Protective Life Announces Results of Life Insurance and Annuity Study

December 19 2008 - 1:11PM

Business Wire

Protective Life Insurance Company announced today the results of a

new proprietary study sponsored by Protective Life of financial

advisors that measured their interest in life insurance and annuity

products as part of their clients� overall financial plans. Data

was collected between September 10 -- October 26, 2008 from readers

of Registered Rep magazine. This is the fifth year the study has

been conducted. �More advisors are finding that insurance simply

must be a part of their clients� comprehensive financial plans,�

says Eric Miller, Vice President of Marketing and National

Marketing Director for Protective Life. �Ignoring that aspect of

their clients� needs can leave substantial gaps in their planning.�

The results of the study show that advisors agree with Miller. For

example: 77% of advisors currently sell annuities, while 74%

currently sell life insurance Four out of five advisors believe

life insurance is an important part of a financial plan Over half

of the advisors believe annuities are an important part of a

financial plan Two-thirds of those surveyed plan to sell more life

insurance and annuities in the coming two years In addition, 76% of

these advisors indicated that a life insurance product that

provides a systematic stream of guaranteed income to their

beneficiaries at the client�s death would be beneficial. This

finding confirms the timeliness of Protective Term Income

ProviderSM, a new term life insurance policy that provides a

guaranteed income stream death benefit to designated beneficiaries.

Priced more affordably than traditional lump sum term life

products, Protective Term Provider gives consumers the ability to

help their families satisfy immediate financial obligations and

provide for ongoing income needs. The challenge of providing for

ongoing income needs in retirement is a key concern for advisors

and their clients. Those surveyed reported that 94% of their

clients are concerned about providing for income in retirement and

that 73% of advisors selling variable annuities recommend those

with living benefits to help address this need. Protective Life has

been working diligently to find ways to provide income solutions

through the availability of the SecurePay suite of Guaranteed

Lifetime Withdrawal Benefits, which guarantee purchasers a lifetime

stream of payments that will not decrease, regardless of market

performance. Results of the study will be used to help Protective

Life to continue developing products and services that help

financial advisors meet their clients� needs in a changing and

challenging environment. A more detailed account of the study�s

findings appears in �Looking for Guarantees,� an article by Alan

Lavine published in the December 2008 issue of Registered Rep.

About Protective Life Insurance Company Protective Life Insurance

Company was established on a profound belief in the American dream.

Since 1907, Protective Life Insurance Company has remained true to

its core beliefs: quality, serving people, and growth. This

unwavering commitment to treating people the way we would like to

be treated has been rewarded with stable, long-term relationships

and growth. Today, Protective Life is one of the nation�s leading

insurance companies, proving the wisdom of our Company�s vision:

Doing the right thing is smart business.� Important Consumer

Information Life insurance and annuity products issued by

Protective Life Insurance Company. Securities offered by Investment

Distributors Inc., (IDI). Both located at 2801 Highway 280 South,

Birmingham, AL 35223. PLICO and IDI are each subsidiaries of

Protective Life Corporation. Protective Life Corporation is a

separate company and is not responsible for the financial condition

or the contractual obligations of PLICO or IDI. Protective Term

Provider, issued under policy form TL-16 and state variations

thereof, is a term life insurance policy. Product features and

availability may vary by state. Consult policy for benefits,

riders, limitations and exclusions. Subject to underwriting.

Subject to up to a two-year contestable and suicide period.

Benefits adjusted for misstatements of age or sex. In Montana,

unisex rates apply. SecurePay Guaranteed Lifetime Withdrawal

Benefits are issued under rider form numbers IPV-2154 and�-2157

(and state variations thereof). Available only in conjunction with

the purchase of a Protective Life variable annuity. Flexible

premium deferred variable and fixed annuity contracts are issued

under form numbers IPV-2112, -2113, -2132 and -2133 (and state

variations thereof). Please consult the prospectus for more

detailed information. All guarantees are subject to the

claims-paying ability of Protective Life Insurance Company.

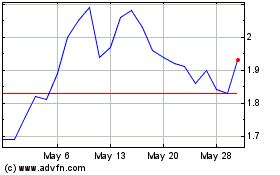

Planet Labs PBC (NYSE:PL)

Historical Stock Chart

From May 2024 to Jun 2024

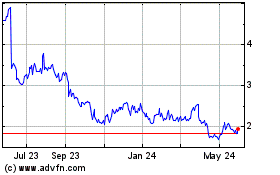

Planet Labs PBC (NYSE:PL)

Historical Stock Chart

From Jun 2023 to Jun 2024