OMC Steps on Asian Med Dais - Analyst Blog

March 09 2012 - 8:30AM

Zacks

A strong ad market, tough peers, an

increased consumer spending behavior-- both in the domestic and

international markets—have been increasing the likelihood of

acquisition activity among the ‘Admen’. In this backdrop,

Omnicom Group Inc. (OMC), one of the world’s

leading global marketing and corporate communications companies,

also stands to gain from strategic acquisitions aimed at fortifying

the group’s business while inducing long-term profitability.

Recently, Omnicom Group's

Diversified Agency Services (DAS) announced an agreement with

ITOCHU Corporation and a number of venture capital funds to acquire

a majority stake in Medical Collective Intelligence Co. Ltd. (MCI).

MCI is a highly respected Japanese online medical communications

agency, founded in 2007. It offers clients in the pharmaceutical

and medical device industries with powerful online market research

services and online CRM solutions.

Diversified Agency Services (DAS),

a division of Omnicom, manages Omnicom's holdings in a variety of

marketing disciplines, including customer relationship management,

public relations and specialty communications. The division’s deal

with the Japanese communication agency looks impressive as the

combined strength of Omnicom's healthcare agencies with the digital

capabilities of MCI is anticipated to significantly boost Omnicom's

overall client offering in Japan. The acquisition is also expected

to position Omnicom as the leading dedicated healthcare marketing

group in Japan. ITOCHU remains a shareholder in this acquisition

deal—partnering with the focal parties concerned--to grow and

develop the business.

Omnicom’s key growth strategy

involving acquisition of complementary companies is aimed at

expanding its client base while strengthening the entrepreneurial

management teams globally. The latest acquisition involves a

stronger challenge for Omnicom to operate in the world's second

largest pharmaceutical market. MCI's digital CRM solutions

and research are well poised to capitalize on the fastest growing

marketing communications sector, backed by the increased client

spending on digital and interactive communications platforms.

MCI is also looking forward to

further extend services throughout the Asia-Pacific region. With

their online market research and detailing solutions, they plan to

penetrate into the diverse growth markets of China and India, and

other South East Asian countries. With this partnership with

Omnicom, they foresee expansion opportunities in the U.S. and

Europe with customized solutions in the significant healthcare

markets. MCI has planned to persist its operation as a stand-alone

agency within Omnicom in Asia, working closely with its sister

healthcare companies including Targis, AgencyRx Japan and Polaris

Consumer Healthcare.

Omnicom's branded networks and

numerous specialty firms provide advertising, strategic media

planning and buying, digital and interactive marketing, direct and

promotional marketing, public relations and other specialty

communications services worldwide. It directly competes with its

peers, such as The Interpublic Group of Companies

Inc. (IPG), Publicis Groupe SA (PUBGY)

and WPP pl. (WPPGY).

The strategic acquisitions,

clinched earlier by the company viz, Indian PR agency, Sampark, New

Zealand-based TouchCast, Biz Tequila from Vietnam and Jump in the

Netherlands, are quite noteworthy. Besides, strategic acquisitions

in complementary businesses and increased integration, needs

special mention. We believe, such deals in time, would be accretive

to growth and business development.

We currently maintain a long-term

Neutral recommendation on the stock. Omnicom has a Zacks #3 Rank,

which translates into a short-term Hold rating (1-3 months).

INTERPUBLIC GRP (IPG): Free Stock Analysis Report

OMNICOM GRP (OMC): Free Stock Analysis Report

PUBLICIS GP-ADR (PUBGY): Free Stock Analysis Report

WPP GRP PLC (WPPGY): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

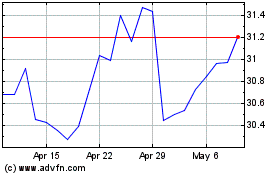

Interpublic Group of Com... (NYSE:IPG)

Historical Stock Chart

From Apr 2024 to May 2024

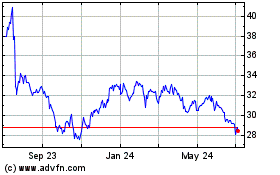

Interpublic Group of Com... (NYSE:IPG)

Historical Stock Chart

From May 2023 to May 2024