Company Delivers $451 Million in Revenue and

Continues its Business Expansion

Freedom Holding Corp. (the “Company”) (NASDAQ: FRHC), a

multinational diversified financial services holding company with a

presence through its subsidiaries in 22 countries, today announced

the results for their first quarter ended June 30, 2024 of fiscal

2025. Highlights include:

- $451 million in revenue

- Net income of $34 million or $0.57 per share, diluted

- Total expense of $409 million

- $8.5 billion in total assets as of end of quarter

- S&P outlook for Company’s core subsidiaries revised from

negative to positive and the Company’s outlook from negative to

stable

- Approximately 6,800 employees and 132 offices as of end of

quarter

- Launch of the Freedom Bank KZ mobile application SuperApp

- Board of directors adds three new members

Income Statement Highlights:

The Company recognized revenue of approximately $451 million for

the first quarter of fiscal 2025, compared to $316 million in the

first quarter of fiscal 2024, a 43% increase. The Company's total

expenses were approximately $409 million in the first quarter of

fiscal 2025 compared to $232 million for the same period last year,

an increase of approximately 77%.

Net income was approximately $34 million for the first quarter

of fiscal 2025 as compared to $68 million for the same period in

fiscal 2024, a 50% decrease, providing for basic and diluted

earnings per share of $0.58 and $0.57, respectively. This compares

to $1.16 and $1.15 for the same period last year. Weighted average

common shares outstanding used to compute diluted earnings per

share for the three-month periods ended June 30, 2024, and 2023

were 60.3 million and 59.3 million, respectively. The decrease in

net income was driven largely by an unrealized net loss of $64.9

million attributable to Kazakhstan sovereign bonds held in

proprietary trading portfolio, primarily as a consequence of market

price declines, as well as increased expenses, corresponding with

the growth and development of the Company’s business.

Balance Sheet Highlights:

Total assets were $8.5 billion at June 30, 2024, as compared to

$8.3 billion at March 31, 2024 and cash and cash equivalents

totaled $719 million at June 30, 2024, compared to $545 million at

March 31, 2024. Shareholder’s equity remained relatively constant

at approximately $1.2 billion as of each of June 30, 2024 and March

31, 2024.

“Our investments in people, systems, and the expansion of our

fintech ecosystem continues to bear fruit…”

Timur Turlov, the Company's founder and chief executive officer,

provided commentary on the quarter by stating, "As has been our

process for the past number of years, we continue to direct our

profits into the further expansion of our business and the first

quarter of fiscal 2025 was no exception. With a $177 million

increase in total expenses as compared to the same period last

year, we managed to contribute over $34 million to the bottom line

during the quarter. Our investments in people, systems, and the

expansion of our fintech ecosystem continues to bear fruit, which

is evidenced by a 188% increase in insurance underwriting income, a

51% increase in interest income, and a 17% increase in fee and

commission income, with these three being our largest sources of

revenue for the quarter.”

Turlov continued, “Consistent with our general growth, I’m

pleased to report that we have brought our global headcount to over

6,800 highly professional team members who support our business

expansion. This compares to 5,100 for the first quarter of last

year.”

“Our strongest contributor to our top line was interest income

of just over $226 million, followed by insurance underwriting

income of $129 million, and fee and commission income of $115

million. We were also pleased to note that we experienced an

increase in brokerage accounts to 532,000 from 399,000 in the same

period last year, of which there was an 81% increase in active

accounts.”

“…now our digital fintech platform includes our retail bank,

insurance companies, and a growing list of popular ancillary

services that are contributing to the growth of our customer

base.”

Turlov continued, “Historically brokerage accounts set the

foundation for the overall growth of our digital fintech platform,

but now our platform includes our retail bank, insurance companies,

and a growing list of popular ancillary services that are

contributing to the growth of our customer base. These include

on-line grocery, travel and entertainment services, additional

regional retail offerings, and planned telecommunications and media

service offerings. In support of this, in April of this year our

retail bank, Freedom Bank KZ, launched its SuperApp, a one-stop

shop of financial services that our customers can use to check

their account balances, review transaction histories, make

transfers and payments, open and manage deposits as well as have

real-time portfolio monitoring and access to a whole array of

investing support services at their fingertips. This is a win-win

scenario as our customers will gain the convenience of access to

needed products and services and we will gain significant amounts

of consumer data that will allow us to continue to build value-add

products that our customers will enjoy. We expect innovation like

this to be a significant driver of future growth.”

“…the quarter sets the stage for another exemplary

year...”

“Overall, we are pleased with the results of the quarter which

sets the stage for another exemplary year for Freedom Holding Corp.

We continue to position our company for success by making strategic

investments to accelerate our organic growth and by winning the

battle for expertise, both operationally and from a corporate

governance perspective, in a highly competitive talent marketplace.

In June of this year, we welcomed three new members to our board of

directors: Dr. Kairat Kelimbetov, Andrew Gamble, and Philippe

Vogeleer, all with deep experience and with diverse backgrounds

which we expect will be instrumental in helping guide the continued

expansion strategy of our company. Going forward, we will continue

to pursue organic growth objectives and review potential

acquisition targets and opportunities for additional international

expansion. We are encouraged about the future prospects of the

enterprise,” Turlov concluded.

Additional Select First Quarter Fiscal 2025

Highlights:

The Company’s Banking segment, comprising Freedom Bank KZ,

experienced a 3% decrease in assets, a 5% decrease in its loan

portfolio and an 11% increase in its deposit portfolio during the

quarter, in comparison with the year-end of fiscal 2024. The Bank’s

trading portfolio also decreased by 8%, driven primarily by the

volatility on the debt instruments in its proprietary trading

portfolio.

As of June 30, 2024 and March 31, 2024, the Company’s Insurance

segment comprising Freedom Life and Freedom Insurance reported

assets of $546 million and $411 million in liabilities and $530

million in assets and $403 million in liabilities, respectively.

Active contracts in the life insurance business grew to 888,787

from 616,000 from in the previous year and general insurance grew

to 276,234 at June 30, 2024 from 191,000 at March 31, 2024, with

the increase driven primarily by innovative and competitive

products as well as significant investments in our sales force and

related advertising initiatives in the Kazakhstan market.

About Freedom Holding Corp.

Freedom Holding Corp., a Nevada corporation, is a diversified

financial services holding company conducting retail securities

brokerage, securities trading, investment research, investment

counseling, investment banking and underwriting services,

mortgages, insurance, and commercial banking as well as several

ancillary businesses which complement its core financial services

businesses, all through its subsidiaries, operating under the name

Freedom24 in Europe, Freedom Broker in, Central Asia and Freedom

Capital Markets in the United States. Through its subsidiaries,

Freedom Holding Corp. employs more than 6,800 people and is a

professional participant in the Kazakhstan Stock Exchange, the

Astana International Exchange, the Republican Stock Exchange of

Tashkent, the Uzbek Republican Currency Exchange, and is a member

of the New York Stock Exchange and the Nasdaq Stock Exchange.

Freedom Holding Corp. is incorporated in Nevada, and has

operations and subsidiaries in 22 countries, including Kazakhstan,

the United States, Cyprus, Poland, Spain, Uzbekistan, and

Azerbaijan, among others.

Freedom Holding Corp.'s common shares are registered with the

United States Securities and Exchange Commission and are traded

under the symbol FRHC on the Nasdaq Capital Market, operated by

Nasdaq, Inc.

To learn more about Freedom Holding Corp., visit

www.freedomholdingcorp.com.

Cautionary Note Regarding Forward-Looking Statements

This release contains "forward-looking" statements, including

with respect to Freedom Holding Corp.'s potential for future growth

and success. All forward-looking statements are subject to

uncertainty and changes in circumstances. In some cases,

forward-looking statements can be identified by terminology such as

"expect," "new," "plan," "seek," and "will," or the negative of

such terms or other comparable terminology used in connection with

any discussion of future plans, actions, and events.

Forward-looking statements are not guarantees of future results or

performance and involve risks, assumptions, and uncertainties that

could cause actual events or results to differ materially from the

events or results described in, or anticipated by, the

forward-looking statements. Factors that could materially affect

such forward-looking statements include certain economic, business,

and regulatory risks and factors identified in the Company's

periodic and current reports filed with the U.S. Securities and

Exchange Commission. All forward-looking statements are made only

as of the date of this release and the Company assumes no

obligation to update forward-looking statements to reflect

subsequent events or circumstances. Readers should not place undue

reliance on these forward-looking statements.

Website Disclosure

Freedom Holding Corp. intends to use its website,

https://ir.freedomholdingcorp.com, as a means for disclosing

material non-public information and for complying with U.S.

Securities and Exchange Commission Regulation FD and other

disclosure obligations.

June 30, 2024

March 31, 2024

ASSETS

Cash and cash equivalents (including $257

and $203 from related parties)

$

718,678

$

545,084

Restricted cash (including $1,121 and $—

with related parties)

1,179,510

462,637

Trading securities (including $1,256 and

$1,326 with related parties)

3,393,936

3,688,620

Available-for-sale securities, at fair

value

262,860

216,621

Margin lending, brokerage and other

receivables, net (including $37,836 and $22,039 due from related

parties)

1,217,885

1,660,275

Loans issued (including $136,558 and

$147,440 to related parties)

1,314,552

1,381,715

Fixed assets, net

100,474

83,002

Intangible assets, net

45,535

47,668

Goodwill

50,591

52,648

Right-of-use asset

35,006

36,324

Insurance contract assets

24,949

24,922

Other assets, net (including $23,057 and

$5,257 with related parties)

139,584

102,414

TOTAL ASSETS

$

8,483,560

$

8,301,930

LIABILITIES AND SHAREHOLDERS’

EQUITY

Securities repurchase agreement

obligations

$

2,558,794

$

2,756,596

Customer liabilities (including $84,970

and $44,127 to related parties)

2,699,912

2,273,830

Margin lending and trade payables

(including $255 and $507 to related parties)

836,309

867,880

Liabilities from insurance activity

(including $57 and $470 to related parties)

320,394

297,180

Current income tax liability

40,485

32,996

Debt securities issued

266,398

267,251

Lease liability

35,390

35,794

Liability arising from continuing

involvement

505,659

521,885

Other liabilities (including $8,349 and

$9,854 to related parties)

68,040

81,560

TOTAL LIABILITIES

$

7,331,381

$

7,134,972

Commitments and Contingent Liabilities

(Note 22)

—

—

SHAREHOLDERS’ EQUITY

Preferred stock - $0.001 par value;

20,000,000 shares authorized, no shares issued or outstanding

—

—

Common stock - $0.001 par value;

500,000,000 shares authorized; 60,721,010 shares issued and

outstanding as of June 30, 2024, and 60,321,813 shares issued and

outstanding as of March 31, 2024, respectively

60

60

Additional paid in capital

197,205

183,788

Retained earnings

1,033,140

998,740

Accumulated other comprehensive loss

(81,393

)

(18,938

)

TOTAL FRHC SHAREHOLDERS’ EQUITY

$

1,149,012

$

1,163,650

Non-controlling interest

3,167

3,308

TOTAL SHAREHOLDERS’ EQUITY

$

1,152,179

$

1,166,958

TOTAL LIABILITIES AND SHAREHOLDERS’

EQUITY

$

8,483,560

$

8,301,930

Three Months Ended June

30,

2024

2023

Revenue:

Fee and commission income (including $866

and $15,896 from related parties)

$

115,489

$

98,703

Net (loss)/gain on trading securities

(52,102

)

31,816

Interest income (including $270 and $5,352

from related parties)

226,004

149,349

Insurance underwriting income

129,408

44,889

Net gain on foreign exchange

operations

8,089

19,301

Net gain/(loss) on derivative

12,494

(30,605

)

Other income

11,333

2,757

TOTAL REVENUE, NET

$

450,715

$

316,210

Expense:

Fee and commission expense (including $157

and $99 from related parties)

$

80,147

$

28,684

Interest expense (including $381 and $168

from related parties)

145,718

95,046

Insurance claims incurred, net of

reinsurance

47,309

21,514

Payroll and bonuses

57,524

31,630

Professional services

7,268

6,625

Stock compensation expense

10,615

1,233

Advertising expense

17,201

8,100

General and administrative expense

(including $2,725 and $478 from related parties)

45,105

24,475

(Recovery of)/provision for allowance for

expected credit losses

(1,770

)

14,326

TOTAL EXPENSE

$

409,117

$

231,633

INCOME BEFORE INCOME TAX

41,598

84,577

Income tax expense

(7,339

)

(16,656

)

NET INCOME

$

34,259

$

67,921

Less: Net loss attributable to

non-controlling interest in subsidiary

(141

)

(181

)

NET INCOME ATTRIBUTABLE TO COMMON

SHAREHOLDERS

$

34,400

$

68,102

OTHER COMPREHENSIVE INCOME

Change in unrealized gain on investments

available-for-sale, net of tax effect

3,374

2,239

Reclassification adjustment for net

realized loss on available-for-sale investments disposed of in the

period, net of tax effect

(18

)

(958

)

Foreign currency translation

adjustments

(65,811

)

(1,760

)

OTHER COMPREHENSIVE LOSS

(62,455

)

(479

)

COMPREHENSIVE (LOSS)/INCOME BEFORE

NON-CONTROLLING INTERESTS

$

(28,196

)

$

67,442

Less: Comprehensive loss attributable to

non-controlling interest in subsidiary

(141

)

(181

)

COMPREHENSIVE (LOSS)/INCOME

ATTRIBUTABLE TO COMMON SHAREHOLDERS

$

(28,055

)

$

67,623

EARNINGS PER COMMON SHARE (In U.S.

dollars):

Earnings per common share - basic

0.58

1.16

Earnings per common share - diluted

0.57

1.15

Weighted average number of shares

(basic)

59,258,085

58,512,215

Weighted average number of shares

(diluted)

60,255,593

59,293,691

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240808856504/en/

Ramina Fakhrutdinova (KZ) Public Relations

Freedom Finance JSC +7 777 377 8868

pr@ffin.kz

Natalia Kharlashina Public Relations Freedom

Holding Corp. +7 701 364 1454

prglobal@ffin.kz

Al Palombo (US) Global Communications Chief

Freedom US Markets +1 212-980-4400, Ext. 1013

apalombo@freedomusmkts.com

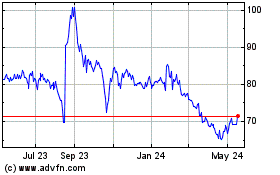

Freedom (NASDAQ:FRHC)

Historical Stock Chart

From Feb 2025 to Mar 2025

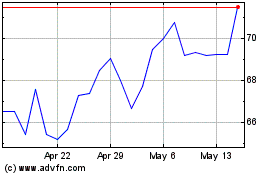

Freedom (NASDAQ:FRHC)

Historical Stock Chart

From Mar 2024 to Mar 2025