0001490281False00014902812023-11-212023-11-21

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): November 21, 2023

Commission File Number: 1-35335 | | | | | | | | | | | | | | |

| Groupon, Inc. |

| (Exact name of registrant as specified in its charter) |

| | | | |

| Delaware | | 27-0903295 |

| (State or other jurisdiction of incorporation or organization) | | (I.R.S. Employer Identification No.) |

| | | | |

| 600 W Chicago Avenue | | 60654 |

| Suite 400 | | (Zip Code) |

| Chicago | | |

| Illinois | | (312) | 334-1579 |

| (Address of principal executive offices) | | (Registrant's telephone number, including area code) |

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR

240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR

240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act: | | | | | | | | | | | | | | |

| Title of each class | | Trading Symbol(s) | | Name of each exchange on which registered |

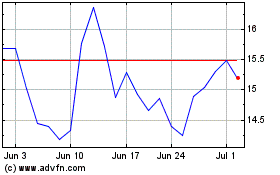

| Common stock, par value $0.0001 per share | | GRPN | | NASDAQ Global Select Market |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (240.12b-2 of this chapter)

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 8.01. Other Events.

Commencement of Rights Offering

On November 21, 2023, Groupon, Inc. (the “Company”) commenced its previously announced

$80.0 million fully backstopped rights offering (the “Rights Offering”). The Company expects to receive gross proceeds of $80.0 million, less expenses related to the Rights Offering. Pursuant to the Rights Offering, the Company will distribute to all eligible stockholders as of 5:00 p.m., New York City time on November 20, 2023 (the “Record Date”), at no cost and on a pro rata basis, non-transferable basic subscription rights to purchase shares of the Company’s common stock, par value $0.0001 per share (the “Common Stock”), at a subscription price of $11.30 per share. Each basic subscription right will entitle the rights holder to purchase 0.222257 shares of Common Stock.

The Rights Offering is fully backstopped by Pale Fire Capital SICAV a.s. (the “Backstop Party”), an entity affiliated with Dusan Senkypl, the Company’s Interim Chief Executive Officer and a member of the Board of Directors (the “Board”), and Jan Barta, a member of the Board. Pursuant to the terms of the previously disclosed binding Backstop Agreement, dated November 9, 2023, by and between the Company and the Backstop Party and subject to the satisfaction of certain conditions thereunder, the Backstop Party has committed to (i) fully exercise its basic subscription rights prior to 5:00 p.m., New York City time on January 17, 2024 (the “Expiration Date”) and (ii) fully purchase any and all unsubscribed shares in the Rights Offering following the Expiration Date at a price of $11.30 per share and on the same terms and conditions as other rights holders (the “Remaining Shares”). The Remaining Shares will be issued to the Backstop Party in a private placement exempt from registration under Section 4(a)(2) of the Securities Act of 1933, as amended (the “Securities Act”), and/or Regulation D promulgated thereunder.

The Rights Offering includes an over-subscription privilege to permit each rights holder that exercises its basic subscription rights in full to purchase additional shares of Common Stock (if any) that remain unsubscribed on the Expiration Date. The availability of the over-subscription privilege is subject to certain terms and restrictions as set forth in the prospectus supplement relating to the Rights Offering filed with the Securities and Exchange Commission (the “SEC”) on the date hereof (the “prospectus supplement”). If the aggregate subscriptions (basic subscriptions plus over-subscriptions) exceed the number of shares of Common Stock offered in the Rights Offering, then the aggregate over-subscription amount will be pro-rated among the rights holders exercising their respective over-subscription privileges based on the basic subscription amounts of such rights holders.

The Company reserves the right to extend, amend or terminate the Rights Offering, subject to certain conditions, at any time.

The offering of the Company’s Common Stock is being made pursuant to the Company’s existing effective shelf registration statement on Form S-3 (File No. 333-273533) (the “Registration Statement”) on file with the SEC, including the base prospectus contained therein, and the prospectus supplement. Additional information regarding the Rights Offering is set forth in the prospectus supplement (and the accompanying base prospectus).

Copies of the prospectus supplement (and accompanying base prospectus) can be accessed through the SEC’s website and subscription documents will be distributed to all holders of record on the Record Date beginning on or about November 21, 2023. Holders of shares of Common Stock held in “street name” through a brokerage account, bank or other nominee should contact their broker, bank or other nominee for details regarding participation in the Rights Offering. For any questions or further information about the Rights Offering, please contact Kroll Issuer Services (US), which will be acting as the information agent for the Rights Offering, at (844) 369-8502 (Toll-Free) or (646) 651-1193 (International), or via email at groupon@is.kroll.com.

This Current Report on Form 8-K shall not constitute an offer to sell or a solicitation of an offer to buy any securities of the Company, nor shall there be any offer, solicitation or sale of any securities of the Company in any state or jurisdiction in which such offer, solicitation or sale would be unlawful under the securities laws of such state or jurisdiction.

In connection with the Rights Offering, the Company is filing certain ancillary documents as Exhibits 4.1, 99.1, 99.2 and 99.3 to this Current Report on Form 8-K for the purpose of incorporating such items by reference as exhibits to the Registration Statement. Also in connection with the Rights Offering, the Company is filing, as Exhibit 5.1, the opinion of Winston & Strawn LLP, counsel to the Company, in connection with the issuance of the Common Stock upon exercise of the basic subscription rights and over-subscription privilege, if applicable. The foregoing descriptions of Exhibits 4.1, 5.1, 99.1, 99.2 and 99.3 do not purport to be complete and each is qualified in its entirety by reference to the full text of such exhibit.

On November 21, 2023, the Company issued a press release announcing the launch of the Rights Offering. A copy of the press release is attached as Exhibit 99.4 to this Current Report on Form 8-K.

Conversion Rate Adjustment under Convertible Notes Indenture

Pursuant to Section 14.04(c) of the Indenture, dated as of March 25, 2021, by and between the Company and U.S. Bank Trust Company, National Association, as Trustee (as amended, supplemented or otherwise modified to the date hereof, the “Indenture”), governing the terms of the Company’s 1.125% Convertible Senior Notes due 2026 (the “Convertible Notes”), the conversion rate of the Convertible Notes has been adjusted from 14.6800 per $1,000 principal amount of Convertible Notes to 15.6619 per $1,000 principal amount of Convertible Notes, effective immediately prior to the open of business on the Ex-Dividend Date for the Rights Offering which is November 17, 2023, as a result of the Company’s distribution of rights to acquire shares of the Company’s Common Stock to all holders of record on the Record Date in connection with the Rights Offering (such adjusted Conversion Rate, the “Adjusted Conversion Rate”).

In accordance with Section 14.04(c) of the indenture, the Company has calculated the Adjusted Conversion Rate pursuant to the following formula:

Where,

CR0 = the Conversion Rate in effect immediately prior to the open of business on the Ex-Dividend Date for the Rights Offering;

CR1 = the Conversion Rate in effect immediately after the open of business on the Ex-Dividend Date for the Rights Offering;

SP0 = the average of the Last Reported Sale Prices of the Common Stock over the 10 consecutive Trading Day period ending on, and including, the Trading Day immediately preceding the Ex-Dividend Date for the Rights Offering; and

FMV = the fair market value (as determined by the Company in good faith and in a commercially reasonable manner) of the Distributed Property with respect to each outstanding share of the Common Stock on the Ex-Dividend Date for the Rights Offering.

SumUp Share Purchase Agreement

As previously disclosed, on November 9, 2023, the Company entered into a Share Purchase Agreement pursuant to which the Company agreed to sell shares representing approximately 11.7% of its approximate 2.08% interest in SumUp Holdings S.à r.l., a private limited liability company (société à responsabilité limitée) (“SumUp”), to other investors in SumUp (the "Second SumUp Transaction"). Subsequently in late November 2023, the Second SumUp Transaction was finalized and the Company received cash of $10.2 million in connection with the Second SumUp Transaction.

Forward Looking Statements

This Current Report on Form 8-K includes forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended, including statements regarding the Company’s future results of operations and financial position, business strategy and plans and the Company’s objectives for future operations and future liquidity. The words "may," "will," "should," "could," "expect," "anticipate," "believe," "estimate," "intend," "continue" and other similar expressions are intended to identify forward-looking statements. We have based these forward-looking statements largely on current expectations and projections about future events and financial trends that we believe may affect the Company’s financial condition, results of operations, business strategy, short-term and long-term business operations and objectives, and financial needs, including, without limitation, the Company’s expectations regarding the Rights Offering, including the size, timing, price, and use of proceeds. These forward-looking statements involve risks and uncertainties that could cause the Company’s actual results to differ materially from those expressed or implied in the Company’s forward-looking statements. Factors that may cause such differences include prevailing market

conditions, whether holders of record will exercise their rights to purchase Common Stock and the amount subscribed, and whether the Company will be able to successfully complete the Rights Offering, in addition to (without limitation), the Company’s ability to execute, and achieve the expected benefits of, the Company’s go-forward strategy; execution of the Company’s business and marketing strategies; volatility in the Company’s operating results; challenges arising from the Company’s international operations, including fluctuations in currency exchange rates, legal and regulatory developments in the jurisdictions in which the Company operates and geopolitical instability resulting from the conflicts in Ukraine and the Middle East; global economic uncertainty, including as a result of inflationary pressures, ongoing impacts from the COVID-19 pandemic and labor and supply chain challenges; retaining and adding high quality merchants and third- party business partners; retaining existing customers and adding new customers; competing successfully in the Company’s industry; providing a strong mobile experience for the Company’s customers; managing refund risks; retaining and attracting members of the Company’s executive and management teams and other qualified employees and personnel; customer and merchant fraud; payment-related risks; the Company’s reliance on email, internet search engines and mobile application marketplaces to drive traffic to the Company’s marketplace; cybersecurity breaches; maintaining and improving the Company’s information technology infrastructure; reliance on cloud-based computing platforms; completing and realizing the anticipated benefits from acquisitions, dispositions, joint ventures and strategic investments; lack of control over minority investments; managing inventory and order fulfillment risks; claims related to product and service offerings; protecting the Company’s intellectual property; maintaining a strong brand; the impact of future and pending litigation; compliance with domestic and foreign laws and regulations, including the CARD Act, GDPR, CPRA, other privacy-related laws and regulations of the Internet and e-commerce; classification of the Company’s independent contractors, agency workers or employees; the Company’s ability to remediate its material weakness over internal control over financial reporting; risks relating to information or content published or made available on the Company’s websites or service offerings the Company makes available; exposure to greater than anticipated tax liabilities; adoption of tax laws; the Company’s ability to use its tax attributes; impacts if the Company becomes subject to the Bank Secrecy Act or other anti-money laundering or money transmission laws or regulations; the Company’s ability to raise capital if necessary; the Company’s ability to continue as a going concern; risks related to the Company’s access to capital and outstanding indebtedness, including the Company’s Convertible Notes; the Company’s Common Stock, including volatility in the Company’s stock price; the Company’s ability to realize the anticipated benefits from the capped call transactions relating to the Convertible Notes; difficulties, delays or the Company’s inability to successfully complete all or part of the announced restructuring actions or to realize the operating efficiencies and other benefits of such restructuring actions; higher than anticipated restructuring charges or changes in the timing of such restructuring charges; and those risks and other factors discussed in Part I, Item 1A. Risk Factors of the Company’s Annual Report on Form 10-K for the year ended December 31, 2022 and Part II, Item 1A. Risk Factors of the Company’s Quarterly Reports on Form 10-Q for the quarters ended March 31, 2023, June 30, 2023, and September 30, 2023, and the Company’s other filings with the SEC, copies of which may be obtained by visiting the Company's Investor Relations web site at investor.groupon.com or the SEC's web site at www.sec.gov. Groupon's actual results could differ materially from those predicted or implied and reported results should not be considered an indication of future performance.

You should not rely upon forward-looking statements as predictions of future events. Although the Company believes that the expectations reflected in the forward-looking statements are reasonable, it cannot guarantee that the future results, levels of activity, performance or events and circumstances reflected in the forward-looking statements will be achieved or occur. Moreover, neither the Company nor any other person assumes responsibility for the accuracy and completeness of the forward-looking statements. The forward-looking statements reflect the Company’s expectations as of November 21, 2023. We undertake no obligation to update publicly any forward-looking statements for any reason after the date of this Current Report on Form 8-K to conform these statements to actual results or to changes in the Company’s expectations.

Item 9.01. Financial Statements and Exhibits.

| | | | | | | | | | | | | | |

| (d) | Exhibits: | |

| | Exhibit No. | | |

| 4.1 | | |

| 5.1 | | |

| 23.1 | | |

| 99.1 | | |

| 99.2 | | |

| 99.3 | | |

| 99.4 | | |

| 104 | | Cover Page Interactive Data File (embedded within the Inline XBRL document) |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | |

| | GROUPON, INC. |

| Date: November 21, 2023 | |

| | By: /s/ Jiri Ponrt Name: Jiri Ponrt Title: Chief Financial Officer |

| | | | | |

| NAME OF REGISTERED HOLDER: | |

| CERTIFICATE #: | NUMBER OF SUBSCRIPTION RIGHTS: |

THE TERMS AND CONDITIONS OF THE RIGHTS OFFERING ARE SET FORTH IN THE COMPANY’S PROSPECTUS SUPPLEMENT, DATED NOVEMBER 21, 2023, AND THE ACCOMPANYING BASE PROSPECTUS (TOGETHER, THE “PROSPECTUS”) AND ARE INCORPORATED HEREIN BY REFERENCE. COPIES OF THE PROSPECTUS ARE AVAILABLE ON THE WEBSITE OF THE SECURITIES AND EXCHANGE COMMISSION AT HTTP://WWW.SEC.GOV OR UPON REQUEST FROM KROLL ISSUER SERVICES (US) (“KROLL”), THE INFORMATION AGENT.

GROUPON, INC.

Incorporated under the laws of the State of Delaware

NON-TRANSFERABLE SUBSCRIPTION RIGHTS CERTIFICATE

Evidencing non-transferable Subscription Rights to purchase common stock, par value $0.0001, of Groupon, Inc.

Subscription Price: $11.30 per whole share of common stock

THE SUBSCRIPTION RIGHTS WILL EXPIRE IF NOT EXERCISED PRIOR TO 5:00 P.M., NEW YORK CITY TIME, ON JANUARY 17, 2024,

SUBJECT TO EXTENSION OR EARLIER TERMINATION.

THIS CERTIFIES THAT the registered owner whose name is inscribed hereon above is the owner of the number of non-transferable basic subscription rights (“Rights”) set forth above. Each Right entitles the holder thereof to subscribe for and purchase 0.222257 of a share of common stock, par value $0.0001 (the “Common Stock”) of Groupon, Inc., a Delaware corporation (the “Company”), at a subscription price of $11.30 per whole share (the “Subscription Price”), pursuant to a rights offering (the “Rights Offering”), on the terms and subject to the conditions set forth in the Prospectus and the “Instructions as to Use Of Groupon, Inc. Rights Certificates” accompanying this Subscription Rights Certificate. If you exercise your Rights in full, and any shares of Common Stock being offered in the Rights Offering remain available and unsubscribed for in the Rights Offering, you will be entitled to an over-subscription privilege (the “Over-Subscription Privilege”) to purchase a portion of the unsubscribed shares of Common Stock at the Subscription Price. The Rights represented by this Subscription Rights Certificate may be exercised by completing the appropriate forms and returning the full payment of the Subscription Price for each whole share of Common Stock purchased pursuant to the Rights. If the Company is unable to issue to the registered owner named above the full number of shares of Common Stock requested, the Subscription Agent will return to the registered owner named above any excess funds submitted as soon as practicable, without interest or deduction.

DELIVERY OPTIONS FOR SUBSCRIPTION RIGHTS CERTIFICATE:

To exercise Rights, complete your Subscription Form and upload the completed Subscription Rights Certificate, together with payment in full of the Subscription Price, to the Subscription Agent, so that it will be actually received by the Subscription Agent prior to the Expiration Date. The Subscription Agent will hold all funds it receives in a segregated bank account until completion of the Rights Offering. To exercise your Rights, you must complete the Subscription Form through Kroll’s electronic subscription submission portal (the “Electronic Portal). To access the Electronic Portal, visit https://is.kroll.com/groupon, click on the “Submit Rights Certificate” section of the website and follow the instructions to submit your Subscription Form and Subscription Rights Certificate. Your Subscription Form must be completed, executed and returned so that it is actually received by Kroll prior to the Expiration Date. To be deemed a valid submission, an Eligible Holder must complete the Subscription Form in its entirety which includes the confirmed submission of the Rights Certificate via an upload through the Electronic Portal.

PLEASE DO NOT SEND RIGHTS CERTIFICATES OR PAYMENTS DIRECTLY TO THE COMPANY.

Your payment of the Subscription Price must be made in U.S. dollars for the full number of whole shares of Common Stock you are subscribing for by wire transfer of immediately available funds to the Subscription Agent. Cashier’s checks, money orders and certified checks will not be accepted. If you are a beneficial owner of Common Stock that is registered in the name of a broker, dealer, bank or other nominee, you will need to coordinate exercises of Rights through your broker, dealer, bank or other nominee in order for them to transmit payment to the Subscription Agent. In this case, you will not receive a Subscription Rights Certificate.

DELIVERY OTHER THAN IN THE MANNER LISTED ABOVE WILL NOT CONSTITUTE VALID DELIVERY

ANY QUESTIONS OR REQUESTS FOR ASSISTANCE CONCERNING THE RIGHTS OFFERING SHOULD BE DIRECTED TO KROLL ISSUER SERVICES (US), THE INFORMATION AGENT, AT (844) 369-8502 (TOLL-FREE) or (646) 651-1193 (INTERNATIONAL), OR VIA EMAIL AT GROUPON@IS.KROLL.COM.

Exhibit 5.1

November 21, 2023

Groupon, Inc.

600 West Chicago Avenue

Suite 400

Chicago, Illinois 60654

| | | | | | | | |

| Re: | Registration Statement on Form S-3 |

Ladies and Gentlemen:

We have acted as counsel for Groupon, Inc., a Delaware corporation (the “Company”), in connection with its Registration Statement on Form S-3 (File No. 333-273533), as may be amended from time to time (the “Registration Statement”), with the Securities and Exchange Commission (the “Commission”) under the Securities Act of 1933, as amended (the “Securities Act”). The Registration Statement contains a prospectus (the “Prospectus”), which was supplemented by a Prospectus Supplement, dated November 21, 2023 (as amended and supplemented, the “Prospectus Supplement”), that was furnished to holders of record of the Company’s common stock, par value $0.0001 per share (the “Common Stock”), in connection with the issuance by the Company to such stockholders of non-transferable subscription rights (the “Rights”) entitling the holders thereof to purchase up to 7,079,646 shares of the Company’s Common Stock. The Registration Statement relates to (i) the Rights and (ii) the shares of Common Stock that may be issued and sold by the Company upon the exercise of the Rights (the “Rights Offering”).

This opinion letter is being furnished in accordance with the requirements of Item 601(b)(5) of Regulation S-K under the Securities Act.

In connection therewith, we have reviewed originals or copies certified or otherwise identified to our satisfaction of (1) the Registration Statement, as amended to the date hereof, (2) the Prospectus and the Prospectus Supplement, (3) the form of certificate representing the Rights, (4) the Restated Certificate of Incorporation of the Company, (5) the Amended and Restated By-Laws of the Company, (6) resolutions, minutes and records of the corporate proceedings of the Company with respect to the Rights Offering and the issuance of the shares of Common Stock upon exercise of the Rights and (7) such other documents, certificates, corporate records, opinions and other instruments as we have deemed necessary or appropriate for the purposes of this opinion.

In such examination, we have assumed the genuineness of all signatures, the legal capacity of natural persons, the authenticity of all documents submitted to us as originals, the conformity to original documents of all documents submitted to us as certified or photostatic copies and the authenticity of the originals of such copies. As to any facts material to the opinions hereinafter expressed that we did not independently establish or verify, we have relied upon certificates, statements and representations of officers and other representatives of the Company and upon certificates of public officials.

Based upon and subject to the foregoing, it is our opinion that the shares of Common Stock issuable upon exercise of the Rights are duly authorized and, when such shares are issued and delivered upon the exercise of Rights and the receipt of the consideration payable therefor in accordance with their terms as described in the Registration Statement, the Prospectus and the Prospectus Supplement, such shares will be validly issued, fully paid and nonassessable.

The opinion expressed herein is based upon and limited to the General Corporation Law of the State of Delaware (including the statutory provisions, all applicable provisions of the Delaware Constitution and reported judicial decisions interpreting the foregoing). We express no opinion herein as to any other laws, statutes, regulations or ordinances.

We hereby consent to the filing of this opinion letter as Exhibit 5.1 to the Current Report on Form 8-K of the Company dated on or about the date hereof, which will be incorporated by reference into the Registration Statement,

Groupon, Inc.

November 21, 2023

Page 2

and to the reference to our firm in the Prospectus and Prospectus Supplement forming a part of the Registration Statement under the caption “Legal Matters.” In giving such consent, we do not thereby admit that we are experts within the meaning of the Securities Act or that our firm is within the category of persons whose consent is required under Section 7 of the Securities Act or the rules and regulations of the Commission.

| | |

|

| Very truly yours, |

|

| /s/ Winston & Strawn LLP |

GROUPON, INC.

(CUSIP 399473206 / ISIN US3994732069)

INSTRUCTIONS AS TO USE OF GROUPON, INC. RIGHTS CERTIFICATE AND SUBSCRIPTION FORM

FOR USE BY REGSITERED HOLDERS OF RIGHTS CERTIFICATES

(FOR SHARES NOT HELD IN “STREET NAME”)

PLEASE CONSULT KROLL ISSUER SERVICES (US), THE INFORMATION AGENT, YOUR BANK OR BROKER AS TO ANY QUESTIONS.

The following instructions relate to a rights offering (the “Rights Offering”) by Groupon, Inc., a Delaware corporation (the “Company”), to the holders of record of its common stock, par value $0.0001 per share (“Common Stock”), as described in the Company’s Base Prospectus, dated August 9, 2023 (the “Base Prospectus”) and the Prospectus Supplement, dated November 21, 2023 (the “Prospectus Supplement” and, together with the Base Prospectus, the “Prospectus”). The Company will distribute to each holder of Common Stock as of 5:00 p.m., New York City time, on November 20, 2023 (the “Record Date”) non-transferable basic subscription rights (the “Rights”) to purchase shares of Common Stock.

In the Rights Offering, the Company is offering up to an aggregate of 7,079,646 shares of Common Stock pursuant to the Prospectus. The Rights may be exercised at any time during the subscription period, which commences on November 21, 2023 and ends at 5:00 p.m., New York City time, on January 17, 2024, unless extended in the sole and absolute discretion of the Company (as it may be extended, the “Expiration Date”). After the Expiration Date, any unexercised Rights will be null and void.

As described in the Prospectus, each holder of shares of Common Stock is entitled to one Right for each whole share of Common Stock owned by such holder on the Record Date, evidenced by non-transferable Rights certificates (the “Rights Certificates”). Each Right allows the holder thereof to subscribe (the “Basic Subscription Right”) at the cash price of $11.30 per whole share (the “Subscription Price”) for 0.222257 of a share of Common Stock. The Rights are described in the Prospectus.

The Rights will be evidenced by Rights Certificates unless your shares are held in “street name” through a broker, dealer, custodian bank or other nominee. In this case, your broker, dealer, custodian bank or other nominee is the record holder of the Rights you own. Your broker, dealer, custodian bank or other nominee, as the record holder, will notify you of the Rights Offering. The record holder must exercise the Rights and send payment of the aggregate subscription price on your behalf. If you wish to exercise Rights in the Rights Offering, you should contact your broker, dealer, custodian bank or other nominee as soon as possible. You will not receive a Rights Certificate. In lieu of a Rights Certificate, holders whose shares are held in “street name” must exercise their Rights through the customary procedures of Depository Trust and Clearing Corporation (“DTC”) using DTC’s Automated Subscription Offer Program (commonly referred to as “ASOP”).

The Company will not be required to issue shares of Common Stock to you if Kroll Issuer Services (US) (the “Subscription Agent”) receives your Rights Certificate or your subscription payment at, or after, the Expiration Date. The Company has the option to extend the Rights Offering by giving oral or written notice to the Subscription Agent prior to the Expiration Date in the Company’s sole and absolute discretion. If the Company elects to extend the Rights Offering, the Company will issue a press release announcing the extension no later than 9:00 a.m., New York City time, on the next business day after the most recently announced Expiration Date.

Rights may only be exercised in aggregate for whole numbers of shares of Common Stock; no fractional shares of the Common Stock will be issued in the Rights Offering. Any fractional shares of the Common Stock resulting from the exercise of the Rights will be rounded down to the nearest whole share. Any excess subscription payments received by the Subscription Agent in respect of fractional shares will be returned as soon as reasonably practicable after the Expiration Date, without interest or deduction.

In addition, Rights holders that exercise their Rights in full also will be eligible to subscribe, at the same cash price of $11.30 per whole share, for any shares of Common Stock that are offered in the Rights Offering but are not purchased by the other Rights holders under their Rights (the “Over-Subscription Privilege”). If an insufficient number of shares of Common Stock is available to fulfill all Over-Subscription Privilege requests, the available shares will be allocated pro rata (in proportion to the number of shares of Common Stock held after giving effect to all Rights) among those Rights holders who fully exercised their Rights.

You may exercise your Over-Subscription Privilege only if you have exercised your Rights in full and other holders of Rights do not exercise their Rights in full.

Subject to the conditions and procedures set forth in the Prospectus, the Company may amend or terminate the Rights Offering in its sole and absolute discretion at any time on or before the Expiration Date.

The number of Rights to which you are entitled is printed on the face of your Rights Certificate provided in Annex II of this document. You should indicate your wishes with regard to the exercise of your Rights by completing the appropriate portions of the Subscription Form attached as Annex I hereto (the “Subscription Form”) and returning the Rights Certificate and the Subscription Form to the Subscription Agent pursuant to the procedures described in the Prospectus and this document.

YOUR SUBSCRIPTION FORM, RIGHTS CERTIFICATE AND SUBSCRIPTION PRICE PAYMENT FOR ALL SHARES OF COMMON STOCK, INCLUDING ANY OVER-SUBSCRIPTION SHARES, BY WIRE, MUST BE ACTUALLY RECEIVED PRIOR TO THE EXPIRATION DATE. ONCE A HOLDER OF RIGHTS HAS EXERCISED THEIR RIGHTS AND THE OVER-SUBSCRIPTION PRIVILEGE, IF APPLICABLE, SUCH EXERCISE MAY NOT BE REVOKED. RIGHTS NOT VALIDLY EXERCISED PRIOR TO THE EXPIRATION DATE WILL EXPIRE WITHOUT VALUE. IF YOU HOLD RIGHTS THROUGH A BROKER OR OTHER NOMINEE, YOU SHOULD VERIFY WITH YOUR BROKER OR NOMINEE BY WHEN YOU MUST DELIVER YOUR INSTRUCTION.

1.Method of Subscription—Exercise of Rights. To exercise Rights, complete your Subscription Form and upload your Subscription form and your Rights Certificate to the Electronic Portal (as defined and described below), together with payment in full of the Subscription Price by wire, to the Subscription Agent, so that all required documents and payment will be actually received by the Subscription Agent prior to the Expiration Date. The Subscription Agent will hold all funds it receives in a segregated bank account until completion of the Rights Offering. PLEASE DO NOT SEND SUBSCRIPTION FORMS, RIGHTS CERTIFICATES OR PAYMENTS DIRECTLY TO THE COMPANY. Your payment of the Subscription Price must be made in U.S. dollars for the full number of whole shares of Common Stock you are subscribing for by wire transfer of immediately available funds to the Subscription Agent. Cashier’s checks, money orders and certified checks will not be accepted. If you are a beneficial owner of Common Stock that is registered in the name of a broker, dealer, bank or other nominee, you will need to coordinate exercises of Rights through your broker, dealer, bank or other nominee in order for them to transmit payment to the Subscription Agent. In this case, you will not receive a Rights Certificate.

2.Acceptance of Payments. Payments will be deemed to have been received by the Subscription Agent only upon the clearance of wire transfer of immediately available funds per the below instructions:

Bank Name: Citibank NA Account Name: Kroll Restructuring Administration LLC as Agent for Groupon, Inc. Subscription Account

ABA Number: 021000089

Bank Address: 153 East 53rd Street, 23rd Floor, New York, New York 10022

SWIFT: CITIUS33

Account Number: 6881808248

Reference Line: Please include your full name exactly as it appears on your Rights Certificate in the Reference Line of the Wire.

NOTE: If you do not include your full name exactly as it appears on your Rights Certificate in the Reference Line of the Wire, the Subscription Agent will not be able to match your wire to your Rights exercise and your Rights exercise will not be considered valid and will not be accepted by the Company.

If you are a beneficial owner of Common Stock that is registered in the name of a broker, dealer, bank or other nominee, you will need to coordinate payments through your broker, dealer, bank or other nominee.

Payment by wire is the only valid method of payment. Payment other than the manner listed above will not constitute valid payment.

3.Delivery of Subscription Materials. You should deliver your Rights Certificate and accompanying Subscription Form to the Subscription Agent by the method described below:

If, as of the Record Date, you were the record holder of the shares of Common Stock, then you should submit your Rights Certificate and complete the associated Subscription Form through Kroll’s electronic subscription submission portal (the “Electronic Portal”) by visiting Kroll’s website at https://is.kroll.com/

groupon. Kroll will accept your Rights Certificate and Subscription Form if properly completed through the Electronic Portal. To access the Electronic Portal, visit https://is.kroll.com/groupon, click on the “Submit Rights Certificate” section of the website and follow the instructions to submit your Subscription Form and Rights Certificate. Your Subscription Form must be completed, executed and returned so that it is actually received by Kroll prior to the Expiration Date. To be deemed a valid submission, an Eligible Holder must complete the Subscription Form in its entirety which includes the confirmed submission of the Rights Certificate via an upload through the Electronic Portal.

Submission through the Electronic Portal is the only valid method of submission. Submission other than the manner listed above will not constitute valid submission.

4.Missing or Incomplete Subscription Forms or Payment. If you fail to complete and sign the Subscription Form or otherwise fail to follow the subscription procedures that apply to the exercise of your Rights prior to the Expiration Date, the Subscription Agent will reject the exercise of your Rights or accept it only to the extent of the payment received. Neither the Company nor the Subscription Agent undertakes any responsibility or action to contact you concerning an incomplete or incorrect Subscription Form, nor is the Company or the Subscription Agent under any obligation to correct such incorrect Subscription Forms. The Company has the sole and absolute discretion to determine whether a Rights exercise properly complies with the subscription procedures. If you send a payment that is insufficient to purchase the number of shares of Common Stock you requested, or if the number of shares of Common Stock you requested is not specified in the Subscription Forms, the payment received will be applied to exercise your Rights to the fullest extent possible based on the amount of the payment received. If your aggregate Subscription Price payment is greater than the amount you owe for your Rights, such excess subscription payment received by the Subscription Agent will be returned, without interest or penalty, as soon as practicable following the Expiration Date.

5. Deliveries to Holders. The following deliveries and payments to you will be made:

(a) Common Stock. We will deliver to you the shares which you purchased via exercise of your Rights as soon as practicable after the Expiration Date. All shares that are purchased in the Rights Offering will be issued in uncertificated book-entry form meaning that you will receive a direct registration account statement from the Company’s transfer agent reflecting ownership of the purchased shares if you are a holder of record. If you hold your shares in the name of a bank, broker, dealer or other nominee, the Depository Trust Company will credit your nominee with the shares you purchased in the Rights Offering.

(b) Excess Payments. If you exercised your Over-Subscription Privilege and are allocated less than all of the shares for which you wished to subscribe pursuant to the Over-Subscription Privilege, your excess payment for shares that were not allocated to you will be returned, without interest or deduction, as soon as practicable after the Expiration Date. We will deliver or cause the transfer agent to deliver shares that you purchased as soon as practicable after the Expiration Date and after all pro rata allocations and adjustments have been completed.

6. Fees and Expenses. The Company will pay all customary fees and expenses of the Subscription Agent and the Information Agent related to their acting in such roles in connection with the Rights Offering.

7. Execution. The signature on the Subscription Form must correspond with the name of the registered holder exactly as it appears on the face of the Rights Certificate without any alteration, enlargement or change. Persons who sign the Subscription Form in a representative or other fiduciary capacity on behalf of a registered holder must indicate their capacity when signing and, unless waived by the Subscription Agent in its sole and absolute discretion, must present to the Subscription Agent satisfactory evidence of their authority so to act.

8. Method of Delivery. Delivery of and payment of the Subscription Price to the Subscription Agent is only permitted via wire using the instructions in item 2 above. You should allow a sufficient number of days to ensure delivery to the Subscription Agent prior to the Expiration Date.

9. Revocation. Once you have exercised your Rights, including the Over-Subscription Privilege, if applicable, you may not revoke such exercise. All exercises of Rights, including the Over-Subscription Privilege, are irrevocable, even if you subsequently learn information about the Company that you consider to be unfavorable. You should not exercise your Rights, including the Over-Subscription Privilege, if applicable, unless you are certain that you wish to purchase Common Stock in the Rights Offering.

10. Procedures Relating to the Delivery of Rights through the Depository Trust Company. If you are a broker, a dealer, a trustee or a depositary for securities who holds the Company’s Common Stock for the account of others as a nominee holder and thus will hold Common Stock for the account of others as a nominee holder, you may exercise your beneficial owners’ Rights and Over-Subscription Privilege, if applicable, through The Depository Trust Company (“DTC”). Any Rights exercised through DTC are referred to as “DTC Exercised Rights.” You may exercise your DTC Exercised Rights through DTC’s PSOP Function on the “agents subscription over PTS” procedures and instructing DTC to charge the applicable DTC account for the subscription payment and to deliver such amount to the Subscription Agent. DTC must receive the subscription instructions and payment for the purchased shares prior to the Expiration Date.

11. Determinations Regarding the Exercise of Your Rights. The Company will decide, in its sole and absolute discretion, all questions concerning the timeliness, validity, form, and eligibility of the exercise of your Rights, including any determinations as to beneficial ownership as described herein. Any such determinations by the Company will be final and binding. The Company, in its sole and absolute discretion, may waive, in any particular instance, any defect or irregularity or permit, in any particular instance, a defect or irregularity to be corrected within such time as the Company may determine. The Company will not be required to make uniform determinations in all cases. The Company may reject the exercise of any of your Rights because of any defect or irregularity. The Company will not accept any exercise of Rights until all irregularities have been waived by the Company or cured by you within such time as the Company decides, in its sole and absolute discretion.

Neither the Company, the Subscription Agent or the Information Agent will be under any duty to notify you of any defect or irregularity in connection with your submission of your Subscription Form or Rights Certificates, and the Company will not be liable for failure to notify you of any defect or irregularity. The Company reserves the right to reject your exercise of Rights if it determines that your exercise is not in accordance with the procedures set forth in the Prospectus and this document. The Company will also not accept the exercise of your Rights if the issuance of shares of Common Stock to you could be deemed unlawful under applicable law.

12. Questions and Request for Additional Materials. For questions regarding the Rights Offering, assistance regarding the method of exercising Rights or for additional copies of relevant documents, please contact the information agent for the Rights Offering, Kroll, at (844) 369-8502 (Toll-Free) or (646) 651-1193 (International), or via email at groupon@is.kroll.com.

ANNEX I

SUBSCRIPTION FORM

(FOR HOLDERS WHO DO NOT HOLD IN “STREET NAME” THROUGH A BROKER, DEALER, CUSTODIAN BANK OR OTHER NOMINEE)

The undersigned acknowledge(s) receipt of your letter and the enclosed materials referred to therein relating to the grant of non-transferable basic subscription rights (the “Rights”) to purchase shares of common stock, par value $0.0001 per share (“Common Stock”), of Groupon, Inc. (the “Company”) pursuant to a rights offering (the “Rights Offering”) as described further in the Company’s prospectus supplement, dated November 21, 2023 (the “Prospectus Supplement”), and the accompanying prospectus, dated August 9, 2023 (the “Base Prospectus,” and together with the Prospectus Supplement, the “Prospectus”), the receipt of which is hereby acknowledged.

You are hereby instructed, on the undersigned’s behalf, to exercise the Rights and the Over-Subscription Privilege, if applicable, to purchase Common Stock with respect to the shares of Common Stock held by you for the account of the undersigned, pursuant to the terms and subject to the conditions set forth in the Prospectus and the related “Rights Certificate,” as follows:

PLEASE PRINT ALL INFORMATION CLEARLY AND LEGIBLY

SECTION 1: OFFERING INSTRUCTIONS

IF YOU WISH TO EXERCISE ALL OR A PORTION OF YOUR RIGHTS, PLEASE FILL OUT THE INFORMATION BELOW:

Please exercise my Rights for Common Stock pursuant to the Rights Offering, as set forth below:

Name of Registered Holder:

Number of Shares of Common Stock Held as of the Record Date:

Number of Rights Issued based on Record Date Holdings (one right per one share held):

Section 1a. Rights

(1 Right = 0.222257 shares of Common Stock)

| | | | | | | | | | | | | | | | | | | | |

| Number of Rights to be exercised (not to exceed number of Rights received) |

X | Rights Factor | Number of shares of Common Stock subscribed for under the Rights (rounded down to the nearest whole number) |

X | Purchase Price | Payment to be made in connection with the Common Stock subscribed for under the Rights (rounded at $0.005 to the nearest cent) |

|

0.222257 | | $11.30 | |

Section 1b. Over-Subscription Privilege (ONLY TO BE COMPLETED IF RIGHTS IN SECTION 1A. ABOVE ARE EXERCISED IN FULL)

| | | | | | | | | | | |

| Number of shares of Common Stock requested pursuant to the Over-Subscription Privilege (rounded down to the nearest whole number) |

X | Purchase Price | Payment to be made in connection with the Common Stock requested pursuant to the Over-Subscription Privilege (rounded at $0.005 to the nearest cent) |

| $11.30 | |

Section 1c. Totals

Total Number of Rights to be Exercised:

Total Number of shares of Common Stock subscribed for and/or requested:

Total Payment: $

* You will receive one Right for each share of Common Stock owned as of the Record Date. For every Right held, you will be entitled to purchase 0.222257 shares of Common Stock at the Subscription Price of $11.30 per share. The number of shares of Common Stock to be issued to you will be rounded down to the nearest whole number and fractional shares will not be issued upon the exercise of the Rights. Accordingly, if you held 100 Subscription Rights, your Subscription Rights entitle you to purchase up to 22 shares of Common Stock.

** If you purchase all of the shares available to you pursuant to your Rights, you may subscribe for additional shares pursuant to your Over-Subscription Privilege, if any, using the Subscription Price of $11.30 per share. See the description of the Over-Subscription Privilege in the Prospectus.

SECTION 2: PAYMENT INSTRUCTIONS

Kroll Wire Instructions:

| | | | | |

| Account Name | Kroll Restructuring Administration LLC as Agent for Groupon, Inc. Subscription Account |

| Bank Account No. | 6881808248 |

| ABA/Routing No. | 021000089 |

| SWIFT (for international wires) | CITIUS33 |

| Bank Name | Citibank NA |

| Reference | Please include your full name exactly as it appears on your Rights Certificate in the Reference Line of the Wire. NOTE: If you do not include your full name exactly as it appears on your Rights Certificate in the Reference Line of the Wire, the Subscription Agent will not be able to match your wire to your Rights exercise and your Rights exercise will not be considered valid and will not be accepted by the Company. |

Your wire information in the event a refund is needed:

Please use the chart below to provide the appropriate wire information in the event the Subscription Agent must refund a portion (or all) of your subscription payment, as applicable.

| | | | | |

| Account Name | |

| Bank Account No. | |

| ABA/Routing No. | |

| Bank Name | |

| Bank Address | |

| Reference | |

SECTION 3: SUBSCRIPTION AUTHORIZATION

I acknowledge that I have received the Prospectus for this offering of Rights and I hereby exercise such Rights and Over-Subscription Privilege, as applicable, for the number of shares indicated above on the terms and conditions specified in the Prospectus. I hereby agree that if I fail to pay in full for the Common Stock for which I have subscribed, the Company may exercise any of the remedies provided for in the Prospectus.

Name of Holder (s) (the Holder name(s) must match the name of the holder(s) inscribed on the Rights Certificate you received): _________________________________________________________________________________

Signature(s) of subscriber(s) (executed by the Holder(s) whose name(s) appears on the Rights Certificate):

| | | | | | | | |

Print Name:_________________________________ (Name of Signatory Above) | | Print Name: _________________________________ (Name of Signatory Above) |

| |

Signature(s) of representative(s) authorized to sign on behalf of Holder (this must conform to the requirements set forth in Item 7 of the accompanying Instructions): |

| | |

Print Name:_________________________________

(Name of Authorized Signatory Above) | | Print Name:__________________________________

(Name of Authorized Signatory Above) |

Representative’s Role: ________________________ | | Representative’s Role: _________________________ |

Telephone No.:______________________________ | |

Telephone No.:_______________________________ |

| |

| Date:______________________________________ | | Date:_______________________________________ |

| | | | | |

ANNEX II NAME OF REGISTERED HOLDER: | |

| CERTIFICATE #: | NUMBER OF SUBSCRIPTION RIGHTS: |

THE TERMS AND CONDITIONS OF THE RIGHTS OFFERING ARE SET FORTH IN THE COMPANY’S PROSPECTUS SUPPLEMENT, DATED NOVEMBER 21, 2023, AND THE ACCOMPANYING BASE PROSPECTUS (TOGETHER, THE “PROSPECTUS”) AND ARE INCORPORATED HEREIN BY REFERENCE. COPIES OF THE PROSPECTUS ARE AVAILABLE ON THE WEBSITE OF THE SECURITIES AND EXCHANGE COMMISSION AT HTTP://WWW.SEC.GOV OR UPON REQUEST FROM KROLL ISSUER SERVICES (US) (“KROLL”), THE INFORMATION AGENT.

GROUPON, INC.

Incorporated under the laws of the State of Delaware

NON-TRANSFERABLE SUBSCRIPTION RIGHTS CERTIFICATE

Evidencing non-transferable Subscription Rights to purchase common stock, par value $0.0001, of Groupon, Inc.

Subscription Price: $11.30 per whole share of common stock

THE SUBSCRIPTION RIGHTS WILL EXPIRE IF NOT EXERCISED PRIOR TO 5:00 P.M., NEW YORK CITY TIME, ON JANUARY 17, 2024,

SUBJECT TO EXTENSION OR EARLIER TERMINATION.

THIS CERTIFIES THAT the registered owner whose name is inscribed hereon above is the owner of the number of non-transferable basic subscription rights (“Rights”) set forth above. Each Right entitles the holder thereof to subscribe for and purchase 0.222257 of a share of common stock, par value $0.0001 (the “Common Stock”) of Groupon, Inc., a Delaware corporation (the “Company”), at a subscription price of $11.30 per whole share (the “Subscription Price”), pursuant to a rights offering (the “Rights Offering”), on the terms and subject to the conditions set forth in the Prospectus and the “Instructions as to Use Of Groupon, Inc. Rights Certificates” accompanying this Subscription Rights Certificate. If you exercise your Rights in full, and any shares of Common Stock being offered in the Rights Offering remain available and unsubscribed for in the Rights Offering, you will be entitled to an over-subscription privilege (the “Over-Subscription Privilege”) to purchase a portion of the unsubscribed shares of Common Stock at the Subscription Price. The Rights represented by this Subscription Rights Certificate may be exercised by completing the appropriate forms and returning the full payment of the Subscription Price for each whole share of Common Stock purchased pursuant to the Rights. If the Company is unable to issue to the registered owner named above the full number of shares of Common Stock requested, the Subscription Agent will return to the registered owner named above any excess funds submitted as soon as practicable, without interest or deduction.

DELIVERY OPTIONS FOR SUBSCRIPTION RIGHTS CERTIFICATE:

To exercise Rights, complete your Subscription Form and upload the completed Subscription Rights Certificate, together with payment in full of the Subscription Price, to the Subscription Agent, so that it will be actually received by the Subscription Agent prior to the Expiration Date. The Subscription Agent will hold all funds it receives in a segregated bank account until completion of the Rights Offering. To exercise your Rights, you must complete the Subscription Form through Kroll’s electronic subscription submission portal (the “Electronic Portal). To access the Electronic Portal, visit https://is.kroll.com/groupon, click on the “Submit Rights Certificate” section of the website and follow the instructions to submit your Subscription Form and Subscriptions Rights Certificate. Your Subscription Form must be completed, executed and returned so that it is actually received by Kroll prior to the Expiration Date. To be deemed a valid submission, an Eligible Holder must complete the Subscription Form in its entirety which includes the confirmed submission of the Subscription Rights Certificate via an upload through the Electronic Portal.

PLEASE DO NOT SEND RIGHTS CERTIFICATES OR PAYMENTS DIRECTLY TO THE COMPANY.

Your payment of the Subscription Price must be made in U.S. dollars for the full number of whole shares of Common Stock you are subscribing for by wire transfer of immediately available funds to the Subscription Agent. Cashier’s checks, money orders and certified checks will not be accepted. If you are a beneficial owner of Common Stock that is registered in the name of a broker, dealer, bank or other nominee, you will need to coordinate exercises

of Rights through your broker, dealer, bank or other nominee in order for them to transmit payment to the Subscription Agent. In this case, you will not receive a Rights Certificate.

DELIVERY OTHER THAN IN THE MANNER LISTED ABOVE WILL NOT CONSTITUTE VALID DELIVERY

ANY QUESTIONS OR REQUESTS FOR ASSISTANCE CONCERNING THE RIGHTS OFFERING SHOULD BE DIRECTED TO KROLL ISSUER SERVICES (US), THE INFORMATION AGENT, AT (844) 369-8502 (TOLL-FREE) or (646) 651-1193 (INTERNATIONAL), OR VIA EMAIL AT GROUPON@IS.KROLL.COM.

Exhibit 99.2

November 21, 2023

Dear Stockholder:

Groupon, Inc. (“Groupon” or the “Company”) is pleased to commence a fully backstopped $80.0 million rights offering (the “Rights Offering”) to purchase shares of Groupon’s common stock, par value $0.0001 per share (the “Common Stock”). Groupon expects to use the net proceeds from the Rights Offering for general corporate purposes, which may include the repayment of debt.

A summary of the material terms of the Rights Offering is set forth below. The summary of material terms set forth below does not contain all of the information you should consider before participating in the Rights Offering. You should carefully read the entire accompanying prospectus and prospectus supplement, including each of the documents incorporated therein by reference, before making an investment decision.

SUMMARY OF THE MATERIAL TERMS

| | | | | | | | | | | |

| • | | Each stockholder receives one non-transferable basic subscription right (the “Right”) for each share of Common Stock owned as of 5:00 p.m., New York City time, on November 20, 2023 (the “Record Date”). Stockholders can purchase 0.222257 shares of Common Stock for each Right issued, rounded down to the nearest whole share. Stockholders who exercise their Rights in full will have an over-subscription privilege. |

| • | | The subscription price for all eligible stockholders, including the Backstop Party (defined below), is $11.30 per share of Common Stock. |

| • | | The Rights Offering expires at 5:00 p.m., New York City time, on January 17, 2024 (the “Expiration Date”). Subject to the conditions and procedures set forth in the prospectus supplement, the Company may cancel, amend or extend the Rights Offering at any time prior to the Expiration Date. |

| • | | Pursuant to the terms of the previously disclosed binding Backstop Agreement, dated November 9, 2023, by and between the Company and the Backstop Party, the Rights Offering is fully backstopped by Pale Fire Capital SICAV a.s. (the “Backstop Party”), an entity affiliated with Dusan Senkypl, the Company’s Interim Chief Executive Officer and a member of the Board of Directors (the “Board”), and Jan Barta, a member of the Board. The Backstop Party will be backstopping the Rights Offering on the same terms and conditions as other eligible stockholders. |

If you hold your shares of Common Stock under your name directly on the books and records of Computershare, Groupon’s transfer agent, you may exercise your Rights by completing the Subscription Form with associated Rights Certificate online at https://is.kroll.com/groupon (click on the “Submit Rights Certificate” section of the website and follow the instructions to submit your Subscription Form and Rights Certificate). If your shares are held in the name of your broker, you must contact your broker to participate in the Rights Offering. Please contact Kroll, Groupon’s information agent at (844) 369-8502 (Toll-Free) or (646) 651-1193 (International), or via email at groupon@is.kroll.com, if you have any questions about the Rights Offering.

Thank you for your loyalty and confidence in Groupon as you consider investing.

Sincerely,

| | | | | | | | |

| | |

Dusan Senkypl Interim CEO | | Jiri Ponrt CFO |

Exhibit 99.3

LETTER TO NOMINEE HOLDERS

7,079,646 Shares of Common Stock Issuable

Upon Exercise of Non-Transferable Subscription Rights

November 21, 2023

THE RIGHTS OFFERING SUBSCRIPTION PERIOD WILL EXPIRE AT 5:00 P.M., NEW YORK CITY TIME, ON JANUARY 17, 2024, UNLESS EXTENDED BY GROUPON, INC.

To Securities Dealers, Commercial Banks, Trust Companies and Other Nominees:

This letter is being distributed to securities dealers, commercial banks, trust companies and other nominees by Groupon, Inc. (the “Company”) in connection with an offering (the “Rights Offering”) of non-transferable basic subscription rights (the “Subscription Rights”) to subscribe for and purchase shares of common stock, par value $0.0001 per share, of the Company (“Common Stock”). The Subscription Rights are being distributed to all holders of record of Common Stock (“Eligible Holders”) as of 5:00 p.m., New York City time, on November 20, 2023 (the “Record Date”). The Rights Offering is described in the Company’s enclosed Prospectus Supplement, dated November 21, 2023 (the “Prospectus Supplement”), and its accompanying prospectus, dated August 9, 2023 (the “Base Prospectus,” and together with the Prospectus Supplement, the “Prospectus”). We are requesting that you contact your clients for whom you hold Common Stock, and who are to receive the Subscription Rights distributable with respect to those shares, regarding the Rights Offering.

In the Rights Offering, the Company is offering an aggregate of 7,079,646 shares of Common Stock to be issued upon the exercise of the Subscription Rights and Over-Subscription Privilege (as defined below), which are described further in the Prospectus. The Subscription Rights will expire if they are not exercised by 5:00 p.m., New York City time, on January 17, 2024, unless the Company extends the Rights Offering period as described in the Prospectus (such date and time, as it may be extended, the “Expiration Date”).

As described in the Prospectus, Eligible Holders will receive one Subscription Right for each share of Common Stock owned as of the Record Date. For every Subscription Right held, Eligible Holders will be entitled to purchase 0.222257 new shares of Common Stock. The number of shares of Common Stock to be issued to Eligible Holders will be rounded down to the nearest whole number and fractional shares of Common Stock will not be issued upon the exercise of the Subscription Rights. Eligible Holders will be required to pay for Common Stock issuable upon the exercise of Subscription Rights at the subscription price of $11.30 per share of Common Stock (the “Subscription Price”).

Pursuant to the terms of the previously disclosed binding Backstop Agreement, dated November 9, 2023, by and between the Company and the Backstop Party, the Rights Offering is fully backstopped by Pale Fire Capital SICAV a.s. (the “Backstop Party”), an entity affiliated with Dusan Senkypl, the Company’s Interim Chief Executive Officer and a member of the Board of Directors (the “Board”), and Jan Barta, a member of the Board. The Backstop Party has committed to (i) fully exercise its Subscription Rights prior to the Expiration Date and (ii) fully purchase any and all unsubscribed shares in the Rights Offering following the Expiration Date at a price of $11.30 per share and on the same terms and conditions as other Eligible Holders.

You should be aware that there will be an over-subscription privilege associated with the Rights Offering. As described further in the Prospectus, Eligible Holders who fully exercise all Subscription Rights initially issued to them are entitled to an Over-Subscription Privilege to buy those shares of Common Stock (“Over-Subscription Shares”) that remain unsubscribed at the Expiration Date at the same Subscription Price, which is $11.30 per share of Common Stock. If enough Over-Subscription Shares are available, all such requests will be honored in full. If the requests for Over-Subscription Shares exceed the Over-Subscription Shares available, the available Over-Subscription Shares will be allocated pro rata among the Eligible Holders who have fully exercised their Subscription Rights and who have requested to over-subscribe, based on the number of shares of Common Stock

purchased by virtue of their Subscription Rights. See the Prospectus for further details regarding the Over-Subscription Privilege.

Eligible Holders will be required to submit payment in full for all of the Common Stock they wish to purchase pursuant to the exercise of their Subscription Rights and Over-Subscription Privilege to Kroll Issuer Services (US) (“Kroll”), the subscription agent for the Rights Offering, prior to 5:00 p.m., New York City time, on the Expiration Date. Any excess payments made by Eligible Holders as a result of the exercise of their Over-Subscription Privilege (if any) will be refunded and will be returned by Kroll to such Eligible Holder as soon as practicable after the Expiration Date.

The Subscription Rights will be evidenced by a distribution of Rights through DTC.

We are asking that you contact your clients for whom you hold shares of Common Stock registered in your name(s) or in the name(s) of your nominee(s) to obtain instructions with respect to the Subscription Rights. If you hold Subscription Rights for the account of more than one client, your subscription elections must be made at the beneficial owner level.

All commissions, fees and other expenses (including brokerage commissions), other than fees and expenses paid to Kroll, incurred in connection with the exercise of the Subscription Rights will be for the account of the Eligible Holder of the Subscription Rights, and none of such commissions, fees or expenses will be paid by the Company or Kroll.

A suggested letter to your clients that can be used to further describe the Rights Offering and instruction procedures is attached as Exhibit A hereto.

Enclosed are copies of the following documents:

1.The Prospectus; and

2.Instructions for the Rights Offering and accompanying Beneficial Owner Election Form, on which you may obtain your clients’ instructions with regard to the Rights Offering.

Your prompt action is requested. As indicated in the Prospectus, to exercise the Subscription Rights on behalf of your underlying holders, you must exercise such Subscription Rights through the customary procedures of the Depository Trust and Clearing Corporation (“DTC”) using DTC’s Participant Subscription Offer Program (commonly referred to as “PSOP”).

Additional copies of the enclosed materials may be obtained from Kroll, the Company’s information agent. In addition, any questions or requests for assistance regarding the Rights Offering should be directed to Kroll. You may contact Kroll at (844) 369-8502 (Toll-Free) or (646) 651-1193 (International), or via email at groupon@is.kroll.com.

Very truly yours,

GROUPON, INC.

NOTHING CONTAINED IN THE PROSPECTUS OR IN ANY OF THE ENCLOSED DOCUMENTS SHALL MAKE YOU OR ANY PERSON AN AGENT OF THE COMPANY, THE SUBSCRIPTION AGENT, OR ANY OTHER PERSON MAKING OR DEEMED TO BE MAKING OFFERS OF THE SECURITIES ISSUABLE UPON VALID EXERCISE OF THE SUBSCRIPTION RIGHTS, OR AUTHORIZE YOU OR ANY OTHER PERSON TO MAKE ANY STATEMENTS ON BEHALF OF ANY OF THEM WITH RESPECT TO THE RIGHTS OFFERING EXCEPT FOR STATEMENTS MADE IN THE PROSPECTUS.

EXHIBIT A

LETTER TO CLIENTS OF NOMINEE HOLDERS

7,079,646 Shares of Common Stock Issuable Upon Exercise of Non-Transferable Subscription Rights

November 21, 2023

THE RIGHTS OFFERING SUBSCRIPTION PERIOD WILL EXPIRE AT

5:00 P.M., NEW YORK CITY TIME, ON JANUARY 17, 2024, UNLESS EXTENDED

BY GROUPON, INC.

To Our Clients:

This notice is being distributed by Groupon, Inc. (the “Company”) to all holders of record of its shares of common stock, par value $0.0001 per share (“Common Stock”), as of 5:00 p.m., New York City time, on November 20, 2023 (the “Record Date”), in connection with an offering (the “Rights Offering”) of non-transferable basic subscription rights (the “Subscription Rights”) to subscribe for and purchase new shares of Common Stock. The Rights Offering is described in the Company’s enclosed prospectus supplement, dated November 21, 2023 (the “Prospectus Supplement”), and its accompanying prospectus, dated August 9, 2023 (the “Base Prospectus” and collectively, with the Prospectus Supplement, the “Prospectus”).

In the Rights Offering, the Company is offering an aggregate of 7,079,646 shares of Common Stock to be issued upon the exercise of the Subscription Rights and Over-Subscription Privilege (as defined below), which are described further in the Prospectus. The Subscription Rights will expire if they are not exercised by 5:00 p.m., New York City time, on January 17, 2024, unless the Company extends the Rights Offering period as described in the Prospectus (such date and time, as it may be extended, the “Expiration Date”).

As described in the Prospectus, you will receive one Subscription Right for each share of Common Stock owned as of the Record Date. For every Subscription Right held, you will be entitled to purchase 0.222257 shares of Common Stock. The number of shares of Common Stock to be issued to you will be rounded down to the nearest whole number shares. No fractional shares of Common Stock will be issued upon the exercise of the Subscription Rights and you will only be entitled to purchase a whole number of shares of Common Stock if you exercise your Subscription Rights, rounded down to the nearest whole number. You will be required to pay for shares of Common Stock at the subscription price of $11.30 per share of Common Stock (the “Subscription Price”). You should read the Prospectus carefully before deciding whether to exercise the Subscription Rights.

Pursuant to the terms of the previously disclosed binding Backstop Agreement, dated November 9, 2023, by and between the Company and the Backstop Party (as defined below), the Rights Offering is fully backstopped by Pale Fire Capital SICAV a.s. (the “Backstop Party”), an entity affiliated with Dusan Senkypl, the Company’s Interim Chief Executive Officer and a member of the Board of Directors (the “Board”), and Jan Barta, a member of the Board. The Backstop Party has committed to (i) fully exercise its Subscription Rights prior to the Expiration Date and (ii) fully purchase any and all unsubscribed shares in the Rights Offering following the Expiration Date at a price of $11.30 per share and on the same terms and conditions as other Eligible Holders.

You should be aware that there will be an over-subscription privilege (the “Over-Subscription Privilege”) associated with the Rights Offering. As described further in the Prospectus, if you fully exercise all Subscription Rights initially issued to you, you are entitled to an Over-Subscription Privilege to purchase shares of Common Stock that remain unsubscribed after the Expiration Date (such shares of Common Stock, the “Over-Subscription Shares”), at the same Subscription Price. If enough Over-Subscription Shares are available, all such requests will be honored in full. If the requests for Over-Subscription Shares exceed the Over-Subscription Shares available, the available Over-Subscription Shares will be allocated pro rata among the Eligible Holders with Over-Subscription Privilege requests based on the number of Subscription Rights. See the Prospectus for further details on the Over-Subscription Privilege.

You will be required to submit payment in full for all of the Common Stock you wish to buy pursuant to the exercise of your Subscription Rights and Over-Subscription Privilege, if applicable. Any excess payments received by the subscription agent caused by proration will be returned by the subscription agent to you, without interest or deduction, as soon as practicable after the Expiration Date.

The Subscription Rights will be evidenced by a distribution of Subscription Rights through DTC.

THE MATERIALS ENCLOSED ARE BEING PROVIDED TO YOU AS THE BENEFICIAL OWNER OF COMMON STOCK CARRIED BY US IN YOUR ACCOUNT BUT NOT REGISTERED IN YOUR NAME. EXERCISES OF SUBSCRIPTION RIGHTS AND OVER-SUBSCRIPTION PRIVILEGES, IF APPLICABLE, MAY BE MADE ONLY BY US AS THE RECORD OWNER AND PURSUANT TO YOUR INSTRUCTIONS.

Accordingly, we request instructions as to whether you wish us to elect to subscribe for any shares of Common Stock to which you are entitled, pursuant to the terms and subject to the conditions set forth in the enclosed Prospectus. We urge you to read the Prospectus carefully before instructing us whether to exercise your Subscription Rights.

Your instructions to us should be forwarded as promptly as possible in order to permit us to exercise the Subscription Rights on your behalf in accordance with the provisions of the Rights Offering.

Any questions or requests for assistance regarding the Rights Offering should be directed to Kroll Issuer Services (US) (“Kroll”), the Company’s information agent. You may contact Kroll at (844) 369-8502 (Toll-Free) or (646) 651-1193 (International), or via email at groupon@is.kroll.com.

Very truly yours,

GROUPON, INC.

Exhibit 99.4

Groupon Announces Commencement of $80.0 Million Fully Backstopped Rights Offering for Common Stock

CHICAGO – November 21, 2023 - Groupon, Inc. (NASDAQ: GRPN) (the “Company”) announced today that it has commenced its $80.0 million fully backstopped rights offering (the “Rights Offering”) pursuant to which the Company will receive gross proceeds of $80.0 million, less expenses related to the Rights Offering. The Company intends to use the proceeds from the Rights Offering for general corporate purposes, which may include the repayment of debt.

The Company is distributing to all holders of record of its common stock, par value $0.0001 (the “Common Stock”), as of 5:00 p.m., New York City time, on November 20, 2023 (the “Record Date”), for each share of Common Stock held as of the Record Date, one non-transferable basic subscription right to purchase 0.222257 shares of Common Stock, at a subscription price of $11.30 per share, on such terms and subject to such conditions as may be required to comply with any applicable Nasdaq Global Select Market (the “Nasdaq”) stock exchange rules and regulations. All holders of record of Common Stock held as of the Record Date will have the opportunity to participate in the Rights Offering and subscribe for newly issued shares of Common Stock in proportion to their respective ownership amount as of the Record Date.

The Rights Offering will expire at 5:00 p.m., New York City time, on January 17, 2024 (the “Expiration Date”), unless extended by the Company. The Company reserves the right to extend, amend or terminate the Rights Offering, subject to certain conditions, at any time prior to the Expiration Date.

The Rights Offering is fully backstopped by Pale Fire Capital SICAV a.s. (the “Backstop Party”), an entity affiliated with Dusan Senkypl, the Company’s Interim Chief Executive Officer and a member of the Company’s Board of Directors (the “Board”), and Jan Barta, a member of the Company’s Board. The Backstop Party has committed to (i) fully exercise its basic subscription rights prior to the Expiration Date and (ii) fully purchase any and all unsubscribed shares in the Rights Offering following the Expiration Date at a price of $11.30 per share and on the same terms and conditions as other rights holders.

The Rights Offering will include an over-subscription privilege to permit each rights holder that exercises their basic subscription rights in full to purchase additional shares of Common Stock (if any) that remain unsubscribed at the expiration of the Rights Offering. The availability of the over-subscription privilege will be subject to certain terms and restrictions set forth in the prospectus supplement. If the aggregate subscriptions (basic subscriptions plus over-subscriptions) exceed the number of shares of Common Stock offered in the Rights Offering, then the aggregate over-subscription amount will be pro-rated among the holders exercising their respective over-subscription privileges (in proportion to the number of shares of Common Stock held after giving effect to all basic subscriptions).

The shares of Common Stock to be issued upon exercise of the basic subscription rights and over-subscription privilege, if applicable, will be listed for trading on the Nasdaq under the symbol “GRPN.” The basic subscription rights and over-subscription privilege, if applicable, are non-transferable and the Company will not be listing the basic subscription rights on Nasdaq or any other national securities exchange. The Company will not issue fractional shares of Common Stock. Any fractional shares of Common Stock that would remain after the exercise of the basic subscription rights will be rounded down to the nearest whole share, and any excess payments in respect thereof will be returned.

The Company expects that Kroll Issuer Services (US), the information agent for the Rights Offering, will distribute subscription documents for the Rights Offering to holders of record of Common Stock as of the Record Date beginning on or about November 21, 2023. Holders of shares of Common Stock held in “street name” through a brokerage account, bank or other

nominee should contact their broker, bank or other nominee for details regarding participation in the Rights Offering. For any questions or further information about the Rights Offering, please contact Kroll Issuer Services (US), which will be acting as the information agent for the Rights Offering, at (844) 369-8502 (Toll-Free) or (646) 651-1193 (International), or via email at groupon@is.kroll.com.

Neither the Company nor its Board has made or will make any recommendation to holders regarding participation in the Rights Offering. Holders should make an independent investment decision about whether to participate in the Rights Offering based on their own assessment of the Company’s business and the Rights Offering.

The offering of the Common Stock pursuant to the Rights Offering is being made pursuant to the Company’s existing effective shelf registration statement on Form S-3 (Reg. No. 333-273533) on file with the Securities and Exchange Commission (the “SEC”) and a prospectus supplement (and the accompanying base prospectus) filed with the SEC on the date hereof.

The information herein is not complete and is subject to change. This press release does not constitute an offer to sell or the solicitation of an offer to buy any of the basic subscription rights, Common Stock or any other securities, nor will there be any sale of the basic subscription rights, Common Stock or any other securities in any state or other jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any such state or other jurisdiction. This document is not an offering, which can only be made by the prospectus supplement (and the accompanying base prospectus), both of which contain information about the Company and the Rights Offering, and should be read carefully before investing.

About Groupon

Groupon (www.groupon.com) (NASDAQ: GRPN) is a trusted local marketplace where consumers go to buy services and experiences that make life more interesting and deliver boundless value. To find out more about Groupon, please visit press.groupon.com.

Contacts:

Investor Relations

ir@groupon.com

Public Relations

Emma Coleman

press@groupon.com

Forward-Looking Statements