023 | | |

Dec 31, 2024 | | |

Dec 31, 2023 | |

| | |

| | |

| | |

| | |

| |

| | |

(in thousands) | |

| Net cash provided by (used in) operating activities | |

$ | 10,371 | | |

$ | 7,236 | | |

$ | (4,215 | ) | |

$ | (23,488 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| Net cash provided by (used in) investing activities | |

| (5,013 | ) | |

| 6,941 | | |

| (15,658 | ) | |

| 15,309 | |

| | |

| | | |

| | | |

| | | |

| | |

| Net cash provided by (used in) financing activities | |

| 2,772 | | |

| (3,563 | ) | |

| (5,928 | ) | |

| (25,263 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| Effect of exchange rate changes | |

| 6,126 | | |

| 379 | | |

| 5,639 | | |

| (3,672 | ) |

| Net increase (decrease) in cash and cash equivalents and restricted cash | |

| 14,256 | | |

| 10,993 | | |

| (20,162 | ) | |

| (37,114 | ) |

| Cash and cash equivalents and restricted cash, beginning of the period | |

| 35,756 | | |

| 59,181 | | |

| 70,174 | | |

| 107,288 | |

| Cash and cash equivalents and restricted cash, end of the period | |

$ | 50,012 | | |

$ | 70,174 | | |

$ | 50,012 | | |

$ | 70,174 | |

Use of Non-GAAP Financial Measures

To supplement Emeren Group Ltd’s financial

statements presented on a US GAAP basis, Emeren Group Ltd provides non-GAAP financial data as supplemental measures of its performance.

To provide investors with additional insight

and allow for a more comprehensive understanding of the information used by management in its financial and decision-making surrounding

pro-forma operations, we supplement our consolidated financial statements presented on a basis consistent with U.S. generally accepted

accounting principles, or GAAP, with EBITDA, Adjusted EBITDA as non-GAAP financial measures of earnings.

· EBITDA represents net income before income tax expense (benefit), interest expense, depreciation and amortization.

· Adjusted EBITDA

represents EBITDA plus discount of electricity subsidy in China, plus share-based compensation, plus impairment of long-lived assets,

plus loss/(gain) on disposal of assets, plus foreign exchange loss/(gain).

Our management uses EBITDA, Adjusted

EBITDA as financial measures to evaluate the profitability and efficiency of our business model. We use these non-GAAP financial measures

to access the strength of the underlying operations of our business. These adjustments, and the non-GAAP financial measures that are

derived from them, provide supplemental information to analyze our operations between periods and over time.

We find these measures especially useful

when reviewing pro-forma results of operations, which include large non-cash impairment of long-lived assets and loss on disposal of

assets. Investors should consider our non-GAAP financial measures in addition to, and not as a substitute for, financial measures prepared

in accordance with GAAP.

Appendix 4: Adjusted EBITDA

| | |

Three Months Ended | | |

Twelve Months Ended | |

| | |

Dec 31, 2024 | | |

Sep 30, 2024 | | |

Dec 31, 2023 | | |

Dec 31, 2024 | | |

Dec 31, 2023 | |

| | |

| | |

| | |

| | |

| | |

| |

| | |

(in thousands) | |

| Net income (loss) | |

$ | (12,542 | ) | |

$ | 5,674 | | |

$ | (3,481 | ) | |

$ | (11,610 | ) | |

$ | (5,431 | ) |

| Income tax expenses (benefit) | |

| (1,124 | ) | |

| 647 | | |

| 2,050 | | |

| 2,021 | | |

| 2,529 | |

| Interest expenses (income), net | |

| 231 | | |

| 431 | | |

| 574 | | |

| 559 | | |

| 411 | |

| Depreciation & Amortization | |

| 1,917 | | |

| 1,781 | | |

| 1,979 | | |

| 6,919 | | |

| 7,438 | |

| EBITDA | |

$ | (11,518 | ) | |

$ | 8,533 | | |

$ | 1,122 | | |

$ | (2,111 | ) | |

$ | 4,947 | |

| Discount of electricity subsidy in China | |

| (35 | ) | |

| (83 | ) | |

| 603 | | |

| 272 | | |

| 656 | |

| Share based compensation | |

| 133 | | |

| 106 | | |

| 203 | | |

| 370 | | |

| 1,443 | |

| Loss on disposal of property, plant and equipment | |

| - | | |

| - | | |

| 616 | | |

| - | | |

| 2,128 | |

| Interest income of discounted electricity subsidy in China | |

| (2 | ) | |

| 130 | | |

| 60 | | |

| (198 | ) | |

| 109 | |

| Foreign exchange loss (gain) | |

| 9,047 | | |

| (4,615 | ) | |

| (5,850 | ) | |

| 8,522 | | |

| (5,892 | ) |

| Adjusted EBITDA | |

$ | (2,375 | ) | |

$ | 4,071 | | |

$ | (3,246 | ) | |

$ | 6,855 | | |

$ | 3,391 | |

v3.25.1

Cover

|

Mar. 13, 2025 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

Mar. 13, 2025

|

| Entity File Number |

001-33911

|

| Entity Registrant Name |

EMEREN GROUP LTD

|

| Entity Central Index Key |

0001417892

|

| Entity Tax Identification Number |

00-0000000

|

| Entity Incorporation, State or Country Code |

D8

|

| Entity Address, Address Line One |

149 Water Street

|

| Entity Address, Address Line Two |

Suite 302

|

| Entity Address, City or Town |

Norwalk

|

| Entity Address, State or Province |

CT

|

| Entity Address, Postal Zip Code |

06854

|

| City Area Code |

+1 925

|

| Local Phone Number |

425-7335

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

American Depositary Shares, each representing 10 shares, no par value per share

|

| Trading Symbol |

SOL

|

| Security Exchange Name |

NYSE

|

| Entity Emerging Growth Company |

false

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

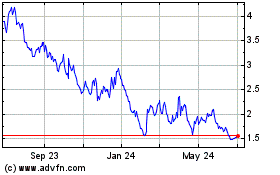

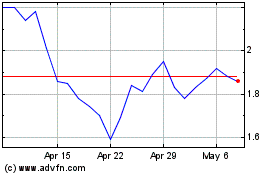

Emeren (NYSE:SOL)

Historical Stock Chart

From Feb 2025 to Mar 2025

Emeren (NYSE:SOL)

Historical Stock Chart

From Mar 2024 to Mar 2025