0001103982FALSE00011039822024-08-222024-08-220001103982us-gaap:CommonClassAMember2024-08-222024-08-220001103982mdlz:OnePointSixTwentyFivePercentNotesDue2027Member2024-08-222024-08-220001103982mdlz:ZeroPointTwoFiftyPercentNotesDue2028Member2024-08-222024-08-220001103982mdlz:ZeroPointSevenFiftyPercentNotesDue2033Member2024-08-222024-08-220001103982mdlz:TwoPointThreeSeventyFivePercentNotesDue2035Member2024-08-222024-08-220001103982mdlz:FourPointFivePercentNotesDue2035Member2024-08-222024-08-220001103982mdlz:OnePointThreeSeventyFivePercentNotesDue2041Member2024-08-222024-08-220001103982mdlz:ThreePointEightSeventyFivePercentNotesDue2045Member2024-08-222024-08-22

| | |

|

UNITED STATES SECURITIES AND EXCHANGE COMMISSION Washington, D.C. 20549 |

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (date of earliest event reported): August 22, 2024

MONDELĒZ INTERNATIONAL, INC.

(Exact name of registrant as specified in its charter)

| | | | | | | | |

Virginia (State or other jurisdiction of incorporation) | 1-16483 (Commission File Number) | 52-2284372 (I.R.S. Employer Identification Number) |

| | |

905 West Fulton Market, Suite 200, Chicago, IL 60607 |

(Address of principal executive offices, including zip code) |

| | |

(847) 943-4000 |

(Registrant's telephone number, including area code) |

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| | | | | |

☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | | | | | | | |

Title of each class | | Trading Symbol(s) | | Name of each exchange on which registered |

| Class A Common Stock, no par value | | MDLZ | | The Nasdaq Global Select Market |

| 1.625% Notes due 2027 | | MDLZ27 | | The Nasdaq Stock Market LLC |

| 0.250% Notes due 2028 | | MDLZ28 | | The Nasdaq Stock Market LLC |

| 0.750% Notes due 2033 | | MDLZ33 | | The Nasdaq Stock Market LLC |

| 2.375% Notes due 2035 | | MDLZ35 | | The Nasdaq Stock Market LLC |

| 4.500% Notes due 2035 | | MDLZ35A | | The Nasdaq Stock Market LLC |

| 1.375% Notes due 2041 | | MDLZ41 | | The Nasdaq Stock Market LLC |

| 3.875% Notes due 2045 | | MDLZ45 | | The Nasdaq Stock Market LLC |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (17 CFR §230.405) or Rule 12b-2 of the Securities Exchange Act of 1934 (17 CFR §240.12b-2).

Emerging growth company ☐

| | |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐ |

|

Item 8.01. Other Events.

On August 22, 2024, we announced and priced an offering (the “Notes Offering”) of senior notes due 2034 (the “Notes”).

In connection with the Notes Offering, on August 22, 2024, we entered into a Terms Agreement in respect of the Notes (the “Terms Agreement”) with BBVA Securities Inc., J.P. Morgan Securities LLC, Mizuho Securities USA LLC, and Wells Fargo Securities, LLC, as representatives of the several underwriters named therein (the “Underwriters”), pursuant to which we agreed to issue and sell the Notes to the Underwriters. The provisions of an Amended and Restated Underwriting Agreement dated as of February 28, 2011 (the “Underwriting Agreement”) are incorporated by reference into the Terms Agreement. A copy of the Underwriting Agreement is filed as Exhibit 1.1, and a copy of the Terms Agreement is filed as Exhibit 1.2 to this Current Report.

We have filed with the Securities and Exchange Commission (the “SEC”) a Prospectus, dated as of February 27, 2023, and a Prospectus Supplement for the Notes, dated as of August 22, 2024, each of which forms a part of our Registration Statement on Form S-3 (Registration No. 333-270063) (the “Registration Statement”) in connection with the offering of the Notes. We are filing the items listed below as exhibits to this Current Report for the purpose of incorporating them as exhibits to the Registration Statement.

We expect the Notes Offering to close on August 28, 2024, subject to the satisfaction of customary closing conditions.

Item 9.01. Financial Statements and Exhibits.

(d) The following exhibits are being filed with this Current Report on Form 8-K.

| | | | | | | | |

Exhibit

Number | | Description |

1.1 | | |

1.2 | | |

104 | | The cover page from Mondelēz International, Inc.’s Current Report on Form 8-K, formatted in Inline XBRL (included as Exhibit 101). |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | | | | |

| MONDELĒZ INTERNATIONAL, INC. | |

| | | |

| | | |

| By: | /s/ Luca Zaramella |

| Name: | Luca Zaramella | |

| Title: | Executive Vice President and Chief Financial Officer |

Date: August 23, 2024

Exhibit 1.2

Execution Version

MONDELĒZ INTERNATIONAL, INC.

(the “Company”)

Debt Securities

TERMS AGREEMENT

(this “Agreement”)

August 22, 2024

To: The Representatives of the Underwriters identified herein

Ladies and Gentlemen:

The undersigned agrees to sell to the several Underwriters named in Schedule A hereto for their respective accounts, on and subject to the terms and conditions of the Amended and Restated Underwriting Agreement relating to debt securities covered by the Company’s registration statement on Form S-3 (File No. 333-270063) (incorporated by reference to Exhibit 1.1 to the Company’s registration statement on Form S-3 (File No. 333-172488) filed on February 28, 2011) (the “Underwriting Agreement”), the following securities (the “Offered Securities”) on the following terms (unless otherwise defined herein, terms defined in the Underwriting Agreement are used herein as therein defined):

OFFERED SECURITIES

Title:

4.750% Notes due 2034 (the “Notes”).

Principal Amount:

$500,000,000 aggregate principal amount of the Notes.

Interest:

Interest on the Notes is payable semi-annually in arrears in equal installments on February 28 and August 28 of each year, commencing February 28, 2025 until the Maturity Date for the Notes, provided that if any such date (other than the Maturity Date or a date fixed for redemption) is not a business day, the interest payment date will be postponed to the next succeeding business day, and no interest will accrue as a result of such delayed payment on amounts payable from and after such interest payment date to the next succeeding business day. The Notes will bear interest at the rate of 4.750% per annum. Interest on the Notes will accrue from August 28, 2024.

For a full semi-annual interest period, interest on the Notes will be computed on the basis of a 360-day year of twelve 30-day months and for any period that is not a full semi-annual interest period, interest on the Notes will be computed on the basis of a 365-day year and the actual number of days in such interest period.

Interest on the Notes will be paid to the persons in whose names such Notes are registered at the close of business on the date that is 15 days prior to the relevant interest payment date (or to the applicable depositary, as the case may be).

Maturity Date:

The Notes will mature on August 28, 2034.

Currency of Denomination:

The Notes will be denominated in United States Dollars ($).

Currency of Payment:

All payments of interest and principal, including payments made upon any redemption of the Notes, will be made in United States Dollars ($).

Form and Denomination:

Book-entry form only represented by one or more global securities deposited with The Depository Trust Company, including its participants Clearstream or Euroclear, or their respective designated custodian, in minimum denominations of $2,000 and integral multiples of $1,000 in excess thereof.

Change of Control:

Upon the occurrence of a Change of Control Triggering Event (as defined in the Pricing Prospectus), the Company will be required to make an offer to purchase the Notes at a price equal to 101% of the aggregate principal amount of such Notes repurchased, plus accrued and unpaid interest, if any, on the Notes repurchased, to the date of repurchase as and to the extent set forth in the Pricing Prospectus under the caption “Description of Notes—Change of Control.”

Optional Redemption:

Prior to the Par Call Date (as defined below), the Company may redeem the Notes, at its option, in whole or in part, at any time and from time to time, at the redemption prices described under the caption “Description of Notes—Optional Redemption” in the Pricing Prospectus.

On or after the Par Call Date, the Company may redeem the Notes, at its option, in whole or in part, at any time and from time to time, at a redemption price equal to 100%

of the principal amount of such Notes being redeemed, plus accrued and unpaid interest, if any, thereon to, but excluding, the redemption date.

“Par Call Date” means May 28, 2034 (the date that is three months prior to the scheduled maturity date for the Notes).

Conversion Provisions:

None.

Sinking Fund:

None.

Listing:

None.

Purchase Price:

99.429% of the principal amount of the Notes, plus accrued interest, if any, from August 28, 2024.

Expected Reoffering Price:

99.779% of the principal amount of the Notes, plus accrued interest, if any, from August 28, 2024.

OTHER MATTERS

Closing:

9:00 a.m., New York City time, on August 28, 2024, at the offices of Simpson Thacher & Bartlett LLP, 425 Lexington Avenue, New York, New York 10017. Payment for the Notes will be made in Federal (same day) funds.

Settlement and Trading:

Book-Entry only via DTC, Clearstream or Euroclear.

Names and Addresses of the Representatives and Lead Underwriters:

BBVA Securities Inc.

1345 Avenue of the Americas, 44th Floor

New York, New York 10105

Attention: US Debt Capital Markets

J.P. Morgan Securities LLC

383 Madison Avenue

New York, New York 10179

Attention: Investment Grade Syndicate Desk

Facsimile: (212) 834-6081

Mizuho Securities USA LLC

1271 Avenue of the Americas

New York, New York 10020

Attention: Debt Capital Markets

Facsimile: (212) 205-7812

Wells Fargo Securities, LLC

550 South Tryon Street, 5th Floor

Charlotte, North Carolina 28202

Attention: Transaction Management

Email: tmgcapitalmarkets@wellsfargo.com

The respective principal amounts of the Offered Securities to be severally purchased by each of the Underwriters, on and subject to the terms and conditions of the Underwriting Agreement, are set forth opposite their names in Schedule A hereto.

The provisions of the Underwriting Agreement are incorporated herein by reference, except that:

(1)The definition of “Pricing Prospectus” in Section 2(a) is hereby replaced as follows: “; the Preliminary Prospectus that was included in the Registration Statement immediately prior to the Applicable Time (as defined below), including the preliminary prospectus supplement relating to the Securities and the Base Prospectus, is hereinafter called the “Pricing Prospectus.””

(2)The definition of “Prospectus” in Section 2(a) is hereby replaced as follows: “; and the final prospectus, in the form first filed pursuant to Rule 424(b) under the Act, including the final prospectus supplement relating to the Securities and the Base Prospectus, is hereinafter called the “Prospectus.””

(3)The definition of “Issuer Free Writing Prospectus” in Section 2(a) is hereby replaced as follows: ““Issuer Free Writing Prospectus” means any “issuer free writing prospectus,” as defined in Rule 433 under the Act (including any electronic roadshow).”

(4)Section 2(x) of the Underwriting Agreement is hereby replaced in its entirety as follows:

“(x) Except as otherwise disclosed in the Pricing Prospectus and the Prospectus, (i) to the knowledge of the Company after due inquiry, neither the Company nor any of its subsidiaries nor any director, officer, agent, employee or affiliate of the Company or any of its subsidiaries is aware of or has taken any action, directly or indirectly, that would result in a violation by such persons (A) of the Foreign Corrupt Practices Act of 1977, as amended, and the rules and regulations thereunder (the “FCPA”), including,

without limitation, making use of the mails or any means or instrumentality of interstate commerce corruptly in furtherance of an offer, payment, promise to pay or authorization of the payment of any money, or other property, gift, promise to give, or authorization of the giving of anything of value to any “foreign official” (as such term is defined in the FCPA) or any foreign political party or official thereof or any candidate for foreign political office, in contravention of the FCPA; (B) the U.K. Bribery Act 2010 (the “Bribery Act”); or (C) any other applicable anti-bribery or corruption law of any jurisdiction and (ii) the Company, its subsidiaries and, to the knowledge of the Company after due inquiry, its affiliates have conducted and will continue to conduct their businesses in compliance in all material respects with the FCPA, the Bribery Act and other applicable anti-bribery and corruption laws, and have instituted and maintain policies and procedures designed to ensure, and which are reasonably expected to continue to ensure, continued compliance therewith.”

(5)Section 2(z) of the Underwriting Agreement is hereby replaced in its entirety as follows:

“(z) None of the Company, any of its subsidiaries or, to the knowledge of the Company, any director, officer, agent, employee or affiliate of the Company or any of its subsidiaries is an individual or entity (“Person”) currently the target of any sanctions (each, a “Sanctions Target”), or owned 50% or more or otherwise controlled by, or acting on behalf of one or more Persons subject to or the target of any sanctions, including, without limitation, sanctions enforced by the United States Government such as the U.S. Department of the Treasury’s Office of Foreign Assets Control, as well as sanctions enforced by the United Nations Security Council, the European Union, or His Majesty’s Treasury (collectively, “Sanctions”); nor is the Company or any of its subsidiaries located, organized, or resident in a country or territory that is the subject of comprehensive Sanctions, including the territories referred to as the People’s Republic of Donetsk, the People’s Republic of Luhansk, the non-government controlled areas of the Kherson and Zaporizhzhia Regions and any other Covered Region of Ukraine identified pursuant to Executive Order 14065; and, except as permitted by a competent government agency or department, pursuant to license, regulatory exemption or other applicable provision of law, the Company will not directly or indirectly use the proceeds of the sale of the Securities, or lend, contribute, or otherwise make available such proceeds to any subsidiaries, joint venture partners, or other Person, (i) for the purpose of funding or facilitating any activities of or business with any Person that, at the time of such funding or facilitation, is a Sanctions Target, (ii) for the purpose of funding or facilitating any activities of or business in any country or territory that is the subject of comprehensive Sanctions, including the territories referred to as the People’s Republics of Donetsk and the People’s Republic of Luhansk, the non-government controlled areas of the Kherson and Zaporizhzhia Regions and any other Covered Region of Ukraine identified pursuant to Executive Order 14065 or (iii) in any other manner that will result in a violation by any Person (including any Person participating in the transaction, whether as underwriter, advisor, investor or otherwise) of Sanctions.”

(6)Section 5(d) of the Underwriting Agreement is hereby replaced in its entirety as follows:

“(d) The Representatives shall have received an opinion, dated the Closing Date, from: (i) Hunton Andrews Kurth LLP, Virginia legal counsel to the Company, with respect to the matters set forth in Exhibit A and (ii) Gibson, Dunn & Crutcher LLP, New York legal counsel to the Company, with respect to the matters set forth in Exhibit B.”

(7)Each of Section 6(a) and Section 6(b) of the Underwriting Agreement is hereby amended to replace “directors and officers” in the first sentence thereof with “directors, officers, employees, agents and affiliates,” and Section 6(a) of the Underwriting Agreement is further amended to replace “Underwriter” the fourth and fifth time it appears in such section with “indemnified person” and to replace “any Issuer Free Writing Prospectus or any “issuer information” filed or required to be filed” in the first sentence thereof with “any Issuer Free Writing Prospectus, or any “issuer information” filed or required to be filed.”

(8)Notwithstanding anything in Section 4(h) of the Underwriting Agreement to the contrary, the Company covenants and agrees with the several Underwriters that the Company will pay or cause to be paid the following: (i) the fees, disbursements and expenses of the Company’s counsel and accountants in connection with the registration of the Offered Securities under the Act and all other expenses in connection with the preparation, printing, reproduction and filing of the Base Prospectus, any Preliminary Prospectus, any Issuer Free Writing Prospectus, the Prospectus and amendments and supplements thereto and the mailing and delivering of copies thereof to the Underwriters and dealers; (ii) any fees charged by securities rating services for rating the Offered Securities; (iii) the cost of preparing the Securities; (iv) the fees and expenses of the Trustee and any paying agent or sub-paying agent (the “Paying Agent”) and any agent of the Trustee or the Paying Agent and the fees and disbursements of counsel for the Trustee and the Paying Agent in connection with the Indenture and the Securities; and (v) all other costs and expenses incident to the performance of its obligations hereunder which are not otherwise specifically provided for in this Section. It is understood, however, that, except as provided in this paragraph, and Sections 6 and 8 of the Underwriting Agreement, the Underwriters will pay all of their own costs and expenses, including the fees of their counsel and any advertising expenses connected with any offers they may make.

(9)Section 10 of the Underwriting Agreement is hereby replaced in its entirety as follows:

“10. Notices. All communications hereunder will be in writing and, if sent to the Underwriters, will be mailed, delivered, telecopied or transmitted by any other standard form of telecommunication and confirmed to the Representatives at their address set forth in the Terms Agreement, or, if sent to the Company, will be mailed, delivered, telecopied or transmitted by any other standard form of telecommunication (including email) and confirmed to it at 905 West Fulton Market, Suite 200, Chicago, Illinois 60607, facsimile: (570) 235-3005, email: corporate.secretary@mdlz.com, Attention: Corporate Secretary.”

In addition to the representations and warranties contained in Section 2 of the Underwriting Agreement, the Company, as of the date hereof and as of the Closing Date, represents and warrants to, and agrees with, each Underwriter that the interactive data in

eXtensible Business Reporting Language incorporated by reference in the Registration Statement, the Pricing Prospectus and the Prospectus fairly presents the information called for in all material respects and has been prepared in accordance with the Commission’s rules and guidelines applicable thereto. Signatures to this Agreement transmitted by facsimile transmission, by electronic mail in “.pdf” form, or by any other electronic means intended to preserve the original graphic and pictorial appearance of a document, shall have the same effect as physical delivery of the paper document bearing the original signatures.

All references to “Kraft Foods Inc.” in the Underwriting Agreement shall be deemed to refer to Mondelēz International, Inc.

All references to the Indenture, dated as of October 17, 2001, between the Company and Deutsche Bank Trust Company Americas (as successor to The Bank of New York and The Chase Manhattan Bank) in the Underwriting Agreement shall be deemed to refer to the Indenture, dated as of March 6, 2015, between the Company and Deutsche Bank Trust Company Americas, as amended and supplemented through to the date hereof.

For purposes of the Underwriting Agreement, the “Applicable Time” shall be 3:10 p.m. (New York City time) on August 22, 2024.

The Offered Securities will be made available for inspection at the offices of Simpson Thacher & Bartlett LLP, 425 Lexington Avenue, New York, New York 10017, prior to the Closing Date.

For purposes of Section 6 of the Underwriting Agreement, the only Underwriter Information consists of the following information in the Prospectus: the information contained in the sixth, seventh and eighth paragraphs under the caption “Underwriting” in the Pricing Prospectus.

Recognition of U.S. Special Resolution Regimes:

In the event that any Underwriter that is a Covered Entity (as defined below) becomes subject to a proceeding under a U.S. Special Resolution Regime (as defined below), the transfer from such Underwriter of this Agreement, and any interest and obligation in or under this Agreement, will be effective to the same extent as the transfer would be effective under the U.S. Special Resolution Regime if this Agreement, and any such interest and obligation, were governed by the laws of the United States or a state of the United States.

In the event that any Underwriter that is a Covered Entity or a BHC Act Affiliate (as defined below) of such Underwriter becomes subject to a proceeding under a U.S. Special Resolution Regime, Default Rights (as defined below) under this Agreement that may be exercised against such Underwriter are permitted to be exercised to no greater extent than such Default Rights could be exercised under the U.S. Special Resolution Regime if this Agreement were governed by the laws of the United States or a state of the United States.

“BHC Act Affiliate” has the meaning assigned to the term “affiliate” in, and shall be interpreted in accordance with, 12 U.S.C. § 1841(k).

“Covered Entity” means any of the following:

(i)a “covered entity” as that term is defined in, and interpreted in accordance with, 12 C.F.R. § 252.82(b);

(ii)a “covered bank” as that term is defined in, and interpreted in accordance with, 12 C.F.R. § 47.3(b); or

(iii)a “covered FSI” as that term is defined in, and interpreted in accordance with, 12 C.F.R. § 382.2(b).

“Default Right” has the meaning assigned to that term in, and shall be interpreted in accordance with, 12 C.F.R. §§ 252.81, 47.2 or 382.1, as applicable.

“U.S. Special Resolution Regime” means each of (i) the Federal Deposit Insurance Act and the regulations promulgated thereunder and (ii) Title II of the Dodd-Frank Wall Street Reform and Consumer Protection Act and the regulations promulgated thereunder.

Recognition of EU Bail-In Powers:

Notwithstanding, and to the exclusion of, any other term of this Agreement or any other agreements, arrangements, or understandings among the parties hereto, each of the Company and the Underwriters acknowledges and accepts that a BRRD Liability arising under this Agreement may be subject to the exercise of Bail-in Power by the Relevant Resolution Authority, and acknowledges, accepts, and agrees to be bound by:

(1) the effect of the exercise of Bail-in Powers by the Relevant Resolution Authority in relation to any BRRD Liability of each Covered Underwriter to the Company under this Agreement, that (without limitation) may include and result in any of the following, or some combination thereof: (i) the reduction of all, or a portion, of the BRRD Liability or outstanding amounts due thereon; (ii) the conversion of all, or a portion, of the BRRD Liability into shares, other securities or other obligations of the relevant Covered Underwriter or another person, and the issue to or conferral on the Company of such shares, securities or obligations; (iii) the cancellation of the BRRD Liability; or (iv) the amendment or alteration of any interest, if applicable, thereon, or the dates on which any payments are due, including by suspending payment for a temporary period;

(2) the variation of the terms of this Agreement as they relate to any BRRD Liability of a Covered Underwriter, as deemed necessary by the Relevant Resolution Authority, to give effect to the exercise of the Bail-in Powers by the Relevant Resolution Authority.

For the purposes of this subsection,

“Bail-in Legislation” means in relation to a member state of the European Economic Area which has implemented, or which at any time implements, the BRRD, the relevant implementing law, regulation, rule or requirement as described in the EU Bail-in Legislation Schedule from time to time.

“Bail-in Powers” means any Write-down and Conversion Powers as defined in the EU Bail-in Legislation Schedule, in relation to the relevant Bail-in Legislation.

“BRRD” means Directive 2014/59/EU establishing a framework for the recovery and resolution of credit institutions and investment firms.

“BRRD Liability” means a liability in respect of which the relevant Write Down and Conversion Power in the applicable Bail-in Legislation may be exercised.

“Covered Underwriter” means any Underwriter subject to the Bail-In Legislation.

“EU Bail-in Legislation Schedule” means the document described as such, then in effect, and published by the Loan Market Association (or any successor person) from time to time at http://www.lma.eu.com/documents-guidelines/eu-bail-legislation-schedule.

“Relevant Resolution Authority” means the resolution authority with the ability to exercise any Bail-in Powers in relation to the relevant Covered Underwriter.

U.K. Bail-in Legislation:

Notwithstanding and to the exclusion of any other term of this Agreement or any other agreements, arrangements, or understanding between the Underwriters and the Company, the Company acknowledges and accepts that a UK Bail-in Liability arising under this Agreement may be subject to the exercise of UK Bail-in Powers by the relevant UK resolution authority, and acknowledges, accepts, and agrees to be bound by:

(1) the effect of the exercise of UK Bail-in Powers by the relevant UK resolution authority in relation to any UK Bail-in Liability of the Underwriters to the Company under this Agreement, that (without limitation) may include and result in any of the following, or some combination thereof:

(a) the reduction of all, or a portion, of the UK Bail-in Liability or outstanding amounts due thereon;

(b) the conversion of all, or a portion, of the UK Bail-in Liability into shares, other securities or other obligations of the Underwriters or another person, and the issue to or conferral on the Issuer of such shares, securities or obligations;

(c) the cancellation of the UK Bail-in Liability;

(d) the amendment or alteration of any interest, if applicable, thereon, the maturity or the dates on which any payments are due, including by suspending payment for a temporary period;

(2) the variation of the terms of this Agreement, as deemed necessary by the relevant UK resolution authority, to give effect to the exercise of UK Bail-in Powers by the relevant UK resolution authority.

For the purpose of this subsection, (1) “UK Bail-in Legislation” means Part I of the UK Banking Act 2009 and any other law or regulation applicable in the UK relating to the resolution of unsound or failing banks, investment firms or other financial institutions or their affiliates (otherwise than through liquidation, administration or other insolvency proceedings); (2) “UK Bail-in Powers” means the powers under the UK Bail-in Legislation to cancel, transfer or dilute shares issued by a person that is a bank or investment firm or affiliate of a bank or investment firm, to cancel, reduce, modify or change the form of a liability of such a person or any contract or instrument under which that liability arises, to convert all or part of that liability into shares, securities or obligations of that person or any other person, to provide that any such contract or instrument is to have effect as if a right had been exercised under it to suspend any obligation in respect of that liability; and (3) “UK Bail-in Liability” means a liability in respect of which the UK Bail-in Powers may be exercised.

(Remainder of page intentionally left blank)

If the foregoing is in accordance with your understanding of our agreement, kindly sign and return to the Company one of the counterparts hereof, whereupon it will become a binding agreement between the Company and the several Underwriters in accordance with its terms.

| | | | | |

| Very truly yours, |

| |

| MONDELĒZ INTERNATIONAL, INC. |

| |

| |

| By: | /s/ Vitus Alig |

| Name: Vitus Alig |

| Title: Senior Vice President, Global FP&A and Treasurer |

[SIGNATURE PAGE TO TERMS AGREEMENT]

| | | | | | | | |

| The foregoing Terms Agreement is hereby confirmed and accepted as of the date first above written. |

| | |

| BBVA SECURITIES INC. |

| | |

| By: | /s/ Scott D. Whitney |

| Name:

Title: | Scott D. Whitney

Managing Director |

| | |

| | |

| J.P. MORGAN SECURITIES LLC |

| | |

| By: | /s/ Robert Bottamedi |

| Name:

Title: | Robert Bottamedi

Executive Director |

| | |

| | |

| MIZUHO SECURITIES USA LLC |

| | |

| By: | /s/ Colby Griffith |

| Name:

Title: | Colby Griffith Managing Director |

| | |

| | |

| WELLS FARGO SECURITIES, LLC |

| | |

| By: | /s/ Carolyn Hurley |

| Name:

Title: | Carolyn Hurley

Managing Director

|

| | |

| | |

| | |

| Acting on behalf of themselves and as the Representatives of the several Underwriters. |

[SIGNATURE PAGE TO TERMS AGREEMENT]

SCHEDULE A

| | | | | | | | |

| Underwriters | | Principal Amount of Notes |

| BBVA Securities Inc. | | $ 92,500,000 |

| J.P. Morgan Securities LLC | | 92,500,000 |

| Mizuho Securities USA LLC | | 92,500,000 |

| Wells Fargo Securities, LLC | | 92,500,000 |

NatWest Markets Securities Inc. | | 25,000,000 |

| Standard Chartered Bank | | 25,000,000 |

| SMBC Nikko Securities America, Inc. | | 25,000,000 |

| Truist Securities, Inc. | | 25,000,000 |

| Bancroft Capital, LLC | | 10,000,000 |

| Blaylock Van, LLC | | 10,000,000 |

| C.L. King & Associates, Inc. | | 10,000,000 |

Total | | $500,000,000 |

EXHIBIT A

Form of Opinion of Hunton Andrews Kurth LLP

1.The Company is a corporation validly existing and, based solely on the Good Standing Certificate, in good standing under the laws of the Commonwealth of Virginia as of the date of such certificate, and has the corporate power and authority to own or hold its properties and to conduct the businesses in which it is engaged as described in the Prospectus.

2.No filing with, notice to, or consent, approval, authorization or order of any governmental agency or body or official of the Commonwealth of Virginia or, to our knowledge, any court thereof, is required to be made or obtained in connection with the execution, delivery and performance of the Terms Agreement or the consummation of the transactions contemplated by the Terms Agreement, except as may be required under the blue sky laws of the Commonwealth of Virginia (as to which we express no opinion).

3.The Terms Agreement, the Indenture and the Notes have been duly authorized, executed and delivered by the Company.

4.None of the execution and delivery by the Company of the Terms Agreement, the consummation by the Company of the transactions contemplated by the Terms Agreement and the Indenture, or the issuance and sale of the Notes or compliance with the terms and provisions thereof, will (a) violate the Articles of Incorporation or the By-Laws or (b) violate any law, rule, regulation or order, known to us to be applicable to the Company, of any Virginia court or governmental agency under the laws of the Commonwealth of Virginia.

EXHIBIT B

Form of Opinion of Gibson, Dunn & Crutcher LLP

1.Each subsidiary of the Company listed on Annex A (each, a “Significant Subsidiary”) is a validly existing limited liability company in good standing under the laws of the State of Delaware with the requisite limited liability company or other power and authority to own its properties and conduct its business as described in the Prospectus.

2.The Indenture constitutes a legal, valid and binding obligation of the Company, enforceable against the Company in accordance with its terms.

3.The Notes, when executed and authenticated in accordance with the provisions of the Indenture and delivered to and paid for by the Underwriters in accordance with the terms of the Underwriting Agreement, will be legal, valid and binding obligations of the Company, enforceable against the Company in accordance with their terms.

4.The Note Documents have been duly executed by the Company, to the extent such actions are governed by the laws of the State of New York.

5.The execution and delivery by the Company of the Note Documents to which it is a party, the performance of its obligations thereunder, and the issuance by the Company of the Notes to the Underwriters:

(i)do not and will not result in a breach of or default under any agreement to which the Company is a party that is identified to us in a certificate of the Company as being material to the Company and its subsidiaries taken as a whole, which agreements are listed on Annex B; and

(ii)do not and will not violate, or require any filing with or approval of any governmental authority or regulatory body of the State of New York or the United States of America under, any law, rule or regulation of the State of New York or the United States of America applicable to the Company that, in our experience, is generally applicable to transactions in the nature of those contemplated by the Underwriting Agreement, except for such filings or approvals as already have been made or obtained under the Securities Act of 1933, as amended (the “Securities Act”).

6.Insofar as the statements in the Pricing Disclosure Package and the Prospectus under the caption “Description of Notes” and “Description of Debt Securities” purport to describe specific provisions of the Notes or the Indenture, such statements present in all material respects an accurate summary of such provisions.

7.Insofar as the statements in the Pricing Disclosure Package and the Prospectus under the caption “Certain U.S. Federal Income Tax Considerations” purport to describe specific provisions of the Internal Revenue Code of 1986, as amended, or the rules and regulations thereunder, or legal conclusions with respect thereto, such statements present in all material respects an accurate summary of such provisions or conclusions.

8.The Company is not and, after giving effect to the sale of the Notes and the use of proceeds therefrom as described in the Prospectus, will not be an “investment company” that is required to be registered under the Investment Company Act of 1940, as amended (the “Investment Company Act”). For purposes of this paragraph 8, the term “investment company” has the meanings ascribed to such term in the Investment Company Act.

9.On the basis of the foregoing, and except for the financial statements and schedules, statistical information that is purported to have been provided on the authority of an expert or public official and other information of an accounting or financial nature and the Statement of Eligibility on Form T-1 of the Trustee included or incorporated by reference therein, as to which we express no opinion or belief, no facts have come to our attention that led us to believe: (a) that the Registration Statement, at the time it became effective (which, for purposes of this letter, shall mean February 15, 2024), or the Prospectus, as of the date of the Final Prospectus Supplement, were not appropriately responsive in all material respects to the requirements of the Securities Act and the Trust Indenture Act and the applicable rules and regulations of the Commission thereunder; or (b)(i) that the Registration Statement, at the time it became effective, contained an untrue statement of a material fact or omitted to state a material fact required to be stated therein, or necessary to make the statements therein not misleading, (ii) that the General Disclosure Package, at the Applicable Time, included an untrue statement of a material fact or omitted to state a material fact necessary to make the statements therein, in the light of the circumstances under which they were made, not misleading or (iii) that the Prospectus, as of its date or as of the date hereof, included or includes an untrue statement of a material fact or omitted or omits to state a material fact necessary in order to make the statements therein, in the light of the circumstances under which they were made, not misleading.

v3.24.2.u1

Cover

|

Aug. 22, 2024 |

| Document Information [Line Items] |

|

| Document Type |

8-K

|

| Document Period End Date |

Aug. 22, 2024

|

| Entity Registrant Name |

MONDELĒZ INTERNATIONAL, INC.

|

| Entity Incorporation, State or Country Code |

VA

|

| Entity Address, Address Line One |

905 West Fulton Market, Suite 200

|

| Entity Address, City or Town |

Chicago

|

| Entity Address, State or Province |

IL

|

| Entity Address, Postal Zip Code |

60607

|

| City Area Code |

847

|

| Local Phone Number |

943-4000

|

| Entity File Number |

1-16483

|

| Entity Tax Identification Number |

52-2284372

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Entity Emerging Growth Company |

false

|

| Amendment Flag |

false

|

| Entity Central Index Key |

0001103982

|

| Class A Common Stock, no par value |

|

| Document Information [Line Items] |

|

| Title of 12(b) Security |

Class A Common Stock, no par value

|

| Trading Symbol |

MDLZ

|

| Security Exchange Name |

NASDAQ

|

| 1.625% Notes due 2027 |

|

| Document Information [Line Items] |

|

| Title of 12(b) Security |

1.625% Notes due 2027

|

| Trading Symbol |

MDLZ27

|

| Security Exchange Name |

NASDAQ

|

| 0.250% Notes due 2028 |

|

| Document Information [Line Items] |

|

| Title of 12(b) Security |

0.250% Notes due 2028

|

| Trading Symbol |

MDLZ28

|

| Security Exchange Name |

NASDAQ

|

| 0.750% Notes due 2033 |

|

| Document Information [Line Items] |

|

| Title of 12(b) Security |

0.750% Notes due 2033

|

| Trading Symbol |

MDLZ33

|

| Security Exchange Name |

NASDAQ

|

| 2.375% Notes due 2035 |

|

| Document Information [Line Items] |

|

| Title of 12(b) Security |

2.375% Notes due 2035

|

| Trading Symbol |

MDLZ35

|

| Security Exchange Name |

NASDAQ

|

| 4.500% Notes due 2035 |

|

| Document Information [Line Items] |

|

| Title of 12(b) Security |

4.500% Notes due 2035

|

| Trading Symbol |

MDLZ35A

|

| Security Exchange Name |

NASDAQ

|

| 1.375% Notes due 2041 |

|

| Document Information [Line Items] |

|

| Title of 12(b) Security |

1.375% Notes due 2041

|

| Trading Symbol |

MDLZ41

|

| Security Exchange Name |

NASDAQ

|

| 3.875% Notes due 2045 |

|

| Document Information [Line Items] |

|

| Title of 12(b) Security |

3.875% Notes due 2045

|

| Trading Symbol |

MDLZ45

|

| Security Exchange Name |

NASDAQ

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=us-gaap_CommonClassAMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=mdlz_OnePointSixTwentyFivePercentNotesDue2027Member |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=mdlz_ZeroPointTwoFiftyPercentNotesDue2028Member |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=mdlz_ZeroPointSevenFiftyPercentNotesDue2033Member |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=mdlz_TwoPointThreeSeventyFivePercentNotesDue2035Member |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=mdlz_FourPointFivePercentNotesDue2035Member |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=mdlz_OnePointThreeSeventyFivePercentNotesDue2041Member |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=mdlz_ThreePointEightSeventyFivePercentNotesDue2045Member |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

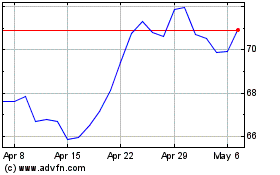

Mondelez (NASDAQ:MDLZ)

Historical Stock Chart

From Nov 2024 to Dec 2024

Mondelez (NASDAQ:MDLZ)

Historical Stock Chart

From Dec 2023 to Dec 2024