Famous Dave's Beats by a Penny - Analyst Blog

February 23 2012 - 4:45AM

Zacks

Famous Dave's of America

Inc. (DAVE) recently reported fourth quarter 2011 adjusted

earnings of 9 cents per share, which beat the Zacks Consensus

Estimate by a penny and the prior-year quarter's earnings by 2

cents. Including the non-cash impairment charges of approximately 4

cents, the earnings for the reported quarter were 5 cents. In

fiscal 2011, earnings were 72 cents per share versus 67 cents in

the prior year.

Famous Dave’s, which owns,

franchises and operates restaurants in the U.S., reported total

revenue of $37.5 million, up 3.6% year over year. Company-owned

restaurants sales were $33.3 million, up 3.4% year over year.

Franchise royalty revenue climbed 7.4% year over year to $4.0

million. In fiscal 2011, revenue jumped 4.4% to $154.8 million year

over year.

Quarter

Highlights

Same-store sales for company-owned

restaurants grew 3.6% during the quarter compared with an upside of

3.3% in the year-ago quarter.

The upside in comparable sales was

attributable to strong sales promotion and innovative offerings.

Same-store sales from franchise-operated restaurants rose 2.1%

versus a decline of 0.8% in the fourth quarter of 2010.

As a percentage of restaurant

sales, both food and beverage costs and labor and benefit expense

spiked 90 basis points (bps) to 30.8% and 32.3%, respectively and

operating expense rose 30 bps to 29.4%. However, as a percentage of

total revenue, general and administrative expense dipped 170 bps to

10.5% and depreciation and amortization expense remained flat year

over year at 0.5%. Hence, the company’s operating margin contracted

70 basis points (bps) to 2.1%.

Store Update

During the quarter, the company

opened three franchised restaurants and one company-owned

restaurants. At the end of 2011, the company operated 187

restaurants, including 54 company-owned restaurants and 133

franchise-operated restaurants.

In 2012, Famous Dave's expects to

open up to 15 restaurants, out of which 10 to 12 are

franchise-operated restaurants and 2 to 3 are company-owned

restaurants. The above openings also include first international

location, a restaurant in Winnipeg that is expected to open in

June.

Financial

Position

Minnetonka, Minnesota-based company

ended 2011 with cash and cash equivalents of $1.1 million and

shareholders’ equity of $34.1 million.

During the quarter, the company

repurchased 304,036 shares at an average price of $8.68.

Our Take

As the economy is showing signs of

improvement, we believe Famous Dave's will likely generate improved

earnings. In 2012, the company will focus on four key areas i.e.

growth in new restaurants – both company and franchise, menu,

restaurant format, and guest satisfaction continues evaluation,

excellence in core systems and processes with a focus on continuous

improvement and lastly enhancing shareholder value.

However, increasing input costs,

lower consumer spending and stiff competition from peers like

Jamba, Inc. (JMBA) and Darden Restaurants,

Inc. (DRI) will drag profits.

Famous Dave's currently retains a

Zacks #1 Rank, which implies a short-term Strong Buy rating on the

stock. We reiterate our long-term Neutral recommendation.

FAMOUS DAVES (DAVE): Free Stock Analysis Report

DARDEN RESTRNT (DRI): Free Stock Analysis Report

JAMBA INC (JMBA): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

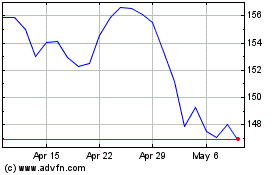

Darden Restaurants (NYSE:DRI)

Historical Stock Chart

From May 2024 to Jun 2024

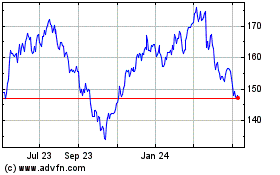

Darden Restaurants (NYSE:DRI)

Historical Stock Chart

From Jun 2023 to Jun 2024