UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16

OF THE SECURITIES EXCHANGE ACT OF 1934

For the month of September 2023

Commission File Number: 001-40258

HIGH TIDE INC.

(Registrant)

11127 - 15 Street N.E., Unit 112

Calgary, Alberta

Canada T3K 2M4

(Address of Principal Executive Offices)

Indicate by check mark whether the Registrant files or will file annual reports under cover of Form 20-F or Form 40-F.

Form 20-F ☐ Form 40-F ☒

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

|

|

|

HIGH TIDE INC.

|

|

|

|

|

|

(Registrant)

|

|

|

|

|

|

|

Date: September 1, 2023

|

|

|

|

By

|

|

/s/ Raj Grover

|

|

|

|

|

|

|

|

Raj Grover

|

|

|

|

|

|

|

|

President and Chief Executive Officer

|

|

|

|

|

|

|

|

|

EXHIBIT INDEX

Exhibit

99.1

High Tide Announces At-The-Market Program of

up to CAD$30,000,000 for Strategic Initiatives to Replace Previous At-The-Market Program

CALGARY, AB, Sept. 1, 2023 /CNW/ - High Tide Inc.

("High Tide" or the "Company") (Nasdaq: HITI) (TSXV: HITI) (FSE: 2LYA), the high-impact, retail-forward

enterprise built to deliver real-world value across every component of cannabis, is pleased to announce that in order to replace its previous

at-the-market equity offering program that ended on May 22, 2023, it has established an at-the-market equity offering program (the "ATM

Program") that allows the Company to issue up to CAD$30 million (or the equivalent in U.S. dollars) of common shares ("Common

Shares") from treasury to the public from time to time, at the Company's discretion and subject to regulatory requirements (the

"Offering"). Any Common Shares sold through the ATM Program will be sold at prevailing market prices when issued (i)

in ordinary brokers' transactions on the Nasdaq Capital Market ("Nasdaq") or another U.S. marketplace on which the Common

Shares are listed, quoted or otherwise traded or (ii) in ordinary brokers' transactions on the TSX Venture Exchange ("TSXV"),

or another Canadian marketplace on which the Common Shares are listed, quoted or otherwise traded. Since the Common Shares will be distributed

at the prevailing market prices at the time of their sale or as otherwise permitted by law, prices may vary among purchasers and during

the period of distribution.

The Company will determine, at its sole discretion,

the date, minimum price and maximum number of Common Shares to be sold under the ATM Program. The Common Shares will be distributed at

the prevailing market prices at the time of each sale, at prices relating to such prevailing market prices, and/or in any other manner

permitted by applicable law. As such, the prices may vary between purchasers over time. The Company is not required to sell any Common

Shares at any time during the term of the ATM Program.

The Company intends to use the net proceeds of the

Offering, if any, and at the discretion of the Company, to fund two specific strategic initiatives it is currently developing, to support

the growth and development of the Company's existing operations, to fund future acquisitions, as well as for working capital and general

corporate purposes. The Company will pay the Agents (as defined below) a cash fee of up to 2% of the gross proceeds for Common Shares

sold under the ATM Agreement and will reimburse certain expenses incurred by the Agents.

"I am pleased to announce the replacement of

our previous at-the-market equity offering program. Even though the broader cannabis capital markets have been challenging, we have remained

very disciplined in raising equity capital. For instance, I note that we only raised approximately $10 million from our $40 million previous

at-the-market program over the 25-month period before it expired. The ATM Program in place can act as a low-cost source of capital, should

the need arise," said Raj Grover, President and Chief Executive Officer of High Tide.

"Being a Nasdaq-listed company, and a leader

in Canadian cannabis, there are plenty of growth opportunities regularly coming our way. That said, we will continue to be highly selective

and disciplined regarding what we choose to pursue. As previously communicated to the market, our focus remains on generating positive

free cash flow and becoming less reliant on macro factors and industry sentiment," added Mr. Grover.

Sales of Common Shares through the ATM Program will

be made pursuant to the terms of an equity distribution agreement dated August 31, 2023 entered into and among the Company, ATB Capital

Markets Inc. and ATB Capital Markets USA Inc. (the "Agents"). The ATM Program will be effective until the earlier of

(i) the date that all Common Shares available for issue under the ATM Program have been sold, (ii) the date the Canadian Prospectus Supplement

(as defined below) or the Canadian Shelf Prospectus (as defined below) is withdrawn or (iii) the date that the ATM Program is terminated

by the Company or the Agents.

Common Shares issued pursuant to the ATM Program will

be issued pursuant to a prospectus supplement dated August 31, 2023 (the "Canadian Prospectus Supplement") to the Company's

final base shelf prospectus dated August 3, 2023 filed with the securities commissions or similar regulatory authorities in each of the

provinces and territories of Canada (the "Canadian Shelf Prospectus") and pursuant to a prospectus supplement dated August

31, 2023 (the "U.S. Prospectus Supplement") to the Company's U.S. base prospectus dated August 3, 2023 (the "U.S.

Base Prospectus") included in its registration statement on Form F-10 (the "Registration Statement") and filed

with the U.S. Securities and Exchange Commission (the "SEC"). The Canadian Prospectus Supplement and the Canadian Shelf

Prospectus will be available for download from SEDAR+ at www.sedarplus.ca, and the U.S. Prospectus Supplement, the U.S. Base Prospectus

and the Registration Statement will be accessible via EDGAR on the SEC's website at www.sec.gov (collectively, the "Documents").

Alternatively, upon request, any of the Agents participating in the ATM Program will arrange to send you the Documents. To make a request,

please contact, in Canada or in the United States:

ATB Capital Markets, 66 Wellington Street West, Suite

3530, Toronto, ON M5K 1A1 or by telephone at (647) 776-8230, or by email at prospectus@atb.com.

The Offering remains subject to conditional and final

approval from the TSXV, and the Nasdaq has been notified of the Offering.

This news release does not constitute an offer to

sell or the solicitation of an offer to buy the Common Shares, nor shall there be any sale of the Common Shares in any jurisdiction in

which such an offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any such

jurisdiction.

ABOUT HIGH TIDE

High Tide, Inc. is the leading community-grown, retail-forward

cannabis enterprise engineered to unleash the full value of the world's most powerful plant. High Tide (HITI) is uniquely-built around

the cannabis consumer, with wholly-diversified and fully-integrated operations across all components of cannabis, including:

Bricks & Mortar Retail: Canna Cabana™

is the largest non-franchised cannabis retail chain in Canada, with 155 current locations spanning British Columbia, Alberta, Saskatchewan,

Manitoba and Ontario and growing. In 2021, Canna Cabana became the first cannabis discount club retailer in Canada.

Retail Innovation: Fastendr™ is a unique

and fully automated technology that integrates retail kiosks and smart lockers to facilitate a better buying experience through browsing,

ordering and pickup.

E-commerce Platforms: High Tide operates a

suite of leading accessory sites across the world, including Grasscity.com, Smokecartel.com, Dailyhighclub.com, and Dankstop.com.

CBD: High Tide continues to cultivate the possibilities

of consumer CBD through Nuleafnaturals.com, FABCBD.com, blessedcbd.de and blessedcbd.co.uk.

Wholesale Distribution: High Tide keeps that

cannabis category stocked with wholesale solutions via Valiant™.

Licensing: High Tide continues to push cannabis

culture forward through fresh partnerships and license agreements under the Famous Brand™ name.

High Tide consistently moves ahead of the currents,

having been named one of Canada's Top Growing Companies in both 2021 and 2022 by the Globe and Mail's Report on Business Magazine and

was ranked number one in the retail category on the Financial Times list of Americas' Fastest Growing Companies for 2023. To discover

the full impact of High Tide, visit www.hightideinc.com. For investment performance, don't miss the High Tide profile pages on SEDAR and

EDGAR.

Neither the TSX Venture Exchange nor its Regulation

Services Provider (as that term is defined in the policies of the TSXV) accepts responsibility for the adequacy or accuracy of this release.

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

This press release may contain "forward-looking

information" and "forward-looking statements within the meaning of applicable securities legislation. The use of any of the

words "could", "intend", "expect", "believe", "will", "projected", "estimated"

and similar expressions and statements relating to matters that are not historical facts are intended to identify forward-looking information

and are based on the Company's current belief or assumptions as to the outcome and timing of such future events. The forward-looking statements

herein include, but are not limited to, statements regarding: the future offering of Common Shares pursuant to the ATM Program and expected

use of proceeds to be raised, if any, and the receipt of final approval of the TSXV and Nasdaq for listing of the Common Shares. Readers

are cautioned to not place undue reliance on forward-looking information. Actual results and developments may differ materially from those

contemplated by these statements. Although the Company believes that the expectations reflected in these statements are reasonable, such

statements are based on expectations, factors, and assumptions concerning future events which may prove to be inaccurate and are subject

to numerous risks and uncertainties, certain of which are beyond the Company's control, including but not limited to the risk factors

discussed under the heading "Non-Exhaustive List of Risk Factors" in Schedule A to our annual information form dated January

30, 2023, and elsewhere in this press release, as such factors may be further updated from time to time in our periodic filings, available

at www.sedarplus.ca and www.sec.gov, which factors are incorporated herein by reference. Forward-looking statements contained in this

press release are expressly qualified by this cautionary statement and reflect the Company's expectations as of the date hereof and are

subject to change thereafter. The Company undertakes no obligation to update or revise any forward-looking statements, whether as a result

of new information, estimates or opinions, future events or results, or otherwise, or to explain any material difference between subsequent

actual events and such forward-looking information, except as required by applicable law.

View original content to download multimedia:https://www.prnewswire.com/news-releases/high-tide-announces-at-the-market-program-of-up-to-cad30-000-000-for-strategic-initiatives-to-replace-previous-at-the-market-program-301915362.html

SOURCE High Tide Inc.

View original content to download multimedia: http://www.newswire.ca/en/releases/archive/September2023/01/c2426.html

%CIK: 0001847409

For further information: Media Inquiries, Omar Khan, Chief Communications

and Public Affairs Officer, High Tide Inc., omar@hightideinc.com, 403-770-3080; Investor Inquiries, Vahan Ajamian, Capital Markets Advisor,

High Tide Inc., vahan@hightideinc.com

CO: High Tide Inc.

CNW 06:00e 01-SEP-23

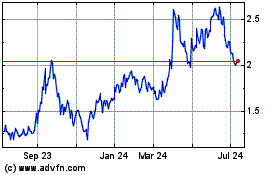

High Tide (NASDAQ:HITI)

Historical Stock Chart

From Oct 2024 to Nov 2024

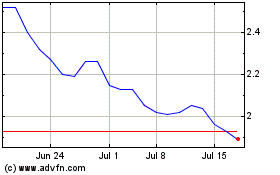

High Tide (NASDAQ:HITI)

Historical Stock Chart

From Nov 2023 to Nov 2024