DaVita Inc - Momentum

January 25 2012 - 7:00PM

Zacks

DVA 012512

Davita (DVA)

Insurance companies

aren’t the only ones who stand to benefit from healthcare for

all. Providers like DaVita will be able to help more sick

patients under the new plan and in turn generate more profits.

They are the

premier kidney care provider in America and serve the more than

400,000 people in need of their services. They are looking to

expand their services over the coming years which should prove to

be a profitable venture according to analysts.

Studies have shown

that many on dialysis are not getting enough treatment. This

is not only true here, but abroad as well. DaVita is working

to make treatment easier, cheaper and more convenient. They

are growing fast and their stock price is doing the same.

Company Description &

Developments

DaVita currently operates or provides administrative services to

approximately 1400 outpatient dialysis centers located in 43 states

and the District of Columbia, serving approximately 110,000

patients.

The company was

recently upgraded to buy at Zacks Equity Research. They cited

strong cash flow and strategic acquisitions. Just yesterday,

DaVita announced a majority stake in Nephrolife India. This

is a longer term strategic move to expand their services

globally.

It’s important to

note that DaVita has achieved clinical outcomes for patients that

have improved year-over-year for more than a decade. They are

making people’s lives better not only with their products, but also

through education, prescription management and assistance with

everything from traveling to home dialysis solutions.

Financial Profile

DaVita is a mid-cap company (7.56 billion) that is trading at about

17 times trailing earnings (P/E). Looking forward, Zacks

Consensus Estimates are calling for that number to drop to 13 with

no change in price from these levels.

DaVita hit the

Zacks Rank 1 Strong Buy list just yesterday from a rank of 2.

It has been a buy (Rank 2) since Jan 5, 2011

DaVita reported a

5.63% quarterly sales increase at their last earnings report on

November 3, 2011.

They saw year

over year sales growth of 9.46% and a 26% rise in earnings per

share in the same period with total sales of roughly 6.4 billion in

FY2010. DaVita is expected to earn $5.05 in FY2011 according

to the Zacks Consensus Estimate.

Earnings Estimates

We saw one analyst revise next quarter’s earnings estimates up

within the past month. The others have stood firm on their

estimates to date. DaVita will report Q4 results on February

16th. Expectations are for DaVita to generate $1.48 in income this

quarter. Of the 13 analysts who cover DaVita, the consensus

is for the company to grow earnings by 15.38% in FY2011 with

another jump of 23.03% in FY2012.

In terms of the

magnitude of analyst estimate trends, we are seeing all of the

consensus estimates higher than they were 90 days ago from current

quarter, out to FY 2012. It’s important to note that

revisions have not been dramatically higher.

DaVita missed

estimates last quarter by 0.68%, with the average earnings surprise

being a positive 0.97% over the past year. It seems as though

analysts tend to be one point with their estimates in DVA.

Market Performance & Technicals

The chart for DaVita has gotten particularly strong over the past

three months. DVA has been up for five trading days and has

been riding along the upper edge of its Bollinger band. This

action leads me to believe that we should see a pullback soon,

which would present an opportunity to ride this recent

momentum.

DVA has remained

above its 50 day moving average since early November. The

stock is about $8.00 away from its 52 week high of $89.76 which was

made back in July of 2011.

The stock just

broke above its 200 day moving average of $77.63, which is the

first time since August of 2011. I would watch this level for

support and if DVA breaks below it, we might see further selling

down to the 50 day average of $75.84.

DaVita has

outpaced the S&P 500 by 8.17% over the past year and almost 10%

over the last twelve weeks. DVA has kept up its momentum,

jumping ahead of the S&P’s performance by 2% during the last

month.

It might be smart

to wait for the pullback before moving into DVA.

Jared A Levy is

the Momentum Stock Strategist for Zacks.com. He is also the Editor

in charge of the market-beating Zacks Whisper Trader Service.

DAVITA INC (DVA): Free Stock Analysis Report

To read this article on Zacks.com click here.

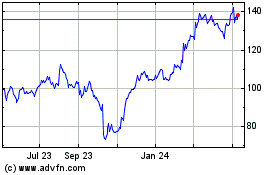

DaVita (NYSE:DVA)

Historical Stock Chart

From May 2024 to Jun 2024

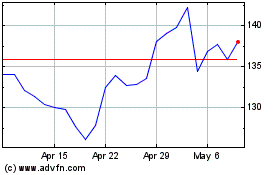

DaVita (NYSE:DVA)

Historical Stock Chart

From Jun 2023 to Jun 2024