Form 8-K - Current report

July 27 2023 - 9:10AM

Edgar (US Regulatory)

0001861541

false

KY

0001861541

2023-07-27

2023-07-27

0001861541

pgss:UnitsEachConsistingOfOneClassOrdinaryShareAndOnehalfOfOneRedeemableWarrantMember

2023-07-27

2023-07-27

0001861541

us-gaap:CommonClassAMember

2023-07-27

2023-07-27

0001861541

pgss:RedeemableWarrantsEachExercisableForOneClassOrdinaryShareAtExercisePriceOf11.50PerShareMember

2023-07-27

2023-07-27

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

July 27, 2023

Date of Report (date of earliest event reported)

Pegasus Digital Mobility Acquisition Corp.

(Exact name of Registrant as specified in its

charter)

| Cayman Islands |

|

001-40945 |

|

98-1596591 |

(State or other jurisdiction of

incorporation or organization) |

|

(Commission

File Number) |

|

(I.R.S. Employer

Identification Number) |

71 Fort Street

George Town

Grand Cayman

Cayman Islands |

|

KY1-1106 |

| (Address of principal executive offices) |

|

(Zip Code) |

+1345 769-4900

(Registrant’s telephone number, including

area code)

Check the appropriate box below if the Form 8-K filing is intended

to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction

A.2. below):

| x |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ¨ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ¨ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act

(17 CFR 240.13e 4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class |

|

Trading

Symbols |

|

Name of each exchange

on which registered |

| Units, each consisting of one Class A Ordinary Share and one-half of one redeemable Warrant |

|

PGSS.U |

|

New York Stock Exchange |

| Class A Ordinary Shares, par value $0.0001 per share |

|

PGSS |

|

New York Stock Exchange |

| Redeemable Warrants, each exercisable for one Class A Ordinary Share at an exercise price of $11.50 per share |

|

PGSS.WS |

|

New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth

company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange

Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company x

If an emerging growth company, indicate by check mark if the registrant

has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant

to Section 13(a) of the Exchange Act.

On

July 27, 2023, Pegasus Digital Mobility Acquisition Corp.

(the "Company") issued a press release announcing the number of the Company's Class A ordinary shares that had been

validly redeemed by shareholders in accordance with Article 54.10 of the Company's second amended and restated memorandum and articles

of association as well as the amount of the voluntary monthly contributions that its sponsor, Pegasus Digital Mobility Sponsor LLC, will

make to the Company's trust account commencing on August 1, 2023 and paid on the first day of each month thereafter until the earliest

of (i) the date on which the Company consummates a business combination or (ii) December 31, 2023.

A copy of the press release is attached to this Current Report on Form 8-K as Exhibit 99.1

and is incorporated herein by reference.

| Item 9.01 |

Financial Statements and Exhibits |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934,

the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| Dated:

July 27, 2023 |

Pegasus Digital Mobility Acquisition Corp. |

| |

|

|

| |

By: |

/s/ F. Jeremey Mistry |

| |

Name: |

F. Jeremey Mistry |

| |

Title: |

Chief Financial Officer |

EXHIBIT 99.1

Pegasus

Digital Mobility Acquisition Corp. Announces Redemption Results and Confirms Voluntary Payment Amount

GREENWICH, CT (July 27,

2023) -- Pegasus Digital Mobility Acquisition Corp. (NYSE: PGSS.U) (the "Company"), a special purpose acquisition company

founded by Pegasus Digital Mobility Sponsor (the "Sponsor") and formed for the purpose of effecting a merger,

share exchange, asset acquisition, share purchase, reorganisation or similar business combination with one or more businesses or assets

(a "Business Combination"), today announced that holders of 2,195,855 of the Company's Class A

ordinary shares exercised their right to redeem their shares for a pro rata portion of the funds in the Company's trust account in connection

with the announcement of the further extension of the period of time the Company has to consummate its proposed Business Combination

with Gebr. SCHMID GmbH (the "SCHMID Group") to December 31, 2023. As a result, approximately $53.7 million will be remaining in the Company's trust

account. Following the redemption, the Company's remaining number of issued and outstanding Class A ordinary shares was 5,003,218.

Commencing on August 1, 2023 and paid on

the first day of each month thereafter until the earliest of (i) the date on which the Company consummates a Business Combination

or (ii) December 31, 2023, the Sponsor will deposit $150,096.54 per month into the Company's trust

account, representing $0.03 (three U.S. cents) per Class A ordinary share then in issue. The contribution amount shall be

made available and paid on a monthly basis after the issuance of a non-convertible unsecured promissory note from the Company to the Sponsor

in connection therewith. Should the Company's Board determine that it will not be able to consummate the initial Business Combination

by December 31, 2023 and that the Company shall instead liquidate, the Sponsor's obligation to continue to make such contributions

shall immediately cease. If the Board determines that more time is needed to consummate the initial Business Combination, a shareholders'

vote in an extraordinary general meeting will be required to change the second amended and restated memorandum and articles of association

of the Company.

Cautionary Statement

Regarding Forward-Looking Statements

This press release contains

statements that constitute "forward-looking statements" within the meaning of the safe harbor provisions of the United States

Private Securities Litigation Reform Act of 1995. All statements other than statements of historical fact included in this press release

are forward-looking statements. Forward-looking statements involve predictions, projections and other statements about future events that

are based on current expectations and assumptions and, as a result, are subject to certain risks and uncertainties, including but not

limited to:

| • | the occurrence of any event, change or other circumstances that could give rise to the termination of

the proposed Business Combination with the SCHMID Group; |

| • | the outcome of any legal proceedings that may be instituted against the Company, the SCHMID Group, the

combined company or others following the announcement of the Business Combination and any definitive agreements with respect thereto; |

| • | the inability to complete the Business Combination with the SCHMID Group due to the failure to obtain

approval of the shareholders of the Company or to satisfy other conditions to closing; |

| • | changes to the proposed structure of the Business Combination with the SCHMID Group that may be required

or appropriate as a result of applicable laws or regulations or as a condition to obtaining regulatory approval of the Business Combination; |

| • | the ability to meet stock exchange listing standards following the consummation of the Business Combination

with the SCHMID Group; |

| • | the risk that the Business Combination disrupts current plans and operations of the Company or the SCHMID

Group as a result of the announcement and consummation of the Business Combination with the SCHMID Group; |

| • | the ability to recognise the anticipated benefits of the Business Combination with the SCHMID Group, which

may be affected by, among other things, competition, the ability of the combined company to grow and manage growth profitably, maintain

relationships with customers and suppliers and retain its management and key employees; |

| • | costs related to the Business Combination with the SCHMID Group; |

| • | changes in applicable laws or regulations and delays in obtaining, adverse conditions contained in, or

the inability to obtain regulatory approvals required to complete the Business Combination with the SCHMID Group; |

| • | the possibility that the Company, the SCHMID Group or the combined company may be adversely affected by

other economic, business, and/or competitive factors; |

| • | the estimates of expenses and profitability and underlying assumptions with respect to shareholder redemptions

and purchase price and other adjustments; and |

| • | other risks and uncertainties set forth in the section entitled "Risk Factors" in the Company's

prospectus on Form S-1 approved by the SEC. |

The foregoing list of

factors is not exhaustive. The forward-looking statements speak only as of the date they are made. Readers are cautioned not to put undue

reliance on forward-looking statements, and the SCHMID Group and the Company assume no obligation and do not intend to update or revise

these forward-looking statements, whether as a result of new information, future events, or otherwise. Copies of the Company's registration

statement are available on the SEC’s website, www.sec.gov.

Additional Information

and Where to Find It

INVESTORS AND SECURITY

HOLDERS OF THE COMPANY ARE URGED TO READ ANY DOCUMENTS (INCLUDING ANY AMENDMENTS OR SUPPLEMENTS THERETO) THE COMPANY FILES WITH THE SEC

CAREFULLY IN THEIR ENTIRETY WHEN THEY BECOME AVAILABLE AS THEY WILL CONTAIN IMPORTANT INFORMATION. Investors and security holders will

be able to obtain free copies of any documents (including any amendments or supplements thereto) filed with the SEC through the website

maintained by the SEC at www.sec.gov or by directing a request to:

Pegasus Contact Information

Investor Relations

investor-relations@pegasusdm.com

v3.23.2

Cover

|

Jul. 27, 2023 |

| Document Information [Line Items] |

|

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

Jul. 27, 2023

|

| Entity File Number |

001-40945

|

| Entity Registrant Name |

Pegasus Digital Mobility Acquisition Corp.

|

| Entity Central Index Key |

0001861541

|

| Entity Tax Identification Number |

98-1596591

|

| Entity Incorporation, State or Country Code |

E9

|

| Entity Address, Address Line One |

71 Fort Street

|

| Entity Address, City or Town |

George Town

|

| Entity Address, State or Province |

KY

|

| Entity Address, Postal Zip Code |

KY1-1106

|

| City Area Code |

345

|

| Local Phone Number |

769-4900

|

| Written Communications |

true

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Entity Emerging Growth Company |

true

|

| Elected Not To Use the Extended Transition Period |

false

|

| Units, each consisting of one Class A Ordinary Share and one-half of one redeemable Warrant [Member] |

|

| Document Information [Line Items] |

|

| Title of 12(b) Security |

Units, each consisting of one Class A Ordinary Share and one-half of one redeemable Warrant

|

| Trading Symbol |

PGSS.U

|

| Security Exchange Name |

NYSE

|

| Common Class A [Member] |

|

| Document Information [Line Items] |

|

| Title of 12(b) Security |

Class A Ordinary Shares, par value $0.0001 per share

|

| Trading Symbol |

PGSS

|

| Security Exchange Name |

NYSE

|

| Redeemable Warrants, each exercisable for one Class A Ordinary Share at an exercise price of $11.50 per share [Member] |

|

| Document Information [Line Items] |

|

| Title of 12(b) Security |

Redeemable Warrants, each exercisable for one Class A Ordinary Share at an exercise price of $11.50 per share

|

| Trading Symbol |

PGSS.WS

|

| Security Exchange Name |

NYSE

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=pgss_UnitsEachConsistingOfOneClassOrdinaryShareAndOnehalfOfOneRedeemableWarrantMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=us-gaap_CommonClassAMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=pgss_RedeemableWarrantsEachExercisableForOneClassOrdinaryShareAtExercisePriceOf11.50PerShareMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

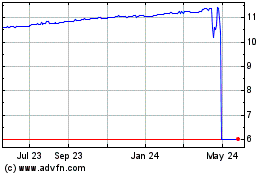

Pegasus Digital Mobility... (NYSE:PGSS)

Historical Stock Chart

From Apr 2024 to May 2024

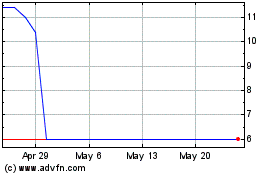

Pegasus Digital Mobility... (NYSE:PGSS)

Historical Stock Chart

From May 2023 to May 2024