Canadian Natural Lags Estimates - Analyst Blog

March 12 2013 - 9:03AM

Zacks

Independent oil and gas explorer Canadian Natural

Resources Ltd. (CNQ) reported weak fourth-quarter 2012

results, owing to lower natural gas production.

Earnings per share, excluding one-time and non-cash items, came in

at 33 Canadian cents (33 US cents) in the quarter, way behind the

Zacks Consensus Estimate of 44 US cents. The Calgary, Alberta-based

operator’s per share profits were also significantly lower than the

fourth-quarter 2011 number of 88 Canadian cents (89 US

cents), hurt by lower price realizations for oil and gas.

Quarterly revenue of C$3,700.0 million (US$3,732.2 million) was

down 12.3% from the year-ago period. The top line also missed our

projection of US$3,933.0 million.

Canadian Natural’s fourth quarter cash flow – a key metric to gauge

its capability to fund new projects and drilling – amounted to

C$1,548.0 million, which was 28.3% lower than that achieved in the

fourth quarter of 2011.

Production

Total production of Canadian Natural during the quarter was up 0.2%

year over year to 658,973 oil-equivalent barrels per day (BOE/d).

Oil and natural gas liquids (NGLs) production increased

approximately 5.8% to 469,964 barrels per day (Bbl/d), primarily

due to successful drilling program of crude oil.

Natural gas production declined 11.4% from the prior-year period to

1,134 million cubic feet per day (MMcf/d) due to the Canadian

Natural’s decision to shut production volumes and to allocate

capital for oil projects that will provide higher return.

Realized Prices

On a reported basis, the average realized crude oil price (before

hedging) during the fourth quarter was C$64.23 per barrel,

representing a drop of 24.7% from the corresponding quarter last

year. The average realized natural gas price (excluding hedging)

during the three months ended Dec 31, 2012 was C$3.16 per thousand

cubic feet (Mcf), down from the year-ago level of C$3.50 per

Mcf.

Capital Expenditure & Balance Sheet

Canadian Natural's total capital spending during the quarter was

C$1,767.0 million, as against C$1,909.0 million in the year-ago

quarter.

As of Dec 31, 2012, Canada’s second largest oil producer had C$37.0

million cash on hand and long-term debt of approximately C$8,736.0

million, representing a debt-to-capitalization ratio of 26.5%.

Guidance

Management is guiding production of 471,000–495,000 Bbl/d of

liquids and 1,130–1,150 MMcf/d of natural gas during the first

quarter of 2013. Canadian Natural is planning to drill 132 net

thermal in situ wells and 1,022 net crude oil wells in North

America during 2013.

For 2013, Canadian Natural estimates production of 482,000–513,000

Bbl/d of liquids and 1,085–1,145 MMcf/d of natural gas.

Dividend

Canadian Natural has recently increased its quarterly cash dividend

payment by 19.0% to 12.5 Canadian cents per share. The

increased dividend will be paid on Apr 1, 2013, to shareholders of

record as on Mar 15, 2013.

Proved Reserve

Total proved reserves at the end of 2012 has increased by 4% to

5.02 billion BOE of which the proportion of liquid is 86.2% and the

remaining is natural gas.

Stocks to Consider

Canadian Natural currently carries a Zacks Rank #3 (Hold), implying

that it is expected to perform in line with the broader U.S. equity

market over the next one to three months.

Meanwhile, one can look at other energy firms like

Compressco Partners LP (GSJK), Range

Resources Corporation (RRC) and EPL Oil & Gas

Inc (EPL) as attractive investments. All these firms –

sporting a Zacks Rank #1 (Strong Buy) – offer value and are worth

accumulating at current levels.

CDN NTRL RSRCS (CNQ): Free Stock Analysis Report

EPL OIL&GAS INC (EPL): Free Stock Analysis Report

COMPRESSCO PTNR (GSJK): Free Stock Analysis Report

RANGE RESOURCES (RRC): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

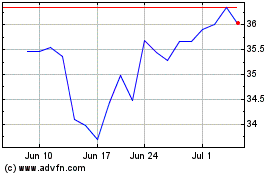

Canadian Natural Resources (NYSE:CNQ)

Historical Stock Chart

From Jun 2024 to Jul 2024

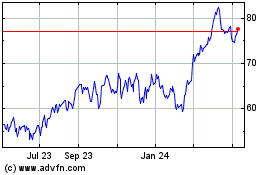

Canadian Natural Resources (NYSE:CNQ)

Historical Stock Chart

From Jul 2023 to Jul 2024