Additional Proxy Soliciting Materials (definitive) (defa14a)

April 17 2017 - 2:46PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE

COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant

to Section 14(a) of the

Securities Exchange Act

of 1934

Filed by the Registrant

x

Filed by a Party other

than the Registrant

¨

Check the appropriate box:

|

|

¨

|

Preliminary

Proxy Statement

|

|

|

¨

|

Confidential,

for Use of the Commission Only (as permitted by Rule 14a-6(e)(2))

|

|

|

¨

|

Definitive

Proxy Statement

|

|

|

x

|

Definitive

Additional Materials

|

|

|

¨

|

Soliciting

Material Pursuant to § 240.14a-12

|

VILLAGE BANK AND

TRUST FINANCIAL CORP.

(Name of Registrant

as Specified In Its Charter)

(Name of Person(s)

Filing Proxy Statement if other than the Registrant)

Payment of Filing Fee (Check

the appropriate box):

|

|

¨

|

Fee

computed on table below per Exchange Act Rules 14a-6(i)(4) and 0-11.

|

|

|

(1)

|

Title

of each class of securities to which transaction applies:

|

|

|

(2)

|

Aggregate

number of securities to which transaction applies:

|

|

|

(3)

|

Per

unit price or other underlying value of transaction computed pursuant to Exchange Act

Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it

was determined:)

|

|

|

(4)

|

Proposed

maximum aggregate value of transaction:

|

|

|

¨

|

Fee

paid previously with preliminary materials.

|

|

|

¨

|

Check

box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and

identify the filing for which the offsetting fee was paid previously. Identify

the previous filing by registration statement number, or the Form or Schedule and the

date of its filing.

|

|

|

1)

|

Amount

Previously Paid:

|

|

|

2)

|

Form,

Schedule or Registration Statement No.:

|

Dear Shareholder,

Thank you for your support in 2016. We are pleased with the

progress we made during the year and grateful for the diligent work of the Village team members who helped us to achieve so much

during 2016.

|

|

·

|

We grew core commercial and consumer loans (excludes acquired student

and USDA loans) by 13.6% in the product categories we are emphasizing strategically;

|

|

|

·

|

We increased low cost relationship deposits (checking, savings and

money market accounts) 13.6% by adding and building business and consumer relationships;

|

|

|

·

|

Village Bank Mortgage Corporation increased loans purchased by investors

by 4.9% leading to 21.4% growth in pretax earnings;

|

|

|

·

|

Nonperforming assets and classified assets were reduced by 47% and

32%, respectively, so that our asset quality metrics now fall comfortably in line with our peer group;

|

|

|

·

|

We sold our former headquarters building and terminated the last of

the regulatory agreements under which we were operating; and

|

|

|

·

|

Our stock price increased by 41% from December 31, 2015 to December

31, 2016 and as of this writing sits at $27.30, an increase of 97% from the offering price in our rights offering on March 27,

2015.

|

While we are pleased with our progress, we are intensely focused

on the journey ahead. Please take a moment to read the strategy section of our 10-K for information on both our destination and

our plans for getting there. During 2016, we made several strategic hires to ensure that we have the talent and depth to accomplish

our aspirations.

|

|

·

|

We restructured our executive team to consolidate risk, technology

and operations functions under Jay Hendricks, a proven leader in team building and exceptional execution, to help ensure that we

excel in these critical areas;

|

|

|

·

|

We hired Price Beazley, an innovative and agile technology leader

from Capital One. As our Chief Technology Officer, we believe he can help us develop differentiated strategies for meeting the

needs of our clients and team members;

|

|

|

·

|

We hired a talented digital marketing manager, Jim Dingus, to strengthen

our marketing team and extend our reach;

|

|

|

·

|

We hired Kim Branco, who brings extensive operations experience to

help lead our compliance and risk management function;

|

|

|

·

|

We successfully navigated a leadership transition in human resources

and were fortunate to attract Lindsay Cheatham to serve as Director of Human Resources. We believe she has the expertise to help

us attract, develop and inspire the talented team members we will need to achieve our aspirations; and

|

|

|

·

|

We hired George Karousos, a seasoned mortgage industry leader in our

market, to succeed Jerry Mabry, who retired in January from his position as Village Bank Mortgage Corporation President. Jerry

leaves behind a legacy of success and a strong team. We believe that George has the vision and skills to grow our mortgage banking

team and footprint, streamline processes, explore ways to better serve the mortgage needs of bank clients, and increase margins

in the business.

|

During 2017, we plan to:

|

|

·

|

Launch the ability to open deposit accounts and apply for consumer

loans online;

|

|

|

·

|

Enhance the impact of our Customer Care Team by expanding staffing

and upgrading technology to deliver a world class customer contact center;

|

|

|

·

|

Launch updated websites for the Bank and the Mortgage Company;

|

|

|

·

|

Hire additional relationship managers to grow our commercial banking

team;

|

|

|

·

|

Expand our consumer loan offerings with a portfolio residential mortgage

product;

|

|

|

·

|

Implement an end to end paperless loan origination process in mortgage

banking;

|

|

|

·

|

Implement a new junior loan officer program and make strategic loan

officer hires in mortgage banking to grow production;

|

|

|

·

|

Increase our digital marketing reach and brand building effectiveness

by fully utilizing social media platforms;

|

|

|

·

|

Achieve core loan and low cost deposit growth comparable to 2016;

|

|

|

·

|

Improve our efficiency ratio through a combination of productivity

initiatives and revenue growth;

|

|

|

·

|

Reduce the burden of preferred stock dividends on earnings available

to common shareholders by redeeming preferred shares as rapidly as we believe is prudent. In February, we paid all accrued, unpaid

dividends on the preferred stock and redeemed 688 shares. These actions alone will reduce preferred dividends in 2017 by $313,000,

or $.22 per common share, from what they otherwise would have been;

|

|

|

·

|

Commit to a strategy for serving the financial advisory and investment

needs of our consumer and business owner clients;

|

|

|

·

|

Prepare and position for successful growth through mergers and acquisitions

that can complement solid, sustainable organic growth; and

|

|

|

·

|

Continue to strengthen the value proposition for our Village teammates

by helping them to be fit to thrive on their journey through life. We plan to offer an enhanced 401k plan, financial education

and planning and wellness initiatives.

|

It seems that the list of tasks and priorities never gets shorter.

As we look to the future, we want to honor two members of our

board of directors who have made a lasting and positive difference for the Company.

Cal Esleeck passed away in October of 2016 after a short battle

with cancer. Cal had an accountant’s business savvy combined with a generous spirit. A proud Marine who served in Vietnam,

he had a great appreciation for the importance of confident and effective leadership and was a trusted coach to more than one executive

and board member. He was a founding member of the Families of the Wounded Fund, a nonprofit that provides financial resources to

families of active duty wounded service members who are being treated at Richmond VA Medical Center in Richmond. In honor of Cal’s

lifelong efforts to serve others in our community, we have created the Cal Esleeck community champion award in his honor. The “CAL

Award” will be awarded annually to recognize a Village team member who goes above and beyond to generously invest his or

her time and talents to make a difference in our community.

As announced earlier, Bill Chandler has chosen not to stand

for reelection at this shareholder meeting. Bill has made numerous important contributions as a director. With his engineering

and production background, he brings a focus on the critical details that drive performance. As a successful business owner, he

is always sensitive to the things that impact the customer experience, and he cares deeply about how we invest in our people and

at the same time hold them accountable to our high expectations. Perhaps the most important qualities these two gentlemen shared

are their authenticity and their willingness to speak their minds on difficult matters. We will dearly miss both of them.

We apologize for the lengthy report, but we believe that you

deserve a comprehensive review of our progress and our plans. Because we have included statements about our plans and objectives

for the future, you will notice below the forward-looking disclaimer that we would typically include in our earnings press releases.

Please join us at our annual shareholder meeting on May 30

th

at 10:00 a.m. at Brandermill Country Club to hear more

of our story. We hope to see you there.

|

|

|

|

|

|

|

|

|

|

|

Regards,

|

|

|

|

|

|

|

|

|

|

/s/ William G. Foster

|

|

/s/ Craig D. Bell

|

|

|

William G. Foster

|

|

Craig D. Bell

|

|

|

President and Chief Executive Officer

|

|

Chairman, Board of Directors

|

|

|

|

|

|

|

|

|

|

|

|

Forward-Looking Statements

In addition to historical information, this letter may contain

forward-looking statements. For this purpose, any statement that is not a statement of historical fact may be deemed to be a forward-looking

statement. These forward-looking statements may include statements regarding profitability, liquidity, allowance for loan losses,

interest rate sensitivity, market risk, growth strategy and financial and other goals. Forward-looking statements often use words

such as “believes,” “expects,” “plans,” “may,” “will,” “should,”

“projects,” “contemplates,” “anticipates,” “forecasts,” “intends” or

other words of similar meaning. You can also identify them by the fact that they do not relate strictly to historical or current

facts. Forward-looking statements are subject to numerous assumptions, risks and uncertainties, and actual results could differ

materially from historical results or those anticipated by such statements.

Additional Information

This letter may be deemed to be solicitation material in respect

of the Company’s 2017 annual meeting of shareholders. The Company filed a definitive proxy statement with the Securities

and Exchange Commission (the “SEC”) on April 17, 2017 in connection with the annual meeting. Shareholders are

urged to read the proxy statement and any other relevant documents that the Company files with the SEC because they will contain

important information. The Company, its directors and certain of its executive officers will be participants in the solicitation

of proxies from shareholders in connection with the annual meeting. Information about the Company’s directors and executive

officers is included in the proxy statement. Investors and shareholders may obtain a copy of the proxy statement and other documents

filed by the Company free of charge from the SEC’s website at www.sec.gov. Shareholders may obtain a copy of the proxy statement

free of charge by writing to C. Harril Whitehurst, Jr., Executive Vice President and Chief Financial Officer, whose address is

P.O. Box 330, Midlothian, Virginia, 23113-0330, or from the Company’s website at www.villagebank.com.

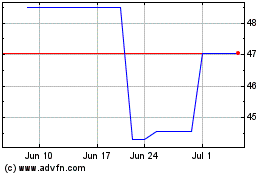

Village Bank and Trust F... (NASDAQ:VBFC)

Historical Stock Chart

From Mar 2024 to Apr 2024

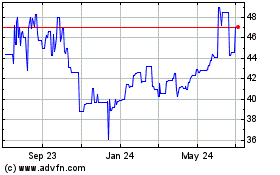

Village Bank and Trust F... (NASDAQ:VBFC)

Historical Stock Chart

From Apr 2023 to Apr 2024