Securities Registration: Employee Benefit Plan (s-8)

September 03 2021 - 6:01AM

Edgar (US Regulatory)

As

filed with the Securities and Exchange Commission on September 2, 2021

Registration

No. 333-

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

WASHINGTON,

D.C. 20549

FORM

S-8

REGISTRATION

STATEMENT

UNDER

THE

SECURITIES ACT OF 1933

NanoVibronix,

Inc.

(Exact

name of registrant as specified in its charter)

|

Delaware

|

|

01-0801232

|

|

(State

or other jurisdiction of

incorporation

or organization)

|

|

(I.R.S. Employer

Identification No.)

|

525

Executive Boulevard

Elmsford,

New York 10523

(Address

of Principal Executive Offices) (Zip Code)

NanoVibronix,

Inc. 2014 Long-Term Incentive Plan

(Full

title of the plan)

Brian

Murphy, Ph.D.

Chief

Executive Officer

NanoVibronix,

Inc.

525

Executive Boulevard

Elmsford,

New York 10523

(Name

and address of agent for service)

(914)

233-3004

(Telephone

number, including area code, of agent for service)

Copy

to:

Rick

A. Werner, Esq.

Jayun

Koo, Esq.

Haynes

and Boone, LLP

30

Rockefeller Plaza, 26th Floor

New

York, New York 10112

Tel.

(212) 659-7300

Fax

(212) 884-8234

Indicate

by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting

company or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,”

“smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

|

|

Large

accelerated filer

|

☐

|

Accelerated

filer

|

☐

|

|

|

Non-accelerated

filer

|

☒

|

Smaller

reporting company

|

☒

|

|

|

|

|

Emerging growth company

|

☐

|

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of the Securities Act. ☐

CALCULATION

OF REGISTRATION FEE

|

Title of securities to be registered

|

|

Amount to be registered (1)

|

|

|

Proposed maximum offering price per share

|

|

|

Proposed

maximum aggregate offering price

|

|

|

Amount of registration fee

(2)

|

|

|

Common Stock, par value $0.001 per share

|

|

|

50,000

|

(3)

|

|

$

|

4.75

|

(4)

|

|

$

|

237,500

|

|

|

$

|

25.91

|

|

|

Common Stock, par value $0.001 per share

|

|

|

42,000

|

(3)

|

|

$

|

2.07

|

(4)

|

|

$

|

86,940

|

|

|

$

|

9.49

|

|

|

Common Stock, par value $0.001 per share

|

|

|

15,000

|

(3)

|

|

$

|

1.86

|

(4)

|

|

$

|

27,900

|

|

|

$

|

3.04

|

|

|

Common Stock, par value $0.001 per share

|

|

|

80,000

|

(3)

|

|

$

|

1.60

|

(4)

|

|

$

|

128,000

|

|

|

$

|

13.96

|

|

|

Common Stock, par value $0.001 per share

|

|

|

180,000

|

(3)

|

|

$

|

1.04

|

(4)

|

|

$

|

187,200

|

|

|

$

|

20.42

|

|

|

Common Stock, par value $0.001 per share

|

|

|

605,000

|

(3)

|

|

$

|

0.84

|

(4)

|

|

$

|

508,200

|

|

|

$

|

55.44

|

|

|

Common Stock, par value $0.001 per share

|

|

|

255,000

|

(3)

|

|

$

|

0.72

|

(4)

|

|

$

|

183,600

|

|

|

$

|

20.03

|

|

|

Common Stock, par value $0.001 per share

|

|

|

6,558

|

(5)

|

|

$

|

2.725

|

(6)

|

|

$

|

17,870.55

|

|

|

$

|

1.95

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total

|

|

|

1,233,558

|

|

|

|

|

|

|

$

|

1,377,210.55

|

|

|

$

|

150.24

|

|

|

|

(1)

|

In

accordance with Rule 416 under the Securities Act of 1933, as amended (the “Securities Act”), we are also registering

an indeterminable number of shares of common stock, par value $0.001 per share, as may be issued in connection with stock splits,

stock dividends or similar transactions.

|

|

|

|

|

|

|

(2)

|

Amount of the registration fee was calculated in accordance

with Section 6(b) and Rule 457 under the Securities Act and was determined by multiplying the aggregate offering price by 0.0001091.

|

|

|

|

|

|

|

(3)

|

Represents

shares of common stock issuable pursuant to stock option awards outstanding (i) under the 2014 Plan Amendments (as defined

herein) to the NanoVibronix, Inc. 2014 Long-Term Incentive Plan (the “2014 Plan”) or (ii) under the 2014 Plan (to

the extent such stock option awards were granted after the filing of the Company’s previous Form S-8 (File No. 333-205577)

on July 9, 2015 (the “2015 S-8”) and are not currently registered under such registration statement).

|

|

|

|

|

|

|

(4)

|

Estimated

solely for the purpose of calculating the registration fee pursuant to Rule 457(h) under the Securities Act of 1933, as amended,

and based upon the price at which such options may be exercised.

|

|

|

|

|

|

|

(5)

|

Represents

shares of common stock available for issuance pursuant to unissued stock option awards under the 2014 Plan Amendments.

|

|

|

|

|

|

|

(6)

|

Estimated

solely for the purpose of calculating the registration fee pursuant to Rule 457(c) and Rule 457(h) under the Securities Act with

respect to 6,558 shares of common stock available for issuance pursuant to unissued stock option awards under the 2014 Plan

Amendments based on the average of the high and low prices per share of common stock as reported by The Nasdaq Capital Market on

September 1, 2021.

|

EXPLANATORY

NOTE

On

February 28, 2014, the Company’s stockholders approved the 2014 Plan, which was adopted by our Board on February 19, 2014. Under

the 2014 Plan, we originally reserved a total of five million (5,000,000) shares of our common stock for issuance pursuant to awards

to key employees, key contractors, and non-employee directors, of which, the maximum number of shares of common stock covering awards

of stock options or stock appreciation rights that could be granted to certain of our executive officers during any calendar year was

one million (1,000,000) shares. On May 7, 2014, we effected a one-for-seven reverse stock split of our common stock. Consequently, the

number of shares of our common stock reserved for issuance pursuant to awards under the 2014 Plan was reduced to seven hundred fourteen

thousand two hundred eighty-six (714,286) shares, and the maximum number of shares of our common stock covered by awards of stock options

or stock appreciation rights that could be granted to certain of our executive officers during any calendar year was reduced to one hundred

forty-two thousand eight hundred fifty-seven (142,857) shares.

At

the annual meeting of the stockholders held on June 13, 2018, the stockholders approved an amendment (the “First Amendment”)

to the 2014 Plan to increase the number of shares of our common stock reserved for issuance pursuant to awards under the 2014 Plan by

an additional seven hundred and fifty thousand (750,000) shares of our common stock to one million four hundred sixty-four thousand two

hundred eighty-six (1,464,286) shares.

At

the annual meeting of the stockholders held on June 13, 2019, the stockholders approved a second amendment (the “Second Amendment”

and, together with the First Amendment, the “2014 Plan Amendments”) to increase (i) the number of shares of our common stock

available for issuance pursuant to awards under the 2014 Plan by four hundred thousand (400,000) shares of our common stock, to a total

of one million eight hundred and sixty-four thousand two hundred eighty-six (1,864,286) shares of our common stock and (ii) the maximum

number of shares of our common stock covering awards of stock options or stock appreciation rights that could be granted to certain of

our executive officers during any calendar year was increased to three hundred fifty-four thousand two hundred fourteen (354,214).

The

2014 Plan provides for the granting of incentive stock options, nonqualified stock options, stock appreciation rights, restricted stock,

restricted stock units, performance awards, dividend equivalent rights, and other awards, which may be granted singly, in combination,

or in tandem, and which may be paid in cash, shares of our common stock, or a combination of cash and shares of our common stock. The

Company has reserved a total of 1,864,286 shares of our common stock for awards under the 2014 Plan (including under the 2014 Plan Amendments),

100% of which may be delivered pursuant to incentive stock options. Certain stock option awards that had been issued under the 2014 Plan

and registered on the 2015 S-8 were later cancelled, and subsequently reissued in connection with new stock option awards; such stock

option awards are not currently registered on the 2015 S-8 and are therefore being registered on this Form S-8.

This

Registration Statement on Form S-8 (this “Registration Statement”) is being filed to register:

|

|

●

|

1,227,000

shares of our common stock to be issued upon the exercise of stock option awards outstanding (i) under the 2014 Plan Amendments or

(ii) under the 2014 Plan (to the extent such stock option awards were granted after the filing of the Company’s 2015 S-8 and

are not currently registered under such registration statement);

|

|

|

|

|

|

|

●

|

6,558

shares of common stock available for issuance pursuant to unissued

stock option awards under the 2014 Plan Amendments.

|

Pursuant to General Instruction E to Form S-8, the Registrant incorporates

by reference into this Registration Statement the contents of its registration statement, including all exhibits filed therewith or incorporated

therein by reference, filed on the 2015 S-8.

PART

II

INFORMATION

REQUIRED IN THE REGISTRATION STATEMENT

Item

3. Incorporation of Documents by Reference.

The

Securities and Exchange Commission (the “Commission”) allows us to “incorporate by reference” certain information

we have filed with the Commission into this Registration Statement, which means that we are disclosing important information to you by

referring you to other information we have filed with the Commission. The information we incorporate by reference is considered part

of this Registration Statement. We specifically are incorporating by reference the following documents filed with the Commission (excluding

those portions of any Current Report on Form 8-K that are furnished and not deemed “filed” pursuant to the General Instructions

of Form 8-K):

|

|

1.

Our Annual Report on Form 10-K for the year ended December 31, 2020, filed with the Commission on April 15, 2021;

|

|

|

|

|

|

2.

The portions of our definitive proxy statement on Schedule 14A that are deemed “filed” with the Commission under the

Securities Exchange Act of 1934, as amended (the “Exchange Act”), filed with the Commission on April 30, 2021, as revised

on July 2, 2021;

|

|

|

3.

Our Quarterly Report on Form 10-Q for the quarter ended March 31, 2021, filed with the Commission on May 24, 2021;

|

|

|

|

|

|

4.

Our Quarterly Report on Form 10-Q for the quarter ended June 30, 2021, filed with the Commission on August 16, 2021;

|

|

|

5.

Our Current Report on Form 8-K, filed with the Commission on January 5, 2021;

|

|

|

|

|

|

6.

Our Current Report on Form 8-K, filed with the Commission on January 22, 2021;

|

|

|

|

|

|

7.

Our Current Report on Form 8-K, filed with the Commission on February 2, 2021;

|

|

|

|

|

|

8. Our Current Report on Form 8-K, filed with the Commission

on April 27, 2021;

|

|

|

|

|

|

9.

Our Current Report on Form 8-K, filed with the Commission on April 28, 2021;

|

|

|

|

|

|

10.

Our Current Report on Form 8-K, filed with the Commission on May 10, 2021;

|

|

|

|

|

|

11.

Our Current Report on Form 8-K, filed with the Commission on May 27, 2021;

|

|

|

|

|

|

12.

Our Current Report on Form 8-K, filed with the Commission on June 1, 2021;

|

|

|

|

|

|

13.

Our Current Report on Form 8-K, filed with the Commission on June 22, 2021;

|

|

|

|

|

|

14.

Our Current Report on Form 8-K, filed with the Commission on August 10, 2021;

|

|

|

|

|

|

15. Our Current Report on Form 8-K, filed with the Commission

on August 17, 2021;

|

|

|

16.

Our Form 10, filed on February 9, 2015 under the Exchange Act (File

No. 000-55368); and

|

|

|

17.

The description of our common stock, which is contained in our

Form 10, filed on February 9, 2015 under the Exchange Act (File No. 000-55368), amended and supplemented by the description of

our common stock contained in Exhibit 4.14 to our Annual Report on Form 10-K for the year ended December 31, 2020, filed with the

SEC on April 15, 2021, and any amendment or report filed with the SEC for purposes of updating such description.

|

Additionally,

all documents subsequently filed by the Company pursuant to Sections 13(a), 13(c), 14 and 15(d) of the Exchange Act (other than any such

documents or portions thereof that are furnished under Item 2.02 or Item 7.01 of a Current Report on Form 8-K, unless otherwise indicated

therein, including any exhibits included with such Items), prior to the filing of a post-effective amendment which indicates that all

securities offered hereby have been sold or which deregisters all securities then remaining unsold, shall be deemed to be incorporated

herein by reference and to be a part of this Registration Statement from the date of filing of such documents. Any statement contained

in a document incorporated herein by reference will be deemed to be modified or superseded for purposes of this Registration Statement

to the extent that a statement contained herein, or in a subsequently filed document incorporated herein by reference, modifies or supersedes

the statement. Any statement modified or superseded will not be deemed, except as modified or superseded, to constitute a part of this

Registration Statement.

Item

8. Exhibits.

The

list of exhibits is set forth under “Exhibit Index” at the end of this Registration Statement and is incorporated herein

by reference.

EXHIBIT

INDEX

|

5.1*

|

|

Opinion of Haynes and Boone, LLP.

|

|

|

|

|

|

23.1*

|

|

Consent of Marcum LLP, Independent Registered Public Accounting Firm.

|

|

|

|

|

|

23.2*

|

|

Consent of Haynes and Boone, LLP (included in Exhibit 5.1).

|

|

|

|

|

|

24.1*

|

|

Power of Attorney (included in signature page).

|

|

|

|

|

|

99.1

|

|

NanoVibronix, Inc. 2014 Long-Term Incentive Plan (incorporated by reference to Exhibit 10.27 to Amendment No. 3 to the Registration Statement on Form S-1, filed with the Commission on April 30, 2014).

|

|

|

|

|

|

99.2

|

|

Form of Incentive Stock Option Award Agreement under the 2014 Long-Term Incentive Plan (incorporated by reference to Exhibit 10.40 to the Annual Report on Form 10-K, filed with the Commission on March 30, 2015).

|

|

|

|

|

|

99.3

|

|

Form of Nonqualified Stock Option Award Agreement under the 2014 Long-Term Incentive Plan (incorporated by reference to Exhibit 10.41 to the Annual Report on Form 10-K, filed with the Commission on March 30, 2015).

|

|

|

|

|

|

99.4

|

|

Form of Restricted Stock Award Agreement under the 2014 Long-Term Incentive Plan (incorporated by reference to Exhibit 10.42 to the Annual Report on Form 10-K, filed with the Commission on March 30, 2015).

|

|

|

|

|

|

99.5

|

|

Form of 3(i) Award Agreement under the Israeli Appendix to the 2014 Long-Term Incentive Plan (incorporated by reference to Exhibit 10.43 to the Annual Report on Form 10-K, filed with the Commission on March 30, 2015).

|

|

|

|

|

|

99.6

|

|

Form of 102 Award Agreement under the Israeli Appendix to the 2014 Long-Term Incentive Plan (incorporated by reference to Exhibit 10.44 to the Annual Report on Form 10-K, filed with the Commission on March 30, 2015).

|

|

|

|

|

|

99.7

|

|

First Amendment to the NanoVibronix, Inc. 2014 Long-Term Incentive Plan (incorporated by reference to Exhibit 10.1 to the Current Report on Form 8-K, filed with the Commission on June 18, 2018).

|

|

|

|

|

|

99.8

|

|

Second

Amendment to the NanoVibronix, Inc. 2014 Long-Term Incentive Plan. (incorporated by reference to Annex A to the Company’s

definitive proxy statement on Schedule 14A (SEC File No. 00001-36445), filed with the SEC on April 30, 2019).

|

*

Filed herewith.

SIGNATURES

Pursuant

to the requirements of the Securities Act, the registrant certifies that it has reasonable grounds to believe that it meets all of the

requirements for filing on Form S-8 and has duly caused this Registration Statement to be signed on its behalf by the undersigned, thereunto

duly authorized, in the City of Elmsford, State of New York, on the 2nd day of September, 2021.

|

|

NANOVIBRONIX,

INC.

|

|

|

|

|

|

|

By:

|

/s/

Brian Murphy, Ph.D.

|

|

|

|

Brian

Murphy, Ph.D.

|

|

|

|

Chief

Executive Officer

|

POWER

OF ATTORNEY

Each

person whose signature appears below constitutes and appoints Brian Murphy, Ph.D. or Stephen Brown, each with full power to act alone,

as his true and lawful attorney-in-fact and agent, with full power of substitution, for him and on his behalf and in his name, place

and stead, in any and all capacities, to execute any and all amendments (including post-effective amendments) to this Registration Statement,

including, without limitation, additional registration statements filed pursuant to Rule 462(b) under the Securities Act, and to file

the same, with all exhibits thereto and other documents in connection therewith, with the Commission, granting unto said attorney-in-fact

and agents, and each of them, full power and authority to do and perform each and every act and thing requisite and necessary to be done

in and about the premises in order to effectuate the same, as fully and to all intents and purposes as he might or could do if personally

present, hereby ratifying and confirming all that said attorneys-in-fact and agents, or either of them, or their substitute or their

substitutes, may lawfully do or cause to be done by virtue hereof.

Pursuant

to the requirements of the Securities Act this Registration Statement has been signed by the following persons in the capacities indicated

and on the 2nd day of September, 2021.

|

|

Signature

|

|

Title

|

|

|

|

|

|

|

|

/s/

Brian Murphy, Ph.D.

|

|

Chief

Executive Officer and Director

|

|

|

Brian

Murphy, Ph.D.

|

|

(Principal

Executive Officer)

|

|

|

|

|

|

|

|

/s/

Stephen Brown

|

|

Chief

Financial Officer

|

|

|

Stephen

Brown

|

|

(Principal

Financial Officer and Principal Accounting Officer)

|

|

|

|

|

|

|

|

/s/

Christopher M. Fashek

|

|

Chairman

of the Board

|

|

|

Christopher

M. Fashek

|

|

|

|

|

|

|

|

|

|

/s/

Harold Jacob, M.D.

|

|

Director

|

|

|

Harold

Jacob, M.D.

|

|

|

|

|

|

|

|

|

|

/s/

Thomas R. Mika

|

|

Director

|

|

|

Thomas

R. Mika

|

|

|

|

|

|

|

|

|

|

/s/

Michael Ferguson

|

|

Director

|

|

|

Michael

Ferguson

|

|

|

|

|

|

|

|

|

|

/s/

Martin Goldstein, M.D.

|

|

Director

|

|

|

Martin

Goldstein, M.D.

|

|

|

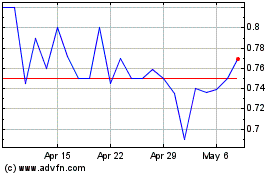

NanoVibronix (NASDAQ:NAOV)

Historical Stock Chart

From May 2024 to Jun 2024

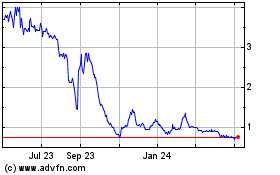

NanoVibronix (NASDAQ:NAOV)

Historical Stock Chart

From Jun 2023 to Jun 2024