false

0001760542

0001760542

2024-06-04

2024-06-04

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of

the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported):

June 4, 2024

HOOKIPA Pharma Inc.

(Exact name of registrant as specified

in its Charter)

| Delaware |

|

001-38869 |

|

81-5395687 |

(State

or Other Jurisdiction

of Incorporation) |

|

(Commission

File Number) |

|

(IRS

Employer

Identification No.) |

350

Fifth Avenue, 72nd Floor,

Suite 7240 |

|

|

| New York, New York |

|

10118 |

| (Address of Principal Executive Offices) |

|

(Zip Code) |

Registrant’s telephone number, including

area code: +43 1

890 63 60

Not applicable

(Former Name or Former Address, if Changed

Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under

any of the following provisions (see General Instructions A.2. below):

| ¨ | Written communications pursuant to Rule 425 under the Securities

Act (17 CFR 230.425) |

| ¨ | Soliciting material pursuant to Rule 14a-12 under the

Exchange Act (17 CFR 240.14a-12) |

| ¨ | Pre-commencement communications pursuant to Rule 14d-2(b) under

the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ | Pre-commencement communications pursuant to Rule 13e-4(c) under

the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of

the Act:

| Title of each

class |

|

Trading

Symbol(s) |

|

Name

of each exchange

on which registered |

| Common Stock, $0.0001 par value per share |

|

HOOK |

|

The Nasdaq Capital Market |

Indicate by check mark whether the registrant is an emerging growth

company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b-2 of the Securities

Exchange Act of 1934 (§ 240.12b-2 of this chapter).

Emerging growth company x

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

Item 7.01 Regulation FD Disclosure.

On June 4, 2024, HOOKIPA Pharma Inc. (the

“Company”) issued a press release entitled “HOOKIPA Pharma Announces Updated Phase 2 Clinical Data at the American Society

for Clinical Oncology 2024 Annual Meeting.” A copy of the press release is attached to this Current Report on Form 8-K as Exhibit 99.1

and is incorporated by reference into this Item 7.01. An updated presentation summarizing the data referenced in the press release is

also available on the investor relations section of the Company’s corporate website at www.ir.hookipapharma.com.

The information in this Item 7.01 and Exhibit 99.1

attached hereto is furnished and shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act

of 1934, as amended (the “Exchange Act”) or otherwise subject to the liabilities of that section, nor shall it be deemed incorporated

by reference in any filing under the Securities Act of 1933, as amended, or the Exchange Act, except as expressly set forth by specific

reference in such filing.

Item 8.01 Other Events.

On June 4, 2024, the Company announced updated

results from its Phase 2 clinical trial of HB-200 in combination with pembrolizumab in patients with recurrent/metastatic human papillomavirus

16 positive (“HPV16+”) head and neck cancer.

Data were presented as of March 29, 2024,

and included 46 first line patients with HPV16+, PD-L1 positive, recurrent or metastatic head and neck squamous cell carcinoma. The updated

data continue to demonstrate a favorable safety profile of HB-200 in combination with pembrolizumab and promising clinical activity as

a first line treatment.

HB-200 + pembrolizumab was generally well tolerated.

Grade ≥3 treatment-related adverse events (“TRAEs”) were reported in 7 (15%) patients, serious TRAEs in 2 (4%) patients,

and TRAEs leading to treatment discontinuation of HB-200 in 2 (4%) patients. No treatment-related deaths were reported.

Among 35 evaluable patients, 4 confirmed complete

responses, 9 confirmed partial responses, and 11 confirmed stable disease were observed. Notably, among patients with PD-L1 CPS ≥20

(N=17), objective response rate was 53% (9/17), complete response rate was 18% (3/17), and disease control rate was 82% (14/17). All responses

were confirmed per RECIST 1.1. Preliminary progression free survival for the CPS 20 or higher subgroup was 16.3 months. The preliminary

overall survival (“OS”) rate was 88% at 9 months, and median OS was unreached as of the cutoff date, with 16 of 19 patients

still alive. Median follow-up for these patients was 8.4 months.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits

SIGNATURES

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

Date: June 4, 2024 |

HOOKIPA Pharma Inc. |

| |

|

|

| |

By: |

/s/ Joern Aldag |

| |

Name: |

Joern Aldag |

| |

Title: |

Chief Executive Officer |

Exhibit 99.1

HOOKIPA Pharma Announces Updated Phase 2 Clinical

Data at the

American Society for Clinical Oncology 2024 Annual Meeting

| · | Encouraging clinical activity with observed deepening of responses in 35

evaluable first line head and neck patients treated with HB-200 plus pembrolizumab |

| · | In a subset of 17 evaluable patients with PD-L1 combined positive score (CPS)

of 20 or higher, the Company’s selected registrational pivotal trial population, data showed confirmed ORR of 53%, CR rate of 18%,

and DCR of 82% |

| · | Preliminary progression-free survival (PFS) was 16.3 months and preliminary

overall survival (OS) rate was 88% at 9 months for the CPS 20 or higher subgroup, comparing favorably to current standard of care |

| · | Company will host a conference call at 4:15 p.m. ET today |

NEW

YORK and VIENNA, June 4, 2024 - HOOKIPA Pharma Inc. (NASDAQ: HOOK, ‘HOOKIPA’), a company developing a

new class of immunotherapeutics based on its proprietary arenavirus platform, today announced positive updated results from its Phase

2 clinical trial of HB-200 in combination with pembrolizumab in patients with recurrent/metastatic human papillomavirus 16 positive (HPV16+)

head and neck cancer.

The

updated data presented at the ASCO 2024 Annual Meeting is as of March 29, 2024 (cutoff date) and includes 46 patients treated with

HB-200 plus pembrolizumab in the first line setting. Results showed rapid and durable activation

of antigen-specific CD8+ T cells and promising clinical activity.

Among 35 evaluable patients

data showed a 37 percent confirmed objective response rate (ORR), 11 percent complete response (CR) rate, and 69% disease control rate

(DCR), per RECIST 1.1 criteria. Duration of response was not yet mature with 62 percent of responders still on treatment as of the cutoff

date.

In a subset of 17 evaluable patients with CPS

of 20 or higher, the updated data showed a 53 percent confirmed ORR, 18 percent CR rate, and 82 percent DCR. These patients are representative

of the Company’s planned pivotal Phase 2/3 trial population, which is targeted to begin enrolling patients in the fourth quarter

of 2024.

Additionally, preliminary PFS for the CPS 20 or

higher subgroup was 16.3 months and is encouraging based on the historical PFS data of 3.4 months reported for pembrolizumab alone1.

The preliminary OS rate was 88% at 9 months, and median OS was unreached as of the cutoff

date with 16 of 19 patients still alive. Median follow-up for these patients was 8.4 months.

“Based on

the evidence from the Phase 2 trial of HB-200 plus pembrolizumab, I am encouraged by the potential this immunotherapy combination

may provide as a targeted therapeutic option for HPV16+ head and neck cancer patients,” said Dr. Alan

Ho, Head and Neck Oncologist at Memorial Sloan Kettering Cancer Center and a trial investigator. “The data show that this

combination has been generally well-tolerated and can likely increase immunogenic tumor cell death, leading to improved response rates

and potential durability.”

“HPV16+

disease is a unique indication that requires a patient-centric and targeted therapeutic approach. HB-200 plus pembrolizumab has shown

to be a potentially powerful combination that has consistently delivered positive outcomes for our patients,” said Joern Aldag,

Chief Executive Officer of HOOKIPA. “Among published data in HPV+ disease, HOOKIPA has a best-in-class asset with the HB-200 combination.

We also have alignment on a clinical development strategy with the U.S. Food and Drug Administration with a path to potential accelerated

approval. Importantly, our pivotal seamless Phase 2/3 trial is just the beginning—our platform continues to demonstrate the potential

power of arenaviral-based immunotherapies to help provide targeted treatments for patients across disease areas and indications.”

Call Details:

HOOKIPA HB-200 ASCO Data Update

Tuesday, June 4, 2024, 4:15 p.m. ET

Webcast Registration

Dial-in Registration

Results:

HB-200

in combination with pembrolizumab:

Data

were presented as of March 29, 2024, and included 46 first line patients with HPV16+, PD-L1 positive, recurrent or metastatic head

and neck squamous cell carcinoma. The updated data continue to demonstrate a favorable safety profile of HB-200 in combination with pembrolizumab

and promising clinical activity as a first line treatment.

HB-200

+ pembrolizumab was generally well tolerated. Grade ≥3 treatment-related adverse events (TRAEs) were reported in 7 (15%) patients,

serious TRAEs in 2 (4%) patients, and TRAEs leading to treatment discontinuation of HB-200 in 2 (4%) patients. No treatment-related deaths

were reported.

Among 35 evaluable

patients, 4 confirmed complete responses, 9 confirmed partial responses, and 11 confirmed stable disease were observed. Notably, among

patients with PD-L1 CPS ≥20 (N=17), ORR was 53% (9/17), complete response rate was 18% (3/17), and DCR was 82% (14/17). All responses

were confirmed per RECIST 1.1. Preliminary PFS for the CPS 20 or higher subgroup was 16.3 months. The preliminary OS rate was 88%

at 9 months, and median OS was unreached as of the cutoff date with 16 of 19 patients still alive. Median follow-up for these patients

was 8.4 months.

Abstract details: ASCO

2024 Annual Meeting

Title: HB-200

arenavirus-based immunotherapy plus pembrolizumab as first-line treatment of patients with recurrent/metastatic HPV16-positive head and

neck cancer: Updated results

Presenter: Dr. Alan

L. Ho, Head and Neck Oncologist at Memorial Sloan Kettering Cancer Center and a trial investigator

Abstract

Type: Oral abstract

Session

Name: Head and Neck Cancer

Session

Date and Time: June 4, 2024; 9:45 AM-12:45 PM CDT

Abstract Number: 6005

About HB-200

HB-200 is HOOKIPA’s lead oncology candidate

engineered with the company’s proprietary replicating arenaviral vector platform. It comprises two single-vector compounds with

arenaviral backbones based on lymphocytic choriomeningitis virus (LCMV) and pichinde virus (PICV). Both express the same transgene encoding

an E7E6 fusion protein derived from HPV16. HB-200 is an alternating 2-vector immunotherapy designed to further focus the immune response

against the encoded antigen.

HB-200 in combination with pembrolizumab received

Fast Track Designation from the U.S. Food and Drug Administration and PRIME designation from the European Medicines Agency for the treatment

of first-line HPV16+ recurrent/metastatic oropharyngeal squamous cell carcinoma. These designations are supported by preliminary clinical

evidence from the Phase 1/2, open-label, clinical trial (NCT04180215) evaluating safety, T cell response, and efficacy based on objective

response rate (ORR) and disease control rate (DCR) as defined by RECIST 1.1.

1 Harrington

et al. Pembrolizumab With or Without Chemotherapy in Recurrent or Metastatic Head and Neck Squamous Cell Carcinoma: Updated Results of

the Phase III KEYNOTE-048 Study. Journal of Clinical Oncology. 2023;41(4);790-802.

About HOOKIPA

HOOKIPA

Pharma Inc. (NASDAQ: HOOK) is a clinical-stage biopharmaceutical company focused on developing novel immunotherapies, based on its proprietary

arenavirus platform, which are designed to mobilize and amplify targeted T cells and thereby fight or prevent serious disease. HOOKIPA’s

replicating and non-replicating technologies are engineered to induce robust and durable antigen-specific CD8+ T cell responses and

pathogen-neutralizing antibodies. HOOKIPA’s pipeline includes its wholly owned investigational arenaviral immunotherapies targeting

Human Papillomavirus 16-positive cancers, KRAS-mutated cancers, and other undisclosed programs. In addition, HOOKIPA aims to develop functional

cures of HBV and HIV in collaboration with Gilead.

Find out more about

HOOKIPA online at www.hookipapharma.com.

Forward Looking Statements

Certain

statements set forth in this press release constitute “forward-looking” statements within the meaning of the Private Securities

Litigation Reform Act of 1995, as amended. Forward-looking statements can be identified by terms such as “anticipates”,

“believes,” “expects,” “plans,” “potential,” “target,” “will,”

“would” or similar expressions and the negative of those terms. Forward-looking statements in this press release include

HOOKIPA’s statements regarding the potential of its product candidates to positively impact quality of life and alter the course

of disease in the patients it seeks to treat, HOOKIPA’s plans, strategies, expectations and anticipated milestones for its preclinical

and clinical programs, including the timing of initiating clinical trials and patient enrollment and the composition of patient populations

for clinical trials, the availability and timing of results from preclinical studies and clinical trials, the timing of regulatory filings,

the expected safety profile of HOOKIPA’s product candidates, and the probability of successfully developing and receiving regulatory

approval for its product candidates, including accelerated approval for HB-200. Such forward-looking

statements involve substantial risks and uncertainties that could cause HOOKIPA’s research and clinical development programs, future

results, performance or achievements to differ significantly from those expressed or implied by the forward-looking statements. Such

risks and uncertainties include, among others, the uncertainties inherent in the drug development process, including HOOKIPA’s

programs’ early stage of development, the process of designing and conducting preclinical and clinical trials, plans and timelines

for the preclinical and clinical development of its product candidates, including the therapeutic potential, clinical benefits and safety

thereof, the timing, success and data announcements of current ongoing preclinical and clinical trials, the ability to initiate new clinical

programs, the risk that the results of current preclinical studies and clinical trials may not be predictive of future results in connection

with current or future preclinical and clinical trials, including those for HB-200, HB-700, HB-400 and HB-500, the regulatory approval

processes, the timing of regulatory filings, the challenges associated with manufacturing drug products, HOOKIPA’s ability to successfully

establish, protect and defend its intellectual property, HOOKIPA’s ability to achieve the expected benefits of its

strategic reprioritization and other matters that could affect the sufficiency of existing cash to fund operations. HOOKIPA undertakes

no obligation to update or revise any forward-looking statements. For a further description of the risks and uncertainties that could

cause actual results to differ from those expressed in these forward-looking statements, as well as risks relating to the business of

the Company in general, see HOOKIPA’s Annual Report on Form 10-K for the year ended December 31, 2023,

as well as discussions of potential risks, uncertainties, and other important factors in HOOKIPA’s subsequent filings with the

Securities and Exchange Commission, which are available on the SEC’s website at https://sec.gov and HOOKIPA’s

website at www.hookipapharma.com. Except as specifically noted otherwise, all information in this press release is

as of the date of the release, and HOOKIPA undertakes no duty to update this information unless required by law.

Availability of Other Information About HOOKIPA

Investors

and others should note that we announce material financial information to our investors using our investor relations website, www.ir.hookipapharma.com,

SEC filings, press releases, public conference calls and webcasts. We use these channels, as well as social media, to communicate with

our investors and the public about our company, our services and other issues. It is possible that the information we post on social

media could be deemed to be material information. Therefore, we encourage investors, the media, and others interested in our company

to review the information we post on the social media channels listed on our investor relations website.

For further information, please contact:

Investors & Media

Michael Kaiser

michael.kaiser@hookipapharma.com

+1 (917) 984-7537

v3.24.1.1.u2

Cover

|

Jun. 04, 2024 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

Jun. 04, 2024

|

| Entity File Number |

001-38869

|

| Entity Registrant Name |

HOOKIPA Pharma Inc.

|

| Entity Central Index Key |

0001760542

|

| Entity Tax Identification Number |

81-5395687

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity Address, Address Line One |

350

Fifth Avenue, 72nd Floor

|

| Entity Address, Address Line Two |

Suite 7240

|

| Entity Address, City or Town |

New York

|

| Entity Address, State or Province |

NY

|

| Entity Address, Postal Zip Code |

10118

|

| City Area Code |

+43

|

| Local Phone Number |

1

890 63 60

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common Stock, $0.0001 par value per share

|

| Trading Symbol |

HOOK

|

| Security Exchange Name |

NASDAQ

|

| Entity Emerging Growth Company |

true

|

| Elected Not To Use the Extended Transition Period |

true

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

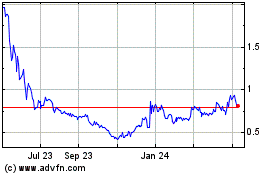

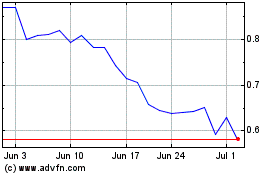

HOOKIPA Pharma (NASDAQ:HOOK)

Historical Stock Chart

From Oct 2024 to Nov 2024

HOOKIPA Pharma (NASDAQ:HOOK)

Historical Stock Chart

From Nov 2023 to Nov 2024