ARK Invest CEO Cathie Wood On What Will Drive Bitcoin Correction

January 11 2022 - 12:00PM

NEWSBTC

The price of bitcoin continues to struggle and investors look

towards various indicators to know when the price of the digital

asset would begin to correct once again. While some indicators have

shown promise in predicting what may yet come, it remains a

guessing game as bitcoin has always been known to have a mind of

its own when it comes to price movements. To this end, Cathie Wood,

famed CEO of ARK Invest, has shared some interesting thoughts

around the market correction and what will drive it. The bitcoin

bull continues to look towards the crypto market through a positive

lens as she shares what will bring about the market correction.

Related Reading | Bitcoin Discount? Peter Brandt On Why You

Shouldn’t Buy The Dip Crypto Market Succumbs To Strike Against

Technology The whole of the crypto market is built on the back of

new technology and as such, will sometimes follow technology trends

in the broader market. ARK Invest CEO Cathie Wood posits in a new

video on the ARK Invest YouTube channel that this is what is behind

the recent crashes. Basically, there has been a strike against

technology, growth, and innovation in the equity markets and the

spillover of this strike is what brought down prices across the

crypto market. However, the CEO does not expect this strike to last

long. Related Reading | Galaxy Digital CEO Mike Novogratz Says

Bitcoin Has Hit The Bottom Addressing the concerns about technology

and innovation stocks being in a bubble, the CEO discounts this

theory. Instead, explaining that these stocks are merely in what

she refers to as a “deep value territory.” Wood is known to take

risky bets on technology and innovation assets, which have paid off

in the long run for her fund, as well as her clients. For the CEO,

Bitcoin falls into this territory and has been vocal about her

support for the digital asset. She also predicts a highly

profitable future for tech and innovation assets, expecting a 10x

growth in the next 10 years. “Based on the last eight years of our

research, the opportunities will scale from $10-12 trillion today,

or roughly 10% of the global public equity market cap, to $200+

trillion during the next ten years.” Where Is Bitcoin Headed? The

new year is now in full swing and the implications of the holiday

spending have been showing on the markets. Bitcoin which hit its

all-time high of $69K last year has since lost over 30% of its

value. The price is not in the $41,000 range, where it continues to

struggle as bears try to pull it down. BTC trading north of $41K |

Source: BTCUSD on TradingView.com For Cathie Wood, it has always

been about the long game. Last year, the CEO, at various times,

said that she expects the price of bitcoin to grow 10x from its

value at the time. She attributes this growth to institutional

investors finally moving at least 5% of their portfolios into the

digital asset, at which point, bitcoin’s price will grow as high as

$500,000 apiece. Featured image from Page One, chart from

TradingView.com

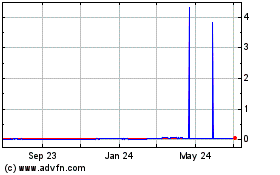

Gala (COIN:GALAUSD)

Historical Stock Chart

From Oct 2024 to Nov 2024

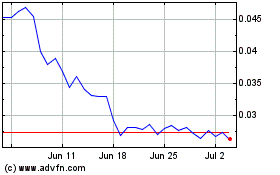

Gala (COIN:GALAUSD)

Historical Stock Chart

From Nov 2023 to Nov 2024