FALSE000010513200001051322023-12-122023-12-12

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

__________

FORM 8-K

__________

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934

Date of Report (date of earliest event reported): December 12, 2023

WD-40 COMPANY

(Exact Name of Registrant as specified in its charter)

__________

| | | | | | | | | | | | | | |

| Delaware | | 000-06936 | | 95-1797918 |

(State or other jurisdiction of incorporation or organization) | | (Commission File Number) WD 40 CO (Commission Company Name) | | (I.R.S. Employer Identification Number) |

9715 Businesspark Avenue, San Diego, California 92131

(Address of principal executive offices, with zip code)

(619) 275-1400

(Registrant’s telephone number, including area code)

N/A

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

| | | | | |

| o | Written Communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

| o | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

| o | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

| o | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | | | | | | | |

| Title of each class | | Trading Symbol | | Name of exchange on which registered |

| Common stock, par value $0.001 per share | | WDFC | | NASDAQ Global Select Market |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter)

Emerging Growth Company o

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act o

| | | | | |

| Item 5.02. | Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers. |

(e) The Amended and Restated 2016 Stock Incentive Plan was adopted by the Board of Directors (“Board”) of WD-40 Company (“Company”) on October 5, 2023, subject to stockholder approval at the Annual Meeting of Stockholders (“Annual Meeting”). As noted below under Item 5.07, at the Annual Meeting the Company held on December 12, 2023, the Company’s stockholders approved the Company’s Amended and Restated 2016 Stock Incentive Plan, which then became effective.

Summary of Material Amendments

The Amended and Restated 2016 Stock Incentive Plan includes the following material changes to the Company’s 2016 Stock Incentive Plan (“2016 Plan”):

a. Increase in Share Reserve. The Amended and Restated 2016 Stock Incentive Plan provides for an increase of 1,000,000 shares over the number of shares of common stock that had been available for issuance under the 2016 Plan.

b. Individual Award Limits. The Amended and Restated 2016 Stock Incentive Plan continues to include the limits on the size of awards that an individual may receive each calendar year, provided that the limits on Full Value Awards that may be granted to any participant in the Amended and Restated 2016 Stock Incentive Plan in any calendar year increases to 60,000 shares (and such limit increases to 120,000 shares during the calendar year in which an employee commences employment).

c. Prohibition on Liberal Share Recycling. The following shares are not returned to the share reserve under the Amended and Restated 2016 Stock Incentive Plan: (1) shares of common stock delivered by the grantee or withheld by us as payment of the exercise price in connection with the exercise of stock options (“Options”) or payment of the tax withholding obligation in connection with any award under the Amended and Restated 2016 Stock Incentive Plan (“Awards”); (2) shares purchased on the open market with the cash proceeds from the exercise of Options; and (3) shares subject to a stock appreciation right (“SAR”) that are not issued in connection with the stock settlement of the SAR on its exercise.

d. Limits on Dividends and Dividend Equivalents. Dividends and dividend equivalents are not paid on Awards subject to vesting conditions unless and until such conditions are met. In addition, the Amended and Restated 2016 Stock Incentive Plan does not permit dividend equivalents to be payable with respect to Options or SARs.

e. Removal of Fixed Term; Extension of Time Period for Granting Incentive Stock Options (“ISOs”). The Amended and Restated 2016 Stock Incentive Plan does not have a fixed term and permits the granting of Options that are intended to qualify as ISOs, as defined under Section 422 of the Internal Revenue Code (“Code”), through October 5, 2033, which is the 10th anniversary of the date the Board adopted the Amended and Restated 2016 Stock Incentive Plan.

f. ISO Limit. The Amended and Restated 2016 Stock Incentive Plan provides that no more than 2,000,000 shares may be issued pursuant to ISOs granted thereunder. The Company has not issued any ISOs or Options under the 2016 Plan, and the Company does not presently intend to issue ISOs or Options.

g. Removal of 162(m) Provisions. Section 162(m) of the Code, prior to the Tax Cuts and Jobs Act of 2017 (the “TCJA”), allowed performance-based compensation that met certain requirements to be tax deductible regardless of amount. This qualified performance-based compensation exception was repealed as part of the TCJA. Certain provisions were removed from the Amended and Restated 2016 Stock Incentive Plan which were otherwise required for awards to qualify as performance-based compensation under the Section 162(m) exception prior to its repeal.

h. Other Updates. The Amended and Restated 2016 Stock Incentive Plan contains other minor, technical, or administrative updates.

A description of the material terms of the Amended and Restated 2016 Stock Incentive Plan was included in the Company’s Definitive Proxy Statement (“Proxy Statement”) on Schedule 14A filed with the Securities and Exchange Commission on November 2, 2023. The foregoing and the description in the Proxy Statement are not complete summaries of the terms of the Amended and Restated 2016 Stock Incentive Plan and are qualified by reference to the full text of the Amended and Restated 2016 Stock Incentive Plan, a copy of which was included as Appendix A to the Proxy Statement, and incorporated by reference herein.

| | | | | |

| Item 5.07. | Submission of Matters to a Vote of Security Holders. |

On December 12, 2023, the Company held its Annual Meeting in a virtual meeting format via webcast. At the Annual Meeting, the holders of 12,643,978 shares of common stock, which represent over 93% of 13,556,684 outstanding shares entitled to vote as of the record date of October 16, 2023, were represented virtually or by proxy. The proposals are described in more detail in the Company’s Proxy Statement. The matters voted upon at the Annual Meeting and the voting results are set forth below.

1. Election of Directors: The Company’s stockholders elected the following directors to each serve until the next Annual Meeting or until a successor is duly elected and qualified. The voting results were as follows:

| | | | | | | | | | | | | | | | | | | | | | | |

| Name | Votes For | | Votes Against | | Abstain | | Broker Non-Votes |

| Steven A. Brass | 10,876,260 | | 123,714 | | 17,148 | | 1,626,856 |

| Cynthia B. Burks | 10,860,604 | | 147,261 | | 9,257 | | 1,626,856 |

| Daniel T. Carter | 10,860,144 | | 147,547 | | 9,431 | | 1,626,856 |

| Eric P. Etchart | 10,845,004 | | 163,187 | | 8,931 | | 1,626,856 |

| Lara L. Lee | 10,850,040 | | 158,761 | | 8,321 | | 1,626,856 |

| Edward O. Magee, Jr. | 10,843,646 | | 160,389 | | 13,087 | | 1,626,856 |

| Trevor I. Mihalik | 10,847,894 | | 160,080 | | 9,148 | | 1,626,856 |

| Graciela I. Monteagudo | 10,803,773 | | 195,849 | | 17,500 | | 1,626,856 |

| David B. Pendarvis | 10,852,872 | | 141,575 | | 22,675 | | 1,626,856 |

| Gregory A. Sandfort | 10,672,807 | | 334,797 | | 9,518 | | 1,626,856 |

| Anne G. Saunders | 10,810,082 | | 188,375 | | 18,665 | | 1,626,856 |

2. Advisory Vote to Approve Executive Compensation: The Company’s stockholders approved, by advisory vote, the compensation paid to the Company’s named executive officers. The voting results were as follows:

| | | | | | | | | | | | | | | | | | | | |

| | | | | | |

| | | | | | |

| Votes For | | Votes Against | | Abstain | | Broker Non-Votes |

| 10,653,724 | | 333,895

| | 29,503

| | 1,626,856 |

| | | | | | |

3. Advisory Vote on the Frequency of Future Advisory Votes Executive Compensation: The Company’s stockholders voted to recommend, by advisory vote, that future advisory votes on the compensation paid to the Company’s named executive officers (“NEO”) be held every year. The voting results were as follows:

| | | | | | | | | | | | | | | | | | | | |

| 1 Year | 2 Years | 3 Years | | Abstain | | Broker Non-Votes |

| 10,775,725 | 18,994 | 196,750 | | 25,654 | | 1,626,856 |

Based upon the results set forth above, and consistent with the Board’s recommendation since 2011, the Company will continue to include an advisory vote on NEO compensation in the Company’s proxy statement every year until the next required vote on the frequency of such votes.

4. Approval of the Company’s Amended and Restated 2016 Stock Incentive Plan: The Company’s stockholders approved the Amended and Restated 2016 Stock Incentive Plan. The voting results were as follows:

| | | | | | | | | | | | | | | | | | | | |

| Votes For | | Votes Against | | Abstain | | Broker Non-Votes |

10,778,391

| | 209,695

| | 29,036

| | 1,626,856

|

5. Ratification of Appointment of Independent Registered Public Accounting Firm: The Company’s stockholders ratified the selection of PricewaterhouseCoopers LLP as the Company’s independent registered public accounting firm for the fiscal year ending August 31, 2024. The voting results were as follows:

| | | | | | | | | | | | | | |

| | | | |

| | | | |

| Votes For | | Votes Against | | Abstain |

| 10,837,386 | | 1,794,958 | | 11,634 |

| | | | |

There were no broker non-votes on this proposal.

On December 12, 2023, the Company issued a press release announcing that the Board declared a quarterly dividend of $0.88 per share on the Company’s common stock, reflecting an increase of 6% compared to last quarter’s dividend. The dividend is payable January 31, 2024 to stockholders of record at the close of business on January 19, 2024. The Company also announced that it had scheduled its first fiscal quarter 2024 earnings conference call to be held on January 9, 2024 at 2:00 p.m., PST.

The full text of the press release is furnished herewith as Exhibit 99.1, and the press release is incorporated by reference into this Item 8.01.

The information in Item 8.01, including Exhibit 99.1, is not deemed to be “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended, or otherwise subject to the liabilities of that Section and is not deemed incorporated by reference into any of the Company’s filings under the Securities Act of 1933, as amended, except as shall be expressly set forth by specific reference in such filing.

| | | | | |

| Item 9.01. | Financial Statements and Exhibits. |

| |

| (d) | Exhibits |

| |

| Exhibit No. | Description |

| |

| 99.1 | |

| |

| 104 | The cover page from this Current Report on Form 8-K, formatted in Inline XBRL. |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | |

| WD-40 Company |

| |

| (Registrant) |

| |

| Date: December 18, 2023 | /s/ PHENIX Q. KIAMILEV |

| Phenix Q. Kiamilev |

| |

| Vice President, General Counsel and |

| |

| Corporate Secretary |

FOR IMMEDIATE RELEASE

Media and Investor Contact:

Wendy Kelley

investorrelations@wd40.com

+1-619-275-9304

WD-40 Company Increases Quarterly Dividend and Schedules First Quarter 2024 Earnings Conference Call

SAN DIEGO – December 12, 2023 ― WD-40 Company (NASDAQ:WDFC) today announced that its board of directors declared on Tuesday, December 12, 2023 a quarterly dividend of $0.88 per share reflecting an increase of 6 percent compared to the previous quarter’s dividend. The quarterly dividend is payable January 31, 2024 to stockholders of record at the close of business on January 19, 2024.

The Company also announced that it has scheduled its first quarter 2024 earnings conference call for Tuesday, January 9, 2024 at 2:00 p.m. PST. On this call, management will discuss financial results, business developments, and other matters affecting the Company. Other forward-looking or material information may also be discussed.

A live webcast of the earnings conference call will be available on the Company’s investor relations website at http://investor.wd40company.com. The webcast will be archived and available on the website for a one-year period following the conference call.

The Company’s quarterly earnings press release will cross the wire after market close on January 9, 2024. Please visit the Company’s investor relations website to view the press release and other supporting materials.

About WD-40 Company

WD-40 Company is a global marketing organization dedicated to creating positive lasting memories by developing and selling products that solve problems in workshops, factories, and homes around the world. The Company owns a wide range of well-known brands that include maintenance products and homecare and cleaning products: WD-40® Multi-Use Product, WD-40 Specialist®, 3-IN-ONE®, GT85®, 2000 Flushes®, no vac®, 1001®, Spot Shot®, Lava®, Solvol®, X-14®, and Carpet Fresh®.

Headquartered in San Diego, California, USA, WD-40 Company recorded net sales of $537.3 million in fiscal year 2023 and its products are currently available in more than 176 countries and territories worldwide. WD-40 Company is traded on the NASDAQ Global Select Market

under the ticker symbol “WDFC.” For additional information about WD-40 Company please visit http://www.wd40company.com.

***

v3.23.4

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

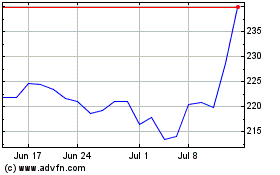

WD 40 (NASDAQ:WDFC)

Historical Stock Chart

From Mar 2024 to Apr 2024

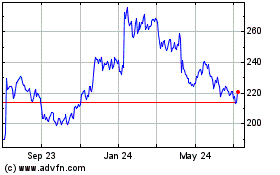

WD 40 (NASDAQ:WDFC)

Historical Stock Chart

From Apr 2023 to Apr 2024