CORRECT:Canadian Natural 2Q Profit Quadruples On Higher Oil Production, Lower Costs

August 05 2010 - 1:37PM

Dow Jones News

Canadian Natural Resources Ltd.'s (CNQ, CNQ.T) net income more

than quadrupled during the second quarter as oil production and

prices rose while the company's production costs decreased.

The only major negative factor the Calgary oil and gas producer

reported was lower expected annual production from its Horizon oil

sands project due to it being taken offline for unscheduled

maintenance last month after a pipeline break.

Second-quarter net earnings came in at C$667 million, or 61

Canadian cents a share, while revenue increased by nearly a third

to $3.6 billion.

Adjusted net earnings, which exclude the effects of hedging and

currency fluctuations, were 63 Canadian cents a share, beating

analysts' mean estimates of 56 Canadian cents a share.

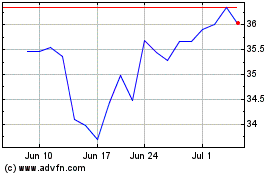

Canadian Natural's shares rose 1.1% to $36.14 in recent trading

on the New York Stock Exchange.

Total production increased 10% to 649,195 barrel of oil

equivalents per day during the quarter compared with a year

earlier.

Canadian Natural's higher profits were largely driven by higher

oil prices, as well as increased oil production. The company's

average realized oil price rose 7% to C$63.62 a barrel. Much of

Canadian Natural's production is heavy oil, which trades at a

discount U.S. light oil benchmark prices, which averaged $77.99

during the quarter. Crude oil makes up 68% of Canadian Natural's

production volume and 86% of its revenue.

"Canadian Natural continues to benefit from the decision to

allocate capital to the oil portion of our portfolio rather than

the natural gas portion," President Steve Laut said during a

conference call Thursday, adding that the company expects natural

gas prices to remain "challenged" near $4 a million British thermal

units for the rest of this year.

The company's best production results came from its thermal

heavy oil assets, where it reached record production of 96,000

barrels a day, a 53% increase from a year earlier.

Operating costs for the company's crude oil and natural gas

liquids production also dropped 23% from a year ago due to

operational efficiencies, and the company slightly lowered its

annual operating cost guidance for all its operations, except oil

sands.

The company lowered the top end of its production guidance for

its Horizon oil sands project in northeast Alberta to 90,000 to

100,000 barrels a day--the previous top end had been 105,000

barrels a day--as a result of a pipeline break at the end of last

month. Company executives said during the conference call that the

break was likely caused by corrosion from high concentrations of an

ammonia compound. Horizon would likely be up and running again by

the end of next week and steps would be taken to prevent the same

incident from happening again, the executives said.

Laut said during the conference call that the company was

committed to moving forward with the second phase of Horizon's

development, which would take production to 232,000 barrels a day,

"but only when we can be certain that reasonable cost certainty can

be achieved." The company estimated the project won't enter

production until 2012 or 2013.

The company is also moving forward with its 45,000 barrel-a-day

Kirby oil sands project in Alberta, which it expects to receive

regulatory approval for this summer and to sanction in the fourth

quarter.

-By Edward Welsch, Dow Jones Newswires; 403-229-9095;

edward.welsch@dowjones.com

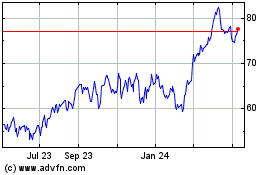

Canadian Natural Resources (NYSE:CNQ)

Historical Stock Chart

From Jun 2024 to Jul 2024

Canadian Natural Resources (NYSE:CNQ)

Historical Stock Chart

From Jul 2023 to Jul 2024