Amarin Corporation plc (NASDAQ: AMRN), today announced financial

results for the fourth quarter of 2024 and provided a review of

fourth quarter and recent operational highlights.

“Since taking on the role of CEO of Amarin last

year, I have worked with our leadership team and the Board of

Directors to identify opportunities to leverage our unique assets,

skills and resources to drive value,” said Aaron Berg, President

& CEO, Amarin. “In 2024, while still progressing with the early

launch in markets outside the U.S. and despite a dynamic generic

market in the U.S., we generated more than $200 million in revenue

and ended the year with nearly $300 million in cash and no debt --

all measures exemplifying the strength and resilience of our

franchise and the impact of our disciplined approach to capital

deployment. Specifically, we continued to capture efficient branded

revenue in the U.S. market for VASCEPA, unlocked access to

VASCEPA/VAZKEPA in six additional global markets -- including

Italy, China and Australia -- both on our own and through

partnerships, and progressed in an additional 16 countries at

various stages towards commercialization. The global VASCEPA

franchise remains poised to continue expanding its impact

on cardiovascular disease for at-risk patients worldwide.”

In addition, Aaron Berg commented,

“Building on our efforts and results in 2024, we continue

to identify steps to advance the company. As a publicly traded

company, there is considerable value in maintaining our Nasdaq

listing. To this effect, today we announced our intent to

initiate a ratio change to our ADS program.”

1-For-20 ADS Ratio Change

In a separate press release issued today, the

Company announced its intent to effect a Ratio Change on its

American Depositary Shares (“ADS”) from one (1) ADS representing

one (1) ordinary share, to the new ratio of one (1) ADS

representing twenty (20) ordinary shares (the "Ratio Change"). The

effective date of the Ratio Change is expected to be on or about

April 11, 2025. The objective of the Ratio Change is to maintain

the Company’s listing on the Nasdaq Capital Market and to preserve

the Company’s long-term access to the equity capital

markets.

For further information, please refer to the press

release issued on March 12, 2025. Additional questions and answers

regarding the Ratio Change can be found under the Investor

Relations section of Amarin’s corporate web site here:

https://cms.amarincorp.com/sites/default/files/2025-03/e6713d4c-9083-4623-a9e9-6b13d8a4201b.pdf

Fourth Quarter 2024 & Recent

Operational Highlights

The Company continued to advance

commercialization and pricing and reimbursement efforts across

European markets:

- In all European countries

where VAZKEPA has launched, in-market demand grew in the fourth

quarter versus the third quarter of 2024.

- In Italy, the Company

secured national reimbursement. Access has already been

unlocked in 9 (of 21) regions of this EU5 market, representing

more than 50% of the total VAZKEPA eligible population. Based on

recent scientific leader feedback, the appetite for the product is

very strong across all regions in Italy.

- In Austria, national reimbursement

for VAZKEPA was secured in late February; as of April 1, 2025,

VAZKEPA will be included in Austria’s Code of Reimbursement

(EKO).

Through partnerships, the Company continues to

make progress towards regulatory approvals, access and

commercialization in Rest of World (RoW) markets:

- Two of our partners launched in

cardiovascular risk reduction, EddingPharm in China and CSL Seqirus

in Australia.

- While early in the launch phase for

a number of RoW markets, all partners saw growth in demand for

VASCEPA/VAZKEPA in the fourth quarter.

- Amarin and its partners are

continuing to advance regulatory processes in seven additional RoW

markets.

The Company’s R&D Team and other

investigators have continued to generate, present and publish

important new data which add to the significant body of evidence

demonstrating the unique benefits of VASCEPA/VAZKEPA. In 2024, a

total of 45 additional publications including abstracts, posters,

and manuscripts were presented or published that, both individually

and in aggregate, helped to advance an ever-broadening

understanding of the science and value of icosapent ethyl and

EPA.

- In 2024, investigators presented

additional subgroup analyses from the landmark

REDUCE-IT® cardiovascular outcomes trial in patients with and

without coronary artery disease (CAD) history and data on the

mechanistic effects of eicosapentaenoic acid (EPA), including

its antioxidant effects in endothelial cells and the ability of EPA

to impact the oxidation of Lp(a) particles made of protein and fats

(lipids) that carry cholesterol through the bloodstream, at the

American Heart Association (AHA) Scientific Sessions. The medical

community has increased its focus on Lp(a) as a key cardiovascular

risk factor.

- A recent post hoc analysis of

REDUCE-IT published in the Journal of the American Heart

Association evaluated the impact of icosapent ethyl on patients

with various LDL-C levels at baseline, including those with very

well-controlled LDL-C (<55 mg/dL). The analysis showed

consistent cardiovascular risk reduction benefit irrespective of

baseline LDL-C level. This data reinforces the need to go beyond

LDL lowering for greater cardiovascular risk reduction and supports

that VASCEPA/VAZKEPA is a “complementary” therapy to current LDL-C

lowering therapies.

- In March 2025, the Company will

support the presentation of additional data at ACC.25, providing

further evidence of the potential mechanistic activity of EPA,

administered clinically in the form of VASCEPA/VAZKEPA (icosapent

ethyl), to reduce cardiovascular (CV) events in at-risk patients --

specifically, the antioxidant effects of EPA on lipoprotein(a)

[Lp(a)]-enriched human plasma and the effects of a GLP-1 receptor

agonist in combination with EPA on the changes in antioxidant

protein expression in human endothelial cells during inflammation

in vitro. With widespread GLP-1 use, there are likely an increasing

number of patients with lipid abnormalities requiring LDL-C

lowering therapy and with other co-morbidities and risk

characteristics that are in need of a complementary therapy like

VASCEPA/VAZKEPA to further reduce cardiovascular events.

Fourth Quarter 2024 Financial

Highlights

|

($ in millions) |

Three months ended December 31, 2024 |

Three months ended December 31, 2023 |

% Change |

|

Total Net Revenue |

$62.3 |

$74.7 |

-17% |

|

Operating Expenses |

$43.0 |

$49.7 |

-18% |

|

Cash |

$294.2 |

$320.7 |

-8% |

| |

|

|

|

Total net revenue for the three months ended

December 31, 2024 was $62.3 million, compared to $74.7 million in

the corresponding period of 2023, a decrease of 17%. Net product

revenue for the three months ended December 31, 2024 was $60.1

million, compared to $70.6 million in the corresponding period of

2023, a decrease of 15%. This decrease was driven primarily by a

lower net selling price due to US generic competition as well as a

reduction in volume primarily related to an exclusive account no

longer covering VASCEPA.

- U.S. net product

revenue was $44.2 million for the three months ended

December 31, 2024 compared to $64.9 million in the corresponding

period of 2023.

- European net product

revenue was $4.0 million for the three months ended

December 31, 2024 compared to $1.5 million in the corresponding

period of 2023.

- Rest of World (RoW) net

product revenue was $11.9 million for the three months

ended December 31, 2024 compared to $4.2 million in the

corresponding period of 2023.

Cost of goods sold, excluding non-cash inventory

restructuring of $36.5 million, for the three months ended December

31, 2024 was $35.4 million, compared to $29.6 million in the

corresponding period of 2023. Excluding the non-cash inventory

restructuring charge in the three months ended December 31, 2024,

gross margin was 41% and 58%, respectively.

Selling, general and administrative expenses for

the three months ended December 31, 2024 were $37.0 million,

compared to $43.9 million in the corresponding period of 2023. This

decrease primarily reflects the impact of ongoing cost optimization

efforts across the business, first initiated by the Company in

2023.

Research and development expenses for the three

months ended December 31, 2024 were $6.0 million, compared to $5.8

million in the corresponding period of 2023.

Under U.S. GAAP, the Company reported net loss

of $48.6 million for the three months ended December 31, 2024, or

basic and diluted loss per share of $0.12. For the three months

ended December 31, 2023, the Company reported net loss of $5.8

million, or basic and diluted loss per share of

$0.01.

On a non-GAAP basis, excluding non-cash

stock-based compensation expense and restructuring charges,

adjusted net loss for the three months ended December 31, 2024 was

$8.7 million or adjusted basic and diluted loss per share of $0.02,

compared with an adjusted net loss of $0.9 million or adjusted

basic and diluted loss per share of $0.00 for the three months

ended December 31, 2023.

As of December 31, 2024, the Company reported

aggregate cash and investments of $294.2 million, compared to

aggregate cash and investment of $320.7 million as of December 31,

2023.

2025 Strategic Outlook

The Company is committed to capitalizing on the

significant opportunity in Europe, while continuing to explore all

strategies to accelerate growth in the region where there remains

significant untapped potential, including more than 5 million

high-risk patients with established cardiovascular disease in

Europe, efficiently generating revenue and maximizing cash

generation in the U.S., and from the RoW income stream. The Company

continues to tightly manage its operating expenses and its

cash position. The Company reaffirms its belief that current cash

and investments and other assets are adequate to support continuing

operations for the foreseeable future. The Company continues to

explore and be open to all opportunities to get VASCEPA/VAZKEPA

into the hands of as many at-risk patients as possible around the

world.

Fourth Quarter & Full-Year 2024

Earnings Conference Call and Webcast Information

Amarin will host a conference call on March 12,

2025, at 8:00 a.m. ET to discuss this information. The conference

call can be accessed on the investor relations section of the

company's website at www.amarincorp.com, or via telephone by

dialing 888-506-0062 within the United States, 973-528-0011 from

outside the United States, and referencing conference ID 575561. A

replay of the call will be made available for a period of two weeks

following the conference call. To listen to a replay of the call,

dial 877-481-4010 from within the United States and 919-882-2331

from outside of the United States, and reference conference ID

51859. A replay of the call will also be available through the

company's website shortly after the call.

About Amarin

Amarin is an innovative pharmaceutical company

leading a new paradigm in cardiovascular disease management. We are

committed to increasing the scientific understanding of the

cardiovascular risk that persists beyond traditional therapies and

advancing the treatment of that risk for patients worldwide. Amarin

has offices in Bridgewater, New Jersey in the United States, Dublin

in Ireland, Zug in Switzerland, and other countries in Europe as

well as commercial partners and suppliers around the

world.

About VASCEPA®/VAZKEPA® (icosapent

ethyl) Capsules

VASCEPA (icosapent ethyl) capsules are the first

prescription treatment approved by the U.S. Food and Drug

Administration (FDA) comprised solely of the active ingredient,

icosapent ethyl (IPE), a unique form of eicosapentaenoic acid.

VASCEPA was launched in the United States in January 2020 as the

first drug approved by the U.S. FDA for treatment of the studied

high-risk patients with persistent cardiovascular risk despite

being on statin therapy. VASCEPA was initially launched in the

United States in 2013 based on the drug’s initial FDA approved

indication for use as an adjunct therapy to diet to reduce

triglyceride levels in adult patients with severe (≥500 mg/dL)

hypertriglyceridemia. Since launch, VASCEPA has been prescribed

more than twenty-five million times. VASCEPA is covered by most

major medical insurance plans. In addition to the United States,

VASCEPA is approved and sold in Canada, China, Australia, Lebanon,

the United Arab Emirates, Saudi Arabia, Qatar, Bahrain, and Kuwait.

In Europe, in March 2021 marketing authorization was granted to

icosapent ethyl in the European Union for the reduction of risk of

cardiovascular events in patients at high cardiovascular risk,

under the brand name VAZKEPA. In April 2021 marketing authorization

for VAZKEPA (icosapent ethyl) was granted in Great Britain

(applying to England, Scotland and Wales). VAZKEPA (icosapent

ethyl) is currently approved and sold in Europe in Sweden, Finland,

England/Wales, Spain, Netherlands, Scotland, Greece, Portugal,

Italy and Denmark.

United States

Indications and Limitation of Use

VASCEPA is indicated:

- As an adjunct to maximally

tolerated statin therapy to reduce the risk of myocardial

infarction, stroke, coronary revascularization and unstable angina

requiring hospitalization in adult patients with elevated

triglyceride (TG) levels (≥ 150 mg/dL) and

- established cardiovascular disease or

- diabetes mellitus and two or more additional risk factors for

cardiovascular disease.

- As an adjunct to diet to reduce TG

levels in adult patients with severe (≥ 500 mg/dL)

hypertriglyceridemia.

The effect of VASCEPA on the risk for

pancreatitis in patients with severe hypertriglyceridemia has not

been determined.

Important Safety

Information

- VASCEPA is contraindicated in

patients with known hypersensitivity (e.g., anaphylactic reaction)

to VASCEPA or any of its components.

- VASCEPA was associated with an

increased risk (3% vs 2%) of atrial fibrillation or atrial flutter

requiring hospitalization in a double-blind, placebo-controlled

trial. The incidence of atrial fibrillation was greater in patients

with a previous history of atrial fibrillation or atrial

flutter.

- It is not known whether patients

with allergies to fish and/or shellfish are at an increased risk of

an allergic reaction to VASCEPA. Patients with such allergies

should discontinue VASCEPA if any reactions occur.

- VASCEPA was associated with an

increased risk (12% vs 10%) of bleeding in a double-blind,

placebo-controlled trial. The incidence of bleeding was greater in

patients receiving concomitant antithrombotic medications, such as

aspirin, clopidogrel or warfarin.

- Common adverse reactions in the

cardiovascular outcomes trial (incidence ≥3% and ≥1% more frequent

than placebo): musculoskeletal pain (4% vs 3%), peripheral edema

(7% vs 5%), constipation (5% vs 4%), gout (4% vs 3%), and atrial

fibrillation (5% vs 4%).

- Common adverse reactions in the

hypertriglyceridemia trials (incidence >1% more frequent than

placebo): arthralgia (2% vs 1%) and oropharyngeal pain (1% vs

0.3%).

- Adverse events may be reported by

calling 1-855-VASCEPA or the FDA at 1-800-FDA-1088.

- Patients receiving VASCEPA and

concomitant anticoagulants and/or anti-platelet agents should be

monitored for bleeding.

FULL U.S. FDA-APPROVED VASCEPA

PRESCRIBING INFORMATION CAN BE FOUND

AT WWW.VASCEPA.COM

Europe

For further information about the Summary of

Product Characteristics (SmPC) for VAZKEPA® in Europe, please

visit:

https://www.medicines.org.uk/emc/product/12964/smpc.

Globally, prescribing information varies; refer

to the individual country product label for complete

information.

Use of Non-GAAP Adjusted Financial

Information Included in this press release are non-GAAP

adjusted financial information as defined by U.S. Securities and

Exchange Commission Regulation G. The GAAP financial measure most

directly comparable to each non-GAAP adjusted financial measure

used or discussed, and a reconciliation of the differences between

each non-GAAP adjusted financial measure and the comparable GAAP

financial measure, is included in this press release after the

condensed consolidated financial statements.

Non-GAAP adjusted net (loss) income was derived

by taking GAAP net loss and adjusting it for non-cash stock-based

compensation expense, restructuring expense and other one-time

expenses. Management uses these non-GAAP adjusted financial

measures for internal reporting and forecasting purposes, when

publicly providing its business outlook, to evaluate the company’s

performance and to evaluate and compensate the company’s

executives. The company has provided these non-GAAP financial

measures in addition to GAAP financial results because it believes

that these non-GAAP adjusted financial measures provide investors

with a better understanding of the company’s historical results

from its core business operations.

While management believes that these non-GAAP

adjusted financial measures provide useful supplemental information

to investors regarding the underlying performance of the company’s

business operations, investors are reminded to consider these

non-GAAP measures in addition to, and not as a substitute for,

financial performance measures prepared in accordance with GAAP.

Non-GAAP measures have limitations in that they do not reflect all

of the amounts associated with the company’s results of operations

as determined in accordance with GAAP. In addition, it should be

noted that these non-GAAP financial measures may be different from

non-GAAP measures used by other companies, and management may

utilize other measures to illustrate performance in the future.

Forward-Looking Statements

This press release contains forward-looking

statements which are made pursuant to the safe harbor provisions of

the Private Securities Litigation Reform Act of 1995, including

beliefs about Amarin’s key achievements in 2024 and the potential

impact and outlook for achievements in 2025 and beyond; Amarin’s

2025 financial outlook and cash position; Amarin’s overall efforts

to expand access and reimbursement to VAZKEPA across global

markets; expectations regarding potential strategic collaboration

and licensing agreements with third parties, including our ability

to attract additional collaborators, as well as our plans and

strategies for entering into potential strategic collaboration and

licensing agreements and the overall potential and future success

of VASCEPA/VAZKEPA and Amarin that are based on the beliefs and

assumptions and information currently available to Amarin. All

statements other than statements of historical fact contained in

this press release are forward-looking statements, including

statements regarding Amarin’s planned ratio adjustment and its

potential impact on the ADS trading price and on liquidity of the

ADSs, as well as Amarin’s ability to regain compliance with

Nasdaq's minimum bid price requirement and other continued listing

requirements. These forward-looking statements are not promises or

guarantees and involve substantial risks and uncertainties. A

further list and description of these risks, uncertainties and

other risks associated with an investment in Amarin can be found in

Amarin's filings with the U.S. Securities and Exchange Commission,

including Amarin’s annual report on Form 10-K for the fiscal year

ended 2024. Existing and prospective investors are cautioned not to

place undue reliance on these forward-looking statements, which

speak only as of the date they are made. Amarin undertakes no

obligation to update or revise the information contained in its

forward-looking statements, whether as a result of new information,

future events or circumstances or otherwise. Amarin’s

forward-looking statements do not reflect the potential impact of

significant transactions the company may enter into, such as

mergers, acquisitions, dispositions, joint ventures or any material

agreements that Amarin may enter into, amend or terminate.

Availability of Other Information About

Amarin

Investors and others should note that Amarin

communicates with its investors and the public using the company

website (www.amarincorp.com), the investor relations website

(www.amarincorp.com/investor-relations), including but not limited

to investor presentations and investor FAQs, U.S. Securities and

Exchange Commission filings, press releases, public conference

calls and webcasts. The information that Amarin posts on these

channels and websites could be deemed to be material information.

As a result, Amarin encourages investors, the media, and others

interested in Amarin to review the information that is posted on

these channels, including the investor relations website, on a

regular basis. This list of channels may be updated from time to

time on Amarin’s investor relations website and may include social

media channels. The contents of Amarin’s website or these channels,

or any other website that may be accessed from its website or these

channels, shall not be deemed incorporated by reference in any

filing under the Securities Act of 1933, as amended or the

Securities and Exchange Act of 1934, as amended.

Amarin Contact Information

Investor & Media Inquiries:

Mark Marmur Amarin Corporation plc

PR@amarincorp.com

-Tables to Follow-

|

|

|

CONSOLIDATED BALANCE SHEET DATA |

|

(U.S. GAAP) |

|

Unaudited * |

|

|

|

|

|

|

|

December 31, 2024 |

|

December 31, 2023 |

|

|

(in thousands) |

|

ASSETS |

|

|

|

|

Current Assets: |

|

|

|

|

Cash and cash equivalents |

$ |

121,038 |

|

|

$ |

199,252 |

|

|

Restricted cash |

|

300 |

|

|

|

525 |

|

|

Short-term investments |

|

173,182 |

|

|

|

121,407 |

|

|

Accounts receivable, net |

|

122,279 |

|

|

|

133,563 |

|

|

Inventory |

|

166,048 |

|

|

|

258,616 |

|

|

Prepaid and other current assets |

|

12,552 |

|

|

|

11,618 |

|

|

Total current assets |

|

595,399 |

|

|

|

724,981 |

|

|

Property, plant and equipment, net |

|

16 |

|

|

|

114 |

|

|

Long-term inventory |

|

64,740 |

|

|

|

77,615 |

|

|

Operating lease right-of-use asset |

|

7,592 |

|

|

|

8,310 |

|

|

Other long-term assets |

|

1,213 |

|

|

|

1,360 |

|

|

Intangible asset, net |

|

16,389 |

|

|

|

19,304 |

|

|

TOTAL ASSETS |

$ |

685,349 |

|

|

$ |

831,684 |

|

|

LIABILITIES AND STOCKHOLDERS’ EQUITY |

|

|

|

|

Current Liabilities: |

|

|

|

|

Accounts payable |

$ |

40,366 |

|

|

$ |

52,762 |

|

|

Accrued expenses and other current liabilities |

|

139,583 |

|

|

|

204,174 |

|

|

Current deferred revenue |

|

— |

|

|

|

2,341 |

|

|

Total current liabilities |

|

179,949 |

|

|

|

259,277 |

|

|

Long-Term Liabilities: |

|

|

|

|

Long-term deferred revenue |

|

— |

|

|

|

2,509 |

|

|

Long-term operating lease liability |

|

7,723 |

|

|

|

8,737 |

|

|

Other long-term liabilities |

|

11,501 |

|

|

|

9,064 |

|

|

Total liabilities |

|

199,173 |

|

|

|

279,587 |

|

|

Stockholders’ Equity: |

|

|

|

|

Common stock |

|

305,298 |

|

|

|

302,756 |

|

|

Additional paid-in capital |

|

1,914,750 |

|

|

|

1,899,456 |

|

|

Treasury stock |

|

(65,326 |

) |

|

|

(63,752 |

) |

|

Accumulated deficit |

|

(1,668,546 |

) |

|

|

(1,586,363 |

) |

|

Total stockholders’ equity |

|

486,609 |

|

|

|

552,097 |

|

|

TOTAL LIABILITIES AND STOCKHOLDERS’ EQUITY |

$ |

685,349 |

|

|

$ |

831,684 |

|

|

|

|

|

|

|

* Unaudited as a standalone schedule; copied from consolidated

financial statements |

|

|

|

|

|

|

CONSOLIDATED STATEMENTS OF OPERATIONS DATA |

|

(U.S. GAAP) |

|

Unaudited * |

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended December 31, |

|

Year Ended December 31, |

|

|

(in thousands, except per share amounts) |

|

(in thousands, except per share amounts) |

|

|

2024 |

|

2023 |

|

2024 |

|

2023 |

|

|

|

|

|

|

|

|

|

|

Product revenue, net |

$ |

60,068 |

|

|

$ |

70,555 |

|

|

$ |

204,590 |

|

|

$ |

285,299 |

|

|

Licensing and royalty revenue |

|

2,238 |

|

|

|

4,158 |

|

|

|

24,024 |

|

|

|

21,612 |

|

|

Total revenue, net |

|

62,306 |

|

|

|

74,713 |

|

|

|

228,614 |

|

|

|

306,911 |

|

|

Less: Cost of goods sold |

|

35,399 |

|

|

|

29,589 |

|

|

|

110,758 |

|

|

|

102,142 |

|

|

Less: Cost of goods sold - restructuring inventory |

|

36,474 |

|

|

|

— |

|

|

|

36,474 |

|

|

|

39,228 |

|

|

Gross margin |

|

(9,567 |

) |

|

|

45,124 |

|

|

|

81,382 |

|

|

|

165,541 |

|

|

Operating expenses: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Selling, general and administrative (1) |

|

36,970 |

|

|

|

43,941 |

|

|

|

152,310 |

|

|

|

199,938 |

|

|

Research and development (1) |

|

5,985 |

|

|

|

5,791 |

|

|

|

20,869 |

|

|

|

22,219 |

|

|

Restructuring |

|

— |

|

|

|

229 |

|

|

|

— |

|

|

|

10,972 |

|

|

Total operating expenses |

|

42,955 |

|

|

|

49,961 |

|

|

|

173,179 |

|

|

|

233,129 |

|

|

Operating loss |

|

(52,522 |

) |

|

|

(4,837 |

) |

|

|

(91,797 |

) |

|

|

(67,588 |

) |

|

Interest income |

|

3,371 |

|

|

|

3,419 |

|

|

|

13,403 |

|

|

|

11,863 |

|

|

Interest expense |

|

(3 |

) |

|

|

(2 |

) |

|

|

(7 |

) |

|

|

(8 |

) |

|

Other (expense) income, net |

|

(753 |

) |

|

|

(1,029 |

) |

|

|

1,201 |

|

|

|

2,063 |

|

|

Loss from operations before taxes |

|

(49,907 |

) |

|

|

(2,449 |

) |

|

|

(77,200 |

) |

|

|

(53,670 |

) |

|

Benefit from (provision for) income taxes |

|

1,289 |

|

|

|

(3,332 |

) |

|

|

(4,983 |

) |

|

|

(5,442 |

) |

|

Net loss |

$ |

(48,618 |

) |

|

$ |

(5,781 |

) |

|

$ |

(82,183 |

) |

|

$ |

(59,112 |

) |

|

Loss per share: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic |

$ |

(0.12 |

) |

|

$ |

(0.01 |

) |

|

$ |

(0.20 |

) |

|

$ |

(0.15 |

) |

|

Diluted |

$ |

(0.12 |

) |

|

$ |

(0.01 |

) |

|

$ |

(0.20 |

) |

|

$ |

(0.15 |

) |

|

Weighted average shares outstanding: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic |

|

411,293 |

|

|

|

408,485 |

|

|

|

410,937 |

|

|

|

407,655 |

|

|

Diluted |

|

411,293 |

|

|

|

408,485 |

|

|

|

410,937 |

|

|

|

407,655 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

* Unaudited as a standalone schedule; copied from consolidated

financial statements |

|

(1) |

Excluding non-cash stock-based compensation, selling, general and

administrative expenses were $138,144 and $187,445 for the years

ended December 31, 2024 and 2023, respectively, and research

and development expenses were $17,330 and $18,032, respectively,

for the same periods. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

RECONCILIATION OF NON-GAAP NET (LOSS) INCOME |

|

Unaudited |

|

|

|

|

|

|

|

|

|

|

|

Three months ended December 31, |

|

Year Ended December 31, |

|

|

(in thousands, except per share amounts) |

|

(in thousands, except per share amounts) |

|

|

2024 |

|

2023 |

|

2024 |

|

2023 |

|

|

|

|

|

|

|

|

|

|

Net (loss) income for EPS - GAAP |

$ |

(48,618 |

) |

|

$ |

(5,781 |

) |

|

$ |

(82,183 |

) |

|

$ |

(59,112 |

) |

|

Stock-based compensation expense |

|

3,400 |

|

|

|

4,646 |

|

|

|

17,703 |

|

|

|

16,680 |

|

|

Restructuring Inventory |

|

36,474 |

|

|

|

— |

|

|

|

36,474 |

|

|

|

39,228 |

|

|

Restructuring expense |

|

— |

|

|

|

229 |

|

|

|

— |

|

|

|

10,972 |

|

|

Advisor Fees |

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

6,270 |

|

|

Adjusted net (loss) income for EPS - non-GAAP |

$ |

(8,744 |

) |

|

$ |

(906 |

) |

|

$ |

(28,004 |

) |

|

$ |

14,038 |

|

|

|

|

|

|

|

|

|

|

|

Basic and diluted |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(Loss) earnings per share: |

|

|

|

|

|

|

|

|

Basic - non-GAAP |

$ |

(0.02 |

) |

|

$ |

(0.00 |

) |

|

$ |

(0.07 |

) |

|

$ |

0.03 |

|

|

Diluted - non-GAAP |

$ |

(0.02 |

) |

|

$ |

(0.00 |

) |

|

$ |

(0.07 |

) |

|

$ |

0.03 |

|

|

|

|

|

|

|

|

|

|

|

Weighted average shares: |

|

|

|

|

|

|

|

|

Basic |

|

411,293 |

|

|

|

408,485 |

|

|

|

410,937 |

|

|

|

407,655 |

|

|

Diluted |

|

411,293 |

|

|

|

408,485 |

|

|

|

410,937 |

|

|

|

422,966 |

|

|

|

|

|

|

|

|

|

|

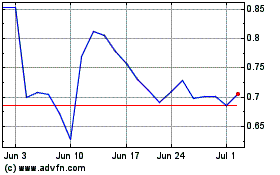

Amarin (NASDAQ:AMRN)

Historical Stock Chart

From Feb 2025 to Mar 2025

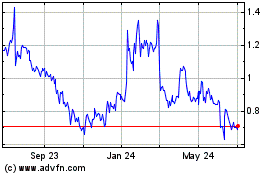

Amarin (NASDAQ:AMRN)

Historical Stock Chart

From Mar 2024 to Mar 2025