Filed

pursuant to Rule 425 of the Securities Act of 1933, as amended

and deemed filed pursuant to Regulation 14A

under the Securities and Exchange Act of 1934, as amended

Subject

Companies:

Kayne Anderson Energy Infrastructure Fund, Inc.

Commission File No. 811-21593

Kayne Anderson NextGen Energy & Infrastructure, Inc.

Commission File No. 811-22467

Fund Advisors

Proposed Merger of KYN and KMF

Frequently Asked Questions

While this Q&A has been provided for your convenience, it is recommended

that you read the definitive joint proxy statement/prospectus when available. Please refer to the Glossary in the joint proxy statement/prospectus

for the meaning of capitalized terms not otherwise defined herein.

Q: What is being proposed?

A: The combination of Kayne Anderson Energy Infrastructure Fund,

Inc. (“KYN”) and Kayne Anderson NextGen Energy & Infrastructure, Inc. (“KMF”) by means of a merger, pursuant

to which KMF will be merged with and into a wholly owned subsidiary (“Merger Sub”) of KYN (the “Merger”)1.

Pursuant to that certain Agreement and Plan of Merger, dated March 24, 2023, as amended and restated on April 24, 2023, by and among KYN

and KMF (the “Merger Agreement”), KMF stockholders will be entitled to receive in exchange for each of their outstanding shares

of KMF common stock either (i) shares of KYN common stock, which shall be based on the relative per share NAVs of KYN and KMF (i.e., the

value received shall be equal to 100% of the NAV per share of the KMF common stock) (“Stock Consideration”), or (ii) an amount

of cash equal to 95% of the NAV per share of the KMF common stock (“Cash Consideration”). KMF stockholders’ right to

elect to receive Cash Consideration is subject to the adjustment and proration procedures set forth in the Merger Agreement to ensure

that the total number of shares of KMF common stock converted into the right to receive Cash Consideration will not exceed 7,079,620 shares

(representing 15% of the outstanding shares of KMF common stock prior to the closing of the Merger). In accordance with the opinion described

in the joint proxy statement/prospectus under “Proposal One: Merger—Material U.S. Federal Income Tax Consequences of the Merger,”

the Merger will qualify as a tax-free merger for federal income tax purposes. This means it is expected that stockholders will recognize

no gain or loss for federal income tax purposes as a result of the Merger, except that gain (but not loss) will be recognized by KMF stockholders

in an amount not to exceed the amount of cash received as part of the Cash Consideration (other than cash received in lieu of a fractional

share) and gain or loss generally will be recognized by KMF stockholders with respect to cash received in lieu of fractional shares of

KYN common stock. See below for a description of how the Stock Consideration and Cash Consideration are calculated.

Q: Why is the Merger

being recommended by the Boards of Directors?

A: The Board of Directors of KYN (the “KYN Board”)

and the Board of Directors of KMF (the “KMF Board”, and together with the KYN Board, the “Boards”) have unanimously

approved the Merger because they have determined that the Merger is in the best interests of each Company and that the interests of the

existing stockholders of each Company will not be diluted as a result of the Merger. In making this determination, the KYN Board and the

KMF Board considered the expected benefits and principal risks of the transaction for each Company. In addition, the Boards considered

the material differences between the Companies, specifically that (i) KYN has higher base management fee than KMF and as such KMF stockholders

will be subject to an increased management fee immediately following the Merger, (ii) KYN, as a corporation for tax purposes, is subject

to federal income tax, while KMF, which qualifies as a regulated investment company (a “RIC”), is generally not subject to

federal income tax and (iii) KYN, because it is subject to federal income tax, has the ability to invest more than 25% of its total assets

in MLPs, while KMF, as a RIC, does not. The Boards also considered the principal risks associated with these differences, as more fully

described in the “Risk Factors” section of the joint proxy statement/prospectus. The Boards believe that the benefits of a

combination outweigh the risks to the stockholders.

1

KMF and KYN are sometimes referred to herein as a “Company” and collectively as the “Companies”.

KYN following the Merger is sometimes referred to herein as the “Combined Company”.

The Combined Company will pursue KYN’s investment objective

which is to provide a high after-tax total return with an emphasis on making cash distributions to stockholders. The Combined Company

intends to achieve this objective by investing at least 80% of total assets in the securities of Energy Infrastructure Companies.

Q: What are some of

the material factors that the KYN Board and the KMF Board considered in determining that the Merger is in the best interests of the Companies?

A: The material factors that the Boards considered in determining

that the Merger is in the best interests of both Companies include:

| · | Significant similarities between the Companies, with a small number of

material differences |

The Boards recognize that while KYN and KMF have very similar fundamental

investment limitations, principal investment policies, principal investment strategies and current portfolio holdings, there are some

material differences between the Companies. Specifically, (i) KYN, as a corporation for tax purposes, is subject to federal income tax,

while KMF, which qualifies as a regulated investment company (a “RIC”), is generally not subject to federal income tax and

(ii) KYN, because it is subject to federal income tax, has the ability to invest more than 25% of its total assets in MLPs, while KMF,

as a RIC, does not. KYN currently invests approximately half of its total assets in MLPs, while KMF invests slightly less than 25% of

its total assets in MLPs. With respect to fundamental investment limitations, KYN’s investment concentration limitation excludes

investments in the Energy Infrastructure Industry, while KMF’s excludes investments in Energy Companies. In addition, KYN has a

higher base management fee than KMF and as such KMF stockholders will be subject to an increased management fee immediately following

the Merger. The Boards also considered the principal risks associated with these differences, as more fully described in the “Risk

Factors” section of the joint proxy statement/prospectus. The Boards believe that the benefits of a combination outweigh the risks

to the stockholders.

| · | Merger may result in an increase in KMF’s distribution level |

Currently, KYN pays a quarterly cash distribution of $0.21 per share ($0.84

on an annualized basis) or an annualized distribution rate as a percentage of net asset value (“NAV”) per share of 8.9%. Currently,

KMF pays a quarterly cash distribution of $0.16 per share ($0.64 share on an annualized basis) or an annualized distribution rate as a

percentage of NAV per share of 7.8%. Based on these distribution levels, the Merger may result in an increase to the distribution received

by KMF’s common stockholders of approximately $0.09 on an annualized basis, or approximately 14% greater than KMF’s current

annualized distribution rate. Upon closing of the Merger, KYN’s management plans to recommend a $0.01 per share increase in KYN’s

quarterly distribution (to a quarterly rate of $0.22 per share), which if approved by the KYN Board, would increase KYN’s distribution

to an annualized rate of $0.88 per share. This would result in an approximate 20% increase in the current annualized distribution received

by KMF’s common stockholders. This increase is based on KMF’s per share distribution rate pro forma for the Merger ($0.191

per share) relative to KMF’s current per share distribution rate ($0.16 per share). However, the proposed increase in KMF’s

distribution level is not certain as payment of future distributions is subject to the KYN Board’s approval, as well as meeting

the covenants of KYN’s debt agreements and terms of its preferred stock. There can be no guarantee that the KYN quarterly distribution

will ultimately increase (due to changes in market conditions or otherwise) or that it would not subsequently decrease.

These estimates are based on the relative NAV per share of the Companies

as of May 31, 2023, which would have resulted in an exchange ratio of approximately 0.870 shares of KYN for each share of KMF. The exchange

ratio will be determined based on the relative NAV per share of each Company on the business day prior to closing of the Merger. Historically,

a portion of the distributions paid to common stockholders of KYN and KMF has been classified as a return of capital. The final tax characterization

of distributions paid in future periods will depend on the earnings and profits of the Combined Company in any given year. A “return

of capital” represents a return of a stockholder’s original investment and should not be confused with a dividend from earnings

and profits. In addition, a “return of capital” distribution should not be considered a total or complete return of your investment,

and any payment of distributions would only be made after the payment of fees and expenses.

| · | KMF’s common stockholders may benefit from enhanced market liquidity

and may benefit from improved trading relative to NAV per share |

The larger market capitalization of the Combined Company relative

to KMF should provide an opportunity for enhanced market liquidity over the long-term. Greater market liquidity may lead to a narrowing

of bid-ask spreads and reduce price movements on a trade-to-trade basis. The table below illustrates the equity market capitalization

and average daily trading volume for each Company on a standalone basis as well as for the Combined Company. KMF stockholders will be

part of a much larger company with significantly higher trading volume. The KMF Board also considered the fact that KYN has historically

traded at a smaller discount to NAV compared to KMF’s historical discount to NAV. For example, for the three years ended February

28, 2023, KYN has traded at an average discount to NAV of 14.3%, and KMF has traded at an average discount to NAV of 19.8%. Further,

in the period from KMF’s initial public offering (November 2010) through February 28, 2023, KYN’s average discount to NAV

was 4.3% and KMF’s average discount to NAV was 12.2%.

| | |

KYN | | |

KMF | | |

Pro Forma

Combined

Company(1) | |

| Equity capitalization ($ in millions) | |

$ | 1,213 | | |

$ | 349 | | |

$ | 1,532 | |

| Average daily trading volume(2) | |

| 454 | | |

| 127 | | |

| NA | |

As of February 28, 2023.

| (1) | Pro forma for the Merger (assuming the maximum aggregate

amount of Cash Consideration is elected). |

| (2) | 90-day average trading volume in thousands of shares. |

However, no guarantee can be made that KMF stockholders will benefit

from enhanced market liquidity or that the common stock of the Combined Company will trade at a smaller discount to NAV than KMF has on

a standalone basis. To the extent that KMF is trading at a narrower discount or wider premium than the acquiring fund at the time of the

Merger, KMF shareholders may be negatively impacted if the Merger is consummated. The Combined Company stockholders would only benefit

from a discount perspective to the extent the post-Merger discount or premium improved. There can be no assurance that after the Merger,

common shares of the Combined Company will trade at, above or below NAV.

| · | The Combined Company will have more flexibility than KMF regarding its

portfolio of Energy Infrastructure Companies, however the Combined Company will not qualify as a RIC and will be subject to entity level

tax |

KMF currently qualifies as a regulated investment company (“RIC”)

under Subchapter M of the Internal Revenue Code of 1986, as amended (the “Code”). As long as KMF meets certain portfolio diversification

and other requirements that govern its sources of income and timely distribution of earnings to stockholders, KMF will not be subject

to federal income tax. For KMF to qualify as a RIC, at the end of each quarter, KMF must have (i) at least 50% of the value of its total

assets comprised of investments that are not greater in value than 5% of total assets and (ii) no more than 25% of the value of its total

assets invested in the securities of one or more qualified publicly traded partnership (“PTPs”).

Currently, these requirements

are limiting the types of investments that KMF could make – in particular, the fund’s investments in MLPs (as defined in the

Glossary), which are considered PTPs for the purpose of KMF’s RIC diversification requirement, cannot exceed 25% of its total assets.

In contrast, KYN, which is a taxable corporation, does not have these same portfolio constraints. See “Proposal One: Merger –

Investment Objectives and Policies of KYN” in the joint proxy statement/prospectus. Upon completion of the Merger, the Combined

Company will operate as a taxable corporation and pursue KYN’s investment objective. We believe the benefits of additional portfolio

flexibility, which enables KYN to invest across a full spectrum of Energy Infrastructure Companies (in particular, the ability to hold

more than 25% of its portfolio in MLPs), outweigh the benefits of qualifying as a RIC. However, the fact that KYN is not required to meet

the portfolio diversification requirements of a RIC could make it more subject to risks related to concentration of investments. In addition,

the flexibility afforded by not qualifying as a RIC means that KYN is subject to federal income taxes, whereas KMF generally is not.

| · | Increased management fee for KMF stockholders immediately following the

Merger |

As of May 31, 2023, KYN was subject to a management fee of 1.375%

on its $1.8 billion of management fee total assets and KMF was subject to a management fee of 1.25% on its $0.5 billion of management

fee total assets. Based on KMF’s current management fee, the Combined Company’s management fee as a percentage of net assets

is expected to be higher than KMF’s standalone fee. Though the fee before waivers will increase for KMF stockholders, the Boards

took into consideration the waivers described below as part of their determinations that the Merger was in the best interests of the Companies.

| · | Potential for reduced management fee in the future as assets appreciate,

due to revised KYN management fee waiver |

Pro forma for the combination and assuming the maximum aggregate

amount of Cash Consideration is elected, the Combined Company would have pro forma total assets for purposes of calculating the management

fee of $2.2 billion, based on the Companies’ assets as of May 31, 2023. Subject to and beginning at the completion of the Merger,

KAFA has agreed to revise its existing contractual management fee waiver agreement (the “Tier Waiver”) with KYN to reduce

the asset tiers for fee waivers. The Tier Waiver is reviewed annually by the Board of KYN and does not have a termination date. The initial

asset tier for the Tier Waiver will be reset to the pro forma Combined Company total assets for purposes of calculating the management

fee of as of the closing of the Merger (for example, if total assets of the Combined Company at closing are $2.5 billion, then the initial

asset tier for the Tier Waiver will be set at $2.5 billion). The revised Tier Waiver will lower the effective management fee that KYN

pays as its assets appreciate. There can be no guarantee that the Combined Company’s total assets will increase to levels for the

asset tier fee waivers to be effective. The table below outlines the current and revised management fee waivers under the current and

updated Tier Waiver assuming the Merger was completed on May 31, 2023:

| KYN

Asset Tiers for Contractual Fee Waiver | |

Management Fee | | |

Applicable | |

| Current | |

Revised | |

Waiver | | |

Management Fee(1) | |

| $0 to $4.0 billion | |

$0 to $2.2 billion(2) | |

| 0.000 | % | |

| 1.375 | % |

| $4.0 billion to $6.0 billion | |

$2.2

billion(2) to $4.0 billion | |

| 0.125 | % | |

| 1.250 | % |

| $6.0 billion to $8.0 billion | |

$4.0 billion to $6.0 billion | |

| 0.250 | % | |

| 1.125 | % |

| Greater than $8.0 billion | |

Greater than $6.0 billion | |

| 0.375 | % | |

| 1.000 | % |

| (1) | Represents the management fee, after giving effect to the fee waiver, applicable to the incremental total assets at each tier. |

| (2) | Initial asset tier for fee waiver of $2.2 billion based on the approximate management fee total asset values at each Company as of

May 31, 2023. The actual amount of the first asset tier will be reset to the pro forma Combined Company management fee total asset value

as of closing. |

In addition to reducing the Tier Waiver, KAFA has also separately

contractually agreed to waive an additional amount of management fees (based on KYN and KMF assets at closing of the Merger) (the “Merger

Waiver”) such that the pro forma fees payable to KAFA are equal to the aggregate management fees payable if KYN and KMF had remained

standalone companies. The Merger Waiver will last for three years from the closing of the Merger so long as KAFA is the Combined Company’s

investment adviser and is estimated to be approximately $0.6 million per year (i.e., the product of KMF’s total assets for purposes

of calculating KMF’s management fee multiplied by 0.125%) based on KYN and KMF assets as of May 31, 2023. The updated Tier Waiver

and the new Merger Waiver would be effective as of the closing of the Merger and would not be subject to recoupment, either with respect

to KYN, KMF or the Combined Company. If the investment management agreement, Tier Waiver and/or Merger Waiver were to be terminated, the

management fee payable by the Combined Company could increase.

| · | KMF’s stockholders may benefit from the larger asset base of the

Combined Company |

The larger asset base of the Combined Company relative to KMF may

provide greater financial flexibility. In particular, as a larger entity, KMF’s stockholders may benefit from the Combined Company’s

access to attractive leverage terms and a wider range of alternatives for raising capital to grow the Combined Company.

| · | Increase in expenses for KMF stockholders |

The Merger is expected to result in an increase in expenses as a

percentage of net assets for KMF stockholders, which the Boards considered in making their determinations with respect to the Merger.

The increase in expenses as a percentage of net assets for KMF’s stockholders is also a result of (i) the net deferred tax liability

(as a percentage of total assets) at KYN and the Combined Company as compared to standalone KMF, which causes net assets for the Combined

Company to be smaller as a percentage of total assets as compared to standalone KMF and (ii) the entity level income taxes that are expected

to be borne by KYN and the Combined Company. KYN is a taxable corporation with entity level income taxes whereas KMF is a regulated investment

company (or RIC) that does not have entity level income taxes.

| · | Potential for elimination of certain duplicative expenses and potential

for greater economies of scale |

It is expected that the Combined Company will have a lower expense

level than KYN, driven by estimated cost savings (which would occur only after the payment of the costs of the Merger), a portion of which

is expected to be attributable to reduced operating costs. Each Company incurs operating expenses that are fixed (e.g., board fees, printing

fees, legal, tax returns and auditing services) and operating expenses that are variable (e.g., administrative and custodial services

that are based on assets under management). Many of these fixed expenses are duplicative between the Companies and can be reduced/eliminated

as a result of the Merger. There will also be an opportunity to reduce variable expenses by taking advantage of greater economies of scale.

Because the Merger is expected to be completed during the second half of fiscal 2023, and because there are expenses associated with the

Merger, the full impact of the elimination of duplicative expenses will not be entirely recognized during fiscal 2023. We expect the Combined

Company to realize the full benefit of these expense reductions during fiscal 2024. However, we cannot guarantee that the expense reductions

will be achieved in full or at all.

Q: What are the material

differences between the Companies?

A: The

Boards recognize that while KYN and KMF have very similar fundamental investment limitations, principal investment policies, principal

investment strategies and current portfolio holdings, there are some material differences between the Companies. Specifically, (i) KYN,

as a corporation for tax purposes, is subject to federal income tax, while KMF, which qualifies as a regulated investment company (a “RIC”),

is generally not subject to federal income tax and (ii) KYN, because it is subject to federal income tax, has the ability to invest more

than 25% of its total assets in MLPs, while KMF, as a RIC, does not. KYN currently invests approximately half of its total assets in MLPs,

while KMF invests slightly less than 25% of its total assets in MLPs. With respect to fundamental investment limitations, KYN’s

investment concentration limitation excludes investments in the Energy Infrastructure Industry, while KMF’s excludes investments

in Energy Companies. In addition, KYN has a higher base management fee than KMF and as such KMF stockholders will be subject to an increased

management fee immediately following the Merger. The Boards also considered the principal risks associated with these differences, as

more fully described in the “Risk Factors” section of the joint proxy statement/prospectus. The Boards believe that the benefits

of a combination outweigh the risks to the stockholders.

Q: How is the leverage

level of the Combined Company expected to compare to the leverage levels of KYN and KMF on a standalone basis?

A: The amount of leverage as a percentage of total assets

following the Merger is not expected to materially change from that of each Company’s standalone leverage levels. The table below

illustrates the leverage of each Company on both a standalone and pro forma basis.

| ($ in millions) | |

KYN | | |

KMF | | |

Pro

Forma

Combined

KYN(1) | |

| Total Debt | |

$ | 294 | | |

$ | 80 | | |

$ | 374 | |

| Mandatory Redeemable Preferred Stock | |

$ | 112 | | |

$ | 42 | | |

$ | 154 | |

| Leverage | |

$ | 406 | | |

$ | 122 | | |

$ | 528 | |

| Leverage as % of total assets | |

| 23 | % | |

| 24 | % | |

| 23 | % |

As of May 31, 2023.

| (1) | Pro forma for the Merger (assuming the maximum aggregate

amount of Cash Consideration is elected). |

Q. How has KYN performed relative to KMF on a total return basis?

A: The performance table below illustrates the average annual

total returns of an investment in each Company. These average annual returns are based on net asset values, which reflect the total expenses

incurred at each Company for the periods presented and, for KYN, this includes the impact of income taxes.

| | |

Average

Annual Total Returns Based on Net Asset Value(1) | |

| | |

1-Year | | |

3-Year | | |

5-Year | | |

10-Year | | |

Since 11/30/10(2) | |

| | |

| | |

| | |

| | |

| | |

| |

| KYN/Acquirer | |

| (5.5 | )% | |

| 21.4 | % | |

| (3.7 | )% | |

| (2.6 | )% | |

| 1.0 | % |

| KMF/Target | |

| (14.9 | )% | |

| 18.6 | % | |

| (2.6 | )% | |

| (5.1 | )% | |

| (0.3 | )% |

| (1) | Average annual total returns are based on net asset values, rather than stock prices, and are shown as of May 31, 2023. These returns

reflect each Company’s total expense ratio, which includes net operating expenses, interest expense and current and deferred tax

expense (or benefit), as applicable, as well as the reinvestment of distributions pursuant to each Companies’ dividend reinvestment

plan. |

| (2) | KYN commenced operations in September 2004 while KMF commenced operations in November 2010. Returns for the period since November

30, 2010 represent the applicable average total return of the Companies since the first month-end following KMF’s commencement of

operations. |

The performance table below illustrates the average total returns

of an investment in each Company based on market value.

| | |

Average

Annual Total Returns Based on Market Value(1) | |

| | |

1-Year | | |

3-Year | | |

5-Year | | |

10-Year | | |

Since 11/30/10(2) | |

| | |

| | |

| | |

| | |

| | |

| |

| KYN/Acquirer | |

| (7.8 | )% | |

| 21.6 | % | |

| (7.2 | )% | |

| (5.5 | )% | |

| (1.0 | )% |

| KMF/Target | |

| (14.4 | )% | |

| 19.5 | % | |

| (5.1 | )% | |

| (7.3 | )% | |

| (2.2 | )% |

| (1) | Average annual total returns based on market value are shown as of May 31, 2023 and reflect the reinvestment of distributions pursuant

to each Companies’ dividend reinvestment plan. |

| (2) | KYN commenced operations in September 2004 while KMF commenced operations in November 2010. Returns for the period since November

30, 2010 represent the applicable average total return of the Companies since the first month-end following KMF’s commencement of

operations. |

Past performance does not predict future performance, and the tables

above do not reflect the deduction of taxes that a stockholder would pay on distributions or the sale of shares of common stock. The investment

return and principal value of an investment will fluctuate with changes market conditions and other factors so that an investor’s

shares, when sold, may be worth more or less than their original cost.

Q: Is the Merger expected

to be a taxable event for stockholders?

A: In

accordance with the opinion described in the joint proxy statement/prospectus under “Proposal One: Merger—Material U.S. Federal

Income Tax Consequences of the Merger,” the Merger will qualify as a tax-free merger for federal income tax purposes. This means

it is expected that stockholders will recognize no gain or loss for federal income tax purposes as a result of the Merger, except that

gain (but not loss) will be recognized by KMF stockholders in an amount not to exceed the amount of cash received as part of the Cash

Consideration (other than cash received in lieu of a fractional share) and gain or loss generally will be recognized by KMF stockholders

with respect to cash received in lieu of fractional shares of KYN common stock. If the Merger fails to qualify as a tax-free reorganization

because KYN or KMF fail to meet the asset diversification tests of Section 368(a)(2)(F) of the Internal Revenue Code of 1986, as amended

(the “Code”), or for any other reason, then the transaction will be taxable to the non-diversified investment company and

its stockholders.

Q: Will the Merger cause

a change in value of KYN’s deferred tax liability?

A: The Merger should not result in any incremental net deferred

income tax liability for KYN. KMF, as a regulated investment company (“RIC”), is not generally subject to federal income tax

and as such does not have a deferred tax liability associated with unrealized gains on investments (nor any deferred tax asset associated

with capital loss carryforwards). As of November 30, 2022, KMF had $402 million of capital loss carryforwards and an unrealized gain on

investment for tax purposes of $100 million. As a RIC, KMF capital loss carryforwards would be eligible to be carried forward indefinitely

and generally would not be limited. Following the Merger, all pre-Merger KMF capital losses would be subject to a five year carryforward

period as applicable to taxable corporations. KYN, as a corporation, is obligated to pay federal and state income tax on its taxable income

and accrues deferred income tax in accordance with the Income Tax Topic of the FASB Accounting Standards Codification (ASC 740). In the

Merger, KYN as the tax acquirer will succeed to any capital loss carryforward that KMF has as of the time of the Merger. Any such capital

loss carryforward acquired will be subject to certain limitations under the Code. It is KYN’s expectation that KMF capital losses

available post-Merger will equal, if not exceed, the amount of the KMF net unrealized gain (if any) as of the Merger date such that KYN

should not be required to increase its net deferred tax liability in connection with the Merger. Any KMF capital losses in excess of the

limitations imposed by the Code will expire unused. As of May 31, 2023, the net value of the prospective benefit to KYN post-Merger of

the KMF capital losses acquired was estimated to be a range of zero to $13 million. Post-Merger, KYN will continue to periodically assess

whether or not a valuation allowance is required for any deferred tax assets that may exist in accordance with the Income Tax Topic of

the Financial Accounting Standards Board (FASB) Accounting Standards Codification (ASC 740). If a valuation allowance is required to reduce

any deferred tax asset in the future, or if a valuation allowance is determined to no longer be necessary, this could have a material

impact on KYN’s net asset value and results of operations in the period it is recorded.

Even though KYN is subject to federal income tax and may enjoy a

future economic benefit of the capital losses acquired, the Boards did not deem it appropriate to ascribe any value to KMF’s capital

losses as (i) the capital losses have no deferred tax value to KMF on a standalone basis, (ii) any value of the capital losses to KYN

is contingent upon the successful completion of the Merger, (iii) the prospective value of the capital losses is dependent upon the realization

of capital gains post-Merger (which may or may not occur) prior to the expiration of the KMF capital losses acquired, (iv) the expectation

that the majority of the capital losses available post-Merger would likely be utilized to offset unrealized gains that might exist as

of the Merger date, and (v) the potential value of the remaining portion of available capital losses is dependent upon future asset appreciation

post-Merger (which may or may not occur).

Q: How are distributions to KYN stockholders treated for tax purposes

and how does that compare to the tax treatment of distributions to KMF stockholders?

A: As a corporation, the tax character of KYN distributions paid

is generally either taxable dividends (eligible to be treated as “qualified dividend income”) or return of capital. As a RIC,

the tax character of KMF distributions paid may be ordinary income, qualified dividend income, capital gains or return of capital. The

tax character of each Company’s common distributions for fiscal 2022 and since their inception is included below.

| | |

Fiscal

Year 2022 | | |

Since

Inception(1) | |

| Tax

Character of Distributions | |

KYN | | |

KMF | | |

KYN | | |

KMF | |

| Return

of Capital(2) | |

| 0 | % | |

| 79 | % | |

| 43 | % | |

| 23 | % |

| Qualified

Dividend Income | |

| 100 | % | |

| 21 | % | |

| 57 | % | |

| 25 | % |

| Ordinary

Income | |

| NA | (3) | |

| - | | |

| NA | (3) | |

| 32 | % |

| Long-Term

Capital Gains | |

| NA | | |

| - | | |

| NA | | |

| 20 | % |

| (1) |

Based on the cumulative tax character of distributions for each Company since its inception and through the fiscal year ended November 30, 2022. |

| (2) |

For both KYN and KMF, if the distributions paid exceed the Company’s current or accumulated earnings and profits, the distribution will be treated as a return of capital to the extent of the stockholder’s basis. Any distribution received in excess of a stockholder’s basis would be taxable as capital gain. |

| (3) |

If stockholders meet the requisite holding period requirement (and certain other requirements), KYN's taxable dividends should be eligible to be treated as tax-advantaged qualified dividend income. |

We cannot assure you what percentage of the distributions paid on the pro

forma Combined Company’s common stock, if any, will be treated as tax-advantaged qualified dividend income or tax-deferred return

of capital in the future. Historically, more of KYN’s distributions to its stockholder has been classified as tax-advantaged qualified

dividend income and tax-deferred return of capital as compared to distributions paid to KMF stockholders. As a stockholder of KYN, provided

that you meet the requisite holding period requirement (and certain other requirements), taxable dividends should be eligible to be treated

as tax-advantaged qualified dividend income and not ordinary income. Qualified dividend income is taxed at lower capital gain rates. The

final tax characterization of distributions paid in future periods will depend on the earnings and profits of the Combined Company in

any given year. Historically, a portion of the cash distributions received from KYN’s and KMF’s portfolio investments was

characterized as a return of capital which contributed to the amount of return of capital that KYN and KMF have paid to their respective

stockholders. A reduction in the return of capital portion of the distributions received from KYN and KMF portfolio investments (or an

increase in each Company’s earnings and profits) may reduce the portion of the distribution paid by KYN and KMF that is treated

as a tax-deferred return of capital. A “return of capital” represents a return of a stockholder’s original investment

and should not be confused with a dividend from earnings and profits.

Q: How will the Merger

affect KYN and KMF common stockholders, including with respect to taxable income, tax basis and holding period?

A: KYN stockholders will remain stockholders of KYN. KMF stockholders

who receive Stock Consideration will become stockholders of KYN and will recognize no gain or loss (except with respect to cash received

in lieu of a fractional share of KYN common stock). Such KMF stockholders will have the same aggregate tax basis in its KYN common stock

as it did its KMF shares surrendered in exchange therefor (reduced by any amount of tax basis allocable to a fractional share of common

stock for which cash is received). Furthermore, for KMF stockholders that receive KYN shares pursuant to the Merger, the holding period

for such KYN shares received will include the holding period of the KMF shares surrendered in exchange therefor. KMF will then cease its

separate existence under Maryland law.

Q: What will happen

to the shares of KYN that I currently own as a result of the Merger?

A: For

the KYN stockholders, your currently issued and outstanding shares of common and preferred stock of KYN will remain unchanged.

Q: What will happen

to the common shares of KMF that I currently own as a result of the Merger?

A: KMF

common stockholders will be entitled to receive in exchange for each of their outstanding shares of KMF common stock either (i) shares

of KYN common stock, which shall be based on the relative per share NAVs of KYN and KMF (i.e., the value received shall be equal to 100%

of the NAV per share of the KMF common stock), which is referred to as the Stock Consideration, or (ii) an amount of cash equal to 95%

of the NAV per share of the KMF common stock, which is referred to as the Cash Consideration (see below for a description of how the Stock

Consideration and the Cash Consideration are calculated). If you make no election or an untimely election, or are otherwise deemed not

to have submitted an effective form of election, you will receive the Stock Consideration. Your right to elect to receive the Cash Consideration

is subject to the adjustment and proration procedures set forth in the Merger Agreement to ensure that the total number of shares of KMF

common stock converted into the right to receive cash consideration will not exceed 7,079,620 shares (representing 15% of the outstanding

shares of KMF common stock prior to the closing of the Merger). The precise consideration that you will receive if you elect to receive

Cash Consideration will not be known at the time that you vote on the approval of the Merger or make an election because it is dependent

upon the per share NAV of KMF prior to the closing of the Merger and is subject to proration. No fractional shares of KYN common stock

will be issued in the Merger; instead KMF stockholders will receive cash in an amount equal to the value of the fractional shares of KYN

common stock that they would otherwise have received.

Q: What will happen

to the preferred shares of KMF that I currently own as a result of the Merger?

A: KMF

preferred stockholders will receive, on a one-for-one basis, newly issued KYN preferred shares having substantially identical terms as

the KMF preferred shares you held immediately prior to the closing of the Merger.

Q: How are the Stock

Consideration and the Cash Consideration determined?

A: The Stock Consideration will be determined based on the

relative NAVs per share of each Company on the business day prior to the closing of the Merger. As of May 31, 2023, KYN’s NAV per

share was $9.47 and KMF’s was $8.24. For illustrative purposes, if these were the NAVs on the business day prior to closing of the

Merger, then KMF common stockholders who elect Stock Consideration would be issued approximately 0.870 shares of KYN for each share of

KMF.

The Cash Consideration will be determined based on the NAV per share

of the KMF common stock on the business day prior to the closing of the Merger (and will equal 95% of the NAV per share). For illustrative

purposes, if the NAV per share of KMF as of May 31, 2023 was the NAV on the business day prior to closing of the Merger, then KMF common

stockholders who elect Cash Consideration would receive approximately $7.83 for each share of KMF subject to proration.

Q: How will the net

asset values utilized in calculating the Stock Consideration and the Cash Consideration be determined?

A: The net asset value of a share of common stock of each

Company will be calculated in a manner consistent with past practice and will include the impact of each Company’s share of the

costs of the Merger.

Q: If I elect to receive Cash Consideration, under what circumstances

will my Cash Consideration be prorated and how will the proration be calculated?

A: In the event that KMF stockholders elect to receive Cash

Consideration for an aggregate number of shares of KMF common stock, which are referred to as cash election shares, in excess of 7,079,620

shares (representing 15% of the outstanding shares of KMF common stock prior to the closing of the Merger), all cash election shares will

be converted into the right to receive Stock Consideration or Cash Consideration as follows:

| · | No more than 7,079,620 shares (representing 15% of the outstanding shares

of KMF common stock in the aggregate) will be converted into the right to receive the Cash Consideration. Each record holder of KMF common

stock having made a cash election will be entitled to receive the Cash Consideration in respect of approximately their pro rata portion

of the aggregate shares of KMF common stock converted into the right to receive the Cash Consideration. In some cases, due to rounding,

a KMF stockholder’s pro rata portion may be zero, such that none of such KMF stockholder’s shares of KMF common stock will

be converted into the right to receive the Cash Consideration. |

| · | The remainder of each such holder’s cash election shares will not be

converted into a right to receive the Cash Consideration and will instead be converted into the right to receive the Stock Consideration,

including cash in lieu of any fractional share, if applicable. |

The number of cash election shares of a holder of KMF common stock

that are to remain cash election shares pursuant to the calculation described above will be rounded downward where needed. The calculations

described above will be performed by American Stock Transfer & Trust Company, KYN’s and KMF’s transfer agent (the “Exchange

Agent”).

Q: How do I make an election to receive Cash Consideration or

Stock Consideration for my shares of KMF common stock?

A: Prior to the closing of the Merger, the Exchange Agent

will provide a form of election and appropriate transmittal materials to holders of record of shares of KMF common stock advising such

holders of the procedure for exercising their right to make an election. If you hold shares of KMF common stock in street name, you will

need to follow the procedures established by your broker, bank or other nominee in order to make an election. Once you make an election,

it is likely that you will be unable to trade your shares unless you properly revoke the election. Further, for the period of time after

the deadline to make such an election occurs and prior to the Merger closing, you will not be able to change nor revoke any such election.

Q: What is the deadline for submitting an election?

A: To be effective, a form of election must be properly completed,

signed and submitted to the Exchange Agent by 5:00 PM (Eastern Time) on the business day that is five trading days prior to the closing

date for the Merger, or such other date and time as KYN may publicly announce with the consent of KMF, which is referred to as the election

deadline. You can revoke your election before the election deadline by written notice that is sent to and received by the Exchange Agent

prior to the election deadline.

Q: What happens if I don’t make an election?

A: A holder of shares of KMF common stock who makes no election

or an untimely election, or is otherwise deemed not to have submitted an effective form of election, or who has validly revoked his or

her merger consideration election but has not properly submitted a new duly completed form of election, will be deemed to have made a

stock election.

Q: How will KYN fund the cash portion of the per share merger

consideration?

A: KYN expects to fund the cash portion of the per share merger

consideration with cash on hand, securities sales, additional borrowings under its unsecured credit facility, or some combination thereof.

Upon closing of the Merger, we do not expect the Combined Company leverage levels to vary materially from that of KYN or KMF on a standalone

basis.

Q: Will I have to pay

any sales load, commission or other similar fees in connection with the Merger?

A: No, you will not pay any sales loads or commissions in

connection with the Merger.

Q: How will the costs

associated with the proposed Merger be allocated?

A: The

Companies will bear the costs associated with the proposed Merger whether or not the Merger is completed. In accordance with the terms

of the Merger Agreement, costs will be allocated 50% to KYN and 50% to KMF. Costs related to the Merger are currently estimated to be

approximately $1.8 million or 0.1% of pro forma Combined Company net assets, which equates to $0.9 million or $0.01 per share for KYN

on a standalone basis and $0.9 million or $0.02 per share for KMF on a standalone basis as of May 31, 2023. The costs associated with

the Merger include all estimated costs expected to be borne by the common stockholders of the Companies other than costs associated with

portfolio rebalancing (i.e., trading costs which include brokerage commissions and other transactional expenses). Costs associated with

portfolio rebalancing would be borne by each Company (and ultimately by each Company’s common stockholders) based on their respective

portfolio turnover; however, the Companies believe that any portfolio rebalancing costs would not be material to the Combined Company.

Q: Who do we expect

to vote on the Merger and the issuance of additional KYN common stock in connection with the Merger?

A: KMF’s common and preferred stockholders are being

asked to vote, together as a single class, on the Merger. KYN’s common and preferred stockholders are being asked to vote, together

as a single class, to approve the issuance of KYN shares required to complete the Merger.

Q: What happens if KMF

stockholders do not approve the Merger or KYN stockholders do not approve the issuance of additional shares of KYN common stock in connection

therewith?

A: The Merger must be approved by KMF’s common and preferred

stockholders, voting together as a single class. In addition, the issuance of additional shares of KYN common stock in connection with

the Merger must be approved by KYN’s common and preferred stockholders, voting together as a single class. If KMF stockholders do

not approve the Merger, or if KYN stockholders do not approve the issuance of additional KYN common stock in connection therewith, then

the Merger will not take place and KYN and KMF will continue to operate as separate entities. Further, if the Merger is not approved,

KYN’s current asset tiers for fee waivers will remain in effect.

Q: What is the timetable

for the Merger?

A: The Merger is expected to take effect prior to the end

of fiscal 2023, following the receipt of stockholder approvals and once other customary conditions to closing are satisfied.

Q: What actions do I need to take at this time?

A: You do not need to do anything at this time. Additional information

on the Merger will be contained in the definitive joint proxy statement/prospectus which will be distributed to stockholders following

a review period with the SEC.

Q: Where can I find more information?

A: You may contact Kayne Anderson Investor Relations toll-free

at 877-657-3863 for further information. In addition, it is recommended that you read the definitive joint proxy statement/prospectus

when available.

Q: Will anyone contact

me?

A: You may receive a call from AST Fund Solutions, the Companies’

proxy solicitor, to verify that you received your proxy materials, to answer any questions you may have about the proposals and to encourage

you to authorize your proxy. We recognize the inconvenience of the proxy solicitation process and would not impose it on you if we did

not believe that the matters being proposed were important. Once your vote has been registered with the proxy solicitor, your name will

be removed from the solicitor’s follow-up contact list.

###

No assurance can be given that the anticipated positive impacts

of the Merger will be achieved. In addition, stockholders should fully read the joint proxy statement/prospectus, including the risk factors

included therein, when available. KYN, KMF and their directors and executive officers may be deemed participants in the solicitation of

proxies from KYN’s and KMF’s stockholders with respect to the Merger. Information regarding the persons who may, under SEC

rules, be deemed participants in the solicitation of proxies to KYN’s and KMF’s stockholders and their interests in the solicitation

of proxies in connection with the proposed Merger is included in the preliminary proxy statement/prospectus filed with the SEC.

This information is provided for general informational purposes

only. It does not constitute, and should not be construed as, tax, legal, investment, or other professional advice and cannot be used

or relied upon for the purpose of avoiding tax penalties. Investors should consult their tax adviser or legal counsel for advice and

information concerning their particular situation.

Kayne Anderson Energy Infrastructure Fund, Inc. (NYSE: KYN) is

a non-diversified, closed-end management investment company registered under the Investment Company Act of 1940, as amended, whose common

stock is traded on the NYSE. KYN’s investment objective is to provide a high after-tax total return with an emphasis on making cash

distributions to stockholders. KYN intends to achieve this objective by investing at least 80% of its total assets in securities of Energy

Infrastructure Companies. See Glossary of Key Terms in KYN’s most recent annual report for a description of these investment categories

and the meaning of capitalized terms.

Kayne Anderson NextGen Energy & Infrastructure, Inc. (NYSE:

KMF) is a non-diversified, closed-end management investment company registered under the Investment Company Act of 1940, as amended, whose

common stock is traded on the NYSE. KMF’s investment objective is to provide a high level of total return with an emphasis on making

cash distributions to its stockholders. KMF seeks to achieve its investment objective by investing at least 80% of its total assets in

securities of Energy Companies and Infrastructure Companies. KMF anticipates that the majority of its investments will consist of investments

in “NextGen” companies, which are defined as Energy Companies and Infrastructure Companies that are meaningfully participating

in, or benefitting from, the Energy Transition. See Glossary of Key Terms in KMF’s most recent annual report for a description of

these investment categories and the meaning of capitalized terms.

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS: This document

contains statements reflecting assumptions, expectations, projections, intentions, or beliefs about future events. These and other statements

not relating strictly to historical or current facts constitute forward-looking statements as defined under the U.S. federal securities

laws. Forward-looking statements involve a variety of risks and uncertainties. These risks include, but are not limited to, changes in

economic and political conditions; regulatory and legal changes; energy industry risk; leverage risk; valuation risk; interest rate risk;

tax risk; and other risks discussed in detail in each Company’s filings with the SEC, available at www.kaynefunds.com or www.sec.gov.

Actual events could differ materially from these statements or from our present expectations or projections. You should not place undue

reliance on these forward-looking statements, which speak only as of the date they are made. Kayne Anderson undertakes no obligation to

publicly update or revise any forward-looking statements made herein. There is no assurance that either company’s investment objectives

will be attained.

SAFE HARBOR STATEMENT: This document shall not constitute an offer

to sell or a solicitation to buy, nor shall there be any sale of these securities in any state or jurisdiction in which such offer or

solicitation or sale would be unlawful prior to registration or qualification under the laws of such state or jurisdiction.

Contact: Investor Relations at 877-657-3863 or cef@kaynecapital.com

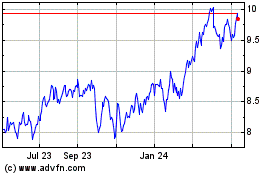

Kayne Anderson Energy In... (NYSE:KYN)

Historical Stock Chart

From Apr 2024 to May 2024

Kayne Anderson Energy In... (NYSE:KYN)

Historical Stock Chart

From May 2023 to May 2024