Form 425 - Prospectuses and communications, business combinations

September 27 2023 - 8:46AM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d) OF

THE

SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported): September 26, 2023

INTEGRATED WELLNESS ACQUISITION CORP

(Exact name of registrant as specified in its charter)

| Cayman Islands |

|

001-41131 |

|

98-1615488 |

| (State or other jurisdiction of incorporation) |

|

(Commission File Number) |

|

(IRS Employer Identification No.) |

59 N. Main Street

Florida, NY 10921

(Address of principal executive offices, including

zip code)

Registrant’s telephone number, including

area code: (845) 651-5039

Not

Applicable

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K

filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| x | Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ¨ | Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ¨ | Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ | Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| Title of each

class |

|

Trading

Symbol(s) |

|

Name of each exchange on

which registered |

| Units, each consisting of one Class A ordinary share, $0.0001 par value, and one-half of one redeemable warrant |

|

WEL.U |

|

The New York Stock Exchange |

| Class A ordinary shares included as part of the units |

|

WEL |

|

The New York Stock Exchange |

| Redeemable warrants included as part of the units |

|

WEL.WS |

|

The New York Stock Exchange |

Indicate by check mark whether the registrant

is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2

of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company x

If an emerging

growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any

new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

Item 1.02 Termination of A Material Definitive

Agreement.

On September 26, 2023, Integrated

Wellness Acquisition Corp (the “Company”) notified Refreshing USA, LLC that the Company had elected to terminate the Agreement

and Plan of Merger among the parties, dated as of February 10, 2023 (the “Merger Agreement”), effective immediately, pursuant

to Section 8.1(b) thereof, since the conditions to the closing of the initial business combination were not satisfied or waived by the

outside date of July 31, 2023 (the “Termination”). As a result, the Merger Agreement is of no further force and effect, with

the exception of certain specified provisions in the Merger Agreement, which shall survive the Termination and remain in full force and

effect in accordance with their respective terms. The Company and its sponsor intend to seek alternative ways to consummate an initial

business combination.

Item 8.01 Other Events

On

September 27, 2023, the Company issued a press release announcing the Termination. A copy of the press release is attached hereto

as Exhibit 99.1 and is incorporated herein by reference.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits

SIGNATURE

Pursuant to the requirements

of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto

duly authorized.

| |

Integrated Wellness Acquisition Corp |

| |

|

| |

By: |

/s/ Steven Schapera |

| |

|

Name: Steven Schapera |

| |

|

Title: Chief Executive Officer |

Dated: September 27, 2023

Exhibit 99.1

Integrated Wellness Acquisition Corp Announces

Termination of Merger Agreement

NEW YORK, NY – September 27, 2023 (GLOBE

NEWSWIRE) - Integrated Wellness Acquisition Corp (NYSE: WEL) (the “Company”) announced that it notified Refreshing

USA, LLC that the Company had elected to terminate the Agreement and Plan of Merger among the

parties, dated as of February 10, 2023 (the “Merger Agreement”), effective immediately,

pursuant to Section 8.1(b) thereof, since the conditions to the closing of the initial business combination were not satisfied or waived

by the outside date of July 31, 2023 (the “Termination”). As a result, the Merger Agreement is of no further force and effect,

with the exception of certain specified provisions in the Merger Agreement, which shall survive the Termination and remain in full force

and effect in accordance with their respective terms. The Company and its sponsor intend to seek alternative ways to consummate an initial

business combination.

About Integrated Wellness Acquisition Corp

Integrated Wellness Acquisition Corp (NYSE: WEL)

is a special purpose acquisition company formed for the purpose of effecting a merger, share exchange, asset acquisition, share purchase,

recapitalization, reorganization, or similar business combination with one or more businesses. While Integrated Wellness may pursue an

acquisition opportunity in any industry or sector, it intends to focus on businesses in the health, nutrition, fitness, wellness, and

beauty sectors and the products, devices, applications, and technology driving growth within these verticals. Integrated Wellness is led

by Chief Executive Officer Steven Schapera, Chairman of the Board Antonio Varano Della Vergiliana, Chief Financial Officer James MacPherson,

and Chief Operating Officer Robert Quandt. Integrated Wellness’ independent directors include Gael Forterre, Scott Powell, and Hadrien

Forterre.

Forward-Looking Statements

This press release contains statements that constitute “forward-looking

statements.” Forward-looking statements are subject to numerous conditions, many of which are beyond the control of the Company,

including those set forth in the Risk Factors section of the Company’s registration statement and prospectus for the offering filed

with the SEC. Copies are available on the SEC’s website, www.sec.gov. The Company undertakes no obligation to update these statements

for revisions or changes after the date of this release, except as required by law.

Contact Information

Steven Schapera

Chief Executive Officer

Integrated Wellness Acquisition Corp

Email: investor@integratedwellnessholdings.com

Website: www.integratedwellnessholdings.com

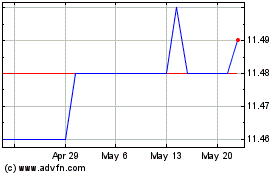

Integrated Wellness Acqu... (NYSE:WEL)

Historical Stock Chart

From Mar 2024 to Apr 2024

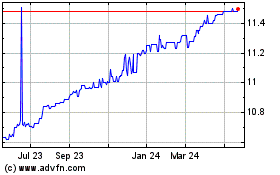

Integrated Wellness Acqu... (NYSE:WEL)

Historical Stock Chart

From Apr 2023 to Apr 2024