Soluna Holdings Reports Strong Adjusted EBITDA and Q2’24 Results

August 15 2024 - 8:00AM

Business Wire

362% Increase in Revenue year-over-year

Soluna Holdings, Inc. (“SHI” or the “Company”), (NASDAQ: SLNH),

a developer of green data centers for intensive computing

applications including Bitcoin mining and AI, announced financial

results for the second quarter ended June 30, 2024.

This press release features multimedia. View

the full release here:

https://www.businesswire.com/news/home/20240815547957/en/

(Graphic: Business Wire)

John Belizaire, CEO of Soluna, said, “I am honored to lead such

a resilient team. This year's quarterly results show a markedly

different company with many opportunities ahead. We have now

successfully implemented all of our revenue diversification

strategies and I am proud that the results are beginning to show

and that we have achieved significant project milestones this

quarter.”

Belizaire said, “Our venture into AI, the construction phase of

Dorothy 2, the development of Project Kati, and the continued

development of our 2 GW pipeline represents the next frontier of

growth for our enterprise.”

Finance and Operational Highlights:

- Strong Revenue – Revenue increased by 362% to $9.7

million in the three months ended of second quarter of 2024

compared to $2.1 million in the three months ended of second

quarter of 2023.

- Operating loss – Operating loss significantly improved

to $3.7 million in the three months ended second quarter of 2024, a

substantial 48% reduction from the $7.1 million operating loss in

the second quarter of 2023.

- Strong Adjusted EBITDA – Adjusted EBITDA (non-GAAP)

ramped to $1.8 million compared to the second quarter of 2023 of

($2.0 million), an increase of $3.8 million driven by strong

revenue growth and cost discipline through the Bitcoin

halving.

- Strong Cash Growth – Unrestricted cash increased 50%

from the end of 2023, reaching $9.6 million.

- HP Enterprise Partnership – Soluna has partnered with

Hewlett Packard Enterprise to launch Soluna Cloud. By utilizing

Soluna Cloud, enterprise customers can rapidly deploy AI workloads

on a more sustainable and scalable platform, made possible by

renewable energy, direct liquid cooling (DLC), and waste-heat

recovery.

- Signed Definitive Power Purchase Agreement with EDF

Renewables – Project Kati is Soluna’s second Renewable

Computing data center project in Texas. It will be co-located at a

wind facility owned by EDF Renewables and Masdar. Project Kati will

be executed in two phases, with each phase delivering 83 MW of

renewable energy capacity to power high-performance computing

applications, including Bitcoin Hosting and AI.

- Completed Spring Demand Response Period and Began Summer

Period – As part of its Demand Response Plan, Soluna has earned

$1.2 million for the six months ended June 2024 at Project

Dorothy.

- Reduced Convertible Debt – Driven by strong share

price momentum and trading volume, Convertible Note Holders reduced

their principal balance through conversions from $7.7 million at

the end of the first quarter of 2024 to $5.3 million at the end of

the second quarter of 2024.

Financial Summary:

Key financial results for the second quarter include:

- The strong second-quarter revenue of $9.7 million and the

4th consecutive quarter of positive Adjusted EBITDA showcased our

resilience, reflecting only a 22% revenue decrease compared to

the first quarter of 2024, despite the challenges posed by the

Bitcoin halving in April, which drove the lower Adjusted EBITDA, as

expected. The second quarter resulted in a revenue increase of

362% compared to the second quarter of 2023.

- Cryptocurrency Mining Revenue increased by $3.6 million

compared to the second quarter of 2023 when Project Sophie switched

to Data Hosting, and Project Dorothy 1B was energized in the third

quarter of 2023.

- Data Hosting Revenue increased by approximately $3.7

million – compared to the second quarter of 2023, primarily

related to the energization and deployment of hosting customers at

Project Dorothy 1A and Project Sophie in 2023.

- Adjusted EBITDA of $1.8 million – Adjusted EBITDA

(non-GAAP) ramped from ($2.0 million) in the second quarter of 2023

to $1.8 million in the second quarter of 2024, an increase of $3.8

million driven by strong revenue growth and cost discipline.

Revenue & Cost of Revenue

by Project Site

Second Quarter 2024

(Dollars in

thousands)

Project Dorothy 1B

Project Dorothy 1A Project Sophie

Project Marie Other Total

Cryptocurrency mining

revenue $

4,484

$

-

$

-

$

-

$

-

$

4,484

Data hosting revenue

-

3,567

1,331

-

-

4,898

Demand response services

-

-

-

-

293

293

Total revenue $

4,484

$

3,567

$

1,331

$

-

$

293

$

9,675

Cost of cryptocurrency mining, exclusive of depreciation

$

1,883

$

-

-

-

-

1,883

Cost of data hosting revenue, exclusive of depreciation

-

1,758

418

-

-

2,176

Cost of revenue- depreciation

1,073

282

151

-

-

1,506

Total cost of revenue $

2,956

$

2,040

$

569

$

-

$

-

$

5,565

Revenue & Cost of Revenue

by Project Site

Second Quarter 2023

(Dollars in

thousands)

Project Dorothy 1B

Project Dorothy 1A Project Sophie

Project Marie Other Total

Cryptocurrency mining

revenue $

-

$

-

$

915

$

-

$

-

$

915

Data hosting revenue

-

456

692

-

5

1,153

Demand response services

-

-

-

-

-

-

Total revenue $

-

$

456

$

1,607

$

-

$

5

$

2,068

Cost of cryptocurrency mining, exclusive of depreciation

$

224

$

-

936

-

-

1,160

Cost of data hosting revenue, exclusive of depreciation

-

508

251

-

-

759

Cost of revenue- depreciation

14

185

332

8

-

539

Total cost of revenue $

238

$

693

$

1,519

$

8

$

-

$

2,458

- Gross Profit improved by $4.5 million - as Project

Sophie pivoted to Data Hosting and Project Dorothy reached full

energization, costs of revenue either met or exceeded expectations,

enabling strong Gross Profit (Loss) growth from ($390 thousand) for

the second quarter of 2023 to $4.1 million for the second quarter

of 2024.

- Gross profit for the second quarter of 2024 compared to the

first quarter of 2024 decreased by $2.8 million, while revenue

declined by $2.9 million. This highlights the company's cost

management practices and discipline.

- General and administrative expenses, excluding depreciation

and amortization for the second quarter of 2024 increased by

approximately $1.3 million in the second quarter of 2024 or 32%

over the second quarter of 2023 - to $5.4 million from $4.1

million. The increase in general and administrative expenses was

mainly due to employee-related expenses, legal fees, investor

relations, and professional fees which are partially offset by a

decrease in stock compensation expenses.

The unaudited financial statements are available online,

here. A presentation of this Second Quarter Update can

also be found online, here.

___

Safe Harbor Statement

This announcement contains forward-looking statements. These

statements are made under the "safe harbor" provisions of the U.S.

Private Securities Litigation Reform Act of 1995. These

forward-looking statements can be identified by terminology such as

"will," "expects," "anticipates," "future," "intends," "plans,"

"believes," "estimates," "confident" and similar statements. Soluna

Holdings, Inc. may also make written or oral forward-looking

statements in its periodic reports to the U.S. Securities and

Exchange Commission, in its annual report to shareholders, in press

releases and other written materials, and in oral statements made

by its officers, directors, or employees to third parties.

Statements that are not historical facts, including but not limited

to statements about Soluna’s beliefs and expectations, are

forward-looking statements. Forward-looking statements involve

inherent risks and uncertainties, further information regarding

which is included in the Company's filings with the Securities and

Exchange Commission. All information provided in this press release

is as of the date of the press release, and Soluna Holdings, Inc.

undertakes no duty to update such information, except as required

under applicable law.

In addition to figures prepared in accordance with GAAP, Soluna

from time to time presents alternative non-GAAP performance

measures, e.g., EBITDA, adjusted EBITDA, adjusted net profit/loss,

adjusted earnings per share, free cash flow. These measures should

be considered in addition to, but not as a substitute for, the

information prepared in accordance with GAAP. Alternative

performance measures are not subject to GAAP or any other generally

accepted accounting principle. Other companies may define these

terms in different ways.

About Soluna Holdings, Inc (SLNH)

Soluna is on a mission to make renewable energy a global

superpower using computing as a catalyst. The company designs,

develops and operates digital infrastructure that transforms

surplus renewable energy into global computing resources. Soluna’s

pioneering data centers are strategically co-located with wind,

solar, or hydroelectric power plants to support high-performance

computing applications including Bitcoin Mining, Generative AI, and

other compute intensive applications. Soluna’s proprietary software

MaestroOS(™) helps energize a greener grid while delivering

cost-effective and sustainable computing solutions, and superior

returns. To learn more visit solunacomputing.com. Follow us on X

(formerly Twitter) at @SolunaHoldings.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240815547957/en/

John Tunison Chief Financial Officer Soluna Holdings, Inc.

jtunison@soluna.io

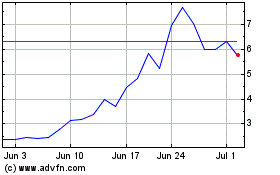

Soluna (NASDAQ:SLNH)

Historical Stock Chart

From Nov 2024 to Dec 2024

Soluna (NASDAQ:SLNH)

Historical Stock Chart

From Dec 2023 to Dec 2024