Discovery Fund Summary

Class/Ticker: Class A - WFDAX; Class C - WDSCX

Summary Prospectus

February 1, 2013

|

Link to Prospectus

|

Link to SAI

|

Before you invest, you may want to review the Fund's prospectus, which contains more information about the Fund and its risks.

You can find the Fund's prospectus and other information about the Fund online at wellsfargoadvantagefunds.com/reports. You

can also get information at no cost by calling 1-800-222-8222, or by sending an email request to wfaf@wellsfargo.com. The

current prospectus ("Prospectus") and statement of additional information ("SAI"), dated February 1, 2013 are incorporated

by reference into this summary prospectus. The Fund's SAI may be obtained, free of charge, in the same manner as the Prospectus.

Investment Objective

The Fund seeks long-term capital appreciation.

Fees and Expenses

These tables are intended to help you understand the various costs and expenses you will pay if you buy and hold shares of

the Fund. You may qualify for sales charge discounts if you and your family invest, or agree to invest in the future, at least

$50,000 in the aggregate in specified classes of certain

Wells Fargo Advantage Funds

®

. More information about these and other discounts is available from your financial professional and in "A Choice of Share

Classes" and "Reductions and Waivers of Sales Charges" on pages 43 and 45 of the Prospectus and "Additional Purchase and Redemption

Information" on page 50 of the Statement of Additional Information.

|

Shareholder Fees (fees paid directly from your investment)

|

|

|

|

|

Class A

|

Class C

|

|

Maximum sales charge (load) imposed on purchases (as a percentage of offering price)

|

5.75%

|

None

|

|

Maximum deferred sales charge (load) (as a percentage of offering price)

|

None

1

|

1.00%

|

|

1.

|

Investments of $1 million or more are not subject to a front-end sales charge but generally will be subject to a deferred

sales charge of 1.00% if redeemed within 18 months from the date of purchase.

|

|

Annual Fund Operating Expenses (expenses that you pay each year as a percentage of the value of your investment)

|

|

|

Class A

|

Class C

|

|

Management Fees

|

0.71%

|

0.71%

|

|

Distribution (12b-1) Fees

|

0.00%

|

0.75%

|

|

Other Expenses

|

0.58%

|

0.58%

|

|

Acquired Fund Fees and Expenses

|

0.01%

|

0.01%

|

|

Total Annual Fund Operating Expenses

|

1.30%

|

2.05%

|

|

Fee Waivers

|

0.07%

|

0.07%

|

|

Total Annual Fund Operating Expenses After Fee Waiver

1

|

1.23%

|

1.98%

|

|

1.

|

The Adviser has committed through January 31, 2014, to waive fees and/or reimburse expenses to the extent necessary to cap

the Fund's Total Annual Fund Operating Expenses After Fee Waiver at 1.22% for Class A and 1.97% for Class C. Brokerage commissions,

stamp duty fees, interest, taxes, acquired fund fees and expenses, and extraordinary expenses are excluded from the cap. After

this time, the cap may be increased or the commitment to maintain the cap may be terminated only with the approval of the

Board of Trustees.

|

Example of Expenses

The example below is intended to help you compare the costs of investing in the Fund with the costs of investing in other

mutual funds. The example assumes a $10,000 initial investment, 5% annual total return, and that operating expenses remain

the same as in the tables above. The example also assumes that the Total Annual Fund Operating Expenses After Fee Waiver shown

above will only be in place for the length of the current waiver commitment. Although your actual costs may be higher or lower,

based on these assumptions your costs would be:

|

|

Assuming Redemption at End of Period

|

|

|

Assuming No Redemption

|

|

After:

|

Class A

|

Class C

|

|

|

|

Class C

|

|

|

1 Year

|

$693

|

$301

|

|

|

|

$201

|

|

|

3 Years

|

$957

|

$636

|

|

|

|

$636

|

|

|

5 Years

|

$1,241

|

$1,097

|

|

|

|

$1,097

|

|

|

10 Years

|

$2,047

|

$2,374

|

|

|

|

$2,374

|

|

Portfolio Turnover

The Fund pays transaction costs, such as commissions, when it buys and sells securities (or "turns over" its portfolio). A

higher portfolio turnover rate may indicate higher transaction costs and may result in higher taxes when Fund shares are held

in a taxable account. These costs, which are not reflected in annual fund operating expenses or in the example, affect the

Fund's performance. During the most recent fiscal year, the Fund's portfolio turnover rate was 104% of the average value of

its portfolio.

Principal Investment Strategies

Under normal circumstances, we invest at least 80% of the Fund's net assets in equity securities of small- and medium-capitalization

companies and up to 25% of the Fund's total assets in equity securities of foreign issuers through ADRs and similar investments.

We invest in equity securities of small- and medium-capitalization companies that we believe offer favorable opportunities

for growth. We define small- and medium capitalization companies as those with market capitalizations at the time of purchase

equal to or lower than the company with the largest market capitalization in the Russell Midcap® Index, which was approximately

$20.8 billion as of May 31, 2012, and is expected to change frequently. We may also invest in equity securities of foreign

issuers through ADRs and similar investments.

We seek to identify companies that have the prospect for improving sales and earnings growth rates, enjoy a competitive advantage

(for example, dominant market share) and that we believe have effective management with a history of making investments that

are in the best interests of shareholders (for example, companies with a history of earnings and sales growth that are in

excess of total asset growth). We pay particular attention to balance sheet metrics such as changes in working capital, property,

plant and equipment growth, inventory levels, accounts receivable, and acquisitions. We also look at how management teams

allocate capital in order to drive future cash flow. Price objectives are determined based on industry specific valuation

methodologies including relative price-to-earnings multiples, price-to-book value, operating profit margin trends, enterprise

value to EBITDA (Earnings Before Interest, Taxes, Depreciation and Amortization) and free cash flow yield. In addition to

meeting with management, we take a surround the company approach by surveying a company's vendors, distributors, competitors

and customers to obtain multiple perspectives that help us make better investment decisions. Portfolio holdings are continuously

monitored for changes in fundamentals. The team seeks a favorable risk/reward relationship to fair valuation, which we define

as the value of the company (i.e. our price target for the stock) relative to where the stock is currently trading. We may

invest in any sector, and at times we may emphasize one or more particular sectors. We may choose to sell a holding when it

no longer offers favorable growth prospects, reaches our target price, or to take advantage of a better investment opportunity.

Principal Investment Risks

An investment in the Fund may lose money, is not a deposit of Wells Fargo Bank, N.A. or its affiliates, is not insured or

guaranteed by the Federal Deposit Insurance Corporation or any other governmental agency, and is primarily subject to the

risks briefly summarized below.

Foreign Investment Risk.

Foreign investments face the potential of heightened illiquidity, greater price volatility and adverse effects of political,

regulatory, tax, currency, economic or other macroeconomic developments.

Growth Style Investment Risk.

Growth stocks may be more expensive relative to the values of other stocks and carry potential for significant volatility

and loss.

Issuer Risk.

The value of a security may decline because of adverse events or circumstances that directly relate to conditions at the

issuer or any entity providing it credit or liquidity support.

Liquidity Risk.

A security may not be able to be sold at the time desired or without adversely affecting the price.

Management Risk.

There is no guarantee of the Fund's performance or that the Fund will meet its objective. The market value of your investment

may decline and you may suffer investment loss.

Market Risk.

The market price of securities owned by the Fund may rapidly or unpredictably decline due to factors affecting securities

markets generally or particular industries.

Regulatory Risk.

Changes in government regulations may adversely affect the value of a security. An insufficiently regulated industry or market

might also permit inappropriate practices that adversely affect an investment.

Sector Emphasis Risk.

Investing a substantial portion of the Fund's assets in related industries or sectors may have greater risks because companies

in these sectors may share common characteristics and may react similarly to market developments.

Smaller Company Securities Risk.

Securities of companies with smaller market capitalizations tend to be more volatile and less liquid than larger company

stocks.

Performance

The following information provides some indication of the risks of investing in the Fund by showing changes in the Fund's

performance from year to year. The Fund's average annual total returns are compared to the performance of one or more indices.

Past performance before and after taxes is no guarantee of future results. Current month-end performance is available on the

Fund's Web site at wellsfargoadvantagefunds.com.

Calendar Year Total Returns for Class A as of 12/31 each year

(Returns do not reflect sales charges and would be lower if they did)

|

Highest Quarter: 3rd Quarter 2009

|

+17.55%

|

|

Lowest Quarter: 4th Quarter 2008

|

-29.33%

|

|

Average Annual Total Returns for the periods ended 12/31/2012 (Returns reflect applicable sales charges)

|

|

|

Inception Date of Share Class

|

1 Year

|

5 Year

|

10 Year

|

|

Class A (before taxes)

|

7/31/2007

|

9.24%

|

2.98%

|

10.62%

|

|

Class A (after taxes on distributions)

|

7/31/2007

|

8.34%

|

2.68%

|

9.57%

|

|

Class A (after taxes on distributions and the sale of Fund Shares)

|

7/31/2007

|

7.18%

|

2.53%

|

9.06%

|

|

Class C (before taxes)

|

7/31/2007

|

14.04%

|

3.43%

|

10.48%

|

|

Russell 2500™ Growth Index (reflects no deduction for fees, expenses, or taxes)

|

|

16.13%

|

4.07%

|

10.55%

|

After-tax returns are calculated using the historical highest individual federal marginal income tax rates and do not reflect

the impact of state, local or foreign taxes. Actual after-tax returns depend on an investor's tax situation and may differ

from those shown, and after-tax returns shown are not relevant to tax-exempt investors or investors who hold their Fund shares

through tax-deferred arrangements, such as 401(k) Plans or Individual Retirement Accounts. After-tax returns are shown only

for the Class A shares. After-tax returns for the Class C shares will vary.

Fund Management

|

Investment Adviser

|

Sub-Adviser

|

Portfolio Manager, Title / Managed Since

|

|

Wells Fargo Funds Management, LLC

|

Wells Capital Management Incorporated

|

Thomas J. Pence, CFA

, Portfolio Manager / 2001

Michael T. Smith, CFA

, Portfolio Manager / 2011

Chris Warner, CFA

, Portfolio Manager / 2012

|

Purchase and Sale of Fund Shares

In general, you can buy or sell shares of the Fund by mail, internet, phone or wire on any day the New York Stock Exchange

is open for regular trading. You also may buy and sell shares through a financial professional.

|

Minimum Investments

|

To Buy or Sell Shares

|

|

Minimum Initial Investment

Regular Accounts: $1,000

IRAs, IRA Rollovers, Roth IRAs: $250

UGMA/UTMA Accounts: $50

Employer Sponsored Retirement Plans: No Minimum

Minimum Additional Investment

Regular Accounts, IRAs, IRA Rollovers, Roth IRAs: $100

UGMA/UTMA Accounts: $50

Employer Sponsored Retirement Plans: No Minimum

|

Mail:

Wells Fargo Advantage Funds

P.O. Box 8266

Boston, MA 02266-8266

Internet:

wellsfargoadvantagefunds.com

Phone or Wire:

1-800-222-8222

Contact your financial professional.

|

Tax Information

Any distributions you receive from the Fund may be taxable as ordinary income or capital gains, except when your investment

is in an IRA, 401(k) or other tax advantaged investment plan. However, subsequent withdrawals from such a tax advantaged investment

plan may be subject to federal income tax. You should consult your tax adviser about your specific tax situation.

Payments to Broker-Dealers and Other Financial Intermediaries

If you purchase a Fund through a broker-dealer or other financial intermediary (such as a bank), the Fund and its related

companies may pay the intermediary for the sale of Fund shares and related services. These payments may create a conflict

of interest by influencing the broker-dealer or other intermediary and your salesperson to recommend the Fund over another

investment. Consult your salesperson or visit your financial intermediary's Web site for more information.

|

Link to Prospectus

|

Link to SAI

|

Discovery Fund Summary

Class/Ticker: Administrator Class - WFDDX

Summary Prospectus

February 1, 2013

|

Link to Prospectus

|

Link to SAI

|

Before you invest, you may want to review the Fund's prospectus, which contains more information about the Fund and its risks.

You can find the Fund's prospectus and other information about the Fund online at wellsfargoadvantagefunds.com/reports. You

can also get information at no cost by calling 1-800-222-8222, or by sending an email request to wfaf@wellsfargo.com. The

current prospectus ("Prospectus") and statement of additional information ("SAI"), dated February 1, 2013 are incorporated

by reference into this summary prospectus. The Fund's SAI may be obtained, free of charge, in the same manner as the Prospectus.

Investment Objective

The Fund seeks long-term capital appreciation.

Fees and Expenses

These tables are intended to help you understand the various costs and expenses you will pay if you buy and hold shares of

the Fund.

|

Shareholder Fees (fees paid directly from your investment)

|

|

|

|

|

|

Maximum sales charge (load) imposed on purchases (as a percentage of offering price)

|

None

|

|

Maximum deferred sales charge (load) (as a percentage of offering price)

|

None

|

|

Annual Fund Operating Expenses (expenses that you pay each year as a percentage of the value of your investment)

|

|

|

|

|

Management Fees

|

0.71%

|

|

Distribution (12b-1) Fees

|

0.00%

|

|

Other Expenses

|

0.42%

|

|

Acquired Fund Fees and Expenses

|

0.01%

|

|

Total Annual Fund Operating Expenses

|

1.14%

|

|

Fee Waivers

|

0.00%

|

|

Total Annual Fund Operating Expenses After Fee Waiver

1

|

1.14%

|

|

1.

|

The Adviser has committed through January 31, 2014, to waive fees and/or reimburse expenses to the extent necessary to cap

the Fund's Total Annual Fund Operating Expenses After Fee Waiver at 1.15% for Administrator Class. Brokerage commissions,

stamp duty fees, interest, taxes, acquired fund fees and expenses, and extraordinary expenses are excluded from the cap. After

this time, the cap may be increased or the commitment to maintain the cap may be terminated only with the approval of the

Board of Trustees.

|

Example of Expenses

The example below is intended to help you compare the costs of investing in the Fund with the costs of investing in other

mutual funds. The example assumes a $10,000 initial investment, 5% annual total return, and that operating expenses remain

the same as in the tables above. The example also assumes that the Total Annual Fund Operating Expenses After Fee Waiver shown

above will only be in place for the length of the current waiver commitment. Although your actual costs may be higher or lower,

based on these assumptions your costs would be:

|

|

|

|

After:

|

|

|

1 Year

|

$116

|

|

3 Years

|

$362

|

|

5 Years

|

$628

|

|

10 Years

|

$1,386

|

Portfolio Turnover

The Fund pays transaction costs, such as commissions, when it buys and sells securities (or "turns over" its portfolio). A

higher portfolio turnover rate may indicate higher transaction costs and may result in higher taxes when Fund shares are held

in a taxable account. These costs, which are not reflected in annual fund operating expenses or in the example, affect the

Fund's performance. During the most recent fiscal year, the Fund's portfolio turnover rate was 104% of the average value of

its portfolio.

Principal Investment Strategies

Under normal circumstances, we invest at least 80% of the Fund's net assets in equity securities of small- and medium-capitalization

companies and up to 25% of the Fund's total assets in equity securities of foreign issuers through ADRs and similar investments.

We invest in equity securities of small- and medium-capitalization companies that we believe offer favorable opportunities

for growth. We define small- and medium capitalization companies as those with market capitalizations at the time of purchase

equal to or lower than the company with the largest market capitalization in the Russell Midcap® Index, which was approximately

$20.8 billion as of May 31, 2012, and is expected to change frequently. We may also invest in equity securities of foreign

issuers through ADRs and similar investments.

We seek to identify companies that have the prospect for improving sales and earnings growth rates, enjoy a competitive advantage

(for example, dominant market share) and that we believe have effective management with a history of making investments that

are in the best interests of shareholders (for example, companies with a history of earnings and sales growth that are in

excess of total asset growth). We pay particular attention to balance sheet metrics such as changes in working capital, property,

plant and equipment growth, inventory levels, accounts receivable, and acquisitions. We also look at how management teams

allocate capital in order to drive future cash flow. Price objectives are determined based on industry specific valuation

methodologies including relative price-to-earnings multiples, price-to-book value, operating profit margin trends, enterprise

value to EBITDA (Earnings Before Interest, Taxes, Depreciation and Amortization) and free cash flow yield. In addition to

meeting with management, we take a surround the company approach by surveying a company's vendors, distributors, competitors

and customers to obtain multiple perspectives that help us make better investment decisions. Portfolio holdings are continuously

monitored for changes in fundamentals. The team seeks a favorable risk/reward relationship to fair valuation, which we define

as the value of the company (i.e. our price target for the stock) relative to where the stock is currently trading. We may

invest in any sector, and at times we may emphasize one or more particular sectors. We may choose to sell a holding when it

no longer offers favorable growth prospects, reaches our target price, or to take advantage of a better investment opportunity.

Principal Investment Risks

An investment in the Fund may lose money, is not a deposit of Wells Fargo Bank, N.A. or its affiliates, is not insured or

guaranteed by the Federal Deposit Insurance Corporation or any other governmental agency, and is primarily subject to the

risks briefly summarized below.

Foreign Investment Risk.

Foreign investments face the potential of heightened illiquidity, greater price volatility and adverse effects of political,

regulatory, tax, currency, economic or other macroeconomic developments.

Growth Style Investment Risk.

Growth stocks may be more expensive relative to the values of other stocks and carry potential for significant volatility

and loss.

Issuer Risk.

The value of a security may decline because of adverse events or circumstances that directly relate to conditions at the

issuer or any entity providing it credit or liquidity support.

Liquidity Risk.

A security may not be able to be sold at the time desired or without adversely affecting the price.

Management Risk.

There is no guarantee of the Fund's performance or that the Fund will meet its objective. The market value of your investment

may decline and you may suffer investment loss.

Market Risk.

The market price of securities owned by the Fund may rapidly or unpredictably decline due to factors affecting securities

markets generally or particular industries.

Regulatory Risk.

Changes in government regulations may adversely affect the value of a security. An insufficiently regulated industry or market

might also permit inappropriate practices that adversely affect an investment.

Sector Emphasis Risk.

Investing a substantial portion of the Fund's assets in related industries or sectors may have greater risks because companies

in these sectors may share common characteristics and may react similarly to market developments.

Smaller Company Securities Risk.

Securities of companies with smaller market capitalizations tend to be more volatile and less liquid than larger company

stocks.

Performance

The following information provides some indication of the risks of investing in the Fund by showing changes in the Fund's

performance from year to year. The Fund's average annual total returns are compared to the performance of one or more indices.

Past performance before and after taxes is no guarantee of future results. Current month-end performance is available on the

Fund's Web site at wellsfargoadvantagefunds.com.

Calendar Year Total Returns as of 12/31 each year

Administrator Class

|

Highest Quarter: 2nd Quarter 2008

|

+17.58%

|

|

Lowest Quarter: 4th Quarter 2008

|

-29.30%

|

|

Average Annual Total Returns for the periods ended 12/31/2012

|

|

|

Inception Date of Share Class

|

1 Year

|

5 Year

|

10 Year

|

|

Administrator Class (before taxes)

|

4/8/2005

|

15.95%

|

4.36%

|

11.42%

|

|

Administrator Class (after taxes on distributions)

|

4/8/2005

|

15.00%

|

4.07%

|

10.37%

|

|

Administrator Class (after taxes on distributions and the sale of Fund Shares)

|

4/8/2005

|

11.59%

|

3.74%

|

9.80%

|

|

Russell 2500™ Growth Index (reflects no deduction for fees, expenses, or taxes)

|

|

16.13%

|

4.07%

|

10.55%

|

After-tax returns are calculated using the historical highest individual federal marginal income tax rates and do not reflect

the impact of state, local or foreign taxes. Actual after-tax returns depend on an investor's tax situation and may differ

from those shown, and after-tax returns shown are not relevant to tax-exempt investors or investors who hold their Fund shares

through tax-deferred arrangements, such as 401(k) Plans or Individual Retirement Accounts.

Fund Management

|

Investment Adviser

|

Sub-Adviser

|

Portfolio Manager, Title / Managed Since

|

|

Wells Fargo Funds Management, LLC

|

Wells Capital Management Incorporated

|

Thomas J. Pence, CFA

, Portfolio Manager / 2001

Michael T. Smith, CFA

, Portfolio Manager / 2011

Chris Warner, CFA

, Portfolio Manager / 2012

|

Purchase and Sale of Fund Shares

Administrator Class shares are offered primarily for direct investment by institutions such as pension and profit sharing

plans, employee benefit trusts, endowments, foundations and corporations. Administrator Class shares may also be offered through

certain financial intermediaries that may charge their customers transaction or other fees. In general, you can buy or sell

shares of the Fund by mail, internet, phone or wire on any day the New York Stock Exchange is open for regular trading. You

also may buy and sell shares through a financial professional.

|

Minimum Investments

|

To Buy or Sell Shares

|

|

Minimum Initial Investment

Administrator Class: $1 million (certain eligible investors may not be subject to a minimum initial investment)

Minimum Additional Investment

Administrator Class: None

|

Mail:

Wells Fargo Advantage Funds

P.O. Box 8266

Boston, MA 02266-8266

Internet

: wellsfargoadvantagefunds.com

Phone or Wire:

1-800-222-8222

Contact your investment representative.

|

Tax Information

Any distributions you receive from the Fund may be taxable as ordinary income or capital gains, except when your investment

is in an IRA, 401(k) or other tax advantaged investment plan. However, subsequent withdrawals from such a tax advantaged investment

plan may be subject to federal income tax. You should consult your tax adviser about your specific tax situation.

Payments to Broker-Dealers and Other Financial Intermediaries

If you purchase a Fund through a broker-dealer or other financial intermediary (such as a bank), the Fund and its related

companies may pay the intermediary for the sale of Fund shares and related services. These payments may create a conflict

of interest by influencing the broker-dealer or other intermediary and your salesperson to recommend the Fund over another

investment. Consult your salesperson or visit your financial intermediary's Web site for more information.

|

Link to Prospectus

|

Link to SAI

|

Discovery Fund Summary

Class/Ticker: Institutional Class - WFDSX

Summary Prospectus

February 1, 2013

|

Link to Prospectus

|

Link to SAI

|

Before you invest, you may want to review the Fund's prospectus, which contains more information about the Fund and its risks.

You can find the Fund's prospectus and other information about the Fund online at wellsfargoadvantagefunds.com/reports. You

can also get information at no cost by calling 1-800-222-8222, or by sending an email request to wfaf@wellsfargo.com. The

current prospectus ("Prospectus") and statement of additional information ("SAI"), dated February 1, 2013 are incorporated

by reference into this summary prospectus. The Fund's SAI may be obtained, free of charge, in the same manner as the Prospectus.

Investment Objective

The Fund seeks long-term capital appreciation.

Fees and Expenses

These tables are intended to help you understand the various costs and expenses you will pay if you buy and hold shares of

the Fund.

|

Shareholder Fees (fees paid directly from your investment)

|

|

|

|

|

|

Maximum sales charge (load) imposed on purchases (as a percentage of offering price)

|

None

|

|

Maximum deferred sales charge (load) (as a percentage of offering price)

|

None

|

|

Annual Fund Operating Expenses (expenses that you pay each year as a percentage of the value of your investment)

|

|

|

|

|

Management Fees

|

0.71%

|

|

Distribution (12b-1) Fees

|

0.00%

|

|

Other Expenses

|

0.15%

|

|

Acquired Fund Fees and Expenses

|

0.01%

|

|

Total Annual Fund Operating Expenses

|

0.87%

|

|

Fee Waivers

|

0.00%

|

|

Total Annual Fund Operating Expenses After Fee Waiver

1

|

0.87%

|

|

1.

|

The Adviser has committed through January 31, 2014, to waive fees and/or reimburse expenses to the extent necessary to cap

the Fund's Total Annual Fund Operating Expenses After Fee Waiver at 0.89% for Institutional Class. Brokerage commissions,

stamp duty fees, interest, taxes, acquired fund fees and expenses, and extraordinary expenses are excluded from the cap. After

this time, the cap may be increased or the commitment to maintain the cap may be terminated only with the approval of the

Board of Trustees.

|

Example of Expenses

The example below is intended to help you compare the costs of investing in the Fund with the costs of investing in other

mutual funds. The example assumes a $10,000 initial investment, 5% annual total return, and that operating expenses remain

the same as in the tables above. The example also assumes that the Total Annual Fund Operating Expenses After Fee Waiver shown

above will only be in place for the length of the current waiver commitment. Although your actual costs may be higher or lower,

based on these assumptions your costs would be:

|

|

|

|

After:

|

|

|

1 Year

|

$89

|

|

3 Years

|

$278

|

|

5 Years

|

$482

|

|

10 Years

|

$1,073

|

Portfolio Turnover

The Fund pays transaction costs, such as commissions, when it buys and sells securities (or "turns over" its portfolio). A

higher portfolio turnover rate may indicate higher transaction costs and may result in higher taxes when Fund shares are held

in a taxable account. These costs, which are not reflected in annual fund operating expenses or in the example, affect the

Fund's performance. During the most recent fiscal year, the Fund's portfolio turnover rate was 104% of the average value of

its portfolio.

Principal Investment Strategies

Under normal circumstances, we invest at least 80% of the Fund's net assets in equity securities of small- and medium-capitalization

companies and up to 25% of the Fund's total assets in equity securities of foreign issuers through ADRs and similar investments.

We invest in equity securities of small- and medium-capitalization companies that we believe offer favorable opportunities

for growth. We define small- and medium capitalization companies as those with market capitalizations at the time of purchase

equal to or lower than the company with the largest market capitalization in the Russell Midcap® Index, which was approximately

$20.8 billion as of May 31, 2012, and is expected to change frequently. We may also invest in equity securities of foreign

issuers through ADRs and similar investments.

We seek to identify companies that have the prospect for improving sales and earnings growth rates, enjoy a competitive advantage

(for example, dominant market share) and that we believe have effective management with a history of making investments that

are in the best interests of shareholders (for example, companies with a history of earnings and sales growth that are in

excess of total asset growth). We pay particular attention to balance sheet metrics such as changes in working capital, property,

plant and equipment growth, inventory levels, accounts receivable, and acquisitions. We also look at how management teams

allocate capital in order to drive future cash flow. Price objectives are determined based on industry specific valuation

methodologies including relative price-to-earnings multiples, price-to-book value, operating profit margin trends, enterprise

value to EBITDA (Earnings Before Interest, Taxes, Depreciation and Amortization) and free cash flow yield. In addition to

meeting with management, we take a surround the company approach by surveying a company's vendors, distributors, competitors

and customers to obtain multiple perspectives that help us make better investment decisions. Portfolio holdings are continuously

monitored for changes in fundamentals. The team seeks a favorable risk/reward relationship to fair valuation, which we define

as the value of the company (i.e. our price target for the stock) relative to where the stock is currently trading. We may

invest in any sector, and at times we may emphasize one or more particular sectors. We may choose to sell a holding when it

no longer offers favorable growth prospects, reaches our target price, or to take advantage of a better investment opportunity.

Principal Investment Risks

An investment in the Fund may lose money, is not a deposit of Wells Fargo Bank, N.A. or its affiliates, is not insured or

guaranteed by the Federal Deposit Insurance Corporation or any other governmental agency, and is primarily subject to the

risks briefly summarized below.

Foreign Investment Risk.

Foreign investments face the potential of heightened illiquidity, greater price volatility and adverse effects of political,

regulatory, tax, currency, economic or other macroeconomic developments.

Growth Style Investment Risk.

Growth stocks may be more expensive relative to the values of other stocks and carry potential for significant volatility

and loss.

Issuer Risk.

The value of a security may decline because of adverse events or circumstances that directly relate to conditions at the

issuer or any entity providing it credit or liquidity support.

Liquidity Risk.

A security may not be able to be sold at the time desired or without adversely affecting the price.

Management Risk.

There is no guarantee of the Fund's performance or that the Fund will meet its objective. The market value of your investment

may decline and you may suffer investment loss.

Market Risk.

The market price of securities owned by the Fund may rapidly or unpredictably decline due to factors affecting securities

markets generally or particular industries.

Regulatory Risk.

Changes in government regulations may adversely affect the value of a security. An insufficiently regulated industry or market

might also permit inappropriate practices that adversely affect an investment.

Sector Emphasis Risk.

Investing a substantial portion of the Fund's assets in related industries or sectors may have greater risks because companies

in these sectors may share common characteristics and may react similarly to market developments.

Smaller Company Securities Risk.

Securities of companies with smaller market capitalizations tend to be more volatile and less liquid than larger company

stocks.

Performance

The following information provides some indication of the risks of investing in the Fund by showing changes in the Fund's

performance from year to year. The Fund's average annual total returns are compared to the performance of one or more indices.

Past performance before and after taxes is no guarantee of future results. Current month-end performance is available on the

Fund's Web site at wellsfargoadvantagefunds.com.

Calendar Year Total Returns as of 12/31 each year

Institutional Class

|

Highest Quarter: 2nd Quarter 2008

|

+17.61%

|

|

Lowest Quarter: 4th Quarter 2008

|

-29.25%

|

|

Average Annual Total Returns for the periods ended 12/31/2012

|

|

|

Inception Date of Share Class

|

1 Year

|

5 Year

|

10 Year

|

|

Institutional Class (before taxes)

|

8/31/2006

|

16.28%

|

4.61%

|

11.59%

|

|

Institutional Class (after taxes on distributions)

|

8/31/2006

|

15.35%

|

4.32%

|

10.55%

|

|

Institutional Class (after taxes on distributions and the sale of Fund Shares)

|

8/31/2006

|

11.79%

|

3.95%

|

9.95%

|

|

Russell 2500™ Growth Index (reflects no deduction for fees, expenses, or taxes)

|

|

16.13%

|

4.07%

|

10.55%

|

After-tax returns are calculated using the historical highest individual federal marginal income tax rates and do not reflect

the impact of state, local or foreign taxes. Actual after-tax returns depend on an investor's tax situation and may differ

from those shown, and after-tax returns shown are not relevant to tax-exempt investors or investors who hold their Fund shares

through tax-deferred arrangements, such as 401(k) Plans or Individual Retirement Accounts.

Fund Management

|

Investment Adviser

|

Sub-Adviser

|

Portfolio Manager, Title / Managed Since

|

|

Wells Fargo Funds Management, LLC

|

Wells Capital Management Incorporated

|

Thomas J. Pence, CFA

, Portfolio Manager / 2001

Michael T. Smith, CFA

, Portfolio Manager / 2011

Chris Warner, CFA

, Portfolio Manager / 2012

|

Purchase and Sale of Fund Shares

Institutional Class shares are offered primarily for direct investment by institutions such as pension and profit sharing

plans, employee benefit trusts, endowments, foundations and corporations. Institutional Class shares may also be offered through

certain financial intermediaries that may charge their customers transaction or other fees. In general, you can buy or sell

shares of the Fund by mail, internet, phone or wire on any day the New York Stock Exchange is open for regular trading. You

also may buy and sell shares through a financial professional.

|

Minimum Investments

|

To Buy or Sell Shares

|

|

Minimum Initial Investment

Institutional Class: $5 million (certain eligible investors may not be subject to a minimum initial investment)

Minimum Additional Investment

Institutional Class: None

|

Mail:

Wells Fargo Advantage Funds

P.O. Box 8266

Boston, MA 02266-8266

Internet:

wellsfargoadvantagefunds.com

Phone or Wire:

1.800.222.8222

Contact your investment representative.

|

Tax Information

Any distributions you receive from the Fund may be taxable as ordinary income or capital gains, except when your investment

is in an IRA, 401(k) or other tax advantaged investment plan. However, subsequent withdrawals from such a tax advantaged investment

plan may be subject to federal income tax. You should consult your tax adviser about your specific tax situation.

Payments to Broker-Dealers and Other Financial Intermediaries

If you purchase a Fund through a broker-dealer or other financial intermediary (such as a bank), the Fund and its related

companies may pay the intermediary for the sale of Fund shares and related services. These payments may create a conflict

of interest by influencing the broker-dealer or other intermediary and your salesperson to recommend the Fund over another

investment. Consult your salesperson or visit your financial intermediary's Web site for more information.

|

Link to Prospectus

|

Link to SAI

|

Discovery Fund Summary

Class/Ticker: Investor Class - STDIX

Summary Prospectus

February 1, 2013

|

Link to Prospectus

|

Link to SAI

|

Before you invest, you may want to review the Fund's prospectus, which contains more information about the Fund and its risks.

You can find the Fund's prospectus and other information about the Fund online at wellsfargoadvantagefunds.com/reports. You

can also get information at no cost by calling 1-800-222-8222, or by sending an email request to wfaf@wellsfargo.com. The

current prospectus ("Prospectus") and statement of additional information ("SAI"), dated February 1, 2013 are incorporated

by reference into this summary prospectus. The Fund's SAI may be obtained, free of charge, in the same manner as the Prospectus.

Investment Objective

The Fund seeks long-term capital appreciation.

Fees and Expenses

These tables are intended to help you understand the various costs and expenses you will pay if you buy and hold shares of

the Fund.

|

Shareholder Fees (fees paid directly from your investment)

|

|

|

|

|

|

Maximum sales charge (load) imposed on purchases (as a percentage of offering price)

|

None

|

|

Maximum deferred sales charge (load) (as a percentage of offering price)

|

None

|

|

Annual Fund Operating Expenses (expenses that you pay each year as a percentage of the value of your investment)

|

|

|

|

|

Management Fees

|

0.71%

|

|

Distribution (12b-1) Fees

|

0.00%

|

|

Other Expenses

|

0.64%

|

|

Acquired Fund Fees and Expenses

|

0.01%

|

|

Total Annual Fund Operating Expenses

|

1.36%

|

|

Fee Waivers

|

0.07%

|

|

Total Annual Fund Operating Expenses After Fee Waiver

1

|

1.29%

|

|

1.

|

The Adviser has committed through January 31, 2014, to waive fees and/or reimburse expenses to the extent necessary to cap

the Fund's Total Annual Fund Operating Expenses After Fee Waiver at 1.28% for Investor Class. Brokerage commissions, stamp

duty fees, interest, taxes, acquired fund fees and expenses, and extraordinary expenses are excluded from the cap. After this

time, the cap may be increased or the commitment to maintain the cap may be terminated only with the approval of the Board

of Trustees.

|

Example of Expenses

The example below is intended to help you compare the costs of investing in the Fund with the costs of investing in other

mutual funds. The example assumes a $10,000 initial investment, 5% annual total return, and that operating expenses remain

the same as in the tables above. The example also assumes that the Total Annual Fund Operating Expenses After Fee Waiver shown

above will only be in place for the length of the current waiver commitment. Although your actual costs may be higher or lower,

based on these assumptions your costs would be:

|

|

|

|

After:

|

|

|

1 Year

|

$131

|

|

3 Years

|

$424

|

|

5 Years

|

$738

|

|

10 Years

|

$1,629

|

Portfolio Turnover

The Fund pays transaction costs, such as commissions, when it buys and sells securities (or "turns over" its portfolio). A

higher portfolio turnover rate may indicate higher transaction costs and may result in higher taxes when Fund shares are held

in a taxable account. These costs, which are not reflected in annual fund operating expenses or in the example, affect the

Fund's performance. During the most recent fiscal year, the Fund's portfolio turnover rate was 104% of the average value of

its portfolio.

Principal Investment Strategies

Under normal circumstances, we invest at least 80% of the Fund's net assets in equity securities of small- and medium-capitalization

companies and up to 25% of the Fund's total assets in equity securities of foreign issuers through ADRs and similar investments.

We invest in equity securities of small- and medium-capitalization companies that we believe offer favorable opportunities

for growth. We define small- and medium capitalization companies as those with market capitalizations at the time of purchase

equal to or lower than the company with the largest market capitalization in the Russell Midcap® Index, which was approximately

$20.8 billion as of May 31, 2012, and is expected to change frequently. We may also invest in equity securities of foreign

issuers through ADRs and similar investments.

We seek to identify companies that have the prospect for improving sales and earnings growth rates, enjoy a competitive advantage

(for example, dominant market share) and that we believe have effective management with a history of making investments that

are in the best interests of shareholders (for example, companies with a history of earnings and sales growth that are in

excess of total asset growth). We pay particular attention to balance sheet metrics such as changes in working capital, property,

plant and equipment growth, inventory levels, accounts receivable, and acquisitions. We also look at how management teams

allocate capital in order to drive future cash flow. Price objectives are determined based on industry specific valuation

methodologies including relative price-to-earnings multiples, price-to-book value, operating profit margin trends, enterprise

value to EBITDA (Earnings Before Interest, Taxes, Depreciation and Amortization) and free cash flow yield. In addition to

meeting with management, we take a surround the company approach by surveying a company's vendors, distributors, competitors

and customers to obtain multiple perspectives that help us make better investment decisions. Portfolio holdings are continuously

monitored for changes in fundamentals. The team seeks a favorable risk/reward relationship to fair valuation, which we define

as the value of the company (i.e. our price target for the stock) relative to where the stock is currently trading. We may

invest in any sector, and at times we may emphasize one or more particular sectors. We may choose to sell a holding when it

no longer offers favorable growth prospects, reaches our target price, or to take advantage of a better investment opportunity.

Principal Investment Risks

An investment in the Fund may lose money, is not a deposit of Wells Fargo Bank, N.A. or its affiliates, is not insured or

guaranteed by the Federal Deposit Insurance Corporation or any other governmental agency, and is primarily subject to the

risks briefly summarized below.

Foreign Investment Risk.

Foreign investments face the potential of heightened illiquidity, greater price volatility and adverse effects of political,

regulatory, tax, currency, economic or other macroeconomic developments.

Growth Style Investment Risk.

Growth stocks may be more expensive relative to the values of other stocks and carry potential for significant volatility

and loss.

Issuer Risk.

The value of a security may decline because of adverse events or circumstances that directly relate to conditions at the

issuer or any entity providing it credit or liquidity support.

Liquidity Risk.

A security may not be able to be sold at the time desired or without adversely affecting the price.

Management Risk.

There is no guarantee of the Fund's performance or that the Fund will meet its objective. The market value of your investment

may decline and you may suffer investment loss.

Market Risk.

The market price of securities owned by the Fund may rapidly or unpredictably decline due to factors affecting securities

markets generally or particular industries.

Regulatory Risk.

Changes in government regulations may adversely affect the value of a security. An insufficiently regulated industry or market

might also permit inappropriate practices that adversely affect an investment.

Sector Emphasis Risk.

Investing a substantial portion of the Fund's assets in related industries or sectors may have greater risks because companies

in these sectors may share common characteristics and may react similarly to market developments.

Smaller Company Securities Risk.

Securities of companies with smaller market capitalizations tend to be more volatile and less liquid than larger company

stocks.

Performance

The following information provides some indication of the risks of investing in the Fund by showing changes in the Fund's

performance from year to year. The Fund's average annual total returns are compared to the performance of one or more indices.

Past performance before and after taxes is no guarantee of future results. Current month-end performance is available on the

Fund's Web site at wellsfargoadvantagefunds.com.

Calendar Year Total Returns as of 12/31 each year

Investor Class

|

Highest Quarter: 2nd Quarter 2008

|

+17.55%

|

|

Lowest Quarter: 4th Quarter 2008

|

-29.34%

|

|

Average Annual Total Returns for the periods ended 12/31/2012

|

|

|

Inception Date of Share Class

|

1 Year

|

5 Year

|

10 Year

|

|

Investor Class (before taxes)

|

12/31/1987

|

15.77%

|

4.15%

|

11.23%

|

|

Investor Class (after taxes on distributions)

|

12/31/1987

|

14.81%

|

3.85%

|

10.17%

|

|

Investor Class (after taxes on distributions and the sale of Fund Shares)

|

12/31/1987

|

11.50%

|

3.55%

|

9.62%

|

|

Russell 2500™ Growth Index (reflects no deduction for fees, expenses, or taxes)

|

|

16.13%

|

4.07%

|

10.55%

|

After-tax returns are calculated using the historical highest individual federal marginal income tax rates and do not reflect

the impact of state, local or foreign taxes. Actual after-tax returns depend on an investor's tax situation and may differ

from those shown, and after-tax returns shown are not relevant to tax-exempt investors or investors who hold their Fund shares

through tax-deferred arrangements, such as 401(k) Plans or Individual Retirement Accounts.

Fund Management

|

Investment Adviser

|

Sub-Adviser

|

Portfolio Manager, Title / Managed Since

|

|

Wells Fargo Funds Management, LLC

|

Wells Capital Management Incorporated

|

Thomas J. Pence, CFA

, Portfolio Manager / 2001

Michael T. Smith, CFA

, Portfolio Manager / 2011

Chris Warner, CFA

, Portfolio Manager / 2012

|

Purchase and Sale of Fund Shares

In general, you can buy or sell shares of the Fund by mail, internet, phone or wire on any day the New York Stock Exchange

is open for regular trading. You also may buy and sell shares through a financial professional.

|

Minimum Investments

|

To Buy or Sell Shares

|

|

Minimum Initial Investment

Regular Accounts: $2,500

IRAs, IRA Rollovers, Roth IRAs: $1,000

UGMA/UTMA Accounts: $1,000

Employer Sponsored Retirement Plans: No Minimum

Minimum Additional Investment

Regular Accounts, IRAs, IRA Rollovers, Roth IRAs: $100

UGMA/UTMA Accounts: $50

Employer Sponsored Retirement Plans: No Minimum

|

Mail:

Wells Fargo Advantage Funds

P.O. Box 8266

Boston, MA 02266-8266

Internet:

wellsfargoadvantagefunds.com

Phone or Wire:

1-800-222-8222

Contact your financial professional.

|

Tax Information

Any distributions you receive from the Fund may be taxable as ordinary income or capital gains, except when your investment

is in an IRA, 401(k) or other tax advantaged investment plan. However, subsequent withdrawals from such a tax advantaged investment

plan may be subject to federal income tax. You should consult your tax adviser about your specific tax situation.

Payments to Broker-Dealers and Other Financial Intermediaries

If you purchase a Fund through a broker-dealer or other financial intermediary (such as a bank), the Fund and its related

companies may pay the intermediary for the sale of Fund shares and related services. These payments may create a conflict

of interest by influencing the broker-dealer or other intermediary and your salesperson to recommend the Fund over another

investment. Consult your salesperson or visit your financial intermediary's Web site for more information.

|

Link to Prospectus

|

Link to SAI

|

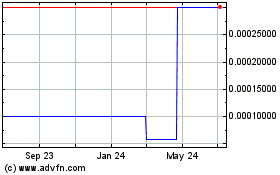

Arno Therapeutics (CE) (USOTC:ARNI)

Historical Stock Chart

From Jun 2024 to Jul 2024

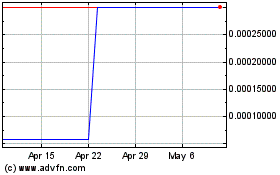

Arno Therapeutics (CE) (USOTC:ARNI)

Historical Stock Chart

From Jul 2023 to Jul 2024