0001144980false00011449802024-10-292024-10-29

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported): October 29, 2024

Asbury Automotive Group, Inc.

(Exact name of registrant as specified in its charter)

Delaware

(State or other jurisdiction of incorporation)

| | | | | | | | | | | | | | |

| 001-31262 | | 01-0609375 | |

| (Commission File Number) | | (IRS Employer Identification No.) | |

| | | | |

| 2905 Premiere Parkway NW Suite 300 | | | |

| Duluth, | GA | | 30097 | |

| (Address of principal executive offices) | | (Zip Code) | |

(770) 418-8200

(Registrant's telephone number, including area code)

None

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | | | | | | | |

| | Trading | | |

| Title of each class | | Symbol(s) | | Name of each exchange on which registered |

| Common stock, $0.01 par value per share | | ABG | | New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02 Results of Operations and Financial Condition.

Asbury Automotive Group, Inc. (the “Company”) issued an earnings release on October 29, 2024, announcing its financial results for the three and nine months ended September 30, 2024. A copy of the earnings release is furnished as Exhibit 99.1 to this Current Report.

The information furnished in this Current Report on Form 8-K, including Exhibit 99.1, shall not be deemed to be “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liability of that section, and shall not be incorporated by reference into any registration statement or other document filed under the Securities Act of 1933, as amended, or the Exchange Act, except as shall be expressly set forth by specific reference in such filing.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits.

The following exhibits are furnished as part of this report.

| | | | | | | | | | | |

| Exhibit No. | | Description |

| | | |

| | | Press Release dated October 29, 2024. |

| 104 | | Cover Page Interactive Data File (embedded within the Inline XBRL document) |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | | | | |

| ASBURY AUTOMOTIVE GROUP, INC. |

| | | |

| Date: October 29, 2024 | By: | | /s/ Michael D. Welch |

| Name: | | Michael D. Welch |

| Title: | | Senior Vice President and Chief Financial Officer |

Exhibit 99.1

Investors & Reporters May Contact:

Joe Sorice

Manager, Investor Relations

(770) 418-8211

ir@asburyauto.com

Asbury Automotive Group Reports Third Quarter Results

•Revenue of $4.2 billion, growth of 16%

•Parts & Service gross profit growth of 16%

•Same store SG&A as a percentage of gross profit of 64.5%; same store adjusted SG&A as a percentage of gross profit, a non-GAAP measure, of 63.8%

•Sequential improvement in SG&A as a percentage of gross profit of 25 bps and adjusted SG&A as a percentage of gross profit, a non-GAAP measure, of 39 bps

•EPS of $6.37 per diluted share; adjusted EPS, a non-GAAP measure, of $6.35 per diluted share

•Estimated EPS impact of $0.39 - $0.43 due to stop sale orders for certain vehicle models (estimated lost sales of nearly 1,200 new units) and lost business from Hurricane Helene

•Repurchased approximately 394,000 shares for $89 million

DULUTH, GA. (October 29, 2024) — Asbury Automotive Group, Inc. (NYSE: ABG) (the “Company”), one of the largest automotive retail and service companies in the U.S., reported third quarter 2024 net income of $126 million ($6.37 per diluted share), a decrease of 25% from $169 million ($8.19 per diluted share) in third quarter 2023. The Company reported third quarter 2024 adjusted net income, a non-GAAP measure, of $126 million ($6.35 per diluted share), a decrease of 25% from $168 million ($8.12 per diluted share) in third quarter 2023.

“Against the backdrop of normalizing inventory levels, certain brand challenges and a hurricane, I am proud of the way our team members rose to the challenge delivering sequential improvements in many of our key operating metrics,” said David Hult, Asbury’s President and Chief Executive Officer. “We were also pleased with the progress in our Parts & Service operations, and in particular the strength we saw in Customer Pay - the largest and most profitable portion of this business. Our SG&A costs declined sequentially, and we executed against our strategic capital allocation framework, repurchasing nearly 400,000 shares in the quarter.”

The financial measures discussed below include both GAAP and adjusted (non-GAAP) financial measures. Please see “Non-GAAP Financial Disclosure and Reconciliation, Same Store Data and Other Data” and the reconciliations for non-GAAP metrics used herein.

Adjusted net income for third quarter 2024 excludes, net of tax, net gain on divestitures of $3 million ($0.14 per diluted share), and losses related to hail damage of $2 million ($0.11 per diluted share).

Adjusted net income for third quarter 2023 excludes, net of tax, a $3 million ($0.13 per diluted share) gain on sale of real estate and $1 million ($0.06 per diluted share) of professional fees related to the acquisition of the Jim Koons Automotive Companies.

Third Quarter 2024 Operational Summary

Total Company vs. 3rd Quarter 2023:

•Revenue of $4.2 billion, increase of 16%

•Gross profit of $718 million, increase of 7%

•Gross margin decreased 142 bps to 16.9%

•New vehicle unit volume increase of 16%; new vehicle revenue increase of 16%; new vehicle gross profit decrease of 11%

•Used vehicle retail unit volume increase of 16%; used vehicle retail revenue increase of 13%; used vehicle retail gross profit decrease of 6%

•Finance and insurance (F&I) per vehicle retailed (PVR) of $2,141, decrease of 3%

•Parts and service revenue increase of 13%; gross profit increase of 16%

•SG&A as a percentage of gross profit of 65.0%

•Adjusted SG&A as a percentage of gross profit of 64.4%

•Operating margin of 5.5%

•Adjusted operating margin of 5.6%

Same Store vs. 3rd Quarter 2023:

•Revenue of $3.5 billion, decrease of 2%

•Gross profit of $612 million, decrease of 8%

•Gross margin decreased 111 bps to 17.3%

•New vehicle unit volume decrease of 1%; new vehicle revenue flat to prior year period; new vehicle gross profit decrease of 24%

•Used vehicle retail unit volume decrease of 6%; used vehicle retail revenue decrease of 8%; used vehicle retail gross profit decrease of 21%

•F&I PVR of $2,111, decrease of 5%

•Parts and service revenue increase of 1%; gross profit increase of 4%

•SG&A as a percentage of gross profit of 64.5%

•Adjusted SG&A as a percentage of gross profit of 63.8%

•Operating margin of 5.7%

•Adjusted operating margin of 5.8%

Liquidity and Leverage

As of September 30, 2024, the Company had cash and floorplan offset accounts of $202 million (which excludes $56 million of cash at Total Care Auto, Powered by Landcar) and availability under the used vehicle floorplan line and revolver of $566 million for a total of $768 million in liquidity. The Company’s transaction adjusted net leverage ratio, which is calculated as set forth in our credit facility, was 2.9x at quarter end.

Share Repurchases

The Company repurchased approximately 394,000 shares for $89 million during the third quarter 2024. Year-to-date through October 28, 2024, the Company has repurchased approximately 830,000 shares for $183 million. As of October 28, 2024, the Company had approximately $276 million remaining on its share repurchase authorization.

The shares may be purchased from time to time in the open market, in privately negotiated transactions or in other manners as permitted by federal securities laws and other legal and contractual requirements. The extent to which the Company repurchases its shares, the number of shares and the timing of any repurchase will depend on such factors as Asbury’s stock price, general economic and market conditions, the potential impact on its capital structure, the expected return on competing uses of capital such as strategic dealership acquisitions and capital investments and other considerations. The program does not require the Company to repurchase any specific number of shares, and may be modified, suspended or terminated at any time without further notice.

Earnings Call

Additional commentary regarding the third quarter results will be provided during the earnings conference call on Tuesday, October 29, 2024, at 10:00 a.m. ET.

The conference call will be simulcast live on the internet. The webcast, together with supplemental materials, and can be accessed by logging onto https://investors.asburyauto.com. A replay and the accompanying materials will be available on this site for at least 30 days.

In addition, live audio will be accessible to the public. Participants may enter the conference call five to ten minutes prior to the scheduled start of the call by dialing:

| | | | | |

| Domestic: | (877) 407-2988 |

| International: | +1 (201) 389-0923 |

| Passcode: | 13749524 |

About Asbury Automotive Group, Inc.

Asbury Automotive Group, Inc. (NYSE: ABG), a Fortune 500 company headquartered in Duluth, GA, is one of the largest automotive retailers in the U.S. In late 2020, Asbury embarked on a multi-year plan to increase revenue and profitability strategically through organic operations, acquisitive growth and innovative technologies, with its guest-centric approach as Asbury’s constant North Star. As of September 30, 2024, Asbury operated 153 new vehicle dealerships, consisting of 202 franchises and representing 31 domestic and foreign brands of vehicles. Asbury also operates Total Care Auto, Powered by Landcar, a leading provider of service contracts and other vehicle protection products, and 37 collision repair centers. Asbury offers an extensive range of automotive products and services, including new and used vehicles; parts and service, which includes vehicle repair and maintenance services, replacement parts and collision repair services; and finance and insurance products, including arranging vehicle financing through third parties and aftermarket products, such as extended service contracts, guaranteed asset protection debt cancellation, and prepaid maintenance. Asbury is recognized as one of America’s Fastest Growing Companies 2024 by the Financial Times.

For additional information, visit www.asburyauto.com.

Forward-Looking Statements

This press release contains "forward-looking statements" within the meaning of the Private Securities Litigation Reform Act of 1995. Forward-looking statements are statements other than historical fact, and may include statements relating to goals, plans, objectives, beliefs, expectations and assumptions, projections regarding Asbury's financial position, liquidity, results of operations, cash flows, leverage, market position, the timing and amount of any stock repurchases, and dealership portfolio, revenue enhancement strategies, operational improvements,

projections regarding the expected benefits of Clicklane, management’s plans, projections and objectives for future operations, scale and performance, integration plans and expected synergies from acquisitions, capital allocation strategy, business strategy. These statements are based on management's current expectations and beliefs and involve significant risks and uncertainties that may cause results to differ materially from those set forth in the statements. These risks and uncertainties include, among other things, adverse outcomes with respect to current and future litigation and other proceedings; our inability to realize the benefits expected from recently completed transactions; our inability to promptly and effectively integrate completed transactions and the diversion of management’s attention from ongoing business and regular business responsibilities; our inability to complete future acquisitions or divestitures and the risks resulting therefrom; any supply chain disruptions impacting our industry and business, market factors, Asbury's relationships with, and the financial and operational stability of, vehicle manufacturers and other suppliers, acts of God, natural disasters including Hurricane Helene and Hurricane Milton, acts of war or other incidents and the shortage of semiconductor chips and other components, which may adversely impact supply from vehicle manufacturers and/or present retail sales challenges; risks associated with Asbury's indebtedness and our ability to comply with applicable covenants in our various financing agreements, or to obtain waivers of these covenants as necessary; risks related to competition in the automotive retail and service industries, general economic conditions both nationally and locally, governmental regulations, legislation, including changes in automotive state franchise laws, and Asbury's ability to execute its strategic and operational strategies and initiatives, including its five-year strategic plan, Asbury's ability to leverage gains from its dealership portfolio, Asbury's ability to capitalize on opportunities to repurchase its debt and equity securities or purchase properties that it currently leases, and Asbury's ability to stay within its targeted range for capital expenditures. There can be no guarantees that Asbury's plans for future operations will be successfully implemented or that they will prove to be commercially successful.

These and other risk factors that could cause actual results to differ materially from those expressed or implied in our forward-looking statements are and will be discussed in Asbury's filings with the U.S. Securities and Exchange Commission from time to time, including its most recent annual report on Form 10-K and any subsequently filed quarterly reports on Form 10-Q. These forward-looking statements and such risks, uncertainties and other factors speak only as of the date of this press release. We undertake no obligation to publicly update any forward-looking statement, whether as a result of new information, future events or otherwise.

Non-GAAP Financial Disclosure and Reconciliation, Same Store Data and Other Data

In addition to evaluating the financial condition and results of our operations in accordance with GAAP, from time to time management evaluates and analyzes results and any impact on the Company of strategic decisions and actions relating to, among other things, cost reduction, growth, and profitability improvement initiatives, and other events outside of normal, or "core," business and operations, by considering certain alternative financial measures not prepared in accordance with GAAP. These measures include "Adjusted income from operations," "Adjusted net income," "Adjusted operating margins," "Adjusted EBITDA," "Adjusted diluted earnings per share ("EPS")," "Adjusted SG&A," "Adjusted operating cash flow," "Transaction adjusted EBITDA" and "Transaction adjusted net leverage ratio." Further, management assesses the organic growth of our revenue and gross profit on a same store basis. We believe that our assessment on a same store basis represents an important indicator of comparative financial performance and provides relevant information to assess our performance at our existing locations.

Non-GAAP measures do not have definitions under GAAP and may be defined differently by and not be comparable to similarly titled measures used by other companies. As a result, any non-GAAP financial measures considered and evaluated by management are reviewed in conjunction with a review of the most directly comparable measures calculated in accordance with GAAP. Management cautions investors not to place undue reliance on such non-GAAP measures, but also to consider them with the most directly comparable GAAP measures. In their evaluation of results from time to time, management excludes items that do not arise directly from core operations or are otherwise of an unusual or non-recurring nature. Because these non-core, unusual or non-recurring charges and gains materially affect Asbury’s financial condition or results in the specific period in which they are recognized, management also evaluates and makes resource allocation and performance evaluation decisions based on, the related non-GAAP measures excluding such items. In addition to using such non-GAAP measures to evaluate results in a specific period, management believes that such measures may provide more complete and consistent comparisons of operational performance on a period-over-period historical basis and a better indication of expected future trends.

Management discloses these non-GAAP measures, and the related reconciliations, because it believes investors use these metrics in evaluating longer-term period-over-period performance, and to allow investors to better understand and evaluate the information used by management to assess operating performance.

Due to the significant effects that dealership acquisitions and divestitures have on our results of operations, and in order to provide more meaningful comparisons, we present herein "Transaction adjusted EBITDA" and "Transaction adjusted net leverage ratio" (collectively, the "Transaction Adjusted Metrics"), which reflect the effects of the dealership acquisitions and divestitures, if any, as if they had occurred on the first day of the last twelve-month periods being presented. For acquisitions, the pre-acquisition period amount being included in Transaction adjusted EBITDA is determined by pro-rating the forecasted adjusted EBITDA for the year following the acquisition. For divestitures, including divestitures due to requirements in connection with an acquisition, the adjusted EBITDA associated with the divestiture(s) is excluded from Transaction adjusted EBITDA. We believe that the Transaction Adjusted Metrics provide relevant information to assess our performance at our existing dealership locations for the last twelve-month periods being presented.

The Transaction Adjusted Metrics do not include any adjustments for other events attributable to the dealership acquisitions or divestitures unless otherwise described. We cannot assure you that such financial information would not be materially different if such information were audited or that our actual results would not differ materially from the Transaction Adjusted Metrics if the dealership acquisitions or divestitures had been completed as of the beginning of the last twelve-month periods being presented.

Same store amounts consist of information from dealerships for identical months in each comparative period, commencing with the first month we owned the dealership. Additionally, amounts related to divested dealerships are excluded from each comparative period.

Amounts presented herein have been calculated using non-rounded amounts for all periods presented and therefore certain amounts may not compute or tie to prior presentation due to rounding.

ASBURY AUTOMOTIVE GROUP, INC.

CONSOLIDATED STATEMENTS OF INCOME (In millions, except per share data)

(Unaudited)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | For the Three Months Ended September 30, | | %

Change | | For the Nine Months Ended September 30, | | %

Change |

| | 2024 | | 2023 | | | 2024 | | 2023 | |

| REVENUE: | | | | | | | | | | | |

| New vehicle | $ | 2,163.5 | | | $ | 1,861.9 | | | 16 | % | | $ | 6,392.6 | | | $ | 5,572.2 | | | 15 | % |

| Used vehicle: | | | | | | | | | | | |

| Retail | 1,148.5 | | | 1,016.8 | | | 13 | % | | 3,507.0 | | | 3,051.8 | | | 15 | % |

| Wholesale | 146.2 | | | 94.9 | | | 54 | % | | 452.6 | | | 293.8 | | | 54 | % |

| Total used vehicle | 1,294.7 | | | 1,111.7 | | | 16 | % | | 3,959.6 | | | 3,345.6 | | | 18 | % |

| Parts and service | 593.1 | | | 526.5 | | | 13 | % | | 1,764.3 | | | 1,568.2 | | | 13 | % |

| Finance and insurance, net | 185.4 | | | 166.1 | | | 12 | % | | 567.5 | | | 505.0 | | | 12 | % |

| TOTAL REVENUE | 4,236.7 | | | 3,666.2 | | | 16 | % | | 12,684.1 | | | 10,991.0 | | | 15 | % |

| COST OF SALES: | | | | | | | | | | | |

| New vehicle | 2,013.1 | | | 1,693.6 | | | 19 | % | | 5,924.4 | | | 5,040.1 | | | 18 | % |

| Used vehicle: | | | | | | | | | | | |

| Retail | 1,092.4 | | | 957.0 | | | 14 | % | | 3,329.6 | | | 2,855.5 | | | 17 | % |

| Wholesale | 142.9 | | | 92.6 | | | 54 | % | | 437.7 | | | 280.1 | | | 56 | % |

| Total used vehicle | 1,235.3 | | | 1,049.6 | | | 18 | % | | 3,767.3 | | | 3,135.6 | | | 20 | % |

| Parts and service | 256.0 | | | 235.3 | | | 9 | % | | 753.2 | | | 702.9 | | | 7 | % |

| Finance and insurance | 14.2 | | | 14.1 | | | 1 | % | | 40.5 | | | 29.6 | | | 37 | % |

| TOTAL COST OF SALES | 3,518.6 | | | 2,992.7 | | | 18 | % | | 10,485.3 | | | 8,908.2 | | | 18 | % |

| GROSS PROFIT | 718.0 | | | 673.5 | | | 7 | % | | 2,198.8 | | | 2,082.8 | | | 6 | % |

| OPERATING EXPENSES: | | | | | | | | | | | |

| Selling, general, and administrative | 466.5 | | | 391.7 | | | 19 | % | | 1,411.6 | | | 1,203.3 | | | 17 | % |

| Depreciation and amortization | 18.9 | | | 17.0 | | | 11 | % | | 55.8 | | | 50.5 | | | 10 | % |

| Asset impairments | — | | | — | | | — | % | | 135.4 | | | — | | | — | % |

| | | | | | | | | | | |

| INCOME FROM OPERATIONS | 232.7 | | | 264.7 | | | (12) | % | | 596.0 | | | 829.0 | | | (28) | % |

| OTHER EXPENSES: | | | | | | | | | | | |

| Floor plan interest expense | 22.3 | | | — | | | — | % | | 66.1 | | | 1.5 | | | NM |

| Other interest expense, net | 45.7 | | | 38.7 | | | 18 | % | | 134.9 | | | 115.3 | | | 17 | % |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| Gain on dealership divestitures | (5.0) | | | — | | | — | % | | (8.6) | | | (13.5) | | | (36) | % |

| Total other expenses, net | 63.0 | | | 38.7 | | | 63 | % | | 192.4 | | | 103.3 | | | 86 | % |

| INCOME BEFORE INCOME TAXES | 169.7 | | | 226.0 | | | (25) | % | | 403.6 | | | 725.7 | | | (44) | % |

| Income tax expense | 43.4 | | | 56.8 | | | (24) | % | | 102.1 | | | 178.7 | | | (43) | % |

| | | | | | | | | | | |

| | | | | | | | | | | |

| NET INCOME | $ | 126.3 | | | $ | 169.2 | | | (25) | % | | $ | 301.5 | | | $ | 547.0 | | | (45) | % |

| EARNINGS PER SHARE: | | | | | | | | | | | |

| Basic— | | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| Net income | $ | 6.40 | | | $ | 8.22 | | | (22) | % | | $ | 15.03 | | | $ | 26.02 | | | (42) | % |

| Diluted— | | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| Net income | $ | 6.37 | | | $ | 8.19 | | | (22) | % | | $ | 14.99 | | | $ | 25.91 | | | (42) | % |

| WEIGHTED AVERAGE SHARES OUTSTANDING: | | | | | | | | | | | |

| Basic | 19.7 | | | 20.6 | | | | | 20.1 | | | 21.0 | | | |

| | | | | | | | | | | |

| Restricted stock | 0.1 | | | 0.1 | | | | | — | | | 0.1 | | | |

| Performance share units | — | | | — | | | | | 0.1 | | | — | | | |

| Diluted | 19.8 | | | 20.7 | | | | | 20.1 | | | 21.1 | | | |

______________________________

NM—Not Meaningful

ASBURY AUTOMOTIVE GROUP, INC.

Additional Disclosures-Consolidated (In millions)

(Unaudited)

| | | | | | | | | | | | | | | | | | | | | | | |

| | September 30, 2024 | | December 31, 2023 | | Increase

(Decrease) | | % Change |

| SELECTED BALANCE SHEET DATA | | | | | | | |

| Cash and cash equivalents | $ | 60.3 | | | $ | 45.7 | | | $ | 14.6 | | | 32 | % |

| Inventory, net (a) | 2,030.8 | | | 1,768.3 | | | 262.5 | | | 15 | % |

| Total current assets | 3,104.5 | | | 3,057.1 | | | 47.4 | | | 2 | % |

| Floor plan notes payable | 1,486.0 | | | 1,785.7 | | | (299.8) | | | (17) | % |

| Total current liabilities | 2,594.2 | | | 2,875.7 | | | (281.5) | | | (10) | % |

| CAPITALIZATION: | | | | | | | |

| Long-term debt (including current portion) | $ | 3,382.8 | | | $ | 3,206.2 | | | $ | 176.7 | | | 6 | % |

| Shareholders' equity | 3,362.4 | | | 3,244.1 | | | 118.3 | | | 4 | % |

| Total | $ | 6,745.2 | | | $ | 6,450.3 | | | $ | 294.9 | | | 5 | % |

_____________________________

(a) Excluding $47.9 million and $84.5 million of inventory classified as assets held for sale as of September 30, 2024 and December 31, 2023, respectively.

| | | | | | | | | | | | | | | | | |

| | September 30, 2024 | | December 31, 2023 | | September 30, 2023 |

| Days Supply | | | | | |

| New vehicle inventory | 63 | | | 43 | | | 36 | |

| Used vehicle inventory | 38 | | | 32 | | | 29 | |

_____________________________

Days supply of inventory is calculated based on new and used inventory, in units, at the end of each reporting period and a 30-day historical unit sales.

Brand Mix - New Vehicle Revenue by Brand

| | | | | | | | | | | |

| | For the Three Months Ended September 30, |

| | 2024 | | 2023 |

| Luxury | | | |

| Lexus | 10 | % | | 10 | % |

| Mercedes-Benz | 7 | % | | 8 | % |

| BMW | 2 | % | | 3 | % |

| Land Rover | 2 | % | | 2 | % |

| Porsche | 2 | % | | 2 | % |

| Acura | 1 | % | | 2 | % |

| | | |

| Other luxury | 4 | % | | 5 | % |

| Total luxury | 30 | % | | 31 | % |

| Imports | | | |

| Toyota | 19 | % | | 18 | % |

| Honda | 9 | % | | 10 | % |

| Hyundai | 5 | % | | 4 | % |

| Nissan | 2 | % | | 3 | % |

| Subaru | 2 | % | | 2 | % |

| Kia | 2 | % | | 2 | % |

| | | |

| Other imports | 2 | % | | 1 | % |

| Total imports | 41 | % | | 41 | % |

| Domestic | | | |

| Ford | 13 | % | | 10 | % |

| Chrysler, Dodge, Jeep, Ram | 8 | % | | 12 | % |

| Chevrolet, Buick, GMC | 8 | % | | 6 | % |

| Total domestic | 29 | % | | 28 | % |

| Total New Vehicle Revenue | 100 | % | | 100 | % |

| | | | | | | | | | | |

| For the Three Months Ended September 30, |

| 2024 | | 2023 |

| Revenue mix | | | |

| New vehicle | 51.1 | % | | 50.8 | % |

| Used vehicle retail | 27.1 | % | | 27.7 | % |

| Used vehicle wholesale | 3.5 | % | | 2.6 | % |

| Parts and service | 14.0 | % | | 14.4 | % |

| Finance and insurance, net | 4.4 | % | | 4.5 | % |

| Total revenue | 100.0 | % | | 100.0 | % |

| Gross profit mix | | | |

| New vehicle | 20.9 | % | | 25.0 | % |

| Used vehicle retail | 7.8 | % | | 8.9 | % |

| Used vehicle wholesale | 0.5 | % | | 0.3 | % |

| Parts and service | 46.9 | % | | 43.2 | % |

| Finance and insurance, net | 23.8 | % | | 22.6 | % |

| Total gross profit | 100.0 | % | | 100.0 | % |

ASBURY AUTOMOTIVE GROUP, INC.

OPERATING HIGHLIGHTS-CONSOLIDATED (In millions)

(Unaudited)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | For the Three Months Ended September 30, | | %

Change | | For the Nine Months Ended September 30, | | %

Change |

| | 2024 | | 2023 | | | 2024 | | 2023 | |

| Revenue | | | | | | | | | | | |

| New vehicle | $ | 2,163.5 | | | $ | 1,861.9 | | | 16 | % | | $ | 6,392.6 | | | $ | 5,572.2 | | | 15 | % |

| Used vehicle: | | | | | | | | | | | |

| Retail | 1,148.5 | | | 1,016.8 | | | 13 | % | | 3,507.0 | | | 3,051.8 | | | 15 | % |

| Wholesale | 146.2 | | | 94.9 | | | 54 | % | | 452.6 | | | 293.8 | | | 54 | % |

| Total used vehicle | 1,294.7 | | | 1,111.7 | | | 16 | % | | 3,959.6 | | | 3,345.6 | | | 18 | % |

| Parts and service | 593.1 | | | 526.5 | | | 13 | % | | 1,764.3 | | | 1,568.2 | | | 13 | % |

| Finance and insurance, net | 185.4 | | | 166.1 | | | 12 | % | | 567.5 | | | 505.0 | | | 12 | % |

| Total revenue | $ | 4,236.7 | | | $ | 3,666.2 | | | 16 | % | | $ | 12,684.1 | | | $ | 10,991.0 | | | 15 | % |

| Gross profit | | | | | | | | | | | |

| New vehicle | $ | 150.4 | | | $ | 168.3 | | | (11) | % | | $ | 468.3 | | | $ | 532.1 | | | (12) | % |

| Used vehicle: | | | | | | | | | | | |

| Retail | 56.1 | | | 59.8 | | | (6) | % | | 177.4 | | | 196.2 | | | (10) | % |

| Wholesale | 3.3 | | | 2.3 | | | 45 | % | | 14.9 | | | 13.7 | | | 9 | % |

| Total used vehicle | 59.4 | | | 62.1 | | | (4) | % | | 192.3 | | | 210.0 | | | (8) | % |

| Parts and service | 337.1 | | | 291.1 | | | 16 | % | | 1,011.1 | | | 865.3 | | | 17 | % |

| Finance and insurance, net | 171.2 | | | 152.0 | | | 13 | % | | 527.0 | | | 475.4 | | | 11 | % |

| Total gross profit | $ | 718.0 | | | $ | 673.5 | | | 7 | % | | $ | 2,198.8 | | | $ | 2,082.8 | | | 6 | % |

| Unit sales | | | | | | | | | | | |

| New vehicle: | | | | | | | | | | | |

| Luxury | 8,951 | | | 8,150 | | | 10 | % | | 26,248 | | | 25,504 | | | 3 | % |

| Import | 22,500 | | | 19,659 | | | 14 | % | | 66,650 | | | 57,015 | | | 17 | % |

| Domestic | 11,156 | | | 9,037 | | | 23 | % | | 33,065 | | | 27,093 | | | 22 | % |

| Total new vehicle | 42,607 | | | 36,846 | | | 16 | % | | 125,963 | | | 109,612 | | | 15 | % |

| Used vehicle retail | 37,347 | | | 32,117 | | | 16 | % | | 115,370 | | | 96,729 | | | 19 | % |

| Used to new ratio | 87.7 | % | | 87.2 | % | | | | 91.6 | % | | 88.2 | % | | |

| Average selling price | | | | | | | | | | | |

| New vehicle | $ | 50,778 | | | $ | 50,531 | | | — | % | | $ | 50,750 | | | $ | 50,836 | | | — | % |

| Used vehicle retail | $ | 30,751 | | | $ | 31,660 | | | (3) | % | | $ | 30,398 | | | $ | 31,550 | | | (4) | % |

| Average gross profit per unit | | | | | | | | | | | |

| New vehicle: | | | | | | | | | | | |

| Luxury | $ | 6,906 | | | $ | 7,553 | | | (9) | % | | $ | 6,982 | | | $ | 7,975 | | | (12) | % |

| Import | 2,508 | | | 3,458 | | | (27) | % | | 2,638 | | | 3,584 | | | (26) | % |

| Domestic | 2,881 | | | 4,286 | | | (33) | % | | 3,302 | | | 4,592 | | | (28) | % |

| Total new vehicle | 3,529 | | | 4,567 | | | (23) | % | | 3,718 | | | 4,855 | | | (23) | % |

| Used vehicle retail | 1,501 | | | 1,861 | | | (19) | % | | 1,538 | | | 2,029 | | | (24) | % |

| Finance and insurance | 2,141 | | | 2,204 | | | (3) | % | | 2,184 | | | 2,304 | | | (5) | % |

| Front end yield (1) | 4,723 | | | 5,511 | | | (14) | % | | 4,859 | | | 5,834 | | | (17) | % |

| Gross margin | | | | | | | | | | | |

| Total new vehicle | 7.0 | % | | 9.0 | % | | (209) bps | | 7.3 | % | | 9.5 | % | | (222) bps |

| Used vehicle retail | 4.9 | % | | 5.9 | % | | (100) bps | | 5.1 | % | | 6.4 | % | | (137) bps |

| Parts and service | 56.8 | % | | 55.3 | % | | 154 bps | | 57.3 | % | | 55.2 | % | | 213 bps |

| Total gross profit margin | 16.9 | % | | 18.4 | % | | (142) bps | | 17.3 | % | | 19.0 | % | | (162) bps |

| Operating expenses | | | | | | | | | | | |

| Selling, general, and administrative | $ | 466.5 | | | $ | 391.7 | | | 19 | % | | $ | 1,411.6 | | | $ | 1,203.3 | | | 17 | % |

| Adjusted selling, general, and administrative | $ | 462.5 | | | $ | 393.5 | | | 18 | % | | $ | 1,404.6 | | | $ | 1,202.7 | | | 17 | % |

| SG&A as a % of gross profit | 65.0 | % | | 58.2 | % | | 680 bps | | 64.2 | % | | 57.8 | % | | 643 bps |

| Adjusted SG&A as a % of gross profit | 64.4 | % | | 58.4 | % | | 598 bps | | 63.9 | % | | 57.7 | % | | 614 bps |

| Income from operations as a % of revenue | 5.5 | % | | 7.2 | % | | (173) bps | | 4.7 | % | | 7.5 | % | | (284) bps |

| Income from operations as a % of gross profit | 32.4 | % | | 39.3 | % | | (690) bps | | 27.1 | % | | 39.8 | % | | (1,270) bps |

| Adjusted income from operations as a % of revenue | 5.6 | % | | 7.2 | % | | (159) bps | | 5.8 | % | | 7.5 | % | | (173) bps |

| Adjusted income from operations as a % of gross profit | 33.0 | % | | 39.0 | % | | (608) bps | | 33.6 | % | | 39.8 | % | | (625) bps |

_____________________________

(1) Front end yield is calculated as gross profit from new vehicles, used retail vehicles and finance and insurance (net), divided by combined new and used retail unit sales.

ASBURY AUTOMOTIVE GROUP, INC.

SAME STORE OPERATING HIGHLIGHTS-CONSOLIDATED (In millions)

(Unaudited)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | For the Three Months Ended September 30, | | %

Change | | For the Nine Months Ended September 30, | | %

Change |

| | 2024 | | 2023 | | | 2024 | | 2023 | |

| Revenue | | | | | | | | | | | |

| New vehicle | $ | 1,834.1 | | | $ | 1,841.7 | | | — | % | | $ | 5,368.7 | | | $ | 5,501.4 | | | (2) | % |

| Used vehicle: | | | | | | | | | | | |

| Retail | 921.0 | | | 1,005.6 | | | (8) | % | | 2,795.3 | | | 3,000.9 | | | (7) | % |

| Wholesale | 104.4 | | | 92.4 | | | 13 | % | | 333.8 | | | 283.9 | | | 18 | % |

| Total used vehicle | 1,025.4 | | | 1,098.1 | | | (7) | % | | 3,129.0 | | | 3,284.8 | | | (5) | % |

| Parts and service | 524.7 | | | 519.1 | | | 1 | % | | 1,547.5 | | | 1,542.5 | | | — | % |

| Finance and insurance, net | 152.7 | | | 165.0 | | | (7) | % | | 463.8 | | | 500.4 | | | (7) | % |

| Total revenue | $ | 3,536.9 | | | $ | 3,623.9 | | | (2) | % | | $ | 10,509.0 | | | $ | 10,829.2 | | | (3) | % |

| Gross profit | | | | | | | | | | | |

| New vehicle | $ | 126.2 | | | $ | 167.0 | | | (24) | % | | $ | 391.5 | | | $ | 526.8 | | | (26) | % |

| Used vehicle: | | | | | | | | | | | |

| Retail | 46.4 | | | 59.1 | | | (21) | % | | 145.7 | | | 193.0 | | | (24) | % |

| Wholesale | 2.3 | | | 2.4 | | | (3) | % | | 9.6 | | | 13.9 | | | (31) | % |

| Total used vehicle | 48.8 | | | 61.5 | | | (21) | % | | 155.4 | | | 207.0 | | | (25) | % |

| Parts and service | 298.1 | | | 287.5 | | | 4 | % | | 889.0 | | | 852.2 | | | 4 | % |

| Finance and insurance, net | 138.5 | | | 150.9 | | | (8) | % | | 423.3 | | | 470.9 | | | (10) | % |

| Total gross profit | $ | 611.5 | | | $ | 666.8 | | | (8) | % | | $ | 1,859.1 | | | $ | 2,056.8 | | | (10) | % |

| Unit sales | | | | | | | | | | | |

| New vehicle: | | | | | | | | | | | |

| Luxury | 8,730 | | | 8,184 | | | 7 | % | | 25,423 | | | 25,405 | | | — | % |

| Import | 19,421 | | | 19,198 | | | 1 | % | | 56,103 | | | 55,661 | | | 1 | % |

| Domestic | 7,780 | | | 8,929 | | | (13) | % | | 23,559 | | | 26,806 | | | (12) | % |

| Total new vehicle | 35,931 | | | 36,311 | | | (1) | % | | 105,085 | | | 107,872 | | | (3) | % |

| Used vehicle retail | 29,668 | | | 31,665 | | | (6) | % | | 91,167 | | | 94,604 | | | (4) | % |

| Used to new ratio | 82.6 | % | | 87.2 | % | | | | 86.8 | % | | 87.7 | % | | |

| Average selling price | | | | | | | | | | | |

| New vehicle | $ | 51,044 | | | $ | 50,719 | | | 1 | % | | $ | 51,089 | | | $ | 50,999 | | | — | % |

| Used vehicle retail | $ | 31,044 | | | $ | 31,759 | | | (2) | % | | $ | 30,661 | | | $ | 31,720 | | | (3) | % |

| Average gross profit per unit | | | | | | | | | | | |

| New vehicle: | | | | | | | | | | | |

| Luxury | $ | 7,003 | | | $ | 7,529 | | | (7) | % | | $ | 7,066 | | | $ | 7,966 | | | (11) | % |

| Import | 2,305 | | | 3,486 | | | (34) | % | | 2,419 | | | 3,609 | | | (33) | % |

| Domestic | 2,606 | | | 4,306 | | | (39) | % | | 3,231 | | | 4,608 | | | (30) | % |

| Total new vehicle | 3,512 | | | 4,599 | | | (24) | % | | 3,725 | | | 4,883 | | | (24) | % |

| Used vehicle retail | 1,566 | | | 1,866 | | | (16) | % | | 1,599 | | | 2,040 | | | (22) | % |

| Finance and insurance | 2,111 | | | 2,219 | | | (5) | % | | 2,157 | | | 2,325 | | | (7) | % |

| Front end yield (1) | 4,743 | | | 5,545 | | | (14) | % | | 4,894 | | | 5,880 | | | (17) | % |

| Gross margin | | | | | | | | | | | |

| Total new vehicle | 6.9 | % | | 9.1 | % | | (219) bps | | 7.3 | % | | 9.6 | % | | (228) bps |

| Used vehicle retail | 5.0 | % | | 5.9 | % | | (83) bps | | 5.2 | % | | 6.4 | % | | (122) bps |

| Parts and service | 56.8 | % | | 55.4 | % | | 144 bps | | 57.4 | % | | 55.2 | % | | 220 bps |

| Total gross profit margin | 17.3 | % | | 18.4 | % | | (111) bps | | 17.7 | % | | 19.0 | % | | (130) bps |

| Operating expenses | | | | | | | | | | | |

| Selling, general, and administrative | $ | 394.3 | | | $ | 386.2 | | | 2 | % | | $ | 1,185.5 | | | $ | 1,181.8 | | | — | % |

| Adjusted selling, general, and administrative | $ | 390.3 | | | $ | 389.7 | | | — | % | | $ | 1,178.4 | | | $ | 1,182.9 | | | — | % |

| SG&A as a % of gross profit | 64.5 | % | | 57.9 | % | | 657 bps | | 63.8 | % | | 57.5 | % | | 631 bps |

| Adjusted SG&A as a % of gross profit | 63.8 | % | | 58.4 | % | | 538 bps | | 63.4 | % | | 57.5 | % | | 587 bps |

_____________________________

(1)Front end yield is calculated as gross profit from new vehicles, used retail vehicles and finance and insurance (net), divided by combined new and used retail unit sales.

ASBURY AUTOMOTIVE GROUP, INC.

SEGMENT REPORTING (Unaudited) | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended September 30, 2024 | | Three Months Ended September 30, 2023 |

| Dealerships | | TCA After Eliminations | | Total Company | | Dealerships | | TCA After Eliminations | | Total Company |

| (In millions) |

| Revenue | | | | | | | | | | | |

| New | $ | 2,163.5 | | | $ | — | | | $ | 2,163.5 | | | $ | 1,861.9 | | | $ | — | | | $ | 1,861.9 | |

| Used | 1,294.7 | | | — | | | 1,294.7 | | | 1,111.7 | | | — | | | 1,111.7 | |

| Parts and service | 603.3 | | | (10.2) | | | 593.1 | | | 535.4 | | | (9.0) | | | 526.5 | |

| Finance and insurance, net | 149.0 | | | 36.4 | | | 185.4 | | | 129.9 | | | 36.2 | | | 166.1 | |

| Total revenue | $ | 4,210.5 | | | $ | 26.2 | | | $ | 4,236.7 | | | $ | 3,638.9 | | | $ | 27.3 | | | $ | 3,666.2 | |

| Cost of sales | | | | | | | | | | | |

| New | $ | 2,013.1 | | | $ | — | | | $ | 2,013.1 | | | $ | 1,693.6 | | | $ | — | | | $ | 1,693.6 | |

| Used | 1,235.3 | | | — | | | 1,235.3 | | | 1,049.6 | | | — | | | 1,049.6 | |

| Parts and service | 266.2 | | | (10.2) | | | 256.0 | | | 240.2 | | | (4.9) | | | 235.3 | |

| Finance and insurance | — | | | 14.2 | | | 14.2 | | | — | | | 14.1 | | | 14.1 | |

| Total cost of sales | $ | 3,514.6 | | | $ | 4.0 | | | $ | 3,518.6 | | | $ | 2,983.4 | | | $ | 9.2 | | | $ | 2,992.7 | |

| Gross profit | | | | | | | | | | | |

| New | $ | 150.4 | | | $ | — | | | $ | 150.4 | | | $ | 168.3 | | | $ | — | | | $ | 168.3 | |

| Used | 59.4 | | | — | | | 59.4 | | | 62.1 | | | — | | | 62.1 | |

| Parts and service | 337.1 | | | — | | | 337.1 | | | 295.2 | | | (4.1) | | | 291.1 | |

| Finance and insurance, net | 149.0 | | | 22.2 | | | 171.2 | | | 129.9 | | | 22.1 | | | 152.0 | |

| Total gross profit | $ | 695.9 | | | $ | 22.2 | | | $ | 718.0 | | | $ | 655.5 | | | $ | 18.0 | | | $ | 673.5 | |

| Selling, general and administrative | $ | 469.2 | | | $ | (2.7) | | | $ | 466.5 | | | $ | 396.4 | | | $ | (4.7) | | | $ | 391.7 | |

| Income from operations | $ | 214.7 | | | $ | 17.9 | | | $ | 232.7 | | | $ | 244.9 | | | $ | 19.8 | | | $ | 264.7 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Nine Months Ended September 30, 2024 | | Nine Months Ended September 30, 2023 |

| Dealerships | | TCA After Eliminations | | Total Company | | Dealerships | | TCA After Eliminations | | Total Company |

| (In millions) |

| Revenue | | | | | | | | | | | |

| New | $ | 6,392.6 | | | $ | — | | | $ | 6,392.6 | | | $ | 5,572.2 | | | $ | — | | | $ | 5,572.2 | |

| Used | 3,959.6 | | | — | | | 3,959.6 | | | 3,345.6 | | | — | | | 3,345.6 | |

| Parts and service | 1,794.0 | | | (29.7) | | | 1,764.3 | | | 1,594.6 | | | (26.4) | | | 1,568.2 | |

| Finance and insurance, net | 462.7 | | | 104.8 | | | 567.5 | | | 401.7 | | | 103.3 | | | 505.0 | |

| Total revenue | $ | 12,609.0 | | | $ | 75.1 | | | $ | 12,684.1 | | | $ | 10,914.0 | | | $ | 76.9 | | | $ | 10,991.0 | |

| Cost of sales | | | | | | | | | | | |

| New | $ | 5,924.4 | | | $ | — | | | $ | 5,924.4 | | | $ | 5,040.1 | | | $ | — | | | $ | 5,040.1 | |

| Used | 3,767.3 | | | — | | | 3,767.3 | | | 3,135.6 | | | — | | | 3,135.6 | |

| Parts and service | 782.9 | | | (29.7) | | | 753.2 | | | 717.3 | | | (14.4) | | | 702.9 | |

| Finance and insurance | — | | | 40.5 | | | 40.5 | | | — | | | 29.6 | | | 29.6 | |

| Total cost of sales | $ | 10,474.5 | | | $ | 10.8 | | | $ | 10,485.3 | | | $ | 8,893.0 | | | $ | 15.2 | | | $ | 8,908.2 | |

| Gross profit | | | | | | | | | | | |

| New | $ | 468.3 | | | $ | — | | | $ | 468.3 | | | $ | 532.1 | | | $ | — | | | $ | 532.1 | |

| Used | 192.3 | | | — | | | 192.3 | | | 210.0 | | | — | | | 210.0 | |

| Parts and service | 1,011.1 | | | — | | | 1,011.1 | | | 877.3 | | | (12.0) | | | 865.3 | |

| Finance and insurance, net | 462.7 | | | 64.3 | | | 527.0 | | | 401.7 | | | 73.8 | | | 475.4 | |

| Total gross profit | $ | 2,134.5 | | | $ | 64.3 | | | $ | 2,198.8 | | | $ | 2,021.0 | | | $ | 61.8 | | | $ | 2,082.8 | |

| Selling, general, and administrative | $ | 1,422.2 | | | $ | (10.6) | | | $ | 1,411.6 | | | $ | 1,219.9 | | | $ | (16.6) | | | $ | 1,203.3 | |

| Income from operations | $ | 537.0 | | | $ | 59.0 | | | $ | 596.0 | | | $ | 758.3 | | | $ | 70.7 | | | $ | 829.0 | |

ASBURY AUTOMOTIVE GROUP, INC.

Supplemental Disclosures

(Unaudited)

The following tables provide reconciliations for our non-GAAP metrics: | | | | | | | | | | | | | | | | | | | | | | | |

| For the Three Months Ended | | For the Twelve Months Ended |

| September 30, 2024 | | September 30, 2023 | | September 30, 2024 | | June 30, 2024 |

| (Dollars in millions) |

| Adjusted leverage ratio: | | | | | | | |

| Long-term debt | | | | | $ | 3,382.8 | | | $ | 3,601.3 | |

| Cash and floor plan offset | | | | | (257.5) | | | (478.6) | |

| TCA cash | | | | | 55.6 | | | 14.7 | |

| Availability under our used vehicle floor plan facility | | | | | (310.3) | | | (286.1) | |

| Adjusted long-term net debt | | | | | $ | 2,870.6 | | | $ | 2,851.2 | |

| | | | | | | |

| Calculation of earnings before interest, taxes, depreciation and amortization ("EBITDA"): | | | | | | | |

| Net income | $ | 126.3 | | | $ | 169.2 | | | $ | 357.1 | | | $ | 400.0 | |

| | | | | | | |

| Depreciation and amortization | 18.9 | | | 17.0 | | | 73.0 | | | 71.1 | |

| Income tax expense | 43.4 | | | 56.8 | | | 122.2 | | | 135.5 | |

| Swap and other interest expense | 45.7 | | | 38.7 | | | 176.1 | | | 169.1 | |

| Earnings before interest, taxes, depreciation and amortization ("EBITDA") | $ | 234.3 | | | $ | 281.8 | | | $ | 728.3 | | | $ | 775.7 | |

| | | | | | | |

| Non-core items - expense (income): | | | | | | | |

| Gain on dealership divestitures | $ | (5.0) | | | $ | — | | | $ | (8.6) | | | $ | (3.6) | |

| Gain on sale of real estate | — | | | (3.6) | | | — | | | (3.6) | |

| Legal settlement | — | | | — | | | (1.0) | | | — | |

| Asset impairments | — | | | — | | | 252.6 | | | 252.6 | |

| Professional fees associated with acquisition | — | | | 1.8 | | | 2.4 | | | 4.1 | |

| Fixed assets write-off | — | | | — | | | 1.1 | | | 1.1 | |

| Hail damage | 4.0 | | | — | | | 5.3 | | | 3.1 | |

| | | | | | | |

| Total non-core items | (1.0) | | | (1.8) | | | 251.7 | | | 253.7 | |

| | | | | | | |

| Adjusted EBITDA | $ | 233.3 | | | $ | 280.0 | | | $ | 980.0 | | | $ | 1,029.5 | |

| | | | | | | |

| Impact of dealership acquisitions and divestitures | | | | | $ | 17.2 | | | $ | 26.6 | |

| Transaction adjusted EBITDA | | | | | $ | 997.2 | | | $ | 1,056.1 | |

| | | | | | | |

| Transaction adjusted net leverage ratio | | | | | 2.9 | | | 2.7 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended September 30, 2024 |

| GAAP | | Gain on dealership divestitures | | Asset impairments | | Hail damage | | Income tax effect | | Non-GAAP adjusted |

| (In millions, except per share data) |

| Selling, general and administrative | $ | 466.5 | | | $ | — | | | $ | — | | | $ | (4.0) | | | $ | — | | | $ | 462.5 | |

| Income from operations | $ | 232.7 | | | $ | — | | | $ | — | | | $ | 4.0 | | | $ | — | | | $ | 236.7 | |

| Net income | $ | 126.3 | | | $ | (5.0) | | | $ | — | | | $ | 4.0 | | | $ | 0.5 | | | $ | 125.8 | |

| | | | | | | | | | | |

| Weighted average common share outstanding - diluted | 19.8 | | | | | | | | | | | 19.8 | |

| | | | | | | | | | | |

| Diluted EPS | $ | 6.37 | | | $ | (0.14) | | | $ | — | | | $ | 0.11 | | | $ | — | | | $ | 6.35 | |

| | | | | | | | | | | |

| SG&A as a % of gross profit | 65.0 | % | | | | | | | | | | 64.4 | % |

| Income from operations as a % of revenue | 5.5 | % | | | | | | | | | | 5.6 | % |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended September 30, 2023 |

| GAAP | | Gain on sale of real estate | | | | Professional fees associated with acquisition | | Income tax effect | | Non-GAAP adjusted |

| (In millions, except per share data) |

| Selling, general and administrative | $ | 391.7 | | | $ | 3.6 | | | | | $ | (1.8) | | | $ | — | | | $ | 393.5 | |

| Income from operations | $ | 264.7 | | | $ | (3.6) | | | | | $ | 1.8 | | | $ | — | | | $ | 262.9 | |

| Net income | $ | 169.2 | | | $ | (3.6) | | | | | $ | 1.8 | | | $ | 0.5 | | | $ | 167.9 | |

| | | | | | | | | | | |

| Weighted average common share outstanding - diluted | 20.7 | | | | | | | | | | | 20.7 | |

| | | | | | | | | | | |

| Diluted EPS | $ | 8.19 | | | $ | (0.13) | | | | | $ | 0.06 | | | $ | — | | | $ | 8.12 | |

| | | | | | | | | | | |

| SG&A as a % of gross profit | 58.2 | % | | — | % | | | | — | % | | — | % | | 58.4 | % |

| Income from operations as a % of revenue | 7.2 | % | | — | % | | | | — | % | | — | % | | 7.2 | % |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Nine Months Ended September 30, 2024 |

| GAAP | | Gain on dealership divestitures | | Asset impairments | | Hail damage | | | | | | | | | | | | | | Income tax effect | | Non-GAAP adjusted |

| (In millions, except per share data) |

| Selling, general, and administrative | $ | 1,411.6 | | | $ | — | | | $ | — | | | $ | (7.1) | | | | | | | | | | | | | | | $ | — | | | $ | 1,404.6 | |

| Income from operations | $ | 596.0 | | | $ | — | | | $ | 135.4 | | | $ | 7.1 | | | | | | | | | | | | | | | $ | — | | | $ | 738.4 | |

| Net income | $ | 301.5 | | | $ | (8.6) | | | $ | 135.4 | | | $ | 7.1 | | | | | | | | | | | | | | | $ | (33.4) | | | $ | 402.0 | |

| | | | | | | | | | | | | | | | | | | | | | | |

| Weighted average common share outstanding - diluted | 20.1 | | | | | | | | | | | | | | | | | | | | | | | 20.1 | |

| | | | | | | | | | | | | | | | | | | | | | | |

| Diluted EPS | $ | 14.99 | | | $ | (0.32) | | | $ | 5.05 | | | $ | 0.26 | | | | | | | | | | | | | | | $ | — | | | $ | 19.98 | |

| | | | | | | | | | | | | | | | | | | | | | | |

| SG&A as a % of gross profit | 64.2 | % | | | | | | | | | | | | | | | | | | | | | | 63.9 | % |

| Income from operations as a % of revenue | 4.7 | % | | | | | | | | | | | | | | | | | | | | | | 5.8 | % |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Nine Months Ended September 30, 2023 |

| GAAP | | Gain on dealership divestiture, net | | Legal settlement | | Hail damage | | Gain on sale of real estate | | Professional fees associated with acquisition | | Income tax effect | | Non-GAAP adjusted |

| (In millions, except per share data) |

| Selling, general, and administrative | $ | 1,203.3 | | | $ | — | | | $ | 1.9 | | | $ | (4.3) | | | $ | 3.6 | | | $ | (1.8) | | | $ | — | | | $ | 1,202.7 | |

| Income from operations | $ | 829.0 | | | $ | — | | | $ | (1.9) | | | $ | 4.3 | | | $ | (3.6) | | | $ | 1.8 | | | $ | — | | | $ | 829.6 | |

| Net income | $ | 547.0 | | | $ | (13.5) | | | $ | (1.9) | | | $ | 4.3 | | | $ | (3.6) | | | $ | 1.8 | | | $ | 3.2 | | | $ | 537.3 | |

| | | | | | | | | | | | | | | |

| Weighted average common share outstanding - diluted | 21.1 | | | | | | | | | | | | | | | 21.1 | |

| | | | | | | | | | | | | | | |

| Diluted EPS | $ | 25.91 | | | $ | (0.48) | | | $ | (0.07) | | | $ | 0.15 | | | $ | (0.13) | | | $ | 0.06 | | | $ | — | | | $ | 25.45 | |

| | | | | | | | | | | | | | | |

| SG&A as a % of gross profit | 57.8 | % | | — | % | | — | % | | — | % | | — | % | | — | % | | — | % | | 57.7 | % |

| Income from operations as a % of revenue | 7.5 | % | | — | % | | — | % | | — | % | | — | % | | — | % | | — | % | | 7.5 | % |

| | | | | | | | | | | | | | | | | |

| Three Months Ended September 30, 2024 |

| GAAP | | Hail damage | | Non-GAAP adjusted |

| (In millions) |

| Selling, general and administrative (Same Store) | $ | 394.3 | | | $ | (4.0) | | | $ | 390.3 | |

| | | | | |

| SG&A as a % of gross profit (Same Store) | 64.5 | % | | | | 63.8 | % |

| | | | | | | | | | | |

| For the Nine Months Ended September 30, |

| 2024 | | 2023 |

| (In millions) |

| Adjusted cash flow from operations: | | | |

| Cash provided by operating activities | $ | 427.0 | | | $ | 239.8 | |

| Change in Floor Plan Notes Payable—Non-Trade, net | (70.6) | | | (2.8) | |

| Change in Floor Plan Notes Payable—Non-Trade associated with floor plan offset, used vehicle borrowing base changes adjusted for acquisition and divestitures | 175.9 | | | 233.7 | |

| Change in Floor Plan Notes Payable—Trade associated with floor plan offset, adjusted for acquisition and divestitures | (45.1) | | | 42.9 | |

| Adjusted cash flow provided by operating activities | $ | 487.2 | | | $ | 513.6 | |

Cover Page

|

Oct. 29, 2024 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Document Period End Date |

Oct. 29, 2024

|

| Entity Registrant Name |

Asbury Automotive Group, Inc.

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity File Number |

001-31262

|

| Entity Tax Identification Number |

01-0609375

|

| Entity Address, Address Line One |

2905 Premiere Parkway NW Suite 300

|

| Entity Address, City or Town |

Duluth,

|

| Entity Address, State or Province |

GA

|

| Entity Address, Postal Zip Code |

30097

|

| City Area Code |

770

|

| Local Phone Number |

418-8200

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common stock, $0.01 par value per share

|

| Trading Symbol |

ABG

|

| Security Exchange Name |

NYSE

|

| Entity Emerging Growth Company |

false

|

| Entity Central Index Key |

0001144980

|

| Amendment Flag |

false

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

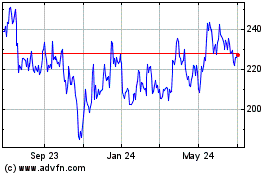

Asbury Automotive (NYSE:ABG)

Historical Stock Chart

From Jan 2025 to Feb 2025

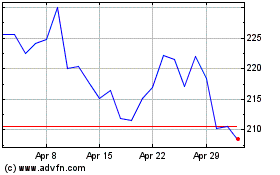

Asbury Automotive (NYSE:ABG)

Historical Stock Chart

From Feb 2024 to Feb 2025