000085847012-312023Q2FALSEhttp://fasb.org/us-gaap/2023#OtherAssetsNoncurrenthttp://fasb.org/us-gaap/2023#OtherAssetsNoncurrenthttp://fasb.org/us-gaap/2023#AccruedLiabilitiesCurrenthttp://fasb.org/us-gaap/2023#AccruedLiabilitiesCurrenthttp://fasb.org/us-gaap/2023#AccruedLiabilitiesCurrenthttp://fasb.org/us-gaap/2023#AccruedLiabilitiesCurrenthttp://fasb.org/us-gaap/2023#OtherLiabilitiesNoncurrenthttp://fasb.org/us-gaap/2023#OtherLiabilitiesNoncurrenthttp://fasb.org/us-gaap/2023#OtherLiabilitiesNoncurrenthttp://fasb.org/us-gaap/2023#OtherLiabilitiesNoncurrent00008584702023-01-012023-06-3000008584702023-08-04xbrli:shares00008584702023-06-30iso4217:USD00008584702022-12-31iso4217:USDxbrli:shares0000858470us-gaap:NaturalGasProductionMember2023-04-012023-06-300000858470us-gaap:NaturalGasProductionMember2022-04-012022-06-300000858470us-gaap:NaturalGasProductionMember2023-01-012023-06-300000858470us-gaap:NaturalGasProductionMember2022-01-012022-06-300000858470us-gaap:OilAndCondensateMember2023-04-012023-06-300000858470us-gaap:OilAndCondensateMember2022-04-012022-06-300000858470us-gaap:OilAndCondensateMember2023-01-012023-06-300000858470us-gaap:OilAndCondensateMember2022-01-012022-06-300000858470srt:NaturalGasLiquidsReservesMember2023-04-012023-06-300000858470srt:NaturalGasLiquidsReservesMember2022-04-012022-06-300000858470srt:NaturalGasLiquidsReservesMember2023-01-012023-06-300000858470srt:NaturalGasLiquidsReservesMember2022-01-012022-06-3000008584702023-04-012023-06-3000008584702022-04-012022-06-3000008584702022-01-012022-06-300000858470cog:OtherRevenuesMember2023-04-012023-06-300000858470cog:OtherRevenuesMember2022-04-012022-06-300000858470cog:OtherRevenuesMember2023-01-012023-06-300000858470cog:OtherRevenuesMember2022-01-012022-06-3000008584702021-12-3100008584702022-06-300000858470us-gaap:CommonStockMember2022-12-310000858470us-gaap:TreasuryStockCommonMember2022-12-310000858470us-gaap:AdditionalPaidInCapitalMember2022-12-310000858470us-gaap:AccumulatedOtherComprehensiveIncomeMember2022-12-310000858470us-gaap:RetainedEarningsMember2022-12-310000858470us-gaap:RetainedEarningsMember2023-01-012023-03-3100008584702023-01-012023-03-310000858470us-gaap:AdditionalPaidInCapitalMember2023-01-012023-03-310000858470us-gaap:TreasuryStockCommonMember2023-01-012023-03-310000858470us-gaap:CommonStockMember2023-01-012023-03-310000858470us-gaap:CommonStockMember2023-03-310000858470us-gaap:TreasuryStockCommonMember2023-03-310000858470us-gaap:AdditionalPaidInCapitalMember2023-03-310000858470us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-03-310000858470us-gaap:RetainedEarningsMember2023-03-3100008584702023-03-310000858470us-gaap:AdditionalPaidInCapitalMember2023-04-012023-06-300000858470us-gaap:TreasuryStockCommonMember2023-04-012023-06-300000858470us-gaap:CommonStockMember2023-04-012023-06-300000858470us-gaap:RetainedEarningsMember2023-04-012023-06-300000858470us-gaap:CommonStockMember2023-06-300000858470us-gaap:TreasuryStockCommonMember2023-06-300000858470us-gaap:AdditionalPaidInCapitalMember2023-06-300000858470us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-06-300000858470us-gaap:RetainedEarningsMember2023-06-300000858470us-gaap:CommonStockMember2021-12-310000858470us-gaap:TreasuryStockCommonMember2021-12-310000858470us-gaap:AdditionalPaidInCapitalMember2021-12-310000858470us-gaap:AccumulatedOtherComprehensiveIncomeMember2021-12-310000858470us-gaap:RetainedEarningsMember2021-12-310000858470us-gaap:RetainedEarningsMember2022-01-012022-03-3100008584702022-01-012022-03-310000858470us-gaap:AdditionalPaidInCapitalMember2022-01-012022-03-310000858470us-gaap:TreasuryStockCommonMember2022-01-012022-03-310000858470us-gaap:AccumulatedOtherComprehensiveIncomeMember2022-01-012022-03-310000858470us-gaap:CommonStockMember2022-03-310000858470us-gaap:TreasuryStockCommonMember2022-03-310000858470us-gaap:AdditionalPaidInCapitalMember2022-03-310000858470us-gaap:AccumulatedOtherComprehensiveIncomeMember2022-03-310000858470us-gaap:RetainedEarningsMember2022-03-3100008584702022-03-310000858470us-gaap:RetainedEarningsMember2022-04-012022-06-300000858470us-gaap:AdditionalPaidInCapitalMember2022-04-012022-06-300000858470us-gaap:CommonStockMember2022-04-012022-06-300000858470us-gaap:TreasuryStockCommonMember2022-04-012022-06-300000858470us-gaap:CommonStockMember2022-06-300000858470us-gaap:TreasuryStockCommonMember2022-06-300000858470us-gaap:AdditionalPaidInCapitalMember2022-06-300000858470us-gaap:AccumulatedOtherComprehensiveIncomeMember2022-06-300000858470us-gaap:RetainedEarningsMember2022-06-300000858470cog:ProvedOilAndGasPropertiesMember2023-06-300000858470cog:ProvedOilAndGasPropertiesMember2022-12-310000858470cog:UnprovedOilAndGasPropertiesMember2023-06-300000858470cog:UnprovedOilAndGasPropertiesMember2022-12-310000858470cog:GatheringAndPipelineSystemsMember2023-06-300000858470cog:GatheringAndPipelineSystemsMember2022-12-310000858470cog:LandBuildingsAndOtherEquipmentMember2023-06-300000858470cog:LandBuildingsAndOtherEquipmentMember2022-12-310000858470us-gaap:SeniorNotesMembercog:ThreePointSixtyFivePercentageWeightedAveragePrivatePlacementSeniorNotesMember2023-06-30xbrli:pure0000858470us-gaap:SeniorNotesMembercog:ThreePointSixtyFivePercentageWeightedAveragePrivatePlacementSeniorNotesMember2022-12-310000858470cog:ThreePointNineZeroPercentageSeniorNotesDueMay152027Member2023-06-300000858470cog:ThreePointNineZeroPercentageSeniorNotesDueMay152027Memberus-gaap:SeniorNotesMember2023-06-300000858470cog:ThreePointNineZeroPercentageSeniorNotesDueMay152027Memberus-gaap:SeniorNotesMember2022-12-310000858470cog:FourPointThreeSevenFivePercentageSeniorNotesDueMarch152029Member2023-06-300000858470us-gaap:SeniorNotesMembercog:FourPointThreeSevenFivePercentageSeniorNotesDueMarch152029Member2023-06-300000858470us-gaap:SeniorNotesMembercog:FourPointThreeSevenFivePercentageSeniorNotesDueMarch152029Member2022-12-310000858470us-gaap:RevolvingCreditFacilityMemberus-gaap:LineOfCreditMember2023-06-300000858470us-gaap:RevolvingCreditFacilityMemberus-gaap:LineOfCreditMember2022-12-310000858470us-gaap:RevolvingCreditFacilityMembercog:JPMorganChaseBankNAMemberus-gaap:LineOfCreditMember2023-03-100000858470us-gaap:RevolvingCreditFacilityMembercog:JPMorganChaseBankNAMembercog:SwinglineSubFacilityMemberus-gaap:LineOfCreditMember2023-03-100000858470cog:JPMorganChaseBankNAMemberus-gaap:LineOfCreditMemberus-gaap:LetterOfCreditMember2023-03-100000858470us-gaap:RevolvingCreditFacilityMemberus-gaap:SecuredOvernightFinancingRateSofrOvernightIndexSwapRateMembercog:JPMorganChaseBankNAMemberus-gaap:LineOfCreditMember2023-03-102023-03-100000858470us-gaap:RevolvingCreditFacilityMembercog:JPMorganChaseBankNAMembersrt:MinimumMemberus-gaap:BaseRateMemberus-gaap:LineOfCreditMember2023-03-102023-03-100000858470us-gaap:RevolvingCreditFacilityMembersrt:MaximumMembercog:JPMorganChaseBankNAMemberus-gaap:BaseRateMemberus-gaap:LineOfCreditMember2023-03-102023-03-100000858470us-gaap:RevolvingCreditFacilityMemberus-gaap:SecuredOvernightFinancingRateSofrOvernightIndexSwapRateMembercog:JPMorganChaseBankNAMembersrt:MinimumMemberus-gaap:LineOfCreditMember2023-03-102023-03-100000858470us-gaap:RevolvingCreditFacilityMemberus-gaap:SecuredOvernightFinancingRateSofrOvernightIndexSwapRateMembersrt:MaximumMembercog:JPMorganChaseBankNAMemberus-gaap:LineOfCreditMember2023-03-102023-03-100000858470us-gaap:RevolvingCreditFacilityMembercog:JPMorganChaseBankNAMembersrt:MinimumMemberus-gaap:LineOfCreditMember2023-03-102023-03-100000858470us-gaap:RevolvingCreditFacilityMembersrt:MaximumMembercog:JPMorganChaseBankNAMemberus-gaap:LineOfCreditMember2023-03-102023-03-100000858470us-gaap:RevolvingCreditFacilityMembercog:JPMorganChaseBankNAMemberus-gaap:LineOfCreditMember2023-03-102023-03-100000858470cog:WahaGasCollarsMembersrt:ScenarioForecastMember2023-07-012023-09-30utr:MMBTU0000858470cog:WahaGasCollarsMembersrt:ScenarioForecastMember2023-10-012023-12-310000858470cog:WahaGasCollarsMembersrt:ScenarioForecastMember2023-09-30iso4217:USDutr:MMBTU0000858470cog:WahaGasCollarsMembersrt:ScenarioForecastMember2023-12-310000858470cog:NYMEXCollarsMembersrt:ScenarioForecastMember2023-07-012023-09-300000858470cog:NYMEXCollarsMembersrt:ScenarioForecastMember2023-10-012023-12-310000858470cog:NYMEXCollarsMembersrt:ScenarioForecastMember2023-09-300000858470cog:NYMEXCollarsMembersrt:ScenarioForecastMember2023-12-310000858470cog:WTIOilCollarsMembersrt:ScenarioForecastMember2023-07-012023-09-300000858470cog:WTIOilCollarsMembersrt:ScenarioForecastMember2023-10-012023-12-310000858470cog:WTIOilCollarsMembersrt:ScenarioForecastMember2023-09-300000858470cog:WTIOilCollarsMembersrt:ScenarioForecastMember2023-12-310000858470cog:WTIMidlandOilBasisSwapsMembersrt:ScenarioForecastMember2023-07-012023-09-300000858470cog:WTIMidlandOilBasisSwapsMembersrt:ScenarioForecastMember2023-10-012023-12-310000858470cog:WTIMidlandOilBasisSwapsMembersrt:ScenarioForecastMember2023-09-300000858470cog:WTIMidlandOilBasisSwapsMembersrt:ScenarioForecastMember2023-12-310000858470us-gaap:CommodityContractMemberus-gaap:NondesignatedMember2023-06-300000858470us-gaap:CommodityContractMemberus-gaap:NondesignatedMember2022-12-310000858470cog:GasContractsMember2023-04-012023-06-300000858470cog:GasContractsMember2022-04-012022-06-300000858470cog:GasContractsMember2023-01-012023-06-300000858470cog:GasContractsMember2022-01-012022-06-300000858470cog:OilContractsMember2023-04-012023-06-300000858470cog:OilContractsMember2022-04-012022-06-300000858470cog:OilContractsMember2023-01-012023-06-300000858470cog:OilContractsMember2022-01-012022-06-300000858470us-gaap:FairValueInputsLevel1Memberus-gaap:FairValueMeasurementsRecurringMember2023-06-300000858470us-gaap:FairValueInputsLevel2Memberus-gaap:FairValueMeasurementsRecurringMember2023-06-300000858470us-gaap:FairValueInputsLevel3Memberus-gaap:FairValueMeasurementsRecurringMember2023-06-300000858470us-gaap:FairValueMeasurementsRecurringMember2023-06-300000858470us-gaap:FairValueInputsLevel1Memberus-gaap:FairValueMeasurementsRecurringMember2022-12-310000858470us-gaap:FairValueInputsLevel2Memberus-gaap:FairValueMeasurementsRecurringMember2022-12-310000858470us-gaap:FairValueInputsLevel3Memberus-gaap:FairValueMeasurementsRecurringMember2022-12-310000858470us-gaap:FairValueMeasurementsRecurringMember2022-12-31cog:impaired_asset_and_liability0000858470us-gaap:CarryingReportedAmountFairValueDisclosureMember2023-06-300000858470us-gaap:EstimateOfFairValueFairValueDisclosureMember2023-06-300000858470us-gaap:CarryingReportedAmountFairValueDisclosureMember2022-12-310000858470us-gaap:EstimateOfFairValueFairValueDisclosureMember2022-12-3100008584702023-07-012023-06-3000008584702022-01-012022-12-3100008584702023-02-012023-02-2700008584702023-02-280000858470us-gaap:RestrictedStockUnitsRSUMember2023-04-012023-06-300000858470us-gaap:RestrictedStockUnitsRSUMember2022-04-012022-06-300000858470us-gaap:RestrictedStockUnitsRSUMember2023-01-012023-06-300000858470us-gaap:RestrictedStockUnitsRSUMember2022-01-012022-06-300000858470us-gaap:RestrictedStockMember2023-04-012023-06-300000858470us-gaap:RestrictedStockMember2022-04-012022-06-300000858470us-gaap:RestrictedStockMember2023-01-012023-06-300000858470us-gaap:RestrictedStockMember2022-01-012022-06-300000858470us-gaap:PerformanceSharesMember2023-04-012023-06-300000858470us-gaap:PerformanceSharesMember2022-04-012022-06-300000858470us-gaap:PerformanceSharesMember2023-01-012023-06-300000858470us-gaap:PerformanceSharesMember2022-01-012022-06-300000858470cog:DeferredPerformanceSharesMember2023-04-012023-06-300000858470cog:DeferredPerformanceSharesMember2022-04-012022-06-300000858470cog:DeferredPerformanceSharesMember2023-01-012023-06-300000858470cog:DeferredPerformanceSharesMember2022-01-012022-06-300000858470cog:CoterraEnergyInc2023EquityIncentivePlanMember2023-05-040000858470us-gaap:RestrictedStockUnitsRSUMemberus-gaap:ShareBasedPaymentArrangementEmployeeMember2023-01-012023-06-300000858470us-gaap:RestrictedStockUnitsRSUMembersrt:MinimumMemberus-gaap:ShareBasedPaymentArrangementEmployeeMember2023-01-012023-06-300000858470us-gaap:RestrictedStockUnitsRSUMembersrt:MaximumMemberus-gaap:ShareBasedPaymentArrangementEmployeeMember2023-01-012023-06-300000858470us-gaap:RestrictedStockUnitsRSUMemberus-gaap:ShareBasedPaymentArrangementNonemployeeMember2023-06-012023-06-300000858470cog:TSRPerformanceSharesMember2023-01-012023-06-300000858470cog:MarketBasedPerformanceShareAwardsMember2023-01-012023-06-300000858470cog:TSRPerformanceSharesMember2022-02-282022-02-280000858470cog:TSRPerformanceSharesMembersrt:MinimumMember2023-01-012023-06-300000858470cog:TSRPerformanceSharesMembersrt:MaximumMember2023-01-012023-06-300000858470cog:TreasuryStockMethodMember2023-04-012023-06-300000858470cog:TreasuryStockMethodMember2022-04-012022-06-300000858470cog:TreasuryStockMethodMember2023-01-012023-06-300000858470cog:TreasuryStockMethodMember2022-01-012022-06-30

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

☒ QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934.

For the quarterly period ended June 30, 2023

OR

☐ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934.

Commission file number 1-10447

| | |

|

| COTERRA ENERGY INC. |

(Exact name of registrant as specified in its charter) |

| | | | | | | | |

| Delaware | | 04-3072771 |

(State or other jurisdiction of

incorporation or organization) | | (I.R.S. Employer

Identification Number) |

Three Memorial City Plaza

840 Gessner Road, Suite 1400, Houston, Texas 77024

(Address of principal executive offices, including ZIP code)

(281) 589-4600

(Registrant’s telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | |

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

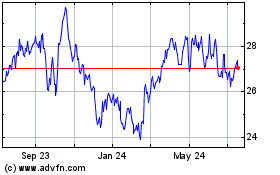

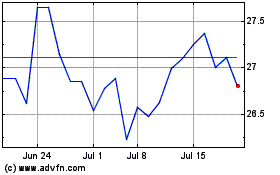

| Common Stock, par value $0.10 per share | CTRA | New York Stock Exchange |

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports) and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes ☒ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| | | | | | | | | | | |

| Large accelerated filer | ☒ | Accelerated filer | ☐ |

| | | |

| Non-accelerated filer | ☐ | Smaller reporting company | ☐ |

| | | |

| | Emerging growth company | ☐ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No ☒

As of August 4, 2023, there were 755,045,540 shares of Common Stock, Par Value $0.10 Per Share, outstanding.

COTERRA ENERGY INC.

TABLE OF CONTENTS

PART I. FINANCIAL INFORMATION

ITEM 1. Financial Statements

COTERRA ENERGY INC.

CONDENSED CONSOLIDATED BALANCE SHEET (Unaudited)

| | | | | | | | | | | | | | |

| (In millions, except per share amounts) | | June 30,

2023 | | December 31,

2022 |

| ASSETS | | | | |

| Current assets | | | | |

| Cash and cash equivalents | | $ | 841 | | | $ | 673 | |

| Restricted cash | | 9 | | | 10 | |

| Accounts receivable, net | | 604 | | | 1,221 | |

| Income taxes receivable | | 18 | | | 89 | |

| Inventories | | 65 | | | 63 | |

| Derivative instruments | | 88 | | | 146 | |

| Other current assets | | 15 | | | 9 | |

| Total current assets | | 1,640 | | | 2,211 | |

| Properties and equipment, net (Successful efforts method) | | 17,801 | | | 17,479 | |

| | | | |

| | | | |

| | | | |

| Other assets | | 438 | | | 464 | |

| | $ | 19,879 | | | $ | 20,154 | |

| | | | |

| LIABILITIES, REDEEMABLE PREFERRED STOCK AND STOCKHOLDERS' EQUITY | | | | |

| Current liabilities | | | | |

| Accounts payable | | $ | 626 | | | $ | 844 | |

| | | | |

| Accrued liabilities | | 294 | | | 328 | |

| | | | |

| Interest payable | | 21 | | | 21 | |

| | | | |

| Total current liabilities | | 941 | | | 1,193 | |

| Long-term debt, net | | 2,171 | | | 2,181 | |

| | | | |

| Deferred income taxes | | 3,367 | | | 3,339 | |

| Asset retirement obligations | | 277 | | | 271 | |

| | | | |

| | | | |

| Other liabilities | | 456 | | | 500 | |

| Total liabilities | | 7,212 | | | 7,484 | |

| | | | |

| Commitments and contingencies | | | | |

| | | | |

| Cimarex redeemable preferred stock | | 8 | | 11 |

| | | | |

| Stockholders' equity | | | | |

| Common stock: | | | | |

Authorized — 1,800 shares of $0.10 par value in 2023 and 2022 | | | | |

Issued — 755 shares and 768 shares in 2023 and 2022, respectively | | 76 | | | 77 | |

| Additional paid-in capital | | 7,639 | | | 7,933 | |

| Retained earnings | | 4,931 | | | 4,636 | |

| Accumulated other comprehensive income | | 13 | | | 13 | |

| | | | |

| | | | |

| Total stockholders' equity | | 12,659 | | | 12,659 | |

| | | $ | 19,879 | | | $ | 20,154 | |

The accompanying notes are an integral part of these condensed consolidated financial statements.

COTERRA ENERGY INC.

CONDENSED CONSOLIDATED STATEMENT OF OPERATIONS (Unaudited)

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Three Months Ended

June 30, | | Six Months Ended

June 30, |

| (In millions, except per share amounts) | | 2023 | | 2022 | | 2023 | | 2022 |

| OPERATING REVENUES | | | | | | | | |

| Natural gas | | $ | 436 | | | $ | 1,468 | | | $ | 1,258 | | | $ | 2,579 | |

| Oil | | 626 | | | 876 | | | 1,241 | | | 1,575 | |

| NGL | | 129 | | | 280 | | | 306 | | | 525 | |

| Gain (loss) on derivative instruments | | (12) | | | (66) | | | 126 | | | (457) | |

| Other | | 6 | | | 14 | | | 31 | | | 29 | |

| | | 1,185 | | | 2,572 | | | 2,962 | | | 4,251 | |

| OPERATING EXPENSES | | | | | | | | |

| Direct operations | | 130 | | | 116 | | | 264 | | | 216 | |

| Transportation, processing and gathering | | 258 | | | 238 | | | 494 | | | 471 | |

| Taxes other than income | | 63 | | | 98 | | | 149 | | | 174 | |

| Exploration | | 5 | | | 7 | | | 9 | | | 13 | |

| Depreciation, depletion and amortization | | 395 | | | 414 | | | 764 | | | 774 | |

| | | | | | | | |

| General and administrative | | 58 | | | 87 | | | 134 | | | 194 | |

| | | 909 | | | 960 | | | 1,814 | | | 1,842 | |

| | | | | | | | |

| Gain (loss) on sale of assets | | — | | | (3) | | | 5 | | | (1) | |

| INCOME FROM OPERATIONS | | 276 | | | 1,609 | | | 1,153 | | | 2,408 | |

| | | | | | | | |

| Interest expense | | 16 | | | 22 | | | 33 | | | 43 | |

| Interest income | | (10) | | | (1) | | | (22) | | | (1) | |

| | | | | | | | |

| Income before income taxes | | 270 | | | 1,588 | | | 1,142 | | | 2,366 | |

| Income tax expense | | 61 | | | 359 | | | 256 | | | 529 | |

| NET INCOME | | $ | 209 | | | $ | 1,229 | | | $ | 886 | | | $ | 1,837 | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| Earnings per share | | | | | | | | |

| Basic | | $ | 0.28 | | | $ | 1.53 | | | $ | 1.16 | | | $ | 2.28 | |

| Diluted | | $ | 0.27 | | | $ | 1.52 | | | $ | 1.16 | | | $ | 2.27 | |

| | | | | | | | |

| Weighted-average common shares outstanding | | | | | | | | |

| Basic | | 755 | | | 803 | | | 760 | | | 806 | |

| Diluted | | 760 | | | 808 | | | 764 | | | 809 | |

| | | | | | | | |

| | | | | | | | |

The accompanying notes are an integral part of these condensed consolidated financial statements.

COTERRA ENERGY INC.

CONDENSED CONSOLIDATED STATEMENT OF CASH FLOWS (Unaudited)

| | | | | | | | | | | | | | |

| | | Six Months Ended

June 30, |

| (In millions) | | 2023 | | 2022 |

| CASH FLOWS FROM OPERATING ACTIVITIES | | | | |

| Net income | | $ | 886 | | | $ | 1,837 | |

| Adjustments to reconcile net income to cash provided by operating activities: | | | | |

| Depreciation, depletion and amortization | | 764 | | | 774 | |

| | | | |

| Deferred income tax expense | | 27 | | | 101 | |

| (Gain) loss on sale of assets | | (5) | | | 1 | |

| | | | |

| (Gain) loss on derivative instruments | | (126) | | | 457 | |

| Net cash received (paid) in settlement of derivative instruments | | 184 | | | (464) | |

| | | | |

| | | | |

| Amortization of debt premium and debt issuance costs | | (10) | | | (19) | |

| | | | |

| Stock-based compensation and other | | 24 | | | 38 | |

| Changes in assets and liabilities: | | | | |

| Accounts receivable, net | | 617 | | | (489) | |

| Income taxes | | 71 | | | (200) | |

| Inventories | | (2) | | | (9) | |

| Other current assets | | (6) | | | (6) | |

| Accounts payable and accrued liabilities | | (336) | | | 147 | |

| Interest payable | | — | | | 1 | |

| Other assets and liabilities | | 52 | | | 32 | |

| | | | |

| Net cash provided by operating activities | | 2,140 | | | 2,201 | |

| | | | |

| CASH FLOWS FROM INVESTING ACTIVITIES | | | | |

| Capital expenditures for drilling, completion and other fixed asset additions | | (1,075) | | | (741) | |

| Capital expenditures for leasehold and property acquisitions | | (6) | | | (4) | |

| | | | |

| Proceeds from sale of assets | | 33 | | | 4 | |

| | | | |

| | | | |

| | | | |

| Net cash used in investing activities | | (1,048) | | | (741) | |

| | | | |

| CASH FLOWS FROM FINANCING ACTIVITIES | | | | |

| | | | |

| | | | |

| Repayments of finance leases | | (3) | | | (3) | |

| Common stock repurchases | | (325) | | | (487) | |

| | | | |

| Dividends paid | | (588) | | | (940) | |

| | | | |

| Cash received for stock option exercises | | — | | | 10 | |

| Cash paid for conversion of redeemable preferred stock | | (1) | | | (10) | |

| Tax withholding on vesting of stock awards | | (1) | | | (7) | |

| Capitalized debt issuance costs | | (7) | | | — | |

| | | | |

| Net cash used in financing activities | | (925) | | | (1,437) | |

| | | | |

| Net increase in cash, cash equivalents and restricted cash | | 167 | | | 23 | |

| Cash, cash equivalents and restricted cash, beginning of period | | 683 | | | 1,046 | |

| Cash, cash equivalents and restricted cash, end of period | | $ | 850 | | | $ | 1,069 | |

| | | | |

| | | | |

| | | | |

The accompanying notes are an integral part of these condensed consolidated financial statements.

COTERRA ENERGY INC.

CONDENSED CONSOLIDATED STATEMENT OF STOCKHOLDERS' EQUITY (Unaudited)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| (In millions, except per share amounts) | | Common Shares | | Common Stock Par | | Treasury Shares | | Treasury Stock | | Paid-In Capital | | Accumulated Other Comprehensive Income | | Retained Earnings | | Total |

| Balance at December 31, 2022 | | 768 | | | $ | 77 | | | — | | | $ | — | | | $ | 7,933 | | | $ | 13 | | | $ | 4,636 | | | $ | 12,659 | |

| Net income | | — | | | — | | | — | | | — | | | — | | | — | | | 677 | | | 677 | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| Stock amortization and vesting | | — | | | — | | | — | | | — | | | 13 | | | — | | | — | | | 13 | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| Conversion of Cimarex redeemable preferred stock | | — | | | — | | | — | | | — | | | 3 | | | — | | | — | | | 3 | |

| Common stock repurchases | | — | | | — | | | 11 | | | (271) | | | — | | | — | | | — | | | (271) | |

| Common stock retirements | | (11) | | | (1) | | | (11) | | | 271 | | | (270) | | | — | | | — | | | — | |

| | | | | | | | | | | | | | | | |

Cash dividends on common stock at $0.57 per share | | — | | | — | | | — | | | — | | | — | | | — | | | (438) | | | (438) | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| Balance at March 31, 2023 | | 757 | | | $ | 76 | | | — | | | $ | — | | | $ | 7,679 | | | $ | 13 | | | $ | 4,875 | | | $ | 12,643 | |

| Net income | | — | | | — | | | — | | | — | | | — | | | — | | | 209 | | | 209 | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| Stock amortization and vesting | | — | | | — | | | — | | | — | | | 17 | | | — | | | — | | | 17 | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| Common stock repurchases | | — | | | — | | | 2 | | | (57) | | | — | | | — | | | — | | | (57) | |

| Common stock retirements | | (2) | | | — | | | (2) | | | 57 | | | (57) | | | — | | | — | | | — | |

Cash dividends on common stock at $0.20 per share | | — | | | — | | | — | | | — | | | — | | | — | | | (153) | | | (153) | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| Balance at June 30, 2023 | | 755 | | | $ | 76 | | | — | | | $ | — | | | $ | 7,639 | | | $ | 13 | | | $ | 4,931 | | | $ | 12,659 | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| (In millions, except per share amounts) | | Common Shares | | Common Stock Par | | Treasury Shares | | Treasury Stock | | Paid-In Capital | | Accumulated Other Comprehensive Income | | Retained Earnings | | Total |

| Balance at December 31, 2021 | | 893 | | | $ | 89 | | | 79 | | | $ | (1,826) | | | $ | 10,911 | | | $ | 1 | | | $ | 2,563 | | | $ | 11,738 | |

| Net income | | — | | | — | | | — | | | — | | | — | | | — | | | 608 | | | 608 | |

| Exercise of stock options | | — | | | — | | | — | | | — | | | 6 | | | — | | | — | | | 6 | |

| Stock amortization and vesting | | — | | | — | | | — | | | — | | | 10 | | | — | | | — | | | 10 | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| Common stock repurchases | | — | | | — | | | 8 | | | (192) | | | — | | | — | | | — | | | (192) | |

| Cash dividends: | | | | | | | | | | | | | | | | |

Common stock at $0.56 per share | | — | | | — | | | — | | | — | | | — | | | — | | | (455) | | | (455) | |

Preferred stock at $20.3125 per share | | — | | | — | | | — | | | — | | | — | | | — | | | (1) | | | (1) | |

| Other comprehensive income | | — | | | — | | | — | | | — | | | — | | | 4 | | | — | | | 4 | |

| Balance at March 31, 2022 | | 893 | | | $ | 89 | | | 87 | | | $ | (2,018) | | | $ | 10,927 | | | $ | 5 | | | $ | 2,715 | | | $ | 11,718 | |

| Net income | | — | | | — | | | — | | | — | | | — | | | — | | | 1,229 | | | 1,229 | |

| Exercise of stock options | | — | | | — | | | — | | | — | | | 3 | | | — | | | — | | | 3 | |

| Stock amortization and vesting | | — | | | — | | | — | | | — | | | 18 | | | — | | | — | | | 18 | |

| Conversion of Cimarex redeemable preferred stock | | 1 | | | — | | | — | | | — | | | 28 | | | — | | | — | | | 28 | |

| Common stock repurchases | | — | | | — | | | 12 | | | (321) | | | — | | | — | | | — | | | (321) | |

Cash dividends on common stock at $0.60 per share | | — | | | — | | | — | | | — | | | — | | | — | | | (484) | | | (484) | |

| | | | | | | | | | | | | | | | |

| Balance at June 30, 2022 | | 894 | | | $ | 89 | | | 99 | | | $ | (2,339) | | | $ | 10,976 | | | $ | 5 | | | $ | 3,460 | | | $ | 12,191 | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

The accompanying notes are an integral part of these condensed consolidated financial statements.

COTERRA ENERGY INC.

NOTES TO THE CONDENSED CONSOLIDATED FINANCIAL STATEMENTS (Unaudited)

1. Financial Statement Presentation

During interim periods, Coterra Energy Inc. (the “Company”) follows the same accounting policies disclosed in its Annual Report on Form 10-K for the year ended December 31, 2022 (the “Form 10-K”) filed with the Securities and Exchange Commission (“SEC”), except for any new accounting pronouncements adopted during the period. The interim condensed consolidated financial statements are unaudited and should be read in conjunction with the notes to the consolidated financial statements and information presented in the Form 10-K. In management’s opinion, the accompanying interim condensed consolidated financial statements contain all material adjustments, consisting only of normal recurring adjustments, necessary for a fair statement. The results for any interim period are not necessarily indicative of the results that may be expected for the entire year.

From time to time, we make certain reclassifications to prior year statements to conform with the current year presentation. These reclassifications have no impact on previously reported stockholders’ equity, net income or cash flows.

2. Properties and Equipment, Net

Properties and equipment, net are comprised of the following: | | | | | | | | | | | | | | |

| (In millions) | | June 30,

2023 | | December 31,

2022 |

| Proved oil and gas properties | | $ | 18,353 | | | $ | 17,085 | |

| Unproved oil and gas properties | | 4,881 | | | 5,150 | |

| Gathering and pipeline systems | | 507 | | | 450 | |

| Land, buildings and other equipment | | 194 | | | 183 | |

| Finance lease right-of-use asset | | 25 | | | 24 | |

| | 23,960 | | | 22,892 | |

| Accumulated depreciation, depletion and amortization | | (6,159) | | | (5,413) | |

| | | $ | 17,801 | | | $ | 17,479 | |

Capitalized Exploratory Well Costs

As of June 30, 2023, the Company did not have any projects with exploratory well costs capitalized for a period of greater than one year after drilling.

3. Debt and Credit Agreements

The following table includes a summary of the Company’s long-term debt:

| | | | | | | | | | | | | | |

| (In millions) | | June 30,

2023 | | December 31,

2022 |

| | | | |

3.65% weighted-average private placement senior notes | | $ | 825 | | | $ | 825 | |

3.90% senior notes due May 15, 2027 | | 750 | | | 750 | |

4.375% senior notes due March 15, 2029 | | 500 | | | 500 | |

| Revolving credit agreement | | — | | | — | |

| Total | | 2,075 | | | 2,075 | |

| Net premium | | 101 | | | 111 | |

| Unamortized debt issuance costs | | (5) | | | (5) | |

| Long-term debt | | $ | 2,171 | | | $ | 2,181 | |

At June 30, 2023, the Company was in compliance with all financial and other covenants for its revolving credit agreement (as defined below), 3.65% weighted-average private placement senior notes (the “private placement senior notes”) and the 3.90% senior notes due May 15, 2027 and 4.375% senior notes due March 15, 2029 (the “senior notes”).

Revolving Credit Agreement

On March 10, 2023, the Company entered into a revolving credit agreement (the “Credit Agreement”) with JPMorgan Chase Bank, N.A., as administrative agent (“JPMorgan”), and certain lenders and issuing banks party thereto. The aggregate revolving commitments under the Credit Agreement are $1.5 billion, with a discretionary swingline sub-facility of up to $100 million and a letter of credit sub-facility of up to $500 million. The Company may also increase the revolving commitments under the Credit Agreement by up to an additional $500 million subject to certain conditions and the agreement of the lenders providing commitments with respect to such increase.

Borrowings under the Credit Agreement bear interest at a rate per annum equal to, at the Company’s option, either a term secured overnight financing rate (“SOFR”) plus a 0.10 percent credit spread adjustment for all tenors or a base rate, plus an interest rate margin which ranges from 0 to 75 basis points for base rate loans and 100 to 175 basis points for term SOFR loans based on the Company’s credit rating. The commitment fee on the unused available credit is calculated at annual rates ranging from 10 basis points to 27.5 basis points. The Credit Agreement matures on March 10, 2028. The maturity date can be extended for additional one-year periods on up to two occasions upon the agreement of the Company and lenders holding at least 50 percent of the commitments under the Credit Agreement.

The Credit Agreement contains customary covenants, including the maintenance of a maximum leverage ratio of no more than 3.0 to 1.0 as of the last day of any fiscal quarter until such time as the Company has no other debt in a principal amount in excess of $75 million outstanding that has a financial maintenance covenant based on a leverage ratio, at which time the Credit Agreement requires maintenance of a ratio of total debt to total capitalization of no more than 65 percent (with all calculations based on definitions contained in the Credit Agreement).

Concurrently with the Company’s entry into the Credit Agreement, the Company terminated its existing Second Amended and Restated Credit Agreement, dated as of April 22, 2019, with the lenders party thereto and JPMorgan, as administrative agent thereunder.

At June 30, 2023, the Company had no borrowings outstanding under its revolving credit agreement and unused commitments of $1.5 billion.

4. Derivative Instruments

As of June 30, 2023, the Company had the following outstanding financial commodity derivatives:

| | | | | | | | | | | | | | | | | | |

| | | | | |

| | | 2023 | | | | |

| Natural Gas | | Third Quarter | | Fourth Quarter | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| Waha gas collars | | | | | | | | |

| Volume (MMBtu) | | 8,280,000 | | | 8,280,000 | | | | | |

| Weighted average floor ($/MMBtu) | | $ | 3.03 | | | $ | 3.03 | | | | | |

| Weighted average ceiling ($/MMBtu) | | $ | 5.39 | | | $ | 5.39 | | | | | |

| | | | | | | | |

| NYMEX collars | | | | | | | | |

| Volume (MMBtu) | | 32,200,000 | | | 29,150,000 | | | | | |

| Weighted average floor ($/MMBtu) | | $ | 4.07 | | | $ | 4.03 | | | | | |

| Weighted average ceiling ($/MMBtu) | | $ | 6.78 | | | $ | 6.61 | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | |

| | 2023 | | | | | | | | |

| Oil | | Third Quarter | | Fourth Quarter | | | | | | | | |

| WTI oil collars | | | | | | | | | | | | |

| Volume (MBbl) | | 920 | | | 920 | | | | | | | | | |

| Weighted average floor ($/Bbl) | | $ | 65.00 | | | $ | 65.00 | | | | | | | | | |

| Weighted average ceiling ($/Bbl) | | $ | 89.66 | | | $ | 89.66 | | | | | | | | | |

| | | | | | | | | | | | |

| WTI Midland oil basis swaps | | | | | | | | | | | | |

| Volume (MBbl) | | 920 | | | 920 | | | | | | | | | |

| Weighted average differential ($/Bbl) | | $ | 1.01 | | | $ | 1.01 | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

Effect of Derivative Instruments on the Condensed Consolidated Balance Sheet

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | Fair Values of Derivative Instruments |

| | | | | Derivative Assets | | Derivative Liabilities |

| (In millions) | | Balance Sheet Location | | June 30,

2023 | | December 31,

2022 | | June 30,

2023 | | December 31,

2022 |

| | | | | | | | | | |

| Commodity contracts | | Derivative instruments (current) | | $ | 88 | | | $ | 146 | | | $ | — | | | $ | — | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

Offsetting of Derivative Assets and Liabilities in the Condensed Consolidated Balance Sheet

| | | | | | | | | | | | | | |

| (In millions) | | June 30,

2023 | | December 31,

2022 |

| Derivative assets | | | | |

| Gross amounts of recognized assets | | $ | 89 | | | $ | 147 | |

| Gross amounts offset in the condensed consolidated balance sheet | | (1) | | | (1) | |

| Net amounts of assets presented in the condensed consolidated balance sheet | | 88 | | | 146 | |

| Gross amounts of financial instruments not offset in the condensed consolidated balance sheet | | 1 | | | 2 | |

| Net amount | | $ | 89 | | | $ | 148 | |

| | | | |

| Derivative liabilities | | | | |

| Gross amounts of recognized liabilities | | $ | 1 | | | $ | 1 | |

| Gross amounts offset in the condensed consolidated balance sheet | | (1) | | | (1) | |

| Net amounts of liabilities presented in the condensed consolidated balance sheet | | — | | | — | |

| Gross amounts of financial instruments not offset in the condensed consolidated balance sheet | | — | | | 1 | |

| Net amount | | $ | — | | | $ | 1 | |

Effect of Derivative Instruments on the Condensed Consolidated Statement of Operations

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Three Months Ended

June 30, | | Six Months Ended

June 30, |

| (In millions) | | 2023 | | 2022 | | 2023 | | 2022 |

| Cash received (paid) on settlement of derivative instruments | | | | | | | | |

| Gas contracts | | $ | 82 | | | $ | (161) | | | $ | 181 | | | $ | (203) | |

| Oil contracts | | 2 | | | (132) | | | 3 | | | (261) | |

| Non-cash gain (loss) on derivative instruments | | | | | | | | |

| Gas contracts | | (96) | | | 133 | | | (54) | | | (49) | |

| Oil contracts | | — | | | 94 | | | (4) | | | 56 | |

| | | $ | (12) | | | $ | (66) | | | $ | 126 | | | $ | (457) | |

5. Fair Value Measurements

The Company follows the authoritative guidance for measuring fair value of assets and liabilities in its financial statements. For further information regarding the fair value hierarchy, refer to Note 1 of the Notes to the Consolidated Financial Statements in the Form 10-K.

Financial Assets and Liabilities

The following fair value hierarchy table presents information about the Company’s financial assets and liabilities measured at fair value on a recurring basis:

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| (In millions) | | Quoted Prices in

Active Markets for

Identical Assets

(Level 1) | | Significant Other

Observable Inputs

(Level 2) | | Significant

Unobservable Inputs

(Level 3) | | Balance at

June 30, 2023 |

| Assets | | | | | | | | |

| Deferred compensation plan | | $ | 47 | | | $ | — | | | $ | — | | | $ | 47 | |

| Derivative instruments | | — | | | — | | | 89 | | | 89 | |

| | $ | 47 | | | $ | — | | | $ | 89 | | | $ | 136 | |

| Liabilities | | | | | | | | |

| Deferred compensation plan | | $ | 47 | | | $ | — | | | $ | — | | | $ | 47 | |

| Derivative instruments | | — | | | — | | | 1 | | | 1 | |

| | $ | 47 | | | $ | — | | | $ | 1 | | | $ | 48 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| (In millions) | | Quoted Prices in

Active Markets for

Identical Assets

(Level 1) | | Significant Other

Observable Inputs

(Level 2) | | Significant

Unobservable Inputs

(Level 3) | | Balance at

December 31, 2022 |

| Assets | | | | | | | | |

| Deferred compensation plan | | $ | 43 | | | $ | — | | | $ | — | | | $ | 43 | |

| Derivative instruments | | — | | | — | | | 147 | | | 147 | |

| | $ | 43 | | | $ | — | | | $ | 147 | | | $ | 190 | |

| Liabilities | | | | | | | | |

| Deferred compensation plan | | $ | 55 | | | $ | — | | | $ | — | | | $ | 55 | |

| Derivative instruments | | — | | | — | | | 1 | | | 1 | |

| | $ | 55 | | | $ | — | | | $ | 1 | | | $ | 56 | |

The Company’s investments associated with its deferred compensation plans consist of mutual funds and deferred shares of the Company’s common stock that are publicly traded and for which market prices are readily available. During the second quarter of 2023, all shares of the Company’s common stock held in the deferred compensation plan were sold and invested in other investment options.

The derivative instruments were measured based on quotes from the Company’s counterparties or internal models. Such quotes and models have been derived using an income approach that considers various inputs, including current market and contractual prices for the underlying instruments, quoted forward commodity prices, basis differentials, volatility factors and interest rates for a similar length of time as the derivative contract term as applicable. Estimates are derived from, or verified using, relevant NYMEX futures contracts, and/or are compared to multiple quotes obtained from counterparties. The determination of the fair values presented above also incorporates a credit adjustment for non-performance risk. The Company measured the non-performance risk of its counterparties by reviewing credit default swap spreads for the various financial institutions with which it has derivative contracts while non-performance risk of the Company is evaluated using market credit spreads provided by several of the Company’s banks. The Company has not incurred any losses related to non-performance risk of its counterparties and does not anticipate any material impact on its financial results due to non-performance by third parties.

The most significant unobservable inputs relative to the Company’s Level 3 derivative contracts are basis differentials and volatility factors. An increase (decrease) in these unobservable inputs would result in an increase (decrease) in fair value, respectively. The Company does not have access to the specific assumptions used in its counterparties’ valuation models. Consequently, additional disclosures regarding significant Level 3 unobservable inputs were not provided.

The following table sets forth a reconciliation of changes in the fair value of financial assets and liabilities classified as Level 3 in the fair value hierarchy: | | | | | | | | | | | | | | |

| | Six Months Ended

June 30, |

| (In millions) | | 2023 | | 2022 |

| Balance at beginning of period | | $ | 146 | | | $ | (152) | |

| Total gain (loss) included in earnings | | 126 | | | (450) | |

| Settlement (gain) loss | | (184) | | | 457 | |

| Transfers in and/or out of Level 3 | | — | | | — | |

| Balance at end of period | | $ | 88 | | | $ | (145) | |

| | | | |

| Change in unrealized gains (losses) relating to assets and liabilities still held at the end of the period | | $ | 42 | | | $ | (112) | |

Non-Financial Assets and Liabilities

The Company discloses or recognizes its non-financial assets and liabilities, such as impairments of oil and gas properties or acquisitions, at fair value on a nonrecurring basis. As none of the Company’s other non-financial assets and liabilities were measured at fair value as of June 30, 2023, additional disclosures were not required.

The estimated fair value of the Company’s asset retirement obligations at inception is determined by utilizing the income approach by applying a credit-adjusted risk-free rate, which takes into account the Company’s credit risk, the time value of money, and the current economic state to the undiscounted expected abandonment cash flows. Given the unobservable nature of the inputs, the measurement of the asset retirement obligations was classified as Level 3 in the fair value hierarchy.

Fair Value of Other Financial Instruments

The estimated fair value of other financial instruments is the amount at which the instruments could be exchanged currently between willing parties. The carrying amounts reported in the Condensed Consolidated Balance Sheet for cash and cash equivalents and restricted cash approximate fair value, due to the short-term maturities of these instruments. Cash and cash equivalents and restricted cash are classified as Level 1 in the fair value hierarchy and the remaining financial instruments are classified as Level 2.

The fair value of the Company’s senior notes is based on quoted market prices, which is classified as Level 1 in the fair value hierarchy. The Company uses available market data and valuation methodologies to estimate the fair value of its private placement senior notes. The fair value of the private placement senior notes is the estimated amount the Company would have to pay a third party to assume the debt, including a credit spread for the difference between the issue rate and the period end market rate. The credit spread is the Company’s default or repayment risk. The credit spread (premium or discount) is determined by comparing the Company’s senior notes and revolving credit agreement to new issuances (secured and unsecured) and secondary trades of similar size and credit statistics for both public and private debt. The fair value of the private placement senior notes is based on interest rates currently available to the Company. The Company’s private placement senior notes are valued using an income approach and are classified as Level 3 in the fair value hierarchy.

The carrying amount and estimated fair value of debt is as follows:

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | June 30, 2023 | | December 31, 2022 |

| (In millions) | | Carrying

Amount | | Estimated Fair

Value | | Carrying

Amount | | Estimated Fair

Value |

| Long-term debt | | $ | 2,171 | | | $ | 1,962 | | | $ | 2,181 | | | $ | 1,955 | |

| | | | | | | | |

| | | | | | | | |

6. Asset Retirement Obligations

Activity related to the Company’s asset retirement obligations is as follows:

| | | | | | | | |

| (In millions) | | Six Months Ended

June 30, 2023 |

| Balance at beginning of period | | $ | 277 | |

| Liabilities incurred | | 3 | |

| Liabilities settled | | 1 | |

| | |

| Liabilities divested | | (4) | |

| | |

| Accretion expense | | 5 | |

| Balance at end of period | | 282 | |

| Less: current asset retirement obligations | | (5) | |

| Noncurrent asset retirement obligations | | $ | 277 | |

7. Commitments and Contingencies

Contractual Obligations

The Company has various contractual obligations in the normal course of its operations. There have been no material changes to the Company’s contractual obligations described under “Transportation, Processing and Gathering Agreements” and “Lease Commitments” as disclosed in Note 8 of the Notes to Consolidated Financial Statements in the Form 10-K.

Legal Matters

Securities Litigation

In October 2020, a class action lawsuit styled Delaware County Emp. Ret. Sys. v. Cabot Oil and Gas Corp., et. al. (U.S. District Court, Middle District of Pennsylvania), was filed against the Company, Dan O. Dinges, its then Chief Executive Officer, and Scott C. Schroeder, its then Chief Financial Officer, alleging that the Company made misleading statements in its periodic filings with the SEC in violation of Section 10(b) and Section 20 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”). The plaintiffs allege misstatements in the Company’s public filings and disclosures over a number of years relating to its potential liability for alleged environmental violations in Pennsylvania. The plaintiffs allege that such misstatements caused a decline in the price of the Company’s common stock when it disclosed in its Quarterly Report on Form 10-Q for the quarterly period ended June 30, 2019 two notices of violations from the Pennsylvania Department of Environmental Protection and an additional decline when it disclosed on June 15, 2020 the criminal charges brought by the Office of the Attorney General of the Commonwealth of Pennsylvania related to alleged violations of the Pennsylvania Clean Streams Law, which prohibits discharge of industrial wastes. The court appointed Delaware County Employees Retirement System to represent the purported class on February 3, 2021. In April 2021, the complaint was amended to include Phillip L. Stalnaker, the Company’s then Senior Vice President of Operations, as a defendant. The plaintiffs seek monetary damages, interest and attorney’s fees.

Also in October 2020, a stockholder derivative action styled Ezell v. Dinges, et. al. (U.S. District Court, Middle District of Pennsylvania) was filed against the Company, Messrs. Dinges and Schroeder and the Board of Directors of the Company serving at that time, for alleged securities violations under Section 10(b) and Section 21D of the Exchange Act arising from the same alleged misleading statements that form the basis of the class action lawsuit described above. In addition to the Exchange Act claims, the derivative actions also allege claims based on breaches of fiduciary duty and statutory contribution theories. In December 2020, the Ezell case was consolidated with a second derivative case filed in the U.S. District Court, Middle District of Pennsylvania with similar allegations. In January 2021, a third derivative case was filed in the U.S. District Court, Middle District of Pennsylvania with substantially similar allegations and it too was consolidated with the Ezell case in February 2021.

On February 25, 2021, the Company filed a motion to transfer the class action lawsuit to the U.S. District Court for the Southern District of Texas, in Houston, Texas, where its headquarters are located. On June 11, 2021, the Company filed a motion to dismiss the class action lawsuit on the basis that the plaintiffs’ allegations do not meet the requirements for pleading a claim under Section 10(b) or Section 20 of the Exchange Act. On June 22, 2021, the motion to transfer the class action lawsuit to the Southern District of Texas was granted. Pursuant to the prior agreement of the parties, the consolidated derivative case discussed in the preceding paragraph was also transferred to the Southern District of Texas on July 12, 2021. Subsequently, an additional stockholder derivative action styled Treppel Family Trust U/A 08/18/18 Lawrence A. Treppel and Geri D. Treppel for the benefit of Geri D. Treppel and Larry A. Treppel v. Dinges, et al. (U.S. District Court, Southern District of Texas,

Houston Division), asserting substantially similar Delaware common law claims as in the existing derivative cases, was filed in the Southern District of Texas and consolidated with the existing consolidated derivative cases. On January 12, 2022, the U.S. District Court for the Southern District of Texas granted the Company’s motion to dismiss the class action lawsuit but allowed the plaintiffs to file an amended complaint. The class action plaintiffs filed their amended complaint on February 11, 2022. The Company filed a motion to dismiss the amended class action complaint on March 10, 2022. On August 10, 2022, the U.S. District Court for the Southern District of Texas granted in part and denied in part the Company’s motion to dismiss the amended class action complaint, dismissing certain claims with prejudice but allowing certain claims to proceed. The Company filed its answer to the amended class action complaint on September 14, 2022. The class action case is presently in the discovery and class certification stage. With respect to the consolidated derivative cases, on April 1, 2022, the U.S. District Court for the Southern District of Texas granted the Company’s motion to dismiss such consolidated derivative cases but allowed the plaintiffs to file an amended complaint. The derivative plaintiffs filed their third amended complaint on May 16, 2022. The Company filed its motion to dismiss such amended complaint on June 24, 2022, and filed its reply in support of such motion to dismiss on September 4, 2022. On March 27, 2023, the U.S. District Court for the Southern District of Texas denied the motion to dismiss the derivative case as moot and ordered the Company to file a renewed motion to dismiss addressing certain issues regarding the impact of the class action litigation on the derivative case. The Company filed its renewed motion to dismiss on April 28, 2023, which is now fully briefed and pending for decision. The Company intends to vigorously defend the class action and derivative lawsuits.

In November 2020, the Company received a stockholder demand for inspection of books and records under Section 220 of the General Corporation Law of the State of Delaware (“Section 220 Demand”). The Section 220 Demand seeks broad categories of documents reviewed by the Board of Directors and minutes of meetings of the Board of Directors pertaining to alleged environmental violations in Pennsylvania, as well as documents relating to any board of directors conflicts of interest, dating from January 1, 2015 to the present. The Company also received three other similar requests from other stockholders in February and June 2021. On May 17, 2021, the Company was served with a complaint filed in the Court of Chancery of the State of Delaware by the stockholder making the February 2021 Section 220 Demand to compel the production of books and records requested. After making an agreed books and records production, the Section 220 complaint was voluntarily dismissed effective September 21, 2021. The Company also provided substantially the same books and records production in response to the other three Section 220 requests described above. It is possible that one or more additional stockholder suits could be filed pertaining to the subject matter of the Section 220 Demands and the class and derivative actions described above.

Other Legal Matters

The Company is a defendant in various other legal proceedings arising in the normal course of business. All known liabilities are accrued when management determines they are probable based on its best estimate of the potential loss. While the outcome and impact of these legal proceedings on the Company cannot be predicted with certainty, management believes that the resolution of these proceedings will not have a material effect on the Company’s financial position, results of operations or cash flows.

Contingency Reserves

When deemed necessary, the Company establishes reserves for certain legal proceedings. The establishment of a reserve is based on an estimation process that includes the advice of legal counsel and subjective judgment of management. While management believes these reserves to be adequate, it is reasonably possible that the Company could incur additional losses with respect to those matters for which reserves have been established. The Company believes that any such amount above the amounts accrued would not be material to the Condensed Consolidated Financial Statements. Future changes in facts and circumstances not currently known or foreseeable could result in the actual liability exceeding the estimated ranges of loss and amounts accrued.

8. Revenue Recognition

Disaggregation of Revenue

The following table presents revenues from contracts with customers disaggregated by product: | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended June 30, | | Six Months Ended June 30, |

| (In millions) | | 2023 | | 2022 | | 2023 | | 2022 |

| Natural gas | | $ | 436 | | | $ | 1,468 | | | $ | 1,258 | | | $ | 2,579 | |

| Oil | | 626 | | | 876 | | | 1,241 | | | 1,575 | |

| NGL | | 129 | | | 280 | | | 306 | | | 525 | |

| Other | | 6 | | | 14 | | | 31 | | | 29 | |

| | $ | 1,197 | | | $ | 2,638 | | | $ | 2,836 | | | $ | 4,708 | |

All of the Company’s revenues from contracts with customers represent products transferred at a point in time as control is transferred to the customer and generated in the U.S.

Transaction Price Allocated to Remaining Performance Obligations

As of June 30, 2023, the Company had $6.9 billion of unsatisfied performance obligations related to natural gas sales that have a fixed pricing component and a contract term greater than one year. The Company expects to recognize these obligations over the next 16 years.

Contract Balances

Receivables from contracts with customers are recorded when the right to consideration becomes unconditional, generally when control of the product has been transferred to the customer. Receivables from contracts with customers were $434 million and $1.1 billion as of June 30, 2023 and December 31, 2022, respectively, and are reported in accounts receivable, net in the Condensed Consolidated Balance Sheet. As of June 30, 2023, the Company has no assets or liabilities related to its revenue contracts, including no upfront payments or rights to deficiency payments.

9. Capital Stock

Dividends

Common Stock

In February 2023, the Company’s Board of Directors approved an increase in the base quarterly dividend from $0.15 per share to $0.20 per share.

The following table summarizes the Company’s dividends on its common stock for each quarter in 2023 and 2022:

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Rate per share | | |

| | Fixed | | Variable | | Total | | Total Dividends

(In millions) |

2023: | | | | | | | | |

| First quarter | | $ | 0.20 | | | $ | 0.37 | | | $ | 0.57 | | | $ | 438 | |

| Second quarter | | 0.20 | | | — | | | 0.20 | | | 153 | |

| | | | | | | | |

| | | | | | | | |

| Total year-to-date | | $ | 0.40 | | | $ | 0.37 | | | $ | 0.77 | | | $ | 591 | |

2022: | | | | | | | | |

| First quarter | | $ | 0.15 | | | $ | 0.41 | | | $ | 0.56 | | | $ | 455 | |

| Second quarter | | 0.15 | | | 0.45 | | | 0.60 | | 484 | |

| | | | | | | | |

| | | | | | | | |

| Total year-to-date | | $ | 0.30 | | | $ | 0.86 | | | $ | 1.16 | | | $ | 939 | |

Treasury Stock

In February 2023, the Company’s Board of Directors approved a new share repurchase program which authorizes the purchase of up to $2.0 billion of the Company’s common stock.

During the six months ended June 30, 2023, the Company repurchased and retired 13 million shares for $328 million under its new repurchase program. As of June 30, 2023, the Company had $1.7 billion remaining under its current share repurchase program. During the six months ended June 30, 2022, the Company repurchased 20 million shares for $513 million under its previous share repurchase program.

10. Stock-Based Compensation

General

Stock-based compensation expense of awards issued under the Company’s incentive plans, and the income tax benefit of awards vested and exercised, are as follows:

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended June 30, | | Six Months Ended

June 30, |

| (In millions) | | 2023 | | 2022 | | 2023 | | 2022 |

| | | | | | | | |

| Restricted stock units - employees and non-employee directors | | $ | 7 | | | $ | 11 | | | $ | 14 | | | $ | 19 | |

| Restricted stock awards | | 4 | | | 5 | | | 8 | | | 10 | |

| Performance share awards | | 3 | | | 4 | | | 8 | | | 10 | |

| Deferred performance shares | | (7) | | | 1 | | | (7) | | | 5 | |

| | | | | | | | |

| Total stock-based compensation expense | | $ | 7 | | | $ | 21 | | | $ | 23 | | | $ | 44 | |

| Income tax benefit | | $ | 1 | | | $ | — | | | $ | 2 | | | $ | 5 | |

Refer to Note 13 of the Notes to the Consolidated Financial Statements in the Form 10-K for further description of the various types of stock-based compensation awards and the applicable award terms.

On May 4, 2023, the Company’s stockholders approved the Coterra Energy Inc. 2023 Equity Incentive Plan (the “2023 Plan”) which replaced the existing Cabot Oil & Gas Corporation 2014 Incentive Plan (the “Prior Cabot Plan”) and the Cimarex Energy Co. Amended and Restated 2019 Equity Incentive Plan (the “Prior Cimarex Plan). Under the 2023 Plan, permitted awards include, but are not limited to, options, stock appreciation rights, restricted stock, restricted stock units, performance stock units and other cash and stock-based awards. A total of 22.95 million shares of common stock may be issued under the 2023 Plan. The 2023 Plan expires on February 21, 2033. No additional awards may be granted under the Prior Cabot Plan or the Prior Cimarex Plan on or after May 4, 2023. Awards outstanding under any of the Company’s prior plans will remain outstanding and vest in accordance with their original terms and conditions.

Restricted Stock Units - Employees

During the six months ended June 30, 2023, the Company granted 666,303 restricted stock units to employees of the Company with a weighted average grant date value of $23.00 per unit. The fair value of restricted stock unit grants is based on the closing stock price on the grant date. Restricted stock units generally vest either at the end of a three-year service period or on a graded or graduated vesting basis at each anniversary date over a three-year service period. The Company used an annual forfeiture rate assumption of zero to five percent for purposes of recognizing stock-based compensation expense for its restricted stock units. The annual forfeiture rate assumption was based on the Company’s actual forfeiture history or expectations for this type of award.

Restricted Stock Units - Non-Employees Directors

In June 2023, the Company granted 73,593 restricted stock units, with a weighted-average grant date value of $24.46 per unit, to the Company’s non-employee directors. The fair value of these units is measured based on the closing stock price on grant date. These units will vest in May 2024 and the Company will recognize compensation expense ratably over the vesting period.

The Company did not use as annual forfeiture rate for purposes of recognizing stock-based compensation expense for these awards. The annual forfeiture rate assumption was based on the Company’s actual forfeiture history or expectations for this type of award.

Performance Share Awards

Total Shareholder Return (“TSR”) Performance Share Awards. During the six months ended June 30, 2023, the Company granted 577,172 TSR Performance Share Awards, which are earned, or not earned, based on the comparative

performance of the Company’s common stock measured against a predetermined group of companies in the Company’s peer group and certain industry-related indices over a three-year performance period, which commenced on February 1, 2023 and ends on January 31, 2026.

These awards have both an equity and liability component, with the right to receive up to the first 100 percent of the award in shares of common stock and the right to receive up to an additional 100 percent of the value of the award in excess of the equity component in cash. These awards also include a feature that will reduce the potential cash component of the award if the actual performance is negative over the three-year period and the base calculation indicates an above-target payout. The equity portion of these awards is valued on the grant date and is not marked to market, while the liability portion of the awards is valued as of the end of each reporting period on a mark-to-market basis. The Company calculates the fair value of the equity and liability portions of the awards using a Monte Carlo simulation model.

The Company did not use an annual forfeiture rate for purposes of recognizing stock-based compensation expense for these awards. The annual forfeiture rate assumption was based on the Company’s actual forfeiture history or expectations for this type of award.

The following assumptions were used to determine the grant date fair value of the equity component on February 21, 2023 and the period-end fair value of the liability component of the TSR Performance Share Awards: | | | | | | | | | | | | | | |

| | | Grant Date | | June 30, 2023 |

| Fair value per performance share award | | $ | 17.18 | | | $11.36 - $12.63 |

| Assumptions: | | | | |

| Stock price volatility | | 44.8 | % | | 40.9% - 42.6% |

| Risk-free rate of return | | 4.40 | % | | 4.59% - 5.02% |

11. Earnings per Common Share

Basic earnings per share (“EPS”) is computed by dividing net income available to common stockholders by the weighted-average number of common shares outstanding for the period. Diluted EPS is similarly calculated, except that the common shares outstanding for the period is increased using the treasury stock and as-if converted methods to reflect the potential dilution that could occur if outstanding stock awards were vested or exercised at the end of the applicable period. Anti-dilutive shares represent potentially dilutive securities that are excluded from the computation of diluted income or loss per share as their impact would be anti-dilutive.

The following is a calculation of basic and diluted earnings per share under the two-class method:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended

June 30, | | Six Months Ended

June 30, | | |

| (In millions, except per share amounts) | | 2023 | | 2022 | | 2023 | | 2022 | | | | |

| | | | | | | | | | | | |

| Income (Numerator) | | | | | | | | | | | | |

| Net income | | $ | 209 | | | $ | 1,229 | | | $ | 886 | | | $ | 1,837 | | | | | |

| Less: dividends attributable to participating securities | | (1) | | | (1) | | | (3) | | | (3) | | | | | |

| Less: Cimarex redeemable preferred stock dividends | | — | | | — | | | — | | | (1) | | | | | |

| Net income available to common stockholders | | $ | 208 | | | $ | 1,228 | | | $ | 883 | | | $ | 1,833 | | | | | |

| | | | | | | | | | | | |

| Shares (Denominator) | | | | | | | | | | | | |

| Weighted average shares - Basic | | 755 | | | 803 | | | 760 | | | 806 | | | | | |

| Dilution effect of stock awards at end of period | | 5 | | | 5 | | | 4 | | | 3 | | | | | |

| Weighted average shares - Diluted | | 760 | | | 808 | | | 764 | | | 809 | | | | | |

| | | | | | | | | | | | |

| Earnings per share: | | | | | | | | | | | | |

| Basic | | $ | 0.28 | | | $ | 1.53 | | | $ | 1.16 | | | $ | 2.28 | | | | | |

| Diluted | | $ | 0.27 | | | $ | 1.52 | | | $ | 1.16 | | | $ | 2.27 | | | | | |

The following is a calculation of weighted-average shares excluded from diluted EPS due to anti-dilutive effect: | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended

June 30, | | Six Months Ended

June 30, | | |

| (In millions) | | 2023 | | 2022 | | 2023 | | 2022 | | | | |

| | | | | | | | | | | | |

| Weighted-average stock awards excluded from diluted EPS due to the anti-dilutive effect calculated using the treasury stock method | | — | | | — | | | 1 | | | 1 | | | | | |

| | | | | | | | | | | | |

12. Restructuring Costs

Restructuring costs are primarily related to workforce reductions and associated severance benefits that were triggered by the merger with Cimarex Energy Co. that closed on October 1, 2021. The following table summarizes the Company’s restructuring liabilities:

| | | | | | | | | | | | | | |

| | Six Months Ended

June 30, |

| (In millions) | | 2023 | | 2022 |

| Balance at beginning of period | | $ | 77 | | | $ | 43 | |

| Additions related to merger integration | | 11 | | 33 |

| Payments of merger-related restructuring costs | | (18) | | | (7) | |

| Balance at end of period | | $ | 70 | | | $ | 69 | |

13. Additional Balance Sheet Information

Certain balance sheet amounts are comprised of the following:

| | | | | | | | | | | | | | |

| (In millions) | | June 30,

2023 | | December 31,

2022 |

| Accounts receivable, net | | | | |

| Trade accounts | | $ | 434 | | | $ | 1,067 | |

| Joint interest accounts | | 169 | | | 108 | |

| Other accounts | | 3 | | | 48 | |

| | | 606 | | | 1,223 | |

| Allowance for credit losses | | (2) | | | (2) | |

| | | $ | 604 | | | $ | 1,221 | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| Other assets | | | | |

| Deferred compensation plan | | $ | 47 | | | $ | 43 | |

| Debt issuance costs | | 9 | | | 3 | |

| | | | |

| Operating lease right-of-use assets | | 357 | | | 382 | |

| | | | |

| | | | |

| Other accounts | | 25 | | | 36 | |

| | | $ | 438 | | | $ | 464 | |

| Accounts payable | | | | |

| Trade accounts | | $ | 75 | | | $ | 27 | |

| | | | |

| Royalty and other owners | | 208 | | | 438 | |

| Accrued transportation | | 77 | | | 85 | |

| Accrued capital costs | | 180 | | | 148 | |

| Taxes other than income | | 5 | | | 73 | |

| Accrued lease operating costs | | 41 | | | 32 | |

| | | | |

| | | | |

| Other accounts | | 40 | | | 41 | |

| | | $ | 626 | | | $ | 844 | |

| Accrued liabilities | | | | |

| Employee benefits | | $ | 37 | | | $ | 74 | |

| Taxes other than income | | 48 | | | 62 | |

| Restructuring liability | | 41 | | | 39 | |

| | | | |

| Operating lease liabilities | | 115 | | | 114 | |

| Financing lease liabilities | | 6 | | | 6 | |

| | | | |

| Other accounts | | 47 | | | 33 | |

| | | $ | 294 | | | $ | 328 | |

| Other liabilities | | | | |

| Deferred compensation plan | | $ | 47 | | | $ | 55 | |

| Postretirement benefits | | 16 | | | 17 | |

| | | | |

| Operating lease liabilities | | 260 | | | 287 | |

| Financing lease liabilities | | 9 | | | 11 | |

| Restructuring liability | | 29 | | | 38 | |

| Other accounts | | 95 | | | 92 | |

| | | $ | 456 | | | $ | 500 | |

14. Interest Expense

Interest expense is comprised of the following:

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended June 30, | | Six Months Ended June 30, |

| (In millions) | | 2023 | | 2022 | | 2023 | | 2022 |

| Interest Expense | | | | | | | | |

| Interest expense | | $ | 21 | | | $ | 27 | | | $ | 41 | | | 57 | |

| Debt premium amortization | | (6) | | | (8) | | | (11) | | | (19) | |

| Debt financing costs | | 1 | | | 1 | | | 2 | | | 2 | |

| Other | | — | | | 2 | | | 1 | | | 3 | |

| | $ | 16 | | | $ | 22 | | | $ | 33 | | | $ | 43 | |

ITEM 2. Management’s Discussion and Analysis of Financial Condition and Results of Operations

The following review of operations of Coterra Energy Inc. (“Coterra,” “our,” “we” and “us”) for the three and six month periods ended June 30, 2023 and 2022 should be read in conjunction with our Condensed Consolidated Financial Statements and the Notes included in this Quarterly Report on Form 10-Q (this “Form 10-Q”) and with the Consolidated Financial Statements, Notes and Management’s Discussion and Analysis included in our Annual Report on Form 10-K for the year ended December 31, 2022 (our “Form 10-K”).

OVERVIEW

Financial and Operating Overview

Financial and operating results for the six months ended June 30, 2023 compared to the six months ended June 30, 2022 reflect the following:

•Equivalent production increased 3.5 MMBoe from 114.2 MMBoe, or 630.8 MBoepd, in 2022 to 117.7 MMBoe, or 650.1 MBoepd in 2023. The increase was attributable to higher production in the Permian and Anadarko Basins due to the timing and productivity of our 2023 drilling and completion activities.

•Natural gas production increased 2.1 Bcf from 510.3 Bcf, or 2,819 Mmcf per day, in 2022 to 512.4 Bcf, or 2,831 Mmcf per day, in the 2023 period. The slight increase was primarily attributable to higher production in the Anadarko Basin, partially offset by slightly lower production in the Permian Basin, both of which were due to the timing of our drilling and completion activities.

•Oil production increased 1.5 MMBbl from 15.5 MMBbl, or 85.6 MBblpd, in 2022 to 17.0 MMBbl, or 94.0 MBblpd, in 2023. The increase was attributable to higher production in the Permian Basin due to the timing and productivity of our drilling and completion activities.

•NGL volumes increased 1.6 MMBbl from 13.6 MMBbl, or 75.3 MBblpd, in 2022 to 15.2 MMBbl, or 84.2 MBblpd, in 2023. The increase was attributable to increased volumes in the Permian and Anadarko Basins due to the timing and productivity of our drilling and completion activities.

•Average realized natural gas price was $2.81 per Mcf, $1.85 lower than the $4.66 per Mcf realized in the corresponding period of the prior year.

•Average realized oil price was $73.11 per Bbl, $11.65 lower than the $84.76 per Bbl realized in the corresponding period of the prior year.

•Average realized NGL price was $20.11 per Bbl, $18.44 lower than the $38.55 per Bbl realized in the corresponding period of the prior year.

•Total capital expenditures for drilling, completion and other fixed assets were $1.1 billion compared to $794 million in the corresponding period of the prior year. The increase was driven by higher planned completion activity levels across our operations and higher costs.

•Drilled 125 gross wells (82.3 net) with a success rate of 100 percent compared to 127 gross wells (88.3 net) with a success rate of 100 percent for the corresponding period of the prior year.

•Turned in line 131 gross wells (87.3 net) in 2023 compared to 105 gross wells (57.0 net) in the corresponding period of 2022.

•Average rig count during the first six months of 2023 was approximately 6.0, 3.0 and 1.5 rigs in the Permian Basin, Marcellus Shale and Anadarko Basin, respectively, compared to an average rig count of approximately 6.3, 2.8 and 1.7 rigs in the Permian Basin, Marcellus Shale and Anadarko Basin, respectively, during the corresponding period of 2022.

•Increased our quarterly base dividend from $0.15 per share for regular quarterly dividends in 2022 to $0.20 per share as part of our returns-focused strategy.

•Implemented our new $2.0 billion share repurchase program and repurchased 13 million shares for $328 million during the six months ended June 30, 2023. We repurchased 20 million shares for $513 million during the six months ended June 30, 2022 under our previous share repurchase program.

Market Conditions and Commodity Prices

Our financial results depend on many factors, particularly commodity prices and our ability to find, develop and market our production on economically attractive terms. Commodity prices are affected by many factors outside of our control, including changes in market supply and demand, which are impacted by pipeline capacity constraints, inventory storage levels, basis differentials, weather conditions, and geopolitical, economic and other factors.

NYMEX oil and natural gas futures prices have strengthened since the reduction of pandemic-related restrictions and increased OPEC+ cooperation. Improving oil and natural gas futures prices in part reflect market expectations of limited U.S. supply growth from publicly traded companies as a result of capital investment discipline and a focus on delivering free cash flow returns to stockholders. In addition, natural gas prices have benefited from strong worldwide liquefied natural gas demand, which is, in part, a result of buyers shifting from Russian gas due to the Ukraine invasion, sustained higher U.S. exports, lower associated gas growth from oil drilling and improved U.S. economic activity. These pricing increases have been partially offset by reduced gas consumption due to warmer winter weather in the U.S. and Europe and concerns over potential economic recession, negatively impacting natural gas and NGL prices. Oil price futures have improved (although such future prices are still lower than current spot prices) coinciding with recovering global economic activity, lower supply from major oil producing countries, OPEC+ cooperation and moderating inventory levels.