Future Of Bitcoin: Michael Saylor Envisions Market Cap Climbing To $200 Trillion

March 04 2025 - 2:30PM

NEWSBTC

In a recent interview with CNBC, Michael Saylor, co-founder of

Strategy, reiterated his bullish outlook on Bitcoin (BTC),

predicting the cryptocurrency could reach a staggering $200

trillion market cap. Saylor Forecasts $10 Million Per Bitcoin

Currently valued at about $2 trillion, Saylor believes Bitcoin’s

trajectory will see it grow to $20 trillion and eventually hit the

$200 trillion mark, translating to an approximate price of $10

million per BTC based on its capped supply of 21 million coins.

Saylor attributes this potential growth to a global shift in

capital investment, stating, “That capital is coming from overseas…

from China, from Russia, from Europe, from Africa, from Asia, from

the 20th century to the 21st century.” Related Reading:

Ethereum Price Breaks Out—10% Surge Sparks Bullish Momentum His

forecast comes against the backdrop of President Donald Trump’s

recent announcement regarding the creation of a Crypto Strategic

Reserve, which would include BTC alongside Ethereum (ETH), XRP,

Solana (SOL), and Cardano (ADA), which ignited a heated debate

within financial and crypto circles. While Saylor acknowledges the

appeal of a Bitcoin-only reserve, he supports Trump’s broader

strategy that encompasses multiple cryptocurrencies. He emphasized,

“There’s no way to interpret this other than this is bullish for

Bitcoin and is bullish for the entire US crypto industry.”

Although some conservatives, such as Coinbase CEO Brian Armstrong

and Gemini co-founder Tyler Winklevoss, have advocated for more

restrictive, Bitcoin-centric policies, Saylor noted that the

president’s approach allows for a more inclusive economic policy.

Saylor Dismisses Volatility Concerns When asked about his

involvement with the White House, Saylor confirmed he has been in

discussions with various lawmakers, both Democratic and Republican,

as well as members of the Cabinet and administration. “For

the last four and a half years, I’ve been talking about Bitcoin to

anybody, anywhere in the world, every day,” Michael Saylor stated

during his interview, highlighting his commitment to promoting the

cryptocurrency. Saylor argues that establishing a strategic Bitcoin

reserve could provide the United States with significant economic

advantages, including the potential to alleviate the national

debt. Saylor posits, “If the United States takes a position

in the emerging crypto economy, if it buys up 10, 20% of the

Bitcoin network, we’re going to pay off the national debt. And so

why wouldn’t that be in the interest of the United States?” Related

Reading: Dogecoin Will Start A Move To $4 If Current Demand Holds –

Can Bulls Step In? Addressing concerns about Bitcoin’s notorious

volatility, Saylor pointed to its historical long-term gains,

asserting, “I don’t think anybody’s ever lost money in the Bitcoin

network holding for four years. Presumably, you want to buy

Bitcoin, you want to hold it for 100 years.” The proposal for a US

Crypto Reserve is still in its infancy, and Saylor indicated that

its success will depend heavily on legislative decisions made in

the coming months. “There are a dozen people on it: the head

of the Treasury, the SEC, the CFTC, Commerce, the Attorney General,

the President… both the Republicans and the Democrats,” he noted,

emphasizing the diverse range of opinions that will influence the

outcome. At the time of writing, BTC has found support at around

$83,869 after posting losses of 7% and 6% over the past 24 hours

and seven days, respectively. Featured image from DALL-E, chart

from TradingView.com

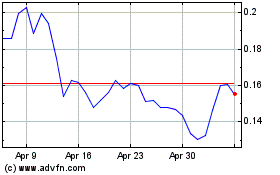

Dogecoin (COIN:DOGEUSD)

Historical Stock Chart

From Feb 2025 to Mar 2025

Dogecoin (COIN:DOGEUSD)

Historical Stock Chart

From Mar 2024 to Mar 2025