Form 8-K - Current report

January 24 2024 - 5:05PM

Edgar (US Regulatory)

false

0001568385

0001568385

2024-01-18

2024-01-18

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

8-K

CURRENT

REPORT

Pursuant

to Section 13 or 15(d) of

the Securities Exchange Act of 1934

Date

of Report (Date of earliest event reported): January 18, 2024

Bright

Mountain Media, Inc.

(Exact

name of registrant as specified in its charter)

Florida

(State

or other jurisdiction of incorporation)

| 000-54887 |

|

27-2977890 |

| (Commission

File Number) |

|

(IRS

Employer Identification No.) |

6400

Congress Avenue, Suite 2050

Boca

Raton, Florida 33487

(Address

of principal executive offices) (Zip Code)

Registrant’s

telephone number, including area code (760) 707-5959

(Former

name or former address, if changed since last report)

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under

any of the following provisions:

| |

☐ |

Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

|

|

| |

☐ |

Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

|

|

| |

☐ |

Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

|

|

| |

☐ |

Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities

registered pursuant to Section 12(b) of the Act:

| Title

of Each Class |

|

Trading

Symbol(s) |

|

Name

of Each Exchange on Which Registered |

| None |

|

N/A |

|

N/A |

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405

of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging

growth company ☐

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item

5.02. Departure of Directors or Principal Officers; Election of Directors; Appointment of Principal Officers; Compensatory Arrangements

of Certain Officers.

On

January 18, 2024, Pamela J. Parizek, a director of Bright Mountain Media, Inc. (the “Company”), notified the Company that

she was resigning from the board of directors, effective immediately. At the time of her resignation, Ms. Parizek was also the Chair

of the Company’s audit committee. Ms. Parizek’s resignation was prompted by a disagreement as to how to handle a matter with

the Company’s lender. Over the course of several conversations and meetings, Management of the Company and the Board discussed

the matter with the Company’s internal counsel and outside counsel. Pursuant to its standard procedures, outside SEC

counsel recommended to the Board that the Company pursue the course of action that ultimately prevailed, supported by a four to one vote

by the Board of Directors.

A

copy of Ms. Parizek’s resignation letter is attached as an exhibit to this Form 8-K.

Item

9.01. Financial Statements and Exhibits.

(d) Exhibits

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, as amended, the Company has duly caused this report to be signed on its behalf

by the undersigned hereunto duly authorized.

| |

Bright

Mountain Media, Inc. |

| |

|

|

| Date:

January 24, 2024 |

By: |

/s/

Matt Drinkwater |

| |

|

Matt

Drinkwater |

| |

|

Chief

Executive Officer |

Exhibit

17.1

PAMELA

J. PARIZEK

1224

Aldebaran Drive

McLean,

VA 22101

January

18, 2024

| To: |

Board

of Directors |

| |

Bright

Mountain Media, Inc. |

I

hereby submit my resignation as a member of the Board of Directors of Bright Mountain Media, Inc. (“BMTM” or the “Company”).

This

action was and is prompted by the Board’s decision to authorize the Company to execute a release of liability for all known and

unknown claims, past or future, against Centre Lane Partners Master Credit Fund II, LP (the “Lender”), without legal advice

on the implications of the release vis-à-vis our fiduciary responsibilities as Board members to preserve all assets of the Company

for the benefit of all stakeholders – particularly in the event of a voluntary or involuntary corporate restructuring.

In

the past, I have raised with the Board my concerns about the level of dominion and control exercised by the Lender in connection with

material transactions and business decisions. The Board’s decision tonight to yield what the Company’s own counsel described

as an “aggressive” and “obnoxious” demand by the Lender to execute a full release or receive a default letter,

is a case in point.

My

understanding of the facts and circumstances surrounding this release is that the Company’s CFO learned that the Company had not

executed Deposit Account Control Agreements (“DACA”) on all of its bank accounts as required by certain amendments to its

credit agreement(s) with the Lender, and proactively reported and cured the technical defaults to the Lender. In response, the Lender

documented the cure and then demanded the Company to execute a full release of any and all claims, known or unknown, past and future

against the Lender. At an emergency meeting held yesterday, I expressed the view that the Board required legal advice before authorizing

management to execute the release. When management communicated that request to the Lender, the Lender declared its intention to issue

the Company a default letter on its obligations. Under duress from the Lender, the majority of Board members – citing business

judgment – determined to give in to the Lender’s unreasonable demand.

My

concerns regarding the Lender, which have been communicated to the Board and management, are summarized as follows:

| |

1. |

The

Company requires a capital restructuring to provide the shareholders with an opportunity of a value recovery of the equity securities

issued by the Company. |

| |

|

|

| |

2. |

The

Company has not been pursuing such a capital restructuring because it has been and is acting, as a practical matter, at the direction

of the Lender, whose motives are not aligned with those of the Company and its other stakeholders. |

| |

3. |

The

Lender, which is a credit fund with less than $250 million of capital under management based on public reports (and over 25% invested

in BMTM), appears to be encouraging the Company to avoid a capital restructuring because such a restructuring would require a substantial

write-down (or mark-to-market) of its investment in the Company, given that such a mark-to-market would substantially impair the

overall value of the Lender, given the concentration of the Lender’s investment in the Company vis-à-vis the investor

capital committed to the Lender itself. |

| |

|

|

| |

4. |

There

is no existing equity security interest value in the Company. |

| |

|

|

| |

5. |

If

the Lender’s senior secured collateral interest is not set aside by an equitable subordination claim (brought by unsecured

creditors) in bankruptcy court or otherwise, whatever value that is remaining in the Company’s assets or enterprise belongs

to the Lender. It appears that the only reason the Lender is not enforcing its rights to its collateral and taking ownership control

thereof is its avoidance of an accurate mark-to-market of its investment in the Company. |

| |

|

|

| |

6. |

Public

shareholders that purchase shares of the Company’s stock are purchasing securities whose future value is dependent on a capital

restructuring, which is not clearly disclosed in the Company’s public filings. |

Simply

put, the Company has disclosed the factors that show the necessity of the Company to restructure its debt to continue as a going concern.

I have urged the Board to pursue such a restructuring. The Board has not agreed to engage restructuring professionals and to date, management

has not engaged in restructuring negotiations with the Lender. Instead, the Board and management have relinquished any and all claims

against the Lender based on the Lender’s threat to issue a default letter in response to good faith actions taken by the Company.

Given

the current disagreement between management, the Board members, and me as to how best to preserve value and exercise our fiduciary duties

as Board members, I have no choice but to resign from the Board of Directors, effective immediately.

I

wish each of you and the Company the best in your future endeavors.

Respectfully,

Pam

v3.23.4

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

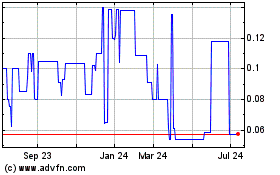

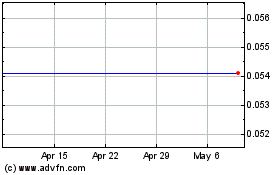

Bright Mountain Media (QB) (USOTC:BMTM)

Historical Stock Chart

From Apr 2024 to May 2024

Bright Mountain Media (QB) (USOTC:BMTM)

Historical Stock Chart

From May 2023 to May 2024