As

filed with the Securities and Exchange Commission on February 26, 2024

Registration

Statement No. 333-276771

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

WASHINGTON,

D.C. 20549

AMENDMENT NO. 2

TO

FORM

S-1

REGISTRATION

STATEMENT

UNDER

THE

SECURITIES ACT OF 1933

BONE

BIOLOGICS CORPORATION

(Exact

name of registrant as specified in its charter)

| Delaware |

|

2834 |

|

42-1743430 |

(State

or other jurisdiction of

incorporation

or organization) |

|

(Primary

Standard Industrial

Classification

Code Number) |

|

(I.R.S.

Employer

Identification

Number) |

2

Burlington Woods Drive, Suite 100

Burlington,

MA 01803

(781)

552-4452

(Address,

including zip code, and telephone number, including area code, of registrant’s principal executive offices)

Jeffrey

Frelick

Chief

Executive Officer

Bone

Biologics Corporation

2

Burlington Woods Drive, Suite 100

Burlington,

MA 01803

(781)

552-4452

(Name,

address, including zip code, and telephone number, including area code, of agent for service)

Copies

to:

Alexander

R. McClean, Esq.

Margaret

K. Rhoda, Esq.

Harter

Secrest & Emery LLP

1600

Bausch & Lomb Place

Rochester,

New York 14604

(585)

232-6500

|

|

Steven M. Skolnick,

Esq.

Lowenstein Sandler LLP

1251 Avenue of the Americas

New York, New York 10020

(212) 262-6700 |

Approximate

date of commencement of proposed sale to the public:

As

soon as practicable after the effective date of this registration statement.

If

any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the

Securities Act of 1933 check the following box: ☒

If

this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the

following box and list the Securities Act registration statement number of the earlier effective registration statement for the same

offering. ☐

If

this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the

Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If

this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the

Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

Indicate

by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting

company or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,”

“smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large

accelerated filer |

☐ |

Accelerated

filer |

☐ |

| Non-accelerated

filer |

☒ |

Smaller

reporting company |

☒ |

| |

|

Emerging

growth company |

☐ |

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided to Section 7(a)(2)(B) of the Securities Act. ☐

The

registrant hereby amends this registration statement on such date or dates as may be necessary to delay its effective date until the

registrant shall file a further amendment which specifically states that this registration statement shall thereafter become effective

in accordance with Section 8(a) of the Securities Act of 1933 or until the registration statement shall become effective on such date

as the Securities and Exchange Commission, acting pursuant to said Section 8(a), may determine.

EXPLANATORY NOTE

Bone

Biologics Corporation is filing this Amendment No. 2 to its registration statement on Form S-1 (File No. 333-276771) solely to file Exhibits 10.18 and 10.19. Accordingly, this amendment consists only of the facing page, this explanatory note, Part II of the Registration Statement, the

signature page to the Registration Statement and the filed exhibits. The remainder of the Registration Statement is unchanged and has

therefore been omitted.

PART

II — INFORMATION NOT REQUIRED IN PROSPECTUS

Item

13. Other Expenses of Issuance and Distribution

The

following table sets forth all expenses, other than the placement agent fees, payable by the registrant in connection with the sale of

the securities being registered. All the amounts shown are estimates except the SEC registration fee and the FINRA filing fee.

| |

|

Amount

to be paid |

|

| SEC

registration fee |

|

$ |

1,531.35 |

|

| FINRA filing fee |

|

|

2,056.25 |

|

| Transfer

agent and registrar fees |

|

|

20,000.00 |

|

| Accounting

fees and expenses |

|

|

25,000.00 |

|

| Legal

fees and expenses |

|

|

120,000.00 |

|

| Printing

and engraving expenses |

|

|

15,000.00 |

|

| Miscellaneous |

|

|

- |

|

| Total |

|

$ |

183,587.60 |

|

Item

14. Indemnification of Directors and Officers

Section

102 of the DGCL permits a corporation to eliminate the personal liability of directors of a corporation to the corporation or its stockholders

for monetary damages for a breach of fiduciary duty as a director, except where the director breached his duty of loyalty to us or our

stockholders, acted or failed to act (an omission) not in good faith or that involved intentional misconduct or a knowing violation of

law, engaged in intentional misconduct or knowingly violated a law, authorized the payment of a dividend or approved a stock repurchase

in violation of the DGCL, or obtained an improper personal benefit. Our Amended and Restated Certificate of Incorporation, as amended

(“Certificate of Incorporation”) provides that no director of the Company shall be personally liable to it or its stockholders

for monetary damages for any breach of fiduciary duty as a director, notwithstanding any provision of law imposing such liability, except

to the extent that the DGCL prohibits the elimination or limitation of liability of directors for breaches of fiduciary duty.

Section

145 of the DGCL provides that a corporation has the power to indemnify a director, officer, employee, or agent of the corporation, or

a person serving at the request of the corporation for another corporation, partnership, joint venture, trust or other enterprise in

related capacities against expenses (including attorneys’ fees), judgments, fines and amounts paid in settlement actually and reasonably

incurred by the person in connection with an action, suit or proceeding to which he was or is a party or is threatened to be made a party

to any threatened, ending or completed action, suit or proceeding by reason of such position, if such person acted in good faith and

in a manner he reasonably believed to be in or not opposed to the best interests of the corporation, and, in any criminal action or proceeding,

had no reasonable cause to believe his conduct was unlawful, except that, in the case of actions brought by or in the right of the corporation,

no indemnification shall be made with respect to any claim, issue or matter as to which such person shall have been adjudged to be liable

to the corporation unless and only to the extent that the Court of Chancery or other adjudicating court determines that, despite the

adjudication of liability but in view of all of the circumstances of the case, such person is fairly and reasonably entitled to indemnity

for such expenses which the Court of Chancery or such other court shall deem proper.

Our

Certificate of Incorporation and Amended and Restated Bylaws provide indemnification for our directors and officers to the fullest extent

permitted by the DGCL. We will indemnify each person who was or is a party or threatened to be made a party to any threatened, pending

or completed action, suit or proceeding (other than an action by or in the right of us) by reason of the fact that he or she is or was,

or has agreed to become, a director or officer, or is or was serving, or has agreed to serve, at our request as a director, officer,

partner, employee or trustee of, or in a similar capacity with, another corporation, partnership, joint venture, trust or other enterprise

(all such persons being referred to as an “Indemnitee”), or by reason of any action alleged to have been taken or omitted

in such capacity, against all expenses (including attorneys’ fees), judgments, fines and amounts paid in settlement actually and

reasonably incurred in connection with such action, suit or proceeding and any appeal therefrom, if such Indemnitee acted in good faith

and in a manner he or she reasonably believed to be in, or not opposed to, our best interests, and, with respect to any criminal action

or proceeding, he or she had no reasonable cause to believe his or her conduct was unlawful. Our Certificate of Incorporation and Amended

and Restated Bylaws provide that we will indemnify any Indemnitee who was or is a party to an action or suit by or in the right of us

to procure a judgment in our favor by reason of the fact that the Indemnitee is or was, or has agreed to become, a director or officer,

or is or was serving, or has agreed to serve, at our request as a director, officer, partner, employee or trustee of, or in a similar

capacity with, another corporation, partnership, joint venture, trust or other enterprise, or by reason of any action alleged to have

been taken or omitted in such capacity, against all expenses (including attorneys’ fees) and, to the extent permitted by law, amounts

paid in settlement actually and reasonably incurred in connection with such action, suit or proceeding, and any appeal therefrom, if

the Indemnitee acted in good faith and in a manner he or she reasonably believed to be in, or not opposed to, our best interests, except

that no indemnification shall be made with respect to any claim, issue or matter as to which such person shall have been adjudged to

be liable to us, unless a court determines that, despite such adjudication but in view of all of the circumstances, he or she is entitled

to indemnification of such expenses. Notwithstanding the foregoing, to the extent that any Indemnitee has been successful, on the merits

or otherwise, he or she will be indemnified by us against all expenses (including attorneys’ fees) actually and reasonably incurred

in connection therewith. Expenses must be advanced to an Indemnitee under certain circumstances.

As

of the date of this prospectus, we have entered into separate indemnification agreements with each of our directors and executive officers.

Each indemnification agreement provides, among other things, for indemnification to the fullest extent permitted by law and our Certificate

of Incorporation against any and all expenses, judgments, fines, penalties and amounts paid in settlement of any claim. The indemnification

agreements provide for the advancement or payment of all expenses to the indemnitee and for the reimbursement to us if it is found that

such indemnitee is not entitled to such indemnification. In addition, we have obtained a general liability insurance policy that covers

certain liabilities of directors and officers of our corporation arising out of claims based on acts or omissions in their capacities

as directors or officers.

Item

15. Recent Sales of Unregistered Securities

The

information below lists all of the securities sold by us during the past three years which were not registered under the Securities Act:

| ● | On

November 16, 2023, we sold registered shares of common stock in a registered direct offering

and contemporaneously therewith sold unregistered warrants to purchase up to an aggregate

of 142,384 shares of our common stock in a private placement, to certain institutional investors,

for approximately $729,000. The warrants were sold in reliance on the exemptions from registration

provided by Section 4(a)(2) under the Securities Act and/or Regulation D promulgated thereunder. |

| ● | On

November 16, 2023, we issued warrants to purchase up to an aggregate of 8,543 shares of our

common stock to H.C. Wainwright (equal to 6.0% of the aggregate number of shares of common

stock sold in a registered direct offering) in connection with the services it provided as

placement agent in the registered direct offering and private placement, in reliance on the

exemptions from registration provided by Section 4(a)(2) under the Securities Act and/or

Regulation D promulgated thereunder. |

Item

16. Exhibits and Financial Statement Schedules

The

following exhibits to this registration statement included in the Exhibit Index are incorporated by reference.

EXHIBIT

INDEX

| Exhibit |

|

|

Incorporated

by reference

(unless otherwise indicated) |

| Number |

|

Exhibit

Title |

|

Form |

|

File |

|

Exhibit |

|

Filing

date |

| |

|

|

|

|

|

|

|

|

|

|

| 2.1 |

|

Agreement and Plan of Merger, dated as of September 19, 2014, by and among AFH Acquisition X, Inc., Bone Biologics Acquisition Corp., and Bone Biologics, Inc. |

|

8-K |

|

000-53078 |

|

2.1 |

|

September

25, 2014 |

| |

|

|

|

|

|

|

|

|

|

|

| 2.2 |

|

Certificate of Merger as filed with the California Secretary of State effective September 19, 2014 |

|

8-K |

|

000-53078 |

|

2.2 |

|

September

25, 2014 |

| |

|

|

|

|

|

|

|

|

|

|

| 3.1 |

|

Amended and Restated Certificate of Incorporation of Bone Biologics Corporation |

|

8-K |

|

000-53078 |

|

3.1(i) |

|

September

25, 2014 |

| |

|

|

|

|

|

|

|

|

|

|

| 3.2 |

|

Certificate of Amendment to Amended and Restated Certificate of Incorporation of Bone Biologics Corporation |

|

8-K |

|

000-53078 |

|

3.1 |

|

October

15, 2021 |

| |

|

|

|

|

|

|

|

|

|

|

| 3.3 |

|

Certificate of Amendment to Amended and Restated Certificate of Incorporation of Bone Biologics Corporation |

|

8-K |

|

001-40899 |

|

3.1 |

|

June

6, 2023 |

| |

|

|

|

|

|

|

|

|

|

|

| 3.4 |

|

Certificate of Amendment to Amended and Restated Certificate of Incorporation of Bone Biologics Corporation |

|

8-K |

|

001-40899 |

|

3.1 |

|

December

18, 2023 |

| |

|

|

|

|

|

|

|

|

|

|

| 3.5 |

|

Amended and Restated Bylaws of Bone Biologics Corporation |

|

8-K |

|

001-40899 |

|

3.1 |

|

March

8, 2022 |

| |

|

|

|

|

|

|

|

|

|

|

| 3.6 |

|

Amendment No. 1 to the Amended and Restated Bylaws of Bone Biologics Corporation |

|

8-K |

|

001-40899 |

|

3.1 |

|

October

24, 2023 |

| |

|

|

|

|

|

|

|

|

|

|

| 4.1 |

|

Warrant Agent Agreement between the Company and Equiniti Trust Company dated as of October 13, 2021 |

|

8-K |

|

000-53078 |

|

4.1 |

|

October

15, 2021 |

| |

|

|

|

|

|

|

|

|

|

|

| 4.2 |

|

Form of Warrant (October 2021) |

|

S-1 |

|

333-276771 |

|

4.2 |

|

January 30, 2024 |

| |

|

|

|

|

|

|

|

|

|

|

| 4.3 |

|

Form of Representative’s Warrant (October 2021) |

|

8-K |

|

000-53078 |

|

1.1 |

|

October

15, 2021 |

| 4.4 |

|

Warrant Agent Agreement between the Company and Equiniti Trust Company dated as of October 7, 2022 |

|

8-K |

|

001-40899 |

|

4.1 |

|

October

11, 2022 |

| |

|

|

|

|

|

|

|

|

|

|

| 4.5 |

|

Form of Series A Warrant (October 2022) |

|

S-1 |

|

333-276771 |

|

4.5 |

|

January

30, 2024 |

| |

|

|

|

|

|

|

|

|

|

|

| 4.6 |

|

Form of Series B Warrant (October 2022) |

|

S-1 |

|

333-276771 |

|

4.6 |

|

January 30, 2024 |

| |

|

|

|

|

|

|

|

|

|

|

| 4.7 |

|

Form of Series C Warrant (October 2022) |

|

S-1 |

|

333-276771 |

|

4.7 |

|

January 30, 2024 |

| |

|

|

|

|

|

|

|

|

|

|

| 4.8 |

|

Form of Representative’s Warrant (October 2022) |

|

8-K |

|

001-40899 |

|

1.1 |

|

October

11, 2022 |

| |

|

|

|

|

|

|

|

|

|

|

| 4.9 |

|

Form of Warrant (November 2023) |

|

S-3 |

|

333-276412 |

|

4.1 |

|

January

5, 2024 |

| |

|

|

|

|

|

|

|

|

|

|

| 4.10 |

|

Form of Placement Agent Warrant (November 2023) |

|

8-K |

|

001-40899 |

|

4.2 |

|

November

20, 2023 |

| |

|

|

|

|

|

|

|

|

|

|

| 4.11 |

|

Form of Warrant |

|

S-1/A |

|

333-276771 |

|

4.11 |

|

February

23, 2024 |

| |

|

|

|

|

|

|

|

|

|

|

| 4.12 |

|

Form of Pre-Funded Warrant |

|

S-1/A |

|

333-276771 |

|

4.12 |

|

February

23, 2024 |

| |

|

|

|

|

|

|

|

|

|

|

| 4.13 |

|

Form of Placement Agent Warrant |

|

S-1/A |

|

333-276771 |

|

4.13 |

|

February

23, 2024 |

| |

|

|

|

|

|

|

|

|

|

|

| 5.1 |

|

Opinion of Harter Secrest & Emery LLP |

|

S-1/A |

|

333-276771 |

|

5.1 |

|

February

23, 2024 |

| |

|

|

|

|

|

|

|

|

|

|

| 10.1+ |

|

Director Offer Letter, dated July 1, 2014, by and between Bruce Stroever and Bone Biologics Corporation |

|

8-K |

|

000-53078 |

|

10.4 |

|

September

25, 2014 |

| |

|

|

|

|

|

|

|

|

|

|

| 10.2+ |

|

Form of Indemnification Agreement |

|

S-1 |

|

333-276771 |

|

10.2 |

|

January 30, 2024 |

| |

|

|

|

|

|

|

|

|

|

|

| 10.3+ |

|

Chief Operating Officer Employment agreement, dated June 8, 2015, by and between Bone Biologics Corporation and Jeffrey Frelick |

|

10-Q |

|

000-53078 |

|

10.2 |

|

August

14, 2015 |

| |

|

|

|

|

|

|

|

|

|

|

| 10.4+ |

|

Employment Agreement dated December 17, 2021 between the Company and Deina Walsh |

|

8-K |

|

001-40899 |

|

10.1 |

|

December

22, 2021 |

| |

|

|

|

|

|

|

|

|

|

|

| 10.5+ |

|

Form of Professional Services Agreement, dated January 8, 2016, by and between the Company and the Founders |

|

8-K |

|

000-53078 |

|

10.1 |

|

January

11, 2016 |

| |

|

|

|

|

|

|

|

|

|

|

| 10.6+ |

|

Bone Biologics Corporation Non-Employee Director Compensation Policy |

|

8-K |

|

000-53078 |

|

10.1 |

|

January

4, 2016 |

| |

|

|

|

|

|

|

|

|

|

|

| 10.7+ |

|

Bone Biologics Corporation 2015 Equity Incentive Plan |

|

8-K |

|

000-53078 |

|

10.3 |

|

January

4, 2016 |

| |

|

|

|

|

|

|

|

|

|

|

| 10.8+ |

|

First Amendment to the Bone Biologics Corporation 2015 Equity Incentive Plan |

|

Schedule

14A |

|

001-40899 |

|

Appendix

B |

|

August

3, 2023 |

| |

|

|

|

|

|

|

|

|

|

|

| 10.9+ |

|

Form of Stock Option Grant Notice and Option Agreement for the Bone Biologics Corporation 2015 Equity Incentive Plan |

|

8-K |

|

000-53078 |

|

10.4 |

|

January

4, 2016 |

| |

|

|

|

|

|

|

|

|

|

|

| 10.10+ |

|

Form of Restricted Stock Unit Grant Notice and Restricted Stock Unit Agreement |

|

8-K |

|

000-53078 |

|

10.5 |

|

January

4, 2016 |

| |

|

|

|

|

|

|

|

|

|

|

| 10.11 |

|

Option Agreement for the Distribution and Supply of Sygnal™ dated as of February 24, 2016 |

|

8-K |

|

000-53078 |

|

10.3 |

|

February

26, 2016 |

| |

|

|

|

|

|

|

|

|

|

|

| 10.12 |

|

Amended and Restated Exclusive License Agreement, dated as of March 21, 2019, by and between the Company and The Regents of the University of California |

|

8-K |

|

000-53078 |

|

10.1 |

|

April

16, 2019 |

| 10.13 |

|

First Amendment to the Amended License Agreement dated August 13, 2020 between the Company and the Regents of the University of California |

|

S-1/A |

|

333-257484 |

|

10.40 |

|

October

7, 2021 |

| |

|

|

|

|

|

|

|

|

|

|

| 10.14 |

|

Third Amendment to the Amended License Agreement dated June 8, 2022 between the Company and the Regents of the University of California |

|

8-K |

|

001-40899 |

|

10.1 |

|

June

9, 2022 |

| |

|

|

|

|

|

|

|

|

|

|

| 10.15 |

|

Supply and Development Support Agreement dated March 3, 2022 between the Company and Musculoskeletal Transplant Foundation, Inc. |

|

10-K |

|

001-40899 |

|

10.30 |

|

March

15, 2022 |

| |

|

|

|

|

|

|

|

|

|

|

| 10.16 |

|

Securities Purchase Agreement (November 2023) |

|

S-3/A |

|

333-276412 |

|

99.1 |

|

January

17, 2024 |

| |

|

|

|

|

|

|

|

|

|

|

| 10.17 |

|

Form of Securities Purchase Agreement |

|

S-1/A |

|

333-276771 |

|

10.17 |

|

February

23, 2024 |

| |

|

|

|

|

|

|

|

|

|

|

| 10.18* |

|

Engagement Agreement between H.C. Wainwright & Co., LLC and the Company dated October 30, 2023 |

|

— |

|

— |

|

— |

|

— |

| |

|

|

|

|

|

|

|

|

|

|

| 10.19* |

|

Amendment No. 1 to Engagement Agreement between H.C. Wainwright & Co., LLC and the Company dated February 6, 2024 |

|

— |

|

— |

|

— |

|

— |

| |

|

|

|

|

|

|

|

|

|

|

| 21.1 |

|

List of Subsidiaries |

|

8-K |

|

000-53078 |

|

21.1 |

|

September

25, 2014 |

| |

|

|

|

|

|

|

|

|

|

|

| 23.1 |

|

Consent of Independent Registered Public Accounting Firm, Weinberg & Company, P.A. |

|

S-1/A |

|

333-276771 |

|

23.1 |

|

February

23, 2024 |

| |

|

|

|

|

|

|

|

|

|

|

| 23.2 |

|

Consent of Harter Secrest & Emery LLP (included in Exhibit 5.1) |

|

S-1/A |

|

333-276771 |

|

5.1 |

|

February

23, 2024 |

| |

|

|

|

|

|

|

|

|

|

|

| 24.1 |

|

Power

of Attorney (included on the signature page to the Company's Registration Statement on Form S-1) |

|

S-1 |

|

333-276771 |

|

4.2 |

|

January 30, 2024 |

| |

|

|

|

|

|

|

|

|

|

|

| 101.INS* |

|

Inline XBRL

Instance Document |

|

— |

|

— |

|

— |

|

— |

| |

|

|

|

|

|

|

|

|

|

|

| 101.SCH* |

|

Inline XBRL

Taxonomy Extension Schema Document |

|

— |

|

— |

|

— |

|

— |

| |

|

|

|

|

|

|

|

|

|

|

| 101.CAL* |

|

Inline XBRL

Taxonomy Extension Calculation Linkbase Document |

|

— |

|

— |

|

— |

|

— |

| |

|

|

|

|

|

|

|

|

|

|

| 101.DEF* |

|

Inline XBRL

Taxonomy Extension Definition Linkbase Document |

|

— |

|

— |

|

— |

|

— |

| |

|

|

|

|

|

|

|

|

|

|

| 101.LAB* |

|

Inline XBRL

Taxonomy Extension Label Linkbase Document |

|

— |

|

— |

|

— |

|

— |

| |

|

|

|

|

|

|

|

|

|

|

| 101.PRE* |

|

Inline XBRL

Taxonomy Extension Presentation Linkbase Document |

|

— |

|

— |

|

— |

|

— |

| |

|

|

|

|

|

|

|

|

|

|

| 104 |

|

Cover Page formatted in Inline XBRL and contained in Exhibit 101 |

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

| 107 |

|

Filing Fee Table |

|

S-1 |

|

333-276771 |

|

107 |

|

January

30, 2024 |

*

Filed herewith.

+

Management contract or compensatory arrangement.

Item

17. Undertakings

| The

undersigned registrant hereby undertakes: |

| (a)(1) |

To

file, during any period in which offers or sales are being made, a post-effective amendment to this registration statement: |

| |

(i) |

To

include any prospectus required by Section 10(a)(3) of the Securities Act; |

| |

|

|

| |

(ii) |

To

reflect in the prospectus any facts or events arising after the effective date of the registration statement (or the most recent

post-effective amendment thereof) which, individually or in the aggregate, represent a fundamental change in the information set

forth in the registration statement. Notwithstanding the foregoing, any increase or decrease in volume of securities offered (if

the total dollar value of securities offered would not exceed that which was registered) and any deviation from the low or high end

of the estimated maximum offering range may be reflected in the form of prospectus filed with the SEC pursuant to Rule 424(b) if,

in the aggregate, the changes in volume and price represent no more than 20% change in the maximum aggregate offering price set forth

in the “Calculation of Filing Fee Tables” or “Calculation of Registration Fee” table, as applicable, in the

effective registration statement; and |

| |

|

|

| |

(iii) |

To

include any material information with respect to the plan of distribution not previously disclosed in the registration statement

or any material change to such information in the registration statement; |

provided,

however, that the undertakings set forth in paragraphs (a)(1)(i), (a)(1)(ii) and (a)(1)(iii) above do not apply if the information required

to be included in a post-effective amendment by those paragraphs is contained in reports filed with or furnished to the SEC by the registrant

pursuant to section 13 or section 15(d) of the Securities Exchange Act of 1934 that are incorporated by reference in this registration

statement or are contained in a form of prospectus filed pursuant to Rule 424(b) that is part of this registration statement.

| (2) |

That,

for the purpose of determining any liability under the Securities Act, each such post-effective amendment shall be deemed to be a

new registration statement relating to the securities offered therein, and the offering of such securities at that time shall be

deemed to be the initial bona fide offering thereof. |

| |

|

| (3) |

To

remove from registration by means of a post-effective amendment any of the securities being registered which remain unsold at the

termination of the offering. |

| |

|

| (4) |

That,

for the purpose of determining liability of the registrant under the Securities Act to any purchaser, each prospectus filed pursuant

to Rule 424(b) as part of a registration statement relating to an offering, other than registration statements relying on Rule 430B

or other than prospectuses filed in reliance on Rule 430A, shall be deemed to be part of and included in the registration statement

as of the date it is first used after effectiveness. Provided, however, that no statement made in a registration statement or prospectus

that is part of the registration statement or made in a document incorporated or deemed incorporated by reference into the registration

statement or prospectus that is part of the registration statement will, as to a purchaser with a time of contract of sale prior

to such first use, supersede or modify any statement that was made in the registration statement or prospectus that was part of the

registration statement or made in any such document immediately prior to such date of first use. |

| (5) |

For

the purpose of determining liability of the registrant under the Securities Act to any purchaser in the initial distribution of the

securities, that in a primary offering of securities of the undersigned registrant pursuant to this registration statement, regardless

of the underwriting method used to sell the securities to the purchaser, if the securities are offered or sold to such purchaser

by means of any of the following communications, the undersigned registrant will be a seller to the purchaser and will be considered

to offer or sell such securities to such purchaser: |

| |

(i) |

Any

preliminary prospectus or prospectus of the undersigned registrant relating to the offering required to be filed pursuant to Rule

424; |

| |

(ii) |

Any

free writing prospectus relating to the offering prepared by or on behalf of the undersigned registrant or used or referred to by

the undersigned registrant; |

| |

(iii) |

The

portion of any other free writing prospectus relating to the offering containing material information about the undersigned registrant

or its securities provided by or on behalf of the undersigned registrant; and |

| |

(iv) |

Any

other communication that is an offer in the offering made by the undersigned registrant to the purchaser. |

| |

|

|

| (6) |

That, |

| |

(i) |

For

purposes of determining any liability under the Securities Act, the information omitted from the form of prospectus filed as part

of this registration statement in reliance on Rule 430A and contained in a form of prospectus filed by the undersigned registrant

pursuant to Rule 424(b)(1) or (4) or 497(h) under the Securities Act shall be deemed to be part of this registration statement as

of the time it was declared effective; and |

| |

|

|

| |

(ii) |

For

the purpose of determining any liability under the Securities Act, each post-effective amendment that contains a form of prospectus

shall be deemed to be a new registration statement relating to the securities offered therein, and the offering of such securities

at that time shall be deemed to be the initial bona fide offering thereof. |

| (b) |

The undersigned registrant

hereby undertakes that, for purposes of determining any liability under the Securities Act, each filing of the registrant's annual

report pursuant to Section 13(a) or 15(d) of the Securities Exchange Act of 1934 (and, where applicable, each filing of an employee

benefit plan's annual report pursuant to Section 15(d) of the Securities Exchange Act of 1934) that is incorporated by reference

in the registration statement shall be deemed to be a new registration statement relating to the securities offered therein, and

the offering of such securities at that time shall be deemed to be the initial bona fide offering thereof. |

| Insofar

as indemnification for liabilities arising under the Securities Act of 1933 may be permitted to directors, officers and controlling

persons of the registrant pursuant to the foregoing provisions, or otherwise, the registrant has been advised that in the opinion

of the Securities Exchange Commission such indemnification is against public policy as expressed in the Act and is, therefore, unenforceable.

In the event that a claim for indemnification against such liabilities (other than the payment by the registrant of expenses incurred

or paid by a director, officer or controlling person of the registrant in the successful defense of any action, suit or proceeding)

is asserted by such director, officer or controlling person in connection with the securities being registered, the registrant will,

unless in the opinion of its counsel the matter has been settled by controlling precedent, submit to a court of appropriate jurisdiction

the question whether such indemnification by it is against public policy as expressed in the Act and will be governed by the final

adjudication of such issue. |

SIGNATURES

Pursuant

to the requirements of the Securities Act of 1933, the registrant has duly caused this registration statement to be signed on its behalf

by the undersigned, thereunto duly authorized in the Town of Burlington, Commonwealth of Massachusetts, on February 26, 2024.

| |

BONE

BIOLOGICS CORPORATION |

| |

|

|

| |

By: |

/s/

Jeffrey Frelick |

| |

Name: |

Jeffrey

Frelick |

| |

Title: |

Chief

Executive Officer

(Principal

Executive Officer) |

| Signature |

|

Title |

|

Date |

| |

|

|

|

|

| /s/

Jeffrey Frelick |

|

Chief

Executive Officer (Principal Executive Officer) |

|

February

26, 2024 |

| Jeffrey

Frelick |

|

|

|

|

| |

|

|

|

|

|

*

|

|

Chief

Financial Officer (Principal Financial Officer and |

|

February

26, 2024 |

| Deina

H. Walsh |

|

Principal

Accounting Officer) |

|

|

| |

|

|

|

|

| * |

|

Director |

|

February

26, 2024 |

| Don

R. Hankey |

|

|

|

|

| |

|

|

|

|

| * |

|

Director |

|

February

26, 2024 |

| Siddhesh

Angle |

|

|

|

|

| |

|

|

|

|

| * |

|

Director |

|

February

26, 2024 |

| Robert

Gagnon |

|

|

|

|

| |

|

|

|

|

| * |

|

Director |

|

February

26, 2024 |

| Bruce

Stroever |

|

|

|

|

| * By: |

/s/ Jeffrey Frelick |

|

Attorney-in-Fact |

|

February

26, 2024 |

| |

Jeffrey Frelick |

|

|

|

|

Exhibit

10.18

Execution

Version

October

30, 2023

STRICTLY

CONFIDENTIAL

Bone

Biologics Corporation

2

Burlington Woods Drive, Suite 100

Burlington,

MA 01803

Attn:

Jeffrey Frelick, Chief Executive Officer

Dear

Mr. Frelick:

This

letter agreement (this “Agreement”) constitutes the agreement between Bone Biologics Corporation (the “Company”)

and H.C. Wainwright & Co., LLC (“Wainwright”), that Wainwright shall serve as the exclusive underwriter, agent

or advisor in any offering (each, an “Offering”) of securities of the Company (the “Securities”)

during the Term (as hereinafter defined) of this Agreement. The terms of each Offering and the Securities issued in connection therewith

shall be mutually agreed upon by the Company and Wainwright and nothing herein implies that Wainwright would have the power or authority

to bind the Company and nothing herein implies that the Company shall have an obligation to issue any Securities. It is understood that

Wainwright’s assistance in an Offering will be subject to the satisfactory completion of such investigation and inquiry into the

affairs of the Company as Wainwright deems appropriate under the circumstances and to the receipt of all internal approvals of Wainwright

in connection with an Offering. The Company expressly acknowledges and agrees that Wainwright’s involvement in an Offering is strictly

on a reasonable best efforts basis and that the consummation of an Offering will be subject to, among other things, market conditions.

The execution of this Agreement does not constitute a commitment by Wainwright to purchase the Securities and does not ensure a successful

Offering of the Securities or the success of Wainwright with respect to securing any other financing on behalf of the Company. Wainwright

may retain other underwriters, brokers, dealers or agents on its behalf in connection with an Offering.

A.

Compensation; Reimbursement. At the closing of each Offering (each, a “Closing”), the Company shall compensate

Wainwright as follows:

| 1. | Cash

Fee. The Company shall pay to Wainwright a cash fee, or as to an underwritten Offering

an underwriter discount, equal to 7.0% of the aggregate gross proceeds raised in each Offering. |

| 2. | Warrant

Coverage. The Company shall issue to Wainwright or its designees at each Closing, warrants

(the “Wainwright Warrants”) to purchase that number of shares of common

stock of the Company equal to 6.0% of the aggregate number of shares of common stock (or

common stock equivalent, if applicable) placed in each Offering (and if an Offering includes

a “greenshoe” or “additional investment” component, such number of

shares of common stock sold by the Company pursuant to such “greenshoe” or “additional

investment” component, with the Wainwright Warrants issuable upon the exercise of such

component). If the Securities included in an Offering are convertible, the Wainwright Warrants

shall be determined by dividing the gross proceeds raised in such Offering by the Offering

Price (as defined hereunder). The Wainwright Warrants shall be in a customary form reasonably

acceptable to Wainwright, have a term of five (5) years and an exercise price equal to 125%

of the offering price per share (or unit, if applicable) in the applicable Offering and if

such offering price is not available, the market price of the common stock on the date an

Offering is commenced (such price, the “Offering Price”). If warrants

are issued to investors in an Offering, the Wainwright Warrants shall have the same terms

as the warrants issued to investors in the applicable Offering, except that such Wainwright

Warrants shall have an exercise price equal to 125% of the Offering Price. |

| 3. | Expense

Allowance. Out of the proceeds of each Closing, the Company also agrees to pay Wainwright

(a) a management fee equal to 1.0% of the gross proceeds raised in each Offering; (b) $35,000

for non-accountable expenses; (c) up to $50,000 for fees and expenses of legal counsel and

other out-of-pocket expenses (to be increased to $100,000 in case a public Offering is contemplated

or consummated); plus the additional amount payable by the Company pursuant to Paragraph

D.3 hereunder; provided, however, that such amount in no way limits or impairs the indemnification

and contribution provisions of this Agreement. |

| 4. | Tail.

Wainwright shall be entitled to compensation under clauses (1) and (2) hereunder, calculated

in the manner set forth therein, with respect to any public or private offering or other

financing or capital-raising transaction of any kind (“Tail Financing”)

to the extent that any capital or funds in such Tail Financing is provided to the Company

directly or indirectly by investors whom Wainwright had contacted during the Term or introduced

to the Company during the Term, if such Tail Financing is consummated at any time within

the 12-month period following the expiration or termination of this Agreement. |

| 5. | Right

of First Refusal. If, from the date hereof until the 12-month anniversary following consummation of each Offering, the Company

or any of its subsidiaries (a) decides to dispose of or acquire business units or acquire any of its outstanding securities or make

any exchange or tender offer or enter into a merger, consolidation or other business combination or any recapitalization,

reorganization, restructuring or other similar transaction, including, without limitation, an extraordinary dividend or

distributions or a spin-off or split-off, Wainwright (or any affiliate designated by Wainwright) shall have the right to act as the

Company’s exclusive financial advisor for any such transaction; or (b) decides to finance or refinance any indebtedness,

Wainwright (or any affiliate designated by Wainwright) shall have the right to act as sole book-runner, sole manager, sole placement

agent or sole agent with respect to such financing or refinancing; or (c) decides to raise funds by means of a public offering

(including at-the-market facility) or a private placement or any other capital-raising financing of equity, equity-linked or debt

securities, Wainwright (or any affiliate designated by Wainwright) shall have the right to act as sole book-running manager, sole

underwriter or sole placement agent for such financing. If Wainwright or one of its affiliates decides to accept any such

engagement, the agreement governing such engagement will contain terms customary for transactions of similar size and nature and (i)

with respect to clauses (a) and (b), provisions that shall be mutually agreed upon between the Company and Wainwright, negotiating

in good faith, and (ii) with respect to clause (c), the provisions of this Agreement, in each case, including indemnification, which

are appropriate to such a transaction. |

B.

Term and Termination of Engagement; Exclusivity. The term of Wainwright’s exclusive engagement will begin on the date hereof

and end ninety (90) days thereafter (the “Initial Term”); provided, however, that if an Offering is consummated within

the Initial Term, the term of this Agreement shall be extended by an additional ninety (90) day period (the “Extension Term,”

and together with the Initial Term, the “Term”). For clarity, the term “Term” shall mean the Initial Term

if there is no Extension Term. Notwithstanding anything to the contrary contained herein, the Company agrees that the provisions relating

to the payment of fees, reimbursement of expenses, right of first refusal, tail, indemnification and contribution, confidentiality, conflicts,

independent contractor and waiver of the right to trial by jury will survive any termination or expiration of this Agreement. Notwithstanding

anything to the contrary contained herein, the Company has the right to terminate the Agreement for cause in compliance with FINRA Rule

5110(g)(5)(B)(i). The exercise of such right of termination for cause eliminates the Company’s obligations with respect to the

provisions relating to the tail fees and right of first refusal. Notwithstanding anything to the contrary contained in this Agreement,

in the event that an Offering pursuant to this Agreement shall not be carried out for any reason whatsoever during the Term, the Company

shall be obligated to pay to Wainwright its actual and accountable out-of-pocket expenses related to an Offering (including the fees

and disbursements of Wainwright’s legal counsel) subject to the amounts set forth in Paragraph A.3 hereof. During Wainwright’s

engagement hereunder: (i) the Company will not, and will not permit its representatives to, other than in coordination with Wainwright,

contact or solicit institutions, corporations or other entities or individuals as potential purchasers of the Securities or investment

banks in connection with an Offering and (ii) the Company will not pursue any financing transaction which would be in lieu of an Offering.

Furthermore, the Company agrees that during Wainwright’s engagement hereunder, all inquiries from prospective investors will be

referred to Wainwright. Additionally, except as set forth hereunder, the Company represents, warrants and covenants that no brokerage

or finder’s fees or commissions are or will be payable by the Company or any subsidiary of the Company to any broker, financial

advisor or consultant, finder, placement agent, investment banker, bank or other third-party with respect to any Offering.

C. Information;

Reliance. The Company shall furnish, or cause to be furnished, to Wainwright all information requested by Wainwright for the

purpose of rendering services hereunder and conducting due diligence (all such information being the

“Information”). In addition, the Company agrees to make available to Wainwright upon request from time to time

the officers, directors, accountants, counsel and other advisors of the Company. The Company recognizes and confirms that Wainwright

(a) will use and rely on the Information, including any documents provided to investors in each Offering (the “Offering

Documents”) which shall include any Purchase Agreement (as defined hereunder), and on information available from generally

recognized public sources in performing the services contemplated by this Agreement without having independently verified the same;

(b) does not assume responsibility for the accuracy or completeness of the Offering Documents or the Information and such other

information; and (c) will not make an appraisal of any of the assets or liabilities of the Company. Upon reasonable request, the

Company will meet with Wainwright or its representatives to discuss all information relevant for disclosure in the Offering

Documents and will cooperate in any investigation undertaken by Wainwright thereof, including any document included or incorporated

by reference therein. At each Offering, at the request of Wainwright, the Company shall deliver such legal letters (including,

without limitation, negative assurance letters), opinions, comfort letters, officers’ and secretary certificates and good

standing certificates, all in form and substance satisfactory to Wainwright and its counsel as is customary for such Offering.

Wainwright shall be a third party beneficiary of any representations, warranties, covenants, closing conditions and closing

deliverables made by the Company in any Offering Documents, including representations, warranties, covenants, closing conditions and

closing deliverables made to any investor in an Offering.

D.

Related Agreements. At each Offering, the Company shall enter into the following additional agreements, as applicable:

| 1. | Underwritten

Offering. If an Offering is an underwritten Offering, the Company and Wainwright shall

enter into a customary underwriting agreement in form and substance satisfactory to Wainwright

and its counsel. |

| 2. | Best

Efforts Offering. If an Offering is on a best efforts basis, the sale of Securities to

the investors in the Offering will be evidenced by a purchase agreement (“Purchase

Agreement”) between the Company and such investors in a form reasonably satisfactory

to the Company and Wainwright. Wainwright shall be a third party beneficiary with respect

to the representations, warranties, covenants, closing conditions and closing deliverables

included in the Purchase Agreement. Prior to the signing of any Purchase Agreement, officers

of the Company with responsibility for financial affairs will be available to answer inquiries

from prospective investors. |

| 3. | Escrow,

Settlement and Closing. If each Offering is not settled via delivery versus payment (“DVP”),

the Company and Wainwright shall enter into an escrow agreement with a third party escrow

agent pursuant to which Wainwright’s compensation and expenses shall be paid from the

gross proceeds of the Securities sold. If the Offering is settled in whole or in part via

DVP, Wainwright shall arrange for its clearing agent to provide the funds to facilitate such

settlement; provided, however, if the clearing firm provides the funds in a best efforts

offering and subsequent to such delivery an investor fails to provide the necessary funds

to the clearing agent for such purchase of Securities, Wainwright shall instruct the clearing

agent to promptly return any such Securities to the Company and the Company shall promptly

return such investor’s purchase price to the clearing agent. The Company shall pay

Wainwright closing costs, which shall also include the reimbursement of the out-of-pocket

cost of the escrow agent or clearing agent, as applicable, which closing costs shall not

exceed $15,950. |

| 4. | FINRA

Amendments. Notwithstanding anything herein to the contrary, in the event that Wainwright

determines that any of the terms provided for hereunder shall not comply with a FINRA rule,

including but not limited to FINRA Rule 5110, then the Company shall agree to amend this

Agreement (or include such revisions in the final underwriting agreement) in writing upon

the request of Wainwright to comply with any such rules; provided that any such amendments

shall not provide for terms that are less favorable to the Company than are reflected in

this Agreement. |

E.

Confidentiality. In the event of the consummation or public announcement of any Offering, Wainwright shall have the right to disclose

its participation in such Offering, including, without limitation, the Offering at its cost of “tombstone” advertisements

in financial and other newspapers and journals.

F.

Indemnity.

| 1. | In

connection with the Company’s engagement of Wainwright hereunder, the Company hereby

agrees to indemnify and hold harmless Wainwright and its affiliates, and the respective

controlling persons, directors, officers, members, shareholders, agents and employees of

any of the foregoing (collectively the “Indemnified Persons”), from and

against any and all claims, actions, suits, proceedings (including those of shareholders),

damages, liabilities and expenses incurred by any of them (including the reasonable fees

and expenses of counsel), as incurred, whether or not the Company is a party thereto (collectively

a “Claim”), that are (A) related to or arise out of (i) any actions taken

or omitted to be taken (including any untrue statements made or any statements omitted to

be made) by the Company, or (ii) any actions taken or omitted to be taken by any Indemnified

Person in connection with the Company’s engagement of Wainwright, or (B) otherwise

relate to or arise out of Wainwright’s activities on the Company’s behalf under

Wainwright’s engagement, and the Company shall reimburse any Indemnified Person for

all expenses (including the reasonable fees and expenses of counsel) as incurred by such

Indemnified Person in connection with investigating, preparing or defending any such claim,

action, suit or proceeding, whether or not in connection with pending or threatened litigation

in which any Indemnified Person is a party. The Company will not, however, be responsible

for any Claim that is finally judicially determined to have resulted from the gross negligence

or willful misconduct of any such Indemnified Person for such Claim. The Company further

agrees that no Indemnified Person shall have any liability to the Company for or in connection

with the Company’s engagement of Wainwright except for any Claim incurred by the Company

as a result of such Indemnified Person’s fraud, gross negligence or willful misconduct. |

| 2. | The

Company further agrees that it will not, without the prior written consent of Wainwright,

settle, compromise or consent to the entry of any judgment in any pending or threatened Claim

in respect of which indemnification may be sought hereunder (whether or not any Indemnified

Person is an actual or potential party to such Claim), unless such settlement, compromise

or consent includes an unconditional, irrevocable release of each Indemnified Person from

any and all liability arising out of such Claim. |

| 3. | Promptly

upon receipt by an Indemnified Person of notice of any complaint or the assertion or institution

of any Claim with respect to which indemnification is being sought hereunder, such Indemnified

Person shall notify the Company in writing of such complaint or of such assertion or institution

but failure to so notify the Company shall not relieve the Company from any obligation it

may have hereunder, except and only to the extent such failure results in the forfeiture

by the Company of substantial rights and defenses. If the Company is requested by such Indemnified

Person, the Company will assume the defense of such Claim, including the employment of counsel

for such Indemnified Person and the payment of the fees and expenses of such counsel, provided,

however, that such counsel shall be satisfactory to the Indemnified Person and provided further

that if the legal counsel to such Indemnified Person reasonably determines that the use of

counsel chosen by the Company to represent such Indemnified Person would present such counsel

with a conflict of interest or if the defendant in, or target of, any such Claim, includes

an Indemnified Person and the Company, and legal counsel to such Indemnified Person reasonably

concludes that there may be legal defenses available to it or other Indemnified Persons different

from or in addition to those available to the Company, such Indemnified Person will employ

its own separate counsel (including local counsel, if necessary) to represent or defend him,

her or it in any such Claim and the Company shall pay the reasonable fees and expenses of

such counsel. If such Indemnified Person does not request that the Company assume the defense

of such Claim, such Indemnified Person will employ its own separate counsel (including local

counsel, if necessary) to represent or defend him, her or it in any such Claim and the Company

shall pay the reasonable fees and expenses of such counsel. Notwithstanding anything herein

to the contrary, if the Company fails timely or diligently to defend, contest, or otherwise

protect against any Claim, the relevant Indemnified Person shall have the right, but not

the obligation, to defend, contest, compromise, settle, assert crossclaims, or counterclaims

or otherwise protect against the same, and shall be fully indemnified by the Company therefor,

including without limitation, for the reasonable fees and expenses of its counsel and all

amounts paid as a result of such Claim or the compromise or settlement thereof. In addition,

with respect to any Claim in which the Company assumes the defense, the Indemnified Person

shall have the right to participate in such Claim and to retain his, her or its own counsel

therefor at his, her or its own expense. |

| 4. | The

Company agrees that if any indemnity sought by an Indemnified Person hereunder is held by

a court to be unavailable for any reason then (whether or not Wainwright is the Indemnified

Person), the Company and Wainwright shall contribute to the Claim for which such indemnity

is held unavailable in such proportion as is appropriate to reflect the relative benefits

to the Company, on the one hand, and Wainwright on the other, in connection with Wainwright’s

engagement referred to above, subject to the limitation that in no event shall the amount

of Wainwright’s contribution to such Claim exceed the amount of fees actually

received by Wainwright from the Company pursuant to Wainwright’s engagement. The Company

hereby agrees that the relative benefits to the Company, on the one hand, and Wainwright

on the other, with respect to Wainwright’s engagement shall be deemed to be in the

same proportion as (a) the total value paid or proposed to be paid or received by the Company

pursuant to the applicable Offering (whether or not consummated) for which Wainwright is

engaged to render services bears to (b) the fee paid or proposed to be paid to Wainwright

in connection with such engagement. |

| 5. | The

Company’s indemnity, reimbursement and contribution obligations under this Agreement

(a) shall be in addition to, and shall in no way limit or otherwise adversely affect

any rights that any Indemnified Person may have at law or at equity and (b) shall be effective

whether or not the Company is at fault in any way. |

G.

Limitation of Engagement to the Company. The Company acknowledges that Wainwright has been retained only by the Company, that

Wainwright is providing services hereunder as an independent contractor (and not in any fiduciary or agency capacity) and that the Company’s

engagement of Wainwright is not deemed to be on behalf of, and is not intended to confer rights upon, any shareholder, owner or partner

of the Company or any other person not a party hereto as against Wainwright or any of its affiliates, or any of its or their respective

officers, directors, controlling persons (within the meaning of Section 15 of the Securities Act or Section 20 of the Securities Exchange

Act of 1934, as amended (the “Exchange Act”)), employees or agents. Unless otherwise expressly agreed in writing by Wainwright,

no one other than the Company is authorized to rely upon this Agreement or any other statements or conduct of Wainwright, and no one

other than the Company is intended to be a beneficiary of this Agreement. The Company acknowledges that any recommendation or advice,

written or oral, given by Wainwright to the Company in connection with Wainwright’s engagement is intended solely for the benefit

and use of the Company’s management and directors in considering a possible Offering, and any such recommendation or advice is

not on behalf of, and shall not confer any rights or remedies upon, any other person or be used or relied upon for any other purpose.

Wainwright shall not have the authority to make any commitment binding on the Company. The Company, in its sole discretion, shall have

the right to reject any investor introduced to it by Wainwright.

H.

Limitation of Wainwright’s Liability to the Company. Wainwright and the Company further agree that neither Wainwright nor

any of its affiliates or any of its or their respective officers, directors, controlling persons (within the meaning of Section 15 of

the Securities Act or Section 20 of the Exchange Act), employees or agents shall have any liability to the Company, its security holders

or creditors, or any person asserting claims on behalf of or in the right of the Company (whether direct or indirect, in contract, tort,

for an act of negligence or otherwise) for any losses, fees, damages, liabilities, costs, expenses or equitable relief arising out of

or relating to this Agreement or the services rendered hereunder, except for losses, fees, damages, liabilities, costs or expenses that

arise out of or are based on any action of or failure to act by Wainwright and that are finally judicially determined to have resulted

solely from the fraud, gross negligence or willful misconduct of Wainwright.

I.

Governing Law. This Agreement shall be governed by and construed in accordance with the laws of the State of New York applicable

to agreements made and to be fully performed therein. Any disputes that arise under this Agreement, even after the termination of this

Agreement, will be heard only in the state or federal courts located in the City of New York, State of New York. The parties hereto expressly

agree to submit themselves to the jurisdiction of the foregoing courts in the City of New York, State of New York. The parties hereto

expressly waive any rights they may have to contest the jurisdiction, venue or authority of any court sitting in the City and

State of New York. In the event Wainwright or any Indemnified Person is successful in any action, or suit against the Company, arising

out of or relating to this Agreement, the final judgment or award entered shall be entitled to have and recover from the Company the

costs and expenses incurred in connection therewith, including its reasonable attorneys’ fees. Any rights to trial by jury with

respect to any such action, proceeding or suit are hereby waived by Wainwright and the Company.

J.

Notices. All notices hereunder will be in writing and sent by certified mail, hand delivery, overnight delivery or e-mail, if

sent to Wainwright, at the address set forth on the first page hereof, e-mail: ###, Attention: Head of Investment Banking, and

if sent to the Company, to the address set forth on the first page hereof, e-mail: ###, Attention: Chief Executive Officer. Notices sent

by certified mail shall be deemed received five days thereafter, notices sent by hand delivery or overnight delivery shall be deemed

received on the date of the relevant written record of receipt, notices sent by e-mail shall be deemed received as of the date and time

they were sent.

K.

Conflicts. The Company acknowledges that Wainwright and its affiliates may have and may continue to have investment banking and

other relationships with parties other than the Company pursuant to which Wainwright may acquire information of interest to the Company.

Wainwright shall have no obligation to disclose such information to the Company or to use such information in connection with any contemplated

transaction.

L.

Anti-Money Laundering. To help the United States government fight the funding of terrorism and money laundering, the federal laws

of the United States require all financial institutions to obtain, verify and record information that identifies each person with whom

they do business. This means Wainwright must ask the Company for certain identifying information, including a government-issued identification

number (e.g., a U.S. taxpayer identification number) and such other information or documents that Wainwright considers appropriate to

verify the Company’s identity, such as certified articles of incorporation, a government-issued business license, a partnership

agreement or a trust instrument.

M.

Miscellaneous. The Company represents and warrants that it has all requisite power and authority to enter into and carry out the

terms and provisions of this Agreement and the execution, delivery and performance of this Agreement does not breach or conflict with

any agreement, document or instrument to which it is a party or bound. This Agreement shall not be modified or amended except

in writing signed by Wainwright and the Company. This Agreement shall be binding upon and inure to the benefit of both Wainwright and

the Company and their respective assigns, successors, and legal representatives. This Agreement constitutes the entire agreement of Wainwright

and the Company with respect to the subject matter hereof and supersedes any prior agreements with respect to the subject matter hereof.

If any provision of this Agreement is determined to be invalid or unenforceable in any respect, such determination will not affect such

provision in any other respect, and the remainder of the Agreement shall remain in full force and effect. This Agreement may be executed

in counterparts (including electronic counterparts), each of which shall be deemed an original but all of which together shall constitute

one and the same instrument. Signatures to this Agreement transmitted by electronic mail in “portable document format” (.pdf)

form, or by any other electronic means intended to preserve the original graphic and pictorial appearance of a document, will have the

same effect as physical delivery of the paper document bearing the original signature. The undersigned hereby consents to receipt of

this Agreement in electronic form and understands and agrees that this Agreement may be signed electronically. In the event that any

signature is delivered by electronic mail (including any electronic signature covered by the U.S. federal ESIGN Act of 2000, Uniform

Electronic Transactions Act, the Electronic Signatures and Records Act or other applicable law, e.g., www.docusign.com) or otherwise

by electronic transmission evidencing an intent to sign this Agreement, such electronic mail or other electronic transmission shall create

a valid and binding obligation of the undersigned with the same force and effect as if such signature were an original. Execution and

delivery of this Agreement by electronic mail or other electronic transmission is legal, valid and binding for all purposes.

*********************

In

acknowledgment that the foregoing correctly sets forth the understanding reached by Wainwright and the Company, please sign in the space

provided below, whereupon this letter shall constitute a binding Agreement as of the date indicated above.

| |

Very

truly yours, |

| |

|

| |

H.C.

WAINWRIGHT & CO., LLC |

| |

|

|

| |

By: |

/s/

Edward D. Silvera |

| |

Name: |

Edward

D. Silvera |

| |

Title: |

Chief

Operating Officer |

| |

Date: |

10/30/2023 |

| Accepted

and Agreed: |

|

| |

|

| BONE

BIOLOGICS CORPORATION |

|

| |

|

|

| By: |

/s/

Jeffrey Frelick |

|

| Name: |

Jeffrey

Frelick |

|

| Title: |

Chief

Executive Officer |

|

Exhibit

10.19

Execution

Version

February

6, 2024

STRICTLY

CONFIDENTIAL

Reference

is hereby made to that certain engagement letter, dated as of October 30, 2023 (the “Engagement Letter”), by and between

Bone Biologics Corporation (the “Company”) and H.C. Wainwright & Co., LLC (“Wainwright”). Capitalized

terms used but not defined herein shall have the meanings ascribed thereto in the Engagement Letter. For purposes of clarity, the Company

and Wainwright hereby acknowledge and agree, as evidenced by their signatures hereon, that, if an Offering is consummated during the

Term, the right of first refusal granted to Wainwright in Paragraph A.5 of the Engagement Letter shall continue to apply for twelve (12)

months following the consummation of each such Offering; provided, however, that, for the avoidance of doubt, the Company and

Wainwright acknowledge and agree that the right of first refusal shall be subject to, and comply with, FINRA Rule 5110(g)(6)(A).

This

letter shall be construed and enforced in accordance with the laws of the State of New York, without regards to conflicts of laws principles.

This letter may be executed in two or more counterparts, each one of which shall be an original, with the same effect as if the signatures

thereto and hereto were upon the same instrument. Counterparts may be delivered via electronic mail (including any electronic signature

covered by the U.S. federal ESIGN Act of 2000, Uniform Electronic Transactions Act, the Electronic Signatures and Records Act or other

applicable law, e.g., www.docusign.com) or other transmission method and any counterpart so delivered shall be deemed to have been duly

and validly delivered and be valid and effective for all purposes.

| Accepted

and Agreed: |

|

| |

|

| H.C.

WAINWRIGHT & CO., LLC |

|

| |

|

|

| By: |

/s/

Edward D. Silvera |

|

| Name: |

Edward

D. Silvera |

|

| Title: |

Chief

Operating Officer |

|

| |

|

|

| BONE

BIOLOGICS CORPORATION |

|

| |

|

|

| By: |

/s/

Deina H. Walsh |

|

| Name: |

Deina

H. Walsh |

|

| Title: |

Chief

Financial Officer |

|

430

Park Avenue | New York, New York 10022 | 212.356.0500 | www.hcwco.com

Member:

FINRA/SIPC

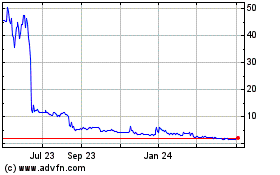

Bone Biologics (NASDAQ:BBLG)

Historical Stock Chart

From Jan 2025 to Feb 2025

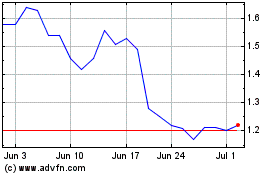

Bone Biologics (NASDAQ:BBLG)

Historical Stock Chart

From Feb 2024 to Feb 2025