TIDMAAZ

RNS Number : 8529F

Anglo Asian Mining PLC

13 July 2023

13 July 2023

Anglo Asian Mining plc

Q2 & H1 2023 Production and Operations Review

Anglo Asian Mining plc ("Anglo Asian" or the "Company"), the AIM

listed gold, copper and silver producer focused in Azerbaijan, is

pleased to provide a production, sales and operational review for

the three months to 30 June 2023 ("Q2 2023") and six months to 30

June 2023 ("H1 2023").

Operational highlights

-- The Company announced its strategic growth plan, that

outlined its 4 year transition to mid-tier production

status with copper as its principal product

-- The Company retains its production target of 50,000

to 54,000 gold equivalent ounces for 2023 and continues

to successfully execute its growth strategy

H1 2023 and Q2 2023 Production update

-- Total production of 23,391 gold equivalent ounces ("GEOs")

in H1 2023 (H1 2022: 28,722 GEOs) and 12,422 GEOs in

Q2 2023 calculated using actual metal prices

-- Copper production increased to 1,860 tonnes in H1 2023

(H1 2022: 1,283 tonnes) and rose by 42 per cent. year-on-year

in Q2 2023 to 1,013 tonnes (Q2 2022: 715 tonnes) as

part of the Company's growth strategy to increase its

copper production

o Ore processed by the expanded flotation plant in

Q2 2023 increased to 190,593 tonnes (Q2 2022: 114,099

tonnes)

-- Gold production of 14,608 ounces during H1 2023 (H1

2022: 20,906 ounces) and 7,867 ounces in Q2 2023 (Q2

2022: 10,866 ounces) due to decreasing grades at Gedabek

o Agitation leaching plant idle from 2 May to 30 May

as ore now processed on a campaign basis

-- Silver production totalled 44,576 ounces in H1 2023

(H1 2022: 99,548 ounces) and 22,010 ounces in Q2 2023

(Q2 2022: 48,874 ounces)

Q2 2023 Sales and cash update

-- Cash of $9.4 million at 30 June 2023 (31 March 2023:

$10.7 million), with inventory valued at $8.9 millionconsisting

of 2,366 ounces of gold valued at $4.5 million and

copper concentrate valued at $4.4 million

-- The Company completed the sale of 1,000 ounces of gold

bullion on 30 June 2023 at $1,947.5 per ounce under

the Company's hedging programme, compared to the LBMA

PM price of $1,912.25 generating additional revenue

of $35,250

Reza Vaziri, President and Chief Executive Officer of Anglo

Asian, commented:

"During the first half of this year, we were delighted to

announce our strategic growth plan, which will see Anglo Asian

reach its operational potential in becoming a producer of circa

36,000 tonnes of copper equivalent by 2028. This is underpinned by

the three new contract areas acquired during 2022 and our enhanced

strategic focus on copper. The execution of this plan is

progressing well, with a number of our assets achieving

developmental milestones during the first half of 2023. In

particular, Gilar is still on track to begin production in the

fourth quarter of the year."

Market Abuse Regulation (MAR) Disclosure

Certain information contained in this announcement would have

been deemed inside information for the purposes of Article 7 of

Regulation (EU) No 596/2014, which was incorporated into UK law by

the European Union (Withdrawal) Act 2018, until the release of this

announcement.

For further information please contact:

Anglo Asian Mining plc

Reza Vaziri, Chief Executive Officer Tel: +994 12 596 3350

Bill Morgan, Chief Financial Officer Tel: +994 502 910 400

Stephen Westhead, Vice President Tel: +994 502 916 894

SP Angel Corporate Finance LLP (Nominated Adviser and Broker) Tel: +44 (0) 20 3470 0470

Ewan Leggat

Adam Cowl

Hudson Sandler (Financial PR) Tel: +44 (0) 20 7796 4133

Charlie Jack

Harry Griffiths

Notes to editors

Anglo Asian Mining plc (AIM:AAZ) is a gold, copper and silver

producer with a high-quality portfolio of production and

exploration assets in Azerbaijan. The Company produced 57,618 gold

equivalent ounces ("GEOs") for the year ended 31 December 2022.

On 30 March 2023, the Company published its strategic plan for

growth which shows a clearly defined path for the Company to

transition to a multi-asset, mid-tier copper and gold producer by

2028. By 2028, copper will be the principal product of the Company,

with forecast production of around 36,000 copper equivalent tonnes.

It plans to achieve this growth by bringing into production four

new mines during 2023 to 2028 at Zafar, Gilar, Xarxar and

Garadag.

The Company owns approximately 19.8 per cent. of Libero Copper

& Gold Corporation ("Libero"). Libero is listed on the TSX

Venture Exchange in Canada and owns, or has the option to acquire,

several copper exploration properties in North and South America,

including Mocoa in Colombia, one of the world's largest undeveloped

copper-molybdenum resources.

https://www.angloasianmining.com/

Q2 2023 Production overview

-- Gold production of 7,867 ounces (Q2 2022: 10,866 ounces):

o 7,375 ounces contained within gold doré

o 16 ounces from sulphidisation, acidification, recycling

and thickening ("SART") processing

o 476 ounces from flotation

-- Copper production of 1,013 tonnes (Q2 2022: 715 tonnes):

o 146 tonnes from SART processing

o 867 tonnes from flotation processing e

-- Silver production totalled 22,010 ounces (Q2 2022:

48,874 ounces):

o 3,593 ounces contained within gold doré

o 10,348 ounces from SART processing

o 8,069 ounces from flotation

Q2 2023 Sales overview

-- Total gold bullion sales of 4,787 ounces at an average

of $1,992 per ounce (Q2 2022: 3,754 ounces at an average

of $1,895 per ounce)

-- The 4,787 ounces of gold sold include 1,000 ounces

sold on 30 June 2023 under the Company's hedge programme

for $1,947.50 per ounce when the LBMA PM gold price

was $1,912.25

-- Total concentrate sales of 5,501 dry metric tonnes

("dmt") with a value of $7.7 million (Q2 2022: 4,642

dmt with a value of $8.1 million)

Q2 2023 Financial overview

-- Cash of $9.4 million ( $10.7 million at 31 March 2023)

-- Unsold gold dor é and copper concentrate inventory

of $8.9 million

Q1 2023 Operations review

The Company mined the following ore during FY 2022 and the six

months to 30 June 2023:

12 months to 3 months to 3 months to

31 December 2022 31 March 2023 30 June 2023

Average Average Average

gold Ore gold Ore gold

Mine Ore mined grade mined grade mined grade

(tonnes) (g/t) (tonnes) (g/t) (tonnes) (g/t)

---------- -------- --------- -------- --------- --------

Open pit 1,705,337 0.47 415,365 0.43 591,118 0.30

Gadir -

u/g 136,715 1.41 38,867 1.64 46,334 1.54

Gedabek

- u/g 373,915 1.30 - - - -

---------- -------- --------- -------- --------- --------

Total 2,215,967 0.67 454,232 0.53 637,452 0.39

---------- ---------- -------- --------- -------- --------- --------

The Company processed the following amounts and grades of ore by

leaching for FY 2022 and the six months to 30 June 2023:

Quarter ended Ore processed Gold grade of ore processed

------------------------------------- ------------------------------------

Heap Heap Heap Heap

leach leach Agitation leach leach Agitation

pad crushed pad ROM leaching pad crushed pad ROM leaching

ore ore plant* ore ore plant*

(tonnes) (tonnes) (tonnes) (g/t) (g/t) (g/t)

------------- ------------- --------- ----------

31 March 2022 115,173 273,577 144,275 0.75 0.48 1.63

30 June 2022 82,814 299,762 162,239 0.78 0.53 1.40

30 September

2022 92,398 302,714 162,669 0.81 0.57 1.42

31 December 2022 24,606 213,120 156,285 0.72 0.56 1.42

------------- ---------- ---------- ------------- --------- ----------

FY 2022 314,991 1,089,173 625,468 0.77 0.56 1.43

------------------ ------------- ---------- ---------- ------------- --------- ----------

31 March 2023 94,518 196,595 62,006 0.74 0.49 1.3

30 June 2023 56,522 203,016 105,213 0.75 0.46 1.4

------------- ---------- ---------- ------------- --------- ----------

H1 2023 151,040 399,611 167,219 0.75 0.49 1.4

------------------ ------------- ---------- ---------- ------------- --------- ----------

* includes previously heap leached ore.

The Company processed the following amounts of ore and contained

metal by flotation for FY 2022 and the six months ended 30 June

2023:

Quarter ended Ore processed Gold content Silver content Copper content

(tonnes) (ounces) (ounces) (tonnes)

-------------- ------------- --------------- ---------------

31 March 2022 104,475 1,921 33,522 577

30 June 2022 114,099 1,293 24,209 745

30 September

2022 143,838 1,314 24,582 724

31 December 2022 119,819 1,389 18,003 670

-------------- ------------- --------------- ---------------

FY 2022 482,231 5,917 100,316 2,716

-------------- ------------- --------------- ---------------

31 March 2023 192,516 1,487 19,787 1,133

30 June 2023 190,593 1,033 10,380 1,191

-------------- ------------- --------------- ---------------

H1 2023 383,109 2,520 30,167 2,324

------------------ -------------- ------------- --------------- ---------------

The following table summarises gold doré production and sales at

Gedabek for FY 2022 and six months ended 30 June 2023:

Quarter ended Gold produced* Silver Gold sales** Gold Sales

(ounces) produced* (ounces) price

(ounces) ($/ounce)

31 March 2022 8,963 7,574 7,519 1,904

30 June 2022 10,137 7,620 3,754 1,895

30 September

2022 10,473 6,949 10,000 1,727

31 December

2022 10,437 4,820 13,645 1,727

-------------- ----------- ------------- ----------

FY 2022 40,010 26,963 34,918 1,783

-------------- -------------- ----------- ------------- ----------

31 March 2023 5,965 2,841 5,719 1,895

30 June 2023 7,375 3,593 4,787 1,992

-------------- ----------- ------------- ----------

H1 2023 13,340 6,434 10,506 1,939

-------------- -------------- ----------- ------------- ----------

Note

* including Government of Azerbaijan's share

** excluding Government of Azerbaijan's share

The gold and silver production from agitation and heap leaching

for FY 2022 and the six months ended 30 June 2023 is as

follows:

Quarter Gold Silver

ended

Agitation Heap Total Agitation Heap Total

leaching leaching leaching leaching

(ounces) (ounces) (ounces) (ounces) (ounces) (ounces)

---------- ---------- ---------- ---------- ---------- ----------

31 March 2022 5,674 3,289 8,963 4,803 2,771 7,574

30 June 2022 6,196 3,941 10,137 4,654 2,966 7,620

30 Sept 2022 5,517 4,956 10,473 3,673 3,276 6,949

31 Dec 2022 5,831 4,606 10,437 2,684 2,136 4,820

---------- ---------- ---------- ---------- ---------- ----------

FY 2022 23,218 16,792 40,010 15,814 11,139 26,963

--------------- ---------- ---------- ---------- ---------- ---------- ----------

31 March 2023 2,105 3,860 5,965 1,077 1,764 2,841

30 June 2023 3,463 3,912 7,375 1,735 1,858 3,593

---------- ---------- ---------- ---------- ---------- ----------

H1 2023 5,568 7,772 13,340 2,812 3,622 6,434

--------------- ---------- ---------- ---------- ---------- ---------- ----------

The following table summarises copper concentrate production

from both the Company's SART and flotation plants at Gedabek for FY

2022 and the six months ended 30 June 2023 is as follows:

Concentrate Copper Gold Silver

production* content* content* content*

(dmt) (tonnes) (ounces) (ounces)

------------ --------- --------- ---------

2022

Quarter ended 31 March

SART processing 330 188 12 25,114

Flotation 2,586 380 1,065 17,986

------------ --------- --------- ---------

Total 2,916 568 1,077 43,100

------------ --------- --------- ---------

Quarter ended 30 June

SART processing 316 168 14 25,582

Flotation 3,811 547 715 15,672

------------ --------- --------- ---------

Total 4,127 715 729 41,254

------------ --------- --------- ---------

Quarter ended 30 September

SART processing 367 208 33 24,077

Flotation 2,805 401 581 14,094

------------ --------- --------- ---------

Total 3,172 609 614 38,171

------------ --------- --------- ---------

Quarter ended 31 December

SART processing 438 244 39 20,833

Flotation 2,648 380 645 11,725

------------ --------- --------- ---------

Total 3,086 624 684 32,558

------------ --------- --------- ---------

2023

Quarter ended 31 March

SART processing 364 190 25 8,750

Flotation 4,544 657 751 10,975

------------ --------- --------- ---------

Total 4,908 847 776 19,725

------------ --------- --------- ---------

Quarter ended 30 June

SART processing 272 146 16 10,348

Flotation 5,613 867 476 8,069

------------ --------- --------- ---------

Total 5,885 1,013 492 18,417

------------ --------- --------- ---------

Note

* including Government of Azerbaijan's share.

Certain amounts for SART and flotation production may differ to

those previously disclosed due to final reconciliation of

production.

The following table summarises total copper concentrate

production and sales for FY 2022 and the six months ended 30 June

2023. Note that sales of concentrates are initially recorded at

provisional amounts until agreement of final assay:

Concentrate Copper Gold Silver Concentrate Concentrate

production* content* content* content* sales** sales**

(dmt) (tonnes) (ounces) (ounces) (dmt) ($000)

Quarter ended

------------ --------- --------- --------- ------------ --------------

31 March 2022 2,916 568 1,077 43,100 1,477 3,248

30 June 2022 4,127 715 729 41,254 4,642 8,127

30 September

2022 3,172 609 614 38,171 1,718 3,378

31 December

2022 3,086 624 684 32,558 4,606 7,487

------------ --------- --------- --------- ------------ --------------

FY 2022 13,301 2,516 3,104 155,083 12,443 22,240

--------------- ------------ --------- --------- --------- ------------ --------------

31 March 2023 4,908 847 776 19,725 1,147 2,743

30 June 2023 5,885 1,013 492 18,417 5,501 7,678

------------ --------- --------- --------- ------------ --------------

H1 2023 10,793 1,860 1,268 38,142 6,648 10,421

--------------- ------------ --------- --------- --------- ------------ --------------

* including Government of Azerbaijan's share

** excludes Government of Azerbaijan's share

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

DRLSFMFWEEDSEFW

(END) Dow Jones Newswires

July 13, 2023 02:00 ET (06:00 GMT)

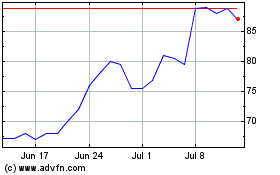

Anglo Asian Mining (LSE:AAZ)

Historical Stock Chart

From Apr 2024 to May 2024

Anglo Asian Mining (LSE:AAZ)

Historical Stock Chart

From May 2023 to May 2024