Filed pursuant to Rule 425 of the Securities

Act of 1933, as amended

and deemed filed pursuant to Regulation 14A

under the Securities and Exchange Act of 1934,

as amended

Subject Companies:

Kayne Anderson Energy Infrastructure Fund,

Inc.

Commission File No. 811-21593

Kayne Anderson NextGen Energy & Infrastructure,

Inc.

Commission File No. 811-22467

October 2, 2023

Dear Fellow Stockholders:

This quarterly update discusses the energy infrastructure

markets, KYN’s portfolio, and the Company’s year-to-date performance. While there is much uncertainty in the financial markets

and competing narratives on the path forward for the economy, we believe the Company’s investments are well positioned to generate

compelling risk-adjusted returns for the next several years. Further, KYN’s balance sheet provides the Company with flexibility

to quickly adapt to changing market conditions. As it relates to fiscal Q3:

| · | KYN’s Net Asset Return for fiscal Q3 was 10.6%; for the

first nine months of fiscal 2023 the Company’s Net Asset Return was 3.1%;(1) |

| · | KYN continued to outpace its benchmark and the Alerian Midstream

Energy Index (AMNA) on a fiscal year-to-date basis (outperforming the benchmark by 480 basis points and outperforming the AMNA by 180

basis points%);(2)(3)(4) |

| · | KYN’s portfolio benefited from a constructive backdrop

for the energy sector and the Company’s midstream investments continue to generate significant free cash flow; and |

| · | KYN maintained conservative leverage levels with ample downside

cushion(5) |

Market Conditions

While the major U.S. equity indices have generated

positive returns, fiscal 2023 has been a volatile year in the financial markets. Examples include the regional banking crisis during the

spring, the political brinkmanship over the federal debt ceiling in May and, more recently, the rapid increase in interest rates (as measured

by yields on U.S. Treasury bonds) in response to the Federal Reserve reiterating its commitment to keeping interest rates “higher

for longer.” These events, in turn, have caused meaningful swings in stock prices. We expect this volatility to continue and, as

a result, we have reduced leverage in response to these market conditions. Put simply, there is much uncertainty in the financial markets,

and we do not expect this to change any time soon.

For instance, the state of the global economy

remains a subject of much debate. Economic activity in the U.S. has been resilient thus far in fiscal 2023, and many economists are optimistic

about the prospects for a “soft landing” in the domestic economy. We too are optimistic, but we readily acknowledge this outcome

is far from certain. Further, we believe that there is a higher-than-normal probability of meaningful stock price volatility as the market

digests new economic data points and the resulting implications for the economy. Our goal is to best position the Company to withstand

this volatility while at the same time capitalizing on our bullish outlook for the energy infrastructure sector.

Fiscal Q3 exhibited broad-based strength across

sectors on solid earnings and positive inflation trends, though pockets of the market sold off on rising interest rates.

| Total Return | |

| | |

S&P 500 | | |

DJIA | | |

NASDAQ | | |

XLE(7) | | |

AMNA(4) | | |

KRII(8) | | |

XLU(9) | |

| Fiscal Q3 2023 | |

| 8.3 | % | |

| 6.1 | % | |

| 8.7 | % | |

| 17.1 | % | |

| 10.4 | % | |

| -7.5 | % | |

| -2.2 | % |

| Fiscal 2023(6) | |

| 11.9 | % | |

| 2.0 | % | |

| 23.2 | % | |

| 0.5 | % | |

| 1.3 | % | |

| -12.1 | % | |

| -9.8 | % |

The energy sector (including energy infrastructure)

enjoyed a very strong fiscal Q3. This is in contrast to the first six months of fiscal 2023, where weak stock price performance for energy

companies did not reflect the companies’ solid financial and operating results. Importantly, nothing has changed in the midstream

sector’s fundamentals to alter our constructive outlook; we continue to believe that consistent operating results, commitment to

returning capital to investors, and steady growing dividends will prove to be a winning formula over time.

Endnotes can be found on page 4.

Fiscal Q3 was an active quarter in the capital

markets for the midstream sector. Kodiak Gas Services (NYSE: KGS) completed the first midstream IPO since 2021. Additionally, NuStar Energy,

Gibson Energy and Hess Midstream completed equity offerings during the quarter for aggregate proceeds of approximately $660 million. The

midstream sector is very different from five years ago, and companies are no longer reliant on the capital markets to finance their growth

projects. Nonetheless, we view these recent deals as an encouraging sign – investors are willing to allocate incremental capital

to the sector.

Crude oil prices were up 23% in fiscal Q3, with

WTI ending the quarter at ~$84 per barrel as global liquids demand reached record highs. In the weeks following quarter-end, supportive

global inventory data and OPEC+ production restraint have driven spot prices in excess of $90 per barrel, introducing renewed focus on

higher gasoline and diesel prices (and the associated implications for the domestic economy). Slower-than-expected Chinese demand growth,

growing crude supply from the Americas (including emerging sources like Guyana), and significant Saudi spare capacity lead us to believe

a sustained rally in excess of $100 per barrel is unlikely. However, we do believe that crude oil prices are likely to remain above $75

(barring an unexpected shift in OPEC+ policy). The combination of lower volatility in crude oil prices and measured domestic production

growth provides a very constructive backdrop for our midstream investments.

The natural gas market also rebounded nicely during

the quarter. After trading for several months near $2.00 per MMBtu, Henry Hub natural gas prices have recovered to a range of $2.50 to

$2.80 per MMBtu. Reduced drilling in response to these low prices has begun to dampen the rate of supply growth, and an extremely warm

summer in the U.S. is driving record levels of gas-fired power generation (~37 Bcf/d of demand)(10). The prices for natural

gas in the futures market remain much higher at ~$3.60 per MMBtu in 2024 and above $4.00 in 2025. European and Asian gas prices spiked

again during the quarter in response to potential strikes at Australian liquefied natural gas (“LNG”) production facilities,

while U.S. LNG exports remain very strong (~11.5 Bcf/d, or virtually 100% utilization)(11). Our outlook for North American

natural gas consumption and LNG exports remains very constructive.

Portfolio and Performance

As has been the case for most of fiscal 2023,

there was a large divergence during fiscal Q3 in performance between the midstream sector and the renewable and utilities sectors. Midstream

equities were up meaningfully during the quarter, while higher interest rates and less accommodative capital markets have weighed on renewables

and utilities equities. While we remain constructive on the fundamental longer-term outlook for U.S. utilities and renewables, the current

market backdrop has us cautious in the near-term, and we have positioned the Company’s portfolio accordingly.

| Comparison of Returns in Fiscal Q3 2023 | |

| | |

| KYN Net Asset Return(1) | |

| 10.6 | % |

| KYN Benchmark(3) | |

| 6.6 | % |

| Midstream(4)(12) | |

| 10.4 | % |

| Renewable Infrastructure(8) | |

| -7.5 | % |

| U.S. Utilities(9) | |

| -2.2 | % |

KYN generated a total Net Asset Return of 10.6%

in fiscal Q3, its best quarter since the second quarter of fiscal 2022. KYN’s Market Return, which is based on stock price performance

rather than Net Asset Value, was 13.1% for fiscal Q3.(13) This exceeded our Net Asset Return as our

stock price traded at a 14.6% discount to NAV as of August 31st compared to a 16.5% discount at the beginning of the fiscal

quarter.

Endnotes can be found on page 4.

While our near-term outlook for energy infrastructure

is nuanced, our intermediate to longer-term outlook is positive for each subsector. In the current environment, we continue to favor companies

that are funding capital spending from internally generated cash flow or have minimal external financial needs. We are also favoring companies

that have strong balance sheets and manageable exposure to floating interest rates and near-term debt maturities. During fiscal Q3, we

continued to increase KYN’s exposure to the midstream sector (88% of the portfolio as of August 31st) and decrease the

Company’s exposure to renewable infrastructure and utilities.

We believe midstream companies are better positioned

to deal with near-term macroeconomic headwinds associated with higher interest rates and benefit from the tailwind of domestic oil and

gas production growth. We are bullish on the longer-term outlook for renewable infrastructure and utilities – these sectors are

poised to benefit from the energy transition. That said, the near-term outlook for these sectors is more challenging – there are

a host of other income-oriented alternatives for investors given the higher interest rate environment, and these companies (most of which

are not generating free cash flow) are faced with the challenge of efficiently financing their growth projects in the near term.

Distribution & Outlook

KYN recently announced a 21 cent per share distribution

to be paid to investors in early October. As a reminder, once the combination with Kayne Anderson NextGen Energy & Infrastructure,

Inc. (NYSE: KMF) is completed, we intend to recommend an additional one cent per share increase in KYN’s quarterly distribution

rate (to $0.22 per share, representing a cumulative 10% annual increase). KYN’s performance thus far in fiscal 2023 and our outlook

for the next 12 to 18 months give us confidence in the portfolio’s ability to support higher distribution levels.

KYN & KMF Proposed Merger

KYN and KMF announced plans to combine the two

funds earlier this year (the “Merger”), with KYN as the surviving entity. The definitive joint proxy statement/prospectus

containing information about the Merger is now on file and available at SEC.gov, and the special meeting

of stockholders to approve the Merger is scheduled for November 1st. Please also refer to kaynefunds.com/insights

for information on the Merger.(14)

We encourage investors to visit our website at

kaynefunds.com for more information about the Company, including the commentary posted on the “Insights”

page that discusses performance, key industry trends, and the Merger. We appreciate your investment in KYN and look forward to providing

future updates.

Endnotes can be found on page 4.

KA Fund Advisors, LLC

| (1) | Net Asset Return is defined as the change in net asset value per share plus cash distributions paid during

the period (assuming reinvestment through our dividend reinvestment plan). |

| (2) | Relative performance based on the difference between the Company’s Net Asset Return and the total

return of KYN’s Benchmark. |

| (3) | KYN’s Benchmark is a composite of energy infrastructure companies. For fiscal 2023, this composite

is comprised of a 75% weighting to the midstream sector, a 12.5% weighting to the renewable infrastructure sector, and a 12.5% weighting

to the U.S. utility sector. The subsector allocations for this composite were established by Kayne Anderson at the beginning of fiscal

2023 based on the estimated target subsector allocations of the Company’s assets over the intermediate term. KYN's portfolio holdings

and/or subsector allocations may change at any time. |

| (4) | The benchmark for the midstream sector is the Alerian Midstream Energy Index (AMNA). |

| (5) | Downside cushion reflects the decrease in total asset value that could be sustained while maintaining

compliance with 1940 Act leverage levels and KYN’s financial covenants. |

| (6) | Fiscal year-to-date 2023 (11/30/22 – 8/31/23). |

| (7) | The benchmark for the broad U.S. energy sector is the Energy Select Sector SPDR Fund (XLE), which is an

exchange-traded fund (“ETF”) linked to the Energy Select Sector Index (IXE), a subset of the S&P 500. |

| (8) | The benchmark for the renewable infrastructure sector is the Kayne Anderson Renewable Infrastructure Index

(KRII), a market-cap weighted index of 35 domestic and international renewable infrastructure companies with individual constituents capped

at a 5% weighting. |

| (9) | The benchmark for the U.S. utility sector is the Utilities Select Sector SPDR Fund (XLU), which is an

exchange-traded fund (“ETF”) linked to the Utilities Select Sector Index (IXU), a subset of the S&P 500. |

| (10) | Source: TPH&Co. Research, Bloomberg. |

| (11) | Source: Reuters/Refinitiv. |

| (12) | Whenever we reference “midstream companies”, the “midstream sector” or the “midstream

industry” it includes both traditional midstream companies and natural gas & LNG infrastructure companies. Traditional midstream

companies are defined as midstream companies that own and/or operate midstream assets related to crude oil, refined products, natural

gas liquids or water. Natural gas & LNG infrastructure companies are defined as midstream companies that primarily own and/or operate

midstream assets related to natural gas or liquefied natural gas. |

| (13) | Market Return is defined as the change in share price plus cash distributions paid during the period (assuming

reinvestment through our dividend reinvestment program). |

| (14) | More information on the Merger is available in the definitive joint proxy statement/prospectus filed with

the Securities and Exchange Commission (SEC). All relevant documents are available at no charge on the SEC website at www.sec.gov. Please

refer to kaynefunds.com/insights for additional information on the combination. |

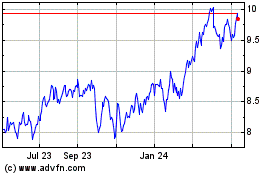

Kayne Anderson Energy In... (NYSE:KYN)

Historical Stock Chart

From Apr 2024 to May 2024

Kayne Anderson Energy In... (NYSE:KYN)

Historical Stock Chart

From May 2023 to May 2024