As filed with the Securities and Exchange Commission on November 16, 2023

Registration No. 333-

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

FORM S-8

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

Expro Group Holdings N.V.

(Exact name of registrant as specified in its charter)

| |

|

|

The Netherlands

|

98-1107145

|

|

(State or Other Jurisdiction of

Incorporation or Organization)

|

(I.R.S. Employer

Identification No.)

|

1311 Broadfield Blvd., Suite 400

Houston, TX 77084

(Address of Principal Executive Offices, Zip Code)

EXPRO GROUP HOLDINGS N.V. 2023 EMPLOYEE STOCK PURCHASE PLAN

(Full title of the plan)

John McAlister

General Counsel

Expro Group Holdings N.V.

1311 Broadfield Blvd., Suite 400

Houston, TX 77084

(713) 463-9776

(Name, address, including zip code, and telephone number, including area code, of agent for service)

Copy to:

Megan Foscaldi

Locke Lord LLP

111 Huntington Ave

Boston, MA 02199

(617) 239-0282

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer”, “smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

|

Large accelerated filer

|

☒

|

Accelerated filer

|

☐

|

| |

|

|

|

|

Non-accelerated filer

|

☐

|

Smaller reporting company

|

☐

|

| |

|

|

|

| |

|

Emerging growth company

|

☐

|

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of the Securities Act. ☐

PART I

INFORMATION REQUIRED IN THE SECTION 10(a) PROSPECTUS

|

Items 1 and 2.

|

Plan Information and Registrant Information and Employee Plan Annual Information.

|

The documents containing the information specified in Part I of Form S-8 will be delivered to employees as specified by Rule 428(b)(1) of the Securities Act 1933, as amended (the “Securities Act”). In accordance with the instructions to Part I of Form S-8, such documents are not being filed with the Securities and Exchange Commission (the “Commission”) either as part of this Registration Statement or as prospectuses or prospectus supplements pursuant to Rule 424 of the Securities Act. Such documents and the documents incorporated by reference in this Registration Statement pursuant to Item 3 of Part II of Form S-8, taken together, constitute a prospectus that meets the requirements of Section 10(a) of the Securities Act.

PART II

INFORMATION REQUIRED IN THE REGISTRATION STATEMENT

|

Item 3.

|

Incorporation of Documents by Reference.

|

The following documents, which have heretofore been filed by the Registrant with the Commission pursuant to the Securities Act and pursuant to the Securities Exchange Act of 1934, as amended (the “Exchange Act”), are incorporated by reference herein and shall be deemed to be a part hereof:

| |

●

|

The Registrant’s Annual Report on Form 10-K for the fiscal year ended December 31, 2022, filed on February 23, 2023, including information specifically incorporated by reference into such Annual Report on Form 10-K from our Definitive Proxy Statement on Schedule 14A for our 2023 Annual General Meeting of Shareholders filed on March 31, 2023;

|

| |

●

|

The Registrant’s Quarterly Reports on Form 10-Q for the fiscal quarters ended March 31, 2023, June 30, 2023 and September 30, 2023, filed on May 4, 2023, July 27, 2023, and October 26, 2023, respectively;

|

| |

●

|

The Registrant’s Current Reports on Form 8-K filed on January 12, 2023, January 18, 2023, March 27, 2023, April 26, 2023, May 25, 2023 and October 11, 2023; and

|

| |

●

|

The Description of Registrant’s Securities contained on Exhibit 4.1 to the Registrant’s Annual Report on Form 10-K for the fiscal year ended December 31, 2022, filed on February 23, 2023, including any amendments or reports filed for the purpose of updating such description.

|

In addition, all documents subsequently filed by the Registrant with the Commission pursuant to Sections 13(a), 13(c), 14 and 15(d) of the Exchange Act, prior to the filing of a post-effective amendment to this Registration Statement which indicate that all securities offered hereby have been sold or which deregister all securities remaining unsold, shall be deemed to be incorporated by reference in this Registration Statement and to be a part hereof from the date of filing of such documents. Notwithstanding the foregoing, unless specifically stated to the contrary, none of the information that the Registrant discloses under Items 2.02 or 7.01 of any Current Report on Form 8-K that it may from time to time furnish to the Commission will be incorporated by reference into, or otherwise included in, this Registration Statement.

Any statement, including financial statements, contained in a document incorporated or deemed to be incorporated by reference herein shall be deemed to be modified or superseded for purposes of this Registration Statement to the extent that a statement contained herein or therein or in any other subsequently filed document which also is or is deemed to be incorporated by reference herein modifies or supersedes such statement. Any such statement so modified or superseded shall not be deemed, except as so modified or superseded, to constitute a part of this Registration Statement.

|

Item 4.

|

Description of Securities.

|

Not applicable.

|

Item 5.

|

Interests of Named Experts and Counsel.

|

Not applicable.

|

Item 6.

|

Indemnification of Directors and Officers.

|

The Registrant’s articles of association provide that to the fullest extent permissible by law and subject to certain exceptions, the Registrant will indemnify, and reimburse and hold harmless, each of the Registrant’s current and former directors and officers (and, in the case of an officer or director that is not a natural person, its affiliates, shareholders, members, managers, directors, officers, partners, employees and agents) for any and all liabilities, claims, judgments, fines and penalties incurred by such indemnitee as a result of any expected, threatened, pending or completed action, investigation or other proceeding, whether civil, criminal or administrative in relation to any act or omission in or related to such indemnitee’s capacity as described above and any expenses (including reasonable attorneys’ fees and litigation costs) incurred by such indemnitee in connection with any of the foregoing. The articles of association also provide that the Registrant shall use all its reasonable endeavors to provide for, and shall bear the cost of, directors’ and officers’ liability insurance on behalf of the Registrant’s indemnitees.

The Registrant has also entered into individual indemnification agreements with each of its directors and certain executive officers. The agreements provide, to the fullest extent permitted by the Registrant’s amended and restated articles of association and the law of The Netherlands, that the Registrant will indemnify the directors and executive officers against any and all liabilities, claims, judgments, fines, penalties, interest and expenses, including attorneys’ fees, incurred in connection with any expected, threatened, pending or completed action, investigation or other proceeding, whether civil, criminal or administrative, involving a director or an executive officer by reason of his or her position as director or officer.

Under the Expro Group Holdings N.V. 2023 Employee Stock Purchase Plan (the “Plan”), members of the committee designated to administer the Plan and any officer or employee of the Registrant or any of its subsidiaries acting at the direction of or on behalf of such committee shall not be personally liable for any action or determination taken or made in good faith with respect to the Plan and shall, to the fullest extent permitted by law, be indemnified and held harmless by the Registrant with respect to any such action or determination.

|

Item 7.

|

Exemption from Registration Claimed.

|

Not applicable.

(a) The undersigned Registrant hereby undertakes:

1. To file, during any period in which offers or sales are being made, a post-effective amendment to this Registration Statement:

(i) To include any prospectus required by Section 10(a)(3) of the Securities Act;

(ii) To reflect in the prospectus any facts or events arising after the effective date of the Registration Statement (or the most recent post-effective amendment thereof) which, individually or in the aggregate, represent a fundamental change in the information set forth in the Registration Statement. Notwithstanding the foregoing, any increase or decrease in volume of securities offered (if the total dollar value of securities offered would not exceed that which was registered) and any deviation from the low or high end of the estimated maximum offering range may be reflected in the form of prospectus filed with the Commission pursuant to Rule 424(b) if, in the aggregate, the changes in volume and price represent no more than a 20 percent change in the maximum aggregate offering price set forth in the “Calculation of Registration Fee” table in the effective Registration Statement; and

(iii) To include any material information with respect to the plan of distribution not previously disclosed in the Registration Statement or any material change to such information in the Registration Statement;

provided, however, that paragraphs (a)(1)(i) and (a)(1)(ii) do not apply if the information required to be included in a post-effective amendment by those paragraphs is contained in periodic reports filed by the Registrant pursuant to Section 13 or Section 15(d) of the Exchange Act that are incorporated by reference in the Registration Statement.

2. That, for the purpose of determining any liability under the Securities Act, each such post-effective amendment shall be deemed to be a new registration statement relating to the securities offered therein, and the offering of such securities at that time shall be deemed to be the initial bona fide offering thereof.

3. To remove from registration by means of a post-effective amendment any of the securities being registered which remain unsold at the termination of the offering.

(b) The undersigned Registrant hereby undertakes that, for purposes of determining any liability under the Securities Act, each filing of the Registrant’s annual report pursuant to Section 13(a) or Section 15(d) of the Exchange Act (and, where applicable, each filing of an employee benefit plan’s annual report pursuant to Section 15(d) of the Exchange Act) that is incorporated by reference in the Registration Statement shall be deemed to be a new registration statement relating to the securities offered therein, and the offering of such securities at that time shall be deemed to be the initial bona fide offering thereof.

(c) Insofar as indemnification for liabilities arising under the Securities Act may be permitted to directors, officers and controlling persons of the Registrant pursuant to the foregoing provisions, or otherwise, the Registrant has been advised that in the opinion of the Commission such indemnification is against public policy as expressed in the Securities Act and is, therefore, unenforceable. In the event that a claim for indemnification against such liabilities (other than the payment by the Registrant of expenses incurred or paid by a director, officer or controlling person of the Registrant in the successful defense of any action, suit or proceeding) is asserted by such director, officer or controlling person in connection with the securities being registered, the Registrant will, unless in the opinion of its counsel the matter has been settled by controlling precedent, submit to a court of appropriate jurisdiction the question whether such indemnification by it is against public policy as expressed in the Securities Act and will be governed by the final adjudication of such issue.

SIGNATURES

Pursuant to the requirements of the Securities Act of 1933, the Registrant certifies that it has reasonable grounds to believe that it meets all of the requirements for filing on Form S-8 and has duly caused this Registration Statement to be signed on its behalf by the undersigned, thereunto duly authorized, in the City of Houston, Texas, on the 16th day of November 2023.

| |

|

EXPRO GROUP HOLDINGS N.V. |

| |

|

|

| |

|

|

|

By:

|

|

/s/ Michael Jardon |

|

Name:

|

|

Michael Jardon

|

|

Title:

|

|

Chief Executive Officer

|

POWER OF ATTORNEY

KNOW ALL PERSONS BY THESE PRESENTS, that each person whose signature appears below constitutes and appoints Michael Jardon, Quinn Fanning, John McAlister and Josh Hancock, and each of them, the individual’s true and lawful attorney-in-fact and agent, with full power of substitution and resubstitution, for him or her and in his or her name, place and stead, in any and all capacities, to sign any and all amendments, including post-effective amendments, to this Registration Statement, and any registration statement relating to the offering covered by this Registration Statement and filed pursuant to Rule 462(b) under the Securities Act of 1933, and to file the same, with exhibits thereto and other documents in connection therewith, with the Securities and Exchange Commission, granting unto said attorneys-in-fact and agents, and each of them, full power and authority to do and perform each and every act and thing requisite and necessary to be done, as fully to all intents and purposes as he or she might or could do in person, hereby ratifying and confirming all that each of said attorneys-in-fact and agents or their substitute or substitutes may lawfully do or cause to be done by virtue hereof.

Pursuant to the requirements of the Securities Act, this Registration Statement has been signed by the following persons in the capacities and on the date indicated.

|

Signature

|

|

Title

|

|

Date

|

| |

|

|

| |

|

|

| /s/ Michael Jardon |

|

Chief Executive Officer and Director |

|

November 16, 2023 |

|

Michael Jardon

|

|

(Principal Executive Officer)

|

|

|

| |

|

|

| |

|

|

| /s/ Quinn Fanning |

|

Chief Financial Officer |

|

November 16, 2023 |

|

Quinn Fanning

|

|

(Principal Financial Officer)

|

|

|

| |

|

|

| |

|

|

| /s/ Michael Bentham |

|

Principal Accounting Officer |

|

November 16, 2023 |

|

Michael Bentham

|

|

|

|

|

| |

|

|

|

|

| |

|

|

| /s/ Michael C. Kearney |

|

Chairman of the Board |

|

November 16, 2023 |

|

Michael C. Kearney

|

|

|

|

|

| |

|

|

|

|

| |

|

|

| /s/ Eitan Arbeter |

|

Director |

|

November 16, 2023 |

|

Eitan Arbeter

|

|

|

|

|

| |

|

|

| |

|

|

| /s/ Robert W. Drummond |

|

Director |

|

November 16, 2023 |

|

Robert W. Drummond

|

|

|

|

|

| /s/ Alan Schrager |

|

Director |

|

November 16, 2023 |

|

Alan Schrager

|

|

|

|

|

| |

|

|

| |

|

|

| /s/ Lisa L. Troe |

|

Director |

|

November 16, 2023 |

|

Lisa L. Troe

|

|

|

|

|

| |

|

|

|

|

| |

|

|

| /s/ Brian Truelove |

|

Director |

|

November 16, 2023 |

|

Brian Truelove

|

|

|

|

|

| |

|

|

|

|

| |

|

|

| /s/ Frances M. Vallejo |

|

Director |

|

November 16, 2023 |

|

Frances M. Vallejo

|

|

|

|

|

| |

|

|

|

|

| |

|

|

| /s/ Eileen G. Whelley |

|

Director |

|

November 16, 2023 |

|

Eileen G. Whelley

|

|

|

|

|

Exhibit 5.1

|

J.J. Viottastraat 52

1071 JT Amsterdam

The Netherlands

T +31 20 760 16 00

info@vancampenliem.com

www.vancampenliem.com

|

To: the Company

Amsterdam, 16 November 2023

Re: Legal opinion Form S-8

Dear Sirs,

You have requested us to render an opinion on matters of Dutch law in connection with the Registration Statement relating to the Plan Shares issuable under the Plan. This opinion letter is rendered to you in order to be filed with the SEC as an exhibit to the Registration Statement.

Capitalised terms used in this opinion letter have the meanings set forth in Exhibit A to this opinion letter. The section headings used in this opinion letter are for convenience of reference only and are not to affect its construction or to be taken into consideration in its interpretation.

This opinion letter is strictly limited to the matters stated in it and may not be read as extending by implication to any matters not specifically referred to in it. Nothing in this opinion letter should be taken as expressing an opinion in respect of any representations or warranties, or other information, contained in the Plan.

In rendering the opinions expressed in this opinion letter, we have reviewed and relied upon pdf copies, of the Plan and the Corporate Documents and we have assumed that Awards made or to be made under the Plan have been or shall be made for bona fide commercial reasons. We have not investigated or verified any factual matter disclosed to us in the course of our review.

This opinion letter sets out our opinion on certain matters of the laws with general applicability of the Netherlands, and, insofar as they are directly applicable in the Netherlands, of the European Union, as at today’s date and as presently interpreted under published authoritative case law of the Dutch courts, the General Court and the Court of Justice of the European Union. We do not express any opinion on Dutch or European competition law, data protection law, tax law, securitization law or regulatory law. No undertaking is assumed on our part to revise, update or amend this opinion letter in connection with or to notify or inform you of, any developments and/or changes of Dutch law subsequent to today’s date. We do not purport to opine on the consequences of amendments to the Plan or the Corporate Documents subsequent to the date of this opinion letter.

Van Campen Liem is the joint trade name of Liem & Partners N.V. and Van Campen & Partners N.V.

Liem & Partners N.V. has its statutory seat at Amsterdam, the Netherlands, and is registered with the Trade Register under number 54787882.

Van Campen & Partners N.V. has its statutory seat at Amsterdam, the Netherlands, and is registered with the Trade Register under number 54033500.

The opinions expressed in this opinion letter are to be construed and interpreted in accordance with Dutch law. The competent courts at Amsterdam, the Netherlands, have exclusive jurisdiction to settle any issues of interpretation or liability arising out of or in connection with this opinion letter. Any legal relationship arising out of or in connection with this opinion letter (whether contractual or non-contractual), including the above submission to jurisdiction, is governed by Dutch law and shall be subject to the general terms and conditions of Van Campen Liem. Any liability arising out of or in connection with this opinion letter shall be limited to the amount which is paid out under Van Campen Liem’s insurance policy in the matter concerned. No person other than Van Campen Liem may be held liable in connection with this opinion letter.

In this opinion letter, legal concepts are expressed in English terms. The Dutch legal concepts concerned may not be identical in meaning to the concepts described by the English terms as they exist under the law of other jurisdictions. In the event of a conflict or inconsistency, the relevant expression shall be deemed to refer only to the Dutch legal concepts described by the English terms.

For the purposes of this opinion letter, we have assumed that:

| |

a.

|

drafts of documents reviewed by us will be signed in the form of those drafts, each copy of a document conforms to the original, each original is authentic, and each signature is the genuine signature of the individual purported to have placed that signature;

|

| |

b.

|

if any signature under any document is an electronic signature (as opposed to a handwritten (“wet ink”) signature) only, it is either a qualified electronic signature within the meaning of the eIDAS Regulation, or the method used for signing is otherwise sufficiently reliable;

|

| |

c.

|

the Deed of Incorporation is a valid notarial deed, which has been executed on the basis of a valid declaration of no objection (verklaring van geen bezwaar) and a valid bank statement as referred to in (and issued in accordance with the requirements of) Section 2:93a DCC;

|

| |

d.

|

the Registration Statement has been declared effective by the SEC in the form reviewed by us;

|

1 These Standard Terms of Engagement were filed at the Court of Amsterdam on May 25, 2018 under number 50/2018.

| |

e.

|

the Current Articles are the Articles of Association currently in force and as they will be in force at each Relevant Moment;

|

| |

f.

|

at each Relevant Moment, the Company will not have (i) been dissolved (ontbonden), (ii) ceased to exist pursuant to a merger (fusie) or a division (splitsing), (iii) been converted (omgezet) into another legal form, either national or foreign, (iv) had its assets placed under administration (onder bewind gesteld), (v) been declared bankrupt (failliet verklaard), (vi) been granted a suspension of payments (surseance van betaling verleend), (vii) started or become subject to statutory proceedings for the restructuring of its debts (akkoordprocedure) or (viii) been made subject to similar proceedings in any jurisdiction or otherwise been limited in its power to dispose of its assets;

|

| |

g.

|

any offering of Awards, to the extent made in the Netherlands, has been, is and will be made in conformity with the Prospectus Regulation and the rules promulgated thereunder;

|

| |

h.

|

at each Relevant Moment, (i) the relevant Award(s) shall have been validly granted as a right to subscribe for Ordinary Shares (recht tot het nemen van aandelen) by the corporate body authorized to do so, (ii) shall be in full force and effect upon being exercised or settled, as applicable, (iii) shall have been validly exercised or settled, as applicable, in accordance with the terms and conditions applicable to such Award(s) and (iv) any pre-emption rights in respect of such Award(s) shall have been validly excluded by the corporate body authorized to do so;

|

| |

i.

|

at each Relevant Moment, each holder of the relevant Award(s) shall be an individual who has not (i) deceased, (ii) had his/her assets placed under administration (onder bewind gesteld), (iii) been declared bankrupt (failliet verklaard), (iv) been granted a suspension of payments (surseance van betaling verleend), (v) been subjected to a debt reorganization procedure (schuldsanering), (vi) started or become subject to statutory proceedings for the restructuring of his/her debts (akkoordprocedure) or (vii) been made subject to similar proceedings in any jurisdiction or otherwise been limited in the power to dispose of his/her assets; and

|

| |

j.

|

at each Relevant Moment, the authorised share capital (maatschappelijk kapitaal) of the Company shall allow for the grant of Awards and the issuance of Plan Shares pursuant to the exercise or settlement thereof, which issuance of the Plan Shares and any other future share issuance shall be in accordance within the limits of and in accordance with terms contained in the authorization granted by the general meeting of shareholders of the Company during the 2023 Annual Meeting (as part of which the management board of the Company is authorized to issue shares up to 20% of the issued share capital as of the date of the 2023 Annual Meeting, for any legal purpose, at the stock exchange or in a private purchase transaction, and during a period of 18 months starting from the date of the 2023 Annual Meeting).

|

Based upon and subject to the foregoing and subject to the qualifications set forth in this opinion letter and to any matters, documents or events not disclosed to us, we express the following opinions:

| |

|

Corporate Status |

| |

|

|

| |

1.

|

The Company has been duly incorporated and is validly existing as a naamloze vennootschap.

|

| |

|

Plan Shares |

| |

|

|

| |

2.

|

The Plan Shares are duly authorized, and subject to receipt by the Company of payment in full for, or other satisfaction of the issue price of, the Plan Shares in accordance with the Plan, and when issued and accepted in accordance with the Plan, the Plan Shares shall be validly issued, fully paid and non-assessable.

|

The opinions expressed above are subject to the following qualifications:

| |

A.

|

Opinion 1 must not be read to imply that the Company cannot be dissolved (ontbonden). A company such as the Company may be dissolved, inter alia by the competent court at the request of the company’s board of directors, any interested party (belanghebbende) or the public prosecution office in certain circumstances, such as when there are certain defects in the incorporation of the company. Any such dissolution will not have retro-active effect.

|

| |

B.

|

Pursuant to Section 2:7 DCC, any transaction entered into by a legal entity may be nullified by the legal entity itself or its liquidator in bankruptcy proceedings (curator) if the objects of that entity were transgressed by the transaction and the other party to the transaction knew or should have known this without independent investigation (wist of zonder eigen onderzoek moest weten). The Dutch Supreme Court (Hoge Raad der Nederlanden) has ruled that in determining whether the objects of a legal entity are transgressed, not only the description of the objects in that legal entity’s articles of association (statuten) is decisive, but all (relevant) circumstances must be taken into account, in particular whether the interests of the legal entity were served by the transaction. Based on the objects clause contained in the Current Articles, we have no reason to believe that, by making Awards under the Plan, the Company would transgress the description of the objects contained in its Articles of Association. However, we cannot assess whether there are other relevant circumstances that must be taken into account, in particular whether the interests of the Company are served by making Awards under the Plan since this is a matter of fact.

|

| |

C.

|

Pursuant to Section 2:98c DCC, a naamloze vennootschap may grant loans (leningen verstrekken) only in accordance with the restrictions set out in Section 2:98c DCC, and may not provide security (zekerheid stellen), give a price guarantee (koersgarantie geven) or otherwise bind itself, whether jointly and severally or otherwise with or for third parties (zich op andere wijze sterk maken of zich hoofdelijk of anderszins naast of voor anderen verbinden) with a view to (met het oog op) the subscription or acquisition by third parties of shares in its share capital or depository receipts. This prohibition also applies to its subsidiaries (dochtervennootschappen). It is generally assumed that a transaction entered into in violation of Section 2:98c DCC is null and void (nietig). Based on the content of the Plan, we have no reason to believe that the Company or its subsidiaries will violate Section 2:98c DCC in connection with the issue of Plan Shares. However, we cannot confirm this definitively, since the determination of whether a company (or a subsidiary) has provided security, has given a price guarantee or has otherwise bound itself, with a view to the subscription or acquisition by third parties of shares in its share capital or depository receipts, as described above, is a matter of fact.

|

| |

D.

|

The opinions expressed in this opinion letter may be limited or affected by:

|

| |

i.

|

rules relating to Insolvency Proceedings or similar proceedings under a foreign law and other rules affecting creditors’ rights generally;

|

| |

ii.

|

the provisions of fraudulent preference and fraudulent conveyance (Actio Pauliana) and similar rights available in other jurisdictions to insolvency practitioners and insolvency office holders in bankruptcy proceedings or creditors;

|

| |

iii.

|

claims based on tort (onrechtmatige daad);

|

| |

iv.

|

sanctions and measures, including but not limited to those concerning export control, pursuant to European Union regulations, under the Sanctions Act 1977 (Sanctiewet 1977) or other legislation;

|

| |

v.

|

the Anti-Boycott Regulation, Anti Money Laundering Laws and related legislation;

|

| |

vi.

|

any intervention, recovery or resolution measure by any regulatory or other authority or governmental body in relation to financial enterprises or their affiliated entities; and

|

| |

vii.

|

the rules of force majeure (niet toerekenbare tekortkoming), reasonableness and fairness (redelijkheid en billijkheid), suspension (opschorting), dissolution (ontbinding), unforeseen circumstances (onvoorziene omstandigheden) and vitiated consent (i.e., duress (bedreiging), fraud (bedrog), abuse of circumstances (misbruik van omstandigheden) and error (dwaling)) or a difference of intention (wil) and declaration (verklaring).

|

| |

E.

|

The term “non-assessable” has no equivalent in the Dutch language and for purposes of this opinion letter such term should be interpreted to mean that a holder of an Ordinary Share shall not by reason of merely being such a holder be subject to assessment or calls by the Company or its creditors for further payment on such Ordinary Share.

|

| |

F.

|

This opinion letter does not purport to express any opinion or view on the operational rules and procedures of any clearing or settlement system or agency.

|

We consent to the filing of this opinion letter as an exhibit to the Registration Statement. In giving this consent we do not admit or imply that we are a person whose consent is required under Section 7 of the United States Securities Act of 1933, as amended, or any rules and regulations promulgated thereunder.

Yours sincerely,

/s/ Van Campen Liem / Liem & Partners N.V.

Van Campen Liem / Liem & Partners N.V.

EXHIBIT A

LIST OF DEFINITIONS

|

“2023 Annual Meeting”

|

The annual meeting of shareholders of the Company on 24 May 2023.

|

| |

|

|

“Anti Money Laundering Laws”

|

The European Anti-Money Laundering Directives, as implemented in the Netherlands in the Money Laundering and Terrorist Financing Prevention Act (Wet ter voorkoming van witwassen en financieren van terrorisme) and the Dutch Criminal Code (Wetboek van Strafrecht).

|

| |

|

|

“Anti-Boycott Regulation”

|

The Council Regulation (EC) No 2271/96 of 22 November 1996 on protecting against the effects of the extra-territorial application of legislation adopted by a third country, and actions based thereon or resulting therefrom.

|

| |

|

|

“Articles of Association”

|

The Company’s articles of association (statuten) as they read from time to time.

|

| |

|

|

“Awards”

|

Rights to subscribe for Ordinary Shares pursuant to the terms and conditions of the relevant Plan.

|

| |

|

|

“Bankruptcy Code”

|

The Dutch Bankrupcty Code (Faillissementswet).

|

| |

|

|

“Commercial Register”

|

The Dutch Commercial Register (handelsregister).

|

| |

|

|

“Company”

|

Expro Group Holdings, N.V. (formerly named Frank’s International N.V.), a public company with limited liability (naamloze vennootschap), registered with the Commercial Register under number 34241787.

|

| |

|

|

“Corporate Documents”

|

The Deed of Incorporation, the Deed of Amendment, the Current Articles and the Registration Statement.

|

| |

|

|

“Current Articles”

|

The Articles of Association as they read immediately the execution of the Deed of Amendment.

|

| |

|

|

“DCC”

|

The Dutch Civil Code (Burgerlijk Wetboek).

|

| |

|

|

“Deed of Amendment”

|

The deed of amendment to the Articles of Association dated 1 October 2021.

|

| |

|

|

“Deed of Incorporation”

|

The Company’s deed of incorporation (akte van oprichting) dated 1 February 2006.

|

| |

|

|

“eIDAS Regulation”

|

Regulation (EU) No 910/2014 of the European Parliament and of the Council of 23 July 2014 on electronic identification and trust services for electronic transactions in the internal market and repealing Directive 1999/93/EC.

|

| |

|

|

“Insolvency Proceedings”

|

Any insolvency proceedings within the meaning of Regulation (EU) 2015/848 of the European Parliament and of the Council of 20 May 2015 on insolvency proceedings listed in Annex A thereto and any statutory proceedings for the restructuring of debts (akkoordprocedure) pursuant to the Bankruptcy Code.

|

|

“the Netherlands”

|

The European territory of the Kingdom of the Netherlands.

|

| |

|

|

“Offering”

|

The initial public offering of Ordinary Shares by the Company.

|

| |

|

|

“Ordinary Shares”

|

Ordinary shares in the Company’s capital, with a nominal value of EUR 0.06 each.

|

| |

|

|

“Plan”

|

The Expro Group Holdings N.V. 2023 Employee Stock Purchase Plan.

|

| |

|

|

“Plan Shares”

|

Up to 5,000,000 Ordinary Shares available for issuance under the Plan.

|

| |

|

|

“Prospectus Regulation”

|

Regulation (EU) 2017/1129 of the European Parliament and of the Council of 14 June 2017 on the prospectus to be published when securities are offered to the public or admitted to trading on a regulated market, and repealing Directive 2003/71/EC.

|

| |

|

|

“Registration Statement”

|

The Company’s registration statement on Form S-8 filed or to be filed with the SEC in connection with the Offering in the form reviewed by us.

|

| |

|

|

“Relevant Moment”

|

Each time when one or more Awards are granted or one or more Plan Shares are issued pursuant to the exercise or settlement of the relevant Award(s).

|

| |

|

|

“SEC”

|

The United States Securities and Exchange Commission.

|

| |

|

|

“Van Campen Liem”

|

Van Campen Liem (Van Campen & Partners N.V. / Liem & Partners N.V.)

|

Exhibit 23.2

CONSENT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

We consent to the incorporation by reference in this Registration Statement on Form S-8 of our reports dated February 23, 2023, relating to the financial statements of Expro Group Holdings N.V. and the effectiveness of Expro Group Holdings N.V.’s internal control over financial reporting, appearing in the Annual Report on Form 10K of Expro Group Holdings N.V for the year ended December 31, 2022.

/s/ DELOITTE & TOUCHE LLP

Houston, Texas

November 16, 2023

Exhibit 99.1

EXPRO GROUP HOLDINGS N.V.

2023 EMPLOYEE STOCK PURCHASE PLAN

ARTICLE I

PURPOSE AND SCOPE OF THE PLAN; DEFINITIONS

Section 1.1 Purpose. Expro Group Holdings, N.V. (the “Company”) previously adopted the Expro Group Holdings N.V. 2023 Employee Stock Purchase Plan (the “Plan”) to encourage employee participation in the ownership and economic progress of the Company. The Plan is intended to qualify as an “employee stock purchase plan” under Section 423 of the Internal Revenue Code of 1986, as amended (the “Code”), and the provisions of the Plan shall be construed so as to extend and limit participation in a manner consistent with the requirements of Section 423; provided that, if and to the extent authorized by the Board, the fact that the Plan does not comply in all respects with the requirements of Section 423 shall not affect the operation of the Plan or the rights of Employees hereunder.

Section 1.2 Definitions. Unless the context clearly indicates otherwise, the following terms have the meaning set forth below:

(a)“ Board of Directors” or “Board” means the Company’s Board of Directors.

(b)“ Code” shall mean the Internal Revenue Code of 1986, as amended from time to time, together with any applicable regulations issued thereunder.

(c)“ Committee” shall mean the committee of officers established by the Board to administer the Plan, which Committee shall administer the Plan as provided in Section 1.3 hereof.

(d)“ Common Stock” shall mean shares of the common stock, par value €0.01 per share, of the Company.

(e)“ Company” shall mean Expro Group Holdings N.V., a limited liability company organized in the Netherlands.

(f)“ Compensation” shall mean the total cash compensation paid by the Company to an Employee as reported by the Company to the applicable government for income tax purposes, excluding the amount of any compensation deferrals made by the Employee to a deferred compensation plan, a tax-qualified retirement plan pursuant to Section 401(k) of the Code or a cafeteria plan pursuant to Section 125 of the Code.

(g)“ Continuous Service” shall mean the period of time, uninterrupted by a termination of employment (other than a termination as a result of a transfer of employment among the Company or a Designated Subsidiary that does not constitute a “separation from service” pursuant to the Nonqualified Deferred Compensation Rules), that an Employee has been employed by the Company or a Designated Subsidiary (or any combination of the foregoing) immediately preceding an Offering Date. Such period of time shall include any approved leave of absence.

(h)“ Designated Subsidiary” shall mean each subsidiary (within the meaning of Section 424(f) of the Code) of the Company set forth on the attached Schedule A and as may be authorized from time to time by the Committee to participate in the Plan. The addition or deletion of a subsidiary from Schedule A will not require a formal amendment to this Plan.

(i)“ Employee” shall mean any person who is employed by the Company or a Designated Subsidiary as a common law employee. Any individual who performs services for the Company or a Designated Subsidiary solely through a leasing or employment agency shall not be considered an Employee.

(j)“ Exchange Act” shall mean the Securities Exchange Act of 1934, as amended from time to time.

(k)“ Exercise Date” shall mean the last business day of each Option Period, or such other date(s) as determined by the Committee.

(l)“ Fair Market Value” means, as of any specified date, (i) if the Common Stock is listed on a national securities exchange, the closing sales price of the Common Stock, as reported on the stock exchange composite tape on the immediately preceding date (or if no sales occur on that date, on the last preceding date on which such sales of the Common Stock are so reported); (ii) if the Common Stock is not traded on a national securities exchange but is traded over the counter at the time a determination of its fair market value is required to be made under the Plan, the average between the reported high and low bid and asked prices of Common Stock on the most recently preceding date on which Common Stock was publicly traded; or (iii) in the event Common Stock is not publicly traded at the time a determination of its value is required to be made under the Plan, the amount determined by the Committee in its discretion in such manner as it deems appropriate, taking into account all factors the Committee deems appropriate, including, without limitation, the Nonqualified Deferred Compensation Rules.

(m)“ Maximum Offering” shall mean the maximum number of shares of Common Stock that may be issued to each Participant under the Plan during any given time period. Unless otherwise determined by the Committee, the Maximum Offering during any single Option Period shall be the largest number of whole shares of Common Stock determined by multiplying $2,083 by the number of full months in the Option Period and dividing the result by the Fair Market Value on the Option Period commencement date of such Option Period.

(n)“ Nonqualified Deferred Compensation Rules” shall mean the limitations or requirements of Section 409A of the Code and the guidance and regulations promulgated thereunder.

(o)“ Offering Date” shall mean, as applicable, (i) the first business day of each Plan Year, and (ii) the date that is six months following the first business day of each Plan Year, or such other date(s) as determined by the Committee.

(p)“ Option Period” or “Period” shall mean the six month period beginning on each Offering Date.

(q)“ Option Price” shall mean the purchase price of a share of Common Stock hereunder as provided in Section 3.1 hereof.

(r)“ Participant” shall mean any Employee who (i) is eligible to participate in the Plan under Section 2.1 hereof and (ii) elects to participate.

(s)“ Plan” shall mean the Company’s 2023 Employee Stock Purchase Plan, as the same may be amended from time to time.

(t)“ Plan Account” or “Account” shall mean an account established and maintained in the name of each Participant.

(u)“ Plan Manager” shall mean any Employee appointed pursuant to Section 1.3 hereof.

(v)“ Plan Year” shall mean the twelve (12) month period commencing on the Effective Date as determined by the Committee pursuant to Section 1.4, and each successive twelve (12) month period thereafter, or such other period as may be specified by the Committee.

(w)“ Stock Purchase Agreement” shall mean the form prescribed by the Committee or the Company which must be completed and executed by an Employee who elects to participate in the Plan.

Section 1.3 Administration of Plan.

(a) Administration. Subject to oversight by the Board of Directors or the Board’s Compensation Committee, the Committee shall have the authority to administer the Plan

(b) Powers and Duties of the Committee. Subject to the express provisions of the Plan, the Committee shall be authorized and empowered to do all things that it determines to be necessary or appropriate in connection with the administration of the Plan, including without limitation:

(i) to prescribe, amend and rescind rules and regulations relating to the Plan and to define terms not otherwise defined in the Plan;

(ii) to determine which persons are eligible to participate in the Plan;

(iii) to interpret and construe the Plan and any rules and regulations under the Plan, and to make exceptions to any such provisions if the Committee, in good faith, determines that it is appropriate to do so;

(iv) to decide all questions concerning the Plan and to determine all ambiguities, inconsistencies and omissions in the terms of the Plan;

(v) to appoint such agents, counsel, accountants, consultants and other persons as may be required to assist in administering the Plan;

(vi) to appoint an Employee as Plan Manager and to delegate to the Plan Manager such authority with respect to the administration of the Plan as the Committee, in its sole discretion, deems advisable from time to time;

(vii) where applicable, determine when an action taken under the Plan becomes administratively practicable;

(viii) to prescribe and amend such forms as may be necessary or appropriate for Eligible Employees to make elections under the Plan or to otherwise administer the Plan, which shall include the form of Stock Purchase Agreement; and

(ix) to do such other acts as it deems necessary or appropriate to administer the Plan in accordance with its terms, or as may be provided for or required by law.

(c) Determinations by the Committee. All decisions, determinations and interpretations by the Committee regarding the Plan and any rules and regulations under the Plan shall be final and binding on all Participants, beneficiaries, heirs, assigns or other persons holding or claiming rights under the Plan. The Committee shall consider such factors as it deems relevant, in its sole and absolute discretion, in making such decisions, determinations and interpretations, including the recommendations or advice of any officer or other employee of the Company and such attorneys, consultants and accountants as it may select. Members of the Board and the Compensation Committee, and members of the Committee, shall be fully protected in relying in good faith upon the advice of counsel.

(d) No Liability of Committee or Board Members. No member of the Committee or the Board shall be personally liable by reason of any contract or other instrument executed by such member or on his or her behalf in his or her capacity as a member of the Committee or the Board nor for any mistake of judgment made in good faith, and the Company shall indemnify and hold harmless each member of the Committee and the Board and each other employee, officer or director of the Company to whom any duty or power relating to the administration or interpretation of the Plan may be allocated or delegated, against any cost or expense (including counsel fees) or liability (including any amount paid in settlement of a claim) arising out of any act or failure to act in connection with the Plan unless arising out of such person’s own fraud or willful bad faith; provided, however, that approval of the Board shall be required for the payment of any amount in settlement of a claim against any such person.

(e) Rules for Foreign Jurisdictions. The Committee may adopt rules or procedures relating to the operation and administration of the Plan to accommodate the specific requirements of local laws and procedures. Without limiting the generality of the foregoing, the Committee is specifically authorized to adopt rules and procedures regarding handling of payroll deductions, payment of interest, conversion of local currency, payroll tax, withholding procedures and handling of stock certificates. The Committee, in consultation with the Compensation Committee, may also adopt sub-plans applicable to particular Designated Subsidiaries or locations, and, with respect to Subsidiaries outside the United States, determine that a sub-plan shall not be considered to be part of an employee stock purchase plan under Section 423 of the Code.

Section 1.4 Effective Date of Plan. The Plan has been adopted effective as of July 1, 2023 (the “Effective Date”).

Section 1. Extension or Termination of Plan. The Plan shall continue in effect through the tenth anniversary of the Effective Date, unless terminated prior thereto pursuant to Section 4.3 hereof, or by the Board of Directors or the Compensation Committee of the Board, each of which shall have the right to extend the term of or terminate the Plan at any time. Upon any such termination, the balance, if any, in each Participant’s Account shall be refunded to him, or otherwise disposed of in accordance with policies and procedures prescribed by the Committee in cases where such a refund may not be possible.

ARTICLE II

PARTICIPATION

Section 2.1 Eligibility. Subject to the restrictions in Section 2.2 below, each Employee as of an Offering Date who is customarily employed as a full time employee of the Company or a Designated Subsidiary shall be eligible to participate in the Plan with respect to options granted under the Plan as of such date. Part-time Employees of the Company or a Designated Subsidiary shall be eligible to participate in the Plan; provided, however, that if the Employee is customarily employed for 20 hours or less per week, or if the Employee’s customary employment is for no more than five months in any calendar year, that part-time Employee will not be eligible to participate. For purposes of this Section 2.1, whether an Employee is “customarily” employed shall be determined by the Committee based on the Company’s or Designated Subsidiary’s policies and procedures in effect from time to time. Notwithstanding the foregoing, the Committee may from time to time prior to an Offering Date elect to exclude employees of the Company and the Designated Subsidiaries who would otherwise be eligible to participate pursuant to the preceding provisions of this Section 2.1 with respect to the Option Period beginning on such Offering Date (and any subsequent Option Periods as determined by the Committee) so long as such exclusion is permitted under Section 423 of the Code.

Section 2.2 Ineligible Employees. Notwithstanding any provisions of the Plan to the contrary, no Employee shall be granted a right to purchase shares of Common Stock under the Plan to the extent that:

(a) immediately after the grant, such Employee would own stock, and/or hold or own options, possessing five percent (5%) or more of the total combined voting power or value of all classes of stock of the Company or any subsidiary corporation (determined under the rules of Sections 423(b)(3) and 424(d) of the Code); or

(b) immediately after the grant, such Employee’s right to purchase Company Stock under all employee stock purchase plans (as defined in Section 423 of the Code) of the Company and any related company would accrue at a rate which exceeds $25,000 in Fair Market Value of such Company Stock (determined at the time such purchase right is granted) for each calendar year in which such purchase right would be outstanding at any time; or

(c) the Employee is a citizen or resident of a jurisdiction other than the United States and (i) the grant of an option under this Plan would be prohibited under the laws of such jurisdiction, or (ii) except as provided in Section 1.3(e) above, to the extent compliance with the laws of the applicable foreign jurisdiction would cause the Plan to violate the requirements of Section 423 of the Code.

Section 2.3 Payroll Deductions. Payment for shares of Common Stock purchased hereunder shall be made by authorized payroll deductions from each payment of Compensation in accordance with instructions received from a Participant. Said deductions shall be expressed as a percentage of the Participant’s Compensation. A Participant may increase or decrease the deduction on one occasion per Option Period. During an Option Period, a Participant may discontinue payroll deductions but have the payroll deductions previously made during that Option Period remain in the Participant’s Account to purchase Common Stock on the next Exercise Date, provided that he or she is an Employee as of that Exercise Date. Any amount remaining in the Participant’s Account after the purchase of Common Stock shall be refunded without interest upon the written request of the Participant. Any Participant who discontinues payroll deductions during an Option Period may again become a Participant for a subsequent Option Period by executing and filing another Stock Purchase Agreement in accordance with Section 2.1. Amounts deducted from a Participant’s Compensation pursuant to this Section 2.3 shall be credited to said Participant’s Account.

Section 2.4 Leaves of Absence. During a paid leave of absence approved by the Company and meeting the requirements of Treasury Regulation § 1.421-1(h)(2), a Participant's elected payroll deductions shall continue. If a Participant takes an unpaid leave of absence that is approved by the Company and meets the requirements of Treasury Regulation § 1.421-1(h)(2), then such Participant’s payroll deductions for such Option Period that were made prior to such leave may remain in the Plan and be used to purchase Common Stock under the Plan on the Exercise Date relating to such Option Period. If a participant takes a leave of absence that does not satisfy one of the two sentences above, then for purposes of the Plan he shall be considered to have terminated his employment and withdrawn from the Plan.

ARTICLE III

PURCHASE OF SHARES

Section 3.1 Option Price. The Option Price per share of the Common Stock sold to Participants hereunder shall be the lesser of (i) eighty-five percent (85%) of the Fair Market Value of the Common Stock on the Offering Date, or (ii) eighty-five percent (85%) of the Fair Market Value of the Common Stock on the last day of the Option Period; provided, however, that the Option Price per share of the Common Stock may be adjusted for subsequent Option Periods by the Committee subject to the requirements of Section 423 of the Code (and in no event shall the Option Price per share be less than the par value of the Common Stock).

Section 3.2 Purchase of Shares. On each Exercise Date, the amount in a Participant's Account shall be charged with the aggregate Option Price of the largest number of whole shares of Common Stock which can be purchased with said amount. The remaining balance, if any, in such account shall be refunded to Participant via payroll within one month of the Exercise Date. If the total number of shares of Common Stock for which options are exercised on any Exercise Date exceeds the maximum number of shares then available for sale under the Plan, the Company shall allocate the available shares by reducing the Participants’ designated payroll deduction authorization percentages in order of the highest percentages until the excess is eliminated, and any remaining balance of payroll deductions credited to the account of a participant under the Plan shall be refunded to him promptly.

Section 3.3 Limitations on Purchase. Notwithstanding any provisions of the Plan to the contrary, no Employee shall be granted an option under the Plan if, immediately after the grant, such Employee’s right to purchase Common Stock under all employee stock purchase plans (as defined in Section 423 of the Code) of the Company and any related company would accrue at a rate which exceeds $25,000 in Market Value of such Common Stock (determined at the time such purchase right is granted) for each calendar year in which such purchase right would be outstanding at any time.

To the extent necessary to comply with Section 423(b)(8) of the Code and the limitations on purchase in this Section 3.3, a Participant’s payroll deductions may be decreased to 0% during any Option Period which is scheduled to end during any calendar year, such that the aggregate of all payroll deductions accumulated with respect to such Option Period and any other Option Period ending within the same calendar year is no greater than twenty-five thousand dollars ($25,000). Payroll deductions shall re-commence at the rate provided in such Participant’s Stock Purchase Agreement at the beginning of the first Option Period which is scheduled to end in the following calendar year, unless suspended by the Participant pursuant to Section 2.3 of the Plan.

ARTICLE IV

PROVISIONS RELATING TO COMMON STOCK

Section 4.1 Common Stock Reserved. There shall be a maximum of 5,000,000 shares of Common Stock reserved for the Plan, subject to adjustment in accordance with Section 4.2 hereof. The aggregate number of shares which may be purchased under the Plan shall not exceed the number of shares reserved for the Plan.

Section 4.2 Adjustment for Changes in Common Stock. In the event that adjustments are made in the number of outstanding shares of Common Stock or said shares are exchanged for a different class of stock of the Company or for shares of stock of any other corporation by reason of merger, consolidation, stock dividend, stock split or otherwise, the Committee shall make appropriate adjustments in (i) the number and class of shares or other securities that may be reserved for purchase, or purchased, hereunder, and (ii) the Option Price. All such adjustments shall be made in the sole discretion of the Committee, and its decision shall be binding and conclusive.

Section 4.3 Insufficient Shares. If the aggregate funds available for purchase of Common Stock on any Exercise Date would cause an issuance of shares in excess of (x) the number provided for in Section 4.1 hereof or (y) the Maximum Offering, (i) the Committee shall proportionately reduce the number of shares which would otherwise be purchased by each Participant in order to eliminate such excess and (ii) the Plan shall automatically terminate immediately after such Exercise Date.

Section 4.4 Confirmation. Confirmation of each purchase of Common Stock hereunder shall be made available to the Participant in either written or electronic format. A record of purchases shall be maintained by appropriate entries on the books of the Company (or in such other manner as specified by the Committee).

Section 4.5 Rights as Shareholders. The shares of Common Stock purchased by a Participant on an Exercise Date shall, for all purposes, be deemed to have been issued and sold as of the close of business on such Exercise Date. Prior to that time, none of the rights or privileges of a shareholder of the Company shall exist with respect to such shares.

ARTICLE V

TERMINATION OF PARTICIPATION

Section 5.1 Voluntary Withdrawal. A Participant may withdraw from the Plan at any time by filing notice of withdrawal prior to the close of business on an Exercise Date. Upon withdrawal, the entire amount, if any, in a Participant’s Account shall be refunded to him without interest. Any Participant who withdraws from the Plan may again become a Participant in accordance with Section 2.1 hereof.

Section 5.2 Termination of Eligibility. If a Participant retires, he may elect to (i) withdraw the entire amount, if any, in his Plan Account, or (ii) have said amount used to purchase whole shares of Common Stock pursuant to Section 3.2 hereof on the next succeeding Exercise Date and have any remaining balance refunded without interest. For purposes of this Section 5.2, a Participant’s retirement age shall be 59-½.

If a Participant ceases to be eligible under Section 2.1 hereof for any reason other than retirement, the dollar amount and the number of unissued shares in such Participant’s Account will be refunded or distributed to the Participant, or, in the case of death, the Participant’s designated beneficiary or estate, or otherwise disposed of in accordance with policies and procedures prescribed by the Committee in cases where such a refund or distribution may not be possible.

ARTICLE VI

GENERAL PROVISIONS

Section 6.1 Notices. Any notice which a Participant files pursuant to the Plan shall be made on forms prescribed by the Committee and shall be effective only when received by the Company.

Section 6.2 Condition of Employment. Neither the creation of the Plan nor participation therein shall be deemed to create any right of continued employment or in any way affect the right of the Company or a Designated Subsidiary to terminate an Employee, nor give any person a right or claim to any benefit under the Plan, unless such right or claim has specifically accrued under the terms of the Plan.

Section 6.3 Transfer and Assignment. An option granted under the Plan shall not be transferable otherwise than by will or the laws of descent and distribution. Each option shall be exercisable, during his lifetime, only by the Employee to whom the option is granted. The Company shall not recognize and shall be under no duty to recognize any assignment or purported assignment by an Employee of his option or of any rights under his option or under the Plan.

Section 6.4 Withholding of Taxes; Other Charges. Each Participant shall, no later than the date as of which the value of an option under the Plan and/or shares of Common Stock first becomes includible in the income of the Participant for income tax purposes, pay to the Company, or make arrangements satisfactory to the Committee regarding payment of, any taxes of any kind required by law to be withheld with respect to such option or shares of Common Stock. The obligations of the Company under the Plan shall be conditional on the making of such payments or arrangements, and the Company shall, to the extent permitted by law, have the right to deduct any such taxes from any payment of any kind otherwise due to the Participant.

In particular, to the extent a Participant is subject to taxation under U.S. Federal income tax law, if the Participant makes a disposition, within the meaning of Section 424(c) of the Code of any share or shares of Common Stock issued to Participant pursuant to Participant’s exercise of an option, and such disposition occurs within the two-year period commencing on the day after the Offering Date or within the one-year period commencing on the day after the Exercise Date, Participant shall, within ten (10) days of such disposition, notify the Company thereof and thereafter immediately deliver to the Company any amount of federal, state or local income taxes and other amounts which the Company informs the Participant the Company may be required to withhold.

Participants shall be solely responsible for any commissions or other charges imposed with respect to the purchase or sale of shares of Common Stock pursuant to the terms of this Plan.

Section 6.5 Amendment or Termination of the Plan. The Plan may be amended or terminated at any time and for any reason by the Compensation Committee; provided, without approval of the shareholders, no amendment may increase the aggregate number of shares reserved under the Plan other than as provided in Section 4.2 hereof, materially increase the benefits accruing to Participants, or materially modify the requirements as to eligibility for participation in the Plan. Any amendment of the Plan must be made in accordance with applicable provisions of the Code and/or any regulations issued thereunder, any other applicable law or regulations, and the requirements of the principal exchange upon which the Common Stock is listed. Notwithstanding the foregoing, no amendment adopted by the Committee or the Board shall be effective without the approval of the shareholders of the Company if shareholder approval of the amendment is then required under Section 423 of the Code.

Section 6.6 Corporate Transactions.

(a) In the event of the proposed liquidation or dissolution of the Company, the Compensation Committee shall, in its discretion, provide for one of the following courses of action: (i) the Offering Period then in effect shall end as of a date selected by the Compensation Committee before the consummation of such liquidation or dissolution of the Company, and each outstanding option granted under the Plan shall be automatically exercised as of such date, or (ii) the Offering Period then in effect shall be terminated as of a date selected by the Compensation Committee before the consummation of such liquidation or dissolution of the Company, and each outstanding option granted under the Plan shall be automatically cancelled and any payroll deductions accumulated for such Offering Period shall be refunded to the applicable Participant as soon as administratively practicable.

(b) In the event of a proposed sale of all or substantially all of the assets of the Company, or the merger or consolidation of the Company (except for (x) a transaction the principal purpose of which is to change the jurisdiction in which the Company is incorporated or (y) a transaction where the acquiring or surviving company is directly or indirectly owned, immediately after such transaction, by the shareholders of the Company in substantially the same proportion as their ownership of stock in the Company immediately before such transaction), the Compensation Committee shall, in its discretion, provide for one of the following courses of action: (i) each outstanding option granted under the Plan shall be assumed or an equivalent option shall be substituted by the successor entity (or a parent or subsidiary thereof); (ii) the Offering Period then in effect shall end as of a date selected by the Compensation Committee before the consummation of such sale, merger or consolidation of the Company, and each outstanding option granted under the Plan shall be automatically exercised as of such date; or (iii) the Offering Period then in effect shall be terminated as of a date selected by the Compensation Committee before the consummation of such sale, merger or consolidation of the Company, and each outstanding option granted under the Plan shall be automatically cancelled and any payroll deductions accumulated for such Offering Period shall be refunded to the applicable Participant as soon as administratively practicable.

Section 6.7 Application of Funds. All funds received by the Company by reason of purchases of Common Stock hereunder may be used for any corporate purpose.

Section 6.8 Legal Restrictions. The Company shall not be obligated to sell shares of Common Stock hereunder if counsel to the Company determines that such sale would violate any applicable law or regulation. Further, all Common Stock acquired pursuant to this Plan shall be subject to the Company’s policies concerning compliance with securities laws and regulations, as such policies may be amended from time to time. The terms and conditions of options granted hereunder to, and the purchase of shares by, persons subject to Section 16 of the Exchange Act, shall comply with any applicable provisions of Rule 16b-3. As to such persons, the Plan shall be deemed to contain, and such options shall contain, and the shares issued upon exercise thereof shall be subject to, such additional conditions and restrictions as may be required from time to time by Rule 16b-3 to qualify for the maximum exemption from Section 16 of the Exchange Act with respect to Plan transactions.

Section 6.9 Severability. If any provision of the Plan shall be held illegal or invalid for any reason, said illegality or invalidity shall not affect the remaining provisions hereof; instead, each provision shall be fully severable and the Plan shall be construed and enforced as if said illegal or invalid provision had never been included herein.

Section 6.10 Gender. Whenever used herein, use of any gender shall be applicable to both genders.

Section 6.11 Electronic and/or Telephonic Documentation and Submission. Any of the payroll deduction authorizations, notices, forms, designations and other documents referenced in the Plan and their submission may be electronic and/or telephonic, as directed by the Committee.

Section 6.12 Governing Law. The Plan and all rights and obligations thereunder shall be constructed and enforced in accordance with the laws of the State of Texas and any applicable provisions of the Code and the related regulations, without giving effect to any conflict of law provisions thereof, except to the extent Texas law is preempted by federal law.

SCHEDULE A

DESIGNATED SUBSIDIARIES

Frank’s International, LLC

Expro Americas, LLC

Expro Meters, Inc.

Expro Midstream Services, LLC

Professional Rental Tools, LLC

Schedule A

Exhibit 107.1

Calculation of Filing Fee Tables

Form S-8

(Form Type)

Expro Group Holdings N.V.

(Exact Name of Registrant as Specified in its Charter)

Table 1: Newly Registered Securities

|

Security

Type

|

Security Class Title

|

Fee

Calculation

Rule

|

Amount

Registered(1)(2)

|

|

Proposed

Maximum

Offering

Price Per

Share(3)

|

|

|

Maximum

Aggregate

Offering

Price

|

|

|

Fee

Rate

|

|

|

Amount of

Registration

Fee

|

|

|

Equity

|

Common Stock, nominal value €0.06 per share

|

457(c) and (h)

|

5,000,000

|

|

$ |

14.60 |

|

|

$ |

73,000,000 |

|

|

$ |

0.0001476 |

|

|

$ |

10,774.80 |

|

|

Total Offering Amounts

|

|

|

|

|

|

|

|

|

|

|

|

|

|

$ |

10,774.80 |

|

|

Total Fee Offsets

|

|

|

|

|

|

|

|

|

|

|

|

|

|

$ |

0 |

|

|

Net Fee Due

|

|

|

|

|

|

|

|

|

|

|

|

|

|

$ |

10,774.80 |

|

|

(1)

|

Pursuant to Rule 416(a) under the Securities Act of 1933, as amended, this registration statement also covers an indeterminate number of additional shares of the Registrant’s Common Stock, with respect to the shares registered herein in the event of stock splits, stock dividends and similar transactions.

|

|

(2)

|

Represents 5,000,000 shares of Common Stock issuable under the Expro Group Holdings N.V. 2023 Employee Stock Purchase Plan (the “Plan”) as of the effective date of the Plan.

|

|

(3)

|

Estimated pursuant to Rule 457(c) and (h) of the Securities Act of 1933, as amended, based upon the average of the high and low sales prices on November 9, 2023 of the shares of Registrant’s Common Stock, as reported on the New York Stock Exchange.

|

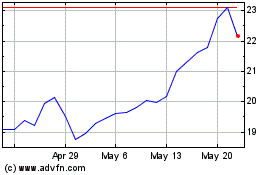

Expro Group Holdings NV (NYSE:XPRO)

Historical Stock Chart

From Mar 2024 to Apr 2024

Expro Group Holdings NV (NYSE:XPRO)

Historical Stock Chart

From Apr 2023 to Apr 2024