As filed with the Securities and Exchange Commission on December , 2023.

Registration Statement No. 333-

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

_______________

Form F-3

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

_______________

Virax Biolabs Group Limited

(Exact name of Registrant as specified in its charter)

_______________

Not Applicable

(Translation of Registrant’s name into English)

_______________

|

|

|

|

|

|

|

|

|

|

Cayman Islands |

|

2835 |

|

Not Applicable |

(State or other jurisdiction of

incorporation or organization) |

|

(Primary Standard Industrial

Classification Code Number) |

|

(I.R.S. Employer

Identification Number) |

20 North Audley Street

London, W1K 6LX

United Kingdom

Telephone: +44 020 7788 7414

(Address, including zip code, and telephone number, including area code, of Registrant’s principal executive offices)

_______________

Virax Biolabs USA Management, Inc.

23501 Cinco Ranch Blvd. Ste H120-289

Katy, TX 77494

+44 020 7788 7414

(Name, address, including zip code, and telephone number, including area code, of agent for service)

_______________

Copies of all communications, including communications sent to agent for service, should be sent to:

|

Lawrence S. Venick, Esq.

Loeb & Loeb LLP

2206-19 Jardine House

1 Connaught Place, Central

Hong Kong SAR

Telephone: +852-3923-1111

Fax: +852-3923-1100 |

_______________

Approximate date of commencement of proposed sale to public: As soon as practicable after this Registration Statement becomes effective.

|

|

If any of the securities being registered on this form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, as amended, check the following box. |

☒ |

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. |

☐ |

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. |

☐ |

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. |

☐ |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act: Emerging growth company. |

☒ |

If an emerging growth company that prepares its financial statements in accordance with U.S. GAAP, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards† provided pursuant to Section 7(a)(2)(B) of the Securities Act. |

☐ |

The Registrant hereby amends this Registration Statement on such date or dates as may be necessary to delay its effective date until the Registrant shall file a further amendment which specifically states that this registration statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933, as amended, or until the registration statement shall become effective on such date as the Commission, acting pursuant to such Section 8(a), may determine.

† The term “new or revised financial accounting standard” refers to any update issued by the Financial Accounting Standards Board to its Accounting Standards Codification after April 5, 2012.

EXPLANATORY NOTE

This registration statement contains two prospectuses:

•a base prospectus which covers the offering, issuance and sale by us of up to US$30,000,000 of our ordinary shares, preferred stock, debt securities, warrants and/or units; and

•a secondary offering prospectus which covers the offer and sale by the selling stockholders described therein of up to 15,195,292 ordinary issuable upon the exercise of the New Warrants (defined below) issued to Armistice Capital Master Fund Ltd. and Placement Agent Warrants (defined below) issued to certain affiliates of H.C. Wainwright & Co., LLC.

The base prospectus immediately follows this explanatory note. The secondary offering prospectus immediately follows the base prospectus. The 15,195,292 ordinary shares that may be offered and sold under the secondary offering prospectus are not included in the US$30,000,000 of securities that may be offered, issued and sold by us under the base prospectus.

The information in this preliminary prospectus is not complete and may be changed. We may not sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. This preliminary prospectus is not an offer to sell these securities and it is not soliciting an offer to buy these securities in any jurisdiction where the offer or sale is not permitted.

Subject to completion, dated December 5, 2023

PROSPECTUS

US$30,000,000

Ordinary Shares

Preferred Shares

Debt Securities

Warrants

Units

Rights

From time to time, we may offer, issue and sell up to US$30,000,000 of any combination of the securities described in this prospectus in one or more offerings. We may also offer securities as may be issuable upon conversion, redemption, repurchase, exchange or exercise of any securities registered hereunder, including any applicable antidilution provisions.

This prospectus provides a general description of the securities we may offer. Each time we offer securities, we will provide specific terms of the securities offered in a supplement to this prospectus. We may also authorize one or more free writing prospectuses to be provided to you in connection with these offerings. The prospectus supplement and any related free writing prospectus may also add, update or change information contained in this prospectus. You should carefully read this prospectus, the applicable prospectus supplement and any related free writing prospectus, as well as any documents incorporated by reference, before you invest in any of the securities being offered.

This prospectus may not be used to sell our securities unless accompanied by a prospectus supplement. The prospectus supplement or any related free writing prospectus may also add to, update, supplement or clarify information contained in this prospectus.

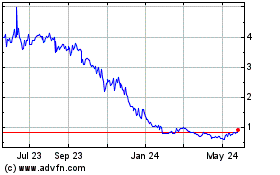

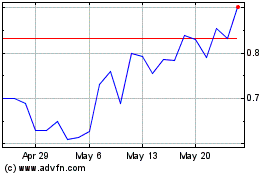

Pursuant to General Instruction I.B.5. of Form F-3, in no event will we sell the securities covered hereby in a public primary offering with a value exceeding more than one-third of the aggregate market value of our Ordinary Shares in any 12-month period so long as the aggregate market value of our outstanding Ordinary Shares held by non-affiliates remains below $75,000,000. The aggregate market value of our outstanding voting and non-voting common equity held by non-affiliates is approximately $4,827,696 based on the closing price of $0.24 per ordinary share on November 27, 2023 and 14,840,381 ordinary shares held by non-affiliates. During the 12 calendar months prior to and including the date of this prospectus, we have not offered or sold any securities pursuant to General Instruction I.B.5 of Form F-3.

Our Ordinary Shares are listed on the Nasdaq Capital Market under the symbol “VRAX.” The applicable prospectus supplement will contain information, where applicable, as to other listings, if any, on the Nasdaq Capital Market or other securities exchange of the securities covered by the prospectus supplement.

Investing in our securities involves a high degree of risk. See “Risk Factors” on page 18 of this prospectus and in the documents incorporated by reference in this prospectus, as updated in the applicable prospectus supplement, any related free writing prospectus and other future filings we make with the Securities and Exchange Commission that are incorporated by reference into this prospectus, for a discussion of the factors you should consider carefully before deciding to purchase our securities.

We may sell these securities directly to investors, through agents designated from time to time or to or through underwriters or dealers. For additional information on the methods of sale, you should refer to the section entitled “Plan of Distribution” in this prospectus. If any underwriters are involved in the sale of any securities with respect to which this prospectus is being delivered, the names of such underwriters and any applicable commissions or discounts will be set forth in a prospectus supplement. The price to the public of such securities and the net proceeds we expect to receive from such sale will also be set forth in a prospectus supplement.

Investing in our securities is highly speculative and involves a significant degree of risk. Virax Biolabs Group Limited, which we refer to as "Virax Cayman", is a holding company incorporated as an exempted company under the laws of the Cayman Islands. As a holding company with no material operations of our own, Virax Cayman conduct a substantial majority of our sales and trading activities through our operating entity established in Singapore, Virax Biolabs Pte. Limited, which we refer to as SingaporeCo. Currently, Virax Cayman indirectly owns 95.65% of the equity interests in SingaporeCo. However, some of Virax Cayman’s operations are currently conducted through our operating entities established in the British Virgin Islands, Hong Kong and Shanghai, primarily, Logico Bioproducts Corp., Virax Immune T-Cell Medical Device Company Limited and Shanghai Xitu Consulting Co., Limited, which we refer to as Logico BVI, Virax Immune T-Cell and Shanghai Xitu, respectively. Our Ordinary Shares offered in this prospectus are shares of our Cayman Islands holding company.

Recent statements by the Chinese government have indicated an intent to exert more oversight and control over offerings that are conducted overseas and/or foreign investments in China based issuers. Any future action by the Chinese government expanding the categories of industries and companies whose foreign securities offerings are subject to government review could significantly limit or completely hinder our ability to offer or continue to offer securities to investors and could cause the value of such securities to significantly decline or be worthless.

Recently, the PRC government initiated a series of regulatory actions and made a number of public statements on the regulation of business operations in China with little advance notice, including cracking down on illegal activities in the securities market, enhancing supervision over China-based companies listed overseas using a variable interest entity structure, adopting new measures to extend the scope of cybersecurity reviews, and expanding efforts in anti-monopoly enforcement. We are not subject to these regulatory actions or statements, as we do not have a variable interest entity structure and our business does not involve the collection of user data, implicate cybersecurity, or involve any other type of restricted industry. Because these statements and regulatory actions are new, however, it is highly uncertain how soon legislative or administrative regulation making bodies in China will respond to them, or what existing or new laws or regulations will be modified or promulgated, if any, or the potential impact such modified or new laws and regulations will have on our daily business operations or our ability to accept foreign investments and list on an U.S. exchange.

The Holding Foreign Companies Accountable Act, or the HFCA Act, was enacted on December 18, 2020. In accordance with the HFCA Act, trading in securities of any registrant on a national securities exchange or in the over-the-counter trading market in the United States may be prohibited if the Public Company Accounting Oversight Board (the “PCAOB”) determines that it cannot inspect or fully investigate the registrant’s auditor for three consecutive years beginning in 2021, and, as a result, an exchange may determine to delist the securities of such registrant. On June 22, 2021, the U.S. Senate passed the Accelerating Holding Foreign Companies Accountable Act, which, if enacted, would amend the HFCA Act and require the SEC to prohibit an issuer’s securities from trading on any U.S. stock exchanges if its auditor is not subject to PCAOB inspections for two consecutive years instead of three, thus reducing the time period before our securities may be prohibited from trading or delisted if our auditor is unable to meet the PCAOB inspection requirement. Pursuant to the HFCA Act, the PCAOB issued a Determination Report on December 16, 2021 which found that the PCAOB is unable to inspect or investigate completely registered public accounting firms headquartered in: (1) mainland China of the People’s Republic of China because of a position taken by one or more authorities in mainland China; and (2) Hong Kong, a Special Administrative Region and dependency of the PRC, because of a position taken by one or more authorities in Hong Kong. In addition, the PCAOB’s report

identified the specific registered public accounting firms which are subject to these determinations. On August 26, 2022, the PCAOB entered into a Statement of Protocol with the China Securities Regulatory Commission and the Ministry of Finance of the PRC and, as summarized in the “Statement on Agreement Governing Inspections and Investigations of Audit Firms Based in China and Hong Kong” published on the U.S. Securities and Exchange Commission’s official website, the parties agreed to the following: (i) in accordance with the Sarbanes-Oxley Act of 2002, or the Sarbanes-Oxley Act, the PCAOB shall have independent discretion to select any issuer audits for inspection or investigation; (ii) the PCAOB shall have direct access to interview or take testimony from all personnel of the audit firms whose issuer engagements are being inspected or investigated; (iii) the PCAOB shall have the unfettered ability to transfer information to the SEC, in accordance with the Sarbanes-Oxley Act; and (iv) the PCAOB inspectors shall have access to complete audit work papers without any redactions, with view-only procedures for certain targeted pieces of information such as personally identifiable information. On December 15, 2022, the PCAOB Board determined that the PCAOB was able to secure complete access to inspect and investigate registered public accounting firms headquartered in mainland China and Hong Kong and voted to vacate its previous determinations to the contrary. However, whether the PCAOB will continue to be able to satisfactorily conduct inspections of PCAOB-registered public accounting firms headquartered in mainland China and Hong Kong is subject to uncertainty and depends on a number of factors out of our, and our auditor’s, control. The PCAOB is continuing to demand complete access in mainland China and Hong Kong moving forward and is already making plans to resume regular inspections in early 2023 and beyond, as well as to continue pursuing ongoing investigations and initiate new investigations as needed. In the future, if there is any regulatory change or step taken by PRC regulators that does not permit our auditor to provide audit documentations located in China or Hong Kong to the PCAOB for inspection or investigation, or the PCAOB expands the scope of the Determination so that we are subject to the HFCA Act, as the same may be amended, you may be deprived of the benefits of such inspection which could result in limitation or restriction to our access to the U.S. capital markets and trading of our securities, including trading on the national exchange and trading on “over-the-counter” markets, may be prohibited under the HFCA Act. On December 29, 2022, a legislation entitled “Consolidated Appropriations Act, 2023” (the “Consolidated Appropriations Act”), was signed into law by President Biden. The Consolidated Appropriations Act contained, among other things, reduces the number of consecutive non-inspection years required for triggering the prohibitions under the HFCA Act from three years to two. Our registered public accounting firm, Reliant CPA PC , is not headquartered in mainland China or Hong Kong and was not identified in this report as a firm subject to the PCAOB’s determination. Notwithstanding the foregoing, if the PCAOB is not able to fully conduct inspections of our auditor’s work papers in China, you may be deprived of the benefits of such inspection which could result in limitation or restriction to our access to the U.S. capital markets and trading of our securities may be prohibited under the HFCA Act.

Within the organization, investor cash inflows have all been received by Virax Cayman. Cash to fund Virax Cayman’s operations is transferred from Virax Cayman down through our Singapore, Hong Kong, BVI entities and then into our Chinese entity through capital contributions and loans. However, the PRC government imposes controls on the convertibility of RMB into foreign currencies and, in certain cases, the remittance of currency out of China, and investment in Chinese companies, which are governed by the Foreign Investment Law and Company Law, and the dividends and distributions from Shanghai Xitu is subject to relevant regulations and restrictions on dividends and payment to parties outside of China. Transfers among our Singapore and Hong Kong entities are not restricted under Singapore and Hong Kong Laws. No dividends or distribution have been made by our subsidiaries or by Virax Cayman to date and we intend to reinvest all cash into our subsidiaries for the foreseeable future. For the years ended March 31, 2023 and 2022, there was no transfer between Virax Cayman and its subsidiaries.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

The date of this prospectus is ________, 2023.

TABLE OF CONTENTS

|

|

|

Page |

About this Prospectus |

9 |

|

|

Commonly Used Defined Terms |

10 |

|

|

Note Regarding Forward-Looking Statements |

11 |

|

|

Company Overview |

12 |

|

|

Risk Factors |

18 |

|

|

Use of Proceeds |

19 |

|

|

Dilution |

19 |

|

|

Description of Share Capital |

20 |

|

|

Description of Our Debt Securities |

27 |

|

|

Description of Our Warrants |

28 |

|

|

Description of Our Units |

29 |

|

|

Plan of Distribution |

30 |

|

|

Legal Matters |

32 |

|

|

Experts |

32 |

|

|

Where You Can Find More Information |

32 |

|

|

Information Incorporated by Reference |

33 |

|

|

Enforceability of Civil Liabilities |

35 |

|

|

Indemnification for Securities Act Liabilities |

37 |

We are responsible for the information contained and incorporated by reference in this prospectus, in any accompanying prospectus supplement, and in any related free writing prospectus we prepare or authorize. We have not authorized anyone to give you any other information, and we take no responsibility for any other information that others may give you. If you are in a jurisdiction where offers to sell, or solicitations of offers to purchase, the securities offered by this documentation are unlawful, or if you are a person to whom it is unlawful to direct these types of activities, then the offer presented in this document does not extend to you. The information contained in this document speaks only as of the date of this document, unless the information specifically indicates that another date applies. Neither the delivery of this prospectus or any accompanying prospectus supplement, nor any sale of securities made under these documents, will, under any circumstances, create any implication that there has been no change in our affairs since the date of this prospectus, any accompanying prospectus supplement or any free writing prospectus we may provide you in connection with an offering or that the information contained or incorporated by reference is correct as of any time subsequent to the date of such information. You should assume that the information in this prospectus or any accompanying prospectus supplement, as well as the information incorporated by reference in this prospectus or any accompanying prospectus supplement, is accurate only as of the date of the documents containing the information, unless the information specifically indicates that another date applies. Our business, financial condition, results of operations and prospects may have changed since those dates.

ABOUT THIS PROSPECTUS

This prospectus is part of a registration statement that we filed with the Securities and Exchange Commission, or the SEC, under the Securities Act of 1933, as amended, or the Securities Act, using a “shelf” registration process. Under this shelf registration process, we may from time to time sell Ordinary Shares, preferred shares, warrants to purchase Ordinary Shares or preferred shares, debt securities or any combination of the foregoing, either individually or as units comprised of one or more of the other securities, in one or more offerings up to a total dollar amount of US$30,000,000. We have provided you in this prospectus a general description of the securities we may offer. Each time we sell securities under this shelf registration, we will, to the extent required by law, provide a prospectus supplement that will contain specific information about the terms of that offering. We may also authorize one or more free writing prospectuses to be provided to you that may contain material information relating to these offerings. The prospectus supplement and any related free writing prospectus that we may authorize to be provided to you may also add, update or change information contained in this prospectus or in any documents that we have incorporated by reference into this prospectus. To the extent there is a conflict between the information contained in this prospectus and the prospectus supplement or any related free writing prospectus, you should rely on the information in the prospectus supplement or the related free writing prospectus; provided that if any statement in one of these documents is inconsistent with a statement in another document having a later date – for example, a document filed after the date of this prospectus and incorporated by reference into this prospectus or any prospectus supplement or any related free writing prospectus – the statement in the document having the later date modifies or supersedes the earlier statement.

We have not authorized any dealer, agent or other person to give any information or to make any representation other than those contained or incorporated by reference in this prospectus and any accompanying prospectus supplement, or any related free writing prospectus that we may authorize to be provided to you. You must not rely upon any information or representation not contained or incorporated by reference in this prospectus or an accompanying prospectus supplement, or any related free writing prospectus that we may authorize to be provided to you. This prospectus and the accompanying prospectus supplement, if any, do not constitute an offer to sell or the solicitation of an offer to buy any securities other than the registered securities to which they relate, nor do this prospectus and the accompanying prospectus supplement constitute an offer to sell or the solicitation of an offer to buy securities in any jurisdiction to any person to whom it is unlawful to make such offer or solicitation in such jurisdiction. You should not assume that the information contained in this prospectus, any applicable prospectus supplement or any related free writing prospectus is accurate on any date subsequent to the date set forth on the front of the document or that any information we have incorporated by reference is correct on any date subsequent to the date of the document incorporated by reference (as our business, financial condition, results of operations and prospects may have changed since that date), even though this prospectus, any applicable prospectus supplement or any related free writing prospectus is delivered or securities are sold on a later date.

As permitted by SEC rules and regulations, the registration statement of which this prospectus forms a part includes additional information not contained in this prospectus. You may read the registration statement and the other reports we file with the SEC at its website or at its offices described below under “Where You Can Find More Information.”

Unless the context otherwise requires, all references in this prospectus to “VRAX,” “we,” “us,” “our,” “the Company,” “the “Registrant” or similar words refer to Virax Biolabs Group Limited, together with our subsidiaries.

COMMONLY USED DEFINED TERMS

Unless we explicitly state otherwise or the context otherwise indicates clearly, all references in this proxy statement to “we,” “us,” “our,” or “our Group” refer to Virax Biolabs Group Limited and its subsidiaries, namely, Virax Biolabs (UK) Limited, Virax Biolabs Group Holdings Limited, Virax Biolabs FZ LLC, Virax Biolabs Trading B.V., Virax Biolabs USA Management, Inc., Virax Biolabs Limited, Virax Immune T-Cell Medical Device Company Limited, Virax Biolabs Pte. Limited, Logico Bioproducts Corp., and Shanghai Xitu Consulting Co., Limited.

•The “Company” or “Virax Cayman” refers to Virax Biolabs Group Limited.

•“GBP” or “GB£” refers to the legal currency of the United Kingdom.

•“HKD” or “HK$” refers to the legal currency of Hong Kong.

•“RMB” or “Renminbi” refers to the legal currency of China.

•“IVD” refers to in-vitro diagnostics.

•“PRC” or “China” refers to the People’s Republic of China, including Hong Kong and Macau.

•“Prospectus” refers to the public offering prospectus unless we explicitly state otherwise, or the context otherwise indicates clearly.

•“SGD” or “S$” refers to the legal currency of Singapore.

•“United Kingdom” or “UK” refers to the England, Scotland, Wales and Northern Ireland for the purpose of this prospectus.

•“$” or “U.S. dollars” or “USD” refers to the legal currency of the United States.

We have made rounding adjustments to some of the figures included in this prospectus. Accordingly, numerical figures shown as totals in some tables may not be an arithmetic aggregation of the figures that preceded them.

Our business is primarily conducted in Europe, and the financial records of our subsidiaries in Asia are maintained in USD, and our functional currency is USD. Our consolidated financial statements are presented in U.S. dollars. We use U.S. dollars as the reporting currency in our consolidated financial statements and in this prospectus.

NOTE REGARDING FORWARD-LOOKING STATEMENTS

This prospectus and our SEC filings that are incorporated by reference into this prospectus contain or incorporate by reference forward-looking statements within the meaning of Section 27A of the Securities Act and Section 21E of the Exchange Act. All statements other than statements of historical fact are “forward-looking statements,” including any projections of earnings, revenue or other financial items, any statements of the plans, strategies and objectives of management for future operations, any statements concerning proposed new projects or other developments, any statements regarding future economic conditions or performance, any statements of management’s beliefs, goals, strategies, intentions and objectives, and any statements of assumptions underlying any of the foregoing. The words “believe,” “anticipate,” “estimate,” “plan,” “expect,” “intend,” “may,” “could,” “should,” “potential,” “likely,” “projects,” “continue,” “will,” and “would” and similar expressions are intended to identify forward-looking statements, although not all forward-looking statements contain these identifying words. Forward-looking statements reflect our current views with respect to future events, are based on assumptions and are subject to risks and uncertainties. We cannot guarantee that we actually will achieve the plans, intentions or expectations expressed in our forward-looking statements and you should not place undue reliance on these statements. There are a number of important factors that could cause our actual results to differ materially from those indicated or implied by forward-looking statements. These important factors include those discussed under the heading “Risk Factors” contained or incorporated by reference in this prospectus and in the applicable prospectus supplement and any free writing prospectus we may authorize for use in connection with a specific offering. These factors and the other cautionary statements made in this prospectus should be read as being applicable to all related forward-looking statements whenever they appear in this prospectus. Except as required by law, we undertake no obligation to update publicly any forward-looking statements, whether as a result of new information, future events or otherwise.

COMPANY OVERVIEW

Overview

Virax Cayman is a holding company incorporated as an exempted company under the laws of the Cayman Islands. As a holding company with no material operations of our own, Virax Cayman conducts our operations through its subsidiaries in the United Kingdom, the United States, Singapore, Hong Kong, China and British Virgin Islands and has been operating since 2013.

Virax Biolabs Group Limited and its subsidiaries is a global innovative biotechnology company focused on the prevention, detection, diagnosis, and risk management of viral diseases with a particular interest in the field of T-Cell in Vitro Diagnostics. The Company is in the process of developing and manufacturing tests that can predict adaptive immunity to viral diseases as well as identify individuals suffering from T-cell exhaustion linked to post viral syndromes. The Company's mission is to protect people from viral diseases and help with the early diagnosis of post viral syndromes associated with T-cell exhaustion and chronic fatigue through the provision of diagnostic tests, tests for adaptive immunity and education through a wellness mobile application which could allow people to make informed decisions regarding their viral risks.

Diagnostics test kits are distributed through our ViraxClear and ViraxVet brands. Currently, we do not manufacture or develop any product that we sell in our ViraxClear and ViraxVet product portfolios, and we act as a distributor of third-party suppliers’ products. Our Company also seeks to maximize consumers’ access to our products and services through competitive pricing and regular evaluations of our pricing arrangements and contracts with our distributors.

We also expect to launch an upcoming brand, ViraxImmune, with the intention of providing an immunology profiling platform that assesses each individual’s immune risk profile against major global viral diseases as well as helping with the early diagnosis of post viral syndromes associated with T-cell exhaustion and chronic fatigue. We are in the process of developing a T-Cell Test under the ViraxImmune brand and will apply for regulatory agency approval. We believe that the T-Cell Tests and immunology platform we are developing under the ViraxImmune brand will be particularly useful in assisting in the threat analysis of the major viruses faced globally as well as helping with the early diagnosis of indications associated with T-cell exhaustion and chronic fatigue. Initially, we will be focusing in diseases associated with post viral syndromes including but not limited to COVID-19, Human Papillomavirus (better known as HPV), Malaria, Hepatitis B, and Herpes (better known as HSV-1). The results and education for specific viruses will be delivered through our mobile-based immunology application.

Recent Developments

Initial Public Offering

On July 20, 2022, Virax entered into an underwriting agreement with Boustead Securities, LLC, as representatives of the several underwriters, in connection with its initial public offering (“IPO”) of 1,350,000 Ordinary Shares, at a price of $5.00 per share, before deducting underwriting discounts, commissions, and other related expenses. The shares began trading on the Nasdaq Capital Market on July 21, 2022. The Company issued Representative’s Warrant to purchase up to 108,675 ordinary shares at $6.00 per share, dated July 20, 2022, to Boustead Securities, LLC. On July 25, 2022, the Company consummated its IPO generating gross proceeds to the Company of $7,762,500, before deducting underwriting discounts and other related expenses.

2022 PIPE Financing

On November 3, 2022, Virax entered into a Securities Purchase Agreement (the “November SPA”) with an accredited investor for a private placement offering (“2022 Private Placement”), pursuant to which the Company received gross proceeds of approximately $3,844,500, before deducting placement agent fees and other offering expenses, in consideration of (i) 1,165,000 Ordinary Shares; (ii) pre-funded warrants to purchase 1,165,000 Ordinary Shares, and (iii) warrants to purchase 3,495,000 Ordinary Shares at a combined purchase price of $1.65 per Ordinary Share and one and a half Ordinary Warrant, or approximately $1.65 per Pre-Funded Warrant and one and a half

Ordinary Warrant if purchasing the Pre-Funded Warrants. The warrants have an exercise price of $1.73 per share. The November SPA contains customary representations and warranties and agreements of the Company and the purchaser and customary indemnification rights and obligations of the parties. The 2021 Private Placement closed on November 8, 2022. Concurrently with the signing of the November SPA, we entered into a registration rights agreement to file with the Securities and Exchange Commission a registration statement covering the resale of all of the registrable securities under the registration rights agreement.

2023 PIPE Financing

On March 8, 2023, Virax entered into a Securities Purchase Agreement (the “PIPE Securities Purchase Agreement”) with an accredited investor for a private placement offering (“2023 Private Placement”), pursuant to which the Company received gross proceeds of approximately $4,000,000, before deducting placement agent fees and other offering expenses, in consideration of (i) 1,500,000 Ordinary Shares; (b) Pre-Funded Warrants to purchase 2,343,309 Ordinary Shares, (iii) Series A Options to purchase 3,497,412 Ordinary Shares, and (iv) Series B Options to purchase 3,843,309 Ordinary Shares at a purchase price of $1.04077 per Ordinary Share and associated Preferred Options and a purchase price of $1.04067 per Pre-Funded Warrant and associated Preferred Options (the “PIPE Offering”). The Preferred Options have an exercise price of $0.80202 per share. In addition, the Company issued warrants to purchase up to 269,032 Ordinary Shares at $1.3010 per share to certain designees of H.C. Wainwright & Co., placement agent of the Offering. The PIPE Securities Purchase Agreement contains customary representations and warranties and agreements of the Company and the purchaser and customary indemnification rights and obligations of the parties. The 2023 Private Placement closed on March 10, 2023. Concurrently with the signing of the PIPE Securities Purchase Agreement, we entered into a registration rights agreement to file with the Securities and Exchange Commission a registration statement covering the resale of all of the registrable securities under the registration rights agreement.

2023 Warrant Inducement

On October 11, 2023, we entered into an inducement offer letter agreement (the “Inducement Letter”) with a certain holder (the “Holder”) of existing Series A and B Options (the “Existing Warrants”) to purchase ordinary shares of the Company. The Existing Warrants were issued on March 10, 2023 and each has an exercise price of $0.80202 per share.

Pursuant to the Inducement Letter, the Holder agreed to exercise for cash its Existing Warrants to purchase an aggregate of 7,340,721 ordinary shares of the Company at a reduced exercise price of $0.2934 per share in consideration for the Company’s agreement to issue new warrants to purchase ordinary share (the “New Warrants”), as described below, to purchase up to 14,681,442 of the Company’s ordinary share of par value US$0.0001 each (the “New Warrant Shares”). The Company received an aggregate gross proceeds of approximately $2.15 million from the exercise of the Existing Warrants by the Holder, before deducting placement agent fees and other offering expenses payable by the Company. Each New Warrant will have an exercise price equal to $0.2934 per share. The New Warrants will be immediately exercisable from the date of issuance until the five-year anniversary of the initial exercise date. The exercise price and number of Ordinary Shares issuable upon exercise is subject to appropriate adjustment in the event of share dividends, share splits, subsequent rights offerings, pro rate distributions, reorganizations, or similar events affecting the Company’s Ordinary Shares and the exercise price.

In addition, on October 16, 2023, the Company issued warrants to purchase up to 513,850 Ordinary Shares of US$0.0001 par value each at $0.36675 per share to certain designees of H.C. Wainwright & Co., placement agent of the offering. The Inducement Letter contains customary representations, warranties and covenants by the Company which were made only for the purposes of such agreements and as of specific dates, were solely for the benefit of the parties to such agreements and may be subject to limitations agreed upon by the contracting parties. Concurrently with the signing of the Inducement Letter Agreement, we agreed to file with the Securities and Exchange Commission a registration statement covering the resale of all of the registrable securities under the registration rights agreement.

Corporate History and Structure

Structural Overview

Virax Cayman is a holding company incorporated as an exempted company under the laws of the Cayman Islands that owns all of the outstanding capital stock of Virax Biolabs (UK) Limited and Virax Biolabs USA Management, Inc., our wholly-owned subsidiaries. Virax Biolabs (UK) Limited, in turn, owns all of the outstanding capital stock of Virax Biolabs Limited, our wholly-owned Hong Kong subsidiary. Virax Biolabs Limited owns all of the outstanding capital stock of Virax Immune T-Cell Medical Device Company Limited, our wholly-owned Hong Kong subsidiary, and 95.65% of the outstanding capital stock of Virax Biolabs Pte. Limited, our operating subsidiary incorporated in Singapore. Virax Biolabs Pte. Limited owns all of the outstanding capital stock of Logico Bioproducts Corp., a wholly-owned British Virgin Islands and a subsidiary of Virax Biolabs Pte. Limited. Logico Bioproducts Corp., in turn, owns all of the outstanding capital stock of Shanghai Xitu, a wholly-owned subsidiary of Logico Bioproducts Corp. and a wholly foreign owned enterprise based in China.

We completed a reorganization and share exchange of our company in September 2021 (the “Reorganization”). Pursuant to the Reorganization, all shareholders of Virax Biolabs Limited (HK) transferred their shares, 102,478,548 ordinary shares in total, to Virax Biolabs (UK) Limited, in exchange for an aggregate of (i) 2,549,028 newly issued Class A Ordinary Shares and (ii) 7,034,306 newly issued Class B Ordinary Shares of Virax Biolabs Group Limited. On June 19, 2022, Virax Cayman underwent a shareholding restructuring whereby the Company’s authorized share capital became a single class of shares of Ordinary Shares and all of the then issued shares were re-designated as Ordinary Shares.

Organization Structure and Purpose

Virax Biolabs Group Limited (“Virax Cayman”) — Virax Biolabs Group Limited is a Cayman Islands exempted company incorporated on September 2, 2021, previously named as “Virax Biolabs (Cayman) Limited” and effected a name change to “Virax Biolabs Group Limited” on January 19, 2022. Structured as a holding company with no material operations, Virax Cayman conducts our operations through its operating subsidiaries in the Hong Kong, Singapore, British Virgin Islands and China.

Virax Biolabs (UK) Limited — Virax Biolabs (UK) Limited was incorporated on August 19, 2021 under the laws of the United Kingdom, a wholly-owned subsidiary of Virax Cayman and structured as a holding company with no material operations.

Virax Biolabs USA Management, Inc. — Virax Biolabs USA Management, Inc. was incorporated on August 1, 2022 under the laws of the United States, a wholly-owned subsidiary of Virax Cayman and structured as a management company for operations within the United States.

Virax Biolabs Limited (“HKco”) — Virax Biolabs Limited, incorporated on April 14, 2020 under the laws of Hong Kong, was previously named as “Shanghai Biotechnology Devices Limited” and effected a name change to “Virax Biolabs Limited” on July 12, 2021. Virax Biolabs Limited, our wholly-owned Hong Kong subsidiary, serves as a holding company.

Virax Immune T-Cell Medical Device Company Limited (“Virax Immune T-Cell”) — Virax Immune T-Cell Medical Device Company Limited, a wholly-owned subsidiary of HKco, incorporated on January 16, 2017 under the laws of Hong Kong, was previously named as “Stork Nutrition Asia Limited” and effected a name change to “Virax Immune T-Cell Medical Device Company Limited” on September 10, 2021. It is primarily engaged in the research and development of T-Cell blood analysis.

Virax Biolabs Pte. Limited (“SingaporeCo”) — Virax Biolabs Pte. Limited, incorporated on May 4, 2013 under the laws of Singapore, was previously named as “Natural Source Group Pte. Limited” and effected a name change to “Virax Biolabs Pte. Limited” on July 2, 2021. 95.65% of its capital stock is owned by Virax Biolabs Limited and the remaining 4.35% is owned by independent third party shareholders. It is our operating company, primarily engaged in the trading and sales of our products and running primarily day to day operations.

Logico Bioproducts Corp. (“Logico BVI”) — Logico Bioproducts Corp., a wholly-owned subsidiary of SingaporeCo, is a limited liability company incorporated in the British Virgin Islands on January 21, 2011, and is primarily engaged in the trading and sales of our products.

Shanghai Xitu Consulting Co., Limited (“Shanghai Xitu”) — Shanghai Xitu, a wholly-owned subsidiary of Logico BVI and a wholly foreign owned enterprise, is a limited liability company incorporated on October 27, 2017 in China. Shanghai Xitu is primarily engaged in procurement.

Virax Biolabs Group Holdings Ltd (“Virax UK HoldCo”) — Virax Biolabs Group Holdings Limited was incorporated on February 22, 2023 under the laws of the United Kingdom, a wholly-owned subsidiary of the Company and structured as a holding company.

Virax Biolabs FZ-LLC (“Virax Dubai”) — Virax Biolabs FZ-LLC was incorporated on April 18, 2023 under the laws of the United Kingdom, a wholly-owned subsidiary of the Company and is primarily engaged as a regional distribution company.

Virax Biolabs Trading B.V. (“Virax Netherlands”) — Virax Biolabs Trading B.V. was incorporated on August 4, 2023 under the laws of the Netherlands, a wholly-owned subsidiary of the Company and is primarily engaged as a regional distribution company.

Virax Biolabs UK Operating LLC (“Virax UK Operating”) — Virax Biolabs UK Operating was incorporated on August 4, 2023 under the laws of the United Kingdom, a wholly-owned subsidiary of the Company and is primarily engaged as a regional operating company.

The following diagram illustrates our corporate structure:

Implications of Being an Emerging Growth Company and a Foreign Private Issuer

Emerging Growth Company

As a company with less than $1.235 billion in revenue during our last fiscal year, we qualify as an “emerging growth company” as defined in the Jumpstart Our Business Startups Act, or JOBS Act, enacted in April 2012, and may take advantage of reduced reporting requirements that are otherwise applicable to public companies. These provisions include, but are not limited to:

•being permitted to present only two years of audited financial statements and only two years of related Management’s Discussion and Analysis of Financial Condition and Results of Operations in our filings with the SEC;

•not being required to comply with the auditor attestation requirements in the assessment of our internal control over financial reporting;

•reduced disclosure obligations regarding executive compensation in periodic reports, proxy statements and registration statements; and

•exemptions from the requirements of holding a nonbinding advisory vote on executive compensation and shareholder approval of any golden parachute payments not previously approved.

We may take advantage of these provisions until the last day of our fiscal year following the fifth anniversary of the date of the first sale of our Ordinary Shares pursuant to this offering. However, if certain events occur before the end of such five-year period, including if we become a “large accelerated filer,” our annual gross revenues exceed $1.235 billion or we issue more than $1.0 billion of non-convertible debt in any three-year period, we will cease to be an emerging growth company before the end of such five-year period.

In addition, Section 107 of the JOBS Act provides that an “emerging growth company” can take advantage of the extended transition period provided in Section 7(a)(2)(B) of the Securities Act of 1933, as amended, or the Securities Act, for complying with new or revised accounting standards. We have elected to take advantage of the extended transition period for complying with new or revised accounting standards and acknowledge such election is irrevocable pursuant to Section 107 of the JOBS Act.

Foreign Private Issuer

We are a “foreign private issuer,” as defined by the SEC. As a result, in accordance with the rules and regulations of The Nasdaq Stock Market LLC, or Nasdaq, we may comply with home country governance requirements and certain exemptions thereunder rather than complying with Nasdaq corporate governance standards. We may choose to take advantage of the following exemptions afforded to foreign private issuers:

•Exemption from filing quarterly reports on Form 10-Q or provide current reports on Form 8-K disclosing significant events within four (4) days of their occurrence.

•Exemption from Section 16 rules regarding sales of Ordinary Shares by insiders, which will provide less data in this regard than shareholders of U.S. companies that are subject to the Exchange Act.

•Exemption from the Nasdaq rules applicable to domestic issuers requiring disclosure within four (4) business days of any determination to grant a waiver of the code of business conduct and ethics to directors and officers. Although we will require board approval of any such waiver, we may choose not to disclose the waiver in the manner set forth in the Nasdaq rules, as permitted by the foreign private issuer exemption.

•Exemption from the requirement that our board of directors have a compensation committee that is composed entirely of independent directors with a written charter addressing the committee’s purpose and responsibilities.

•Exemption from the requirements that director nominees are selected, or recommended for selection by our board of directors, either by (i) independent directors constituting a majority of our board of directors’ independent directors in a vote in which only independent directors participate, or (ii) a committee comprised solely of independent directors, and that a formal written charter or board resolution, as applicable, addressing the nominations process is adopted.

Furthermore, Nasdaq Rule 5615(a)(3) provides that a foreign private issuer, such as us, may rely on our home country corporate governance practices in lieu of certain of the rules in the Nasdaq Rule 5600 Series and Rule 5250(d),

provided that we nevertheless comply with Nasdaq’s Notification of Noncompliance requirement (Rule 5625), the Voting Rights requirement (Rule 5640) and that we have an audit committee that satisfies Rule 5605(c)(3), consisting of committee members that meet the independence requirements of Rule 5605(c)(2)(A)(ii). If we rely on our home country corporate governance practices in lieu of certain of the rules of Nasdaq, our shareholders may not have the same protections afforded to shareholders of companies that are subject to all of the corporate governance requirements of Nasdaq. If we choose to do so, we may utilize these exemptions for as long as we continue to qualify as a foreign private issuer.

Although we are permitted to follow certain corporate governance rules that conform to Cayman Islands requirements in lieu of many of the Nasdaq corporate governance rules, we intend to comply with the Nasdaq corporate governance rules applicable to foreign private issuers.

Corporate Information

Our principal executive office is located at 20 North Audley Street London, W1K 6LX, United Kingdom. Our telephone number is +44 020 7788 7414. Our registered office in the Cayman Islands is located at the office of Ogier Global (Cayman) Limited, 89 Nexus Way, Camana Bay, Grand Cayman, KY1-9009, Cayman Islands.

Our agent for service of process in the United States is Virax Biolabs USA Management, Inc., located at 23501 Cinco Ranch Blvd. Ste H120-289, Katy, TX 77494. Our principal website is located at https://viraxbiolabs.com/. Information contained on, or that can be accessed through, our website is not a part of, and shall not be incorporated by reference into, this prospectus.

RISK FACTORS

Investing in our securities involves a high degree of risk. You should carefully consider the risk factors set forth under “Risk Factors” described in our most recent annual report on Form 20-F, filed on June 14, 2023, as supplemented and updated by subsequent current reports on Form 6-K that we have filed with the SEC, together with all other information contained or incorporated by reference in this prospectus and any applicable prospectus supplement and in any related free writing prospectus in connection with a specific offering, before making an investment decision. Each of the risk factors could materially and adversely affect our business, operating results, financial condition and prospects, as well as the value of an investment in our securities, and the occurrence of any of these risks might cause you to lose all or part of your investment.

USE OF PROCEEDS

Except as described in any prospectus supplement and any free writing prospectus in connection with a specific offering, we currently intend to use the net proceeds from the sale of the securities offered under this prospectus to fund the development and commercialization of our projects and the growth of our business, primarily working capital, and for general corporate purposes. We may also use a portion of the net proceeds to acquire or invest in technologies, products and/or businesses that we believe will enhance the value of our Company, although we have no current commitments or agreements with respect to any such transactions as of the date of this prospectus. We have not determined the amount of net proceeds to be used specifically for the foregoing purposes. As a result, our management will have broad discretion in the allocation of the net proceeds and investors will be relying on the judgment of our management regarding the application of the proceeds of any sale of the securities. If a material part of the net proceeds is to be used to repay indebtedness, we will set forth the interest rate and maturity of such indebtedness in a prospectus supplement. Pending use of the net proceeds will be deposited in interest bearing bank accounts.

DILUTION

If required, we will set forth in a prospectus supplement the following information regarding any material dilution of the equity interests of investors purchasing securities in an offering under this prospectus:

•the net tangible book value per share of our equity securities before and after the offering;

•the amount of the increase in such net tangible book value per share attributable to the cash payments made by purchasers in the offering; and

•the amount of the immediate dilution from the public offering price which will be absorbed by such purchasers.

DESCRIPTION OF SHARE CAPITAL

The following description of our capital stock (which includes a description of securities we may offer pursuant to the registration statement of which this prospectus, as the same may be supplemented, forms a part) does not purport to be complete and is subject to and qualified in its entirety by our Amended and Restated Memorandum and Articles of Association (“M&A”) and by the applicable provisions of Cayman Islands law.

We are an exempted company incorporated with limited liability under the laws of the Cayman Islands and our affairs are governed by:

•Memorandum and Articles of Association;

•The Companies Act (Revised) of the Caymans Islands, which is referred to as the Companies Act below; and

•Common law of the Cayman Islands.

•Our authorized share capital is US$50,000 divided into 500,000,000 Ordinary Shares of $0.0001 par value each.

Ordinary Shares

All of our outstanding Ordinary Shares are fully paid and non-assessable. Certificates representing the Ordinary Shares are issued in registered form. Our shareholders, whether or not they are non-residents of the Cayman Islands, may freely hold and transfer their Ordinary Shares in accordance with our Memorandum and Articles.

Dividends

The holders of our Ordinary Shares are entitled to such dividends as may be declared by our board of directors. Our Articles provide that our board of directors may declare and pay dividends if justified by our financial position and permitted by law. Our articles of association also provides that, subject to the Companies Act, the Company may by also by ordinary resolution declare dividends in accordance with the respective rights of the shareholders but no dividend shall exceed the amount recommended by the directors.

Voting Rights

Holders of our Ordinary Shares vote on all matters submitted to a vote of our shareholders, except as may otherwise be required by law. In respect of matters requiring shareholders’ vote, each ordinary share is entitled to one vote. At any general meeting a resolution put to the vote of the meeting shall be decided on a show of hands unless voting by poll is duly demanded by the chairman of the meeting, by at least two shareholders having the right to vote on the resolutions, or by shareholder(s) together holding at least 10% of the total voting rights of all our shareholders having the right to vote at such general meeting. A quorum required for a meeting of shareholders consists of one or more shareholders who holds at least one-third of our issued voting shares. Shareholders’ meetings may be held annually. Each general meeting, other than an annual general meeting, shall be an extraordinary general meeting. Extraordinary general meetings may be called by a majority of our board of directors or upon a requisition of any one or more shareholders holding at the deposit of the requisition at least 10% of the aggregate share capital of our company that carries the right to vote at a general meeting, in which case on advance notice of at least 7 clear days is required for the convening of our annual general meeting and other general meetings by requisition of our shareholders.

Any ordinary resolution to be made by the shareholders requires the affirmative vote of a simple majority of the votes attaching to the Ordinary Shares cast in a meeting, while a special resolution requires the affirmative vote of no less than two-thirds of the votes attaching to the Ordinary Shares cast in a meeting.

A special resolution will be required for important matters such as amending our memorandum and articles of association or changing the name of the Company.

There are no limitations on non-residents or foreign shareholders in the memorandum and articles of association to hold or exercise voting rights on the Ordinary Shares imposed by foreign law or by the charter or other constituent document of our company. However, no person will be entitled to vote at any general meeting or at any separate meeting of the holders of the Ordinary Shares unless the person is registered as of the record date for such meeting and unless all calls or other sums presently payable by the person in respect of Ordinary Shares in the Company have been paid.

Winding Up; Liquidation

Subject to any special rights, privileges or restrictions as to the distribution of available surplus assets on liquidation applicable to any class or classes of shares (1) if we are wound up and the assets available for distribution among our shareholders are more than sufficient to repay the whole of the capital paid up at the commencement of the winding up, the excess shall be distributed pari passu among our shareholders in proportion to the amount paid up at the commencement of the winding up on the shares held by them, respectively, and (2) if we are wound up and the assets available for distribution among our shareholders as such are insufficient to repay the whole of the paid-up capital, those assets shall be distributed so that, as nearly as may be, the losses shall be borne by our shareholders in proportion to the capital paid up, or which ought to have been paid up, at the commencement of the winding up on the shares held by them, respectively.

Calls on Ordinary Shares and Forfeiture of Ordinary Shares

Our directors may from time to time make calls on our shareholders in respect of any moneys unpaid on their shares including any premium in a notice served to such shareholders at least 14 clear days prior to the specified time of payment. Any Ordinary Shares that have been called upon and remain unpaid are subject to forfeiture.

Redemption of Ordinary Shares

The Companies Act and our Memorandum and Articles permit us to purchase our own shares. In accordance with our Articles, provided the necessary shareholders or board approval have been obtained and requirements under the Companies Act have been satisfied, we may issue shares on terms that are subject to redemption at our option on such terms and in such manner as may be determined by our board of directors.

Inspection of Books and Records

Holders of our Ordinary Shares have no general right under our Articles to inspect or obtain copies of our list of shareholders or our corporate records. However, we will provide our shareholders with annual audited financial statements.

Issuance of Additional Shares

Our Memorandum and Articles authorize our board of directors to issue additional Ordinary Shares from time to time as our board of directors shall determine, to the extent of available authorized but unissued shares. Issuance of these shares may dilute the voting power of holders of Ordinary Shares.

Anti-Takeover Provisions

Some provisions of our Memorandum and Articles may discourage, delay or prevent a change of control of our company or management that shareholders may consider favorable. Our authorized, but unissued Ordinary Shares are available for future issuance without shareholders’ approval and could be utilized for a variety of corporate purposes, including future offerings to raise addition capital, acquisitions and employee benefit plans. The existence of authorized but unissued and unreserved Ordinary Shares could render more difficult or discourage an attempt to obtain control of us by means of a proxy contest, tender offer, merger or otherwise.

Exempted Company

We are an exempted company with limited liability under the Companies Act. The Companies Act distinguishes between ordinary resident companies and exempted companies. Any company that is registered in the Cayman Islands but conducts business mainly outside of the Cayman Islands may apply to be registered as an exempted company. The requirements for an exempted company are essentially the same as for an ordinary company except that an exempted company:

does not have to file an annual return of its shareholders with the Registrar of Companies;

is not required to open its register of members for inspection;

does not have to hold an annual general meeting;

may not issue negotiable or bearer shares, but may issue shares with no par value;

may obtain an undertaking against the imposition of any future taxation (such undertakings are usually given for 20 years in the first instance);

may register by way of continuation in another jurisdiction and be deregistered in the Cayman Islands;

may register as a limited duration company; and

may register as a segregated portfolio company.

“Limited liability” means that the liability of each shareholder is limited to the amount unpaid by the shareholder on the shares of the company.

Preferred Shares

As all the current authorized share capital is designated as Ordinary Shares, shareholders’ special resolution will be needed to amend the Company’s M&A to alter its authorized share capital if the Company decides to issue preferred shares. After such resolution and amendment, the Board is empowered to allot and/or issue (with or without rights of renunciation), grant options over, offer or otherwise deal with or dispose of any unissued shares of the Company (whether forming part of the original or any increased share capital), either at a premium or at par, with or without preferred, deferred or other special rights or restrictions, whether in regard to dividend, voting, return of capital or otherwise and to such persons, on such terms and conditions, and at such times as the Board may decide and they may allot or otherwise dispose of them to such persons (including any director of the Board) on such terms and conditions and at such time as the Board may determine.

You should refer to the prospectus supplement relating to the series of preferred shares being offered for the specific terms of that series, including:

title of the series and the number of shares in the series;

the price at which the preferred shares will be offered;

the dividend rate or rates or method of calculating the rates, the dates on which the dividends will be payable, whether or not dividends will be cumulative or noncumulative and, if cumulative, the dates from which dividends on the preferred shares being offered will cumulate;

the voting rights, if any, of the holders of preferred shares being offered;

the provisions for a sinking fund, if any, and the provisions for redemption, if applicable, of the preferred shares being offered, including any restrictions on the foregoing as a result of arrearage in the payment of dividends or sinking fund installments;

the liquidation preference per share;

the terms and conditions, if applicable, upon which the preferred shares being offered will be convertible into our Ordinary Shares, including the conversion price, or the manner of calculating the conversion price, and the conversion period;

the terms and conditions, if applicable, upon which the preferred shares being offered will be exchangeable for debt securities, including the exchange price, or the manner of calculating the exchange price, and the exchange period;

any listing of the preferred shares being offered on any securities exchange;

a discussion of any material federal income tax considerations applicable to the preferred shares being offered;

the relative ranking and preferences of the preferred shares being offered as to dividend rights and rights upon liquidation, dissolution or the winding up of our affairs;

any limitations on the issuance of any class or series of preferred shares ranking senior or equal to the series of preferred shares being offered as to dividend rights and rights upon liquidation, dissolution or the winding up of our affairs; and

any additional rights, preferences, qualifications, limitations and restrictions of the series.

Upon issuance, the preferred shares will be fully paid and nonassessable, which means that its holders will have paid their purchase price in full and we may not require them to pay additional funds.

Any preferred share terms selected by the Board could decrease the amount of earnings and assets available for distribution to holders of our Ordinary Shares or adversely affect the rights and power, including voting rights, of the holders of our Ordinary Shares without any further vote or action by the stockholders. The rights of holders of our Ordinary Shares will be subject to, and may be adversely affected by, the rights of the holders of any preferred shares that may be issued by us in the future. The issuance of preferred shares could also have the effect of delaying or preventing a change in control of our company or make removal of management more difficult.

Anti-money Laundering—Cayman Islands

In order to comply with legislation or regulations aimed at the prevention of money laundering, we are required to adopt and maintain anti-money laundering procedures and may require subscribers to provide evidence to verify their identity and source of funds. Where permitted, and subject to certain conditions, we may also delegate the maintenance of our anti-money laundering procedures (including the acquisition of due diligence information) to a suitable person.

We reserve the right to request such information as is necessary to verify the identity of a subscriber. In some cases the directors may be satisfied that no further information is required since an exemption applies under the Anti-Money Laundering Regulations (Revised) of the Cayman Islands, as amended and revised from time to time (the “Regulations”). Depending on the circumstances of each application, a detailed verification of identity might not be required where:

•the subscriber makes the payment for their investment from an account held in the subscriber’s name at a recognized financial institution; or

•the subscriber is regulated by a recognized regulatory authority and is based or incorporated in, or formed under the law of, a recognized jurisdiction; or

•the application is made through an intermediary which is regulated by a recognized regulatory authority and is based in or incorporated in, or formed under the law of a recognized jurisdiction and an assurance is provided in relation to the procedures undertaken on the underlying investors.

For the purposes of these exceptions, recognition of a financial institution, regulatory authority, or jurisdiction will be determined in accordance with the Regulations by reference to those jurisdictions recognized by the Cayman Islands Monetary Authority as having equivalent anti-money laundering regulations.

In the event of delay or failure on the part of the subscriber in producing any information required for verification purposes, we may refuse to accept the application, in which case any funds received will be returned without interest to the account from which they were originally debited.

We also reserve the right to refuse to make any redemption payment to a shareholder if our directors or officers suspect or are advised that the payment of redemption proceeds to such shareholder might result in a breach of applicable anti-money laundering or other laws or regulations by any person in any relevant jurisdiction, or if such refusal is considered necessary or appropriate to ensure our compliance with any such laws or regulations in any applicable jurisdiction.

If any person resident in the Cayman Islands knows or suspects or has reason for knowing or suspecting that another person is engaged in criminal conduct or is involved with terrorism or terrorist property and the information for that knowledge or suspicion came to their attention in the course of their business in the regulated sector, or other trade, profession, business or employment, the person will be required to report such knowledge or suspicion to (i) a nominated officer (appointed in accordance with the Proceeds of Crime Act (Revised) of the Cayman Islands) or the Financial Reporting Authority of the Cayman Islands, pursuant to the Proceeds of Crime Act (Revised), if the disclosure relates to criminal conduct or money laundering or (ii) to a police constable or a nominated officer (pursuant

to the Terrorism Act (Revised) of the Cayman Islands) or the Financial Reporting Authority, pursuant to the Terrorism Act (Revised), if the disclosure relates to involvement with terrorism or terrorist financing and terrorist property. Such a report shall not be treated as a breach of confidence or of any restriction upon the disclosure of information imposed by any enactment or otherwise.

Data Protection in the Cayman Islands – Privacy Notice

This privacy notice explains the manner in which we collect, process, and maintain personal data about investors of the Company pursuant to the Data Protection Act (Revised)1 of the Cayman Islands, as amended from time to time and any regulations, codes of practice, or orders promulgated pursuant thereto (the “DPA”).

We are committed to processing personal data in accordance with the DPA. In our use of personal data, we will be characterized under the DPA as a “data controller,” whilst certain of our service providers, affiliates, and delegates may act as “data processors” under the DPA. These service providers may process personal information for their own lawful purposes in connection with services provided to us.

By virtue of your investment in the Company, we and certain of our service providers may collect, record, store, transfer, and otherwise process personal data by which individuals may be directly or indirectly identified.

Your personal data will be processed fairly and for lawful purposes, including (a) where the processing is necessary for us to perform a contract to which you are a party or for taking pre-contractual steps at your request, (b) where the processing is necessary for compliance with any legal, tax, or regulatory obligation to which we are subject, or (c) where the processing is for the purposes of legitimate interests pursued by us or by a service provider to whom the data are disclosed. As a data controller, we will only use your personal data for the purposes for which we collected it. If we need to use your personal data for an unrelated purpose, we will contact you.

We anticipate that we will share your personal data with our service providers for the purposes set out in this privacy notice. We may also share relevant personal data where it is lawful to do so and necessary to comply with our contractual obligations or your instructions or where it is necessary or desirable to do so in connection with any regulatory reporting obligations. In exceptional circumstances, we will share your personal data with regulatory, prosecuting, and other governmental agencies or departments, and parties to litigation (whether pending or threatened), in any country or territory including to any other person where we have a public or legal duty to do so (e.g. to assist with detecting and preventing fraud, tax evasion, and financial crime or compliance with a court order).

Your personal data shall not be held by the Company for longer than necessary with regard to the purposes of the data processing.

We will not sell your personal data. Any transfer of personal data outside of the Cayman Islands shall be in accordance with the requirements of the DPA. Where necessary, we will ensure that separate and appropriate legal agreements are put in place with the recipient of that data.

We will only transfer personal data in accordance with the requirements of the DPA and will apply appropriate technical and organizational information security measures designed to protect against unauthorized or unlawful processing of the personal data and against the accidental loss, destruction, or damage to the personal data.

If you are a natural person, this will affect you directly. If you are a corporate investor (including, for these purposes, legal arrangements such as trusts or exempted limited partnerships) that provides us with personal data on individuals connected to you for any reason in relation to your investment into the Company, this will be relevant for those individuals and you should inform such individuals of the content.

You have certain rights under the DPA, including (a) the right to be informed as to how we collect and use your personal data (and this privacy notice fulfils our obligation in this respect), (b) the right to obtain a copy of your personal data, (c) the right to require us to stop direct marketing, (d) the right to have inaccurate or incomplete personal data corrected, (e) the right to withdraw your consent and require us to stop processing or restrict the processing, or not begin the processing of your personal data, (f) the right to be notified of a data breach (unless the breach is unlikely to be prejudicial), (g) the right to obtain information as to any countries or territories outside the Cayman Islands to

which we, whether directly or indirectly, transfer, intend to transfer, or wish to transfer your personal data, general measures we take to ensure the security of personal data, and any information available to us as to the source of your personal data, (h) the right to complain to the Office of the Ombudsman of the Cayman Islands, and (i) the right to require us to delete your personal data in some limited circumstances.

If you consider that your personal data has not been handled correctly, or you are not satisfied with our responses to any requests you have made regarding the use of your personal data, you have the right to complain to the Cayman Islands’ Ombudsman. The Ombudsman can be contacted by calling +1 (345) 946-6283 or by email at info@ombudsman.ky.

DESCRIPTION OF OUR DEBT SECURITIES

We may issue debt securities from time to time, in one or more series, as either senior or subordinated debt or as senior or subordinated convertible debt. Such convertible debt may be exchangeable for and/or convertible into shares of ordinary shares or any of the other securities that may be sold under this prospectus. The debt securities will be issued under one or more separate indentures between us and a designated trustee. We will include in a prospectus supplement the specific terms of each series of senior or subordinated debt securities being offered, including the terms, if any, on which a series of senior or subordinated debt securities may be convertible into or exchangeable for other securities. In addition, the material terms of any indenture, which will govern the rights of the holders of our senior or subordinated debt securities will be set forth in the applicable prospectus supplement.

We urge you to read the applicable prospectus supplements and any related free writing prospectuses related to the debt securities that we may offer under this prospectus, as well as the complete indenture that contains the terms of the debt securities.

DESCRIPTION OF OUR WARRANTS

We may issue warrants to purchase our debt or equity securities or securities of third parties or other rights, including rights to receive payment in cash or securities based on the value, rate or price of one or more specified commodities, currencies, securities or indices, or any combination of the foregoing. Warrants may be issued independently or together with any other securities and may be attached to, or separate from, such securities. Each series of warrants will be issued under a separate warrant agreement to be entered into between us and a warrant agent. The terms of any warrants to be issued and a description of the material provisions of the applicable warrant agreement will be set forth in the applicable prospectus supplement.

We urge you to read the applicable prospectus supplements and any related free writing prospectuses related to the warrants that we may offer under this prospectus, as well as the complete warrant agreements and warrant certificates that contain the terms of the warrants.

DESCRIPTION OF OUR UNITS

We may issue units consisting of any combination of the other types of securities offered under this prospectus in one or more series. We may evidence each series of units by unit certificates that we will issue under a separate agreement. We may enter into unit agreements with a unit agent. Each unit agent will be a bank or trust company that we select. We will indicate the name and address of the unit agent in the applicable prospectus supplement relating to a particular series of units.

We urge you to read the applicable prospectus supplement and any related free writing prospectus, as well as the complete unit certificate that contains the terms of the units.

Transfer Agent and Registrar

The transfer agent and registrar for our Ordinary Shares is Continental Stock Transfer & Trust Company. The transfer agent and registrar’s address is 1 State Street, 30th Floor, New York, NY 10004.

NASDAQ Capital Market Listing

Our Ordinary Shares are listed on the Nasdaq Capital Market under the symbol “VRAX.”

PLAN OF DISTRIBUTION