Apple Passes Samsung As Top Smartphone Vendor In 4Q - Gartner

February 15 2012 - 4:09AM

Dow Jones News

Apple Inc. (AAPL) overtook Samsung Electronics Co.'s (005930.SE)

position as the world's top vendor of smartphones in the fourth

quarter, industry research firm Gartner said Wednesday.

Apple sold 35.46 million smartphones in the three months to Dec.

31 and had a market share at 23.8%, up from 15.8% the year before,

Gartner said. Samsung, with its popular Galaxy smartphone line-up,

sold 34 million smartphones in the quarter.

"The quarter saw Samsung and Apple cement their positions

further at the top of the market as their brands and new products

clearly stood out," Gartner said.

Total smartphone sales in the quarter totaled 149 million units,

up 47.3% from the same period 2010. Smartphones running Google

Inc.'s (GOOG) Android operating system accounted for 50.9% of all

smartphone sales, up from 30.5%.

Nokia Corp.'s (NOK) Symbian operating system continued to lose

market share, falling to 11.7% of smartphone sales from 32.3% the

previous year.

Nokia last year announced that it is phasing out its aging

Symbian platform, and adopting Microsoft Corp.'s (MSFT) Windows

Phone operating system in all its new smartphones. Despite Nokia's

launch of several new Windows Phone devices, the operating system

remains small, with 1.9% market share in the fourth quarter.

Gartner, which counts sales of mobile handsets to end users,

said total mobile device sales was 476.5 million units in the

fourth quarter, a 5.4% increase from the same quarter in 2010.

Nokia retained its position as the world's largest phone maker,

with a 23.4% share of the total mobile device market, down from

27.1% the same quarter a year ago. However, Samsung is closing in

on the Finnish company and grabbed 19.4% of the mobile market, up

from 17.5% in the same quarter 2010.

Fueled by strong sales of iPhones, Apple became third-largest

mobile phone vendor in the world in the fourth quarter, overtaking

South Korea's LG Electronics Inc. (066570.SE).

Gartner noted that LG, Sony Ericsson (SNE, ERIC), Motorola

Mobility Holdings Inc. (MMI) and Research In Motion Ltd.'s (RIMM)

recorded disappointing results, as the companies struggled to

improve volumes significantly.

"These vendors were also exposed to a much stronger threat from

the midrange and low end of the smartphone market as ZTE Corp.

(0763.HK) and Huawei Technologies Co. continued to gain share

during the quarter," Gartner said.

Gartner expects the overall mobile device market to grow by

about 7% in 2012, while smartphone growth is expected to slow to

around 39%.

-By Sven Grundberg, Dow Jones Newswires; +46-8-5451-3098;

sven.grundberg@dowjones.com

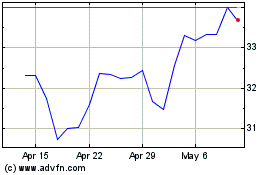

Marcus and Millichap (NYSE:MMI)

Historical Stock Chart

From May 2024 to Jun 2024

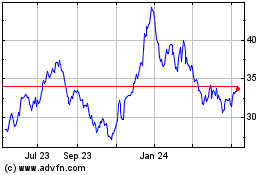

Marcus and Millichap (NYSE:MMI)

Historical Stock Chart

From Jun 2023 to Jun 2024