false000105914200010591422024-03-042024-03-04

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

|

Date of Report (Date of earliest event reported): March 4, 2024 |

Greystone Housing Impact Investors LP

(Exact name of Registrant as Specified in Its Charter)

|

|

|

|

|

Delaware |

001-41564 |

47-0810385 |

(State or Other Jurisdiction

of Incorporation) |

(Commission File Number) |

(IRS Employer

Identification No.) |

|

|

|

|

|

14301 FNB Parkway, Suite 211 |

|

Omaha, Nebraska |

|

68154 |

(Address of Principal Executive Offices) |

|

(Zip Code) |

|

Registrant’s Telephone Number, Including Area Code: 402 952-1235 |

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

|

|

☐ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

☐ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

☐ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

☐ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

Title of each class

|

|

Trading

Symbol(s) |

|

Name of each exchange on which registered

|

Beneficial Unit Certificates representing assignments of limited partnership interests in Greystone Housing Impact Investors LP |

|

GHI |

|

New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 1.01 Entry into a Material Definitive Agreement.

Fifth Amendment to Credit Agreement

On March 4, 2024, Greystone Housing Impact Investors LP (the “Partnership”) entered into a Fifth Amendment to Credit Agreement (the “Fifth Amendment”), with BankUnited, N.A. and Bankers Trust Company (collectively, the “Lenders”), and the sole lead arranger and administrative agent, BankUnited, N.A. (the “Administrative Agent”) which modifies certain provisions of the Credit Agreement dated June 11, 2021, as amended by the First Amendment to Credit Agreement dated November 30, 2021 (the “First Amendment”), the Second Amendment to Credit Agreement dated June 9, 2023 (the “Second Amendment”), the Third Amendment to Credit Agreement dated July 11, 2023 (the “Third Amendment”), and the Fourth Amendment to Credit Agreement dated September 19, 2023 (the “Fourth Amendment”, and collectively with the Credit Agreement, the First Amendment, the Second Amendment, the Third Amendment and the Fifth Amendment, the “Amended Credit Agreement”). In connection with the Fifth Amendment, the Partnership executed a Promissory Note payable to the order of NexBank with an original principal amount of up to $10,000,000 (the “Note”).

The material amendment to the Amended Credit Agreement accomplished by the Fifth Amendment was the addition of NexBank’s commitment of up to $10.0 million, which brings the total maximum commitment of all lenders under the Amended Credit Agreement to $50.0 million.

The Partnership paid to NexBank a commitment fee totaling $25,000 at closing. In addition, the Partnership paid to the Administrative Agent a $15,000 arrangement fee at closing.

The foregoing descriptions of the Fifth Amendment and the Note are a summary and are qualified in its entirety by reference to the full text of the Fifth Amendment and the Note, copies of which are attached as Exhibit 10.1 and Exhibit 10.2 to this Current Report on Form 8-K, respectively, and incorporated by reference herein.

In addition, the full text of the Credit Agreement, which was attached as Exhibit 10.1 to the Current Report on Form 8-K filed by the Partnership with the Securities and Exchange Commission (“SEC”) on June 14, 2021; the First Amendment, which was attached as Exhibit 10.1 to the Current Report on Form 8-K filed by the Partnership with the SEC on December 6, 2021; the Second Amendment, which was attached as Exhibit 10.1 to the Current Report on Form 8-K filed by the Partnership with the SEC on June 15, 2023; the Third Amendment, which was attached as Exhibit 10.1 to the Current Report on Form 8-K filed by the Partnership with the SEC on July 17, 2023; and the Fourth Amendment, which was attached as Exhibit 10.1 to the Current Report on Form 8-K filed by the Partnership with the SEC on September 22, 2023, are incorporated by reference herein.

Item 2.03 Creation of a Direct Financial Obligation or an Obligation under an Off-Balance Sheet Arrangement of a Registrant.

The information included in Item 1.01 above is incorporated by reference into this Item 2.03.

Forward-Looking Statements

Information contained in this Current Report on Form 8-K contains “forward-looking statements,” including but not limited to statements related to the Amended Credit Agreement, Note, related guaranty, and use of the financing proceeds, which are based on current expectations, forecasts, and assumptions that involve risks and uncertainties that could cause actual outcomes and results to differ materially. These risks and uncertainties include, but are not limited to, risks involving fluctuations in short-term interest rates, collateral valuations, bond investment valuations, current maturities of our financing arrangements and our ability to renew or refinance such maturities, and overall economic and credit market conditions. For a further list and description of such risks, see the reports and other filings made by the Partnership with the Securities and Exchange Commission, including its Annual Report on Form 10-K for the year ended December 31, 2023. The Partnership disclaims any intention or obligation to update or revise any forward-looking statements, whether as a result of new information, future events, or otherwise.

Item 9.01 Financial Statements and Exhibits.

(a) Not applicable.

(b) Not applicable.

(c) Not applicable.

(d) Exhibits.

|

|

|

Exhibit Number |

|

Description |

10.1 |

|

Fifth Amendment to Credit Agreement dated March 4, 2024 between Greystone Housing Impact Investors LP, the Lenders, and BankUnited, N.A., as Administrative Agent. |

10.2 |

|

Note dated March 4, 2024 between Greystone Housing Impact Investors LP and payable to NexBank. |

10.3 |

|

Credit Agreement dated June 11, 2021 between America First Multifamily Investors, L.P. (now known as Greystone Housing Impact Investors LP), the Lenders, and BankUnited, N.A., as Administrative Agent (incorporated herein by reference to Exhibit 10.1 to Form 8-K (No. 000-24843), filed by the Partnership on June 14, 2021). |

10.4 |

|

First Amendment to Credit Agreement dated November 30, 2021 between America First Multifamily Investors, L.P. (now known as Greystone Housing Impact Investors LP), the Lenders, and BankUnited, N.A., as Administrative Agent (incorporated herein by reference to Exhibit 10.1 to Form 8-K (No. 000-24843), filed by the Partnership on December 6, 2021). |

10.5 |

|

Second Amendment to Credit Agreement dated June 9, 2023 between Greystone Housing Impact Investors LP, the Lenders, and BankUnited, N.A., as Administrative Agent (incorporated herein by reference to Exhibit 10.1 to Form 8-K (No. 001-41564), filed by the Partnership on June 15, 2023). |

10.6 |

|

Third Amendment to Credit Agreement dated July 11, 2023 between Greystone Housing Impact Investors LP, the Lenders, and BankUnited, N.A., as Administrative Agent (incorporated herein by reference to Exhibit 10.1 to Form 8-K (No. 001-41564), filed by the Partnership on July 17, 2023). |

10.7 |

|

Fourth Amendment to Credit Agreement dated September 19, 2023 between Greystone Housing Impact Investors LP, the Lenders, and BankUnited, N.A., as Administrative Agent. (incorporated herein by reference to Exhibit 10.1 to Form 8-K (No. 001-41564), filed by the Partnership on September 22, 2023). |

99.1 |

|

Press release dated March 6, 2024. |

104 |

|

Cover Page Interactive Data File (embedded within the Inline XBRL document) |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned thereunto duly authorized.

|

|

|

|

|

|

|

Greystone Housing Impact Investors LP |

|

|

|

|

Date: |

March 6, 2024 |

By: |

/s/ Jesse A. Coury |

|

|

|

Printed: Jesse A. Coury

Title: Chief Financial Officer |

FIFTH AMENDMENT TO CREDIT AGREEMENT

This FIFTH AMENDMENT TO CREDIT AGREEMENT (this “Amendment”), with an effective date of March 4, 2024 (the “Effective Date”), is entered into by and among GREYSTONE HOUSING IMPACT INVESTORS LP, a Delaware limited partnership (“Borrower”), the Lenders signatory hereto, and BANKUNITED, N.A., a national banking association, as administrative agent for the Lenders (together with its successors and assigns in such capacity and any replacement administrative agent, "Administrative Agent").

WHEREAS, Borrower (f/k/a AMERICA FIRST MULTIFAMILY INVESTORS, L.P.), Administrative Agent, and Lenders entered into that certain Credit Agreement dated as of June 11, 2021, as amended by that certain First Amendment to Credit Agreement dated as of November 30, 2021, as further amended by that certain Second Amendment to Credit Agreement dated as of June 9, 2023, as further amended by that certain Third Amendment to Credit Agreement dated as of July 11, 2023, as further amended by that certain Fourth Amendment to Credit Agreement dated as of September 19, 2023 (as further amended hereby and as may be further amended, restated, supplemented or otherwise modified from time to time, the “Credit Agreement”).

WHEREAS, Borrower has requested, and Administrative Agent and Lenders have agreed to amend the terms and conditions of the Credit Agreement, pursuant to Section 10.15 of the Credit Agreement, as set forth in this Amendment. Except as expressly modified hereby, the terms of the Credit Agreement remain in full force and effect.

NOW, THEREFORE, in consideration of the foregoing premises, and promises and mutual agreements herein contained and for other valuable consideration, the receipt and sufficiency of which is hereby acknowledged, the parties hereto, intending to be legally bound, hereby agree as follows:

Section 1. Incorporation. The foregoing recitals are incorporated herein by this reference.

Section 2. Definitions. Capitalized terms used herein and not otherwise defined herein shall have the meanings assigned to such terms in the Credit Agreement and the rules of interpretation set forth in Section 1.4 of the Credit Agreement shall apply herein as if fully set forth herein, mutatis mutandis.

Section 3. Amendments to the Credit Agreement. As of the Effective Date (as defined above):

3.1.The following definition set forth in Section 1.1 of the Credit Agreement is hereby amended and restated in its entirety to read as follows:

“Lender” means each Person listed on the signature pages hereto as a Lender, and any other Person that becomes a party hereto as a Lender pursuant to an Assignment and Assumption Agreement or a Joinder Agreement.

3.2.Schedule 1 to the Credit Agreement is hereby deleted in its entirety and replaced with Schedule 1 in the form attached hereto and incorporated herein as Annex A.

Section 4. Conditions Precedent. This Amendment shall become effective on the Effective Date, provided that Administrative Agent shall have received (each in form and substance reasonably satisfactory to Administrative Agent):

(a)an executed counterpart (or counterparts) of this Amendment, from each of the parties hereto;

(b)that certain Lender Joinder Agreement by and among the parties thereto, duly executed and delivered by the Borrower;

(c)the Note reflecting the Incremental Commitment, duly executed by the Borrower;

(d)the Fee Letter, duly executed by the Borrower and NexBank;

(e)a new or updated Beneficial Ownership Certification, as applicable, from the Borrower, if so requested by the Administrative Agent prior to the Effective Date;

(f)payment of all fees, costs and expenses due and payable on or prior to the Effective Date, including the fees due and payable as set forth in each Fee Letter and, to the extent invoiced, the reasonable and documented fees, charges and disbursements of counsel for Administrative Agent in connection with the preparation, execution, and delivery of this Amendment and related documents; and

(g)evidence that all conditions set forth in Section 2.11 of the Credit Agreement have been satisfied.

5.1.Borrower HEREBY ACKNOWLEDGES THAT, ON THE DATE HEREOF, IT HAS NO DEFENSE, COUNTERCLAIM, OFFSET, CROSS-COMPLAINT, CLAIM OR DEMAND OF ANY KIND OR NATURE WHATSOEVER THAT CAN BE ASSERTED TO REDUCE OR ELIMINATE ALL OR ANY PART OF THE BORROWER’S OBLIGATIONS UNDER THE LOAN DOCUMENTS (INCLUDING THE EXPRESS OBLIGATION TO REPAY THE OBLIGATIONS OF THE BORROWER TO THE Administrative AGENT AND THE LENDERS) OR TO SEEK AFFIRMATIVE RELIEF OR DAMAGES OF ANY KIND OR NATURE FROM THE Administrative AGENT OR ANY LENDER OR ANY OF THEIR RESPECTIVE AFFILIATES, PARTICIPANTS, DIRECTORS, PARTNERS, MANAGERS, OFFICERS, AGENTS, EMPLOYEES, OR ATTORNEYS. BORROWER, FOR AND ON BEHALF OF ITSELF AND ALL PERSONS AND/OR ENTITIES CLAIMING BY, THROUGH AND/OR UNDER BORROWER INCLUDING, BUT NOT LIMITED TO, ALL OF ITS PAST AND PRESENT DIRECTORS, SHAREHOLDERS, OFFICERS, EMPLOYEES, ATTORNEYS, ACCOUNTANTS, ADMINISTRATORS, AGENTS, SUBSIDIARIES, AFFILIATES, REPRESENTATIVES, PREDECESSORS, SUCCESSORS AND ASSIGNS (COLLECTIVELY REFERRED TO HEREIN, JOINTLY AND SEVERALLY, AS THE “RELEASORS”) HEREBY

VOLUNTARILY, UNCONDITIONALLY AND KNOWINGLY RELEASES AND FOREVER DISCHARGES THE Administrative AGENT AND EACH OF THE LENDERS AND THEIR RESPECTIVE PAST AND PRESENT DIRECTORS, SHAREHOLDERS, OFFICERS, EMPLOYEES, ATTORNEYS, ACCOUNTANTS, ADMINISTRATORS, AGENTS, PARENT CORPORATIONS, SUBSIDIARIES, AFFILIATES, REPRESENTATIVES, PREDECESSORS, SUCCESSORS, ASSIGNS (COLLECTIVELY REFERRED TO HEREIN AS THE “RELEASEES”), OF, FROM AND WITH RESPECT TO ANY AND ALL GRIEVANCES, DISPUTES, MANNER OF ACTIONS, CAUSES OF ACTION, SUITS, OBLIGATIONS, LIABILITIES, LOSSES, DEBTS, DAMAGES, DUES, SUMS OF MONEY, ACCOUNTS, RECKONINGS, CONTROVERSIES, AGREEMENTS, CLAIMS, DEMANDS, COUNTERCLAIMS AND CROSSCLAIMS, INCLUDING, BUT NOT LIMITED TO ALL CLAIMS AND CAUSES OF ACTION ARISING OUT OF OR RELATED TO THE LOAN DOCUMENTS AND/OR ALL TRANSACTIONS RELATED THERETO, WHETHER KNOWN OR UNKNOWN, ANTICIPATED OR UNANTICIPATED, DIRECT, INDIRECT OR CONTINGENT, ARISING IN LAW OR EQUITY, WHICH THE RELEASORS (OR ANY OF THEM) EVER HAD, NOW HAVE, OR MAY EVER HAVE AGAINST ANY ONE OR MORE OF THE RELEASEES, FROM THE BEGINNING OF TIME THROUGH THE DATE THIS AMENDMENT IS EXECUTED AND DELIVERED.

5.2.BORROWER HEREBY COVENANTS AND AGREES NEVER TO INSTITUTE ANY ACTION OR SUIT AT LAW OR IN EQUITY, NOR INSTITUTE, PROSECUTE, OR IN ANYWAY AID IN THE INSTITUTION OR PROSECUTION OF ANY CLAIM, ACTION OR CAUSE OF ACTION, RIGHTS TO RECOVER DEBTS OR DEMANDS OF ANY NATURE ORIGINATED ON OR BEFORE THE DATE THIS AMENDMENT IS EXECUTED AGAINST THE Administrative AGENT OR ANY OF THE LENDERS OR ANY OF THEIR RESPECTIVE AFFILIATES, PARTICIPANTS, DIRECTORS, PARTNERS, MANAGERS, OFFICERS, AGENTS, EMPLOYEES OR ATTORNEYS ARISING OUT OF OR RELATED TO THE AGENT OR ANY LENDER'S ACTIONS, OMISSIONS, STATEMENTS, REQUESTS OR DEMANDS IN ADMINISTERING, ENFORCING, MONITORING, COLLECTION OR ATTEMPTING TO COLLECT THE INDEBTEDNESS OR OBLIGATIONS OF THE BORROWER UNDER THE LOAN DOCUMENTS.

Section 6. Miscellaneous.

6.1.Amendment is a “Loan Document”. This Amendment is a Loan Document and all references to a “Loan Document” in the Credit Agreement and the other Loan Documents (including, without limitation, all such references in the representations and warranties in the Credit Agreement and the other Loan Documents) shall be deemed to include this Amendment.

6.2.References to the Credit Agreement. Upon the Effective Date, each reference in the Credit Agreement (and in the exhibits to the Credit Agreement) to “this Agreement”, “hereunder”, “hereof”, “herein”, or words of like import shall mean and be a reference to the Credit Agreement (including the exhibits thereto) as amended hereby, and each reference to the Credit Agreement (including the exhibits thereto) in any other document, instrument or agreement executed and/or delivered in connection with the Credit Agreement shall mean and be a reference to the Credit Agreement (and the exhibits thereto) as amended hereby.

6.3.Representations and Warranties. To induce Administrative Agent and Lenders to enter into this Amendment and as partial consideration for the terms and conditions contained herein, Borrower hereby represents and warrants that (i) this Amendment is the legal and binding obligation of such Person, enforceable against such Person in accordance with its terms, (ii) upon the Effective Date (both before and after giving effect to this Amendment), no Event of Default or Default has occurred and is continuing, and (iii) the representations and warranties set forth in the Loan Documents are true and correct in all material respects (other than those representations and warranties that are expressly qualified by a material adverse change or other materiality, in which case such representations and warranties shall be true and correct in all respects) on and as of the Effective Date to the same extent as though made on and as of that date (except to the extent that such representations and warranties expressly relate to an earlier or other specific date, in which case they shall be true and correct as of such earlier date). Borrower further represents and warrants that it has the requisite power and authority to execute, deliver and perform this Amendment, and that the undersigned officer of Borrower is duly authorized to execute this Amendment.

6.4.Reaffirmation of Credit Agreement and Loan Documents. By executing this Amendment, Borrower (a) acknowledges that, notwithstanding the execution and delivery of this Amendment, and except as expressly modified above, the obligations of each under each of the other Loan Documents to which Borrower is a party are not impaired or adversely affected and each of the Loan Documents continues in full force and effect, (b) affirms and ratifies the Credit Agreement and each other Loan Document to which it is a party with respect to all of the Obligations as expanded, extended, modified or amended hereby and (c) reaffirms the security interests, liens, mortgages and conveyances it has granted to or made in favor of Administrative Agent for the benefit of the Lenders in or pursuant to the Loan Documents and confirms that such security interests, liens, mortgages and conveyances continue to secure the Obligations, after giving effect to this Amendment. This Amendment is not intended to and shall not constitute a novation of the Credit Agreement or any other Loan Document.

6.5.No Other Changes. Except as specifically amended by this Amendment, the Credit Agreement and all other documents, instruments and agreements executed and/or delivered in connection therewith shall remain in full force and effect and are hereby ratified and confirmed.

6.6.No Waiver. The execution, delivery and effectiveness of this Amendment shall not operate as a waiver of any right, power or remedy of Administrative Agent or any Lender under the Credit Agreement or any other document, instrument or agreement executed in connection therewith, nor constitute a waiver of any provision contained therein, except as specifically set forth herein.

6.7.Governing Law. This Amendment, and any claims, controversy, dispute or cause of action (whether in contract or tort or otherwise) based upon, arising out of or relating to this Amendment and the transactions contemplated hereby and thereby shall be governed by, and construed in accordance with, the laws of the State of New York without regard to the conflict of law rules thereof other than Sections 5-1401 and 5-1402 of The New York General Obligations Law.

6.8.Cooperation; Other Documents. At all times following the execution of this Amendment, Borrower shall execute and deliver to Administrative Agent, or shall cause to be

executed and delivered to Administrative Agent, and shall do or cause to be done all such other acts and things as Administrative Agent may reasonably deem to be necessary or desirable to assure Administrative Agent and the Lenders of the benefit of this Amendment and the documents comprising or relating to this Amendment.

6.9.Integration. This Amendment and all documents and instruments executed in connection herewith or otherwise relating to this Amendment, including, without limitation, the Loan Documents, constitute the sole agreement of the parties with respect to the subject matter hereof and thereof and supersede all oral negotiations and prior writings with respect to the subject matter hereof and thereof.

6.10.Successors and Assigns. This Amendment and the other Loan Documents: (a) shall be binding upon Administrative Agent, Lenders and Borrower and upon their respective officers, directors, employees, agents, trustees, representatives, nominees, parent corporation, subsidiaries, heirs, executors, administrators, successors or assigns, and (b) shall inure to the benefit of Administrative Agent, Lenders and Borrower and their respective permitted successors and assigns, provided, however, that Borrower may not assign any rights hereunder or any interest herein without obtaining the prior written consent of Lenders, and any such assignment or attempted assignment shall be void and of no effect with respect to Lenders.

6.11.Headings. Section headings used herein are for convenience of reference only, and shall not affect the construction of, or be taken into consideration in interpreting, this Amendment.

6.12.Multiple Counterparts. This Amendment may be executed in any number of counterparts, each of which when so executed and delivered shall be deemed an original, but all such counterparts together shall constitute but one and the same instrument. The words “execution,” “signed,” “signature,” and words of like import in this Amendment shall be deemed to include electronic signatures or the keeping of records in electronic form, each of which shall be of the same legal effect, validity or enforceability as a manually executed signature or the use of a paper-based recordkeeping system, as the case may be, to the extent and as provided for in any applicable law, including the Federal Electronic Signatures in Global and National Commerce Act, or any other similar state laws based on the Uniform Electronic Transactions Act, provided that nothing herein shall require Administrative Agent or any Lender to accept electronic signatures in any form or format without its prior written consent. Administrative Agent and Lenders each reserves the right to request manually executed counterparts of this Amendment and the other Loan Documents at its discretion.

REMAINDER OF PAGE INTENTIONALLY LEFT BLANK

SIGNATURE PAGE FOLLOWS.

IN WITNESS WHEREOF, the parties hereto have caused this Amendment to be duly executed as of the day and year first above written.

BORROWER:

GREYSTONE HOUSING IMPACT INVESTORS LP

By: America First Capital Associates Limited Partnership Two, its general partner

By: Greystone AF Manager LLC, its

general partner

By: /s/ Lisa Schwartz

Name: Lisa Schwartz

Title: Vice President

ADMINISTRATIVE AGENT AND LENDER:

BANKUNITED, N.A.

By: /s/ David Jeddah

Name: David Jeddah

Title: Vice President

LENDERS:

BANKERS TRUST COMPANY

By: /s/ Scott Leighton

Name: Scott Leighton

Title: Senior Vice President

NEXBANK

By:/s/ Kevin Olding

Name: Kevin Olding

Title: SVP - Executive Credit Officer

Signature Page to Fifth Amendment to Credit Agreement

ANNEX A

SCHEDULE 1

Commitments

|

|

|

Lender |

Commitment |

Proportionate Share of Total Commitments |

BankUnited, N.A. |

$30,000,000.00 |

60% |

Bankers Trust Company |

$10,000,000.00 |

20% |

NexBank |

$10,000,000.00 |

20% |

Total |

$50,000,000.00 |

100% |

NOTE

$10,000,000.00 New York, New York

FOR VALUE RECEIVED, GREYSTONE HOUSING IMPACT INVESTORS LP, a Delaware limited partnership (“Borrower”), unconditionally promises to pay to NEXBANK, as a Lender under the Credit Agreement defined below (“Payee”) or its registered assigns, the principal amount of TEN MILLION AND NO/100 DOLLARS ($10,000,000.00), or such lesser principal sum as may then be owed by Borrower to Payee hereunder.

Borrower also promises to pay interest on the unpaid principal amount hereof, from the date hereof until paid in full, at the rates and at the times which shall be determined in accordance with the provisions of the Credit Agreement, dated as of June 11, 2021 (as amended, restated, replaced, supplemented or otherwise modified from time to time, the “Credit Agreement”), among Borrower (f/k/a America First Multifamily Investors, L.P.), the Lenders party thereto from time to time and BankUnited, N.A., as Administrative Agent. Capitalized terms not defined herein shall have the meanings assigned to such terms in the Credit Agreement and the rules of interpretation set forth in Section 1.4 of the Credit Agreement shall apply herein as if fully set forth herein, mutatis mutandis.

Borrower shall repay the principal amount of this Note as set forth in the Credit Agreement.

This Note has been executed and delivered pursuant to the Credit Agreement and is the “Note” referred to in the Credit Agreement. The holder of this Note is entitled to the benefits provided in the Credit Agreement, to which reference is hereby made for a more complete statement of the terms and conditions under which the Loan evidenced hereby was made and is to be repaid.

All payments of principal and interest in respect of this Note shall be made via wire transfer in Dollars in same day funds to such location or bank account as shall be designated in writing for such purpose in accordance with the terms of the Credit Agreement. Payee hereby agrees, by its acceptance hereof, that before disposing of this Note or any part hereof, it will make a notation hereon of all principal payments previously made hereunder and of the date to which interest hereon has been paid; provided that the failure to make a notation of any payment made on this Note, or any error in such notation, shall not limit or otherwise affect the obligations of Borrower hereunder with respect to payments of principal of or interest on this Note.

This Note is subject to mandatory prepayment and to voluntary prepayment at the option of Borrower, each as provided in the Credit Agreement.

THIS NOTE, INCLUDING MATTERS OF CONSTRUCTION, VALIDITY, PERFORMANCE AND THE OBLIGATIONS ARISING HEREUNDER, AND ANY AND ALL CLAIMS RELATING TO OR ARISING OUT OF THIS NOTE OR THE BREACH THEREOF, WHETHER SOUNDING IN CONTRACT, TORT OR OTHERWISE, IN EACH CASE SHALL BE GOVERNED BY, AND CONSTRUED IN ACCORDANCE WITH, THE LAWS OF THE STATE OF NEW YORK WITHOUT REGARD TO PRINCIPLES OF CONFLICT OF LAWS OR CHOICE OF LAWS.

Upon the occurrence of any Event of Default, the unpaid balance of the principal amount of this Note, together with all accrued and unpaid interest thereon, may become, or may be declared to be, due and payable in the manner, upon the conditions and with the effect provided in the Credit Agreement.

The terms of this Note are subject to amendment only in the manner provided in the Credit Agreement.

No reference herein to the Credit Agreement and no provision of this Note or the Credit Agreement shall alter or impair the obligations of Borrower, which are absolute and unconditional, to pay the principal of and interest on this Note at the place, at the respective times, and in U.S. Dollars.

Borrower promises to pay all costs and expenses, including the attorneys’ fees of any external legal counsel for Payee and the Administrative Agent, all as provided in the Credit Agreement, incurred in the collection and enforcement of this Note.

Borrower and all sureties, endorsers, guarantors and other parties ever liable for payment of any sums payable pursuant to this Note hereby consent to renewals and extensions of time at or after the maturity hereof, without notice, and hereby waive diligence, presentment, protest, demand, notice of every kind, notice of acceleration, notice of intent to accelerate, the bringing of suit against any party, and any notice of or defense on account of any extensions, renewals, partial payment or any releases or substitutions of any security, or any delay, indulgence or other act of any trustee of any holder hereof, whether before or after the Maturity Date and, to the fullest extent permitted by law, the right to plead any statute of limitations as a defense to any demand hereunder.

[Remainder of page intentionally left blank.]

IN WITNESS WHEREOF, Borrower has caused this Note to be duly executed and delivered by its officer thereunto duly authorized as of the date and at the place first written above.

|

GREYSTONE HOUSING IMPACT INVESTORS LP

By: America First Capital Associates Limited

Partnership Two, its general partner By: Greystone AF Manager LLC, its general partner By: /s/ Lisa Schwartz

Name: Lisa Schwartz

Title: Vice President |

Signature Page to Note (NexBank)

Exhibit 99.1

|

|

PRESS RELEASE |

FOR IMMEDIATE RELEASE |

|

Omaha, Nebraska |

March 6, 2024

MEDIA CONTACT:

Karen Marotta

Greystone

212-896-9149

Karen.Marotta@greyco.com

INVESTOR CONTACT:

Andy Grier

Senior Vice President

402-952-1235

Greystone Housing Impact Investors LP Increases Line of Credit to $50 Million

OMAHA, Nebraska -- Greystone Housing Impact Investors LP (NYSE: GHI) (the “Partnership”) announced today that on March 4, 2024, it closed on a $10 million increase in the maximum available commitment of its secured revolving Line of Credit facility (“LOC”) to up to $50 million. The additional $10 million commitment was provided by a new lender to the Partnership. BankUnited N.A. serves as sole arranger and administrative agent. The LOC is secured by the Partnership’s joint venture equity investments. An affiliate of the Partnership’s general partner provides a deficiency guaranty for the facility.

“The increase in LOC commitment provided by a new lender further enhances our available liquidity and demonstrates the Partnership’s ability to obtain additional credit from lenders,” said Kenneth C. Rogozinski, Chief Executive Officer of the Partnership.

About Greystone Housing Impact Investors LP

Greystone Housing Impact Investors LP was formed in 1998 under the Delaware Revised Uniform Limited Partnership Act for the primary purpose of acquiring, holding, selling and otherwise dealing with a portfolio of mortgage revenue bonds which have been issued to provide construction and/or permanent financing for affordable multifamily, seniors and student housing properties. The Partnership is pursuing a business strategy of acquiring additional mortgage revenue bonds and other investments on a leveraged basis. The Partnership expects and believes the interest earned on these mortgage revenue bonds is excludable from gross income for federal income tax purposes. The Partnership seeks to achieve its investment growth strategy by investing in additional mortgage revenue bonds and other investments as permitted by its Second Amended and Restated Limited Partnership Agreement, dated December 5, 2022, taking advantage of attractive financing structures available in the securities market, and entering into interest rate risk management instruments. Greystone Housing Impact Investors LP press releases are available at www.ghiinvestors.com.

Safe Harbor Statement

Information contained in this press release contains “forward-looking statements,” which are based on current expectations, forecasts and assumptions that involve risks and uncertainties that could cause actual outcomes and results to differ materially. These risks and uncertainties include, but are not limited to, risks involving current maturities of our financing arrangements and our ability to renew or refinance such maturities, fluctuations in short-term interest rates, collateral valuations, mortgage revenue bond investment valuations and overall economic and credit market conditions. For a further list and description of such risks, see the reports and other filings made by the Partnership with the Securities and Exchange Commission, including but not limited to, its Annual Report on Form 10-K, Quarterly Reports on Form 10-Q, and Current Reports on Form 8-K. Readers are urged to consider these factors carefully in evaluating the forward-looking statements. The Partnership disclaims any intention or obligation to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise.

v3.24.0.1

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

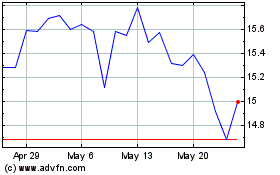

Greystone Housing Impact... (NYSE:GHI)

Historical Stock Chart

From Apr 2024 to May 2024

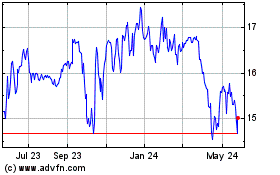

Greystone Housing Impact... (NYSE:GHI)

Historical Stock Chart

From May 2023 to May 2024